Submitted in partial fulfillment of requirements for the Bachelor of Business Administration degree. With due respect, I wish to inform you that it is my pleasure to present this report on “Performance Evaluation of Some Selective NBFIs (LankaBangla Finance Limited, IPDC Finance Limited & IDLC Finance Limited)” as a requirement for completion of my Diploma in Business Administration. This confirms that Fardina Rahman Bably student of BBA Business Administration department.

Performance Evaluation of Some Selective NBFIs (LankaBangla Finance Limited, IPDC Finance Limited & IDLC Finance Limited)" has been submitted as the requirement for the degree of Bachelor of Business Administration. My "Project Report" is a formal part of BBA under Department of Business Administration at Sonargaon University I also express my deepest appreciation to all my faculty members of the Department of Business Administration, Sonargaon University for their individual contribution and cooperation in promoting this report and thereby successfully completing my BBA program.

CHAPTER- 1 INTRODUCTION

- Introduction

- Origin of the report

- Objectives of the report .1 General Objective

- Specific Objective

- Scope of the Study

- Methodology

- Limitations

As part of project report for BBA course requirement, I was assigned to do my report on performance evaluation of some selective NBFIs. This report, "Performance Evaluation of Some Selective NBFIs (LankaBangla Finance Limited, IPDC Finance Limited & IDLC Finance Limited)" has been prepared to fulfill the partial requirement of the BBA program as a means of project paper. This report is a brief summary of the NBFIs that I myself found all over the internet.

The broader aim of the report is to fulfill a partial requirement of the BBA programme. Presentation of the organizational structure and policy of LankaBangla Finance Limited, IPDC Finance Limited & IDLC Finance Limited. It was indeed a very short time to know the details of the three market leading merchant bankers like LankaBangla Finance Limited, IPDC Finance Limited and IDLC Finance Limited.

CHAPTER- 2

ORGANIZATIONAL OVERVIEW

- History

- Vision

- Mission

- Objectives

- Core Values

- SOWT analysis

LankaBangla Finance Limited started its journey way back in 1997 as a joint venture financial institution with multinational collaboration with a license from Bangladesh Bank under the Financial Institutions Act-1993. LankaBangla is now the country's leading provider of integrated financial services, including corporate financial services, retail financial services, SME financial services, stockbroking, corporate advisory and wealth management services. Under the broadest umbrella of products and service offerings, we are the only financial institution that operates credit cards (MasterCard and VISA).

IPDC Finance was established on November 28, 1981 by a distinguished group of shareholders namely International Finance Corporation (IFC), USA, German Investment and Development Company (DEG), Germany, The Aga Khan Fund for Economic Development (AKFED), Switzerland, Commonwealth Development Corporation (CDC), United Kingdom and Government of Bangladesh. It is a limited liability company incorporated in Bangladesh under the Companies Act, 1913 (now the Companies Act, 1994), listed on the Dhaka and Chittagong Stock Exchange Limited since 3 December 2006. Subsequently, a detailed feasibility study and a strategic policy dialogue between the government, the IFC and other international partners led to the creation of the IPDC as an institution to finance alternative development in the private sector.

The company was established through collaboration of International Finance Corporation, German Investment and Development Company, Korea Development Financing Corporation, Aga Khan Fund for Economic Development, Kookmin Bank, The City Bank Limited, Bangladesh Limited and Sadharan Bima Corporation. To become the country's most passionate financial brand, with a special focus on youth, women and underserved areas. To enable our customers and communities to live untethered and realize their full potential by expanding innovative financial solutions in a friendly, timely, transparent &.

CHAPTER- 3

THEORETICAL OVERVIEW

- Introduction

- Definition of NBFIs

- Types of NBFIs

- Functions Of NBFIs

- Financial Intermediation

- Economic Basis of Financial Intermediation

- Inducement to Save

- Mobilization of Savings

- Investment of Funds

- Financial Performance Analysis

In Bangladesh, non-bank financial institutions are one of the most important parts of a financial system. The NBFI sector in Bangladesh, which mainly consists of the development finance institutions, leasing companies, investment companies, investment bankers, etc. NBFIs can provide loans up to a certain amount to their members and the general public and can also perform trust functions with the prior approval of the central bank.

NBFIs are specialists of the intermediation process and their origins can be traced back to the development of specialized financial institutions. One of the important roles that NBFIs play in an economy is to act as a buffer, especially in moments of economic distress. An efficient NBFI sector also serves as systemic risk mitigation and contributes to the overall objective of financial stability in the economy.

The most important function of non-bank financial intermediaries is the transfer of funds from savers to investors. The handling of funds by financial intermediaries is more economical and efficient than that of individual property owners due to the fact that financial intermediation is based on it. a) The law of large numbers, and. These institutions offer a wide range of financial assets as a store of value and provide expert financial services to savers.

In fact, the savings-to-income ratio is positively related to both financial institutions and financial assets. financial progress leads to greater savings at the same level of real income. Financial statement analysis is a process of evaluating the relationship between the component parts of the financial statements to better understand the company's position and performance. For analysis purposes, individual items are studied; After their relationship with other related figures has been established, the data is sometimes rearranged to gain a better understanding of the information using various techniques or tolls for this purpose.

Thus, the analysis of financial statements refers to the treatment of the information contained in the financial statements in a way that enables a complete diagnosis of the profitability and financial position of the firm in question.

CHAPTER- 4

ANALYSIS & EVALUATION

Liquidity Ratio

Liquidity ratios are ratios that measure a company's ability to meet its short-term debt obligations. These ratios measure a company's ability to pay off its short-term obligations when they fall due. The current ratio measures whether or not a firm has sufficient resources to pay its debts over the next 12 months.

Current Ratio

Financial Leverage Ratio

The leverage ratio is a measure of how much assets a company has relative to its equity. A high leverage ratio means that a company uses debt and other liabilities to finance its assets – &, all else being equal, is riskier than a company with lower leverage. The level of leverage depends on a number of factors, such as the availability of collateral, the strength of cash flow from operations and tax treatment.

The lower the percentage, the less leverage a company is using and the stronger its capital position.

Debt

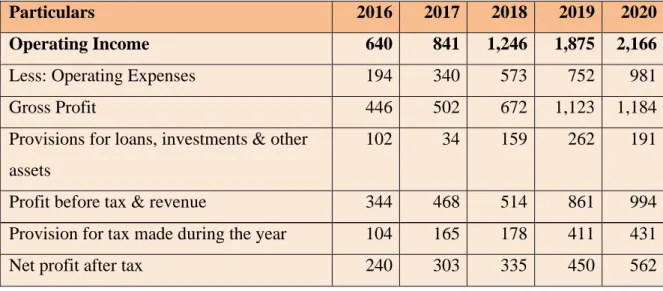

Profitability Ratio

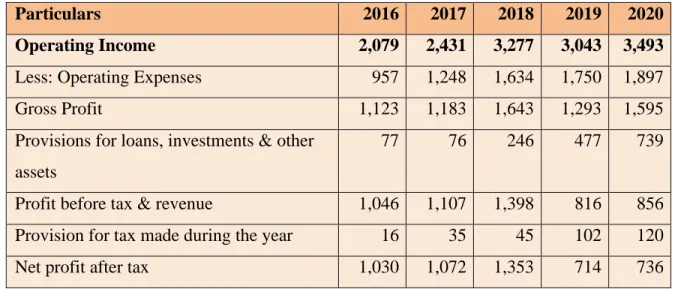

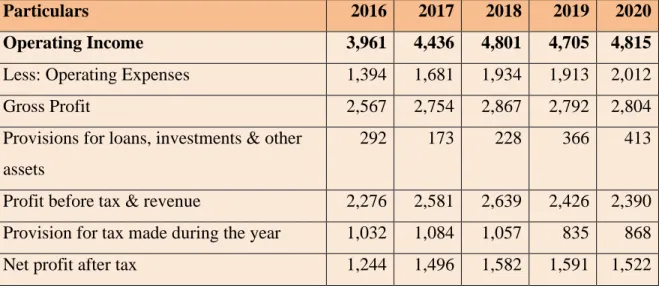

The profitability ratio compares the accounts and categories of the income statement to show a company's ability to generate profits and strengthen its operations. Investors and creditors can use profitability ratios to assess a company's return on investment based on its relative level of resources and assets. In other words, profitability ratios can be used to judge whether companies are generating enough operating profit from their assets.

The return on assets ratio, often called return on total assets, is a profitability ratio that measures the net income generated by total assets over a period of time by comparing net income to average total assets. In other words, the return on assets ratio or ROA measures how effectively a company can manage its assets to generate profit over a period of time. Note: In the case of return on assets, the higher the percentage, the higher the efficiency of the assets.

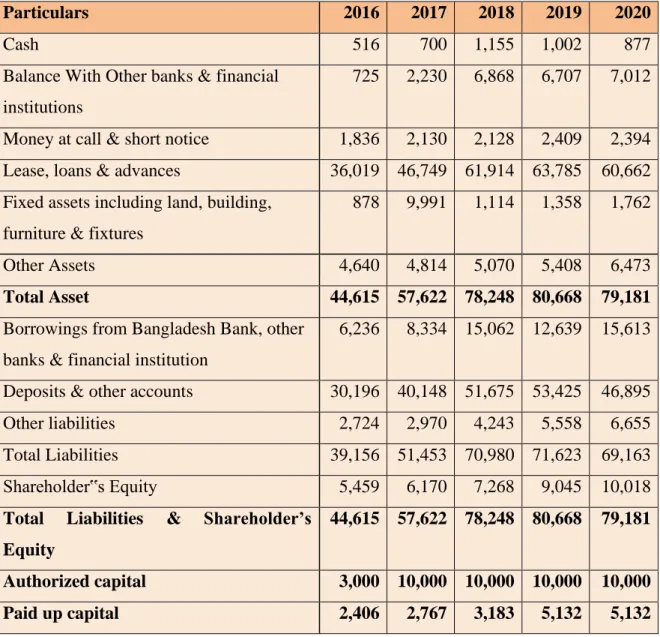

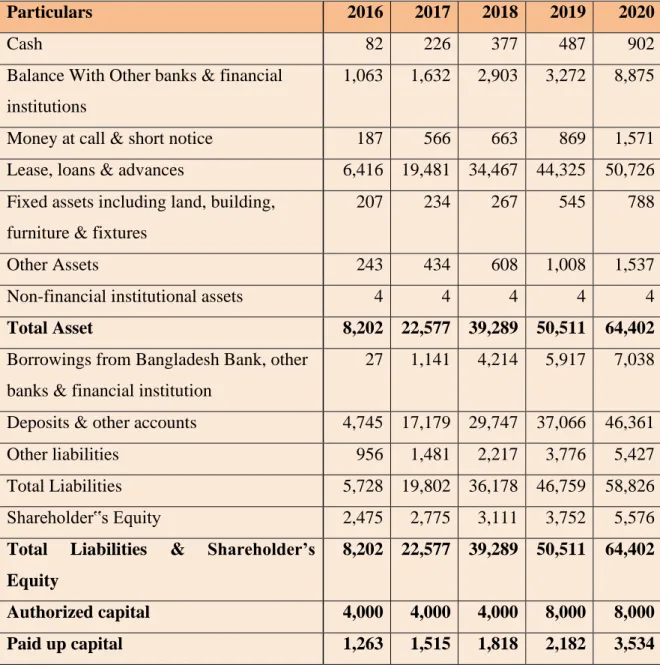

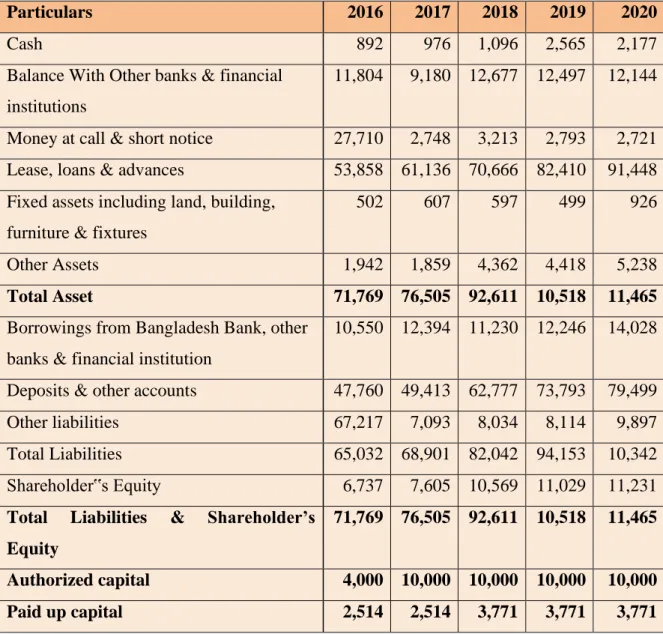

Vertical & Horizontal Analysis of Financial Statement .1 Vertical Analysis of Balance Sheet

- Horizontal Analysis of Balance Sheet

CHAPTER – 5

FINDINGS, RECOMMENDATIONS &

CONCLUSION

Findings

Capital: It has seen all the three market leaders in NBFI's paid up capital increase. Liquidity Ratio: From the current ratio analysis for the last five years, it has been found that LankaBangla Finance Limited, IPDC Finance Limited & IPDC Finance Limited LankaBangla Finance Limited, IPDC Finance Limited & IPDC Finance Limited maintained a satisfactory range of capital assets for smooth operations at to pay their short-term obligations.

- Recommendations

- Conclusion

- Current ratio: The Current Ratio indicates a company‟s ability to meet short- term debt obligations

- Quick Ratio: The most basic definition acid test ratio that, “it measures current (short term) liquidity & position of the company”

- Debt to Equity Ratio: The ratio reveals the relative proportions of debt &

- Times Interest Earned Ratio: Time interest earned ratio is calculated by dividing earnings before interest & tax (EBIT) for a period with interest expense

- Fixed Charge Coverage Ratio: The fixed charge coverage ratio is financial ratio that measures a firm‟s ability to pay all of its fixed charges or expenses with its

- Return on Asset: The return on assets ratio or ROA measures how efficiently a company can manage its assets to produce profits during a period

- Return on Equity: Return on Equity (ROE) is a measure of financial performance calculated by diving net income byshareholder‟s equity

- Net Profit Margin: The measurement reveals the amount of profit that a business can extract from its total sales

- Gross Profit Margin: It measures how efficiently a company uses its materials &

- Operating Profit Margin: The operating margin ratio, also known as the operating profit margin, is a profitability ratio that measures what percentage of

-The growing capitals of all three NBFIs, LankaBangla Finance Limited, IPDC Finance Limited and IDLC Finance Limited were on an upward trend and they need to focus on raising capital in order to maintain their solvency. LankaBangla Finance Limited & IDLC Finance Limited Debt to equity ratio should increase. Although the profitability ratio of IDLC Finance Limited is a stable situation where the other two; Profitability ratios of LankaBangla Finance Limited & IPDC Finance Limited are decreasing year on year.

By unbundling, targeting and specializing in financial services to the needs of the individual, NBFIs are working to increase competition in the financial sector. LankaBangla Finance Limited, IPDC Finance Limited & IDLC Finance Limited are the market leaders among NBFIs of Bangladesh. In all economic conditions of our country, these three NBFIs are working with confidence and competing immensely with each other along with other NBFIs.

Some of the problems were: excessive bad loans, shortage of loans and advances, scarcity of cash due to vault limit, etc. These problems arise from time to time due to economic slowdown, interest rate fluctuations, emerging capital markets, inflation in money market , 2011 Bangladesh stock market scam and so on. Fighting with all these problems and competing with other NBFIs every moment, these three market leaders are trying to do better and better.

If this thing continues, we hope that these three NBFIs will develop even more in the future. Currently, these three market leaders are highly capable of generating new non-banking services. amp; investment concepts or unique ideas that can give a new dimension to today's investment business, also successful in managing its core issues that are very essential to improve & left a milestone in the private non-banking arena. Quick ratio: The most basic definition acid test ratio which, "it measures current (short-term) liquidity and position of the company". short term) liquidity and position of the company”.

Fixed Charge Coverage Ratio: The fixed charge coverage ratio is a financial ratio that measures a company's ability to pay all its fixed charges or expenses with theThe measures a company's ability to pay all its fixed charges or expenses with its income before interest and treasure.