Among them, Exim Bank Limited is one of the most successful and progressive private commercial banks in the financial institution. The vision of Exim Bank Limited is to be a top-class financial institution and a leading contributor to the economy. The report preparation process is completely dependent on my three-month internship at Elephant Road Branch of Exim Bank Limited.

The main purpose of the report is to examine the credit management system at Exim Bank Limited. Customer understanding regarding the performance of Exim Bank Limited and analyze the financial performance in terms of credit management. Exim Bank Limited is one of Bangladesh's most influential market leaders in the banking industry.

Background of topic

By offering the best credit facilities, EXIM hopes to meet the needs of its customers while increasing their profitability.

Specific goal

Scope of the Study

Objective of the study

To find out about credit advance propend, other financial exercises with a piece of down-to-earth information.

Methodology

Primary data

Secondary data

History of Exim Bank

Thanks to its extensive banking background, EXIM Bank was able to ensure full compliance with regard to capital adequacy and asset quality. After his retirement, Mr. Ahmed continued his employment with Exim Bank Limited. With the commitments of concrete resilience of the bank and tailor-made services for its precious customers, a foreign trade master, Mr. Mohammad Feroz Hossain, succeeded Mr. Mohammed Haider Ali Miah as Managing Director Director and CEO on September 16, 2022. With To achieve these objectives, he has revised and refined the task processing and service delivery mechanism for a better customer experience. At the same time, he has worked to restructure the asset and deposit composition to ensure sustainability.

Overall, this forward-thinking foreign trade veteran is instrumental in offering international standard banking and service experience within national borders.

Our Vision

Corporate Culture

Awards & Achievements

Corporate Social Responsibilities (CSR)

Prime Operational Area of the Bank

Banking requirements, we have a robust and competitive Sustainable Finance Committee and a Risk Management Committee of the Board of Directors. A significant portion of our capital is effectively invested in the RMG sector, an essential part of our economy. We have made significant efforts in the field of these phenomena to achieve a comprehensive, realistic and fruitful result.

Investment

Core Banking Solution

If a branch has implemented core banking systems, it allows the user (customers) to manage accounts from any location. The T24 Islamic Banking Solution from Temenos, which has more than 700 installations in 125 countries and more than 40 installations specifically for Islamic Banking, is being used by EXIM Bank. T24 for Islamic Banking is a single core banking software system that manages Islamic financial services along with non-Islamic.

It enables offering the right spectrum of the most advanced competitive Islamic financial products.

Company Organogram

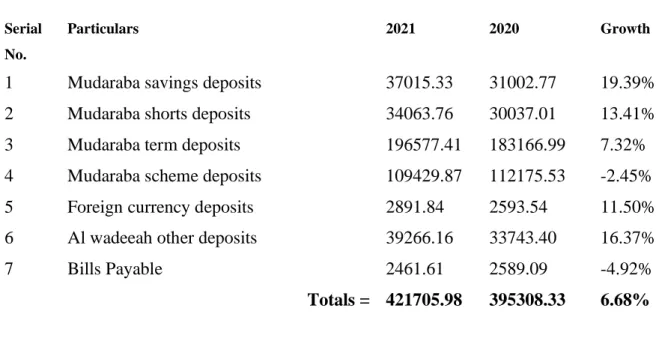

Mudaraba Savings Deposit

Alwadiah Current A/C

Mudaraba Short Term Deposit

Mudaraba Term Deposit (FDR)

Exim Bank’s Attractive Deposit Scheme

Before payout, the savings profit rate plus 1% will be applied if the deposit is removed before the six-year term. However, if the funds are removed within the first year, no profits will be distributed. The deposit (with a savings interest rate of +1%) is handed over to the nominee in case of death of the depositor before the term.

In the absence of a candidate, the legal heirs or successors are paid upon presentation of the certificate of inheritance. The rules for issuing duplicate time deposit certificates apply in the event that a duplicate certificate of deposit is issued. The requirements for the issuance of duplicate time deposit certificates shall apply in the event that a duplicate certificate of deposit is issued.3.

The requirements for issuing a duplicate receipt of a term deposit will apply in the case of a duplicate receipt being issued. 5 (a) the depositor (together with the savings rate) will be given to the nominee in the event of the depositor's death before the term. The legal heirs or successors will receive payment on presentation of the succession certificate in the absence of a nominee.

The deposit is repayable at maturity and includes benefits such as a lump sum or a monthly education allowance starting six years after the end of the relevant term. The depositor must deposit the receipt of the amount payable in monthly installments to the person designated by him or her, as well as any other instrument duly deposited by him, with the written instructions required by the scheme to qualify for the education allowance. If withdrawal takes place earlier than seven years, the profit is determined and paid out based on the current savings rate.

If a withdrawal takes place after seven years, the full amount due on the maturity date of the immediately preceding term will be paid out, together with the profit over the remaining part of the term at the applicable savings interest rate.

Procedure of Closing Account

Dishonour of Cheque

Services Provided by the E-Bank

Bank Remittance

These Izara Bill Baia (term loan) facilities can be medium or long term in nature. A Handelsbank's remittance service helps its customers avoid the risk of theft or loss while moving funds from one location to another or making payments to people in other locations. By assessing "Commission" to its customers, the bank accepts the risk and guarantees payment to the beneficiary.

The methods of bank transfer can be categorized as follows depending on the urgency and type of transaction.

Demand Draft

Payment Order

Telegraphic Transfer

Operation of Cheque

Cheque Collection and Clearing

Again, the date of the check should not be more than one day earlier than the date of receipt; in other words, it should not be "post-dated.". The amount must correspond to the amount written in words and numbers on the check and must also correspond to the amount written in words and numbers on the deposit slip. The name mentioned on both the check and the payment slip is the same.

Clearing

Outward Bills Collection (OBC)

The Sources & Uses of Funds

Capital & Reserve Fund

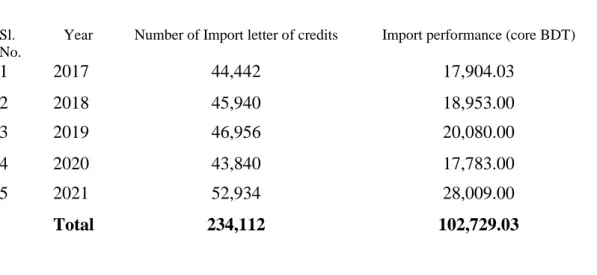

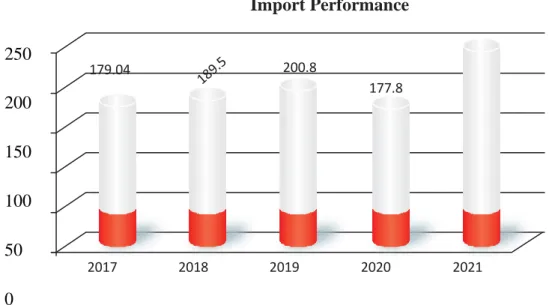

Import Business

Export Business

Credit (loans & Advanced) Of Exim Bank

Secured Overdraft (SOD)

The borrower is not allowed to quickly get another loan in full or in part. Staff can get loan advances from EXIM Bank to buy a car and develop or buy a property. The bank deducts the payment amount from the salary of each employee who receives this portion when withdrawing their paychecks at the end of each month.

The main provider of loans in this sector is the House Building Finance Corporation (HBFC), but EXIM Bank also provides support. The bank also accepts real estate as primary security for housing advances. Under the mortgage agreement, if the borrower defaults, the Bank can seize the mortgaged property.

Cash Credit Pledge

Lease Finance

By filling out a special application form, the potential borrower will apply to EXIM Bank for a loan.

Statements Prepared by the Credit Department

Letter of Credit (L/C)

Features of L/C

Types of L/C

Parties Involved with L/C

Opener/Buyer/Importer/Applicant

Beneficiary Bank

Advising Bank

Negotiating Bank

Confirming Bank

If you want to open an L/C, you have to deposit the required percentage of the whole amount. To settle the claim at the negotiating bank, two out of three are sent to the advising bank and the other two are handed over to the reimbursing bank. After that, the advising bank notifies the importer to send the items in one copy.

The exporter submits the necessary papers to the negotiating bank and receives payment for his claim. The import department's most delicate responsibility is the payment procedures for import documents. By composing a sales note, the customer receives a sales note at the exchange rate of Bangladeshi currency.

Foreign Currency Application: An application is made to the International Department to arrange the appropriate funds for payment.

Significant Issues with L/C Operation

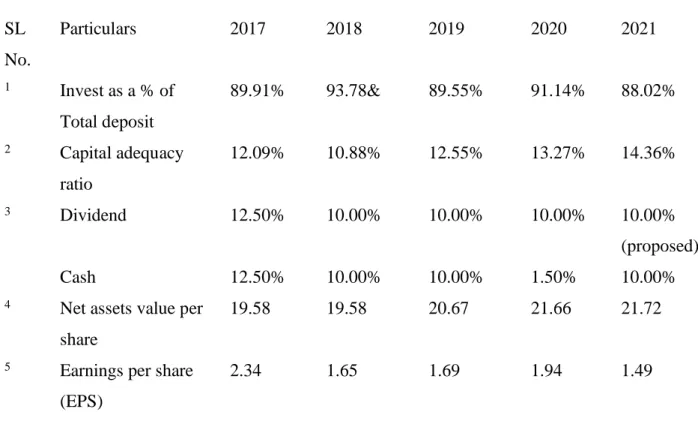

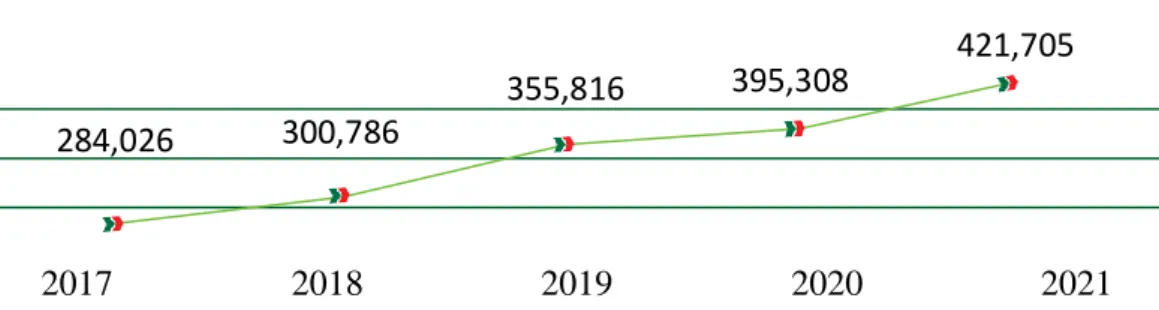

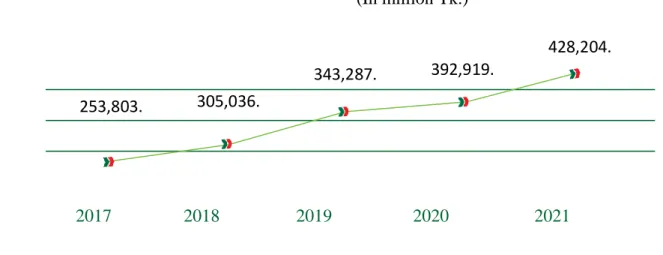

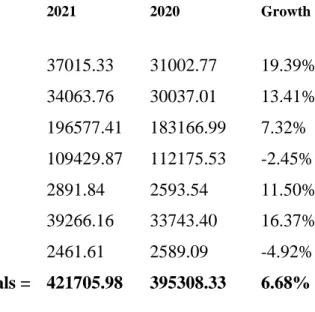

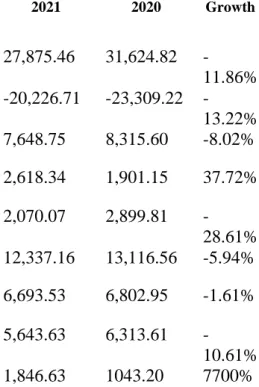

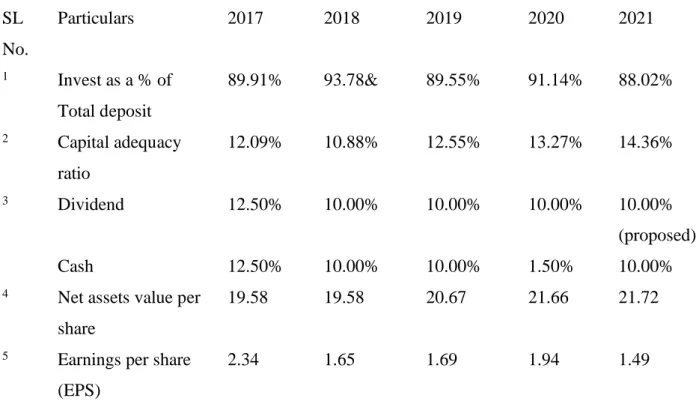

Table description, I am trying to focus on my report five years financial scenario on Exim Bank limited. Here I focus on Total Capital, Total assets, Total liabilities, Total Deposits, Total Investments (General) share, Total contingent liabilities, Total risk-weighted assets, Total fixed assets, Total income, Total expenses. Here I focus on five years. Invest as % of total deposit, capital adequacy ratio, net worth per share, earnings per share (EPS).

EVA is an estimate of the amount by which earnings exceed or fall below the minimum required return for shareholders of comparable risk. EXIM Bank is keen to adopt a well-defined strategy and plan to mobilize resources such as deposits. To meet the needs of a wide spectrum of customers, Mode-wise Investment Bank offers a variety of Shariah-based investment products under several investment modes.

In order to better serve its customers, EXIM Bank has introduced a number of ground-breaking deposit options. Customers of the bank can be individuals, corporates, financial institutions, government entities, independent entities, NGOs, etc. The bank works to diversify its products, its products across industries to reduce risk.

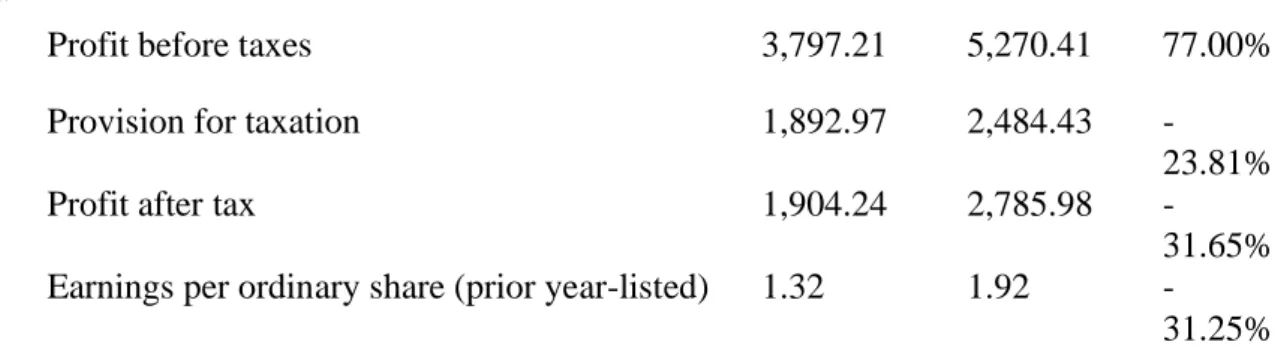

Profit is considered the logical sequence of satisfaction of stakeholders and increasing the capital of the bank. Despite the obstacles, during the year of 2021, the bank earned an operating profit of Tk. 1904.24 million after making/adjusting provision for general investment, provision for off balance sheet exposure, provision for other assets, provision for reduction in value of share, provision for climate risk and provision for tax.

Annual earnings per share increased compared to third quarter earnings per share, mainly due to the increase in investment income and the increase in income from commissions, exchange and brokerage fees. The profit after tax amounted to TK.

Internship in Exim Bank Limited

Findings

Recommendation

In the loan department, strict supervision is necessary to avoid loan defaults, the bank official should visit the project regularly. It can be a scary deal if high-risk borrowers and low-risk borrowers don't have to pay the same interest rate. The bank should deploy more reports and resources to increase mobile banking facilities and agent banking points across the country.

Implement proper integration of mobile banking and agent banking at the same time as regular banking activities to achieve a larger customer base and gaming popularity.

Conclusion