Introduction of three essays

However, I find that external uncertainties moderate the negative association between accounting conservatism and firm environmental performance. This indicates that managers intend to use accounting conservatism as an alternative strategy for dealing with employees. This paper will explore the impact of accounting conservatism on innovation inputs (R&D costs) and outputs (patents and patent citations) and the mechanisms that explain the dynamic relationship between accounting conservatism and corporate innovation.

Literature review

- Definition of accounting conservatism

- Rise of accounting conservatism

- Classification of accounting conservatism

- The impact of accounting conservatism

- The direction of this paper on studying accounting conservatism

Accounting conservatism reduces information asymmetry and potential net loss, thereby increasing firm value and equity (Lin et al., 2014). For accountants, accounting conservatism can improve the reliability and verifiability of financial reporting (Ruch & Taylor, 2015). Therefore, this study will extend the literature on the role of accounting conservatism in corporate policy formation.

Essay one

Introduction

Through mechanism analysis, I find that a possible mechanism affecting the relationship between accounting conservatism and the environment. Therefore, I further examine the impact of environmental uncertainty on the relationship between accounting conservatism and environmental performance. In the heterogeneity analysis, I find that market competition has moderate effects on accounting conservatism and environmental performance.

Hypothesis development

- Accounting conservatism

- Adopting account conservatism as a mechanism to satisfy investors and financial

- Environmental performance

- Accounting conservatism and environmental performance

Third, our study has important policy implications. In the baseline regression, I find that firms tend to substitute accounting conservatism for environmental performance. High level of accounting conservatism can lead to high or low environmental performance based on different theories. On the other hand, high accounting conservatism can lead to low environmental performance according to resource dependence theory.

Data and methodology

- Sample construction

- Variable construction

- Methodology

As a result, managers may make trade-offs to access financial resources and rely only on accounting conservatism rather than both accounting conservatism and environmental performance, if possible. Listed firms' social responsibility reports and their annual reports are assessed by Hexun based on the framework of interest group theory. Based on the above provisions, referring to Xu et al. 2020), I construct a comprehensive environmental disclosure measurement, covering four dimensions, e.g. legal awareness, social evaluation, eco-friendly production and green management, and 11 sub-indicators.

As a third metric, I use cost/sales, which is environmental performance expenditure divided by sales and multiplied by 1000. Therefore, environmental investment is more long-term oriented compared to environmental expenditure. 2021), I use environmental investment as the fourth variable to measure environmental performance. An important characteristic of the quality of accounting information is accounting conservatism, which requires more timely disclosure of negative news and delay in the disclosure of positive news (Basu, 1997).

Where 𝑋𝑖 is the earnings per share divided by the share price at the beginning of the period; 𝑅𝑖 is the stock return of company i in a given year; 𝐷𝑖 is a dummy variable equal to 1 if 𝑅𝑖 is less than 0, and 0 otherwise. By then entering them into equation (3), the CScore (𝛽3) for the accounting conservatism over the entire year can be calculated, which is the measure of accounting conservatism in this study. To ensure that the results are accurate, I also control other variables that may influence environmental performance based on the literature (Anagnostopoulou et al., 2021; Cho et al., 2020; Pan & Zhang, 2021).

These factors include a dummy variable equal to one if a firm's ultimate controller is a government agent or a state-owned enterprise (SOE), and 0 otherwise; Market value to accounting of listed companies (M/B Ratio); sales growth (Sales Growth); leverage ratio (LEV); firm size, calculated as the natural logarithm of total assets (Size); R&D expenses scaled by Sales (R&D/Sales); profitability calculated as net profit after tax on total assets (ROA); shares of the largest shareholder (Top1); the logarithm of the number of board of directors (Board Size); the ratio of the number of independent directors on the board (Independence of the Board); a dummy variable if a listed company employs a Big-4 international auditing firm, and 0 otherwise (Big 4); and provincial GDP growth where a listed firm is headquartered (GDP Growth Rate).

Empirical Results

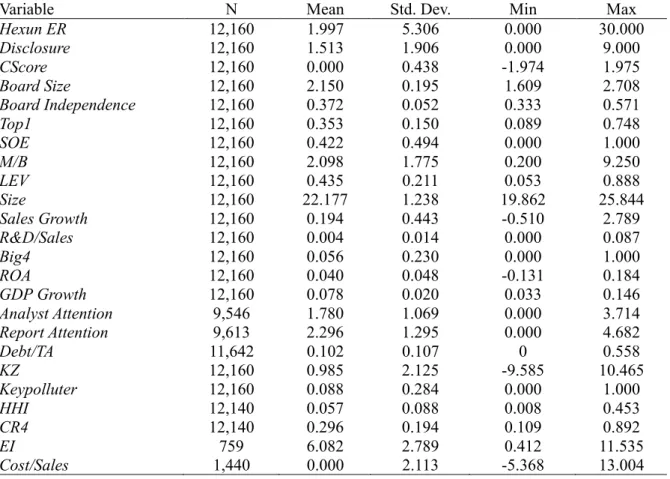

- Descriptive Statistics

- Baseline regression

- Potential channels through accounting conservatism on corporate environmental

- The impact of environmental uncertainty

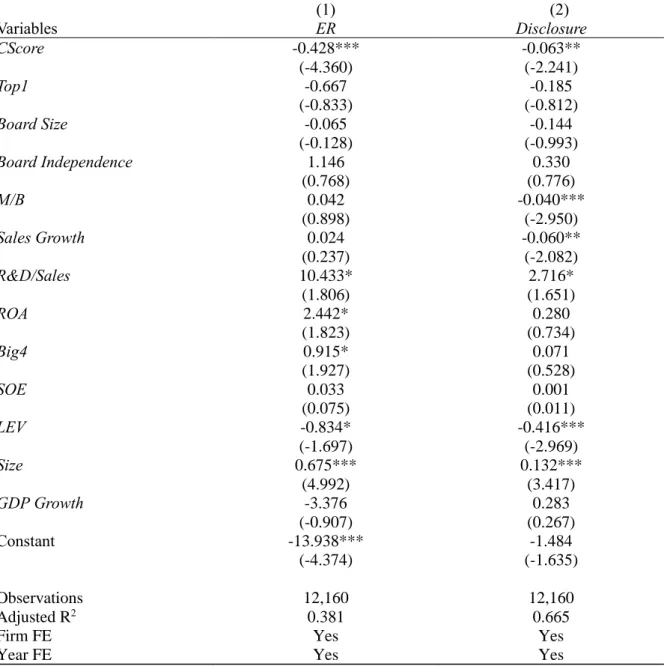

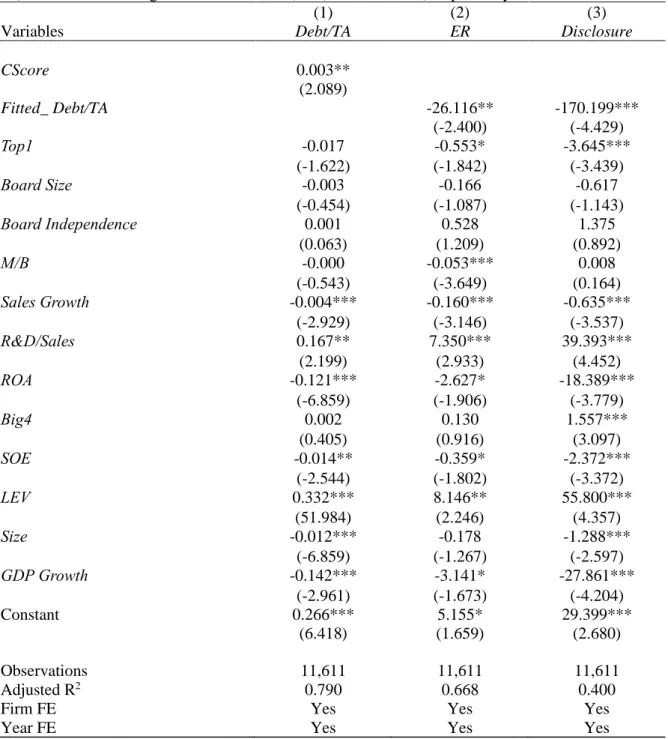

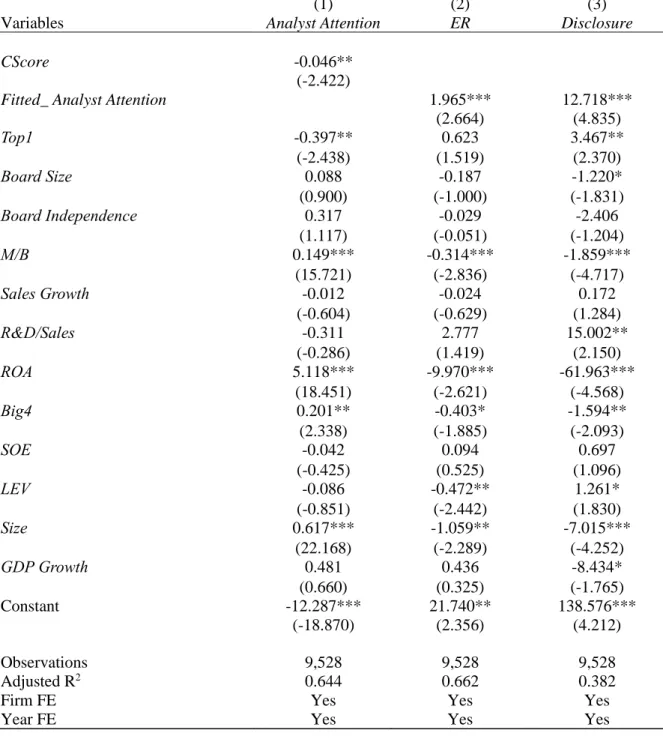

The results of the basic regression are presented in Table 1.2 Columns (1) and (2) show that both indicators of environmental performance are all negatively related to accounting conservatism. Therefore, I adopt the 2SLS approach to explore the mediating role of short-term creditor pressure on accounting conservatism and environmental performance. Therefore, I hypothesize that analyst attention is a channel for firms with high accounting conservatism to decrease their environmental performance.

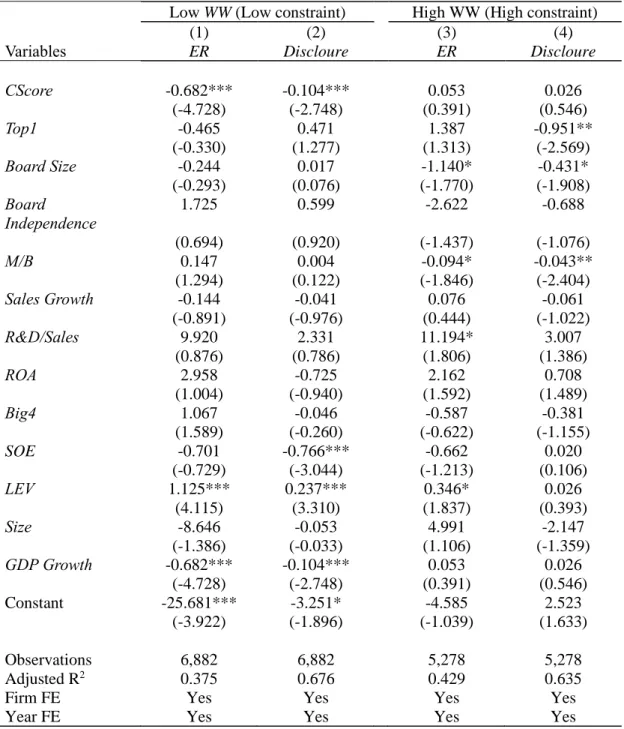

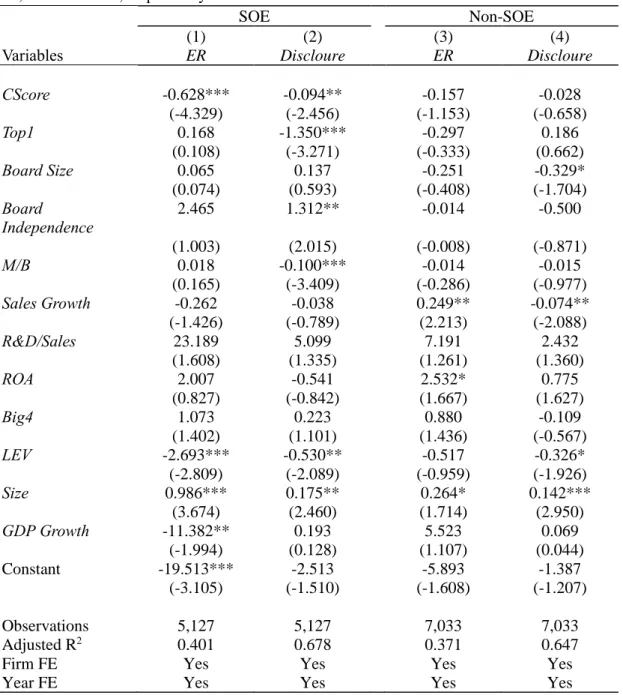

Therefore, I hypothesize that environmental uncertainty can change firms' strategies for accessing external resources and thus affect the relationship between accounting conservatism and environmental performance. I find that the relationship between accounting conservatism and environmental performance becomes insignificant when firms face severe financial constraints. The relationship between accounting conservatism and a firm's environmental performance may be different for key polluters and non-key polluters.

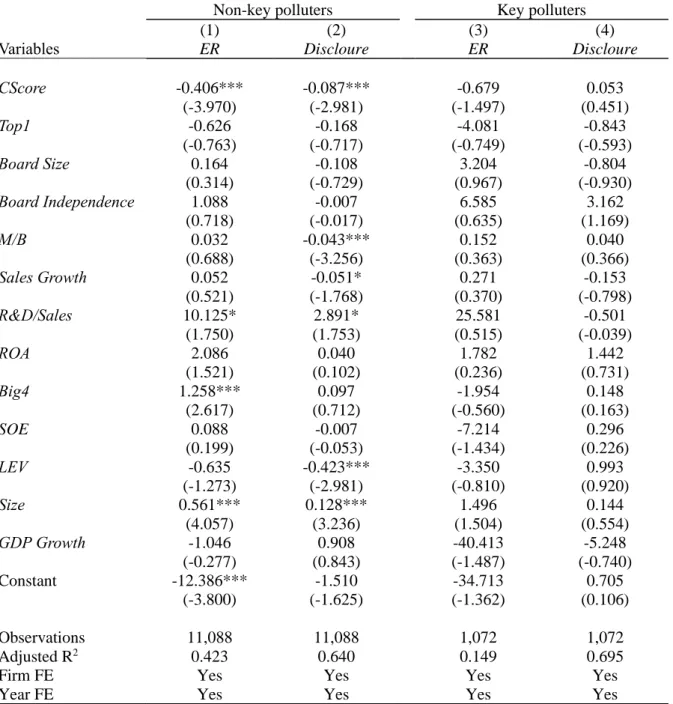

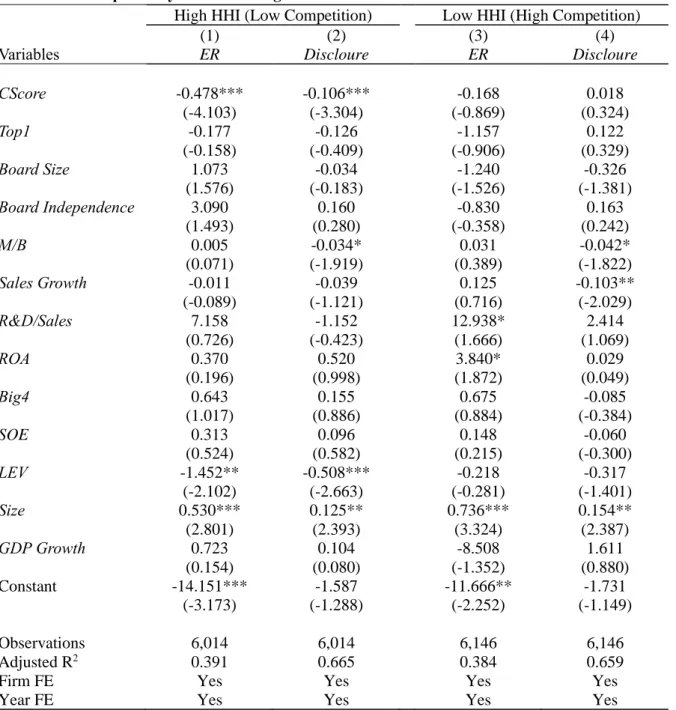

Therefore, I assume that under the pressure of political regulation, the negative correlation between accounting conservatism and environmental performance will no longer become significant. It can be seen that the negative correlation between accounting conservatism and environmental performance no longer becomes significant for key polluters. Panels A and B in Table 1.8 show the relationship between accounting conservatism and environmental performance in high and low industry competition.

I find that when industry competition is high, the negative correlation between accounting conservatism and environmental performance becomes insignificant, confirming the above theory.

Robustness Check

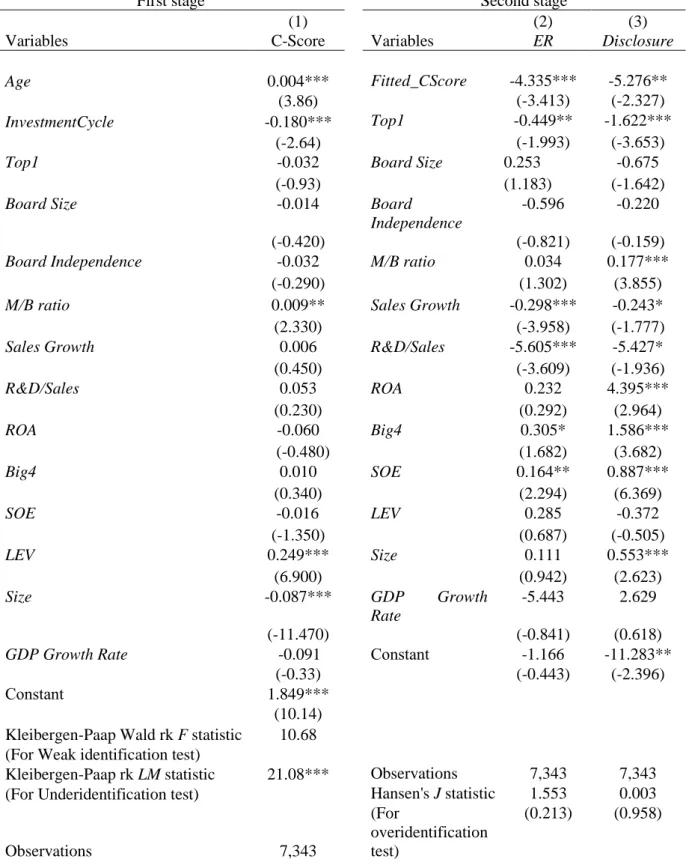

Therefore, I expect that in a highly competitive industry, managers will not reduce environmental performance even when engaging in high accounting conservatism. CR4 is the sum of the market share (revenue) of the four largest major enterprises in a relevant market of an industry. The result is shown in column (1) of table 1.9. Age is positively related to Cscore and Investment Cycle is negatively related to Cscore (both coefficients are statistically significant at the 1% level).

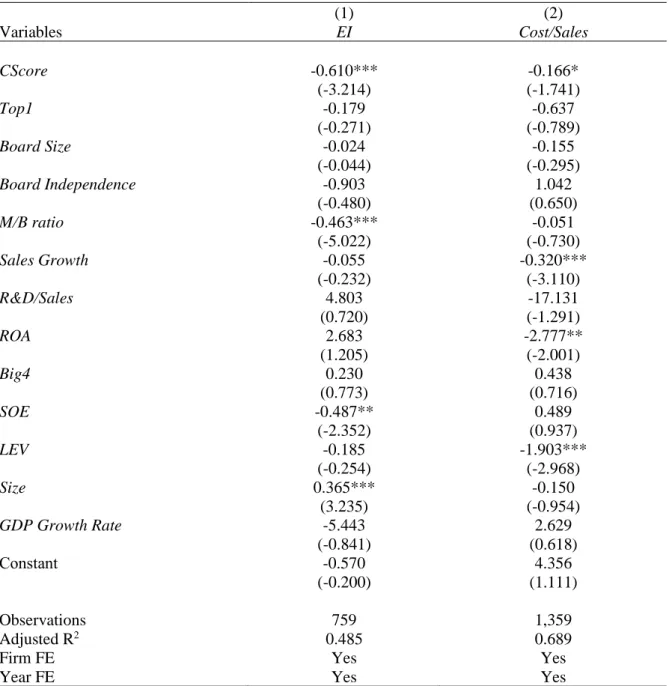

Then, the fitted value of the first-stage regression is collected and used as the independent variable in the second-stage analysis. To avoid errors due to measurement methods, I use two alternative indicators of environmental performance to reestimate our baseline regression. Corporate environmental investment, denoted as EI, is calculated as the natural logarithm of the company's environmental investment plus 1, with data collected from the CSMAR database.

Unlike environmental costs, a company's investment behavior is a function of expected future profitability (Khan et al. 2016). It can be seen that accounting conservatism is still negatively related to the adopted alternative measures of environmental performance. The baseline regression takes into account the influence of unobserved firm characteristics and time-varying heterogeneity, thus controlling for firm and year fixed effects.

It shows that accounting conservatism is still significantly negatively related to environmental performance indicators after controlling for several fixed effects.

Conclusion

Essay two

Introduction

Although the literature shows that employee well-being measures are useful for improving employees' sense of satisfaction, morale, and motivation (Yang, Lin & Maresova, 2021; Wang, Dai, & Kong, 2021), according to the hierarchy of needs theory Maslow, satisfying employees. Career security needs may be a substitute in employee strategies compared to self-actualization needs (Jerome, 2013). Accounting conservatism ensures the interests of employees by reducing employee concerns about the company's performance by limiting the verifiability of earnings (D'Souza, Jacob & Ramesh, 2001). Therefore, managers may choose accounting conservatism as an employee replacement strategy for employee welfare measures, considering the guarantee of employees' career security and its broader role for managers.

I use the employee scores in the Hexun CSR database to evaluate the employee welfare performance of the Chinese listed firms. In Table 2.2, the preliminary results show that accounting conservatism is negatively associated with employee well-being measures. First, this paper extends the literature related to accounting conservatism as a management mechanism and highlights the role of accounting conservatism in satisfying employees' interests.

The existing literature generally focuses on the economic consequences of employee well-being (Chang et al., 2015; Guo, Huang, & Zhang, 2016), but its determinants are under-researched. Based on Hypothesis 2, it is analyzed whether available cash flow is the influencing mechanism of the relationship between accounting conservatism and employee well-being. Heterogeneity analysis, analysis of different firm characteristics (profitability, labor intensiveness of the sector) and different manager characteristics (government background, management capabilities) reshape the relationships between accounting conservatism and employee well-being.

Essay three: Exploring the relationship between accounting conservatism and corporate innovation performance in China.

Essay three

Introduction

Accounting conservatism is beneficial for managers to convey objective information about operations and innovation inputs to shareholders (Ball, Kothari, & Nikolaev, 2013), which can reduce the pressure of shareholder trust on managers and thus the constraints on innovation inputs can be reduced. First, the asymmetry of accounting information will prompt firms to increase their screening criteria for investment projects (Xu, Wang, & Han, 2012), while under conservative accounting policies, profits from innovative projects can only be recognized after results have been achieved (Watts). , 2006). Second, the existing literature has proven that high-quality accounting policies can improve companies' reputations and promote the relationship between companies and stakeholders (Haider, Singh &, Sultana, 2021; Guo et al., 2020; Hui et al., 2012; Cheng & Kong, 2016).

Innovation activities have a long cycle, high income uncertainty and need a large amount of continuous investment (Beladi, Deng, & Hu, 2021). Moreover, innovation increases the short-term performance pressures brought about by accounting conservatism, which will also have adverse effects on short-term borrowers. Executive compensation can act as a mechanism that moderates the relationship between accounting conservatism and innovation.

Offering compensation plans that are more sensitive to innovation can not only encourage managers to put effort into developing innovative ideas, but also prevent managers from pursuing short-term performance and abandoning innovative projects with investment value (Francis, Hasan, & Sharma, 2011). ). First, this article enriches the research on the economic consequences of accounting conservatism and the influential factors of corporate innovation. At the same time, the evidence of this article will be provided by the study of accounting conservatism and the results of innovation.

The mechanism analysis of the relationship between accounting conservatism and innovation further analyzes the mechanisms of influence, such as the incentive to avoid taxes.

Proposed timeline for the completion of Dissertation

The role of accounting conservatism in mitigating conflict between bondholders and shareholders over dividend policy and in reducing debt costs. Ramesh (2001), “Using accounting flexibility to reduce labor renegotiation costs and manage earnings,” Journal of Accounting and Economics. Relationship between corporate environmental disclosure, earnings management and accounting conservatism: evidence from Chinese listed firms.

Analyst Attention The natural logarithm of the number of analysts (teams) covering a company in a year. Report Attention The natural logarithm of the number of analyst research reports on a company in a year. It reports the influence of accounting conservatism on the two measures of corporate environmental performance, including the industry-year adjusted Hexun environmental responsibility rating and environmental disclosure score.

This table presents the 2SLS regression results by Analyst Attention and Report Attention as the mechanism through which accounting conservatism affects corporate environmental performance. Analyst Attention is the natural logarithm of the number of analysts (teams) covering a firm in a year. Report Attention is the natural logarithm of the number of analyst research reports on a firm in a year.