i

THE IMPACT OF LIQUIDITY, PROFITABILITY, SOLVENCY AND

FIRM SIZE ON CAPITAL STRUCTURE OF

COMPANY LISTED IN LQ45

PERIOD 2010-2014

THESIS

Submitted to Faculty of Economic and Business as partial requirement to

achieve Degree of Economic

By:

Ali Fayrazi

109081100023

MANAGEMENT INTERNATIONAL CLASS PROGRAM DEPARTEMENT

FACULTY OF ECONOMIC AND BUSINESS

ISLAMIC STATE UNIVERSITY SYARIF HIDAYATULLAH

JAKARTA

vi

CURRICULUM VITAE

Personal Identities

Name : Ali Fayrazi

Gender : Male

Place of Birth : Situbondo

Date of Birth : August 15th 1991

Address : Jln. Niaga Hijau Raya No 77, Pondok Indah, Jakarta Selatan, Indonesia.

Phone/Mobile : 087757576678

E-mail Address : fayruzyaly@gmail.com

Formal Education

College : UIN Syarif Hidayatullah Jakarta Senior High School : MAN 2 Situbondo

vii ABSTRAK

Tujuan penelitian ini adalah untuk menganalisis pengaruh likuiditas, profitabilitas, solvabilitas dan ukuran perusahaan terhadap struktur modal perusahaan. Untuk memperoleh data variabel tersebut, diambil dari laporan keuangan perusahaan yang terdaftar di LQ-45 periode 2010-2014. Dari hasil pengumpulan data kemudian data-data tersebut diolah sehingga lebih mudah untuk di interprestasikan dan di analisis. Metode analisis data yang dilakukan dalam penelitian ini menggunakan program Statistical Package for Social Science (SPSS). Penelitian ini menggunakan metode kuantitatif dan metode analisis linier berganda. Hasil penelitian menunjukkan bahwa variabel likuiditas memiliki pengaruh positif terhadap struktur modal, profitabilitas memiliki pengaruh negatif terhadap struktur modal, solvabilitas memiliki pengaruh positif terhadap struktur modal dan ukuran perusahaan memiliki pengaruh positif terhadap struktur modal. Nilai koefisien determinasimenunjukkan hasil perhitungan di atas di mana R square sebesar 0.705 atau 70,5%. Hal ini menunjukkan besarnya kontribusi dari likuiditas, profitabilitas, solvabilitas dan ukuran perusahaan terhadap struktur modal sebesar 70,5% sedangkan sisanya 29,5% merupakan kontribusi faktor lain yang tidak diteliti dalam penelitian ini, seperti stabilitas penjualan, leverage operasi, tingkat pertumbuhan dan pajak.

viii ABSTRACT

The purpose of this study was to analyze the effect of liquidity, profitability, solvency and size of the company to the company's capital structure. To obtain data on these variables, taken from the financial statements of companies listed on LQ-45 during the 2010-2014 periods. From the results of data collection and then the data is processed so that the information that occurs is easier to be interpreted and analyzed. Methods of data analysis performed in this study using the program Statistical Package for Social Science (SPSS). The research uses quantitative method and multiple linear regression analysis. The results showed that the variables of liquidity has a positive and significant impact on the capital structure, profitability has negative effect but significantly on capital structure, solvency has a positive and significant impact on the capital structure and the size of the company has a positive and significant impact on the capital structure. The coefficient of determination shows the calculation above where R square of 0.705 or 70.5%. This shows the magnitude of the contribution of liquidity, profitability, solvency and size of the firm on the capital structure of 70.5% while the remaining 29.5% is contributed by other factors not examined in this study, such as the stability of sales, operating leverage, growth rates and taxation.

ix

PREFACE

Assalammu’alaikum Wr.Wb.

Firstly Thanks to Allah SWT, because of His blessing the writer can finished this thesis. Shalawat and Salam also give to the guidance prophet Muhammad SAW also to His Best friends.

Thesis entitled “The Impact of Liquidity, Profitability, Solvency and Firm Size on Capital Structure of Company Listed in LQ45 Period 2010-2014”. This is the final author in completing the undergraduate program at the Faculty of Economics and Business, Management Department of the State Islamic University Syarif Hidayatullah Jakarta.

In this chance, the writer wants to say thanks for supporting and helping from every party. So, thankful would be for:

1. Author parents and author brother who always give love, compassion motivation and support on completing this thesis. Accompaniment of uncessing prayer in each of these step.

2. Dr. Arief Mufraini, Lc., M.Si as Dean of Faculty of Economics and Business Syarif Hidayatullah Jakarta.

3. Dr. Indo Yama Nasarudin, SE,. MBA as first supervisor always motivate and provide the best guidance to the author. So that author can finish this thesis.

4. Titi Dewi Warninda, SE., M.Si as the thesis supervisor II and also as Lead of Management Department who always give guidance for the creation of my thesis with good result.

5. Ms. Ela Patriana, MM as Secretary of Management Department who always give help and solutions when author still study in Faculty of Economic and Business,

x

6. All lecturers and Staff Management Department International Faculty of Economic and Business, State of Islamic University Syarif Hidayatullah Jakarta,

especially to Mr. Bonik.

7. Author Brother Arif Alawiy, thank you always support author.

8. All author best friends in Management International class program and friends in The Kostan Warna-Warni also thank you for help and support.

The author realizes there are still many short comings in the writing of this thesis. Therefore, the author begs criticism and suggestions that are built from the readers.

Jakarta, November 26th 2015 Author

xi

TABLE OF CONTENTS

Cover ... i

Certification from Supervisor ... ii

Certification of Comprehensive Exam Sheet ... iii

Certification of Thesis Exam Sheet ... iv

Sheet Statement Authenticity Scientific Work ... v

Curriculum Vitae ... vi

C. Objectives and Benefits Research ... 8

CHAPTER II LITERATURE REVIEW A. Theoretical Basis………..……….. 9

1. Financial Management……….. 9

a. Understanding Financial Management………… 9

b. Scope of Financial Management………. 11

c. Financial Management Function………. 13

d. The purpose of Financial Management……….. 16

2. Financial Statement Analysis……… 17

3. The Capital Structure……… 19

a. Definition of Capital Structure……… 19

b. Theories of Capital Structure……….. 20

c. The Modigliani-Miller Model………. 26

d. Pecking Order Theory………. 27

e. The Trade off Model……….. 29

f. Agency Theory……… 30

4. Factors Affecting Capital Structure………. 31

a. Liquidity………. 31

b. Profitability………. 37

c. Solvency………. 41

xii

5. The Effect of Independent Variables to Dependent

Variables………... 46

a. Effect of Liquidity on Capital Structure……….. 46

b. Effect of Profitability on Capital Structure….... 46

c. Effect of Solvency on Capital Structure…….. … 47

d. Effect of Firm Size on Capital Structure…….… 47

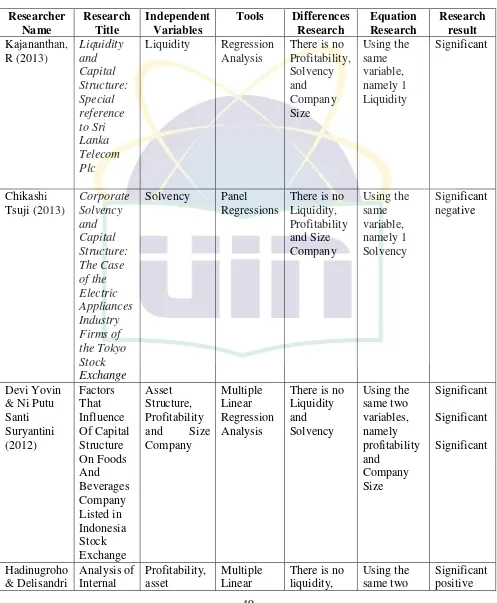

B. Previous Research………. 48

C. Framework………. 51

D. Hypothesis………. 52

CHAPTER III RESEARCH METHODOLOGY A. Scope of Research. ...53

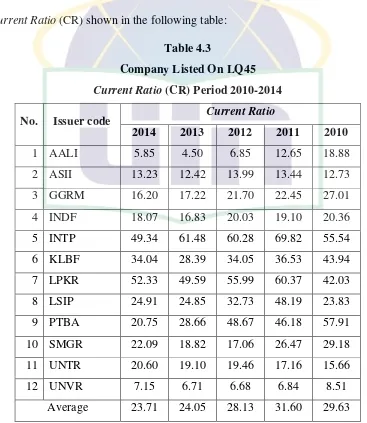

3. Data Measurement Liquidity through Current Ratio (CR) in period of 2010 through 2014 at the Company's Registered In LQ45... 66

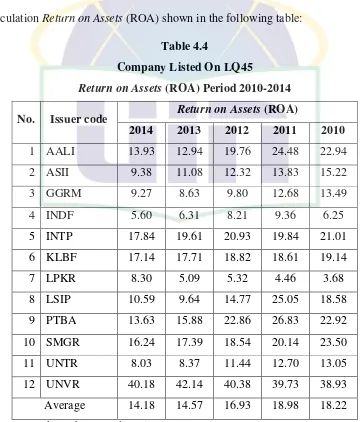

4. Data Measurement Profitability through Return on Assets (ROA) in period of 2010 through 2014 the company listed on LQ45………. 67

5. Data Measurement Solvency through Debt Ratio (DR) in period of 2010 through 2014 the Company Listed On LQ45………. 68

xiii

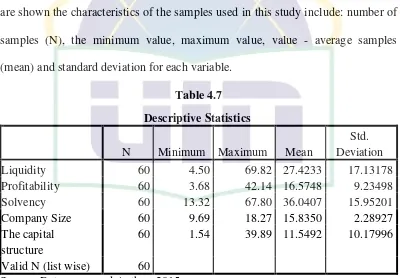

B. Descriptive Data……… 70

C. Classical Assumption Test………. 71

1. Normality Test……… 71

2. Multinolinearity Test ……….. 74

3. Auto Correlation Test ……… 75

4. Heteroskidastity Test ………. 77

D. Multiple Linear Regression Analysis……….. 78

E. Testing Hypothesis……….. 80

G. Discussion of Result……….. 85

1. The Effect of Liquidity on Capital Structure……. 85

2. The Effect of Profitability on Capital structure… 86 3. The Effect of Solvency on Capital Structure…… 87

4. The Effect of Firm Size on Capital Structure……. 87

CHAPTER V CONCLUSIONS AND SUGGESTIONS A. Conclusions………. 89

B. Suggestions………. 90

REFERENCES……… 92

xiv

LIST OF TABLES

2.1 Previous Research ... 49

3.1 List of Research Sample ... 55

4.1 Company Listed on LQ45 ... 64

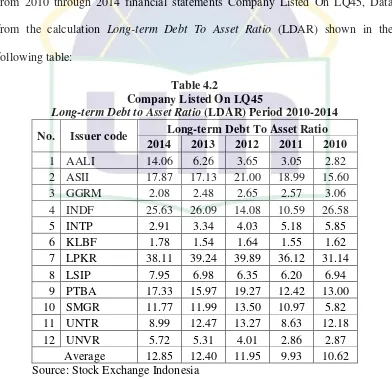

4.2 Company Listed On LQ45 Long-term Debt To Asset Ratio (LDAR) Period 2010-2014 ... 65

4.3 Company Listed On LQ45 Current Ratio (CR) Period 2010-2014 ... 66

4.4 Company Listed On LQ45 Return on Assets (ROA) Period 2010-2014 ... 67

4.5 Company Listed On LQ45 Debt Ratio (DR) Period 2010-2014 ... 68

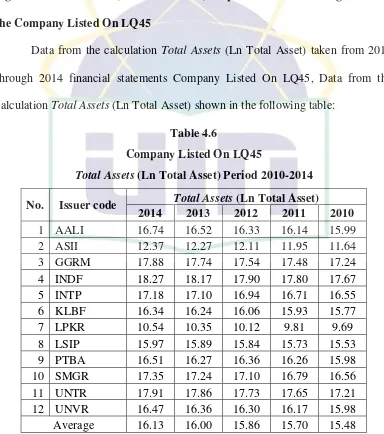

4.6 Company Listed On LQ45 Total Assets (Ln Total Asset) Period 2010-2014. .... 69

4.7 Descriptive Statistic ... 70

4.8 Normality Test data One-Sample Kolmogorov Smirnov Test. ... 72

4.9 Test Multicolinearity Coefficient. ... 74

4.10 Auto Correlation Test. ... 76

4.11 Result of Multiple Linear Regression Analysis. ... 78

4.12 Simultan Test. ... 80

4.13 Partial Test. ... 82

xv

LIST OF FIGURES

1

CHAPTER I

INTRODUCTION

A. Background

In situations such as the current global state boundaries in the field of economy and trade has been almost no limit to the level of competition is so tight, so we need a policy that is appropriate to maintain the viability of the company that still exist and thrive in the future. Problems of capital is one thing that is very important in view of the company will be able to run and develop properly when supported by adequate funding required according to the needs of the company.

2

The theories of capital structure is the issue of the most interesting and complicated in the field of finance. Related to the capital structure of the two sides are often focused on the financial sector which is the impact of the capital structure to firm value associated with the optimal capital structure and the determinants of the capital structure of the company. Decision-making in the capital structure is very much a problem susceptible to all companies because of the effects of internal and external to the company. One of the many goals of financial managers is to maximize the wealth of the company, more specifically shareholder wealth maximization. To maximize the value of the company as well as minimizing funding cost, the manager must establish an optimal capital structure (Hossain, 2012).

Hossain (2012) declared a fundamental component in the capital structure is debt and equity. A firm should attempted to determine the optimal capital structure which caused the maximization of firm value. The positive relationship between leverage and firm value has been identified in several studies (Champion, 1999; Ghosh et al, 2000; Chowdhury Chowdhury S. & A., 2010).

3

financial balance. The company's financial balance can be obtained if a company for perform its functions do not face financial disruptions (Hadinugroho, 2012).

A critical factor in determining the capital structure includes several factors such as liquidity, profitability, solvency and size of the company. Capital structure can be measured from the comparison between total debt to assets ratio is usually measured through Longterm Debt To Asset Ratio (LDAR). Van Horne and Wachowicz argued its capital structure was mix (proportion) of long-term permanent financing represented by debt, equity preferred shares and common stock (Yovin & Suryantini, 2012). There are several factors affecting the capital structure, as disclosed by Sartono namely: the level of sales, asset structure, the level of growth, profitability, company size, variable earnings and tax shelters, the company scale, the conditions internal companies and macroeconomic (Yovin & Suryantini, 2012)

4

tangibility of assets, size, profitability, growth opportunities and non-debt tax shield (Farah & Aditya, 2010).

Liquidity management is essential for companies, where most of the assets consist of current assets. Directly affect the profitability of the company. Too trade off Liquidity is important because if the profitability of working capital management is not given consideration, the company is likely to fail and go bankrupt (Kajananthan, 2013). In this context, known as the working capital gives the power for each unit of economic life and management is considered as one of the most important functions of the management company. Therefore, any organization whether, profit oriented or not, regardless of the size and nature of the business, requiring the amount of working capital required for the smooth functioning of the organization. Working capital is the most important factor to maintain liquidity, viability, solvency, and profitability of the business (Kajananthan, 2013). The high profitability of the company resulted in more companies using funding from within the company, as if profitability is higher, then the company can provide the retained earnings in larger quantities, so that the use of debt can be reduced (Yovin & Suryantini, 2012).

5

cash flow bad and should have more debt, and should be disciplined by debt. Thus according to the agency theory, the ideal relationship between the company's solvency and debt ratios must be positive (Tsuji, 2013). Solvency demonstrated the ability to pay for the long term, this complements for liquidity. Preferably of course, the company in a liquid state and solvable (Mahmud, 2014: 23).

The larger the size of the company, the more easily obtain external capital in large numbers, especially in the form of debt. In other words, the size of the size of a company directly affect the company's capital structure policy (Yovin & Suryantini, 2012). In this study, we will use four factors are interrelated and affect the structure liquidity, profitability, solvency and size of company.

6

In the study conducted by Yovin & Suryantini (2012) with the title of Factors Influencing Capital Structure Of Foods And Beverages At Company Listed on the Indonesian Stock Exchange indicates that the variable asset structure and size of the company and significant positive effect on the capital structure, while profitability has negative and significant effect on the capital structure with the value t count> t table.

Hadinugroho & Delisandri (2012) with the title of research Analysis of Internal Factors Affecting the Company's Capital Structure At the Consumer Goods sector, the results showed a partial, profitability, asset structure, and solvency significant positive effect on the capital structure except profitability has negative relationship. As for sales growth partially no significant effect on the capital structure and have a positive relationship.

The shares which included in the category of index LQ-45 is a collection of preferred shares that meet certain criteria, which belong to the criteria of stock LQ-45 Index are stocks which meet the criteria for high rankings on the total transaction, the transaction value, and frequency of transactions. Group of stocks included in the index LQ-45 is not fixed, every six months there is re-establishment of stocks that meet criteria of and eliminate stocks that no longer meet the criteria that have been defined. Stock positions which eliminated will be filled by the stock in the next rankings, and every three months there is evaluation (Febriana, 2013).

7

because these stocks tend to be stable and active and have high liquidity, making it easier traded good condition the market is weak or strong.

Based on the description it is clear that the depiction terlihatlah with the company's financial condition is very influential on decision making and the formulation of policies carried out in a company. Therefore, the authors are keen to lift into scientific writing with the title " The Impact of Liquidity, Profitability, Solvency and Firm Size on Capital Structure of Company

Listed in LQ45 Period 2010-2014".

B. Problem Formulation

Based on the background described above, formulated research problems are:

1. Does the liquidity, profitability, solvency and firm size partially effect on its capital structure.

2. Does the liquidity, profitability, solvency and firm size simultaneously effect on its capital structure

8

C. Objectives and Benefits Research

1. Objectives

In accordance with the formulation of the problems mentioned above, the purpose of this study was to:

a. Analyze the effect of liquidity, profitability, solvency and size of the company to the company's capital structure partially.

b. Analyze the effect of liquidity, profitability, solvency and size of the company to the company's capital structure simultaneously.

c. Analyzing the magnitude of the independent variable (liquidity, profitability, solvency and company size) influence or explain the company's capital structure.

2. Benefit

While this research is expected to provide benefits for:

a. Issuers, the research results can be used by management companies to determine matters relating to the use of their own capital or loan capital and know the company's ability to meet its obligations, after the financial manager can adopt policies that may be necessary to balance the use of capital.

b. Investors, the results of this study can be used as an overview and consideration to take decisions in investing in a company.

9

CHAPTER II

LITERATURE REVIEW

A. Theoretical Basis

1. Financial Management

a. Understanding Financial Management

The development of financial management science today is so dynamic. This is in line with the high business activity and order of human life in today's era of globalization. This condition led to discussions about financial management science become so attractive for managers, bureaucrats, and not the exception academics and researchers in general (Fahmi, 2014: 1).

According to Riyanto (2013:4) understanding of financial management are: "Financial Management is the whole activity is concerned with efforts to get funding and using or allocating resources." Financial management is a study of planning, inspection, budgeting, management, search, control and storage of funds owned by a company with the overarching goal.

10

that hit many countries in the world, especially in Asia has really put the study and knowledge of financial management really enthused with the inside. In this book we will provide a discussion of the importance of studying financial management at various intricacies (Fahmi, 2014: 1).

Financial sense itself according to Gitman (2012: 4) is "finance can be defined as the science and art of managing money". The financial means can be defined as the art and science of managing money. From these definitions, it can be developed that involves finances as a means of art expertise and experience, while as a science means involving the principles, concepts, theories, and the proportion of existing models in the science of finance. While understanding the financial management According to Horne and Wachowicz Jr. (2012: 2) is a "financial management related to the acquisition of assets, financing and asset management with based on some common goals".

Financial management is the combination of science and art that discuss, examine and analyze how the financial manager by using all the resources of the company to raise funds, manage funds, and funds with the aim of dividing able to provide profit or wealth for shareholders and sustainability (sustainability) of business for the company (Fahmi, 2014: 1-2).

11

financial management continue to grow up to become a science that cannot be removed from the decision-making process by nearly all of corporation or company.

Growth of Financial Management science continues with the emergence of new innovations in financing such as leasing, and growth of the company externally through conglomeration, Mergers and Acquisitions (Tampubolon, 2013: 2).

From the above definition can be concluded that the Financial Management is one of the functions of management for all activities related to the activities of the company to obtain the source of funds, use of funds, and asset management to create wealth for shareholders by maximizing the value of the company.

b. Scope of Financial Management

12

According to (Fahmi, 2014: 2) The field of financial management has three spheres that should be seen by a financial manager, namely:

1) How to find funds.

At this stage it is an early stage of the duties of a financial manager, where he is responsible for finding funding sources that can be used or utilized to serve as the capital of the company. In general, the company's capital comes from its own capital and foreign capital. Own capital in the form of paid-up capital of the owners and was used as capital companies such stock (shares), and foreign capital in the form of loan proceeds to the bank, the sale of shares, including accounts payable and bonds are also others.

2) How to manage funds

13 3) How to divide the funds

At this stage the financial management will make a decision to split the profits to the owners according to the amount of capital paid or placed. This is usually discussed in the GMS (General Meeting of Shareholders). Distribution of profits to the share ownership is usually called the distribution of dividends. There are issues that often occur in the case of corporate management. That is a difference of opinion on the part of company management and its commissioners. Management of the company is that live the company, and the commissioner is a company that has the capital or major shareholders of the company.

c. Financial Management Functions

Fahmi (2014: 3) argues financial management science serves as a guideline for the company's managers in every decision that is made. That is a financial manager must make a breakthrough and creativity of thinking, but it still does not rule out the rules that apply in the science of financial management. Such as obeying the rules contained in SAK (Financial Accounting Standards), GAAP (General Accepted Accounting Principle), Laws and regulations on the financial management of the company, and so forth.

14 1. Investment Decision

The investment decision is an important financial management functions in support of decision making to invest because of concerns about obtaining efficient investment funds, the composition of assets that must be maintained or reduced.

2. Funding decisions (Dividend Payment)

The dividend policy of the company should also be seen as integral to corporate financing decisions. In principle financial management functions as the funding decision concerning the decision whether the profit earned by the company to be distributed to shareholders or detained in order to finance an investment in the future.

3. Asset Management Decisions

Asset Management's decision is a function of financial management decisions concerning the allocation of funds or assets, the composition of funding sources should be maintained and the use of capital both from within the company or outside the company is good for the company.

15

department must look at every decision the field of advertising (advertising) Could affect financial decisions. Ie if the marketing manager sets the benchmark price is too high for advertising costs while at the time of sale are not fit as expected, this would certainly be a problem. Moreover, if the funds were used to finance advertising sourced from borrowed funds.

These conditions also included in the personnel department. If the personnel manager proposed that no employee salary increases while the quality of the resulting performance is not appropriate as expected. It means that the personnel manager's decision is only unilateral, without thinking of the other side. Because the concept and philosophy of finance is trying to create a balance in each financial. The amount of income must be equal to the amount of expenditure, if not balanced then it is a problem. This case also occurs in the production.

Meanwhile, according to Tampubolon (2013: 3) in carrying out the functions of financial management, corporate objectives are, among others:

a) To achieve the welfare of shareholders, maximum. b) Achieve maximum profit in the period penjang. c) Managerial achieve maximum results.

d) Achieve social responsibility in the sense; improving the welfare of the employees of the corporation.

16

the corporation, in order to reach what is meant by "Full of comitment " or fully committed between employees and corporations.

Financial management functions for the purpose is a process; budget planning (budgeting) starts with forecasting sources of funding (fund source), Organizing activities using funds effectively and efficiently, and to anticipate all risks (risk ability).

d. The purpose of Financial Management

According Irawati (2006: 4) financial management the purpose is to maximize profits and minimize costs in order to obtain a maximum decision-making, in running the company towards development and the company running. The company value means maximizing shareholder wealth, not maximize profit. The sense of maximizing profit, is to ignore social responsibility, ignore the risk, and short-term oriented. While the sense of maximizing shareholder wealth or value of the company as follows:

1. Means to maximize the present value of all future profits to be received by the owner of the company.

2. Means more emphasis on the flow of net income results not just in terms of accounting.

17

According to Horne and Wachowicz Jr. (2012: 4) regarding the management goal is the same as the company's goal of "Maximizing the welfare of the owner of the company that exists today". So it can be concluded that the purpose of financial management is done by financial managers is planned to obtain and use the funds to maximize the company's value. Further Fahmi (2014: 4) there are several goals of financial management, namely,

a) Maximizing the value of the company

b) Maintain financial stability in a state that is always under control c) Minimize the risk of companies in the present and future.

Of the three is the most important goal is the first one that maximizes the value of the company. Understanding of how to maximize the value of the company is the management company is able to deliver maximum value at the time the company is entering the market.

2. Financial Statement Analysis

18

The financial statements is information that describes a company's financial condition, and further information can be used as an overview of the company's financial performance. On the other side of Farid and Siswanto said financial report is information that is expected to provide assistance to users to make economic decisions is financial. Further Munawir21 said "The financial report is a very important tool to obtain information relating to the financial position and the results that have been achieved by the company concerned." By doing so the financial statements are expected to be helpful for users (users) to make the economic decisions that are financial (Fahmi, 2014: 21).

According to Harahap (2013:1) "financial report is media information that summarizes all of the activity of the company". Meanwhile, according to Hendra (2010:5) The financial statements can be interpreted as "a summary of a process of recording of financial transactions, which occurred during the financial year in question and the accountability of management to the internal and external parties of the company, which has a relationship with the company" ,

While Tampubolon (2013: 39) argues financial statements of a corporation generally include the Balance Sheet, Income Statement and Statement of Sources and Uses of Funds. The financial statements used for various purposes. Any use different require different information. Bank to basic lending, will require different information to potential investors. Similarly, the Government through the Tax Office or the economy will require different data.

19

The purpose of this analysis is to identify any weaknesses of the financial situation that may cause problems in the future, and to determine any force that can become a corporate excellence. Besides, the analysis conducted by outsiders corporation can be used to determine the level of credibility or potential for investment. Financial ratio analysis is a major tool in financial analysis, because this analysis can be used to answer a variety of questions about the corporation's financial situation.

3. The capital structure

a. Definition of Capital Structure

According to Brigham and Houston (2012: 24), the optimal capital structure of a company is a structure that maximizes the price of the shares of the company, and this is usually asked a debt ratio lower than the ratio that maximizes earnings per share which are expected. Meanwhile, according to Pouraghajan (2012: 167), the capital structure is one of the effective parameters of the most important in the assessment and direction of economic activities in the capital market.

20

understand how to measure and evaluated leverage, Especially when making capital structure decisions.

Brigham and Gapenski states capital structure or capital structure is the proportion or ratio in determining the fulfillment of corporate spending, whether by cars using debt, equity, or by issuing shares. Meanwhile, according to Keown, et al, the capital structure is a guide or a combination of long-term sources of funds used by the company (Rodoni & Ali, 2014: 129).

Based on expert opinions above, it can be concluded that the capital structure is the proportion in determining the fulfillment of corporate spending, where funds were obtained using a combination or manual source derived from long-term funds consists of two main sources, namely the originating and the and outside the company. Who became the problem of the capital structure of the company is how to quickly integrate the composition of the permanent funds are used to looking for a blend of funds that can minimize the cost of capital and to maximize the stock price. This is the final destination of the capital structure, the composition of the most optimal source of financing.

b. Theories of Capital Structure

21

combination of debt and equity in the company's long-term financial structure. In an empirical study leverage is defined as a measure which indicates the extent of the use of debt to finance the company's assets. Meeting the needs of the fund can be obtained through the company's internal and externally. Form of funding internally (internal financing) Is retained earnings and depreciation. Fulfillment is done externally can be divided into debt financing (debt financing) And equity financing (equity financing). Debt financing can be obtained through loans, whereas equity capital by issuing new shares. Capital structure theory to explain whether there is influence changes in capital structure to the company's value, if investment decisions and dividend policy are held constant. If only partially replace equity firms with debt or debt to replace a company's own capital, then if the stock price will change, if the company does not change other financial decisions.

22

Composition is not optimal debt and equity will reduce the profitability of the company and vice versa. Determination of capital structure are the measures taken by the management in order to obtain funding sources that can be used for operational activities of the company. The decision taken by Brigham (2014: 66) by the management in the search for the source of these funds is strongly influenced by the owners / shareholders. In accordance with the company's main goal is to increase the prosperity of our shareholders, so any policy to be taken by the management are always influenced by the wishes of the shareholders. After the capital structure is determined, then the next company will use the funds raised for the company's operations. Operational activities of the company is said to be beneficial if return obtained from the results of these operations is greater than the cost of capital (Cost of Capital); where the cost of capital is a weighted average of the cost of funding (cost of funds) Which consists of the cost (interest) loans and the cost of equity capital.

23

According Riyanto (2001: 297) suggests there are several factors to consider in the capital structure. These factors include:

1. Interest Rate

The interest rate will affect the selection of what kind of capital to be withdrawn, whether the company will issue shares or bonds.

2. Stability of "Earnings"

Stability and magnitude of "earnings" obtained by a company will determine whether the company is justified to attract capital with fixed load or not. A company that has "earnings" stable will always be able to meet its financial obligations as a result of the use of foreign capital. Instead the company that has the "earnings" unstable and "unpredictable" will bear the risk of not being able to pay interest expenses or can not pay the debt installments in the years or bad circumstances.

3. Composition of Assets

Most companies in the industry where most of the capital embedded in fixed assets (fixed assets), will give priority to meeting the needs of capital permanent capital, ie equity, while foreign capital is complementary in nature. It can be connected with the rule that horizontal conservative financial structure which states that the amount of own capital should at least be able to cover the amount of fixed assets plus other assets that are permanent.

4. Levels of Risk Assets

24

risk. Principle aspects of the risk of stating that if there is a risk sensitive assets, then the company should be more finance with its own capital, which is resistant risk capital, and where possible reduce the expenditure by foreign capital or capital are afraid of risk.

5. The amount of Total Capital Required

If the amount of capital required is very large, it is necessary for the company to issue some classes of securities together, while for the company, which needs capital that is not so big enough to just pull out one class of securities only.

6. The State of Capital Markets

Capital market conditions often change due to the conjuncture waves. In general, if the rising wave of investors more interested to invest in stocks.

7. Nature of Management

The nature of management will have a direct influence in decisions about how to meet the needs of funds.

8. Company size

25 9. Stability Sales

A company whose sales are relatively stable can safely take on more debt and the burden remains higher than companies with sales unstable.

10. Risk Business

Business risks or risks inherent to the operation of a risk if the company does not use debt. The higher the company's business risk, the lower the optimal debt ratio.

11. Operating Leverage

If other things being equal, companies with fewer operating laverage have better skills and apply financial leverage because the company would have a smaller business risk.

12. Growth Rate

If other things being equal, a company that grew rapidly to be more reliant on external capital.

13. Profitability

We often observe that companies that have a rate of return on investment is very high use relatively little debt.

14. Tax

26 may decide to use the equity if the company's financial situation is so weak that the use of debt may pose a risk of default.

c. The Modigliani-Miller Model

According to Priscilia (2014:14) Modigliani and Miller found in a state of perfect markets, the use of debt is irrelevant to the value of the company, but with the tax payable will be relevant. However, the study Professor Franco Modigliani and Merton Miller Professor is based on a number of unrealistic assumptions, among others:

1) No brokerage fees (brokerage). 2) No taxes.

3) There is no bankruptcy costs.

4) Investors can borrow at a rate equal to the company.

5) All investors have the same information as the management company of the investment opportunities in the future.

6) EBIT is not affected by the use of debt.

27

entirely financed with debt. Results of the study Professor Modigliani and Miller irrelevant also depends on the assumption that there are no bankruptcy costs.

However, in practice, the cost of bankruptcy can be very expensive. Bankrupt company has legal and accounting costs are very high, and difficult to retain customers, suppliers and employees. According to Brigham (2014: 71), a bankruptcy-related problems tend to arise when companies use more debt in their capital structure.

If the cost of bankruptcy increasingly large, profit levels required by shareholders is also higher. Debt capital costs will also be higher because the lender will charge a higher interest rate to compensate for the increase in the risk of bankruptcy. Therefore, the company will continue to use debt if the benefits payable (tax savings from debt) is still greater than the cost of bankruptcy. If the cost of bankruptcy is greater than the tax savings from debt, the company will company will determine the hierarchy of sources of funds are the most preferred. In summary, according to Brigham (2014: 73) The theory states that:

28

If external funding (external financing) Is required, the company will issue a securities most "safe" first, beginning with the issuance of bonds, followed by securities were characterized options (such as convertible bonds), new end if still insufficient, the new shares issued. Implication pecking order theory is the company does not establish an optimal capital structure, but the company established a policy priority funding sources. Pecking order theory explain why firms profitable (favorable) generally borrow in small amounts. This is not because the company has the target debt ratio Low, but because it requires external financing slightly.

29

e. The Trade off Model

According to Gitman (2012: 88), models trade-offs Assuming that the company's capital structure is the result trade-offs of the tax advantage by using debt at a cost that would result from the use of the debt. Essence the trade-off theory the capital structure is balancing the benefits and sacrifices that arise as a result of the use of debt. As far greater benefits, additional debt is allowed. If the sacrifice for a greater use of debt already, then the additional debt is not allowed.

The conclusion is the use of debt will increase, but only on the value of the company up to a certain point. After that point, the use of debt actually reduce the value of the company. Although models the trade-off theory can not accurately determine the optimal capital structure, but the model provides an important contribution, namely;

a) Companies that have high assets, you should use less debt.

30

f. Agency Theory

According to Horne and Wachowicz (2008: 423), one opinion in agency theory is whoever raises supervision costs, expenses incurred must be the dependents of shareholders. For example, bondholders, as it anticipates the cost of supervision, charge higher interest. The greater the chances of the emergence of supervision, the higher the interest rate, the lower the value of the company in the eyes of shareholders. The costs incurred will affect the capital structure policy are taken by the company.

To be able to perform its function properly, management should be given incentives and adequate supervision. Control can be done through means such as binding agents, examination of the financial statements and restrictions on management decisions can be taken. Surveillance activities of course cost money called agency costs. Agency costs are the costs associated with management oversight to ensure that management acts consistent with contractual agreements with the company's creditors and shareholders.

31

the costs associated with management oversight. This will affect the level of debt the company becomes larger along with the increasing cost of supervision.

4. Factors Affecting Capital Structure

Horne and Wachowicz (2008: 430), the factors affecting capital structure, among others; interest rate, stability of income, asset composition, asset risk levels, the large amount of capital required, the state of capital markets, management properties, the size of a company. One of the functions of financial manager is to meet funding needs. In doing these tasks a financial manager confronted the presence of a variation in spending, in the sense that sometimes the company better to use funds from debt (debt), But sometimes a company better if you use funds from their own capital (equity). Therefore, the financial manager in the operations need to be trying to meet a specific target on the balance between the amount of debt and the amount of equity capital that is reflected in the company's capital structure.

a. Liquidity

1) Definition Liquidity

32

well as in the company (the company's liquidity). Thus, one can say that. the usefulness of this ratio is to determine the company's ability to finance and fulfill obligations (debt) at the time billed.

According Kieso, Weygandt, and Warfield (2010: 190), is the liquidity is "Liquidity describes "the amount of time that is expected to Elapse until an asset is Realized or otherwise converted into cash or until a liability has to be paid.

"Which means that liquidity describes the amount of time expected to be achieved until the asset is realized or converted to cash or to the obligation to pay.

Meanwhile, according to James O. Gill in Kashmir (2014: 130) mentions the liquidity measures the amount of cash or number of investments that can be converted or converted to cash to pay expenses, bills, and all other obligations that have matured. Liquidity or often also referred to as the working capital ratio is the ratio used to measure how its liquid a company. The trick is to compare components in balance, ie total current assets to total current liabilities (short-term debt). Assessment can be done for some period so visible development company liquidity from time to time.

33

sell. To sell the building and the land is not only necessary match the price, but also to look for interested buyers.

Components of current assets, cash and securities seen as liquid assets. Receivables at risk and maturity structure different. To convert receivables into cash (factoring) requires a buyer. Because of the risk and maturity in receivables, of course, buyers are only willing to buy at a price which is lower than the value of the receivables. Therefore, to convert receivables into cash is needed pieces (discounted) Of the value of the receivables, or have to wait until the receivables due. Thus receivables are considered less liquid than the Cash and Securities.

Meanwhile, according to Hery (2015: 150) the liquidity ratio is the ratio that indicates the company's ability to meet obligations or to pay short-term debt. In other words, the liquidity ratio is the ratio that can be used to measure how far level company's ability to repay short-term liabilities that is due soon. If the company has the ability to repay short-term liabilities at due then the company is said to be a company that is liquid. Conversely, if the company does not have the ability to repay short-term obligations at maturity, the company is said to be a company that is not liquid. To meet short term obligations are due soon, the company must have a level of availability of a good amount of cash or other current assets which can quickly be converted, or converted into cash.

34

Measurement and evaluation of this ratio can be done for some period in order to see the development of the company's liquidity level conditions from time to time (Hery, 2015: 150).

There are two results of the assessment of the measurement of liquidity, ie if the company is able to meet its obligations, the company said in a liquid state. Conversely, if the company is unable to meet these obligations, the company said in an illiquid.

2) Objectives and Benefits of Liquidity

According to Kashmir (2014: 132-133) the purpose and benefits of liquidity are as follows:

a) To measure a company's ability to pay obligations or debt immediately due when billed. That is, the ability to pay obligations it is time paid according to schedule predetermined time limit (date and specific month).

b) To carve the company's ability to pay short-term liabilities with current assets overall. That is the amount of the obligation under the age of one year or equal to one year, compared with total current assets.

c) To measure a company's ability to pay short-term liabilities with current assets regardless of dosage or receivable. In this case the current assets less stocks and debt considered lower liquidity.

d) To measure or compare the amount of preparation that exists with the company's working capital

35

f) As a means planning ahead, especially with regard to cash planning and debt.

g) To see the conditions and the company's liquidity position over time by comparing it to some period.

h) To see the weaknesses of the company, of each component in current assets and current liabilities.

Being a trigger tool for the management to improve its performance, by looking at the ratio of liquidity that exists at the moment.

Meanwhile, according to Hery (2015: 151) liquidity ratio provides many benefits to the parties concerned. The liquidity ratio is not only useful for the company alone, melainkanjuga for pihakluar company. In practice, there are many benefits that can be derived from the ratio of liquidity, both for the owner of the company, the company's management, as well as other stakeholders related to the company, such as investors, creditors, and suppliers.

36

interest. Creditors and suppliers will usually provide loans or credits to companies that have good liquidity.

Here are the objectives and benefits of the overall liquidity ratio:

a) To measure the company's ability to pay its obligations or debt that will soon be due.

b) To measure the company's ability to pay short-term obligations by using the total current assets.

c) To measure the company's ability to pay short-term obligations by using very smoothly assets (without taking into account merchandise inventory and other current assets).

d) To measure the level of availability in the company's cash to pay short-term debt.

e) As a financial planning tool in the future, especially with regard to the planning of cash and short-term debt.

f) To see the conditions and the company's liquidity position over time by comparing it during some periode (Hery, 2015:151).

3) Type Liquidity Ratio

According Tampubolon (2013: 40) determines the level of corporate liquidity liquidity ratios are used, among other things:

1) Current Ratio 2) Quick Ratio

37

In this study the authors used or Current Ratio Current Ratio. According to Hery (2015: 152) The current ratio is the ratio used to measure a company's ability to meet its short term obligations are immediately due to the use of total current assets available. In other words, the current ratio describes how large amount of available liquid assets of the company as compared to total current liabilities. Therefore, the current ratio is calculated as the quotient between total current assets to total current liabilities.

Companies must continuously monitor the relationship between the magnitude of current liabilities with current assets. This relationship is especially important to evaluate the company's ability to meet its short-term liabilities using current assets. Companies that have more current liabilities than current assets, the company typically will experience liquidity problems when its current liabilities due.

b. Profitability

1) Understanding Profitability

38

company within a certain time frame, either decrease or increase, while searching for the cause of these changes.

Meanwhile, according to Hery (2015: 192) Profitability ratio is the ratio used to measure a company's ability to generate earnings from normal business activity. The Company is an organization that operates with the goal of making a profit by selling products (goods and / or services) to its customers. Operational goal of most companies is to maximize profits, both short-term profit and long-term profit. Management is required to improve yields (returns) to the owner of the company, as well as to improve the welfare of employees. This all can only happen if the company makes a profit in its business activities.

2) Objectives and Benefits Profitability

Profitability also has a purpose and benefit, not only for the business owner or management, but also for parties outside the company, especially those who have a relationship or interest with the Company.

According to Kashmir (2014: 197-198) the intended use for the company's profitability, as well as for parties outside the company, namely:

a) to measure or calculate the profits from the company within a certain period;

b) to assess the company's earnings position of the previous year with the current year;

c) to assess the profit development from time to time;

39

e) to measure the productivity of the entire fund company that used both loan capital or equity capital;

f) to measure the productivity of the entire fund company used both its own capital;

g) and other destinations

h) Meanwhile, the benefits are to:

i) determine the level of profits from the company during the period;

j) know the position of the company's profit the previous year with the current year;

k) know the profit development from time to time;

l) determine the magnitude of net profit after tax with their own capital; m) determine the productivity of the entire fund company that used both loan

capital or equity capital. Other benefits.

40

Here are the objectives and benefits of profitability ratio according to (Hery: 192-193) as a whole:

a) To measure the company's ability to generate profits for a certain period. b) To assess the company's earnings position of the previous year with the

current year.

c) To assess the earnings growth over time.

d) To measure the amount of net income that will be generated from any embedded Emitter rupiah fund's total assets.

e) To measure the amount of net income that will be generated from every rupiah of funds that are embedded in total equity.

f) To measure the gross margin on net sales.

g) To measure the operating profit margin on net sales. h) To quantify the net margin on net sales.

3) Types of Profitability Ratios

41

funds that are embedded in total assets. This ratio is calculated by dividing net income to total assets. The higher the return on assets means the higher the amount of net profit generated from each rupiah funds that are embedded in total assets. Conversely, the lower the return on assets means that the lower the amount of the net profit generated from each rupiah funds that are embedded in total assets.

c. Solvency

1) Solvency Definition

According to Kashmir (2014: 151) solvency or leverage is used to measure the extent of the company's assets are financed with debt. That is how much the debt burden borne by the company as compared to its assets. In a broad sense it is said that solvency is used to measure a company's ability to pay all its obligations, both short term and long term if the company is dissolved.

42

According Munawir (2004: 32) "solvency demonstrate the capacity or ability of the company to pay off its debts, both short-term and long-term if the company is liquidated". A company that solvable means the company has equity or capital sufficient to pay off all his debts. Conversely, companies that are not solvable means the company has insufficient capital to pay off the debt so that the company will have difficulties to obtain additional loans from creditors before the company adds to its own capital. This situation led to the company is difficult to hold the expansion and increased production.

According to Harahap (2009: 306), the leverage ratio is a ratio that measures how much the company is financed by a liability or an outside party with the ability of companies represented by equity. According to RJ (2010: 331), the leverage ratio is a ratio that measures how far the company dibelanjai with debt. In a broad sense it is said that the solvency ratio (leverage ratio) was used to measure a company's ability to pay all its obligations, both short term and long term if the company is dissolved. If the ratio is high then the fund with more and more debt, making it difficult for companies to obtain additional loans because the company feared not being able to cover its debts with assets owned, with a low ratio of the smaller companies are financed with debt.

43

a) Creditors expect equity (funds provided by the owner) as a safety margin. Meaning that if the owner has a small fund as capital, the biggest business risk to be borne by creditors.

b) By procuring funds through debt, the owners benefit, in the form of still retained possession or control of the company.

c) If the company gets more revenue from funds loaned compared with the interest to be paid, the return to the owner enlarged.

In practice, if the results of the calculation, the company proved to have a high solvency, this will impact the emergence of a greater risk of loss, but also there are also great opportunities for profit. Conversely, if the company has a lower solvency ratio would have a smaller risk of loss as well, especially when the economy declines. This impact also resulted in low levels of the return (return) when the economy is high.

Therefore, financial managers are required to manage the solvency ratio well so as to balance the returns with a high degree of risk. Should be observed also that the size of this ratio is highly dependent on loans owned by the company, in addition to its assets (equity).

Measurement solvency or leverage is done through two approaches, namely:

44

2) Objectives and Benefits of Solvency

According to Rivai (2013:264) The purpose and benefits of solvency ratios are: a) To assess and determine the ability of the company's position on the

obligations of the other party;

b) To assess and determine the company's ability to fulfill permanent obligation;

c) To assess and determine the balance between the value of assets, especially fixed assets to capital;

d) To assess and determine how much the company's assets are financed by debt;

e) To assess and determine how much debt the company affecting the management of assets;

f) To assess and determine or measure how much a part of every penny of their own capital as collateral long-term debt;

g) To assess and determine how many loans that would soon be billed there are so many times their own capital.

45

i) Financial managers are expected to carefully decide and adopt policies that may be necessary to balance the existing alternative sources of financing, which is between financing through debt financing through the capital.

3) Type Solvency Ratio

In this study, the solvency ratio used in this study was Debt to Equity Ratio (DER) According Darsono and Ashari (2005: 54), "Debt to Equity Ratio is the ratio that indicates the percentage of the provision of funds by the shareholders to the lender". The higher the ratio, the more endah corporate funding provided by the shareholders. From the perspective of the ability to pay long-term liabilities, the lower the ratio, the better the company's ability to pay long-term liabilities.

c. Company Size

1) Understanding Company Size

Company size is the amount of assets owned by the company. According to Horne and Wachowicz (2008: 745), a measure to determine the size of the company is the natural log of total assets.

46

5. The Effect of Independent Variables to Dependent Variables

a. Effect of Liquidity on Capital Structure

Liquidity is the ability of a company to fulfill his obligations. The liquidity ratio can be described in a Current Ratio. Current ratio describes the ratio between current assets by current liabilities. The greater the company's liquidity ratio indicates the greater the company's ability to meet its obligations (Nugrahani & Sampurno, 2012).

b. Effect of Profitability on Capital Structure

47

c. Effect of Solvency on Capital Structure

When a company has a high solvency, these companies have to lower the cost of financial difficulties. So for companies that have high solvency, tax shield effects must be invaluable. As a result, from the point of view tax shield effects

and low distress costs, theoretically, a high solvency company can borrow more and has a high debt ratio (Tsuji, 2013). From the standpoint of agency costs Jensen suggests companies that have high solvency, the tendency to face the problem of free cash flow is severe and should have more debt must be disciplined by debt. So according to the agency theory, the ideal relationship between the company's solvency and debt ratios must be positive (Tsuji, 2013),

d. Effect of Firm Size on Capital Structure

48

B. Previous Research

Research conducted Kajananthan, (2013) with the title of research Liquidity and Capital Structure: Special reference to Sri Lanka Telecom Plc indicates that liquidity has a significant impact on the debt to equity in the capital structure.

Chikashi Tsuji (2013) with the title of research Corporate Solvency and Capital Structure: The Case of the Electric Appliances Industry Firms of the Tokyo Stock Exchange shows that there is a negative relationship between the company's solvency capital structure of Electric Appliances Industry Firms of the Tokyo Stock Exchange.

51

C. Framework

Figure 2.1

Theoretical Framework

Effect of Liquidity, Profitability, Solvency and size of the Company's capital structure to the Company Registered in LQ45

in the period from 2010 to 2014

Descriptive Analysis

Classic assumption test: Normality Test Multicollinearity Test

Autocorrelation Test Heteroskidastity Test

Regression Analysis

Coefficient of Determination

T Test F Test

Conclusion Liquidity

Profitability Solvability

Firm Size

52

D. Hypothesis

The hypothesis of this study is a brief statement concluded from a literature review and an interim analysis of the problems that need to be tested back. One hypothesis would be acceptable if the results of the analysis of empirical data to prove that the hypothesis is true, and vice versa.

H0: b1 = 0 that there is no influence current ratio the capital structure. Ha: b1 # 0 that there are significant current ratio the capital structure. H0: b2 = 0 that there is no influence return on assets the capital structure. Ha: b2 # 0 that there are significant return on assets the capital structure. H0: b3 = 0 that there is no influence debt ratio the capital structure. Ha: b3 # 0 that there are significant debt ratio the capital structure.

H0: b4 = 0 that there is no influence on the size of the company's capital structure.

Ha: b4 # 0 that there is the influence of the size of the company on the capital structure.

H0: b1 ... b4 = 0 that there is no influence current ratio,return on assets,debt ratio and the size of the company simultaneously on the capital structure.

53

CHAPTER III

RESEARCH METHODOLOGY

A. The scope of research

The scope of this study is to analyze about the influence current ratio, Return on assets, debt ratio and the size of the company the capital structure of listed companies in LQ 45 period 2010-2014. While the types of data used in this study are secondary data from the financial statements of 2010-2014.

B. Sampling Method

1. Population

Understanding population according Riadi (2015: 16) is the totality of all possible values can be calculated or measured, both quantitatively and qualitatively to the particular characteristics of the complete set of objects and clearly want to learn its properties. Position in a study population holds a very important role because it is this population that will be subject to generalization. The population studied was companies listed in LQ45 the observation period 2010 to 2014.

2. Samples

54

population From the figure above shows that the majority of the population has not been said to be a sample if it has not been through the proper sampling method (Riadi, 2015: 17). Meanwhile, according to Wiratna (2014: 65) The sample is part of the number and characteristics possessed by this population. When a large population, and researchers may not learn all that there is in the population, for example, because of limited funds, manpower and time, the researchers can use the sample drawn from that population. The sampling technique used was purposive sampling is a technique used in determining the sample with particular consideration Sugiyono, (2014: 98). The criteria specified in the sampling are as follows:

a) Companies registered in LQ45during the observation period, b) The company never delisting during the observation period,

c) Companies that publishes financial statements denominated in rupiah d) The company has the complete data regarding the financial statements

during the period of observation. The aim is to simplify the research process.

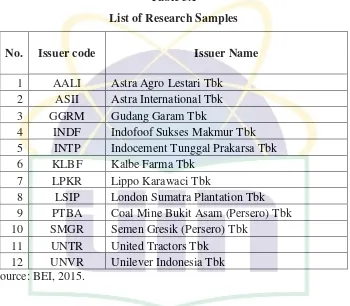

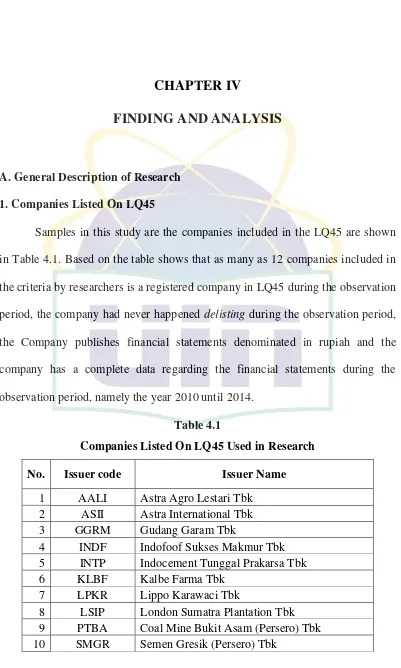

Thus, in this study obtained the number of samples that have been compared with those criteria are as follows:

The number of companies listed in LQ45 45

The Company does not have the data in the observation period

39

Companies delisting from LQ45 16

Companies that publishes financial statements denominated in rupiah

12

55

Table 3.1

List of Research Samples

No. Issuer code Issuer Name

1 AALI Astra Agro Lestari Tbk 2 ASII Astra International Tbk

3 GGRM Gudang Garam Tbk

4 INDF Indofoof Sukses Makmur Tbk 5 INTP Indocement Tunggal Prakarsa Tbk

6 KLBF Kalbe Farma Tbk

7 LPKR Lippo Karawaci Tbk

8 LSIP London Sumatra Plantation Tbk 9 PTBA Coal Mine Bukit Asam (Persero) Tbk 10 SMGR Semen Gresik (Persero) Tbk

11 UNTR United Tractors Tbk 12 UNVR Unilever Indonesia Tbk Source: BEI, 2015.

C. Data Collection Methods

56

collector. The data collected by the authors is in the form of financial statements audited by independent auditors.

According to the data source data used is secondary data. Data obtained indirectly because researchers took through an intermediary medium (obtained and recorded by the other party). Secondary data in general form of evidence, records and historical reports that have been arranged in the record that may be published or which cannot be published. Secondary data used by the authors is obtained from www.idx.co.id. The data is taken from the company's financial reporting data related to research using the period 2010-2014.

D. Data Analysis Methods

Methods of data analysis performed in this study using the program Statistical Package for Social Science (SPSS). From the results of data collection and then the data is processed so that the information that occurs is easier to be interpreted and analyzed further in accordance with the form of discussions analysis techniques used.

1. Testing Assumptions Classic

a. Normality Test