Indonesian agricultural trade policy at the crossroads

Rina Oktaviani, Nur Rakhman Setyoko and David Vanzetti1

Bogor Agricultural University, Bogor, Agency for Trade Research and Development, Jakarta and Australian National University, Canberra

Contributed paper at the 54th AARESAnnual Conference,

Adelaide, South Australia 10-12 February 2010

Abstract

Following the global spike in food prices in 2008, there is renewed interest in Indonesia in self-sufficiency as a means of achieving food security. Restrictive trade policies, including specific tariffs on rice and sugar, and quantitative restrictions on imports and exports, have been used in an attempt to meet conflicting objectives of assisting both producers and consumers. Meanwhile, palm oil exports to the European Union are constrained by the importer‟s concerns about deforestation and its contribution to climate change. Similar constraints may be applied to other commodities as production moves into pristine areas in an attempt to maintain self-sufficiency. On the other hand, more open trade may offer better options to address any agricultural-related costs associated with climate change. A computable general equilibrium model is used to analyze the efficiency and distributional impacts of these agricultural trade policies. The results suggest that removing or reducing tariffs on rice and sugar would increase imports substantially in relative terms but have only a small impact on domestic prices and production. A ban on palm oil exports to the European Union would have a significant impact, although offset somewhat by increased exports elsewhere. In each case the major effects are distributional, involving transfers between producers and consumers. Multiple instruments are necessary to achieve conflicting objectives. For example, social safety nets rather than trade bans should be used to support poor consumers. Support for the agricultural sector should focus on the provision of rural infrastructure, research and development, and the encouragement of private sector investment.

JEL subject codes F13, Q17.

Key words: agriculture, trade, Indonesia

1

Indonesia at the crossroads

The recent rise in international commodity prices from mid 2007 to the end of 2008 created a dilemma for many countries. The need for food security has led many governments to consider buffer stocks and export restrictions as a means of ensuring domestic supply, in contrast to previous policies that relied on international trade to match supply and demand. Indonesia is one of the countries in South East Asia that faces such issues.

Among food commodities, rice and cooking oil are becoming the most strategic commodities in Indonesia. These products involve 15 million farmers and are consumed by 220 million people (TREDA 2008). These two commodities attract significant government intervention and have international and environmental dimensions.

Rice supply is the major focus of Indonesia‟s national food security policy. Rice imports have attracted the most prominent discussion and policy debate. and draw attention to the conflict between protecting both domestic consumers and local farmers at the same time (Timmer and Simatupang 2008).

The rise in the international price of rice is a challenge to Indonesia‟s policy on food security. Concern for food security seems to have shifted during 2008 after the rise in the price of rice. Since January 2008, the international price of rice (White Rice, Thai 100% B second grade, f.o.b. Bangkok) spiralled up from about US$385 per metric tonne toUS$962 per metric tonne by May 2008 (Chart 1). The price fell in 2009 but remains well above the long term trend. The issue is no longer restricted to rice imports. A further concern is how to constrain rice exports including illegal exports from Indonesia.

In response to this phenomenon, the President required all related ministers to consider Indonesia‟s rice policy (Presidential Instruction No.1/2008). Many policies have been adopted, including trade policies. Domestic price stability was one of the main concerns. Based on the Government Regulation No 68/2002 and the Minister of Trade Decree No.22/M-DAG/PER/10/2005, the definition for instability in food prices is when the fluctuations in prices reach 25 percent above the normal price.

Chart 1. Development of Food Prices from 2006

Indonesia‟s crude palm oil (CPO) trade has faced many pressures including endorsing domestic export as the source of foreign exchange, domestic shortage of CPO supply as exports continue, and non-tariff barriers related to environmental issues. CPO is recognized as the cheapest input for cooking oil, which is one of the most politically sensitive commodities in Indonesia. The political pressure for sufficiency of this product at all times is strong. The increase of cooking oil price due to CPO exports is well recognized by domestic policy makers. The government imposed many policies including Domestic Market Obligation, export taxes, market operation for the poor, removal of the value added tax, and an export ban.

Currently Indonesia is engaging in several trade agreements under multilateral, regional, and bilateral framework. These include AFTA, ASEAN-China FTA, ASEAN-Korea FTA, and Indonesia Japan Economic Partnership Agreement (IJEPA). The underlying objective of cooperation in food, agriculture and forestry between ASEAN countries is to strengthen food security in the region (ASEAN Website 2009). The ASEAN Ministers on Agriculture and Forestry (AMAF) have established a Ministerial Understanding (MU) on ASEAN Cooperation in Food, Agriculture and Forestry, signed in October 1993, to facilitate and promote trade in the region.

international markets? Are increasing trade barriers for Indonesia‟s agricultural product a good solution to the environmental issues in Indonesia or is it just a new form of protectionism in the European Union? Would Indonesia be worse off if it consistently opens its markets at all times? Will this internal and external pressure on staple food be detrimental to rural development?

This study will explore the possible outcomes due to hypothetical changes in trade policies. This study will focus on three major commodities; rice, sugar and CPO which are important crops for the poor. A computed general equilibrium model is used to examine the impact of removing tariffs on rice and sugar, of an export ban of EU imports of Indonesian CPO, and finally, the role of trade in smoothing domestic prices. The impacts on Indonesia‟s production, trade and welfare are detailed, and policy implications are drawn from the results.

The first section will explore the evolution of Indonesia‟s trade policy regime. The second section will describe several scenarios and an analysis of the simulation. The last section will sum up the discussion with implications and recommendations.

The Evolution of Indonesia’s Agricultural Trade Policy

The New Order has set food security as its main focus in agricultural policy (Fane and Warr 2009). Provision of food will be very important for domestic stability. Politically, food has become a sensitive issue of policy especially due to the last detrimental short run spike in staple food prices. Self sufficiency is the target of every agricultural policy in Indonesia (Timmer and Pantjar 2008; Fane and Warr 2009), although self-sufficiency comes at a cost and is in conflict to some extent with the objective of an efficient agricultural sector. Some economists describe the self sufficiency objective as a „starve thy neighbour‟ policy (McLeod 2008, Timmer and Pantjar 2008, Fane and Warr 2009).

Indonesia had gone through several alternating policies in agricultural trade policy after the New Order regime. The IMF encouraged Indonesia to loosen up its monopoly structure and create competition within the domestic market. Bulog, a prominent monopoly during The New Order, lost its domestic power to monopolize sugar and rice trade because Indonesia was required to comply with the IMF Letter of Intent. This was the emerging era of more open trade policy in Indonesia. Indonesia started to import flour from the world market and domestic monopoly of Bogasari was faced with external pressure of competition from import.

Chart 2. Indonesia’s Bound and Applied Agricultural Tariffs

Source: UNCTAD TRAINS via WITS. MFN simple average tariffs.

Indonesia started to create an efficient economy by reducing import tariffs. Applied tariffs seem to fall from 2000 to 2009 because of unilateral tariff reduction from domestic tariff harmonization and FTAs with its neighbouring countries in ASEAN through AFTA. Indonesia‟s average MFN applied tariff for agricultural products is relatively low since 2002. The tariff overhang for Indonesia is quite high so as to provide a domestic policy space to react whenever a huge shock in the agriculture creates domestic injury.

The Ministry of Trade has pursued negotiations to increase market access in the international market. Export oriented policies have been the picture of Indonesia‟s agricultural trade policy. Indonesia had become a member of several FTAs including AFTA, ASEAN-China FTA, ASEAN-Korea FTA, and IJEPA. Many agricultural goods are subject to tariff reductions in some of these FTAs. Indonesia still maintains its stated policy to liberalize the agricultural sector to maximize welfare and to create an efficient economy. The role of agriculture in Indonesia‟s exports has increased in recent years. Agricultural exports increased by 16 percent on average annually during 2004-2009. The agriculture sector contributed about 4 to 4.5 percent on average of Indonesia‟s total non-oil exports during 2004-2009. Agricultural sector seems to be getting more open to the world market. However, the benefits are questionable, and depend on the ability of Indonesian agricultural sector to increase its competitiveness and distribute the gain so that poor producers are not left behind.

developing country to take action based on the condition of price or volume triggers without following the procedure of a regular safeguard. This will enable Indonesia to avoid further injury caused by the surge of imports.

Chart 3. Development of Agricultural Sector Share in the Indonesian Economy

Source: Central Bureau Statistics 2009 (Computed)

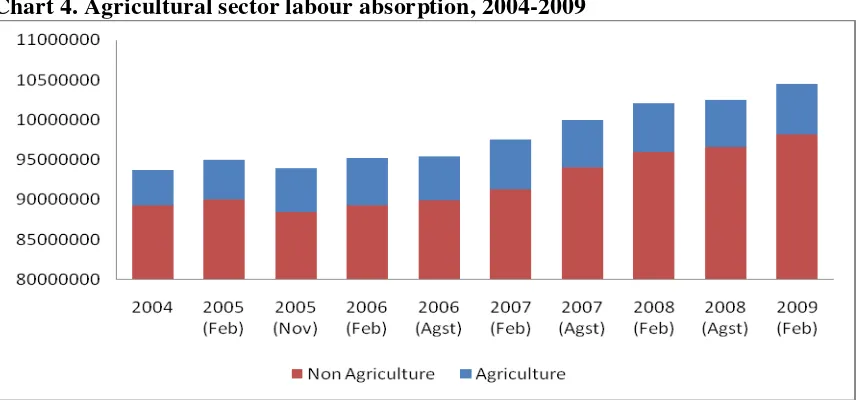

Chart 4. Agricultural sector labour absorption, 2004-2009

Source: Central Bureau of Statistics 2009 (computed)

The performance of agriculture in managed open trade policy has caused the Indonesian agricultural sector to become more open. The agricultural sector is more export oriented during 2006-2008 and agricultural trade openness increased during this period. Indonesia was able to export around 12.86 percent of its output in 2006 and 16.12 percent in 2008. However, the attraction of agricultural exports creates concerns about the availability of agricultural products in the domestic market.

Table 1. Development of Agriculture in Indonesia’s Non Oil Export during

2004-2008 (billion US$)

NO SEKTOR 2004 2008 TREND (%) 04-08

PERUB (%) 08/07

PERAN (%) 2008

Jan-Nov 2008

Jan-Nov 2009

PERUB (%) 09/08

PERAN (%) 2009 I. AGRICULTURE 2.506,60 4.584,60 15,53 25,34 4,25 4.207,90 3.923,90 -6,75 4,53 II. INDUSTRY 48.667,00 88.393,50 16,33 15,61 81,93 82.619,80 65.271,50 -21 75,33 III. MINING 4.761,40 14.906,20 30,8 25,42 13,82 13.567,50 17.441,10 28,55 20,13 IV. OTHERS 4,4 9,9 19,23 12,56 0,01 9,4 9,9 5,09 0,01 V TOTAL NON OIL 55.939,30 107.894,20 17,82 17,26 100 100.404,60 86.646,50 -13,7 100

(Juta US$)

Sumber: Central Bureau of Statistics (computed by TREDA)

international price rises. In fact, the role of agriculture in the economy fell during the commodity price hike. The agricultural sector contributed to around 15 percent on average of the overall economic activity in Indonesia during 2004-2009, but shares of agriculture diminished in every quarter during 2004-2009. The main reason for this is that Indonesia‟s agriculture was open to international competition during 2004-2005.

The declining role of agriculture is influential in determining the government policy which is aimed at securing domestic supply and intensify pro-poor policies. Many of the strategic policies are aimed at keeping prices stable in the domestic market at the expense of exports. Policy shifted to become more domestic oriented during the high world price hike.

The government had put specific efforts to secure domestic supplies of rice by restricting the types of rice that are considered as staple food. The Ministry of Finance (MoF) placed a progressive export tax on CPO to keep supply sufficient in the domestic market. This is mainly to secure the stability of the price of cooking oil, an important commodity for many poor people.

In the 1990s agricultural trade policy moved towards more open trade. However, there is a perception that food security and pro-poor policies have been reduced as a result. This condition is augmented by the more developing domestic oriented industrial development policy and the international price increases. Recent policy initiatives are aimed at reversing this trend.

The GTAP model

The Global Trade Analysis Project (GTAP) model is used to measure the impact of changes in trade policy on the agricultural sector. GTAP is a country and multi-sectoral computable general equilibrium (CGE) model and fully documented in Hertel and Tsigas (1997). For each country (or "region" in the GTAP terminology) there are multistage production processes, a single aggregate household consuming unit, government and investment sectors, and production draws on primary factors of land, labour, capital and natural resources. GTAP allows the formalization of the importing and exporting activities between countries, not just for commodities but also for global banking (savings and investment) services, and the associated demand for global transport services.

each sector can be used as intermediate inputs for industries and as consumption, investment and government uses in domestic and foreign countries.

Allocation of final income between these three uses via a regional "representative consumer" has an advantage that the welfare implications for an individual country or region can be measured from the total income of this household. The total income consists of earnings from the factors of production and net tax revenues while the allocated income consists of savings, private household consumption and government expenditure. The Cobb-Douglas assumption of constant budget shares and the constant difference of elasticity (CDE) functional form are used to allocate commodities in the government and the private household expenditure, respectively.

The regions are linked together by imports and exports of commodities. Similar commodities, which are produced by different countries, are assumed to be imperfect substitutes for one another. The degree of substitution is determined by the Armington elasticities (Armington, 1969).

Factors of production are classified as perfectly mobile or imperfectly mobile between sectors within a region. For imperfectly mobile factors, the degree of mobility can be differentially defined for each such factor in each region. For capital, not only an issue of within-region mobility between sectors, but also inter-regional mobility. In GTAP, capital in one region cannot be reallocated to other regions in the current period. In the long run, capital can move by virtue of investment. Savings in one region can be invested elsewhere.

Aggregation and modification of the GTAP database

The database consists of matrices of bilateral trade flows, transport payments, and policy (taxes and subsidies) variables, which defines the inter-connection among countries or regions, along with input-output (I-O) matrices defining the inter-sectoral flows within each country or region. This study draws on the original GTAP Version 7 database, consisting of 113 regions/countries and 57 sectors or commodities.

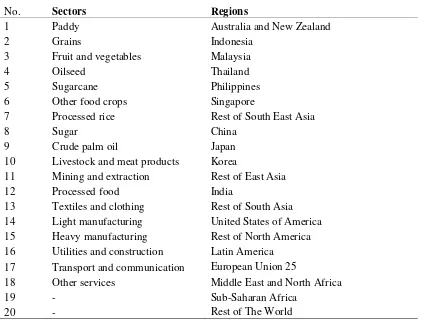

The data base is aggregated into 18 sectors with the focus on keeping detail of the strategic agricultural products, such as rice, sugar, and crude palm oil, which have importance for Indonesian self sufficiency. Meanwhile, the 113 regions are aggregated into 20 regions with emphasis on ASEAN countries and the EU25 which are strongly related with the policy simulations (see Table 2 for sectors and regions).

Table 2. Sectoral and Regional Aggregation

No. Sectors Regions

1 Paddy Australia and New Zealand

2 Grains Indonesia

3 Fruit and vegetables Malaysia

4 Oilseed Thailand

5 Sugarcane Philippines

6 Other food crops Singapore

7 Processed rice Rest of South East Asia

8 Sugar China

9 Crude palm oil Japan

10 Livestock and meat products Korea

11 Mining and extraction Rest of East Asia

12 Processed food India

13 Textiles and clothing Rest of South Asia

14 Light manufacturing United States of America

15 Heavy manufacturing Rest of North America

16 Utilities and construction Latin America

17 Transport and communication European Union 25

18 Other services Middle East and North Africa

19 - Sub-Saharan Africa

20 - Rest of The World

Closure

Macroeconomic closure refers to the specification of endogenous and exogenous variables to satisfy the balancing of the capital and current accounts (i.e. the difference between national savings and investment must equal exports plus international transfers less imports). In this application, the standard closure is modified by fixing the trade balance at its baseline level and endogenising the slack variable on capital goods. This reflects concerns that the Government avoids a trade deficit following trade liberalisation In addition, Scenarios 3 and 4 require further closure swaps to eliminate or fix trade in particular commodities. To achieve this result, an endogenous tax on exports or imports is introduced, the rate of which adjusts to prevent any changes in the volume of imports. Besides capturing the import ban, this study also uses the export ban policy for rice. In recognition of the fact that increases in the international price of rice (2007-2008) could otherwise induce exports of rice and that these exports are currently banned, the volume of rice exports are similarly held fixed, by means of an endogenously adjusting export tax.

Trade Policy Scenarios

Five scenarios are conducted, with technical explanation as follow:

(ii) Reduction of import tariff on “sugar” from Rp 550/kg to Rp 150/kg . (iii) Impose ban on Indonesian exports on CPO to the EU25.

(iv) Ten percent decrease in productivity of the Indonesian rice sector: (a) with trade bans on Indonesian rice imports and exports; and (b) without trade bans.

The first two are self explanatory. The third scenarios attempts to gauge the impact of bans reflecting the negative campaign related to deforestation and climate change. The fourth shows the role of trade in smoothing domestic price fluctuations following a modest shock, such as a drought or a flood, perhaps induced by climate change. Two simulations, with and without trade bans, are compared. These shocks are in relation to 2004 production and trade flow data.

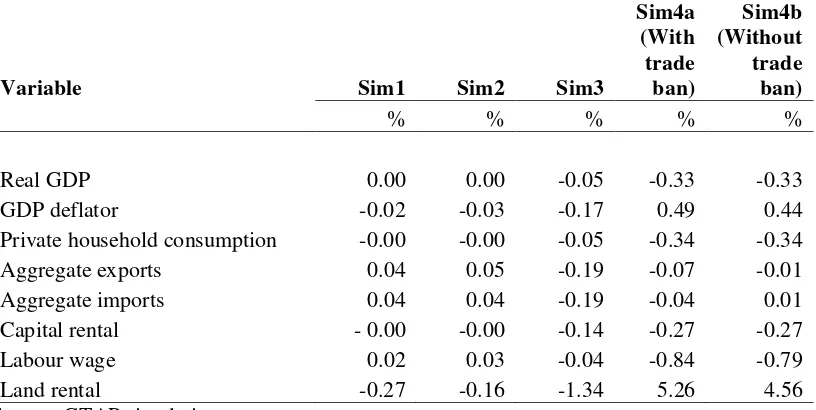

Results

The impact of several scenarios on macroeconomic performance can generally be seen through the changes in the sign and magnitude of macroeconomic variables such as national output (proxied by real GDP), inflation (GDP deflator) and welfare (equivalent variation). The behavior of the real GDP itself can be analyzed from either the income side or expenditure side approach. The income side consists of earnings from capital, labour and land. In most tariff cutting simulations, the rate of return on capital (capital rental) decreases. The reduction in capital costs associated with trade liberalisation is due primarily to the reduction of tariffs on the duty-paid prices of imported inputs to investment and the reduction of average cif-prices of imported capital goods relative to the GDP deflator (Adams et al., 1998). Decreases in capital rental will encourage investment and eventually increase real GDP. Another income side item is wages, which increase in the trade liberalization simulation of rice and sugar. The increase in wages reflects the low labour wage with large populations, the ratio of factor payments to capital and labour is relatively high (more than one), and the land rental in most of the simulations is decreasing.

When viewed from the expenditure side, the changes in GDP relate to changes of private household expenditure and net exports. Private household consumption decreases as the result of the scenarios although only with a slight magnitude (below one percent). Trade liberalization on rice and sugar has little impact at the national level as the macro summary shows.

Table 3. Macroeconomic results for Indonesia

Private household consumption -0.00 -0.00 -0.05 -0.34 -0.34

Aggregate exports 0.04 0.05 -0.19 -0.07 -0.01

The simulation that is the most destructive is the rice production shock in conjunction to the application of rice trade ban (export and import). Decreasing productivity has the consequence of reducing domestic rice supply and raising domestic prices of rice and other commodities. Considering that rice is the main staple food for the majority of Indonesians, this scenario has the potential to decrease private household consumption then reduce real GDP by -0.33 percent.

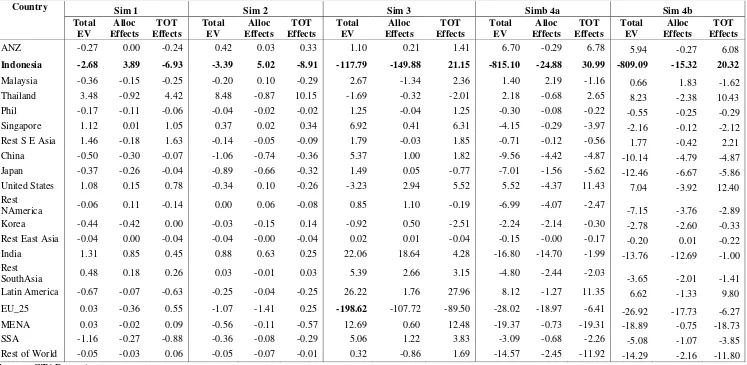

Table A.1 shows welfare changes for each scenario, decomposed into allocative efficiency and term of trade effects for each region. The highest fall for Indonesian welfare is the decreasing productivity of rice (-US$815 million). This derives from the terms of trade effects rather that the allocative efficiency effect. Change in the terms of trade accounted for US$31 million reflects the decline of price competitiveness of Indonesian rice products, where the domestic price is relatively higher than the import price.

Decreasing exports of CPO contribute to the massive decline of Indonesian welfare (-US$150 million), while the EU as the trading partner experiences a higher loss of welfare because of the trade ban (-US$199 million). The impact of the import tariff reduction of rice and sugar also particularly worsens welfare, with each simulation decrease of about -US$2.7 million and -US$3.4 million. The negative welfare effect is caused by the negative terms of trade which more than offsets the positive allocative efficiency effect.

Elimination of 10 percent import tariff and quantitative restrictions of rice

A.4). Because of the assumption of a fixed trade balances, the increase in imports in rice is compensated with decreases in other imports.

Imports of other sectors such as sugar, CPO, meat products, manufacturing sector and services will decrease. Households will consume more rice when it is allowed to be imported and switch their consumption away from other goods.

Exports of rice also increase with lower domestic prices. Rice and other sectors except extraction industries will be exported more (Table A.3). Export of extraction products is not increasing in this scenario but imports show contrary result mainly because there is an increase in domestic demand of extraction that exceeds domestic supply. The increase in demand of extraction is mainly because outputs of manufacturing sectors are increasing.

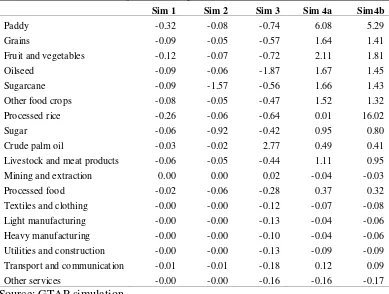

The implication on prices shows consistent result. Prices of rice show a reduction of 0.26 per cent (Table A.2). The reduction of rice price discourages farmers and rice processors from demanding more paddy. The reduction in demand for paddy will lower price of paddy sector by 0.09 percent and paddy output will fall by 0.44 percent (Table A.7).

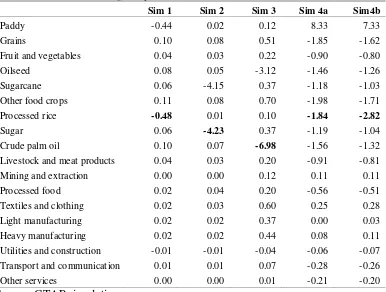

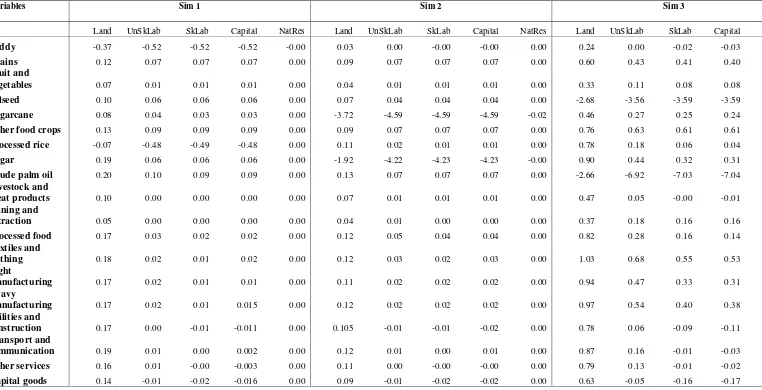

The fall in paddy and processed rice outputs will have a negative impact on landowner‟s return and wages of unskilled labour. The demand of land and unskilled labour decreases by 0.36 per cent and 0.07 per cent respectively due to lower demand for domestic rice and paddy. Since other sectors are not as land intensive as paddy and rice, prices of these inputs will decrease by 0.3 percent and 0.01 percent respectively. Landowners and unskilled labour seem to be worse off due to trade liberalization policy (Table A.8).

Rice farmers earn their income from sales of paddy. The domestic sales of paddy seem to decrease by 0.44 percent under this scenario. Rice processors earn lower sales by around 0.44 per cent. The rice and paddy farmers are worse off with this policy.

However, the fall in rice production is offset somewhat by increases in output of other agricultural sectors such as other grains, fruit and vegetables, oilseeds, sugarcane, other crops, sugar, CPO, and meat products. Producers in these sectors are better off due to increases in prices of their goods and domestic sales.

Reduction of import tariff on “sugar” from Rp 550/kg to Rp 150/kg

reduction of sugar will discourage domestic producers to produce sugar. Domestic sugar production will decrease by 4.23 per cent (Table A.7).

The decrease in sugar supply will reduce the use of factors of production. The demand for sugarcane will decrease by 4.15 per cent. The decrease in sugarcane and sugar outputs will diminish demand of factor of production for these two commodities. Land owners, unskilled labour, skilled labour, and capital owners are worse off through a reduction in their returns due to trade liberalization in the sugar industry. However, natural resources owner are marginally better off because they earn 0.02 per cent more. (Table A.8)

It is important to observe that the demand for sugarcane will decrease. The price of sugarcane will decrease by 1.57 per cent due to a reduction in demand. However, sugarcane farmers will be better off overall because the prices of other food products in the economy tend to have fallen.

There is an increase in sugar exports due to this liberalization scenario. Trade liberalization will make Indonesian agricultural sector more outward oriented. All commodities will reduce their imports and tend to export more under this policy.

Impose ban on Indonesian Export on CPO to the EU 25

The EU ban on CPO imports from Indonesia results in an estimated 15 percent decline in total exports. In the baseline, 22 per cent of Indonesian CPO exports are sent to the EU, so the elimination of this trade is offset by increased exports elsewhere, especially to Malaysia and Latin America. For its part, the EU also increases its exports from other sources, illustrating the limits of imposing a ban on just one country when the product is substitutable with imports from other suppliers. Nonetheless, both countries are worse off. The welfare loss to Indonesia, as noted earlier, is US$150 million, somewhat less than the EU welfare losses (Table A.1). Not taken into account in these calculations are the benefits of the ban to the EU, which include the environmental damage of deforestation avoided. The beneficiaries are the other importers of Indonesian CPO, who now pay marginally lower prices for their imports

The reduction in exports will shift CPO supply to the domestic market. Since trade balance is assumed fixed in this scenario, the reduction will be compensated by the increase in exports of other sectors.

Related resources on CPO has been reduced by 2.65 per cent for land, 6.91 percent for unskilled labour, 7.03 per cent for skilled labour, 7.04 per cent by capital, and almost nothing for natural resources (Table A.8). The release of resources from CPO sector are captured by other sector in proportion to their elasticity of absorption. Land owners, unskilled labour, skilled labour, and capital owners are worse off because their returns have diminished under this scenario.

Since the prices of inputs have gone down, other agricultural sectors will expand their production due to the absorption of these endowments. This will expand production of other agricultural outputs and diminish prices of those sectors. The economy enjoys lower agricultural product prices and creates lower return for farmers and input owners at the rural sector.

Ten percent decrease in productivity of the Indonesian rice sector with and without trade bans

An internal productivity shock is simulated with and without a trade ban. The trade ban has little impact on domestic prices. Output of rice will decrease by two to three per cent after producers respond to the domestic price increase of around 16 to 17 percent. (Table A.7).

The fall in productivity means more inputs a required to produce a given quantity of output. Hence, the demand of endowments such as land, unskilled labour, skilled labour, and natural resources will increase simultaneously, reflecting the assumption of constant elasticity of substitution for the production function.

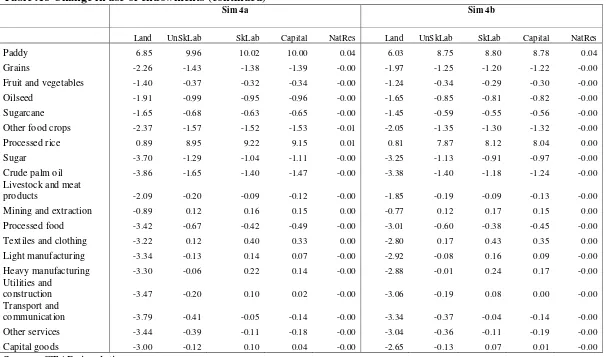

The increase in supply of paddy has an effect on the demand of land, raising its price by 6 per cent. Land will shift from other agricultural sectors to paddy. Use of land for paddy and rice increases by 6.85 per cent and 0.89 per cent respectively (Chart 5). Owners of land suitable for rice production are better off from this shock.

Chart 5. Percentage change in use of endowments after negative productivity shock

Source: GTAP simulation

Since additional resources are dragged into paddy production, other agricultural sectors must bear the consequence. Other agricultural product prices increase substantially as a result. Paddy and rice farmers are worse of in terms of their real incomes because of higher consumption prices.

Urban unskilled labourers are also worse off based on this scenario because their income diminishes while the price of food and other agricultural product increases substantially. It creates an enormous setback in rural development as well as poverty alleviation of the overall economy.

The difference in domestic prices following a productivity shock under the two policy regimes is quite small because the trade share of production is small. This indicates that Indonesia has achieved such a degree of self-sufficiency in rice that complete further insulation from international markets would have little impact on price stability.2

Implications

Indonesia‟s tariff protection on agricultural products is relatively low by developing country standards. On two of the major crops, the tariffs are between 10 and 15 percent, although as these are specific tariffs the ad valorem equivalents will vary with the world price. The bound tariffs on these products are very high, over 100 percent, allowing Indonesia to raise its MFN tariffs in response to an import surge.

According to GTAP modelling estimates, trade liberalization in rice, sugar, and CPO has little impact at the macroeconomic level. The simulation that is the most destructive is the rice production shock in conjunction to the application of rice trade ban (export and import). Removing or reducing tariffs on rice and sugar would

increase imports substantially in relative terms but have only a small impact on domestic prices and production. Because of the high degree of self-sufficiency, a production shock, either positive or negative, would have a much greater impact on prices. However, all scenarios of trade liberalization in sugar and rice have a strong negative impact on land owners and unskilled labour. This is a negative mark on poverty alleviation perspectives.

Nothing has been said here about the numerous domestic support policies that are used to bolster production. These include subsidies to fertilizer, fuel and credit.

The results highlight the conflict between consumer and producer prices. Tariffs support producers, but consumers suffer the costs. The main effect is a transfer from consumers to producers and taxpayers. On the other hand, there are many poor producers who will be worse off if tariffs are reduced. However, a tariff policy, by raising the price of domestic output, benefits mainly the larger producers and is not well-targeted at those most in need. This suggests that multiple instruments are necessary to achieve conflicting objectives. For example, social safety nets rather than trade bans should be used to support poor consumers and poor producers. These can be better targeted than a blunt instrument such as a tariff. Support for the agricultural sector should focus on the provision of rural infrastructure, research and development, and the encouragement of private sector investment

A ban on CPO exports to the EU would be manageable because the significant fall in exports would be offset to some extent by increased exports elsewhere. However, a concern for Indonesia is the likelihood that the EU would extend such a ban to other exporters, or encourage other importers to impose a similar ban. This would further reduce prices on the world market. However, given Indonesia palm oil is substitutable with oil from other sources; it is difficult to imagine a comprehensive ban being effectively implemented.

References

Adams. P., Horridge, M., Parmenter, B. and Zhang. X.G. 1998. Effect on China of APEC Trade Liberalisation. A report prepared for the East Asia Analytical Unit. Department of Foreign Affairs and Trade, Canberra.

Armington, P.A. 1969. ‟A theory of demand for products distinguished by place of production„.IMF Staff Papers 16: 159-78.

Central Bureau of Statistics of Indonesia. 2009. Gross Domestic Product by Sector.

www.bps.go.id (viewed October 2009).

Fane, G. and Warr, P. 2007. „Distortions to Agricultural Incentives in Indonesia‟. Kym Anderson and Will Martin (Eds) Distortions to Agricultural Incentives in Asia World Bank‟s Development Research Group, Washington D.C. (www.worldbank.org/agdistortions).

Hertel, T.W. (ed.) 1997. Global Trade Analysis: Modeling and Applications.

Cambridge University Press. Cambridge.

Food and Agricultural Organization 2009. FAOSTAT Database. www.fao.org (viewed on November 2009).

McLeod, R.H. 2008. „Survey of Recent Developments‟. Bulletin of Indonesian Economic Studies. Vol. 44. No. 2: 183–208.

Pantjar, S. and Timmer, C.P. 2008. „Indonesian rice production: policies and realities‟. Bulletin of Indonesian Economic Studies. Vol. 44. No. 1: 65–79. Trade Research and Development Agency, 2008. Kajian Kebijakan Stabilisasi Harga

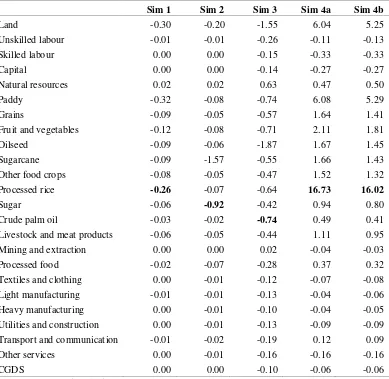

Table A.2. Market Price for Indonesia (%)

Sim 1 Sim 2 Sim 3 Sim 4a Sim 4b

Land -0.30 -0.20 -1.55 6.04 5.25

Unskilled labour -0.01 -0.01 -0.26 -0.11 -0.13

Skilled labour 0.00 0.00 -0.15 -0.33 -0.33

Capital 0.00 0.00 -0.14 -0.27 -0.27

Natural resources 0.02 0.02 0.63 0.47 0.50

Paddy -0.32 -0.08 -0.74 6.08 5.29

Grains -0.09 -0.05 -0.57 1.64 1.41

Fruit and vegetables -0.12 -0.08 -0.71 2.11 1.81

Oilseed -0.09 -0.06 -1.87 1.67 1.45

Sugarcane -0.09 -1.57 -0.55 1.66 1.43

Other food crops -0.08 -0.05 -0.47 1.52 1.32

Processed rice -0.26 -0.07 -0.64 16.73 16.02

Sugar -0.06 -0.92 -0.42 0.94 0.80

Crude palm oil -0.03 -0.02 -0.74 0.49 0.41

Livestock and meat products -0.06 -0.05 -0.44 1.11 0.95

Mining and extraction 0.00 0.00 0.02 -0.04 -0.03

Processed food -0.02 -0.07 -0.28 0.37 0.32

Textiles and clothing 0.00 -0.01 -0.12 -0.07 -0.08

Light manufacturing -0.01 -0.01 -0.13 -0.04 -0.06

Heavy manufacturing 0.00 -0.01 -0.10 -0.04 -0.05

Utilities and construction 0.00 -0.01 -0.13 -0.09 -0.09

Transport and communication -0.01 -0.02 -0.19 0.12 0.09

Other services 0.00 -0.01 -0.16 -0.16 -0.16

CGDS 0.00 0.00 -0.10 -0.06 -0.06

Table A3. Indonesian Exports by sector (%)

Table A4. Indonesian Imports by sector (%)

Table A5. Indonesian Import Price by sector (%)

Table A6. Indonesian Export Price by sector (%)

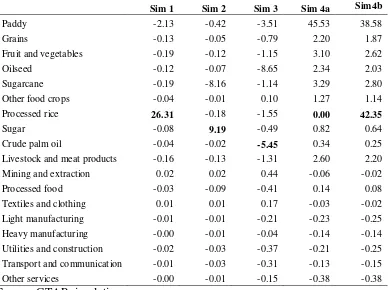

Table A7. Indonesia output by sector (%)

Sim 1 Sim 2 Sim 3 Sim 4a Sim4b

Paddy -0.44 0.02 0.12 8.33 7.33

Grains 0.10 0.08 0.51 -1.85 -1.62

Fruit and vegetables 0.04 0.03 0.22 -0.90 -0.80

Oilseed 0.08 0.05 -3.12 -1.46 -1.26

Sugarcane 0.06 -4.15 0.37 -1.18 -1.03

Other food crops 0.11 0.08 0.70 -1.98 -1.71

Processed rice -0.48 0.01 0.10 -1.84 -2.82

Sugar 0.06 -4.23 0.37 -1.19 -1.04

Crude palm oil 0.10 0.07 -6.98 -1.56 -1.32

Livestock and meat products 0.04 0.03 0.20 -0.91 -0.81

Mining and extraction 0.00 0.00 0.12 0.11 0.11

Processed food 0.02 0.04 0.20 -0.56 -0.51

Textiles and clothing 0.02 0.03 0.60 0.25 0.28

Light manufacturing 0.02 0.02 0.37 0.00 0.03

Heavy manufacturing 0.02 0.02 0.44 0.08 0.11

Utilities and construction -0.01 -0.01 -0.04 -0.06 -0.07

Transport and communication 0.01 0.01 0.07 -0.28 -0.26

Other services 0.00 0.00 0.01 -0.21 -0.20

Table A8 Change in use of endowments (%)

Variables Sim 1 Sim 2 Sim 3

Land UnSkLab SkLab Capital NatRes Land UnSkLab SkLab Capital NatRes Land UnSkLab SkLab Capital N

Paddy -0.37 -0.52 -0.52 -0.52 -0.00 0.03 0.00 -0.00 -0.00 0.00 0.24 0.00 -0.02 -0.03

Grains 0.12 0.07 0.07 0.07 0.00 0.09 0.07 0.07 0.07 0.00 0.60 0.43 0.41 0.40

Fruit and

vegetables 0.07 0.01 0.01 0.01 0.00 0.04 0.01 0.01 0.01 0.00 0.33 0.11 0.08 0.08

Oilseed 0.10 0.06 0.06 0.06 0.00 0.07 0.04 0.04 0.04 0.00 -2.68 -3.56 -3.59 -3.59

Sugarcane 0.08 0.04 0.03 0.03 0.00 -3.72 -4.59 -4.59 -4.59 -0.02 0.46 0.27 0.25 0.24

Other food crops 0.13 0.09 0.09 0.09 0.00 0.09 0.07 0.07 0.07 0.00 0.76 0.63 0.61 0.61

Processed rice -0.07 -0.48 -0.49 -0.48 0.00 0.11 0.02 0.01 0.01 0.00 0.78 0.18 0.06 0.04

Sugar 0.19 0.06 0.06 0.06 0.00 -1.92 -4.22 -4.23 -4.23 -0.00 0.90 0.44 0.32 0.31

Crude palm oil 0.20 0.10 0.09 0.09 0.00 0.13 0.07 0.07 0.07 0.00 -2.66 -6.92 -7.03 -7.04

Livestock and

meat products 0.10 0.00 0.00 0.00 0.00 0.07 0.01 0.01 0.01 0.00 0.47 0.05 -0.00 -0.01

Mining and

extraction 0.05 0.00 0.00 0.00 0.00 0.04 0.01 0.00 0.00 0.00 0.37 0.18 0.16 0.16

Processed food 0.17 0.03 0.02 0.02 0.00 0.12 0.05 0.04 0.04 0.00 0.82 0.28 0.16 0.14

Textiles and

clothing 0.18 0.02 0.01 0.02 0.00 0.12 0.03 0.02 0.03 0.00 1.03 0.68 0.55 0.53

Light

manufacturing 0.17 0.02 0.01 0.01 0.00 0.11 0.02 0.02 0.02 0.00 0.94 0.47 0.33 0.31

Heavy

manufacturing 0.17 0.02 0.01 0.015 0.00 0.12 0.02 0.02 0.02 0.00 0.97 0.54 0.40 0.38

Utilities and

construction 0.17 0.00 -0.01 -0.011 0.00 0.105 -0.01 -0.01 -0.02 0.00 0.78 0.06 -0.09 -0.11

Transport and

communication 0.19 0.01 0.00 0.002 0.00 0.12 0.01 0.00 0.01 0.00 0.87 0.16 -0.01 -0.03

Other services 0.16 0.01 -0.00 -0.003 0.00 0.11 0.00 -0.00 -0.00 0.00 0.79 0.13 -0.01 -0.02

Table A8 Change in use of endowments (continued)

Source: GTAP simulation.

Sim 4a Sim 4b

Land UnSkLab SkLab Capital NatRes Land UnSkLab SkLab Capital NatRes

Paddy 6.85 9.96 10.02 10.00 0.04 6.03 8.75 8.80 8.78 0.04

Grains -2.26 -1.43 -1.38 -1.39 -0.00 -1.97 -1.25 -1.20 -1.22 -0.00

Fruit and vegetables -1.40 -0.37 -0.32 -0.34 -0.00 -1.24 -0.34 -0.29 -0.30 -0.00

Oilseed -1.91 -0.99 -0.95 -0.96 -0.00 -1.65 -0.85 -0.81 -0.82 -0.00

Sugarcane -1.65 -0.68 -0.63 -0.65 -0.00 -1.45 -0.59 -0.55 -0.56 -0.00

Other food crops -2.37 -1.57 -1.52 -1.53 -0.01 -2.05 -1.35 -1.30 -1.32 -0.00

Processed rice 0.89 8.95 9.22 9.15 0.01 0.81 7.87 8.12 8.04 0.00

Sugar -3.70 -1.29 -1.04 -1.11 -0.00 -3.25 -1.13 -0.91 -0.97 -0.00

Crude palm oil -3.86 -1.65 -1.40 -1.47 -0.00 -3.38 -1.40 -1.18 -1.24 -0.00

Livestock and meat

products -2.09 -0.20 -0.09 -0.12 -0.00 -1.85 -0.19 -0.09 -0.13 -0.00

Mining and extraction -0.89 0.12 0.16 0.15 0.00 -0.77 0.12 0.17 0.15 0.00

Processed food -3.42 -0.67 -0.42 -0.49 -0.00 -3.01 -0.60 -0.38 -0.45 -0.00

Textiles and clothing -3.22 0.12 0.40 0.33 0.00 -2.80 0.17 0.43 0.35 0.00

Light manufacturing -3.34 -0.13 0.14 0.07 -0.00 -2.92 -0.08 0.16 0.09 -0.00

Heavy manufacturing -3.30 -0.06 0.22 0.14 -0.00 -2.88 -0.01 0.24 0.17 -0.00

Utilities and

construction -3.47 -0.20 0.10 0.02 -0.00 -3.06 -0.19 0.08 0.00 -0.00

Transport and

communication -3.79 -0.41 -0.05 -0.14 -0.00 -3.34 -0.37 -0.04 -0.14 -0.00

Other services -3.44 -0.39 -0.11 -0.18 -0.00 -3.04 -0.36 -0.11 -0.19 -0.00