For reinforcement, see solutions to the Self-Test Problems in the appendix at the back of the book. We also made changes to many of the problems at the end of each chapter.

47Chapters in This Part

Introduction to

- Finance and Business

- Goal of the Firm

- Managerial Finance Function

- Governance and Agency

1-14 What are the main activities of the CFO that are related to the company's balance sheet. We know that the duty of a financial manager is to increase the wealth of the company's owners.

77Under Water in the Desert

Financial Institutions and Markets

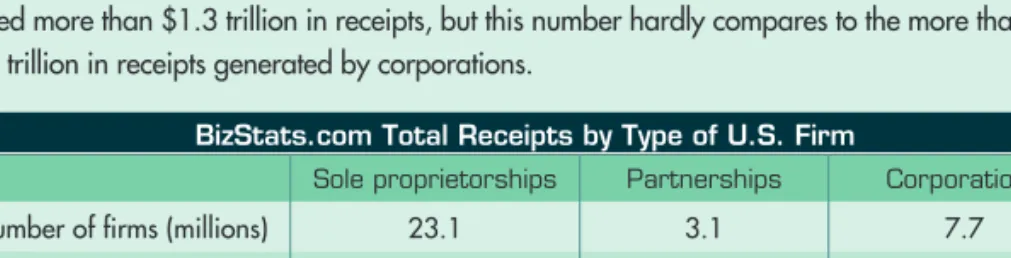

Transactions with short-term debt instruments or marketable securities take place on the money market. RELATIONSHIP BETWEEN INSTITUTIONS AND MARKETS Financial institutions actively participate in financial markets as providers and demanders of funds. In 2012, NYSE Euronext accounted for just over 25 percent of the total dollar volume of all US-traded stocks.

The price of an individual security is determined by the interaction between buyers and sellers in the market.

The Financial Crisis

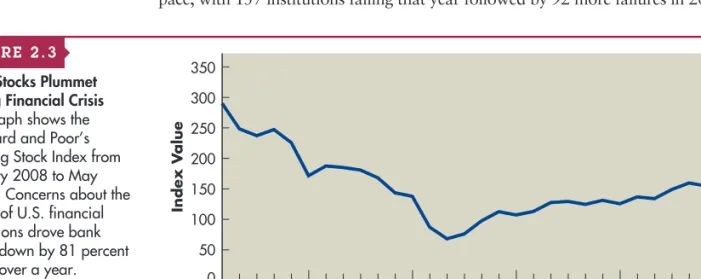

The figure shows the behavior of Standard & Poor's Case-Shiller Index, a barometer of home prices in ten major U.S. housing markets. 2 House prices rise and then fall. The figure shows Standard & Poor's Case-Shiller Home Price Index from January 1987 through February 2013 and that home prices rose almost without interruption for nearly a decade before experiencing a prolonged slump. By 2007, real estate loans had grown to more than half of all loans from major banks, and the share of these loans in the subprime category also increased.

In the aftermath of the Lehman Brothers bankruptcy, money market lending shrank very sharply.

Regulation of Financial Institutions and Markets

After the recent financial crisis and recession, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010. That is, the 1933 act was intended to regulate activity in the primary market in which securities are originally with value issued to the public. An act that regulates the trading of securities such as stocks and bonds in the secondary market.

The greatest benefits of government regulation are the resulting trust in financial institutions and markets that society gains.

Business Taxes

In the current corporate tax structure, the marginal tax rate is 15 percent if the firm earns less than $50,000. In most business decisions that managers make, it is the marginal tax rate that really matters. Dividends received by the firm from common and preferred stock held in other corporations are subject to a 70 percent exemption for tax purposes.1 The dividend exemption effectively eliminates most of the potential tax liability on dividends received from the second and any subsequent corporations.

Companies and governments issue debt and equity securities directly to the public in the primary market.

The Stockholders’ Report

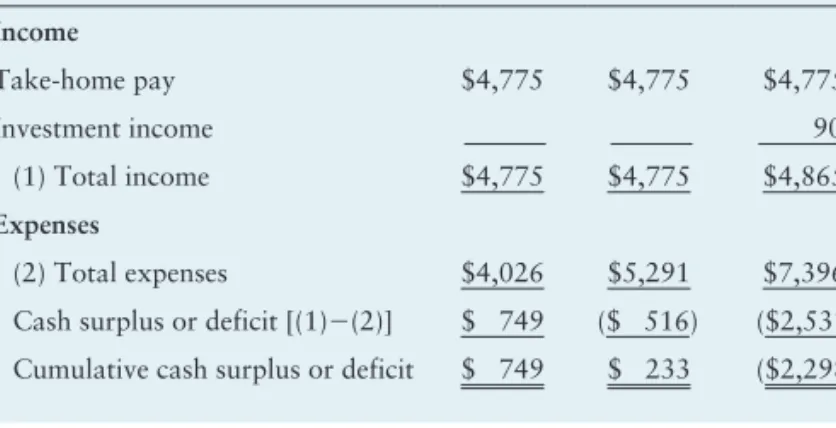

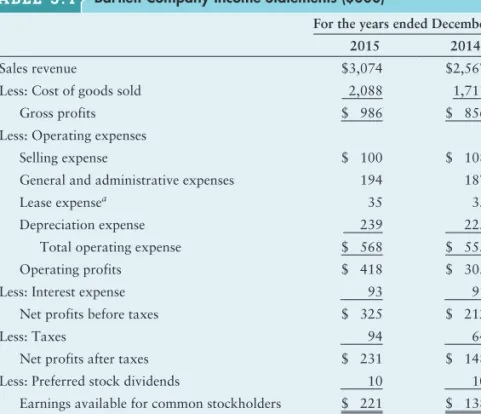

The 2015 statement starts with sales revenue. the total dollar amount of sales during the period, from which the cost of goods sold is subtracted. The statement balances the company's assets (what it owns) with its financing, which can be either debt (what it owes) or equity (what is provided by the owners). Personal net worth (N/E) is a “plug number” – the difference between total assets and total liabilities – which in the case of Jan and Jon Smith is $41,420.

3–4 How is the current rate (translation) method used to consolidate a firm's foreign and domestic financial statements.

Mary's initial reaction to this data was that the firm managed its inventory significantly better than the average firm in the industry. However, on reflection, she realized that a very high inventory turnover could be a sign that the firm does not hold enough inventory. Comparing current to past performance, using ratios, allows analysts to evaluate the firm's progress.

If they have not been audited, the data in them may not reflect the true financial condition of the company.

Liquidity Ratios

The personal liquidity ratio is calculated by dividing the total liquid assets by the total short-term debt. The quick (acid-test) ratio is similar to the current ratio, except that it excludes inventory, which is generally the least liquid current asset. As with the current ratio, the quick ratio that a company should strive to achieve depends largely on the nature of the business in which it operates.

The quick ratio only provides a better measure of total liquidity when a company's inventory cannot be easily converted into cash.

Activity Ratios

This value can also be seen as the average number of days of sales in stock. The average collection period or average age of receivables is useful in evaluating credit and collection policies. Potential lenders and suppliers of trade credit are interested in the average payment period because it provides insight into the company's payment patterns.

3–11 To estimate the firm's average collection period and average payment period ratios, what additional information is needed and why.

The higher this ratio, the higher the company's debt level and the more leverage it has. The debt-to-equity ratio measures the relative proportion of total liabilities to common stock used to finance the company's assets. As with the debt ratio, the higher this ratio, the greater the company's use of financial leverage.

The interest earned ratio, sometimes called the interest coverage ratio, measures a company's ability to pay contractual interest.

Profitability Ratios

Net profit margin measures the percentage of each dollar of sales that remains after all costs and expenses, including interest, taxes and preferred stock dividends, have been deducted. Net profit margin is a commonly cited measure of a firm's success in relation to sales profits. Return on total assets (ROA), often called return on investment (ROI), measures the overall effectiveness of management in generating profits with its available assets.

Return on equity (ROE) measures the return earned on the common shareholders' investment in the company.

Market Ratios

The calculated ROE of 12.6 percent indicates that Bartlett earned 12.6 cents on every $1.00 of common stock shares during 2015. Number of shares of common stock outstanding (3.18) Substituting the appropriate values for Bartlett Company from its 2015 balance sheet, we get. Book value per share of common stock (3.19) Substituting Bartlett Company's year-end 2015 common stock price of $32.25 and its $23.00 book value per share of common stock (calculated above) into the M/B ratio formula gives we.

3–17 How the price-to-earnings ratio (P/E) and the market-to-book ratio (M/B) give a sense of a firm's return and risk.

A Complete Ratio Analysis

The DuPont Analysis System is used to break down a company's financial statements and assess its financial condition. This formula relates the company's return on equity (ROA) to return on equity (ROE). It relates a company's return on total assets (ROA) to return on equity (ROE) using the leverage multiplier (FLM).

Total Assets $ Total Liabilities and Equity $ O’Keefe Industries Balance Sheet December 31, 2015. responsible for the financial performance of the company.

163Making a Profit While Bleeding Cash

Analyzing the Firm’s Cash Flow

The cash flow statement, introduced in Chapter 3, summarizes the company's cash flow over a period of time. Also note that the company's cash flows fall into three categories: (1) cash flow from operating activities, (2) cash flow from investing activities, and (3) cash flow from financing activities. Cash flow from operating activities includes the incoming and outgoing cash flows directly related to the sale and production of the company's products and services.

The cash flow statement allows the financial manager and other interested parties to analyze the cash flow of the company.

The Financial Planning Process

Long-term (strategic) financial plans determine a company's planned financial actions and the expected effect of these actions over periods from 2 to 10 years. Long-term financial plans are part of an integrated strategy that, together with production and marketing plans, guides the company towards strategic goals. Short-term (operational) financial plans specify short-term financial actions and the expected effect of these actions.

Throughout the remainder of this chapter, we will focus on the key outputs of the short-term financial planning process: the cash budget, the pro forma income statement, and the pro forma balance sheet.

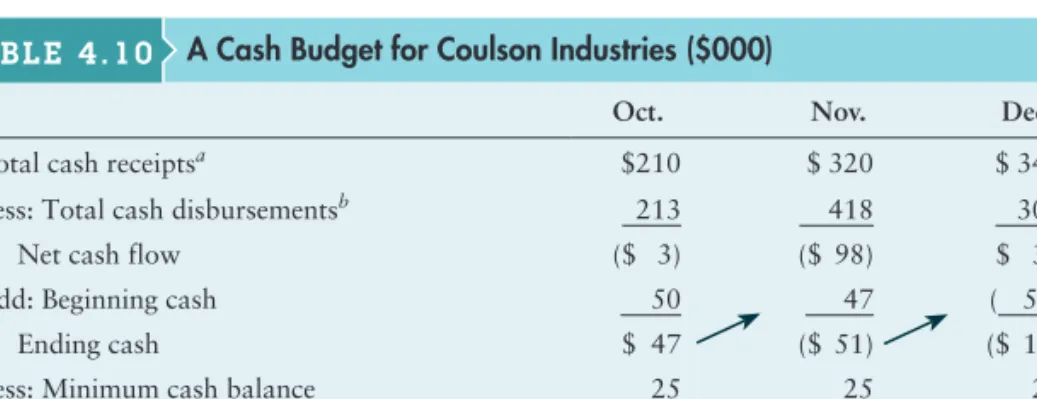

Cash Planning: Cash Budgets

Cash Sales The cash sales shown for each month represent 20% of the forecasted total sales for that month. The sum of the company's beginning cash and its net cash flow for the period. The cash budget shows whether a cash deficit or surplus is expected in each month covered by the forecast.

4–12 How can the two bottom lines of the cash budget be used to determine the company's short-term financing and investment needs.

Profit Planning: Pro Forma Statements

4–13 What is the cause of uncertainty in the cash budget and what two techniques can be used to deal with this uncertainty. A pro forma statement of income, using the percentage of sales method, for Vectra Manufacturing for the year ended December 31, 2016.

Preparing the Pro Forma Income Statement

The best way to adjust for the presence of fixed costs when preparing a pro forma income statement is to break down the company's historical costs and expenses into fixed and variable components. Splitting Vectra's costs and expenses into fixed and variable components provides a more accurate projection of pro forma profit. Clearly, when using a simplified approach to prepare a pro forma income statement, we need to break down costs and expenses into fixed and variable components.

4–16 Why does the presence of fixed costs cause the percent-of-sales method of preparing a pro forma income statement to fail?

Preparing the Pro Forma Balance Sheet

A "plug" figure — called the external financing required — of $8,293 is needed to balance the statement. Once the form of financing is determined, the pro forma balance is changed to replace "external financing required" with the planned increases in debt and/or equity accounts. Once the specific measures have been determined, "required external financing" in the pro forma balance is replaced by the planned reductions in debt and/or equity accounts.

Obviously, in addition to being used to prepare a pro forma balance sheet, external financing is required. socket").

Evaluation of Pro Forma Statements

The goal is to ensure the solvency of the company and generate positive cash flow for the company's owners. Both the size and risk of the cash flows generated on behalf of the owners determine the value of the business. It reconciles changes in the company's cash flows with changes in cash and marketable securities for the period.

What are the firm's expected receipts for the months of August, September, and October?