The Optimization of Capital Structure in Maximizing Profit and Corporate Value

Teks penuh

Gambar

Dokumen terkait

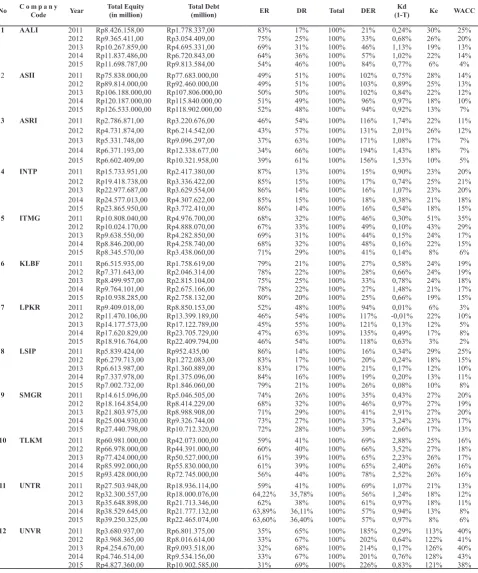

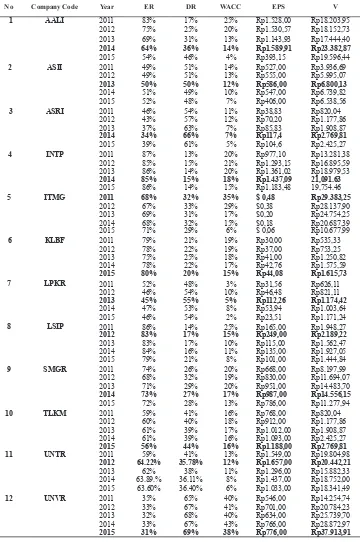

This research measures capital structure through two indicators, which are debt to assets ratio (DAR) and debt to equity ratio (DER), because both ratios shows the

The results of this test can be concluded that the independent variable such as working capital to total assets, debt to equity ratio and inventory turnover ratio

With the ratio of capital structure determinants, which are profitability, asset tangibility , growth rate, firm size, and non-debt tax shield, it makes manufacturing companies to

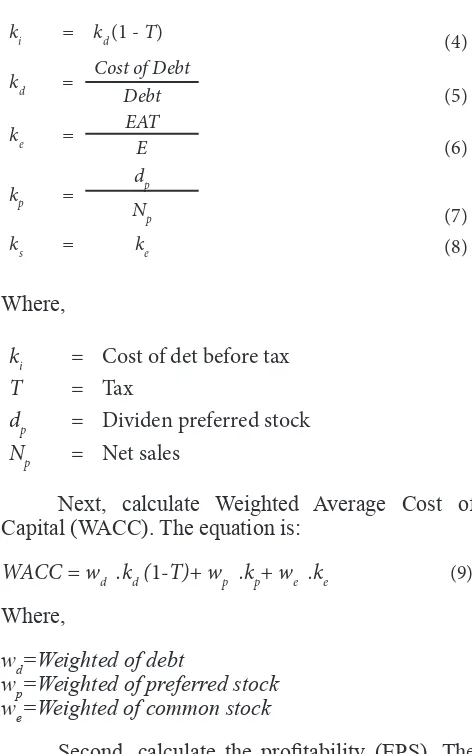

Table 1: Research Variables and Description of Measurements Dependent variables Operational Definition Capital Structure Debt to asset ratio DAR Total debt / total assets x 100

This study used Debt to Asset Ratio DAR and Debt to Equity Ratio DER to see the capital structures of manufacturing companies listed on the Indonesia Stock Exchange BEI from 2015 to

But in the last decades, several theories have emerged explaining firms’ capital structure and the resultant effects on their market values such as the pecking-order theory,the

H2: Capital structure is positively impacted by CEO’s overconfidence Capital Structure’s Effect on Firm Performance Companies utilize a combination of debt and equity ratios called

Specifically, the study sought to establish the effect of short term debt ,long term debt, internal equity and external equity capital on profitability of insurance firms listed at