Topic: Submission of Internship Report on “Foreign Exchange Activities: A Study in Uttara Branch 0f Uttara Bank Ltd”. It is my great pleasure to present this practical report on "Foreign Exchange Activities: A Study on Uttara Bank Ltd." This program has started from July 8, 2018 until now. This is to prove that the internship report on "Foreign Exchange Activities: A Study on Uttara Bank Ltd." done by Nazmin Nahar ID No.

As part of the BBA program requirement, I chose Uttara Bank Limited to do my Internship Report. This report shows the background of the work on "Foreign Exchange Activities: A Study on Uttara Bank Ltd." as a practice report for the BBA Program.

Origin of the Report

Objectives of the Report

Scope the Report

Methodology the Report

Primary Data

Secondary Data

Data processing and Analyzing

Limitations of the report

History of Uttara Bank Limited

In addition, a continuous process of effective and diversified methods to improve market opportunities to provide new customers through the development and expansion of rural facilities, SME financing and offshore banking. In addition to this traditional delivery point, the bank is also very active in the alternative tradition. The Managing Director, Chief Executive Officer Mohammad Rabiul Hossain is proud and encourages all employees to measure their time and talents to help the downtrodden society by participating in the CSR program.

Its main objective is to provide services to the people of the rich or poor and to contribute to the development of the nation.

Uttara Bank Limited at a Glance

Uttara Bank Limited Networks

Mission of UBL

Vision of UBL

Goals of UBL

Objective of the Organization

Strategies of Uttara Bank Limited

Core Values

Loan Products of UBL

Deposits Products

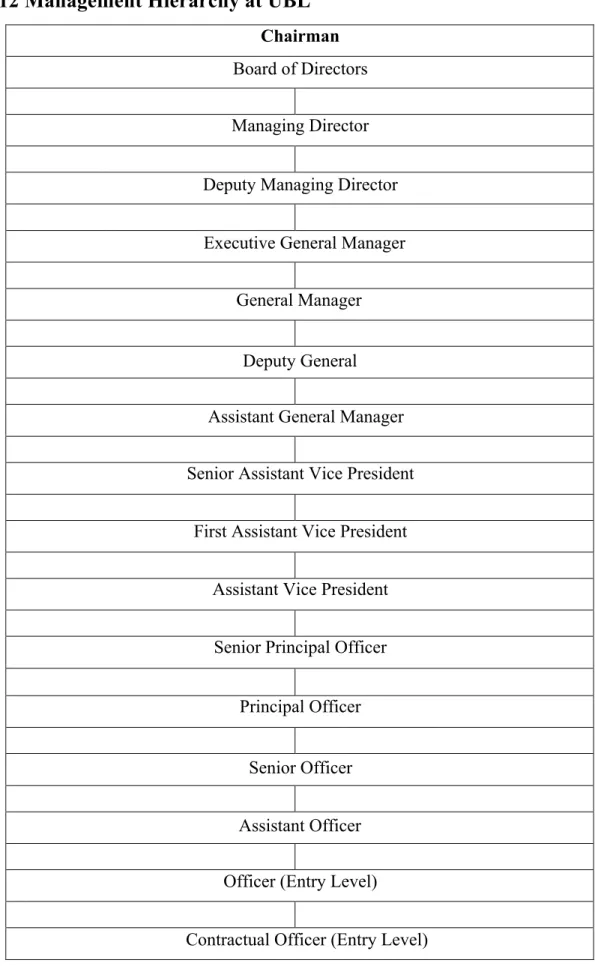

Management Hierarchy at UBL Chairman

Branch Information of Uttara Branch

Foreign Exchange

Historical overview of Exchange Rate System of Bangladesh

Activities Related to foreign exchange

Exports

Imports

Remittances

The Most Commonly Used Documents in Foreign Exchange (a) Documentary Letter of Credit

Letter of Credit

- Parties To letter of Credit Applicant Opener

- Issuing Bank

- Beneficiary

- Advising Bank

- Confirming Bank

- Reimbursing Bank

- Second Beneficiary

The applicant, also called the part of the bill, is usually a product or a buyer or customer, who must pay the beneficiary. The issuing bank is the one that creates a letter of credit and is given the responsibility of receiving money from the recipient or its banker for receiving the documents. The recipient must receive payment within seven working days from the date of receipt of the document, but in accordance with the terms of the document's letter of credit.

A credit is given to him or his agent to pay the delivery in the prescribed document and to comply with the conditions of the L / C. If the L / C is transferable and transfers another credit, it is known as the first or the beneficiary original. An advising bank advises the recipient and takes responsibility for sending the documents to the issuing bank and is generally in the recipient's country.

A bank certificate adds to your guarantee for opening credit with another bank, which represents an additional payment/negotiation by the issuing bank. The bank plays an important role in ensuring that the exporter is not satisfied only with the initiative of the issuing bank. Refunding bank is the bank authorized to fulfill the refund request in the negotiation/acceptance/payment agreement submitted by the negotiating bank.

In general, payment must be made at the bank with which the issuing bank has an account. The second beneficiary is the person who represents the first or original beneficiary of the credit in his absence. In this case, the credits of the original beneficiary are transferable, the rights of the transferee are subject to the conditions of transfer.

Required Document for LC .1 Bill of Lading

Commercial Invoice

Certificate of Origin

Export Section

- Types of Export

- Export under Letter of Credit

- Issuance and disposal of EXP bill

- Reporting of EXP Form

- Formalities of Export

- Examination & Negotiation of Export Bill

34; A documentary letter of credit" is an instrument issued by a Bank (Opening Bank) at the request of the importer (Opener) in favor of the exporter (beneficiary) by which the issuing bank promises to pay the exporter a certain amount against the delivery of documents specified in the credit within a specified time, if all the terms and conditions stipulated in the credit are met Authorized dealers must ensure that the exporter is registered with CCI & E in accordance with the order of inclusion in the 1952 list (importers and exporters) before the certification of any export document Before sending the EXP forms to the customs authorities, the exporter must get copies of the forms certified by an authorized distributor.

From that moment, they will record the complete data of the forms in the export register to be kept and assign a number to each set of EXP forms. After receiving the EXP form and export documents, the authorized traders should compare the signatures on the bill of lading with the signatures of duly authorized employees of the steam companies in the register to ensure the authenticity of the documents. To avoid any loss of foreign exchange in the country, Authorized Dealers will not certify any EXP Form unless they are satisfied with respect to the following:.

Arrangements made for realization of the export proceeds of the goods covered by the respective EXP forms within the prescribed period of four months from the date of shipments. In case of delay in repatriation or non-fulfilment of export proceeds, both the exporter and the authorized distributor and their officials who attest the export forms will be subject to criminal proceedings under the Export Regulation Act. Therefore, in their own interest, both exporters and authorized distributors should be alert and active to ensure timely repatriation of export earnings. a) Duly filled in the prescribed form of Bangladesh Bank online software at the time of certification of EXP form.

After receiving the order from the importer, the exporter keeps the goods ready for dispatch (shipping) either by production or procurement in accordance with the terms of the LC. In this sense, the services of compensating and freight forwarders can be conveniently taken for the actual shipment of goods, commissions, etc. Negotiating an export document is not just a verification of the document, but means giving value to the drafts or documents of the bank authorized to negotiate.

Letter of Credit

Bill of Exchange

Invoice

Insurance

Export Bills for Collection

Documents against payment (D/P): where the presenting bank releases the documents to the buyer only against a cash payment in a prescribed currency: and

- Import Section

- Import Procedure

- Import Mechanism

- The L/C Application

- Securitization of L/C Application

- Dispatching the import L/C

- Remittance Section

- Outward Remittance

- Private remittance A. Family remittance facility

Documents against acceptance (DA): where the presenting bank releases the documents to the buyer against acceptance of a bill (draft) guarantee. f) Registration partnership deed (if any). g) Deed and statutes/certificate of incorporation (if any) (h) Rent receipt of the business premises. i) Certificate of incorporation (if any). Under the Import and Export Control Act of 1950, the Office of the Chief of Import and Export provides an IRC to the importer. To have an import limit of L / C, an importer applies to the EBL department by providing the following information:.

Usually, the importer expresses his desire to open the L/C by quoting the amount of margin in percentage. The UBL officer examines the application in the following manner: -. a) The terms and conditions of the L/C must comply with UCPDC 500 and Exchange Control and Import Trade Regulation. The branch sends an original copy of the L/C for negotiation and a copy to the advising bank for advice.

As a result of this comprehensive reform, the country's exchange rate regime was reformed to lay the foundations for a market-friendly environment for investment recovery, growth and productivity. After liberalization in the conversion phase, most remittances are now authorized by authorized dealers on behalf of the central bank. Only certain remittances of a special nature require the prior approval of the Bangladesh Bank.

Therefore, this summary will not cover purchases and sales of foreign currency as a result of import and export of goods. All foreign remittances are grouped into two broad categories: remittances to the outside world and remittances to the interior. For all other outgoing remittances from T.M. a) Foreign nationals working in Bangladesh with government approval can remit 50% of salary and 100% of leave pay, as well as actual savings and allowable personal benefits, through an authorized dealer.

Remittance of Membership fees/registration fees etc

Education

Travel

For minors (under 12 years old), the applicable rate is half of the adult amount allowed.

Health & Medical

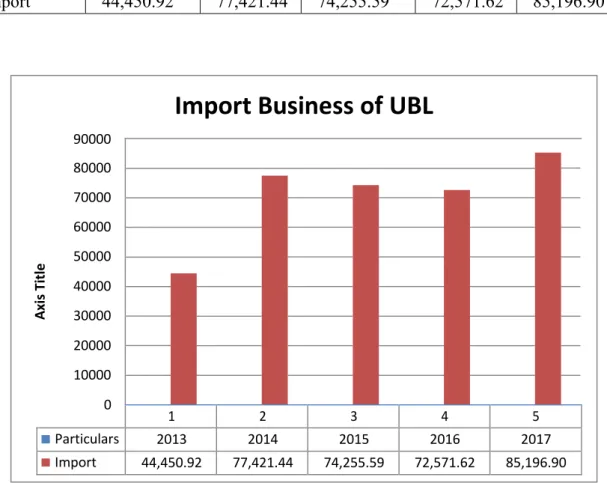

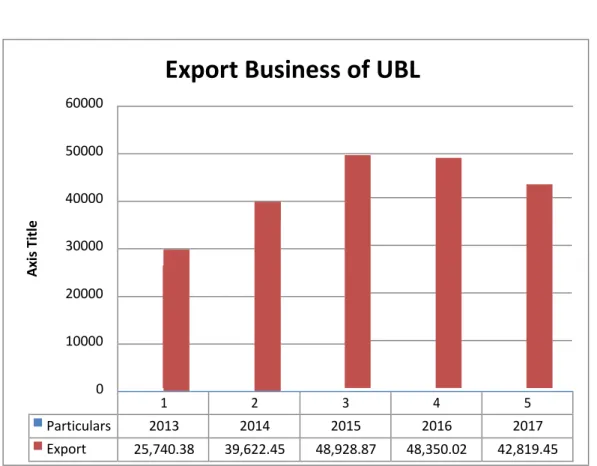

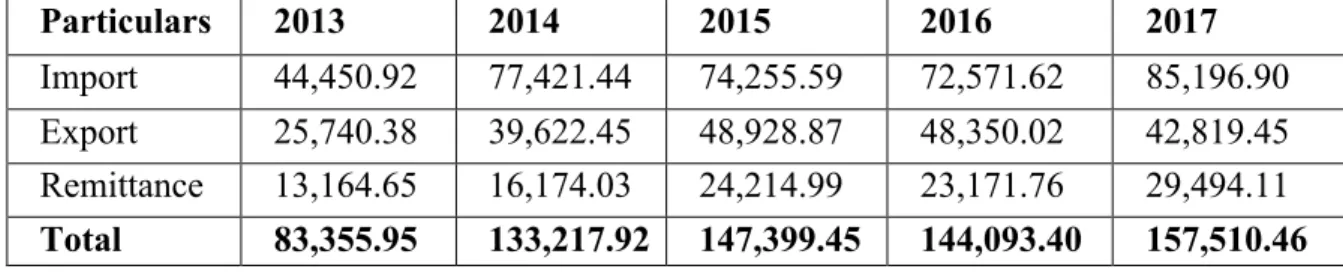

Now we can say that foreign exchange business grew up from year to year and is a positive trend.

Import Business of UBL

Import Business of UBL Table 3.2: Import Business of UBL

Export Business of UBL

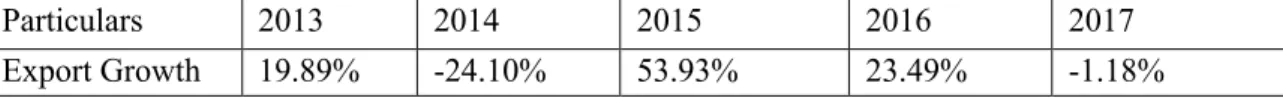

Export Growth

Export Growth Table 3.5: Export Growth

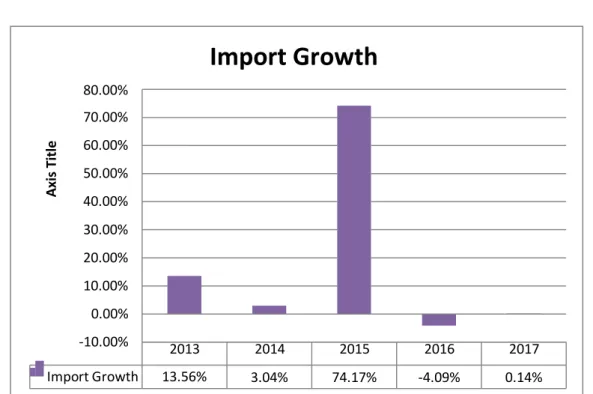

Import Growth

- Import Growth Table 3.6: Import Growth

- Foreign Remittance Growth Table 3.7: Foreign Remittance Growth

- SWOT Analysis of Uttara Bank Ltd

- Strengths

- Weaknesses

- Opportunities

- Threats

- Findings

- Recommendations

- Conclusion

In the Foreign Exchange Division, the bank still uses lots of registers to maintain its foreign exchange transactions. The bank will launch new software to run banking transactions faster and smoother. And sometimes the bank has to suffer from misinterpretation of the rules of the ICC. e) The decision taken by the management is sometimes self-centered ie. the competitiveness of the market is often ignored in order to prioritize their own capacity and resources. f) The management has hardly overcome the notion-".

A bank of armed forces at cantonment" i.e. the banking concept is not yet universalised. g) The top management guides its subordinates when necessary, but the specialization of the staff in a particular task is not ensured. There are a few suggestions for the concern power to overcome the deficiencies in the banking sector in Bangladesh are the following: a) The bank should improve its research center and training center to enrich the knowledge of customs and uniform practice of documentation certification (UCPDC).The administration should give more importance to the advertisement of the bank in various electronic and print media.

Above all, the main purpose of advertising should be to let people know and understand that the bank is universal and everyone can access it. To eliminate currency risk, the bank must be a superior expert who can understand the future economic situation and take the initiative based on the forecast. Here too, the bank can be successful in the economy if it can handle the situation effectively.

Again, the bank must maintain a correspondence relationship with the bank that helps it settle its payment and receipt in relation to the foreign exchange transaction. e) The interior decoration must be introduced for the comfort of the customer. f) Complete computerization of the branch will reduce the time consumed by the manual process. The performance they plan and the new strategies they introduce appeal to the bank. If the bank follows this route in the near future, Uttara Bank Limited can become one of the best.

Bibliography

Books and Articles

Reports

Website