For many, price will have the biggest impact on profits, but small changes made across the business are often more achievable and can have a greater overall impact on the bottom line. Knowing your company's profit drivers helps you analyze the company's ability to withstand adverse conditions, capture opportunities and make informed spending decisions. Knowing the company's financial capacity is critical when considering additional debt or capital expenditures.

Knowing the company's financial capacity to repay debt is therefore critical when considering increasing debt levels. Surveys of some of WA's top-performing farm managers emphasize that they are focused on the business. However, to achieve the greatest impact on overall bottom line, the best approach is probably to make small changes across the company.

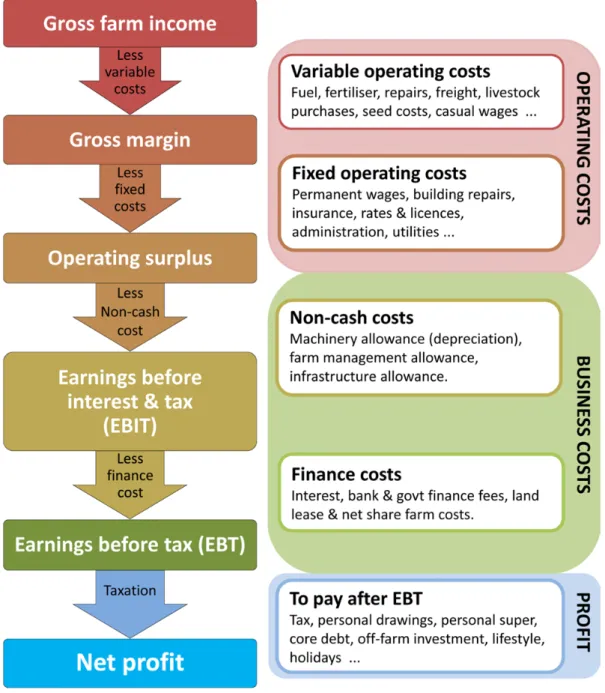

Net profit is the farm's gross income less all costs associated with production and running the business. It is the farmer's ability to effectively manage each of these factors that determines the profitability of the farm under various conditions. Monitoring global and local markets to take advantage of sales opportunities as they arise ie.

Selling as close as possible to the consumer (direct) to bypass part of the supply chain and associated costs.

Managing costs to drive profit

Capital costs – machinery & livestock

While every crop needs to be sown, sprayed, fertilized, harvested and transported, there are ways to reduce the farm's equipment costs.

Finance costs

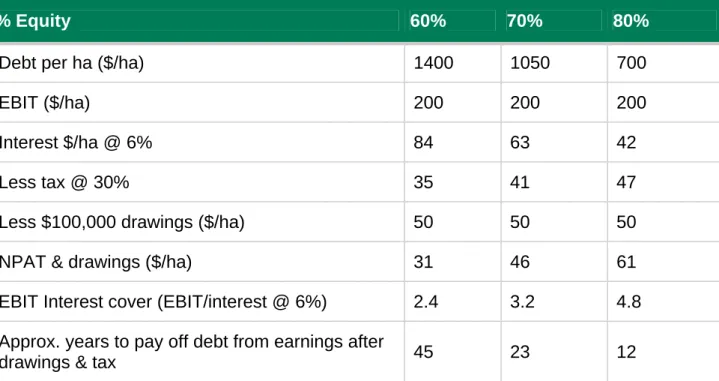

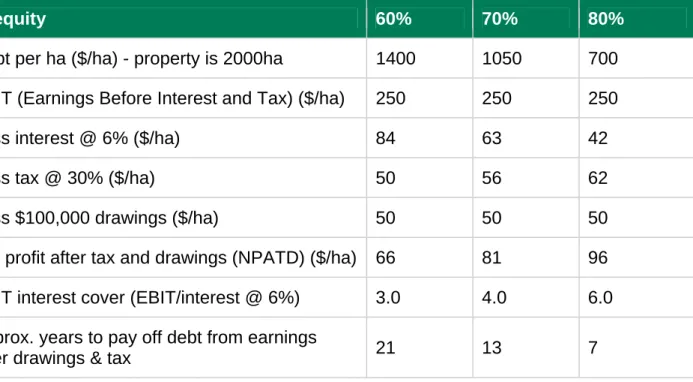

But there would be no cash flow available to pay off debt, personal expenses or upgrade machinery. This table shows that at 60% equity, it would take this farm about 21 years to pay off the debt from after-tax earnings and pumping. The more indebted the company is or the lower the equity ratio, the more sensitive the profit is to changes in interest rates.

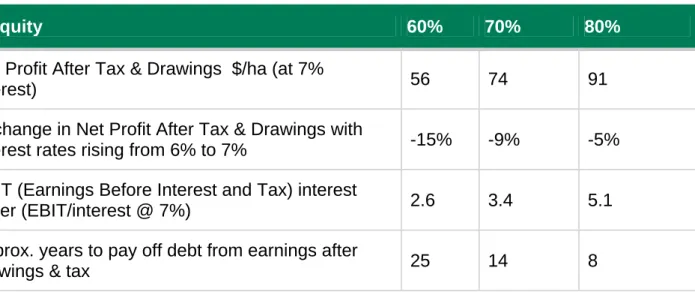

The results in Table 2 highlight the sensitivity of profit to small changes in interest rates. The example in Table 2 shows that if equity is 60%, an increase in interest rates from 6% to 7% results in a 15% decrease in profit after tax and withdrawals (NPATD). If the same business had 80% equity, the NPATD impact of the same increase in interest rates would be 5%.

The table also shows how quickly the repayment period escalates as interest rates rise for a company with lower equity. For example, if the company had 60% equity and interest rates increased from 6% to 7%, the time it takes to repay the debt would increase from 21 years to 25 years. In comparison, the company with 80% equity would take eight years to pay back its debt, compared to seven years at the lower interest rate of 6%.

It shows that a 60% equity business would experience a 53% drop in NPATD to $31/ha, which limits the funds available to repay the debt, so the payback period doubles to 45 years if EBIT continues at this lower level. By comparison, if the business was 80% equity, the $50/ha contraction in EBIT sees NPATD fall by 36% and the payback period extends to 12 years from seven years. Working capital costs and cash flow management should also be considered with financial costs.

This will allow the business manager to draw on funds during periods of peak indebtedness at lower interest rates and, when the income is received, deposit it in an equalization account so that interest charges do not accrue. Options are available to help with smooth cash flow and reduce your maximum debt, such as prepayment, installment payments and deferred payments. The associated costs should be weighed against potential savings in finance costs.

Fixed operating costs (farm overheads)

Variable operating costs

Implement an action plan for different seasons and be flexible to avoid overspending in the bad/dry years or underspending in the good years. Do not take into account costs already incurred or income that would have been received regardless of the additional investment. Rotation can reduce weed and disease costs, as well as the risk of resistance.

Legumes and pastures can reduce the need for nitrogen fertilizer in the following year; but weed control in the next crop can be challenging. Reducing waste, for example installing automatic steering technology to avoid overlapping and thereby reducing fertilizer, chemical, fuel and time (labour) costs; Implement effective strategies to control resistance, especially weeds, worms and other pests and diseases.

Consider bulk buying at a discount, or if a smaller business is trying bulk buying with other farm businesses. For example, monitoring crops and treating earlier (when rates and therefore costs are lower) rather than later when the disease/pest/weed has spread or is more advanced. For example, look for replacements, new technology, consider sharing expensive equipment that is not time critical to the business.

Increase efficiency or optimize yield (production response) to inputs – for example, soil testing and implementing variable rate management techniques, allowing more fertilizer to be applied in areas where yield response will be highest and lowering rate where response is possible limited due to another restrictive limitation. Perform regular maintenance on plant and equipment to reduce delays in critical tasks, reduce repair and maintenance costs and/or reduce breakdowns at critical times. When treating weeds, diseases and pests in crops and animals, always apply adequate doses to achieve the highest possible level of control.

Incorporate precision feeding – assess supplement quality, calibrate feed wagons to monitor how much sheep are offered, assess pasture quality and availability, animal condition scores, set targets for different classes of animals, feed budgeting to determine what supplement is needed to meet targets. Preg-scan ewes to identify dry/single/multi-lamb ewes - separate the dry, single and twin ewes so feed rations match energy requirements to maintain condition thereby optimizing feed costs and maximizing lambing percentage. Consider using contractors – reduce the cost of plant repairs and maintenance and free up time for other management tasks.

Post farm-gate selling costs

Labour and time management

Taxation

How much tax a business pays depends on its profitability, the structure of the business and how actively the farm manager manages tax by maximizing net profit after tax. For more information see the farm deposit management department (FMD) website or visit the Australian Taxation Office website.

Management skills of high performing farm business managers

Conclusion

Case study – Mixed farm business in medium-high rainfall region in WA

What is the largest driver of profit - price, production or costs?

We found similar results for a produce-only business operating in the region with price being the biggest driver of profit. Stocking sheep at optimal levels for your region is recommended as long as there are tactical plans to modify work, feed rations and stocking numbers to accommodate changes in seasonal conditions. If the stocking rate were sub-optimal in our case study, say 10% lower at 8.1DSE/ha, pre-tax profit would fall by roughly the same percentage (9.6%).

Keep in mind that if your farm profit/ha is lower than our case study, the price changes are likely to have a larger percentage impact on your profit. Overall, changes in grain prices for our 50/50 mixed case study business in the current market had a similar effect on earnings as changes in sheep prices (lamb and wool combined). For the mixed farm in our case study, a 1% increase in grain prices led to a 2.1% increase in profits, while a 1% change in lamb and wool prices led to a 1.3% increase.

In our case, an increase of 1% in the volume of grain, wool and lamb in the mixed farm results in a profit increase of 3.5%, assuming that costs do not increase further and quality does not deteriorate. Case study profit impact of a 1% increase in kg of wool, lambs and wheat yield. Changes in grain yield had a slightly larger impact on farm profit than the same percentage changes in marking percentage or wool per ewe in our mixed farm case.

We found that a 1% increase in grain yield increased profit by 1.9% while a 1% increase in production in the sheep enterprise, being lamb branding rate and shearing, had a 1.7% increase. When breaking down the sheep enterprise further, we found that changes in marking rate (from 90%) had twice the impact on profit as similar percentage changes in kilograms of wool shorn (from 5kg/head). Note that if your pre-tax profit is lower than our case study's $191/ha, the profit impact of increased production volumes, in percentage terms, will be higher.

A breakdown of the profit impact of a 1% reduction on each expense for our farm case study is summarized in the table below. In summary, price is the biggest driver of profit in our case study, followed by production followed by cost. If the farm manager could increase the prices received by 10%, increase the production volume by 10% without incurring higher costs, and reduce the cost base by 10%, the profit of this farm would double.

Appendix A – Revenue and cost assumptions for the mixed 50/50 crop/sheep business case study