Section 28(1)(a) of the Royalties for Regions Act 2009 (Act) requires the Western Australian Regional Development Trust (Trust) to submit a report to the Minister for Regional Development (Minister) containing information on the Trust's activities during the financial year. The Trust's work influences how RDL and the Minister develop and manage royalty policies and projects for regions. Prior to the enactment of the Act, the Regional Royalties program operated under section 10(a) of the Financial Management Act 2006.

Article 9(1) of the Law – The Minister, with the consent of the Treasurer, may authorize the expenditure of the money that is on credit to the Fund for the following purposes. Section 5(1) of the Act states that the Royalties Fund for the Regions shall consist of the following subsidiary accounts:. a) Fund of the Local Government of the Country; Mr Shanahan was reappointed to the Trust as a member under section 13(1)(b) of the Act.

Section 12(b) requires the Trust to give advice and recommendations to the Minister on any matter relating to the operation of the Fund referred to it by the Minister. The effect of the omission of 'actual royalty income' in the Act is to change the policy intent. Section 7(1)(b) of the Act only requires money to be 'legally made available to the Fund', which means that the Fund can be increased.

Only when the authorized expenses are charged to the Fund are they no longer included in the calculation of the ceiling.

15Technical amendment

The foundation concluded that there was no basis for establishing a future foundation under the law. The Trust recommended that a Strategic Regional Development Fund (SRDF) be established under the Act. Although the Trust considers a new fund under the Act to be desirable, this recommendation is complicated by the current policy on royalties for regions.

The current policy is that all the funds established under section 5(1) of the Act are funds that are required to be spent by set deadlines in the short to medium term, within the four-year budget cycle. If a new accumulative fund is required for future projects for expenditure in the medium to longer term, extending beyond the budget out years, Bonuses for Regions policy will need to change to accommodate the new fund. The acceleration of Western Australian royalties and the possibility that significant non-royalty income could be pooled into the royalties for regions funds both raise the prospect of significant additional monies being available for royalties for regions.

While in theory such additional funds could be placed in the existing three regional royalty funds rather than a new fund, the design of these funds and the section 8 cap on the size of the $1 billion fund made this difficult. Such funds could be supplemented by additional allocations from the central budget, partnership contributions for license fees for the regions from other private sources; and partnership contributions to royalty for Commonwealth regions. Particularly important for the subject of the law is the possibility of a future development fund to support the provision of social infrastructure that brings greater benefits to target local communities related to priority projects important to the country.

Regional royalties received in advance of expenses create an unallocated "surplus" which, on current royalty revenue indications, is likely to increase more rapidly. By the nature of the law, any unassigned royalties to regions must be used in a timely and responsible manner. With regard to the need for long-term major regional development projects to be considered under royalties for regions not currently contemplated by the fund, any "surplus" in the fund allows for the consideration of major future projects that normally would not be possible. , and to satisfy an unmet need.

The Trust has recommended that Royalties for Regions increase their commitment to human capacity development in the regions. Section 9(1) of the Act is specific with regard to the direction of required expenditure:. a) providing infrastructure and services in regional Western Australia;. The Act requires regional development to be achieved through royalties for regions expenditure on physical capacity building and human capacity building in the nine regions of Western Australia.

19OECD6 insights into the importance of building human capacity

The needs of new regional populations resulting from regional development The Trust considered that building the human capacity of Royalties for the Regions should begin with leadership development. The Trust has recommended that water policies and projects be given greater emphasis in the Tariffs for Regions. With the experience gained by RDL and Royalties for the Regions to date, the Trust is of the view that RDL should move to a more focused planned and strategic approach to water in the context of regional development.

These provisions require the Fund to consult the Minister on his budget proposals for royalties for the regions. The Trust has conducted a thorough review of the 2011-12 regional royalty budget proposals and found that these budget proposals meet the requirements of the Act and the Regional Royalty Policy. The Fund believes that the royalty budget decision-making for regions and the process can be improved.

Such plans would have the advantage of influencing decision-making on informed and strategic RDL royalties for regions. The Trust believes that productivity should be formally included in the criteria for submitting proposals for regional royalties for the 2012-2013 budget. The Trust believes that the 2011-2012 Royalties for Regions budget has benefited from experience and process improvements and better governance systems.

The Parliament and the Government determine the financial framework under which the rights are authorized for the regions. The Trust recognizes that the Treasury and the Department of the Treasury (DoT) have the right to oversee the effects of devolved rights on the state's finances. The Trust considered that the operational experience gained by RDL of Royalties for the Regions from 2008 onwards made it practical to review their governance mechanisms.

The Trust did not find that individual royalties for regional programs or projects are assessed against what objective they achieve and how. Make a clear case for the project within the context of the Bonus for Regions policy objectives, including the outcomes the project should achieve. Identify the funding requirements for the project, including the extent of Royalties for Regions funding.

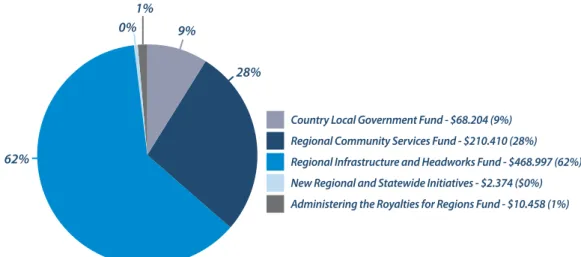

According to Section 6 of the Act, 25 percent of the expected royalty income for that year is attributed to the royalty fund each financial year. The fund supports the allocation and reporting of royalties for regions' investments in part on a nine-region basis.

37Conflict of Interest Policy