INTERNATIONAL

JOURNALoF

BUSINESS' MANAGEMENT ANDEcoNoMICs

Proprietor on behalf of Faculty of Economics and Administrative Sciences, Ya;ar Universify

orhanigoz

-Editor-In-Chief

Orhan i96z Associate EditorsCengiz Prnar, Kutlu Zoral, Edip Teker,6. Baybars Tek, lge prmar, Musa prnar, Qa$r Bulut Assistant Editors

Bora Bodur, $aban Qelik, Senem Yrlmaz, Onur i96z

Editorial

OfIiceIntemational Joumal of Business, Management and Economics Yagar University, Faculty of Economics and Administrative Sciences, Universite Caddesi No: 35-37bomova-lzmir

YaSar Universitesi Selguk Yagar Kamptisii Universite Caddesi, No:35-37, Alagh yol, Bomova lanir pK. 35100 Tel :232411 50 00 Fax: 232411 50 20 e-mail: [email protected]

Iatemational Joumal of Business, Mariagement and Economics is a peer-reviewed intemational joumal published three times a

year in English. The Joumal accepts articles that can be theoretical, applied, empirical, case - Lased oi policy oriented in the areas of Business, Management, and Economics and other related

fields.-International

AdvisorT Board

{ rrl

Aylin Gtiney A. Gtildem Cerit Adnan Kasman Ahmet Faal Ozsoylu Akira Yokoyama Alican Kavas Anneli Andersson Aslrn Yticel Atilla Yaprak Banu Durukan Cengiz Erol Cengiz Rnar

Cewt Tosun Ceytrun Ozgtir $a$n Bulut David Bednall Do$an Grirsoy Douglas A. Hibbs Eberhard Fess Faruk G[ider Fellzi Okumug Giancarlo Marini Halis Murat Yrldz Haluk Soyuer

ige Prmar KuUu Trlre,l M.Hulusi Demir Michael K.McCudd

Musa Rnar

Muzzo (Muzaffer) Uysal Nicholas A.Lash Orhan iEoz Osman G6k Omer Baybars Tek Hnar EWm Mandacr Refik Soyer Scott McDonald Stileyman Yrikgti Tamer Qvuggil

Thomas Lange

Faculty of Economics and Adminisfrative Sciences, Yapr University,

Tu*ey

j

Faculty of Maritime, Dokuz Eylul University, TurteyFaculty of Business, Dokuz EylUl Univer:sity, Turkey

Faculty of Emnomics and Adminisffative Sciences, Cukurova UniveffiiV, Turkey Graduate scfrool of Policy studies, chuo university , Tokyo, Japan

fthod of Business and Economics, Winston Salem State Universilv, Winston-Salem, USA Cinneuniversitetet, lGlmar, Sweden

Faculty of Economics and Adminisfiative Scienes, Yapr University, Turkey

school of Business Adminisilation, wayne satate university, MI,

usA

r Faculty of Business, Dokuz Eyhil University, TurkeyGraduate School of Socail Sciences, Izmir Economy University, Turkey Faculty of Eonomics and Adminisfuative Sciences, Yapr University, Turkey School of Tourism & Hotel Managemen! Mustafa Kemal University, Turtey

College of Business Adminisbation Faqrlty, Valparaiso University, Indiana, USA Faculty of Ercnomics and Mminisfiative Sciences, Yapr University, Tu4<ey Deakin Scftool of Management and Marketing, Deakin University, Ausilalia

School of Hcpitality Business Managemen! College of Business, Washington State University, W& USA

cenbe For fublic sector Rsesardr, Gdteborg university, sweden

Aachen University of Applied Sciences and Technology, University of Franl<furt, Germany School of Business-Isom, Loyala University, Chicago, IN, USA

Rosen College Faarlty, University of Cenb"l Florida, Ft-, USA Faanlty of Eonomics, UniversiV of Rome, Italy

Faculty of ArG, Ryerson University, Gnada

Faculty of Eonomics and AdminisfiaWe Sciene, Ege University, Turkey Faculty of Economics and Adminisfiative Sciences, Yagar Univensity, Turt<ey

Faculty of Eonomics and AdminisfiaUve Sciences, Yapr University, Turtey

Faculty of Engineering, Yagar University, Turtey

ftllege of Business Adminisfuation Faculty, Valparaiso University, Indiana, USA

college of Business Administration,Valparaiso university, Indiana, uSA

School of Hotel, Resburant and Tourism Managemen! University of South C^arolina, SC, USA School of Bu$ness, Loyala University, Chicago, IN, USA

Faculty of Economics and Adminisbative Sciences, Yagar University, Turkey Faculty of Economics and Adminisilative Sciences, Yapr University, Turkey Faotlty of Economics and Administrative Sciences, Yagar University, Turtey

Faculty of Business, Dokuz Eyltil University, Turkey

Instifute for Reliability and Risk Analysis, The George Washington University, Washington, DC, USA fthool of Busins, o<ford Brookes University, united Kingdom

Faculty of Economics and Adminisbative Siiences, Dokuz Eyltil University, Turkey

INTERNATIONAL

JOURNAL

OF BUSINESS,

MANAGEMENT

AND

ECONOMICS

Editor-[n-Chief

Orhan

iglz

Volume

4

lrio.

11-12

l.{ovember - December

2AI0

YITSAR

UNIVEKSITY

Cataloging-

In-

Publication

DataINTERNATIONAL JOURNAL

OF

BUSINESS,MANAGEMENT AND

BCONOMICS

volLrrne 4

No. l1-12

November - Decemberzarc

rssN

1306 1097@

Author(s)

and YagarUniversity

No

partof

material

protectedby

this copyright may

be reproducedor

utilized

in

anyform or by

any means, electronicor

mechanical,including

photocopying, recording or .byany information

storage and retrieval system,without written

permissionfrom

the YagarUniversity. Author(s)

haveright to

publishtheir article

elsewhere electronically orin

another publication.Cover

Design Onur ErbaqPrinted

in Turkey:

META

BaStfn Marbaacrhk HizmerleriTel:

A.232.343 64 54 Bornova -izmir

TNTERI{ATIONAL

JO

MANAGEMENT

COll

Best Papers

of

ICBME'trO.-

Vol

4.No'l.

A MATHEMATICAL

FRAMEWORK F(ORGANIZATIONAL

STRUCTURE (CAMANUFACTURING COMPANY)

Alireeil

Bafundeh Zendeh, Mahdi ParvizptTHE

EFFECTS OF CAREER COMMITh CO}VTMITMENTAND

TRUST ON ORG BEHAVTORS OFHOSPITAL

AI'JDHOl

KrvanE inelmen, Ezgi Ozgiimii$, CiilnihalTHE

EFFECTS OF PERSON-ORGANIZATTITUDES IN THE HOSPITALITY

Ih MustafaTepeci

.r.ri.Honorable Mentioned

Paperq ofICFM

THE

OWNERSHIP STRUCTURE ON TTHE FIRM

PERFORMANCEAgus

Zainul

Arifin

IMPLEMENTING

SIMPLE SLOPE TEC OFWORK VARIABLES

Aydem

Qiftgio$lu,

Ozer Arabacr ...RECENT DEVELOPMENTS IN

PHILIP ErhanYrldrnm,

Selim QakrnakhEXAMINING

THE IMPACT

OF CUST(GENDER ON

SERVICEQUALITY

IN IINTERNATIONIAL JOURNAL

OF'

BUSINESS,

MANAGEMENT

AND

ECONOMICS

CONTENTS

A

MATHEMATICAL

FRAMEWORK

FOR SELECTINGA

SUITABLE

ORGANIZATIONAL

STRUCTURE (CASESTUDY:

TABRIZ MACHINE

MANUFACTURING COMPANY)

Alireza

Bafandeh Zendeh, Mahdiparvi2poor...

...i

THE

EFFECTS OF CAREERCOMMITMENT,

ORGANIZATIONAL

COIVIMITMENT

AND

TRUSToN

ORGANIZATIONAL CITIZENSHIP

BEHAVIORS

OFHOSPITAL

AND

HOTEL

EMPLOYEESKrvang inelmen, Ezgi Ozgtimiig,

Giilnihal

parlak, Nege Salti, Hatice Sanor... ...12 THE EFFECTS OFPERSON-ORGANIZATION FIT

ONEMPLOYEE

JOBATTITUDES IN THE HOSPITALITY INDUSTRY IN TURKEY

Mustafa

Tepeci...

...26F{oltorable

Mentioned

pa ersof

ICFME'l0

r

vol

4.No.l2

December

2010 THE OWNERSHIP STRUCTURE ON THECAPITAL

STRUCTUREAND

THE FIRM PERFORMANCE

Agus

Zainul

Arifin...

...,40IMPLEMENTING SIMPLE

SLOPE TECHNIQUESTO INTERACTION

OFWORK

VARIABLES

Aydem

Qiftgiollu,

6zer

Arabacr

...5g RECENTDEVELOPMENTS IN

PHILIPS CURVEErhan

Yrldrnm,

SelimQakmakh

...-...72EXAMINING

THE IMPACT

OF CUSTOMERAND

PERSONNEL GENDER. ON SERVICEQUALITY

IN

BANKING

INDUSTRY

Musa Prnar, Sandy

Strasser,ZelihaEser...

...,....g7ELECTRICITY CONSUMPTION AND

SPILLOVER EFFECTS _A

DYNAMIC

PANEL

DATA

APPROACHVeysel Ulusoy, Erdem

Krhg...

...1.].1 gdin

anyording or from the lronically

VOLATILITY

TRANSMISSION IN

EMERGING EUROPEAN F'OREIGN EXCHANGEMARKETS

Vit

Bubdk, Evzen Kocenda,Filip

ZikesTHE

IMPACT

OFPRIVATIZATION

ON INCREASE OFPRODUCTION

AND PRODUCTIVITY: A

CASE OFIRANIAN

PUBLIC

SECTORYounos

Vakii

Alroaia, AkramZiari...

...129A

MATHEMATICAL

FRAM

A

SUITABLE,

ORGAI\IZAT]

(CASE STUDY:

TABRIZ MI

MANI.]FACTURING

COMP

Alireza Bafandeh ZENDEH

Islamic Azad University-Tabriz Branch,

Ira

bafandeh@iaut .ac.ir',

ali *baf2,A00@yohao .Mahdi

PARVIT'POOR

Islantic Azad (Jniversity

-

Bonab Branch, Ir mp a rv ig

o o r @ gnra il .c omAtsSTRACT

In

this

paper,

a

mathematical framer structure was inuoduced byAFtr

method. literature,four

criteria (context dimensionrtorms.

These are typeof

strategy, type, o1size

of

organization. Mintzberg's

taxcorganizational structure alternatives. Thest

bureaucracy, professional bureaucracy, div

a

method was developedto

select the rigused

a

case

study's

data.This

case isImportance

of

each criteria and consistetcriterion

were calculated by pair-wais colof

each structureform

was obtained for determined as right structure.Key

Words:

MADM,

AHP, Organtzat Dimensions:unu.,,1,

through ca

affect

thei impact 0n'$l

t{

capitalization

as much as

IDR concerning the sourceof

fundingwhether debt

or

equity,

wouldfunding

in

the

capiul

markets capital structure.ln

modern

companies,including

publi separationof

functions:

ownership and con held by the shareholders, while conuol func arepaid and

conffactedto

carryout

operashareholders.

The

separationof

functions between the shareholders (owners or princ wils rootedin

self-management (Jensen andAs a rational person, the marlager (agent

owner, also

hashis own

personal interest,charging the cost

to

the

company. While containing a total risk that can not be diversouly

be seenfrom

its successin

managing (he

will

still

be ableto

work managing the cra manager

in

managing thefirm u,ill

be an ccompany

in

the same position. lndonesia ClIX.l

.6 paragraphl.c

year 2A04 states that 1public .company directors

shouldnot

bedeclared bankrupcy

or

been found guilty ol years precedinghis

appointment" Because ireduce the

total

risk

by reducing the debt o this may reducefirm

value.Agency

problem between owners and rthe management policies that are opportuni due

to

the managementof

opportunistic beagency cost

of

equity). The

monitoring smonitoring

of internal zurd external monitori;monitoring

can be doneby

the managerialthe

members

of

IndependentBoard

of

Imanagement

can

reduce

opportunistic belinternal control,

because every outcome olimpact

on

themselves.While

external n shareholders (non-managerial) and creditors are expectedto

encourage companiesto

w company performance.Ownership

of

sharesat

Issuers compar Exchange (JSX) scattered at various partieslisted

on

theJSX can

be classifiedinto

thannual report

issuedby

the Indonesian CdTHE

OWNERSHIP STRUCTURE

ON

THE CAPITAL

STRUCTURE

AND THE FIRM

PERFORMANCE

Agus

Zainul

ARIFII\

F acultl, of Economic s, Tarumanagara U nivers it1, , Indortesia

aguszal [email protected]

ABSTRACT

The financing

activity

can

generatea conflict

betweenthe

managementand

the stockholderor

creditor

as a consequenceof

theopportunity

management behaviours. These behaviours have also influence on thetirm

perfbrmance. The phenomenonof

this researchis

the influenceof

the ownership structurein

determining the selectionof

thefirm's

financing sources and on thefrm

performance.The aimof

this research is tofind

the

influence

of

the

ownership structure

on the

capital structure and

on

the

firm

performance on the framework of the agency theory.This

research was conducted at nontinancial public

companies listed at the Jakarta Stock Exchangein

yeans2Nl-2003.

This study

used analysistool of

the rwo

stages least square equation (2SLS) models. Thefirst

modetis to

test the intluenceof

stock ownershipstructue,

assetgrowth

of

the

firm,

and asset structureof

the

firm on

thecapital

structure.The

secondmodel

is to

test

the

influence

of

the

stock

ownership'structure,

capital structure,

firm

size. andrisk

of

stock return on thefirm

performance. The conclusions give answers to atl the problems.Key Words:

Agency Theory, Stock Ownership Structure, Capital Snucture, andFirm

PerformanceJEL

Classificiation:

G32l.INTRODUCTION

The existence

of

capital markets provides an opportunityfor

companiesto

increase funding and improve their capital structure so that they can operate at a larger scalewith

more healthy capital sfiucture, which

in

turn

will

help improve

corporate earnings,society, and the macro

economy.According

to

data

of

IndonesianCapital

Market

DirectotT Q004),

until

the endof

the year2003

the numberof

companiesthat

have alreadyutilized

the capital market (Jakafia Stock Exchange) as an alternative sourceof

financing

for

the

company

was as many

as

333

companies,with

total

marketcapit'aJization

as

much as

IDR concerning the sourceof

funding whether debtor

equity,

would fundingin

the capital

marketscapital structure.

In

modern companies,including

public

companiesin

Indonesia.there has

been sepilrationof

functions: ownership andcontrol.

Ownership functions are automatically held by the shareholders, while control functions are held by professional managers who are paid and contractedto

carry

out

operationsin

accordancewith

the

objectivesof

shareholders.

The

separationof

functions

is

the

initial

causeof

agency

problemsbetween the shareholders (owners

or principals)

and managerc (agents). The problemwas rooted in self-management (Jensen and

Meckling,

1976).As a rational person'

tle

manager (agent) in addition to itsrole for

the benefitof

the owner, also hashis

own

personal interest, thatis

maximizing

his

personalutility

by charging the costto

the

company.while

in

termsof risk,

labor

marketof

manager containing a total risk that can not be diversified, because management performance can only be seenfrom

its successin

managing company ttrat providesursui*""

tohim

thathe

will

still be ableto work

managing the company or dimissedfrom

hisjob.

Failureof

a manager in managing thefirm will

be an obstacle forhim

to get anotherjob

at another company in the same position. Indonesia

capital

Market watchdog Bapepamcode

No.IX.l.6

paragraphl.c

year 2004 states that prospective members and commissionersof

public companydirectors should

not

be

derived

from other

companieswho

havedeclared bankrupcy

or

been found -euiltyof

causing the companytranlrupt within five

years precedinghis

appointment. Becauseit

has borne therisk.

then managementwill

reduce the total

nsk

by

reducing the debtor

use under theoptimal

debtlevel

atthoughthis rnay reduce

firm

value.Agency problem between owners and management

can

be reducedby

monitoring the mana-qementpolicies

that are opportunistic. Shiueholderswealth would

be reduced due to the managementof

opportunistic behaviorif

rnonitoring

isn't

done (called the agency costof

equity).

The

monitoring

systemcan be

done

in

two

ways,

i.e.

the monitoring of internal and external monitoring (Bathala, Moon, and Rao, 1994). lnternal monitoring can be doneby

ttre managerial shareholders, the presenceof

auditors, and the membersof

IndependentBoard

of

Directors placement.

share

ownership

by managementcan

reduce opportunistic behavior

by

managementthrough

the

itself

internalconffol,

becauseevery

outcomeof

management .decisionswill

havea

direct impacton

themselves.while

external

monitoring can be

conducted

by

externalshareholders (non-managerial) ano creditors. Effective monitoring by the various parties ilre expected

to

encourage companiesto

walk

in

theright

direction

thatwill

improve company perfbrmurce.Ownership

of

sharesat

Issuers companieswhich are listed

on

the Jakarta Stock Exchange (JSX) scattered at various pzrties in society. Parties that have issuers' stocks listed on theJSX can

beclassified

into

three groups (classrfication accordingto

thr. annual report issuedby

the IndonesianCapitat Market

Directory).

Among the

three;-

uo,,i"r.

For

comparries, rnanasement decisions through capital rnarkets, which is the choiceof

fundingaffect their

capital

structure.so

the

stock

of

capitalimpact

on

the sffucture

of

corporateownershib

andIAL

nt and the nhaviours.

non of this tion of the

l

is to findr

thefirm

:he Jakaru

:wo stages

e of stock rm on the 0wnership formance.

9, and

o increase

scale with earnings,

rl

Market that have sOurceof

il

marketI

group

of

shareholders,only

the groupof

shareholdersis

the most eff'ective institution that can monitor and influence management policies, because this group have aformal

mechanics and budget and are consistent (Bathala, Moon, and Rao, 1994). Internal partycan

etTectivelymonitor is

managerialstock

ownership, becauseof

it

can

influence management policiesfor

the benefitof

shzueholders. The sizeof

the managerialability

ul'

shareholdersto

monitor

dependson how

much

ownershipof

sharesheld by

the management.The phenomenon

of capiul

sffucture on non-financial issuers companiesin

JakartaStock

Exchange

(JSX),

showed

that the

composition

of

the capital

structure

of

non-financiarl issuersduring the period

1993to

2003

is

more dominated

by

debt, inclicatedby

thelevel

of

leverage The average value above 60Vo. Lccordingto

Lasher (2.003:a3 1), ttreoptimal

capital structurefor

the company's business has a debtlevel

in the range between 30Vo-

509o. Although this criterion is not a regulatory standard,it

has becomean

acceptedwisdom as

a

generalguide

in

managingthe

company'scapi*tl

structure.Performance

of public

companies on the JSXin

the year 2001 to year 2003, can usethe

researchresults

from

SWA

Magazine MarkPlus

and Malter

of

Accounting,University

of

Indonesia(MAKSI

UI),

which

assessesthe

financial

performanceof

companieswith

the

EVA

approach.The result,

itt

2001

(basedon

the

financial statements asof

December31,2000),

Companies that were ableto

recorda

positiveEVA

numbered47, and

in

2002 droped

to

33

companies,and

in

2003 only

24 companies.It

showed some issuersin

Indonesia have not been ableto

generate returns that can cover therisk

capital (Poeradisastra, 2003:28).This

means that fundamentally,it

can be said that the management as an agentof

the shareholders had failed to perfbrm its role to achieve company goals.2.

FORMULATION

OFRESEARCH

Based

on the

background describedearlier, the

problemsin

this

researchare

asfollows:

a.

Does

the

share ownershipby

institutions and the

managerial shareaffect

the capital structure?b. Does the share ownership by the institution and the managerial share ownership, and capital structure affect the corporate performance?

3.

LITERATURE REVIEW

The

company's main objectiveis to

enhance shareholders' valueby

increasing andmaximizing

shareholders'wealth

or firm

(Ross, Westerfield,

and Jaffe'

2002)

ormaximizing

corporatevalue (Keown,

2002). Fama (1978) suggestedthat

maximizingthe

valueof

the

companies ot'ten expressedwith

aform

of

maximizing the

value of company stock. Destination covered companieswithin

both the prosperityof

the stock holders or bond securities. Component selection decisions about whichfunding

sourceswill

be selected,ideally

the company should ret'erto

the company'sobjective,

that ismaximizing welfare, which can be realized

ttrough

improved corporate pedormance. Inother words,

selectionof

the

compositionof

capital

structureby firms

in

financing activitieswill

also affect tlre performance of the company.42

i

The company shares are o\\/tted by vario

Ownership structure

is

the

parties

whoMeckling

(1916) stated that structure or eqr who own sharesin

proportiott (Kuznetov anin

agency relationship

are

separation bfunctions.

Grouping

of

stock

ownership structure Yarnmeesriand

Lodh,

( 1991). ownership management, and outside the cotnpany. MeiPua, (2002),

structure

of

shareholding isindividuals, and

managerial.In

conjunctic managernent,ownership

structures are claOliver"

and Pua. (2002),which

differetttiate and rnanag erial.Demsetz (1983), Shleifer and

VishnyBathala,#*n,

and Rao (1994). Brailsford ownership structuremay affect

the compa managementis the

applicationof

internal managementis

externalcontrol

mechanism can affect marlagernent policiesin

the use olcompany's capital structure.

Jensen and

Meckling

(1976) said ownersl can reduce the managerial incentiveto

doshereholders'

wealth,

and

against

other Behaviour that recluces shareholders' wealth.and

shareholders.This conflict

can be

re between managementand

shareholders. tl However. share ownership by man&flefileot rparties

will

have an impact on the control othe

miillagement),so

it

r.vill encourage the attitude. Share ownershipby

management \debt

is

an

externalcontrol

mechanism. Del exercise confrol over corporate cash flows ar Relationshipwith

the ownership structurfollows

(Jensen andMeckling,

1 97 6).a. Level of share ownership by managern

of

debt, at ahigh

levelof

share ownet be reduced.b.

Block

holders' actively control rules alevels.

c.

Share ownership by management and Ilow

levelsof

share ownershipby

n'holders lead to a rlegative relation witl

ve institution lave a formal Internal pcd,ty )an influence rgerial abiliry

held

by

rheres in Jakarta sfructure

of

ted

by

debt, ng to Lasher debt level inmdard,

it

hasany's capital

003, can use

Accounting, lormance

of

he financial d a positive03

only

24 lrate returns rdamen{ally, I to performarch are as

:

aff'ect rheownership,

'easing and

,

2AA2) or naximizing le valueof

,f the stock Lng sources

ive, that is

'fftiililC0. lfi r financing

Thc company shares are orvned by various parties after becoming a public company. Ownership

structure

is

the

parties

who own

sharesof

the

company.

Jensen and Meckling (1976)suted

that.structure or equity ownershipof

the company is the partieswho own shares

in

proportion (Kuznetov and Muravyev, 2001). The problems that ariserll

agencyrelationship

are

separation betweeu ownership

functious and

controlfunctions.

Grouping

of

stock ownership structure can be donein

various ways. According to Yarnmeesriand

Lodh,

(.1997). ownership sffuctu.resare

groupedinto family

group,management, and outside the cornpany. Meanrvhile, according to Brailsfbrd,

oliver,

and Pua,(2002),

structue

of

shareholding

is

grouped

into:

institutional

shareholders, individuals, and managerial.In

conjunction

with

monitoring the activities

of

policy

management, ownership structures areclixsified

basedon

the opinion

of

Brailsford, 0liver, and Pua, (2002),which

dif't'erentiateinto institutional

shareholders, individuals,and managerial.

Demsefz

(1983),

Shleifer and vishny

(1986),

Agrawal and

Mandelker

(1990); Bathala,Moon,

and Rao(1994). Brailsford,

oliver

andpua

(2002), stated thar sharc ownership structuremay

aft'ectthe

company'scapital

structure. Share ownership by managementis the

application

of

internal control

mechanismfunction, and

by

non management is externalcontrol

mechanism function. The eff'ectivenessof

this

controlcan aft'ect lnanagelnent policies

in

the use oflunding

sources tvhich means alfectin

the company's capital structure.Jensen and

Mecklirg

(1976) said ownership by the manager (managerial ownership) can reduce the managerial incentiveto

clo additional consumption. the acquisitionof

sharebolders'wealth, and

against

other

non-maximizing behaviour

management. Behaviour that reduces shareholders' wealth. This raises aconflict

betrveen management imd shareholders.This conflict

czurbe

reducedthrough

the

alignment

of

interests between managementand

shareholders.through

stock

ownership

by

rnanagement. However. share ownershipby

management over the ownershipof

a numberof

externa.l pertieswill

have an impact ort the controlof

the manager islow

(defensive attitude by the management).so

lt

lvill

encouragethe

managementto

increaseits

opportunistic anitude. Share ownershipby

managementrvill

reduce thehigh

levelsof

debt because debtis

an externalcontrol

mechanism.Debt

management can reduce the freedomof

exercise confrol over corporate ca;h flows and other activitiestiat

are not optimal.Relationship

with

the ownership structure to capital sftucture can be summarized as fbllows (Jensen and Meckling,1976):

a. Level of share ownership by management has a negative correlation with the level of debt, at a

high level of

share ownership by miuragement, the levelof

debtwill

be reduced.

b. Block holders'

actively

control rules and they encourage companies to lower debt levels.c. Share ownership by management and by external block causing the interaction.

At

low

levels

of

shareownership

by

management,more eff'ective

external blocl( lnld.ers lead to a negative relatiouwith

debt ratio. However, the managementwill

r

stay

on the level

of

ownershipin

ahigh level.

Therelationship

between share ownership by block and the ratio of debtwill

be weak.Besides ownership suucture, corporate capital structure is also intluenced

by

other variables ascontrol

variables, namely variable assets shucture and$owth

assets. The structure shows the valueof

collateral assetswith

corpofate a;sets(col/aleral

valueof

assets). The higher company's assets that can be secured, the bigger debt

with

collateral kecurecl, ctebt) can be obtainedfrom

the company. Company that has a guafantee wouldtend

to

use

greaterdebt.

Creditorswill

always

give

credit when there

is

collateral(Titman

and Wessels, 1988). Companies that have insurance against debt,would

moreeasily get

loans comparedwith

tle

companiesthat

do

not

havea

gualanteeof

debt(Brigham and

Gapenski,

1996). One

way

to

avoid

the

agency costs

between management and shareholders is by issuing debtwith

collateral (debt secureA property.For

ttris reason, companies that have assetswhich

can be used as collateral(collateral

assets)to

obtain

the

debt

(secureddebt) allow

issuing more debt

to

gain

a

better invesfinent opportunity. This means that the debt as a compromise between management and shareholders (Myers and Majluf', 1984).Brailsford, Oliver,

and Pua (20fl2) use thecontol

variable annual growttrof

assets(growth)

to

measurcthe

capital sffucture according

to

agencytheory.

Titman

and Wessels (1988) argue thar high growth rate shows greatertlexibility in

investingin

thefuture

andoffers

a

larger opportunityto

takeover

the welfareof

the debtholder.

Sogrowth

is

inversely relatedto

debtratio

or

high

growth rate indicates theability

of

a company's eamings. So generally thereis

a negative relationship betweengrowth

aftd debt.Shareholding sfiucture

and

corporate performanceaccording

to

agency

theory depends on the interaction between the effectsof

alignment and the eft'ectsof

defensefor

managerial shareholders (internal). On one side, an ownership share by malagemelrtis a tool to align

managerial interestswith

shareholders. Management. besideto

be boundby

the contract,is

alsogiven

monetary incentivesto

maximize

andgrow

the company. This condition is called alignment effects. On the other side, share ownershipby

managementcan improve

the defenseby

monitoring

the managementof

external parties when management has alow

skills and wanting an easierlife.

This condition can occurif

the ownershipof

shares by managerial ownership is greater than the other Party'This

situation

is

called

defense effects.Overall,

the

impact

of

shareownership

by managementon firm

performance depends onthe

relative strengththrough

securities and securities defense alignment (Kuznetsov and Muravyyev, 2001).Kuznetsov and Muravyev (2001) found evidence that there is a positive relationship

between

the

highest

concentrationsof

share ownenhip

by

external pafties

on performanceas

measuredby

labor productivity. Soliha

andTaswan

Q$A)

tbund

a significant positive relationship between insider ownership andfirm

value. Furthermore, Lemon andLins

(2003) who investigated the relationshipof

share ownership structure andfirm

value during periodsof

crisisin

eight East Asian countries explained that the structureof

share ownership by management at a high levelof

ownership that canonly

r each 2070 of performance boost.

-

An-u, Cole. andLin

(2000) using a sanshare ownership structure

in finn

pertorm relatedto

the companyif

the shares held binside

managers(2)

positively

related inegatively

if

the arnountof

non-manager slRelations

capital

structure

with

the explained throughempirical

research. Anl lvtotTitoringby

lenders, due to the increasir structure), leadsto

increased corporate pefound

evidence that thereis

no significant thecapiUl

structureof

companies and entelHatfield,

Cheng, alld Davidson0994)

on

industry classificationto

the value (petis

basedon

"v6lueline industrial

classifict Thefirst

group is the cornpany's corporate industry leverageratio

and the second gror (levera$e)below

the average industry levsamples).

Masulis

(1983)

states about Ienterprise value- as

follows:

(1)for

comp:effect

on firm

value, and(2)

for

conlpan affect company value.Stewart (

l99l:66)

stated thatEVA

(ecrfinandial

performance compared rvith most benetitof

a company. Economic value adrcost

of

capital

for

an

investment.Trully

tcompany

is

able

to

producepositive

re negativeEVA

indicates the company's capthe long tenn,

companies cafi have a valr companies thatwill

surrive

are the comparEVA

Calculation

Conrponent: Formula used to calculate theEVA

(SteEVA

-

NOPAT

- cx( x CapitalEVA=(r-c*)xCapital

where:

NOPAT

-

net operating profit after tarCJ

=

cost of a weighted average oCapital

-

Total

funds consistingof

irravailable on the company t(

r

=

NOPAT.

CapitalLauterbach and

Vaninsky

( I 999) havecontrol

variables)

that

aft'ect

firm

perfoAccording

to

them, company performancr-I

l

I

t

il

I

rl

I

I

I I

i

i

I

)en share

by other

;ets. The value

of

;ollateral

:e r,vould ;ollateral ild more

of debt

between

xoperty.

ollater al

a

betteragement

of assets nan and

rg in the

rlder. So

Iit-v

of

anyth and

i

theory' defense agemerlt Je

to

be Irow the vnersh ipextenial ition can

er Party. rship by ecurities

rtionship

rties

or]found a lermore,

Jtructure

that the

can only

Ang. Cole. and

Lin

(2000) using a sanrpleof

1708 cornpanies exarnine the effectof

share ownership structure

in firrn

performance. and concluded. namely:(l)

negativelyrelated to the cornpany

if

the shares held by outside marLagers is greater than that on the inside rnanagers(2)

positively

related

if it

is

state ownership,

and

(3)

correlatednegatively

if

the amountof

non-rnanager share ownership increases.Relations

capital structure

with

the

perfonnanceof

the

company

cin

also

be explained throughempirical

research.Ang,

Cole, andLin

(2000) argued that increased nonitoring by lenders, due to the increasing anrountof

debt (the cornpositionof

capital structure), leadsto

increased corporate perfonnarce.While

Soliha and Taswan (2002) tbund evidence that thereis

nosignificant

positive relationship between debtpolicy

in the capital structure of companies and enterprise value.Hatfield. Cheng, and Davidson (1994) examined the eft'ect

of

capital sfiucture basedon industry classification to the value (perfbrmance) companies. Industry classillcation is based

on"value line industrial

clussificatiorz", which is groupedinto two

companies. The first group is the company's corporate capital structure (leverage) above the average industry leverage ratio and the second group istle

company's corporate capital structure (leverage) below the averageindustry

leverageratio

(the average leverageratio

of

all samples).Masulis

(1983)

statesabout

the effect

of

leverage

with

the

cornpany'senterprise value. as

follows:

(1)

for

companywith

high debt, capital structure, positive etfect onfirm

value, and(2) fbr

companl,rvith

low

debt.capital

structure negativelya1Tect company value.

Stervart (1991:66) stated that

EVA

(economic value added) is a measureof

the real financial perfbrmance comparedwith

most other gaugesin viewing

the actual economicbenefit

of

a company. Economic viilue added is the operatingprofit

after tax minus thecost of capital

fbr

an

investrnent.Trully

(1993:38) statedthat

if

EVA is

positive. the companyis

able

to

produce

positive

results and

create shareholderwealth. while

negativeEVA

indicates the company's capacity as a destroyerof

shareholder welfare.ln

the longtenn.

companiescat

have a valueof

expectedEVA is

positive,

because thecompanies that

will

survive are the companies that could have a positiveEVA

values. EVACalculation

Conrponent:Formula used to calculate the

EVA

(Stewart,1991

137)will

be asfollows:

EVA=NOPAT-c*xCapital

EVA=(r-c*)xCapiral

where:

NOPAT

=

net operatingprofit

after tax (Net Operatingprofit

After

Tax)C-*

=

cost of a weighted average of capital (Weighted Average Cost Of Capital)Capital

=

Total

funds consistingof

interest bearing debt and equity shares that areavailable on the company to fund company operations.

r

=

NOPAT: Capital

Lauterbach and

Vaninsky

(1999) have dift'erent opinions about other variables (ascontrol

variables)

that

aft'ect

firm

performimcelevels according

to

agency

theory. Accordingto

them, company performanceis

lirnited

by

the slzeand

therisk

of

tlier

company share

retum.

Companiesthat

havea

large

sizetypicztlly

havea lwget

net inconrctiom

the company's small size. Companieswith

large size provide compensationtor

the companyto

choose a good and experienced matragement team. The companies have theopportunity to

select theinput

manager. Experienced managerswill

demand relatively high salaries. Managers who havehigh skills

and capabilities ere expected toprovide

superior returnsin

orderto

meet company objectives. Thus,firm

size has apositive relationship

with

perfbrmance. Relationshiprisk

of

sharereturn,

measured by the standard deviationof

shareretun$, with

the share perfonnance is negatively related tofinn

performeurce. Riskof

share return is the proxy of the total risk.4.

RESEARCH HYPOTHESIS

From the description

of

the background of the problem, research problem, literature review and research hypothesis is built as follows:a.

The

proportion

of

institutions

shareownership

by

external,

the

proportion

of

managerial ownershipof

sharesby

internal have effects

on

corporate capital structurewith following

sub-hypotheses:Ownership

of

sharesby

institutions negatively affects the company's capital structure.Managerial share ownership negatively affects the company's capital structure, b.

The proportion

of

share ownershipby

the institution,

the

proportion

of

shareownership

by

the manager, and capital structureaffect

firm

performance. Based on this hypothesis, f'urther sub-hypotheses can be made as follorvs:l)

Ownership

of

shauesby

institutions

has positive iniluence

on

company performance.2)

The managerial share ownership has positive eff'ect onfirm

performance.3)

The company's capital structure negatively affects company performance. 5. RESEARCH

METHODOTOGY

The

objects

of

this study

consist

of

variables

including

exogenous variables: managerial share ownership, irlstitutional share ownership. asset structure, asset growth. company size and share retumrisk.

Endogenous variablesinclude

variablesof

capital structure and corporate performance. The subjectof

this research is issuers listed on the Jakafia Stock Exchange (JSX) as many as 333 companies. The data used are secondary data in theform of

annual tinancial statementsof

the period 2001 - 2003 (pooled data). These periods were chosen because the economic conditions werein

a state ofrelatively

normal after recoveringfiom

the economiccrisis

in

1997. Samples are non-financial issuers (companies outside the barrking andfinancial

institutions and investment). The sampling technique used was purposive samplingcriteria:

(1)

selected non-financial issuers outsidethe

company investment banking andfinancial institutions during

the period 2001 to 2003 (2) issuerswith

positiveequity.

Based on thesecriteria,

193flrms

were found.Each

of

the

193 issuers, research variableswill

be measuredfrom

annual datafbr

3(three) years. except

tbr

annual share returnof risk

variables that usesmonthly

share price data. Operationalizationof

the variables usedin this

study are presentedin

Table16

-

2. The

researchmodel

consistsof

two mcequation

(1)

addtwo

control

variables: assequation

(2)

addtrvo conffol

variables: firt These models are:Capital Sturucture

Model:

CS

=

Fro+

FllS

+

plzMs

+ 0r3AS +[

Conrpany Perfornlance

Model: CP=

Fzr, + fJzlCS + p22lS + pzlMS + pTable 2. Operationalizr

Variable Variable Concepl Cornposition of debt with equ

(Wetson and Copeland. 199,

Measuring the resul[s of an inlt process canied out within the co during the .specified period

(Mulyacli. 1993; and Steward, l Percentae,c of share.s held by insti as an external monitoring agent

the size of their inve,stment.s in c

rnarkets. (Wahidawati, 200 I

Brailsford, Oliver. and Pua,2( The percenta-ge o\4'nership of shar by the rnanagernent a.s internal mc

agency that actively AG'ticiAC

oorporate deci.sion nlalSng (Bathala lvloon, Rao, 1994

Wahidawati. 2001)

Reflect.s the value of col?orate that can be used ?rs coilateral to

loans trom the bondholder (Titrnzur and We.ssels. 1988

Wahidawati. 2001)

'fhe average rate of annual gro\

total asset,s. (Titman and Wessell

Brail.sford, Oliver. ancl Pua, 2

The size of the cornpany's sales

the period. which can be seen fr sales. (Lauterbach and VaninskY Variabilitl' corporate earnings an

is detined as the coef ficient of vi (Lauterbach and Vaninsk-v. ll

Sourch: from many sourches 1) 2) Capital Structure (CS) Company PerJorrn?nce (CP) Institutional Ownership (IS) Managerial ownership (MS) Asset Structurc (AS) As.set Growth (AG) Company Size (sIZ)

Risk Share

Return

l

larger n,et )mpensation r C0ITiP?nies 'rill demiurdexpected tcr

size has a

teasured by

vely related

n, literature

)portion

of

'ate capital

ry's capital

lstructure.

n

of

sharence. Based

c0mparlv

ance. ance.

variables. ;et grolvth. of capital ited on the

secondary

lled data). 'relatively t-financiiil rent). The r-financial luring the

193 firms

data

for

3thly shiu-e

I in Table

2

Thc research model cottsistsof

two cquation (1) addtwo control

variables:eqrration

Q)

add trvoconffol

variables: These models are:Capital

Sturucture Model:

CS = [}ro + FrrlS

+ Fr2MS + Fr3AS Conrpan)'Perfornlance

Model: CP = 026 + [}z rCS+

gzzlS + pztl\4srnodels

of

equation(1)

andQ).The

ttiodel

of

asset structure and Growth asset. The model

of

firni

size andrisk

of

the compatly share returtt.+

[]r+AG

*

tlt

+ Fz+S

V

+ $zsVAR+

e21

Q)

-fable 2. Opcrationalization of Research Variable(1)

Variable Variable Concepl Inclicator

Company

Measuring the resulls of anintelnal

The ratio between IO{OPAT / Capital)/

Pcrlbrmance process canied out within thecompany

WACCJ mull"iplied Capital(CP)

durin-e the specil'ied period. (Mulyadi. 1993; and Steward, 199i)Inslitutional

Percentage of shares held byinstitutions

'lhe ratio betu'een the number ofOwnership

as an external monitoring agent dueto

ordinary shares owned by institutions(lS)

the sizc of their inveslmenls incapilal

(companies, pension funds, insurance.markets. (Wahidawati.

2001;

banks) to total outstanding Brailsford, Oliver. andPua,2002)

common slock'Managerial

The percentage ownership ofsharesheld

The ratio belween the number of orvnership by the management as internalmonitoring

ordinary shares owned by mcmbers of(MS)

agency that actively AGr-ticiAGtein

the managers and direclors to the total corporale decisionnralSng.

common shucs outstanding (Bathala lvloon, Rao. 1994;Wahidawati. 2001)

Capital Structurc

(CS)

A.s.sct

Sllu c turc

(AS) A,s.set Crowth (Ac) Cornpany Size (srz)

Risk Share Return

(vNr.)

Cornpo.sition of debt witli equit1,. (Wetson and Copeland. 1992)

Rcfle ct.s thc valuc of corporate assets

that can bc used as collatcral to obtarn

loans from the bondholder. (f itrnan and Wes.sels. 1988;

Wahidawatr. 2001) 'fhe average rate of annual growth of

total assets. (Titman and Wessels. 1988; Brailsford, Olivcr, and Pua. 20AZ)

The size of the company's salcs during

the pcliod. rvhich can be seen fiom the

sales. (Lauterbach and Vaninsky. 1999).

Variabilitl' corporate earnin{s and profit

is detlned as lhe coel'ficicnt of viuiation.

(Laule rbach and Vaninsky. 1999).

The ratio of book value of long-ternr obligation n'ith a rnalket value of equity

plus long-term obligation

The ratio of flxcd asscts to total

asse [s

The ratio between the total value of

assets by the encl ancl beginning of the ycar divided by the total asset

value at beginning of year. Natulal los of arnnual sales

Standiu'd cleviation of stock pricc

change (per nronth)

Sourch; from many sourches

4.1

6.

ANALYSIS

OF RESEARCH RESULTS AND DISCUSSION

a. Data Analysisof

ResearchModel

In

calculating

the

2SLS model,

the

regressioncoefficient

will

be

searched, theindependent

variables influence

the

dependent

variable,

and

the

coefficient of

cir:tr:rmination (R2). Before the data

is

includedin

the model,first

it

has passed the testof

classical

assumptions.The

model

equation

(3)

and

(4)

satisfy

the

classical :ssumptions (criteria UnbiasedBLUE

= Best Linear Estimators)1)

First

Phase:Model Capital Structure

At

this

stagebuilt into

one basedon

equation(l)

to

see theeffect

of

Institutioniil

share Ownership(lS),

Managerial share Ownership(MS),

Structureof

Assets (SA), andthe Growth

of

Assets

(AG)

to

the Capital

Structure

(CS).

Results

of

statistica.l calculations are presented in Table 3.Table 3. Calculation re.sults of the First Phase (Model Capital Structure) Coefficients

Model Un.s tan dardized Coe fficien [s S tandardized Coeffi cients SIG

STD. Error BETA

-

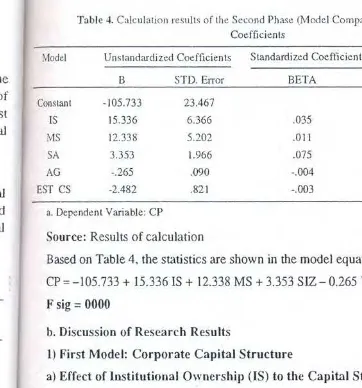

Table 4. Czrlculation re.sults of the Coeffic;SecondModel Unstandardized

Coef{icients

Sta STD. Error Constant IS lvlS SA AG EST CS- 105 .733

15.336 12.338 3.353 -.265 -2.482 23.461 6.366 5.202 t.966 .090 .821 a. Dependent Variable: CP

Source: Results of calculation

Based on Table 4, the statistics are shown CP = -105 .733

+

15.336 IS+

12.338 MS + F sig = 0000b. Discussion of Research Results 1)

First

Model: Corporate

Capital Stru a)Effect of

lnstitutional

Ownership (ISInstitutional

ownership is part of the shalThis party

has an effective capability to mot throughthe voting

rnechanics. The greater Ithe

more eftective

they

monitor the

manamarlagernent

can

make

a

policy

of

fundi servicing obligations are met.On

equation 3. note that institutional ow negative inf-luenceof

capital sffucture of thegreater

ownership

by

the

institution, the inpriority to

the

useof

equity

as a source ofmore

leverage

ratio

to

be

reduced, cet(shareholders

to

push thelow

leverage ratio has been eftective to reduce agency costs.Based

on

theseernpirical

findings, the research results andin

accordancewith

theownership

of

institution

negatively affectr hypothesis can be proven.This

supports thrRao ( 1994).

Significant monitoring

activity by

instinvestments

in

shares,and

has

substantCompanies

that are

monitored

by

the

ICons tant IS ius SA AG .212 -.a47 ,732 .324 -.038 .049 .011 .062 .046 .003 -.030 .060 .783 -.059 4.29? -2.241 3.142

7 .059 -3.97 2

.000 .0t9 .000 .000 .000

a. Dependenl Variable: CS

Source: Results of calculation

Based on Table 3, the stiltistics shown in ttre model equation (Eq. 3) is: CS = 0.212 -

0.047IS

+ 0.232 MS + 0.324 SA - 0.038AG

(3) F sig = 00002) Second Stage

Baned on test results of the OLS equation

of

thefirst

stage, then calculated the eft'ectof

lnstitutional Ownership (IS), Managerial Ownership(MS),

corporate capital structure (CS). Sizeof

Compirny (SIZ),Risk of

Shares(VAR)

on compiury perfonnance (CP). In*ris

test the valueof

capital structure (CS) thatis

usedis

the valueof

capital structurepredictions

(Ci).

fn.

value

of

capital

structure predictions

is

obtained

from

the calculationof

the

first

phase,which

form

the

basistbr

the calculation

of

the

second stage OLS. Calculation resultsin

the form of equations presented in Table 4.Table .1. Calculation re.sults of the Second Phase (ivlodel Co;"npany Performance) Coefficients

Model Un s tandardized Coeffi cien ts S tandardized Coe ffi cie n ts T

STD. Error BETA

SIG

:arched, the

:fficient of

;sed the test

re

classicalInstitutional

s (SA), and

I

statistica]SIG

000 .0r 9 .000 .000 .000

the eff'ect lstructure e (CP). In

structure

from

there second

Constant IS lvlS SA

AG EST CS

- 105 .133

15.336 t2.338

3.353

-.265 -2.482

73.461

6.366

5.2A2

1.966

.090 .821

.035 .01 1

.075 -.004 -.003

4.505

7.409 2.371 t.1 06

2.941 3.023

.000

.012 .a?3 .08 9

.000 .000

a. Dependent Variable: CP Source: Results of calculation

Based on Table 4,, the statistics are shown

in

the model equation (Eq. 4) is: CP=-105 ,733+

15.336 IS+

12.338 MS + 3.353SIZ-0.265 VAR

-

2"482 CSF sig = 0000

b. Discussion

of

Research Resultsl)

First Model: Corporate Capital Structure

a) Effect of

lnstitutional

Ownership (IS)

to theCapital

Structure

(CS)Institutional ownership is part

of

the shareholders who conduct external monitoring. This party has an effective capability tomonitor

becauseit

has the systems and budget through thevoting

mechanics. The greater the proportionof

sharesheld by

institution the more eff'ectivethey

monitor

the

managementof

opportunistic behavior,

so

the managementcan make

a

policy

of

funding

and

fund

managelnentwell

and

debt sewicing obligations are met.On equation 3. note that institutional ownership

of individual

variables(IS)

has the negative influenceof

caprtal structureof

the company (CS), Soin

this

economy meansgreater ownership

by

the institution, the institution

tendsto

reducethe

debt,or

give priorityto

the useof

equity

as a sourceof

corporatefunding,

thus causing more and moreleverage

ratio

to

be

reduced. ceteris paribus.

The

ability

of

institutional shareholdersto

push thelow

leverageratio

indicates themonitoring

by

the institutionhas been effective to reduce agency costs.

Bu;ed

on

theseempirical findings, the

researchis still

consistentwith

previous research results andin

accordancewith

the research hypothesiswhich

states that share ownershipof

institution negatively affects

the

company'scapital

structure.

So

this hypothesis can be proven.This

supports the resultsof

researchby

Bathala,Moon,

and Rao (1994).Significant monitoring

activity

by

institutional

investorsdue

to

the

size

of

their investmentsin

shares,and

ha;

substantial economic interests

to

make

a

profit.

Companiesthat are

monitored

by

the

larger

institutions,

will

require less

debt.19

Ownetship

of

shares by institutional investors acts as an important monitoring agent that plays zur active and consistentrole

in

protecting theequity

investmentat

stakein

thecornpany.

The

monitotittg

mechanics

will

ensure

the

economic prosperity of

shaleholders as a whtlle.

b) Itrffect

of Managerial share orvnership (MS)

on theCapital

structure

(cs)

Equation3

indicates that theindivitlual

variablesatd

managerial ownership (MS) has a positive intluence on the directionof

company's capital sffuctufe (CS).It

means that greater managerial ownershipwill

lead to increasing leverage ratio. Thisfindings

isin

contrastwith

the research hypothesis. The inconsistencyof

research resultswith

the proposed hypothesis, can be explained asfbllows:

i.

Risk

managementis

coveredby a

total

risk

that

cannotbe diversified

in

the managerial labor market. Performance generated by the managementwill

impactpositively

or

negativelyon their future

career asa

memberof

the management company.This

will

also be

able

to

determinewhether

the

managerial labor market accepts themif

they move to another company.With

a totalrisk

inherenton

self-manager, thenthey

will

maximizetheir own welfare by doing

business expansions that arc expected to enhance the status, salary, bonus, compensation. and require excessivefacilities.

Expansionof

the maragemetitwill

use internal funds and external sources(including

debt).To

that end. the company funding source selection decisions are necessary to conffol and supervise.ii.

Managerial share olvnership

is

part

of

the

functionality parallels

between management and shareholders. So managerial share ownership is partof

internalmonitoring by

the shaleholders (Jensen andlvleckling,

1976;Brailsford, Oliver.

and Pua,

20A2). Horvever,

the

efl'ectiveness

of

internal monitoring

byshareholders against rnauagerial opportunistic behavior is determined

by

the sizeof

their votirrg power through its share ownership proportion.If

the proportionof

shares held

by

managerial isrelatively

small, the internal monitoringtunction

is not efl'ective. as a resultof

opportunistic behavior by management that can not be controlled, and vice versa. The study shows that managerial ownership levels arerelatively

low

(2.12Vo,2.39Vo and 2.29V0 rcspectivelytbr

the years2001,2402,

2003).

Bathala,Moon,

andRao

(1994)found

similar

evidencethat

ownership shares below 5% is considered lesseffectivefor

monitoring. Based ontlis,

it

canbe said that the

company'sinternal

monitoring

capacity

is

relatively

small number, so the company's intenralmonitoring

functions are also weak.ltr

ordertbr

themonitoring

t'unctionis

runswell,

there should be externalmonitoring

bycreditors

(bondholders).Creditors

rvill

supervisethe

useof

money loaned

toconfbnn

with

thecredit

proposal submittedto

the company. Creditorswill

also conduct oversightof

these policieswith

the company entered into a conffact thatwould restrict

the

nliuagement

in

rnaking

policy

(bond

covenartts). Bond covenautsmay

reduce the opportunistic natureof

mauagement.so that

agency costs decrease.They

raise the debt burden remainsof

interest. These expenseswill

reducefree

cashflows

that can be

usedby

management.The bigger

the-

compattylettt

at therisk

borne by crconduct more

strirtgent oversight, Qbetweett

shareholdersand

mallag( phenometloll explains why mattagerii gives positive eftect ollcapiul

sffucttiii. Viewed

from

the asymmeffic inforn relationship between managerial sha explairted. The proportiouof

managepafiy

to dominate mallagement of infto

the

other Party.

If

so, the

manufinancing,

and debtwill

optimize retcapital (Myers and

Majluf,

1984). 2)Model'frvo:

Company PerformancThis

section

will

study the

influence share ownership (MS), apd capital structurta)

d,tfectof

Institutional

Share Olvnet The company's main objective is to matrvo

futtctions has

a

conflict

of

inter simultaneously generate agency costs becaRationally

he also

rvantedhis

personal Iutility. At

the same time, thepublic

comppartieS, consisting

of

institutional shareholand other

parties. Each

party

has diffe company's goals. The spreadof

share own between ownership functiotts causes the 'company's overall weaksted.

The

presenceof

institutional

sharehol'Institutions

as shareholders have the resotof

the

companylvith

the

same goal. socontrol

of

the

actions and policies

of

tcontrols,

resultingin

the management of the company management can decide to ris

achievedwell

company,it

cau improl shown thatindividual

institutional ownersinfluetlce on

company performance (CP)research by Kuznetsov

atd

Muravyev (20 Q002). They conclude that institutional s[(monitoring) that cal)

reduce agency cimproved.

b) Effect of Managerial

Share Owne Equation 4 shows thatindividual

mattdirection of

a positive intluence on compiing agerit that t stake

in

the rrosperitvof

:ture (CS)

nership (MS)

lS).

It

meansris findings is iults w,ith the

'sified

in

the twill

impact management lgerial labor risk inherent 'ing business)m pensation.

use internal

rany funding

els

bet"r,eett rt of intenral ford. Oliver,nitoring

by'I

by the size rroportionof

;

function isrt can not be ip levels are 2001 ,2A02,

t

ownership r this"it

can :ively small ak. In order rnitoring byy

loaned torrs

will

a.lso )ontract that urts). Bond that agency se expenses ,bigger the-_

company lent at the

risk

borneby

cretlitorswill

be greater.for

that creditorwill

conduct

more

stringentoversight,

ceteris pzlfibus.Thus. debt

is a

comprotnisebetweell

shareholdersantl

management(Meyers

and

Majluf,

1984).

This phenomenon explains why managerial share ownersltip on the proportion of small gives positive eftbct oli capital sffucture (ceteris piuibus).iii.Viewed

fiom

the asymmefficinfbrmation

theory, the phenomenonof

a

positive relationship between managerial share ownershipof

capitalstructue

can also be explained. The proportionof

managerial orvnership is notsignificatt,

causing the pafiy to dominate management ofinfbmation

(intbrmation superiority) comparedto

the other party.

lf

so,

the

management pref-ersdebt financing than

equity tinancing, and debtwill

optimize resources, since the debtwill

lower

the costof

capital (Myers and

Majluf,

1984). 2) ModelTtvo:

CompanyPerfornance

This

sectionwill

study

the

influence

of

institutional ownership

(IS).

managerial share ownership (MS), and capital structule (CS) on company performance (CP).a) Effect of

Institutional

Share Orvnership(IS)

toPerformance

(CP)The company's main objective is to maximize shareholder wealth. Separation

of

thehvo functions has

a

contlict

of

interest leading

to

problerns

of

agency

thatsimultaneously generate agency costs because

of

the opportunistic natureof

the agenu.Ratiolally

healso

rvantedhis

personal goarl achievedthat

is

maximizing

individu:tl utility.At

the sametime,

thepublic

cornpirny, the ownership shareis

ownedby

many parties. consistingof

institutional

sharebolders. founders' shares. and individuzrl shares. andother parties. Each

party

has

different

interestsalld abilities

in

directing

the cgmpany's goals. The spreadof

share ownershipilrd

control tunctions rvith a separatiott betweel ownership functions causes thecontrol

of

the cornpanyby

theowner

of

the company's overarll weakened.The presence

of

institutional

shareholders thatcontrol

problems can be overcome. Institutions as shareholders irave the resources and budget.It

functions as a part owner of the companywirh

the

samegoal. so he

will

conductan active

and simultaneous controlof

the actions and policies

of

the

management.So the

more eft'ectively

it

controls, resultingin

the managementof

opportunistic behavior can be suppresed andthe company management can decide to remain on the company's true goal.

If

the goal is achievedwell

company,it

can

improve company performance.ln

equation4.

it

is shown thatindividual

institutional ownership variable (IS) has the direction of a positiveinfluelce

on company performance (CP).It

is

still

consistentwith

previous empirical research by Kuznetsov ;urd Muravyev (2001), Bathala et al. (1994) and Berger and Patti (2002). They conclude that institutional shareholders have the good efl-ectof

monitoring (monitoring)that call

reduce agency

costs.so that

company

perfbrmancecan

beimproved.

b) Effect

of Managerial share orvnership (MS)

toPerfornrance

(cP)

Equation 4 shows that

individual

managerial shate owtrership variable(MS)

has the directionof

a positive intluence on company performance (CP). Ownershipof

shares b5'r

managerial is one form

of

corporate internalconfols,

such as internal audit, managementinfbnnation

systems, andother

diamonds.Internal control through

manageria.l share ownership is inherent on its self-management i.e.policy

makers, because every outcolneof

a decision, whether positiveor

negative, the resultwill

be returned at oufselves asilecisiolr

makers. Managerial shareholders also represent other shareholders,with

the same goal. The greater numberof

shares ownedby

management, the greater impactof

decisionwill

makeit

back thernselves as a shareholder. Theretbre. theywill

try

to makea

decision

basedon

company objectives. Managementwill

reduceits

opportunistic properties so that agency costs are reduced and corporate pertbrmaucewill

be increased.c)

Effect of Capital Structure

(CS) toPerformance

(CP)Debt financing

decisions

involve

the two

parties directly

concemed,

namely management andcreditors. From

the sideof

the

company, thedebt

posestwo

main problems of agency costs and problemsof

confolling

capita.l costs and also benefitfrom

Nx

relief on

interest costs.

BOth issueshave

an

impact

on

corporate perfOrmance, whetherpositive

or

negative.For

the management, useof

debt raises theproblem

of

management of risks. Both possibilities give effects that can be explained as

follows:

i. If

a

relatively large

share

of

ownership,

then

the

external

monitoring

by shareholders against managementis

moreeffbctive

andthus reduciltg

agency costs. The useof

debt would cause the costof

monitoring by

creditors. Overall,the

resultof

monitoring by institutional

shareholders and creditorsat

the sametime

increase t}te costof

agency.This

will

reduce the costof

meaningful results.so

decreasing corporate performance. Sowe

can conclude the greater the debt,the

proportion

of

lurge

institutional orvnership,

will

reduce

the

company's performance.ii.

lf

institutional ownership

is

relatively small so that

external

monitoring of

management eff'ectiveness

is low,

the managementof

opportunistic behavior ishigh. Opportunistic

behaviorby

managementis

greaterif

the

management has superiorinfbnnation

cornpared to the other party. To improve the eff'ectivenessof

monitoring, the

use

of

debt

is

a

middle

ground

between shareholders and management. Creditorswill

conduct monitoring over the lif'eof

the loan to reduce the risk of unpaid receivables. Thus cost of agencywill

be reduced.iii.

Accordingto

agency theory, thetotal

risk

borneby

the management cannot bediversified

in

the

manageriallabor

market.The

successof

producing

a

good performance managementwill

ensure the sustainabilityof

thework,

if

otherrvise they can be dismissed.If

management dismissed becauseof

poor performance,it

is

difficult for

themto

get back towork. To

keep the