The Effect of Good Corporate Governance, Leverage, and

Previous Year Audit Opinion Towards Going Concern

Audit Opinion

(Empirical Studies on Real Estate and Property Companies Listed in Indonesia Stock Exchange Period 2013-2015)

by: YUSUF ADIKA

1111082100009

ACCOUNTING DEPARTMENT

INTERNATIONAL CLASS PROGRAM

FACULTY OF ECONOMICS AND BUSINESS

SYARIF HIDAYATULLAH STATE ISLAMIC UNIVERSITY

JAKARTA

vi

CURRICULUM VITAE

Personal Identities

Name : Yusuf Adika

Gender : Male

Religion : Islam

Place of birth : Lanai, September 08th 1992, West Sumatera Address : Binubu Baru, Kab. Pasaman, West Sumatera

Phone/Mobile : 085263585590

E-mail Address : dhikalubis@gmail.com

Formal Education

Collage : UIN Syarif Hidayatullah Jakarta

Senior High School : SMAN 1 Lubuk Sikaping Junior High School : SMPN 1 Padang Gelugur

vii

The Effect of Good Corporate Governance, Leverage, and Previous Year Audit Opinion Towards Going Concern Audit Opinion

(Empirical Studies on Real Estate and Property Companies Listed in Indonesia Stock Exchange Period 2013-2015)

Yusuf Adika

ABSTRACT

The purpose of this research is to investigate the effect of good corporate governance, leverage, and previous year audit opinion towards going concern audit opinion on real estate and property companies that listed in Indonesia Stock Exchange period 2013-2015. In this research the indicator of good corporate governance includes: Board of Commissioner change, Board of Director change, Independent commissioner, leverage and previous year audit opinion. Based on purposive sampling method and established criteria, then there are 40 real estate and property companies selected as sample. So there are 120 sample units. The method to test hypothesis is logistic regression. The result in this research show that previous year audit opinion have an effect toward going concern audit opinion. In the other hand, board of commissioner change (BOC), board of director change (BOD), independent commissioner, and leverage does not effect towards going concern audit opinion.

viii

Pengaruh Good Corporate Governance, Leverage dan Opini audit Tahun Sebelumnya Terhadap Opini Audit Going Concern

(Studi Empiris Pada Perusahaan Real Estate dan Properti yang Terdaftar di Bursa Efek Indonesia Tahun 2013 – 2015)

Yusuf Adika

ABSRAK

Penelitian ini bertujuan untuk menguji pengaruh good corporate governance, leverage, dan opini audit tahun sebelumnya terhadap opini audit going concern pada perusahaan real estate dan properti yang terdaftar di Bursa Efek Indonesia periode 2013 – 2015. Dalam penelitian ini, indikator good corporate governance terdiri dari: perubahan dewan komisaris, perubahan dewan direksi, komisaris independen. Variabel keuangan yaitu leverage dan variable control hasil audit tahun sebelumnya. Berdasarkan metode purposive sampling dan kriteria yang telah ditetapkan, maka terdapat 40 perusahaann real estate dan properti yang terpilih menjadi sampel penelitian. Sehingga terdapat 120 unit sampel. Metode yang digunakan uji hipotesis dalam penelitian ini adalah regresi logistik. Hasil penelitian ini menunjukkan bahwa opini audit sebelumnya perpengaruh terhadap opini audit going concern. Di samping itu perubahan dewan komisaris (BOC), perubahan dewan direksi (BOD), komisaris independen, dan leverage tidak berpengaruh terhadap opini audit going concern.

ix FOREWORD

Asslamu’alaikum Wr. Wb.

All praise to Allah SWT, the Most Gracious and the Most Merciful, the Cherisher and Sustainer of the worlds; who always gives the writer all the best of this life and there is no doubt about it. Shalawat and Salaam to the Prophet Muhammad SAW and his family. With blessing and mercy from Allah SWT, the writer can complete this thesis to fulfill one of the requirements in accomplishing bachelor degree.

The writer is also well-aware that without advice and support from various parties, this thesis will not be realized properly. Therefore, the writer would like to take his opportunity to express his deep and sincere gratitude to the following:

1. Beloved parents and brother, my father Kutarzen, my lovely mother Jermiana Siregar and also my young brother Izan Ismail who have given all their efforts morally and material to my college study. For also being such a great parents and brother that always give me support and advice to finish this thesis. Thank you for your love and prayers that never end I believe I am nothing without each one of you who has helped me to finish this thesis, All this efforts is dedicated to you all. May Allah SWT always give His blessing for us.

2. Dr. Arief Mufraini, Lc., M.si. as the Dean of Economic and Business Faculty.

3. Yessi Fitri, SE., Ak., M.Si and Hepi Prayudiawan,SE ,Ak ,MM., as the Lead and Secretary of Accounting Department.

x

much for your precious time and kindness to help me in finishing this thesis. May Allah reward your kindness.

5. All the lectures who have taught me many things patiently. Thank you for all the knowledge that will lead me to a better future. May your charity and deeds are always recorded by Allah SWT.

6. All the staffs in Economic and Business Faculty. Especially to Mr. Bonyx who always reminds me to finish my thesis and provide me all the procedures I need in making this thesis.

7. My beloved family, oppung, bujing, uda, tulang, nantulang, and to all my big family in Binubu Baru village who always give spirit, motivation, prays for every single things I do I can get the best and cheers me up, always beside me to pick me up when Im getting down, love you to the moon and back.

8. Bang edi, who always remind by asking every week when I will finish my thesis, do we can finish our college, saying maybe we will get old in campus as mahasiswa abadi, and all your ridicule and joking, although some time it’s very annoying and make bored, but no doubt it because you love us you care to us, you don’t want us failed. And also kak tata, thanks for your kindly.

9. To my best friend Erwin, together in one class since junior high school.so many story that can’t be expressed in this opportunity. Sadness, happiness and madness we have face together I can say we more like brother than friend but I don’t meaning blood brother because you have sister, haha you got the point?. And also to Didit have spent your precious time to be great friend since we met. Thanks for your support guys, nice moment, memories and many story that proudly I will tell to my child later haha. 10.All my dear friends in Accounting International Program 2011 for every

xi

me in write this thesis, and all of you that I cannot mention one by one. Thank you for sharing joy moments.

11.All friends in Ciputat, my friends from ikmm and also my friends from Sumut.

12.All of the people who always asked “When will you graduate?” or “I thought you have graduated” to me every time they saw me. Thank you for your teasing. Your words finally motivated me so much.

The writer realizes that this thesis is still far from perfection due to limited knowledge of the writer. All the suggestions and constructive criticism are welcomed in order to make this thesis better. Hope, this thesis will be useful for any researcher or reader. May Allah SWT always bless every step in our life and guide us to the true way jannah way. Amin Ya Robbal A’lamin.

Wassalamua’laikum Wr. Wb.

Jakarta, July 2016 The writer

xii

TABLE OF CONTENTS

INFORMATION PAGE

Cover ... i

Certifivation From Supervisor ... ii

Certification of Comprehensive Exam Sheet ... iii

Certification of Thesis Exam Sheet ... iv

Sheet Statement Authenticity Scientific Work ... v

Curriculum Vitae ... vi

Abstract ... vii

Abstrak ... viii

Foreword ... ix

Table of Content ... xii

List of Tables ... xvi

List of Figures ... xvii

List of Appendix ... xviii

Chapter I INTRODUCTION A. Background Issues ... 1

B. Problem Formulation ... 9

C. Research Objectives ... 9

xiii Chapter II LITERATURE REVIEW

A. Basic of Theoretical ... 12

1. Agency Theory ... 12

2. Signaling Theory ... 13

3. Corporate Governance ... 14

a.Board of Commissioner ... 18

b. Board of Directors ... 20

c. Independent Commissioner ... 21

4. Audit ... 23

a. Definition of Audit ... 23

b. Objectives of Audit ... 25

c. Types of Audit ... 26

d. Standard of Audit ... 27

e. Audit Opinion ... 29

f. Going Concern ... 33

g. Going Concern Audit Opinion ... 34

h. Benefit of Going Concern Audit Opinion ... 37

i. Auditors Responsibilities ... 39

5. Leverage ... 42

6. Previous Year Audit Opinion ... 43

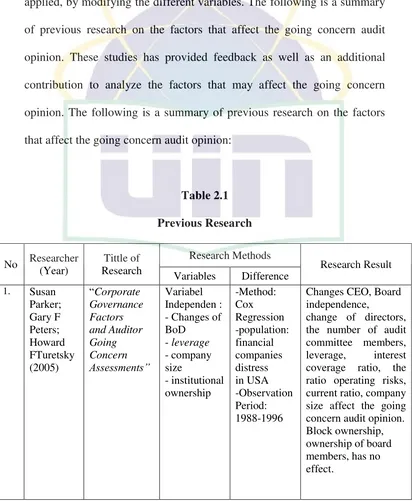

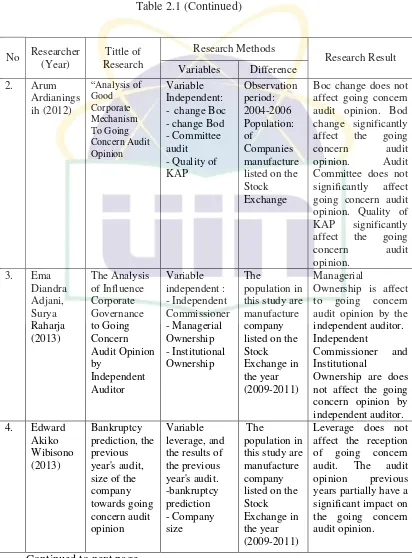

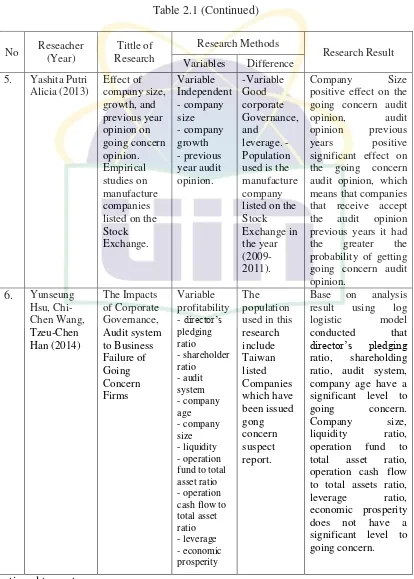

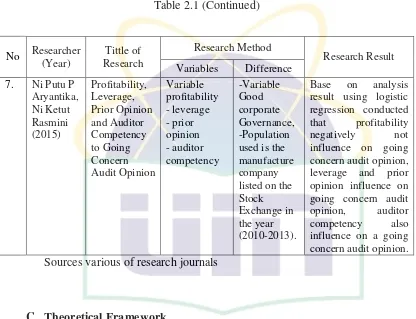

B. The Result of Previous Research ... 44

C. Theoritical Framework ... 47

xiv Chapter III RESEARCH METHODOLOGY

A. Scope of Research ... 53

B. Sampling Method ... 53

C. Data Collection Method ... 54

D. Method of Data Analysis and Hypothesis Testing ... 55

1. Descriptive Statistical Analysis ... 56

2. Logistic Regression ... 56

3. Overall Model Fit Test ... 56

4. Coefficient of Determination (Nagelkerke R Square) ... 57

5. Testing Feasibility of Regression Models ... 58

6. Classification Table ... 58

7. Regression Models ... 58

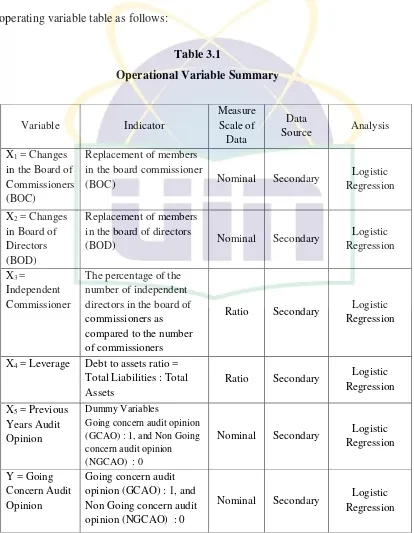

E. Variable Operational Research ... 59

1. Independent Variable ... 59

2. Dependent Variable ... 62

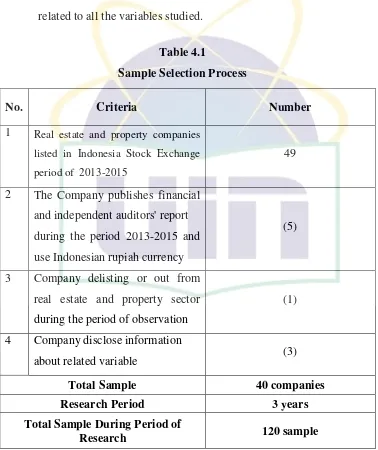

Chapter IV ANALYSIS AND DISCUSSION A. General Description of Research Object ... 64

B. Analysis ... 66

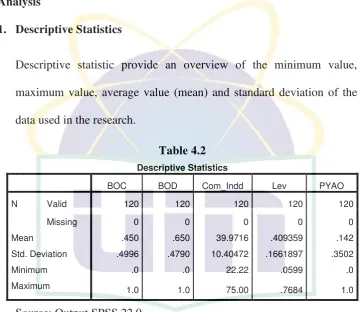

1. Descriptive statistic ... 66

2. Logistic Regression ... 68

a. Overall Model Fit Test ... 68

b. Coefficient of Determination ... 70

xv

d. Classification Table ... 73

e. Result of Regression and Hypothesis Test ... 74

C. Discussion and Interpretation ... 76

Chapter V CONCLUSIONS AND RECOMMENDATIONS A. Conclusion ... 82

B. Implication ... 83

C. Recomendation... 83

REFERENCE ... 85

APPENDIX I ... 90

APPENDIX II ... 92

APEENDIX III ... 96

xvi

LIST OF TABLE

NO DESCRIPTIONS PAGE

2.1 Table Relevant Previous Research ... 44

3.1 Operational Variable Summary ... ... 63

4.1 Sample of Selection ... 65

4.2 Descriptive Statistic ... 66

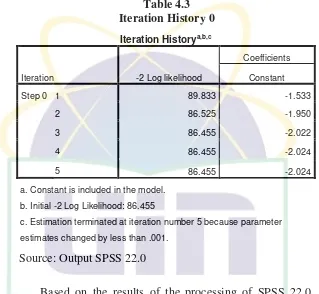

4.3 Iteration History 0 ... 69

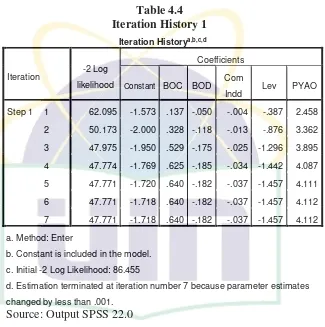

4.4 Iteration History 1 ... 70

4.5 Model Summary ... 71

4.6 Hosmer and Lameshow Test ... 72

4.7 Classification Table ... 73

4.8 Variable in Equation ... 74

xvii

LIST OF FIGURE

xviii

LIST OF APPENDIX

NO DESCRIPTIONS PAGE APPENDIX 1 List of Company Sample ... 90 APPENDIX II List of Data ... 92 APPENDIX III Additional Explanation Regarding the Establishment of Going

1 CHAPTER I INTRODUCTION

A. Research Background

The global financial crisis experienced by the world after the first world war, or rather in the 1920s as a result of post-war conditions. Furthermore, the global crisis with a scale varying also still occur on an ongoing basis. In fact, the world economy has experienced a crisis bubble that is the crisis in the dotcom firms and other technology companies in North America and the European Union which resulted in the bankruptcy of large corporations in the US such as Worldcom, Enron, Lehman Brothers, and so on. In addition, the firm Arthur Anderson also participated in the public eye over the collapse of Enron.

The monetary crisis that hit countries in Asia Pacific in 1997 had an impact on the economic fundamentals of Indonesia. The financial crisis has devastated the Indonesian economy. Rupiah has depreciated in levels beyond the threshold of reasonableness. The impact of deteriorating economic condition in Indonesia is the lack of liquidity and high interest rates, and rising costs of operating companies (Isaac, 1998: 1).

2 and large corporations. That means the company's survival is a consideration for investors to take a decision whether to invest or not.

One company that is experiencing the impact of the economic crisis this is a company engaged in real estate and property sector. In general, since 1998, industrial real estate in Indonesia decreased sales levels significantly because of the declining purchasing power of customers, lower average occupancy rate, termination or delay the development of construction projects in particular, and the increasing availability of property (PT. Sentul City Tbk, 2005).

Before the crisis, the development of real estate and property is relatively high. According to the data obtained, it is known that in 1996 the number of members of the real estate in Indonesia (REI) reached 2,434 national companies while REI Jakarta reached 736 member companies. As a result of the economic crisis that hit Indonesia in 1997, that number continued to decline up to REI amounted to 645 national companies and 218 companies for REI members Jakarta in 2002 (DPP-REI, 2002) as cited (Tulung, 2004: 13).

3 immediately due, decreased capital (capital deficiency) significant financial loss (financial losses) due to exchange rate losses, bear the brunt of the financial, operational losses and the absence of clear action plans of management (Juniarti, 2000 cited Praptitorini and Januarti, 2007: 4).

Tjager, Alijoyo, Djemat, and Soembodo (2003) in Petronila (2007: 128) argues that the financial crisis that hit Asia is seen as a weakness of the practice of Good Corporate Governance (GCG) in these countries. To be able to manage a good company and in order to achieve good corporate governance (GCG), then management needs to uphold the principles of transparency, accountability, liability (responsibility), independence, and fairness.

The existence of an entity reflects the existence of an economic environment. Interest in long-term existence of the entity is able to maintain the viability of its business (going concern) through the assumption of going concern (Praptitorini and Januarti, 2007: 2). The survival of the business is always associated with the ability of management to manage the company in order to survive (Praptitorini and Januarti, 2007: 2). When the economy is something uncertain, investors expect the auditors give an early warning of financial failure (Chen and Chruch: 1996: 118).

4 46). Going concern assumption means an entity is considered to be able to maintain its business operations in the long term and will not be liquidated in the short term (Hani, Cleary, and Mukhlasin, 2003: 3).

The assumption of going concern directly affect the financial statements. The financial statements were prepared using the going concern basis will have structural differences in the financial statements are not prepared using the going concern basis. Ratings are based on the going concern over the company's ability to continue its operations within a period of one year to the next. To come to the conclusion whether the company will have a going concern or not, the auditor should perform a critical evaluation of the management plans (Praptitorini and Januarti, 2007: 4).

To be able to manage the company well so that the company can maintain its viability, then the company needs a mechanism. The mechanism of corporate governance is the means or procedures or rules and a clear relationship between the parties that take decisions by the parties will carry out supervision of the decision (Petronila, 2007: 127). Corporate governance mechanism geared to ensure and oversee the corporate governance system in a company (Syakhroza, 2002a, 2002b; World Bank, 1999; Kim and Nofsinger, 2004) in Petronila (2007: 127).

5 governance mechanism. According Gunarsih (2003: 160), internal corporate governance mechanisms designed to align the interests of managers and shareholders. Meanwhile, external corporate governance mechanism is performed by the corporate control market.

Another factor that proxy of corporate governance mechanism is the ownership structure. According Januarti (2009: 12) in the company's ownership structure, as measured by the ownership of board members can increase the value of the company, thereby reducing the risk of financial difficulties. If the possibility of the smaller companies in financial difficulty, it will reduce the potential bankruptcy of the company and the company can continue to maintain its survival.

6 The presence of independent directors is one of the requirements or devices within the enterprise in order to achieve good corporate governance. Independent commissioner has the responsibility of the principal to encourage the implementation of the principles of good corporate governance (GCG) in the company through the empowerment of the board of commissioners in order to perform the task of monitoring and providing advice to the board of directors effective and provide added value for the company (Task Force Committee national Corporate Governance Policy, p.4). If the independent directors can perform their duties properly, firm performance will increase. The increased performance of the company may indicate that the company can survive for a long time and regardless of the going concern.

In addition to corporate governance mechanisms, the financial condition of the company can determine the viability of the business entity. This is because the company's financial condition illustrates the soundness of the company. If the level of an entity's financial health is low, then it is likely that entity bankrupt and cannot be a going concern is high.

7 audit opinion, while the leverage does not affect the going concern audit opinion.

Going concern audit opinion is the opinion issued by the auditor to determine whether the company can maintain its survival (PSA 341). Financial statement users find that spending going concern audit opinion as predictions of bankruptcy of a company (Santosa and Wedari, 2007: 142). The auditor shall be responsible for going concern audit opinion that is issued because it will affect the decision of users of financial statements (Setiawan, 2006: 66). The audit opinion on the financial statements became one of the important considerations for investors in making an investment decision. Therefore, information about the viability of a company, especially for companies that have gone public, the information is very valuable for investors, both investors in the capital markets and the banks that lend to companies (Setiawati and Agoes, 2005: 9).

Based on the background described, researchers interested in conducting research with the title; "The Effect of Good Corporate Governance, Leverage, and Previous Year Audit Opinion Towards Going Concern Audit Opinion (Empirical Study On Real Estate and Property Company Listed in Indonesia Stock Exchange)".

8 and office buildings that make investors interested to invest their funds, so that, the prospect of trading is expected to continue to rise in the future. On the other hand, Real Estate and Property is one alternative investment that attractive to investors because it is a long-term investment, thus requiring a high capital structure and good management insurance.

This research was development from research doing Ni Putu P Aryantika and Ni ketut Rasmini (2015), regarding the profitability, leverage, and the audit opinion the prior year on going concern audit opinion. The results showed that profitability does not influence the going concern audit opinion, leverage, prior audit opinion and leverage have an influence the going concern opinion. The research population is using purposive sampling which take the population of manufacture companies listed in Indonesia Stock Exchange period 2010 – 2013.

The difference of this research with previous research, namely:

1. Years observed in this research is in 2013-2015. These reason researchers use the year 2013 to 2015, because for the period shows the actual conditions associated with the problem under research. 2. This research focus on one industry that is real estate and property

companies. The goal is to avoid bias caused by differences in the research.

9 B. Problem Formulation

Referring to the background that has been presented above, the formulation of the problem in this research are:

1. Does the Board of Commissioner changes effect the going concern audit opinion?

2. Does the Board of Director changes effect the going concern audit opinion?

3. Does the independent commissioner effect the going concern audit opinion?

4. Does the leverage effect on the going concern audit opinion?

5. Does the Previous Year Audit Opinion effect the going concern audit opinion?

C. Research Objectives

As explaining in problem formulation, The objectives of this research are:

1. To analyze the effect of Board of commissioner changing on going concern audit opinion.

2. To analyze the effect of Board of Director changing on going concern audit opinion.

3. To analyze the effect of independent directors on going concern audit opinion.

10 5. To analyze the effect of Previous Year Audit Opinion on going

concern audit opinion.

D. Benefits of Research

The benefits of this research are: 1. For the Companies

The results of this research is expected to be a source of useful information as well as input and can contribute ideas about the influence of good corporate governance (change of BoC, BoD changes, and independent commissioner), leverage, and the prior year's audit opinion on going concern audit opinion.

2. For Investors

This research can be used as input for investors who want to invest, in order to have a material consideration in investing.

3. For Auditors

This research can be used as an input in its assessment decisions audit opinion which refers to survival (going Concern) of the company in the future.

4. For Auditing

11 5. For Other Parties

For additional information, and knowledge that is useful in the preparation of financial statements and can be used as reference material for future research.

6. For Researchers

12 CHAPTER II

LITERATURE REVIEW

A. Basic of Theoretical 1. Agency Theory

Jensen and Meckling (1976) describe the agency relationship as a contract under one or more principal involving an agent to perform some service for them by delegating authority in taking decisions on the company manager or agent. Both principal and agent is assumed as a rational economic man and solely motivated by personal interests (Praptitorini and Januarti, 2007: 5).

Agency theory is the basis of the theory underlying the company's business practices are used for this. The theory stems from the synergy of economic theory, decision theory, sociology and organization. The main theory principle states their working relationship between the parties that gave the (principal) is investor and a party receiving authority (agency) is the manager, in cooperation contract form called nexus of contract (Elqorni, 2009).

13 Because of these differences in interests, each party trying to increase the benefits for themselves. Principal wants maximum return on investment as soon as possible and that one of them is reflected by the increase in the portion of the dividend for each share owned. Agents want their interests accommodated by providing compensation, bonuses, incentives, or adequate remuneration for its performance. Principal assess the achievements agent based on its ability to maximize profits allocated to dividend. The higher the earnings, the stock price and dividend, then the agent is considered successful in increasing the performance so well that it deserves a high incentive (Elqorni, 2009).

To minimize the conflict of interest between the agent and the principal, it takes an independent third party as a mediator in the relationship between principal and agent. This third party is used to monitor the behavior of the manager (agent) is already acting in accordance with the wishes of the principal. Auditor is deemed capable of bridging the interests of the principal parties (stakeholders) with the manager (agent) in managing the corporate finance (Setiawan, 2006: 62).

2. Signaling Theory

14 been done by management to realize the wishes of the owner. The signal can be information states that the company is better than the other companies and other information (Subraminiam, et al., 2009).

Signaling theorystated that a good quality manufacturing company would deliberately give a signal to the market, so the market is expected to distinguish a quality company bad. In order for the signal to be effective, it must be captured the market and perceived as good, and not easily imitated by companies that are of poor quality (Lianto, 2010).

Signaling theory is rooted in the pragmatic accounting theory which focuses on the influence of information on changes in user behavior information. One of the information that can be used as the signal is the announcement made by an issuer. This announcement will be able to affect the price fluctuations of securities company issuers that do announcements. Companies that have a belief that the company has good prospects in the future will tend to communicate the news to the investors (Lianto, 2010).

3. Corporate Governance

15 Definition of corporate governance issued by the Forum for Corporate Governance in Indonesia (FGCI) (2001), namely:

“a set of rules that define the relationship between shareholders, management, creditors, government, employees and stakeholders internal and external parties related words, the rights and obligations or in other words the system that directs and controls the company. The purpose of corporate governance is to create value for the stakeholders”.

According to the Organization for Economic Cooperation and Development (OECD) in the Study of Application of the OECD Principles of 2004 in Bapepam Regulation on Corporate Governance (2006), corporate governance is:

“Corporate governance is the system by which business corporation are directed and controlled. The corporate governance structure specifies the distribution of right and responsibilities among different participant in the corporation such as boards, manager, shareholders, and other stakeholders and spells out the rules and procedures for making decisions corporate affair. By doing this, it also provides the structure through which the company objectives are set, and the means of attaining those objectives and monitoring performance.”

16 1. Transparency

To maintain objectivity in doing business, companies must provide material and relevant information in a way that is easily accessible and understood by stakeholders. Companies must take the initiative to express not only the problem that required by legislation, but also important for decision-making by shareholders, creditors, and other stakeholders.

2. Accountability

Companies must be accountable for performance in a transparent and fair. Therefore, the company must be properly managed, scalable, and according to the company while taking into account the interests of shareholders and other stakeholders. Accountability is a necessary precondition for achieving continuous performance. 3. Responsibility

Companies must comply with legislation and to implement responsibilities towards society and the environment so that it can maintain the continuity of the business in the long term and to be recognized as a good coporate citizen.

4. Independency

17 5. Fairness

In conducting its activities, the company must always take into consideration the interests of shareholders and other stakeholders based on the principles of fairness and equality.

According to the Forum for Corporate Governance in Indonesia (2011), the delivery of good corporate governance, should be supported by the availability of:

1. The number of independent directors is at least 30% of the total number of commissioners.

2. Importance formed audit committee. 3. Need formed corporate secretary.

In order to achieve good corporate governance, we need a way or mechanism. Corporate governance mechanism is the way a company or applied to achieve good corporate governance. According Syakhroza (2005: 14), in the area of controlling, corporate governance mechanism is divided into two, namely internal corporate governance mechanism and external corporate governance mechanism.

18 designed to align the interests of managers and shareholders. The board of directors of public companies responsible for the development and implementation of this mechanism (Gunarsih, 2003: 160). Kim and Nofsinger (2004) in Petronila (2007: 127), states that the internal mechanism starting from accounting units that generate financial reports and internal auditors who assess the financial reporting process.

External control mechanism is the control of the company conducted by the market (Gunarsih, 2003: 160). Corporate governance mechanism that is external is the interaction between the parties which oversees the performance of the company, among other stakeholders (employees, customers, suppliers, creditors, communities) and reputational agents (accountants, lawyers, rating agency credit, investment manager) (Kim and Nofsinger 2004 in Petrolina, 2007: 127).

a. Board of Commissioners (BoC)

19 commissioners including commissioner is similar. The main task of the commissioner as primus inter pares is to coordinate the activities of the board of commissioners. Commissioners for the implementation of the task can run effectively, it should be filled with the following principles:

a. The composition of the board of commissioners should enable effective decision making, precise and fast, and to act independently.

b. Board members must be professional, namely the integrity and capability so that it can perform its functions properly, including ensuring that directors have the interests of all stakeholders.

c. The function of supervision and advisory board of commissioners include preventive measures, improvement, until the dismissal of temporary (KNKG in guidelines GCG di Indonesia, 2006: 13).

20 In the Limited Liability Company Act (PT) Article 100 provides for the duty and authority relations commissioners (BoC) and the board of directors (BoD) (Petronila, 2007: 130), namely:

a. The Articles of Association can be specified giving authority to the boss to give consent and assistance to the BoD in performing certain legal actions.

b. Based Statutes or GMS, BoC may perform acts of management of the Company in certain circumstances for a certain period of time. c. For the boss who in certain circumstances for a certain period of

time perform acts of management referred to in point (b) applies to all the rights, powers and obligations of the Company's BoD against third parties.

b. Board of Directors (BoD)

21 duties of directors can run effectively, it should be filled with the following principles:

a. The composition of the board of directors should be such so as to enable effective decision making, precise and fast, and to act independently.

b. The Board of Directors shall professionals that possess the integrity and have the experience and skills required to carry out their duties.

c. The Board of Directors is responsible for the management of the company to generate profits and ensure the company's sustainability.

d. Directors accountable for its staff in the General Meeting in accordance with the legislation in force.

The board of directors is a party that is involved in controlling the application of internal governance mechanism. Hofer and Whetten (1997) in Parker et. al. (2005), expressed his view that the management is the party that has a significant share when the company is facing problems. The research was supported by Hofer (1980) in Petronila (2007: 132), which states that the replacement of management is a precondition to reflect a successful business turnaround.

c. Independent Commissioner

22 controlling shareholders, as well as free of a business relationship or other relationship that could affect its ability to act independently or act solely in the interest of the company (Task Force National Committee Corporate Governance Guidelines of the Independent Commissioner, p.2)

According to Bapepam Regulation No. Kep. 29 / PM / 2004 dated 24 September 2004, the board of the Independent Commissioners are: a. Comes from outside the Issuer or a Public Company,

b. There are no shares either directly or indirectly in the Issuer or a Public Company,

c. There are no affiliated with publicly listed companies, directors, or major shareholder of the issuer or public company, and

d. Does not have a business relationship, directly or indirectly related to the business activities of the Issuer or a Public Company.

The tasks to be carried out by an independent board is:

a. Ensure that the company has an effective business strategy, including monitoring the schedule, the budget and the effectiveness of the strategy.

b. Ensure that the company raised the executives and managers of professional managers.

23 d. Ensuring that the company complies with applicable laws and regulations as well as the values set by the company in running its operations.

e. Ensuring risks and potential crisis is always identified and managed properly.

f. Ensuring the principles and practices of good corporate governance are adhered to and implemented well among other things include:

1) To ensure transparency and openness of the company's financial statements.

2) The treatment is fair to minority shareholders and other stakeholders.

3) Disclosure of transactions which contain conflict of interest in a reasonable and fair.

4) Compliance firm on legislation and regulations. 5) Ensure accountability organ of the company.

4. Audit

a. Definition of Audit

Definition audit by Arens and Loebbecke (2010: 4) are as follows:

24 of determining and reporting on the degree of the correspondence between the quantifiable information and established criteria.”

Boyton and Johnson (2006: 6) state that The Report of The Committee on Basic Auditing Concept of The American Accounting Association (Accounting Review, Vol.47) stated auditing as :

“Auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and event to ascertain the degree of correspondence between those assertions and established criteria and communicating the result to interested users.”

Definition of auditing according Agoes (2008: 3) are:

“suatu pemeriksaan yang dilakukan secara kritis dan sistematis, oleh pihak yang independen, terhadap laporan keuangan yang telah disusun oleh managemen, beserta catatan-catatan pembukuan dan bukti-bukti pendukungnya, dengan tujuan untuk memberikan pendapat mengenai kewajaran laporan keuangan tersebut.”

Meanwhile, according to Mulyadi (2010: 9), the definition of auditing is:

“suatu proses sitematik untuk memperoleh dan mengevaluasi bukti secara objektif mengenai persyaratan-persyaratan tentang kegiatan dan kejadian ekonomi, dengan tujuan untuk menetapkan tingkat kesesuaian antara persyaratan-persyaratan tersebut dengan kriteria yang telah ditetapkan, serta

penyampaian hasil-hasilnya kepada pemakai yang

berkepentingan.”

25 achieve the degree of correspondence and compare it with the standards and criteria that exist with goal to provide opinion on the fairness of the financial statements and then communicating the results to the users of financial statements auditee.

b. Objectives of Audit

Public Accountants Professional Standards (SPAP), PSA 02 (SA 110), (IAI, 2001: 110.1), stated that the purpose of the audit of financial statements by an independent auditor general is to express an opinion on the fairness, in all material respects, the financial position , results of operations, changes in equity and cash flows in accordance with generally accepted accounting principles. Meanwhile, according to Boynton et. al. (2006: 231) specific audit objectives are the assertions of management, management's assertions as a guideline auditor to plan the audit evidence collection.

The five management's assertions outlined in Generally Accepted Auditing Standards (GaAs) are as follows:

1. Existence and Occurance 2. Completeness

26 c. Types of Audit

According to Boynton et. al. (2006: 8-9), there are three types of audit, namely financial audit, compliance audits, and operational audits. Types of audits are generally demonstrate as key characteristics included in the definition of auditing. An explanation of the types of audits will be described as follows: 1. Financial Statement of financial statements (financial statement

audits) related to obtaining and evaluating evidence about the reports of entities with a view to be able to give an opinion whether these reports have been presented fairly in accordance with predetermined criteria, namely the principles generally acceptable accounting or Generally Accepted accounting Principles (GAAP). In addition, the audit logic developed for the financial statement audit is the basis by which the auditor of further developing compliance audits, operational audits, as well as a number of attestation services and assurance services. 2. Audit Compliance Audit compliance (compliance audits)

27 provisions concerning conditions of employment, participation and pension programs, as well as conflicts of interest.

3. Operational Audit activities related to obtaining and evaluating evidence about the efficiency and effectiveness of the operations of the entity in relation to the achievement of certain goals. Audits of this type sometimes called a performance audit or management audits. In a business enterprise, the scope of this audit may include all activities of a department, branch, or division.

d. Standards of Audit

According to (SPAP SA Section 150: PSA no.1) in the audit process there are three standards that must be met in order to carry out their professional standards, the general standards, standards of field work and reporting standards. Here are description of the three standards:

1. General standards

a. Audits should be carried out by one or more persons who have the skills and technical training quite enough as an auditor.

28 c. In the implementation of the audit and the preparation of its report, the auditor must use the professional skills carefully and thoroughly.

2. Field Work Standards

a. Work must be planned well and if assistants should be properly supervised.

b. Sufficient understanding on internal control must be obtained to plan the audit and determine the nature, timing, and extent of testing to be done.

c. Sufficient competent audit evidence to be obtained through inspection, observation, inquiry and confirmation as a reasonable basis for an opinion on the audited financial statements.

3. Reporting standards

a. The auditor's report must state whether the financial statements are prepared in accordance with generally accepted accounting principles in Indonesia.

29 c. Informative disclosures in the financial statements should be considered sufficient, unless otherwise stated in the auditor's report.

d. he auditor's report must include a statement of opinion on the financial statements as a whole, or an assertion that such a statement can not be given. If the overall opinion can not be given, then the reason must be stated. Name of the auditor is associated with financial statements, the auditor's report should contain a clear indication of the nature of the audit work performed, if any, and the level of responsibility carried by the auditor.

e. Audit Opinion

Auditors have an obligation to provide an opinion on the financial statements which have been audited. According to (SPAP SA Section 508), there are five types of the auditor's opinion, namely:

30 will affect the users of the financial statements in the decision making.

2. Unqualified Opinion with Explanatory Paragraph (Pendapat Wajar Tanpa Pengecualian dengan bahasa penjelasan yang

ditambahkan dalam laporan keuangan auditor bentuk baku) Unqualified with Explanatory Paragraph Opinion stated when, according to the auditor's judgment, where the conditions or specific circumstances often require that the auditor add an explanatory paragraph (or other explanatory language) in the financial statement auditor raw form. These circumstances include are:

a. The auditor's opinion is partly based on the reports of other independent auditors.

b. Financial Statements presented deviate from an accounting principles issued by the Indonesian Institute of Accountants (IAI).

31 d. Among the accounting period there is a material change in the use of accounting principles or in the method of application (inconsistency).

e. Certain circumstances relating to the auditor's report on comparative financial statements.

f. Certain quarterly financial data required by Bapepam, but not presented or reviewed yet.

g. Additional information required by the Indonesian Accountants Association (IAI) - Financial Accounting Standards Board (DSAK) has been removed, the presentation deviate much from the guidelines issued by the council, and the auditor is unable to complete the audit procedures relating to such information.

h. Other information in a document containing audited financial statements are materially inconsistent with the information presented in the financial statements.

32 This opinion was stated when:

a. The absence of sufficient competent evidence or restrictions on the scope of the audit result the auditor concludes that he is unable to express an unqualified opinion and he has concluded that does not states an opinion.

b. Auditor believe on the basis of the audit, that the financial statements contain departures from generally accepted accounting principles in Indonesia, which have a material impact, and he concluded to not express opinions unreasonable.

4. Adverse Opinion (Pendapat Tidak Wajar)

Adverse opinion stated when, in the judgment of the auditor, the financial statements does not present fairly the financial position, results of operations and cash flows in accordance with generally accepted accounting principles in Indonesia.

5. Disclaimer (Tidak Memberikan Pendapat)

33 auditor facing significant doubts about the viability of the entity (going concern issues) the auditor may does not give an opinion.

f. Going Concern

34 imposed from outside and another similar activities (IAI, 2001: Section 341, PSA 30).

Going concern issue is divided into two, namely the financial and operating problems. Financial problems include a shortage (deficiency) liquidity, deficiency of equity, debt delay in payment, and the difficulty of obtaining funds. While the problem of operations include operating losses continuously, prospecting dubious income, operating capability is threatened, and weak controls over operations (Altman and McGough, 1974 in Setiawan, 2006: 61).

g. Going Concern Audit Opinion

35 Mutchler (1984), in Yusnitasari and Setiawan (2003: 69), shows the going concern decisions taken through the following three-step process:

1. Identification of entity with potential going concern issue. 2. Determine whether the entity with the issue of going concern

must accept the audit report of the going concern.

3. Choosing between the two types of audit reports going concern, namely reasonable modifications to the audit report without reservation or disclaimer.

Meanwhile, Ellingsen et. al. (1989) in Yusnitasari and Setiawan (2003: 71), suggesting the decision-making procedures of going concern is based on SAS 59:

1. Are the results of audit procedures indicate substantial doubt about the company's ability to keep alive in business during the reasonable period of time? If the answer is no, then the auditor has met its responsibilities in accordance with SAS 59. If the answer is yes, then the auditor will conduct the next stage. 2. Analyzing the management plan and assess the ability of the

plan can be implemented effectively.

36 4. Consider the effect that may occur in the financial statements

and the disclosure of going concern issues.

5. Adding an explanatory paragraph (following the opinion paragraph) audit reports on going concern.

Whereas in (IAI, 2001: Section 341, PSA 30) provides guidance to auditors about the impact the ability of the business unit continued survival of the auditor's opinion as follows:

1. If the auditor believes that there are doubts about the ability of the business unit continued survival in a reasonable period of time, he must:

a. Obtain information about the management plan aimed at reducing the impact of conditions and events.

b. Stipulates the possibility that the plan is effectively implemented.

2. If the management does not have a plan that reduces the impact of conditions and events on the ability of the business unit continued survival, the auditor considers does not give an opinion (disclaimer).

37 4. If the auditor concluded the plan is not effective, the auditor

expressed no opinion (disclaimer).

5. If the auditor concluded the plan would effectively but the client did not disclose situation as mentioned in the notes to financial statements, the auditors expressed an unqualified opinion.

6. If the auditor concluded the plan is effective but the client did not disclose the situation in the financial statements, the auditor expressed the opinion unreasonable (adverse opinion).

h. Benefits of Going Concern Information

Bankruptcy information can be useful for some parties as follows:

a. Creditors

Bankruptcy information can be useful to take a decision who will be granted a loan, and then helpful to monitor existing loan policy.

b. Investors

38 signs of bankruptcy as early as possible and then anticipate the possibility.

c. Government

In some sectors, government agencies have a responsibility to supervise enterprises (SOEs) should always be supervised. A government agency has an interest to show the signs of bankruptcy early in order to carry out actions that need to be done early.

d. accountants

Accountants have an interest in the survival of a business information for accountants will look at the ability of a company's going concern.

e. Management

39 financial restruction so that the cost of bankruptcy can be avoided.

i. Auditor's Responsibilities

Auditor's responsibility to evaluate whether there is substantial doubt on the entity's ability to maintain its viability in a reasonable time period, not exceeding one year from the date of the financial statements being audited (hereinafter the period will be referred to the appropriate period of time). Evaluation auditor based on knowledge of the conditions and events that exist at or have occurred before the field work is completed. Information on conditions and events obtained by the auditor of the application of audit procedures are planned and implemented to achieve the objectives of the audit is concerned with management's assertions contained in the financial statements being audited (IAI, 2001: Section 341, PSA 30, Par.02).

Examples of conditions and events are as follows:

1. The negative trend, for example, recurring operating losses occur, lack of working capital, negative cash flows from operations, the key financial ratios are bad.

40 request by the supplier to purchase ordinary credit, debt restructuring, the need to find new funding sources or methods, or the sale of some great asset.

3. The internal problems, for example, work strikes or other labor relations difficulties, large dependence on certain projects successful, long-term commitments that are not economic, the need to significantly improve operations.

4. The problems that have occurred outside, for example, the court filing, the release of the legislation or other problems that may compromising the ability of the entity to operate, 48 losing franchise, license or essential patents, a major loss of customers or suppliers, large disaster losses, such as earthquakes, floods, droughts, that are not insured, but the insurance is not adequate.

Auditor has the responsibility to assess whether there is substantial doubt on the ability of the business unit continued survival (Isaac, 1998: 3). The auditor's assessment was based on knowledge of the conditions and events that exist at or have occurred before the field work is completed. However, the auditor is not responsible for the condition or predict future events (Isaac, 1998: 3).

41 client's ability to continue its business (going concern). The terms contained in SAS No. 59 is as follows:

1. The auditor's responsibility is to evaluate whether the entity going concern for a period of not more than a year from the date of the audited financial statements.

2. The Auditor is not responsible for predict or forecast of future events.

3. The bankruptcy by a company that did not receive reports going concern, although one year from the balance sheet date, does not require the auditor of insufficient performance.

4. The auditor does not have to carry out a specific procedure to determine the going concern entity. Audit procedures for audit purposes the other considered sufficient.

5. The auditor is required to evaluate management's plan to reduce the incidence and circumstances that indicate considerable doubt of the company's going concern.

42 5. Leverage

Harahap (2010) suggested that leverage describes the relationship between the company's debt to equity and assets. This ratio measures how much the company was financed by debt or creditors with the ability of the company described by capital. A good company should have a larger capital composition of the debt. However, the company's funding obtained largely through debt can improve enterprise performance due to faster turnover company.

The leverage ratio which used for this research is the Total Liability to Total Assets. This ratio shows the ratio between debt and equity (capital) in the funding of the company and demonstrates the ability of the company's capital to cover the entire debt. The lower Leverage of the company, it’s mean the better condition of the company.

Leverage formula is as follows:

43 6. Previous Year Audit Opinion

The audit opinion previous years is the audit opinion that auditee received in the previous year or one year before the research of the independent auditor. The audit opinion can be divided into 2 of the going concern audit opinion and non-going concern audit opinion.

44 B. The Results of Previous Research

Research on the going concern audit opinion has been widely applied, by modifying the different variables. The following is a summary of previous research on the factors that affect the going concern audit opinion. These studies has provided feedback as well as an additional contribution to analyze the factors that may affect the going concern opinion. The following is a summary of previous research on the factors that affect the going concern audit opinion:

46 significant effect on the going concern probability of getting going concern audit significant level to going concern. significant level to going concern.

47 result using logistic regression conducted opinion influence on going concern audit opinion, auditor competency also influence on a going concern audit opinion. Sources various of research journals

C. Theoretical Framework

Theoretical framework is networking of association that organized. As logically elaborate between variables which relevant with situations and problems identified trough processes such as interviews, observation, and literature, survey, (Sekaran, 2009: 127). The conceptual framework will connect the independent variables that accompany the role of the variable to be explained.

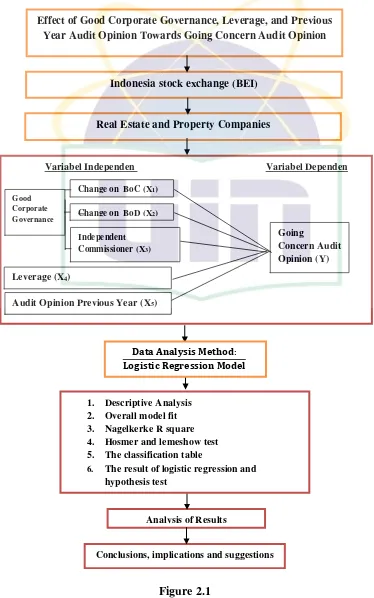

48 Variabel Independen Variabel Dependen Based on the description above, it can be explained as the following framework:

Figure 2.1

Indonesia stock exchange (BEI)

Change on BoC (X1)

Audit Opinion Previous Year (X5) Change on BoD (X2)

Real Estate and Property Companies

Independent Commissioner (X3)

Effect of Good Corporate Governance, Leverage, and Previous Year Audit Opinion Towards Going Concern Audit Opinion

Analysis of Results

Conclusions, implications and suggestions 1. Descriptive Analysis

2. Overall model fit 3. Nagelkerke R square 4. Hosmer and lemeshow test 5. The classification table

6. The result of logistic regression and hypothesis test

�� � � ��� :

49 D. Variables and Hypothesis Formulation

1. BoC Towards Going Concern Audit Opinion

Research on the effects of changes to the central bank going concern audit opinion conducted by Petronila (2007). In Petronila research (2007), showed that the central bank changes significantly influence the going concern audit opinion and have a positive parameter values. This means that if an entity making a change or replacement of Board of Commissioner, it is possible that the entity obtaining high going concern audit opinion than there are no change of (BoC) in the entity.

H01: BoC changes does not affect the going concern audit opinion.

Ha1: BoC changes affect the going concern audit opinion. 2. BoD Towards Going Concern Audit Opinion

50 H02: BoD changes does not affect the going concern audit opinion.

Ha2: BoD changes affect the going concern audit opinion.

3. Independent Commissioner Towards Going Concern Audit Opinion

51 continuity, independent board members more effectively make the company out of a difficult period, thereby reducing the possibility of the company received a going concern opinion.

H03: Independent commissioner does not affect the going concern

audit opinion.

Ha3: Independent commissioner affect the going concern audit

opinion.

4. Leverage Towards Going Concern Audit Opinion

Much research has been done on the effect of leverage on going concern audit opinion. Research Rudyawan and Badera (2009) showed that the leverage which measured by the ratio of debt to total assets does not affect the going concern audit opinion with a negative parameter values. This means that the greater the leverage ratio of a company, then it is likely the company obtained the going concern audit opinion was getting smaller. This research is consistent with research Januarti and Fitrianasari (2008) as measured by debt to equity ratio and Setiawati and Agoes (2005), which uses the same calculations. This means that the leverage ratio is less considered in providing the auditor going concern audit opinion.

H04: Leverage does not affect the going concern audit opinion.

52 5. Previous Year Audit Opinion Towards Going Concern Audit

Opinion

Mutchler (1984) states that "the company which receiving going concern audit opinion on the previous year were more likely to receive the same opinion in the current year". This is because when the auditors give going concern audit opinion on the previous year, the company is is considered have problems in going concern so that auditors tend to give a going concern audit opinion back in the current year. Based on the empirical evidence, there is a significant positive correlation between going concern opinion previous years with going concern audit opinion for the year. If in previous years the auditor has issued a going concern audit opinion, the auditor will be more likely to re-issue going concern audit opinion on the current year.

H05: The previous years audit opinion does not effect on going

concern audit opinion.

Ha5: The previous years audit opinion effect on going concern audit

53 CHAPTER III

RESEARCH METHODOLOGY

A. Scope of Research

Based on the Characteristics of the issues discussed by authors, the design of this research is causality, which is mean type of research is the characteristics of the problem in the form of a causal relationship between two or more (Indriantoro dan Supomo, 2009: 27). This research aims to examine the influence of the independent variables, such as corporate governance mechanisms, leverage, and the previous year's audit opinion on the dependent variable, going concern audit opinion.

The population in this research are all companies engaged in the real estate sector and the property listed on the Indonesia Stock Exchange (BEI) in the period 2013 - 2015. The sampling method used was purposive sampling or sampling method aims to establish certain criteria of the research sample.

B. Method of Sampling

54 Rudyawan and Badera (2009: 11). The criteria for the company that made in the research sample are as follows:

1. The Company's real estate and property sector listed on the Indonesia Stock Exchange (BEI) during the research period (2013-2015).

2. Publish financial statements have been audited by an independent auditor as per December 31 of the year 2013 to 2015.

3. The Company is not delisting or out of the Stock Exchange during the period of observation.

4. Those financial statements are contained with complete information related to all the variables studied.

C. Data Collection Methods

The types and sources of data used in this research is using secondary data types and sources. Secondary data is a source of research data obtained by researchers indirectly through an intermediary medium (obtained and recorded by the other party). Secondary data generally in the form of evidence, records or historical reports that have been compiled in the archive (documentary data) published and unpublished (Indriantoro and Supomo, 2009: 147).

55 and analysis of documents. So it can be seen that the time horizon used in this research were researchers study time series, where this research is more emphasis on research of succession time data. The data collected can also be directly downloaded through the website www.idx.co.id , the researchers collected data information used as the basis for the theory and books and literature-literature related to the preparation of this research.

D. Analysis Method and Testing of Hypothesis

Completion of this research by using quantitative analysis techniques. Quantitative analysis is used in a way to analyze a problem that realized by quantitative. In this research, quantitative analysis is done by quantifying the research data to generate the information needed in the analysis.

56 1. Descriptive Statistics

Descriptive statistics are used to provide a description of the data that is visible from the average, standard deviation, variance, sum, range, kurtosis, maximum, minimum and skewness (Ghozali, 2013; 19). Mean used to estimate the average size of the estimated population of the sample. Standard deviation is used to assess the dispersion of the sample average. Minimum and Maximum used to view the minimum and maximum values of the population. This needs to be done to see the overall picture of the samples were collected and are eligible for the research sample.

2. Logistic Regression

Hypothesis testing is done by using a multivariate logistic regression. Logistic regression is used when the dependent variable is a non-metric with two categories and the independent variables are one or more metric and non-metric (Ghozali, 2013: 333). The dependent variable in this research is a going concern audit opinion expressed by a dummy variable, where category 1 for the company going concern and category 0 for companies non-going concern. 3. Overall Model Fit test

The first analysis done is to assess the overall fit model to the data. Hypotheses to assess model fit is:

H0 : hypothesized model fit to the data

57 From this hypothesis it is clear that we would not reject the hypothesis that no model fit the data. Statistics used by the data likelihood function. Likelihood L of the model is the probability that the hypothesized model that describes the input data. To test the null and alternative hypotheses, L transformed into -2LogL (Ghozali 2013: 340). Decrease likelihood (-2LL) show regression model better, or in other words the hypothesized model fits the data.

4. Coefficient of Determinationn (Nagelkerke R Square)

58 5. Testing Feasibility Regression Models

Feasibility regression model was assessed using the Hosmer and Lemeshow's Goodness of Fit Test. Hosmer and Lemeshow's Goodness of Fit Test to test the null hypothesis that the empirical data fit the model (there is no difference between the data so that the model can be said to be fit). If the value of statistic Hosmer and Lemeshow's Goodness of Fit Test is equal to or less than 0.05, the null hypothesis is rejected, which means there are significant differences between the models with observations that the value of goodness fit model is not good because the model can not predict the value of observations. If the value of statistic Hosmer and Lemeshow's Goodness of Fit Test is greater than 0.05, the null hypothesis cannot be rejected and it is mean model is able to predict the value of observation, or it can be said the model is acceptable because it fits with the data observations.

5. Classification Table

Classification table shows the predictive power of the regression model to calculate the estimated value of right and wrong. This matrix shows the predictive power of the dependent variable, receiving going concern audit opinion.

6. Regression Models and Hypothesis Test

59 leverage, and the previous year's audit opinion on going concern audit opinion on the company's real estate and property.

The regression model in this research are as follows:

Information :

Ln ��

1−�� = Going concern audit opinion, (dummy)

α = constants

BoC = changes of board commissioners (dummy) BoD = changes of board directors (dummy)

Ind_Comm = the percentage of independent commissioner in the total Board of Commissioners

Lev = Total Liabilities : Total Assets

OATS = audit opinion the previous year (dummy)

ε = residual error

E. Variable Operational Research 1. Independent Variable

Variables are not dependent or independent variables are the types of variables that explain or influence of other variables. The independent variable is also called the variables suspected as the cause (Presumed

Ln ��