kang

INDO

BALA

REPO

THIRD Q

ONES

ANC

ORT

UARTER 2

SIA’S

E OF

2009

S

PAY

YMEN

NTS

Contact Address:

Balance of Payments Bureau

Directorate of Economic and Monetary Statistics Bank Indonesia

Sjafruddin Prawiranegara Tower, 16th

Floor Jl. M.H. Thamrin No. 2

Jakarta 10350

INDONESIA’S

BALANCE OF PAYMENTS

REPORT

THIRD QUARTER 2009

RINGKASAN ……… 1

SUMMARY INDONESIA’S BALANCE OF PAYMENTS IN Q3/2009 AND ITS CONTRIBUTING FACTORS ……… ……… 1 3 CURRENT ACCOUNT 1. Non-Oil and Gas Trade Balance ……… 7

1.1. Non-Oil and Gas Exports ……… 8

1.2. Non-Oil and Gas Imports ……… 11

2. Oil and Gas Trade Balance ……… 12

2.1. Oil ……… 13

2.2. Gas ……… 14

3. Services Account ……… 15

4. Income Account ……… 16

5. Current Transfers ……… 17

CAPITAL AND FINANCIAL ACCOUNT 1. Capital Account ……… 19

2. Financial Account ……… 20

2.1. Public Sector ……… 20

2.2. Private Sector ……… 24

RESERVE ASSETS ……… 29

INDICATORS OF EXTERNAL SUSTAINABILITY ……… 31

LIST OF TABLES

Page Page

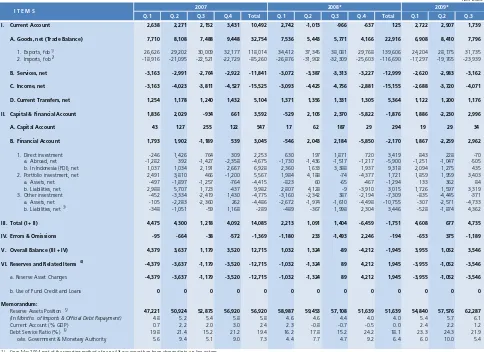

Table 1 Indonesia’s Balance of Payments and Several Economic Indicators in Q3/2009

5 Table 12 Import Value of Raw Materials Based on Country of Origin (C&F)

12

Table 2 Growth of Non-Oil and Gas Exports by Sector 8 Table 13 Import Value of Consumption Goods Based on Country of Origin (C&F)

12

Table 3 Growth of Major Export Commodities 8 Table 14 Import Value of Capital Goods Based on Country of Origin (C&F)

12

Table 4 Non-Oil and Gas Exports to Major Countries of Destination

9 Table 15 Oil Exports and Imports 13

Table 5 Copper Exports To Several Countries of Destination 9 Table 16 Demand and Supply of World Oil 13 Table 6 Coal Exports to Major Countries of Destination 9 Table 17 Indonesian Gas Reserves (billion cubic feet) 14 Table 7 CPO Exports to Major Countries of Destination 10 Table 18 Exports of LNG, LPG and Natural Gas 15 Table 8 Electronic Exports to Major Countries of Destination 10 Table 19 Non-Investment Grant 17 Table 9 Export of Chemical Products to Major Countries of

Destination

11 Table 20 Investment Grant 20

Table 10 Non-Oil & Gas Imports Based on Types of Goods 11 Table 21 Indicators of External Sustainability 31 Table 11 Non-Oil & Gas Import Based on Country of Origin 11

LIST OF CHARTS

Page Page

Chart 1 Current Account 7 Chart 18 Disbursement and Repayment of Government Loan

22

Chart 2 Non-Oil and Gas Trade Balance 8 Chart 19 Program Loan Disbursement 23 Chart 3 World Copper Price 9 Chart 20 Project Loan Disbursement 23 Chart 4 World Coal Price 10 Chart 21 Government Foreign Loan Position 23 Chart 5 World CPO Price 10 Chart 22 Loan Position by Major Creditor Countries 23 Chart 6 World Oil Price 14 Chart 23 Loan Position by Type of Major Currencies 24 Chart 7 Fuel Consumption 14 Chart 24 Financial Account of Private Sector 24 Chart 8 Services account 15 Chart 25 Foreign Direct Investment 25 Chart 9 Travel Services 16 Chart 26 Foreign Direct Investment Based on Country of

Origin

25

Chart 10 Income Account 16 Chart 27 Foreign Direct Investment based on Economic Sector

25

Chart 11 Workers’ Remittances 17 Chart 28 Oil & Gas Foreign Direct Investment 25 Chart 12 Capital and Financial Account by Type of

Investment

19 Chart 29 Non-Oil & Gas Foreign Direct Investment 26

Chart 13 Capital and Financial Account by Sector 20 Chart 30 Foreign Transaction in IDX and the Composite Index

26

Chart 14 Financial Account of Public Sector 20 Chart 31 Foreign Transaction in Private Sector Debt Securities

27

SUMMARY

In Q3/2009, the overall balance of payments recorded a surplus of USD3.5 billion, up from the USD1.1

billion surplus in Q2/2009. Positive contributions to this surplus came from both the current account as well as the

capital and financial account. In response, the international reserves position at end-Q3/2009 mounted to USD62.3

billion, a level equivalent to 6.1 months of imports and servicing of official external debt.

The current account posted a USD1.7 billion surplus in Q3/2009, lower than the Q2/2009 surplus of USD2.9

billion. The lower surplus is explained by reduced performance in the non-oil & gas trade balance and the oil trade

balance. Non-oil & gas exports forged ahead on the upward trend under way since the preceding quarter, bolstered

by strong demand in some Asian economies and rising international market prices for leading primary commodity

exports. However, the accelerated pace of domestic economic activity prompted a surge in non-oil & gas import

growth (16.3%, q.t.q) ahead of non-oil & gas exports (9.5%, q.t.q), resulting in a diminished non-oil & gas trade

balance surplus compared to one quarter earlier. Accelerated domestic economic activity and the seasonal factor of

the Eid-ul-Fitr festivities also led to increased consumption of oil-based fuels and imports of oil with a consequent

deficit in the oil trade balance. Nevertheless, the current account benefited from a heftier surplus in the gas trade

balance following commencement of production at the Tangguh gas field and increases in world oil prices.

Offsetting the reduced current account surplus was stronger performance in the capital and financial

account. During Q3/2009, the capital and financial account posted a USD3.0 billion surplus, after a USD2.2 billion

deficit in the preceding period. Key to this surplus was stronger performance in portfolio investment and other

investments. The steady improvement in domestic macroeconomic conditions combined with attractive interest rates

on rupiah-denominated instruments prompted higher portfolio capital inflows. In other investments, improved

outlook for the economy, easing of global liquidity conditions, and comparatively low international interest rates

have encouraged greater foreign borrowing by the private sector. Other investments also benefited from an

additional allocation of Special Drawing Rights (SDRs). This allocation is intended to bolster the international reserves

held by member countries in the International Monetary Fund (IMF), including Indonesia, as part of the efforts to

The global economic recovery contributed to the improvement in Indonesia’s Balance of Payments

in Q3/2009 that recorded a USD 3.5 billion surplus, higher than a USD 1.1 billion surplus in Q2/2009. This

positive performance was contributed by current account surplus of USD1.7 billion and capital and

financial accounts surplus of USD3.0 billion. The current account surplus contracted compared to the

surplus of preceding quarter. This was primarily due to the descending surplus of non oil/gas trade

balance in line with domestic economic growth acceleration causing non oil/gas imports grew higher than

non oil/gas exports. The decreased in current account surplus also stemmed from the increased deficit of

oil trade balance, services and income account as well as the descending current transfers surplus. The

declining surplus of current account was halted by the increase in gas trade balance surplus. Meanwhile

the performance of capital and financial account improved due to, among others, the growing portfolio

investment inflow. Capital and financial account improvement was also driven by decrease in other

investment deficit due to decrease in government foreign debt repayment, additional SDR allocation by

the IMF, as well as increase in private sector foreign debt disbursement . Following to the above

development, the amount of foreign reserves at end of the period rose to USD 62.3 billion or equivalent

to 6.1 months of imports and official debt service payments.

The development of Indonesia’s Balance of Payment during Q3/2009 was contributed by several

fundamental factors, both stemming from domestic and foreign aspects, such as:

• The global economy showed signs of recovery reflected from the economic growth of major trade

partners such as the US, Japan and the European Union that although still negative (y.o.y) but with a

declining tendency. In the meantime, several Asian countries such as China and India still posted

positive growth. Those countries continued their fiscal stimulus policy in the effort of economic

recovery acceleration. The improved economic performance of those trade partners positively

impacted Indonesian non oil/gas export performance.

• The global demand recovery supported the increased price of several major non oil/gas export

commodities, especially primary commodities. The expectation of global economy recovery promoted

the increase in world oil price that in turn boosted the prices of several other energy commodities

such as gas and coal. The development in the world’s oil price caused the Indonesian crude export

price (average unit price) in Q3/2009 rose to USD 66.5/bl from USD 56.9/bl in previous quarter. The

fluctuation of USD exchange rate against other major currencies also affected world oil price

INDONESIA

’

S BALANCE OF PAYMENTS IN Q3/2009 AND ITS

movement. In line with this increase, LNG price also rose from USD 6.3/MBTU in Q2/2009 to USD

8.2/MBTU during the reporting period.

• In line with the global economy recovery, Indonesian economy in Q3/2009 grew by 4.2%, higher than

4.0% in the previous quarter. By sectors, transportation and communication gave the biggest

contribution to economic growth in Q3/2009 followed by mining, construction, finance and services.

From demand side, consumption still provided considerable support to economic growth. In addition

to the improved consumer’s income and the low inflation rate prospects, the high rate of private

consumption was presumed related to Eid ul-Fitr festivities taking place during the period. This

situation accelerated the import growth especially imports of non oil/gas.

• Inflation rate was 2.8% in Q3/2009, lower than 3.7% in the preceding quarter. This condition was in

line with domestic demand that although increased, but was still considered insufficiently strong. The

appreciation of rupiah during the reporting period contributed to the low inflation rate. In line with

this and in order to boost domestic economic growth, Bank Indonesia mitigated monetary policy by

lowering BI rate. Nevertheless, the spread of domestic and foreign interest rates was still wide enough

to maintain, even increase, the high appeal of foreign portfolio investor.

• The strengthening world demand and the increasing gas production from Tangguh field gave a

positive impact to LNG export volume that rose to 243.7 MBTU, higher than 228.1 MBTU in the

preceding period. Oil production in Q3/2009 reached 0.943 barrel per day (bpd), slightly higher than

the previous period (0.941 bpd) but it was still below government target of 0.960 bpd for 2009.

Apart from natural decline due to old oil fields condition that have passed their optimal limits, several

technical problems were considered as contributing factors to oil production slow recovery. In the

meantime, in line with the increasing domestic economic growth and Eid ul-Fitr festivities, fuel

consumption in Q3/2009 reached 88.3 million barrels, higher than the preceding period (84.5 million

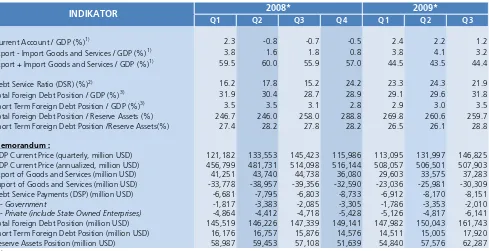

Table 1

Indonesia’s Balance of Payments and

Several Economic Indicators in Q3/2009

Q1 Q2 Q3 Q4 Q1 Q2 Q3

WORLD ECONOMIC INDICATORS

Economic Growth

‐ United States of America % (y.o.y) 2.1 2.0 1.6 0.0 ‐1.9 ‐3.3 ‐3.8 ‐2.3

‐ Japan % (y.o.y) 2.3 1.3 0.6 ‐0.3 ‐4.3 ‐8.6 ‐7.0 ‐4.5

‐ European Union % (y.o.y) 2.8 2.2 1.5 ‐0.4 ‐1.8 ‐2.5 ‐0.2 0.4

‐ Singapore % (y.o.y) 7.8 6.7 2.5 0.0 ‐4.2 ‐9.5 ‐3.3 0.6

‐ China % (y.o.y) 13.0 10.6 10.1 9.0 6.8 6.1 7.1 7.7

World Price Commodity

‐ Crude Oil (OPEC) USD/barel 69.1 92.5 117.5 113.8 53.1 42.9 58.7 67.6

‐ Coal USD/metric ton 66 114 139 163 93 72 66 71

‐ Copper USD/metric ton 7,118 7,796 8,443 7,680 3,905 3,428 4,663 5,859

‐ CPO USD/ton 780 1,156 1,198 928 512 577 743 679

‐ Rubber cent USD/kg 248 293 312 329 203 166 187 221

International Interest Rates ¹⁾

‐ United States of America % (y.o.y) 5.1 3.2 2.1 2.0 1.1 0.25 0.25 0.25

‐ Japan % (y.o.y) 0.5 0.6 0.5 0.5 0.3 0.1 0.1 0.1

‐ European Union % (y.o.y) 3.9 4.0 4.0 4.3 3.2 1.8 1.1 1.0

‐ Singapore % (y.o.y) 2.7 1.5 1.3 1.4 1.0 0.7 0.7 0.7

‐ China % (y.o.y) 6.8 7.5 7.5 7.4 5.9 5.3 5.3 5.3

Inflation ²⁾

‐ United States of America % (y.o.y) 4.1 4.0 5.0 4.9 0.1 ‐0.4 ‐1.4 ‐1.3

‐ Japan % (y.o.y) 0.7 1.2 2.0 2.1 0.4 ‐0.3 ‐1.8 ‐2.2

‐ European Union % (y.o.y) 3.1 3.6 4.0 3.6 1.6 0.6 ‐0.1 ‐0.3

‐ Singapore % (y.o.y) 4.4 6.7 7.5 6.7 4.3 1.6 ‐0.5 ‐0.4

‐ China % (y.o.y) 6.5 8.3 7.1 4.6 1.2 ‐1.2 ‐1.7 ‐0.9

DOMESTIC ECONOMIC INDICATORS

GDP % (y.o.y) 6.3 6.2 6.4 6.4 5.2 4.4 4.0 4.2

CPI Inflation ²⁾ % (y.o.y) 6.6 7.1 11.0 12.1 11.1 7.9 3.7 2.8

Exchange Rates ¹⁾ (Rp/USD) 9,136 9,260 9,264 9,219 11,023 11,630 10,532 10,002

Average Price of Crude Oil Export USD/barel 70.1 93.4 119.3 113.4 48.0 41.8 56.9 66.5

Oil Production mbpd 0.952 0.977 0.981 0.982 0.967 0.962 0.941 0.943

Fuel Consumption mbpy 382.8 95.4 99.0 100.8 86.3 80.7 84.5 88.3

Gas Export (LNG) mbtu 1,080 284 253 259 272 257 228 244

Gas Export Average Price (LNG) USD/mbtu 9.0 11.5 12.8 14.3 8.8 5.5 6.3 8.2

BI Rate 1) % (annual) 8.6 8.0 8.3 9.0 9.4 8.25 7.25 6.58

INDONESIAN BALANCE OF PAYMENTS

‐ Current Account million USD 10,493 2,742 ‐1,013 ‐966 ‐637 2,722 2,907 1,739

‐ Capital and Financial Account million USD 3,591 ‐529 2,105 2,370 ‐5,822 1,886 ‐2,230 2,996

‐ Total million USD 14,085 2,213 1,094 1,404 ‐6,459 4,608 677 4,735

‐ Net Errors and Omissions million USD ‐1,370 ‐1,180 231 ‐1,493 2,246 ‐653 375 ‐1,189

‐ Overall Balance million USD 12,715 1,032 1,324 ‐89 ‐4,212 3,955 1,052 3,546

‐ Foreign Exchange Reserves million USD 56,920 58,987 59,453 57,108 51,639 54,840 57,576 62,287

Source: CEIC, IMF, World Bank, Bank Indonesia, and other sources

¹⁾ an interest rate policy sets by central bank / monetary authority (calculated as the average monthly) ²⁾ end‐month position of the relevant quarter

The current account in Q3/2009 recorded a USD

1.7 billion surplus, lower than USD 2.9 billion surplus in

Q2/2009. This declining surplus was stemmed from the

weakening performance of non-oil & gas and oil trade

balances. Other current account components i.e.

services, income, and current transfers also recorded a

decreasing performance. However, the declining surplus

of current account was slightly offset by the increasing

gas trade balance surplus.

Chart 1 Current Account

Non oil & gas trade balance posted a surplus lower

than the preceding quarter in line with the acceleration

of domestic economic activities which boosted non oil &

gas imports to grow faster than non oil & gas export.

This acceleration accompanied by Eid-ul-Fitr seasonal

factors contributed to the hike of fuel consumption and

oil imports thus consequently generating deficit in oil

trade balance. In the meantime, the increased gas trade

balance surplus was influenced by the rise in gas export

price and volume pursuant to the production of

Tangguh gas field and the hike of world oil price.

The upturn in income balance deficit was due to

the hike of dividend payments to foreign portfolio

investors pursuant to the improving listing company

performance in the preceding year. Services balance

deficit slightly increased from the previous quarter and

was dominated by the increasing of transportation

expenses due to the strengthening of imported goods.

Meanwhile, the decreasing surplus of current transfer

balance was due to a slight inflow drop of workers’

remittance.

1. Non-Oil and Gas Trade Balance

In Q3/2009, non-oil & gas trade balance recorded a

USD5.9 billion surplus, lower than a USD6.4 billion

surplus in Q2/2009. The decreased surplus was due to a

steeper increase of non-oil & gas import growth

(16.3%, q.t.q) than non-oil & gas exports (9.5%, q.t.q).

Domestic economy posted a positive growth of

4.2% (y.o.y) in Q3/2009, higher than the preceding

period (4.0%, y.o.y). Economic growth was mainly due

to private consumption that influenced the hike of

non-oil & gas import. The annual growth of non-non-oil & gas

imports improved from 27.0% (y.o.y) in Q2/2009 to

-19.6% (y.o.y) in this period. The performance of non-oil

& gas exports also improved from 14.8% (y.o.y) to

-9.6% (y.o.y). -5,000

-3,000 -1,000 1,000 3,000 5,000 7,000 9,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

million USD

Services Income Trade Balance Current Trans. Current Account

Chart 2

Non-Oil and Gas Trade Balance

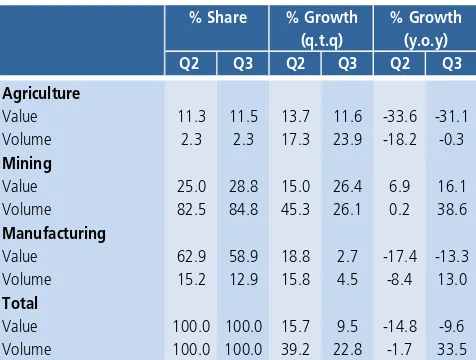

1.1.Non-Oil and Gas Exports

In Q3/2009, non-oil & gas export improved to

USD26.0 billion compared to USD23.8 billion in the

preceding quarter.

The strengthening performance of export value was

mainly related to mining products which increased by

26.4% from the previous quarter. Exports of major

mining commodities, such as coal and copper, increased

mainly in terms of volume in line with the increasing

world demand, especially China. Meanwhile, exports of

agricultural and manufacturing products also posted a

positive growth of 11.6% and 2.7%, respectively.

The improved export performance of the above

three sectors was also reflected on their annual growth.

Mining sector recorded a growth of 16.1% (y.o.y)

compared to 6.9% (y.o.y) in the preceding period.

Despite the negative growth of 31.1% (y.o.y),

agricultural sector showed an improvement compared

to the previous year (-33.6%, y.o.y). Manufacturing

sector still recorded a negative growth of 13.3% (y.o.y)

but not as high as in the preceding quarter (-17.4%,

y.o.y).

Table 2

Growth of Non-Oil and Gas Exports by Sector

The improving performance of non-oil & gas export

value was also reflected in the development of 10 major

commodities. In Q3/2009, almost all major commodities

of non-oil & gas exports, except machinery and

mechanic, recorded an increase compared to the

previous quarter. Five commodities posted a

strengthening annual growth. They are among others,

copper, coal, CPO, chemical and electronic products.

Demand on the above mentioned commodities mainly

came from Asian countries and partly from developed

countries pursuant to the improving economic

performance in those countries.

Table 3

Growth of Major Export Commodities 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 3,000 8,000 13,000 18,000 23,000 28,000 33,000 38,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

million USD million USD

Export Import Trade Balance (RHS)

Q2 Q3 Q2 Q3 Q2 Q3

Agriculture

Value 11.3 11.5 13.7 11.6 -33.6 -31.1

Volume 2.3 2.3 17.3 23.9 -18.2 -0.3

Mining

Value 25.0 28.8 15.0 26.4 6.9 16.1

Volume 82.5 84.8 45.3 26.1 0.2 38.6

Manufacturing

Value 62.9 58.9 18.8 2.7 -17.4 -13.3

Volume 15.2 12.9 15.8 4.5 -8.4 13.0

Total

Value 100.0 100.0 15.7 9.5 -14.8 -9.6

Volume 100.0 100.0 39.2 22.8 -1.7 33.5

% Share % Growth % Growth

(q.t.q) (y.o.y)

Q2 Q3 Q2 Q3 Q2 Q3 Q2 Q3

Copper ‐4.3 41.3 ‐19.2 18.1 7.0 108.1 57.0 193.7

Nickel ‐53.1 29.6 137.3 27.0 ‐79.4 ‐79.7 ‐23.3 136.7

Coal 39.5 23.5 78.6 26.1 42.1 49.7 7.8 48.4

CPO 38.6 16.9 11.5 16.0 ‐29.1 21.9 17.4 90.0

Electrical Appliances 24.2 14.5 21.1 13.3 8.2 15.9 ‐1.6 4.8

Rubber 17.8 13.6 19.2 0.6 ‐56.3 ‐56.4 ‐15.7 ‐16.1

Chemical Product 24.5 7.6 28.5 ‐3.4 ‐16.4 ‐15.2 ‐42.6 ‐5.9

Paper 4.2 5.7 ‐1.5 ‐5.7 ‐27.7 ‐28.9 1.0 ‐16.8

Textile & Tex. Prod 5.9 5.0 12.4 ‐0.7 ‐11.6 ‐13.2 ‐0.9 ‐4.5

Machinery & Mechanic 19.5 ‐27.0 5.4 ‐30.4 ‐13.1 ‐46.9 ‐22.5 ‐57.0

% Growth (q.t.q) % Growth (y.o.y)

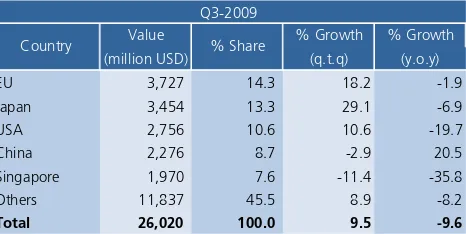

Non-oil & gas exports to Japan recorded the

highest growth of 29.1% (share 13.3%) compared to

the preceding period, followed by export to European

Union (grew by 18.2%, share 14.3%) and the US (grew

by 10.6%, share 10.6%). On annual basis, however,

the non-oil & gas export performance to almost all

major countries of destination still recorded a

downturn, except to China which recorded an increase

of 20.5% (share 8.7%).

Table 4

Non-Oil and Gas Exports to Major Countries of Destination

Copper

In Q3/2009 copper exports reached USD2.1 billion

or grew by 41.3% from the preceding quarter. This

growth was contributed by both price and volume

factors. During this period copper price reached

USD5,859/Mton, higher than the preceding quarter

(USD4,663/Mton). Copper export volume rose by

18.1% (q.t.q) in line with the growing demand,

especially from Japan, South Korea and Malaysia.

Chart 3 World Copper Price

Compared to the same period in the previous year,

copper export performance recorded a positive growth

by 108.1% (y.o.y), far higher than 7% (y.o.y) in the

preceding period.

Table 5

Copper Exports to Several Countries of Destination

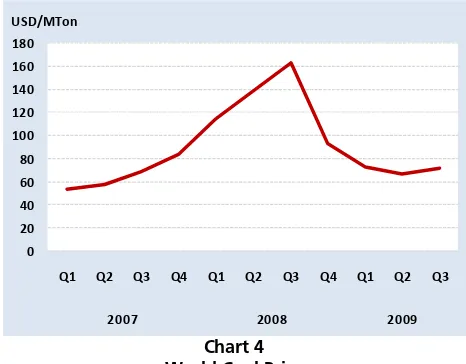

Coal

In Q3/2009 coal export value reached USD4.4

billion or grew by 23.5% from the preceding quarter.

This growth was supported by the increase of export

volume by 26.1% (q.t.q). China’s dependency on coal

in fulfilling this country’s demand of steam power was

still high. Besides China, the main destinations of coal

export were Japan, South Korea, India and Taiwan.

Coal export value also showed a growing trend

compared to the same period in the previous year. In

Q3/2009, coal export grew by 49.7% (y.o.y), higher

than 42.1% (y.o.y) in the preceding year.

Table 6

Coal Exports to Major Countries of Destination

World economic recovery increased the demand on

energy products including coal, which affected the hike

of its price to USD71.31/Mton, higher than the

preceding period (USD66.48/MTon). This rise was in line

Value % Growth % Growth

(million USD) (q.t.q) (y.o.y)

EU 3,727 14.3 18.2 -1.9 Japan 3,454 13.3 29.1 -6.9 USA 2,756 10.6 10.6 -19.7 China 2,276 8.7 -2.9 20.5 Singapore 1,970 7.6 -11.4 -35.8 Others 11,837 45.5 8.9 -8.2

Total 26,020 100.0 9.5 -9.6

Q3-2009

Country % Share

3,000 4,000 5,000 6,000 7,000 8,000 9,000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008 2009

USD/MTon

Value % Growth % Growth (million USD) (q.t.q) (y.o.y) Japan 874 41.1 65.8 299.4 South Korea 243 11.4 19.9 256.2 Malaysia 210 9.9 72.6 36.7 Others 799 37.6 22.2 37.5 Total 2,127 100.0 41.2 108.1

Q3-2009

Country % Share

Value % Growth % Growth

(million USD) (q.t.q) (y.o.y)

Japan 907 20.7 57.2 47.1 China 570 13.0 51.8 122.3 South Korea 565 12.9 11.3 66.7 Taiwan 542 12.4 9.9 17.3 India 529 12.1 -8.7 70.2 Others 2,333 53.3 12.0 36.4 Total 4,374 100.0 23.5 49.7

Q3-2009

with the growing oil price as coal was considered as an

alternative energy commodity.

Chart 4 World Coal Price

CPO

In Q3/2009 CPO exports reached USD2.7 billion or

grew by 16.9% from the previous quarter. The

strengthening export value was in line with the increase

of export volume by 16% (q.t.q). The cancellation of

rise in import duty in India and the celebration of Idul

Fitri in India, Pakistan, Bangladesh and Middle East had

also affected CPO demand. The improving CPO export

performance was also reflected on its annual growth.

CPO exports in this period experienced a significant

growth by 21.9% (y.o.y) in contradiction with the

previous quarter (-29.1%, y.o.y).

Table 7

CPO Exports to Major Countries of Destination

Despite a significant increase in export volume,

CPO export price experienced a decrease. The average

CPO price in Q3/2009 was USD679/MTon, slightly

than the previous quarter (USD743/MTon). According

to Association of Crude Palm Oil Producers (GAPKI), the

decrease of CPO price was due to the increasing supply

from Malaysia and Indonesia. In line with CPO price

drop, the government decreased the export duty from

3% to 0% starting August 2009. This decision refers to

price development in Rotterdam market that reached

USD 674.84/MTon in August 2009, below the price

reference of USD750/MTon.

Chart 5 World CPO Price

Electronic

Export of electronic products reached USD2.9

billion in Q3/2009 or grew by 14.5% from the

preceding quarter. This increase was mainly driven by

the export of digital camera and video player destinated

to European Union and East Asia. The major countries

of electronic export destination were Singapore

(20.2%), European Union (18.5%) and the US (15.4%).

Table 8

Electronic Exports to Major Countries of Destination

0 20 40 60 80 100 120 140 160 180

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008 2009

USD/MTon

Value % Growth % Growth

(million USD) (q.t.q) (y.o.y)

India 872 31.8 13.8 -2.9

EU 549 20.0 78.2 81.2

China 414 15.1 -5.6 190.1

Others 905 33.0 9.0 0.0

Total 2,740 100.0 16.9 21.9

Q3-2009

Country % Share

0 200 400 600 800 1,000 1,200 1,400

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008 2009

USD/MTon

Value % Growth % Growth (million USD) (q.t.q) (y.o.y)

Singapore 579 20.2 9.9 -22.6

EU 531 18.5 18.3 69.6

USA 442 15.4 14.8 53.4

Others 1,317 45.9 13.8 -46.8

Total 2,868 100.0 14.5 15.9 Q3-2009

The performance of electronic exports showed an

improvement compared to the previous year reflected

by the annual growth of 15.9% (y.o.y) or higher than

8.2% (y.o.y) in the preceding period.

Chemical Products

Export of chemical products in Q3/2009 reached

USD 1.7 billion or grew by 7.6% compared to the

preceding quarter. This increase was mainly driven by

price factor while the volume recorded a decrease of

3.4% from the previous quarter. The main export

destinations were China, European Union and Malaysia.

The improved export performance of chemical

products was also reflected in the annual growth of

negative 15.2% (y.o.y), better than the preceding

period (-16.4%, y.o.y).

Table 9

Exports of Chemical Products to Major Countries of Destination

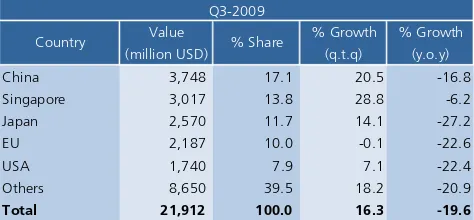

1.2.Non-Oil & Gas Import

In Q3/2009 non-oil & gas import experienced a

steeper increase by recording a growth of 16.3%

(q.t.q), higher than 14% (q.t.q) in Q2/2009. This

growth was related to import of consumption goods,

raw material as well as capital goods.

Table 10

Non-Oil & Gas Imports Based on Types of Goods

Non-oil & gas imports in Q3/2009 reached USD20.1

billion, higher than USD17.3 billion in the preceding

quarter. The imported goods were mainly from China,

Singapore, Japan, European Union and the US.

Table 11

Non-Oil & Gas Import Based on Country of Origin

Import of Raw Materials

In Q3/2009 import of raw materials reached

USD14.2 billion or grew by 16.7% compared to the

preceding period. Demand recovery of imported raw

material was also reflected from the annual growth.

Value % Growth % Growth (million USD) (q.t.q) (y.o.y)

China 248 15.0 23.4 75.0

EU 183 11.0 10.9 -14.1

Malaysia 141 8.5 5.9 -26.7

Others 1,088 65.5 4.2 -22.9

Total 1,660 100.0 7.6 -15.2 Q3-2009

Country % Share

Q2 Q3 Q2 Q3 Q2 Q3

Consumption Goods

Value 7.8 8.1 18.6 20.8 -37.5 -34.5 Volume 5.4 5.0 3.7 9.9 -28.9 -23.1 Raw Material

Value 64.4 64.7 15.6 16.7 -34.6 -24.2 Volume 90.4 91.0 42.7 18.8 -19.9 1.0 Capital Goods

Value 27.0 26.2 9.5 13.1 7.2 2.3 Volume 4.2 4.0 -5.6 13.1 -10.7 -5.4 Total

Value 100.0 100.0 14.0 16.3 -27.0 -19.6 Volume 100.0 100.0 37.0 18.1 -20.1 -0.8 % Share % Growth % Growth

(q.t.q) (y.o.y)

Value % Growth % Growth

(million USD) (q.t.q) (y.o.y)

China 3,748 17.1 20.5 -16.8

Singapore 3,017 13.8 28.8 -6.2 Japan 2,570 11.7 14.1 -27.2

EU 2,187 10.0 -0.1 -22.6

USA 1,740 7.9 7.1 -22.4 Others 8,650 39.5 18.2 -20.9

Total 21,912 100.0 16.3 -19.6

Q3-2009

Despite recording an ongoing minus rate (-24.2%),

it was not as steep as in the previous quarter (-34.6%).

The growing demand on imported raw materials was in

line with the condition of manufacturing sector which

was estimated to recover after the global economic

crisis.

The highest growth of raw materials imports was

from China (14.2%), followed by Singapore (12.4%)

and Japan (12.3%). Major raw materials import

commodities recorded positive growth include animal

feed, steel raw material and electrical equipment. The

growing demand of steel raw material was considered

related to the rise in investment in property sector.

Table 12

Import Value of Raw Materials Based on Country of Origin (C&F)

Import of Consumption Goods

In Q3/2009 imports of consumption goods reached

USD1.8 billion or grew by 20.8% compared to the

preceding quarter. This increase was considered related

to Ramadhan and Eid ul-Fitr celebration reflecting hike

in food, beverage and clothes consumption. This

development was in line with the consumption increase

on GDP in Q3/2009.

The annual growth of consumption goods imports

also increased to minus 34.5% (y.o.y) compared to

minus 37.5% (y.o.y) in the preceding period.

Imports of consumption goods were mainly from

Thailand (share 21.7%), China (20.8%) and Singapore

(8.5%).

Table 13

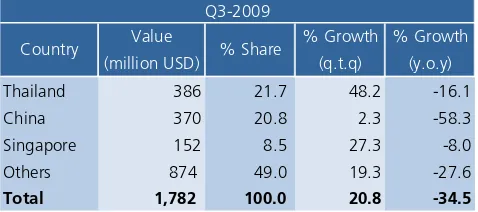

Import Value of Consumption Goods Based on Country of Origin (C&F)

Import of Capital Goods

Import of capital goods in Q3/2009 reached

USD5.8 billion or grew by 13.1% from the preceding

period. The annual growth of capital goods, however,

showed a downturn to 2.3% (y.o.y) from 7.2% (y.o.y)

in the previous quarter.

Imports of capital goods were mainly from China

(share 23.2%), Singapore (18.7%) and Japan (12.3%).

Table 14

Import Value of Capital Goods Based on Country of Origin (C&F)

2. Oil & Gas Trade Balance

In Q3/2009, oil and gas trade balance still provided

a positive contribution to the development of overall

trade balance by posting a USD2.0 billion surplus or

relatively equal to the surplus recorded in Q2/2009

(USD2.0 billion). Despite this equivalent surplus, the

trade balance composition was different with higher

gas surplus and oil deficit.

Value % Growth % Growth

(million USD) (q.t.q) (y.o.y)

China 2,010 14.2 19.2 -18.9 Singapore 1,762 12.4 30.6 -27.4 Japan 1738 12.3 14.3 -31.2 Others 8,661 61.1 14.2 -23.1 Total 14,171 100.0 16.7 -24.2

Q3-2009

Country % Share

Value % Growth % Growth (million USD) (q.t.q) (y.o.y)

Thailand 386 21.7 48.2 -16.1

China 370 20.8 2.3 -58.3

Singapore 152 8.5 27.3 -8.0

Others 874 49.0 19.3 -27.6

Total 1,782 100.0 20.8 -34.5 Q3-2009

Country % Share

Value % Growth % Growth (million USD) (q.t.q) (y.o.y)

China 1,332 23.2 28.0 20.9 Singapore 1,075 18.7 25.5 79.7

Japan 707 12.3 14.3 -20.3

Others 2,636 45.8 2.5 -13.1

Total 5,750 100.0 13.1 2.3 Q3-2009

A growing surplus was recorded in gas trade

balance driven by gas price development while LNG

export volume showed a climbing tendency. Meanwhile

oil import was larger than oil export in response to

domestic demand acceleration related to Eid ul-Fitr

seasonal factor.

2.1. Oil

After recording a surplus of USD68 million in

Q2/2009, oil trade balance experienced a USD779

million deficit in Q3/2009 pursuant to oil import

increase. This trend was related among others to the

growth of fuel consumption before and during Eid

ul-Fitr period.

Table 15 Oil Exports and Imports

Oil exports during the reporting period rose to

USD3.0 billion or grew by 23.1% compared to the

preceding quarter. This mounting trend was mainly

driven by oil price that recording a growth of 18%

while a slight increase was also recorded (around 5%

for crude oil and 1% for oil product) in terms of

volume.

Refinery product exports experienced a slight

increase from 9.9 million barrel in Q2/2009 to 10.0

million barrel in the reporting period with a value

amounting to USD761 million. This export was largely

destinated to Asian countries such as Malaysia, Japan,

Korea, Singapore and China. Crude oil export volume

increased from 31.6 million barrel to 33.1 million barrel

followed by the hike of export value from USD1.8

billion to USD2.2 billion. This exported was mainly to

Australia, Japan, China and Korea and the types of

crude oil exported included SLC, Duri, Senipah and

Belanak.

Oil imports in Q3/2009 recorded a significant

increase from USD2.3 billion to USD3.7 billion. Similar

to export trend, this raise was also partly driven by the

oil price movement. Oil import¹ price rose from

USD58.4/barrel to USD70.3/barrel in average during the

reporting period. In terms of volume oil import

increased from 40.1 million barrel to 50.4 million barrel.

Imports of crude oil during Q3/2009 for refinery

intake were originated from the Middle East with ALC

(Arab Light Crude) oil type and followed by crude oil

from Brunei, Africa, China and Malaysia. These types of

crude oil were used for several refineries such as

Cilacap, Balikpapan and Balongan that are the principal

refineries providing for domestic fuel supply.

Table 16

Demand and Supply of World Oil

The movements of Indonesian oil prices were in

line with world oil price movement. OPEC and WTI

basket crude oil price showed an increase reaching

respectively USD67.17/barrel and USD69.34/barrel. The

expectation for global economic recovery in 2010 and

the weakening USD exchange rate contributed to the

hike in oil price. The oil price still experienced an

increase despite the indication of oversupply in terms of

demand and supply (OPEC Monthly Report).

Exports 2,411 41.5 2,967 43.1

Crude Oil 1,775 31.6 56.2 2,206 33.1 66.6

Refinery Products 635 9.9 64.4 761 10.0 76.4

Imports 2,343 40.1 0.0 3,746 53.3 0.0

Crude Oil 857 17.3 49.4 1,489 22.8 65.2

Refinery Products 1,486 22.8 65.3 2,258 30.5 74.1

Oil Trade Balance 68 ‐779

Source: BPMigas & PT Pertamina (Processed) Price (USD/barel) Details 2009 Q2 Q3

Value (mill.

USD) Volume

(mbbl) Price

(USD/barel) Value (mill.

USD) Volume

(mbbl)

Q1 Q2 Q3

Oil Demand

Northern America 25.5 24.2 23.5 23.0 23.3

China 7.6 8.0 7.6 8.3 8.4

Western Europe 15.3 15.3 14.9 14.4 14.8

Others 37.6 38.1 37.9 37.5 38.0

Total Oil Demand 86.0 85.6 83.9 83.2 84.5 Oil Supply 0.0 0.0 0.0 0.0 0.0

OPEC 30.2 31.2 28.4 28.5 28.8

Non OPEC 54.6 54.8 55.5 55.2 55.7

84.6 0.0 0.0 0.0 0.0

Total Oil Supply 84.8 86.0 84.0 83.7 84.5 Netto Demand ‐ Supply ‐1.2 0.3 0.1 0.5 0.0

Source: OPEC Oil Monthly Report ‐ October 2009

Details

(in mbpd) 2007 2008

Chart 6 World Oil Price

With reference to domestic supply the average

Indonesian oil production reached 0.943 million barrel

per day, slightly higher than the average production in

the previous quarter (0.941 milion barrel per day). This

production was however still below oil production

assumption defined in the 2009 APBN-P 2009 (0.960

million barrel per day). This condition was driven among

others by the production of Cepu field that had not

worked in accordance with the initial target as well as

by the natural declining of old oil fields.

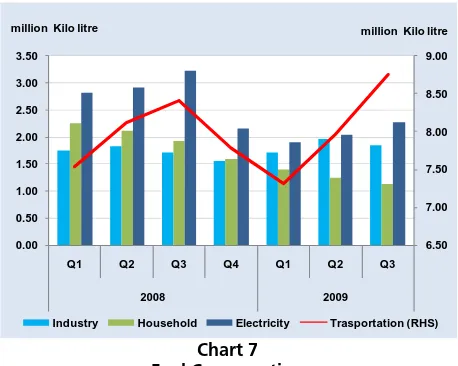

In terms of domestic demand, fuel consumption

during the reporting period experienced an increase to

88.3 million barrel compared to 84.5 million barrel in

the preceding period. Pertaining to user sectors, the

hike in fuel consumption was mainly reflected in

industrial, electrical and transportation sectors while the

use in household sector showed a decrease. Despite

posting an increase compared to the preceding quarter,

the hike of fuel consumption was not steep and the

level was still below the previous year. This was driven

by the success of the conversion program to replace

household oil-based fuels with gas as well as the energy

conversion to coal in several power plants. This success

was reflected in oil consumption which declined to 88.9

million barrel from 100.8 million barrel in the previous

Chart 7 Fuel Consumption

2.2. Gas

The growing trend of oil and gas price had driven

a positive contribution to gas trade balance in Q3/2009

by recording a USD2.7 billion surplus from a USD1.9

billion surplus in Q2/2009. This higher surplus was also

related to the increasing LNG export volume.

The exported LNG product in the reporting period

reached USD2.0 billion (244 mmbtu) or grew from

USD1.4 billion (228 mmbtu) in Q2/2009. This growing

trend was in line with addition of oil production from

Tangguh field. Indonesia has an extensive gas reserves

amounting to 170.1 TSCF (Trillion Standard Cubic Feet)

with the following composition: 112.5 TSCF of proven

reserves and 57.7 TSCF of potential reserves. Gas

reserves was higher in 2008 compared to 2007.

Table 17

Indonesian Gas Reserves (billion cubic feet)

Price factor also improved the export value of

natural gas, compensating the decrease in its export

volume. Export value of natural gas increased from

USD565 million to USD759 million. 30 40 50 60 70 80 90 100 110 120 130 140

Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep

2007 2008 2009

USD/barel

SLC

Indonesian Export Price WTI

OPEC

Source: OPEC, Ditjen Migas

6.50 7.00 7.50 8.00 8.50 9.00 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50

Q1 Q2 Q3 Q4 Q1 Q2 Q3

2008 2009

Industry Household Electricity Trasportation (RHS)

million Kilo litre million Kilo litre

Year Reserves

Proven 91 91 97 94 106 113 Potential 87 98 89 93 59 58

Total 178 188 186 187 165 170

2006 2007 2008

Table 18

Exports of LNG, LPG and Natural Gas

3. Services Account

In line with the strengthening domestic economic

activities that consequently affected the increase of

transportation expenses related to imported products,

the deficit of services account in Q3/2009 rose to

USD3.2 billion compared to USD3.0 billion in

Q2/2009.The hike in economic activities had also

triggered increase in deficit of other services such as

insurance and other financial intermediary services. The

increase in services account deficit was also related to

the declining surplus of travel, communication and

government services.

Chart 8 Services account

Transportation services recorded a deficit of

USD2.4 bilion, higher than USD2.0 billion in the

preceding quarter. The hike in deficit among others

reflected the considerable dependency on foreign fleet

in fulfilling transportation demand. In the effort of

lessening this dependency, the government emanated a

policy of cabotage principle that oblige the shipping of

commodities between domestic ports conducted by

national fleet. This policy had been implemented for

commodities such as palm oil and agricultural products

however the application was still very limited due to

difficulties in new fleet financing.

In Q3/2009 travel services (tourism sector)

recorded a USD223 million surplus, slightly lower than

USD248 million in Q2/2009. This declining surplus was

due to the increase of foreign exchange expenses by

Indonesian travelers abroad from USD1,323 million to

USD1,441 million exceeding the expenses of

international travelers in Indonesia from USD1,572

million to USD1,664 million.

The economic recovery experienced by several

countries contributed to the increase of international

tourists visiting Indonesia. The number of international

tourists (inbound) in Q3/2009 reached 1,671 thousand

people higher than 1,590 thousand people in Q2/2009.

This increase was also triggered by the organization of

several international tourism activities such as Darwin

Ambon Yacht Race 2009 in July 2009 involving

participants from UK, Australia and Germany and Sail

Bunaken event organized early August 2009 in Manado

gathering participants from 33 countries.

The statistic of international tourists was still

dominated by travelers coming from neighboring

countries. Tourists from Singapore were in the first rank

(share 13.9%) followed by Australia (10.8%), Malaysia

(10.8%), Japan (9.01%) and China (6.9%). Only

Australia out of 3 countries (Singapore, Malaysia and

Australia) shows a consistent increase in the number of

tourists since Q1/2009.

Q1 Q2 Q3

LNG

Volume (mmbtu) 1,080 1,068 257 228 244 Value (million USD) 9,723 12,785 1,426 1,448 1,989 Price(USD/mmbtu) 9.0 11.9 5.5 6.3 8.2

LPG

Volume (000 metric ton) 337 101 ‐ ‐ ‐ Value (million USD) 210 79 ‐ ‐ ‐ Price (USD/MTon) 604.7 394.9 ‐ ‐ ‐

Natural Gas

Volume (mmbtu) 293 303 78 77 76 Value (million USD) 2,443 3,469 441 565 759 Price (USD/mmbtu) 8.3 11.3 5.7 7.4 10.0

Gas Trade Balance 12,345 16,147 1,744 1,906 2,697

Export (million USD) 12,376 16,333 1,867 2,013 2,748

Import million USD) 31 186 123 107 51

Source: BPMigas

Details 2007 2008* 2009*

-4000 -3500 -3000 -2500 -2000 -1500 -1000 -500 0 500 1000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

Transportation Travel Other services Services, net

Bali was still considered as the main tourist

destination representing 41.4% of the market share,

followed by Jakarta (21.8%) and Batam (13.0%).

Australia (share 19.5%), Japan (14.0%) and China

(8.3%) were countries with the largest number of

tourists visiting Bali.

Chart 9 Travel Services

On the other hand, the number of Indonesian

people going abroad also grew to 1,495 thousand

people in Q3/2009 from 1,373 thousand people in the

preceding quarter. This growth was followed by the

increase of foreign exchange expenses related to this

trip from USD1.3 billion to USD1.4 billion.

Neighboring ASEAN countries still remained the

main destination of Indonesian travelers such as

Singapore (share 43.9%), Malaysia (25.4%) and

Thailand (3.9%). Australia (5.5%) and the US (4.3%)

were the main destination of Indonesian tourists outside

ASEAN countries.

4. Income Account

In Q3/2009 the income account recorded a

USD4.1 billion deficit, higher than USD3.7 billion deficit

in Q2/2009. This increase was mainly related to the

growing dividend payment to foreign investor portfolio.

The growth of deficit was also contributed by the

increasing profit transfer to foreign companies dealing

with oil & gas sector pursuant to the rise in oil & gas

production. In contrast, the interest payment of

government foreign debt decreased in the reporting

period according to its cyclical pattern.

Chart 10 Income Account

Income from portfolio investment recorded a

USD1.4 billion deficit, higher than USD0.7 billion in the

preceding quarter. The increase of this deficit was

mainly triggered by the rise in dividend payment on

shares owned by foreign investors to USD1.0 billion

from USD0.5 billion. This condition was consistent with

the increase of foreign ownership of domestic shares in

the preceding periods.

The deficit in direct investment income also

mounted to USD2.2 billion from USD2.1 billion in

Q2/2009. This growing deficit was related to the

increased profit transfer reported by oil & gas

companies from USD0.8 billion to USD1.3 billion in the

reporting period.

On the other hand, deficit in other investment in

Q3/2009 decreased to USD0.3 billion from USD0.9

billion in Q2/2009. This contraction was related to the

decrease in foreign debt repayments by the government

from USD0.7 billion to USD0.2 billion.

-800 -600 -400 -200 0 200 400 600 800 -600 -500 -400 -300 -200 -100 0 100 200 300 400 500 600 700

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S

2007 2008 2009

million USD

Inbound (thousan people) Outbound (thousand people)

Trav. Balance (thousand people) Inflows (million USD) RHS

Trav. Balance (million USD) RHS Outflows (million USD) RHS

Thousand people -5,000 -4,500 -4,000 -3,500 -3,000 -2,500 -2,000 -1,500 -1,000 -500 0

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

Income, net Inv. Income DI Income

PI Income OI Income

5. Current Transfers

In Q3/2009 the current transfer posted a

USD1,176 million surplus, slightly lower than USD1,200

million in the previous quarter. The decreased inflows of

remittances from Indonesian labor abroad and the

increased outflows of remittances by foreign labor had

caused this declining surplus. The revenue from

remittances of Indonesian workers was posted

USD1,603 million, slightly lower than USD1,652 million

in the previous period. On the other hand, outflows

from remittance of foreigners working in Indonesia

reached USD440 million, slightly higher than USD432

million in Q2/2009.

Chart 11

Workers’ Remittances

Other component contributing the surplus of

current transfer was the revenue related to

non-investment grant in the form of food, clothes,

medicines and medical equipment. In Q3/2009 this

revenue reached USD40 million, higher than USD32

million in Q2/2009. The grants received during this

quarter was among other from Dutch Government in

the form of hospital medical equipment that officially

accepted by the Indonesian Ambassador for the

Netherland on August 24, 2009. UNICEF had also

provided aid in the form of tents for earthquake victims

in Tasikmalaya, West Java.

Table 19 Non-Investment Grant

-1000 -500 0 500 1000 1500 2000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

TKI Inflow TKA Outflow worker remittance, net

million USD (million USD)

Non Investment Grants

(Current Transfer) Q.1. Q.2. Q.3. Q.4. Q.1. Q.2. Q.3.

Total 86 41 62 145 73 32 40

Public (Govt.) 17 27 38 128 4 15 20

Private (NGO) 69 14 24 17 69 17 20

Source : Ministry of Finance & United Nation

In Q3/2009 capital and financial account posted a

USD3.0 billion surplus, better than a USD 2.2 billion

deficit in the previous quarter. This surplus was

contributed by the improving performance of portfolio

investment and other investment. The strengthening

domestic macroeconomic conditions, supported by a

relatively attractive rupiah interest rate, had triggered

the inflows of portfolio investment. In the meantime,

other investment deficit declined due to the decrease of

scheduled foreign debt repayments by the government,

additional SDR allocation by IMF, and the growing

foreign loan disbursement by private sector. The

strengthening economic prospect, relaxing global

liquidity as well as relatively low overseas interest rate

had contributed to growing private sector foreign

financing.

Unlike portfolio and other investments, direct

investment performance contracted in Q3/2009

compared to the previous period. This decrease was

estimated more related to the descending world

demand on export products since the number of export

oriented foreign direct investment was relatively high. In

line with the existing signs of world economic recovery

it was forecasted that direct investment inflows would

increase in the coming quarters.

Chart 12

Capital and Financial Account by Type of Investment

1. Capital Account

The capital account in Q3/2009 recorded a USD34

million surplus, higher than a surplus of USD29 million

in the previous quarter. This surplus was contributed

mainly by the investment grants such as those for

construction of bridges, schools and housing. The

majority of the grants were allocated in the framework

of aids for natural disaster’s victims in several locations

in the country. As in previous quarters, most of the

grants (88%) was in the form of investment grant

received through private sector (NGO) amounting to

USD30 million and rest through the public sector

(government).

-8,000 -6,000 -4,000 -2,000 0 2,000 4,000 6,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

Direct Investment Portfolio Investment

Other Investment Financial Account

million USD

One example of investment grant was the aid from

Australian government for the construction of 2,000

Junior High School buildings which was estimated for

completion at the end of 2009.

Table 20 Investment Grant

2. Financial Account

The financial account performance in Q3/2009

showed an improvement by recording a USD3.0 billion

surplus after experiencing a USD2.3 billion deficit in

Q2/2009. This improvement emerged in portfolio

investment and other investment accounts. On the

contrary, direct investment posted a deficit after

recording a surplus in the previous quarter. This drop

appeared both in oil & gas and non-oil & gas sectors.

In terms of sector, financial account of public

sector posted a USD5.6 billion surplus compensating a

USD2.6 billion deficit registered by private sector.

Chart 13

Capital and Financial Account by Sector

The growth of portfolio investment inflow was

condition. The improved economic condition had also

increased private corporates’ demand for foreign

financing. Meanwhile, the improved performance of

other investment was contributed by the decrease in

official foreign debt repayment due to seasonal factor

and additional SDR allocation from IMF.

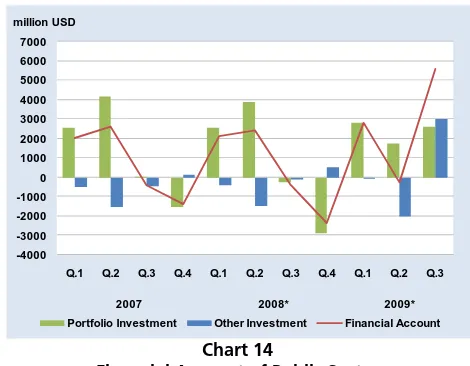

2.1 Public Sector

Public sector’s financial account posted a USD5.6

billion surplus in Q3/2009, in contrast with a USD0.2

billion deficit in Q2/2009. This surplus was related to

portfolio investment and other investment.

Chart 14

Financial Account of Public Sector

Portfolio Investment

Portfolio investment in public sector recorded a

USD2.6 billion surplus, higher than a USD1.8 billion

surplus in the preceding quarter. This surplus was

mainly resulted from the purchase of SBI and

government’s rupiah bond (SUN) by foreign investors

and supported by the issuance of Samurai Bond by the

government amounting to USD0.4 billion.

Transaction on SBI by foreign investor during the

reporting period recorded a USD1.6 billion surplus,

higher than the USD0.4 billion surplus in the preceding

period. SUN transaction also recorded a net buying by

foreign investors amounted to USD0.6 billion but lower

(million USD)

Investment Grants

(Capital Transfer) Q.1. Q.2. Q.3. Q.4. Q.1. Q.2. Q.3.

Total 17 61 186 29 19 29 34

Public (Govt.) 4 6 7 3 2 3 4

Private (NGO) 13 55 179 26 17 26 30

Source : Ministry of Finance & United Nation

2008* 2009* -8,000 -6,000 -4,000 -2,000 0 2,000 4,000 6,000 8,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

Public sector Private sector Capital & financial account million USD -4000 -3000 -2000 -1000 0 1000 2000 3000 4000 5000 6000 7000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3

2007 2008* 2009*

Portfolio Investment Other Investment Financial Account

Transaction on rupiah-denominated government

bonds by foreign investor was dominated by the

purchase of mid to long term tenor that has relatively

low risk of capital reversal. This low risk was due to its

less liquid characteristic and, referring to historical data,

investor generally purchases the government bond on

real money account.

Foreign capital inflows in the form of portfolio

investment during the reporting period were due to

several factors. From external side, relaxed liquidity in

the global financial market as well as the weakening

trend of US Dollar had triggered foreign interest to

invest in developing countries. From domestic side, the

strengthening domestic economic condition, reflected

among others from Moody’s decision to improve

Indonesia’s sovereign credit rating from Ba3 to Ba2 in

September 2009 and favorable Rupiah interest rate was

adequate to attract foreign investment inflows.

In addition to that, portfolio investment inflow was

supported by the descending risk factor. During the

reporting period, the risk rates reflected from several

risk indicators such as CDS (Credit Default Swap), yield

spread Global Bond, and spread EMBIG showed a

descending trend. CDS on Indonesia dropped from 310

bps in Q2/2009 to 183 bps in Q3/2009, while yield

spread between Global Bond Indonesia and US T-Note

dropped from 396 bps to 251 bps. Spread EMBIG also

showed similar trend declining from 432 bps to 345

bps.

Financial asset yield in Rupiah denomination was

still relatively high. The difference of local and overseas

interest rates, known as Uncovered Interest Rate Parity

(UIP), was still high despite showing a descending trend

from 7.00% at the end of Q2/2009 to 6.45% in

Q3/2009. On the other hand, the yield spread between

SUN and US T-Note still recorded the highest rate in

Asian region. The same tendency was also reflected

from the relatively high SBI interest rate.

Chart 15

Indonesia’s Yield Global Bond and US T-Note

Up to the end of the reporting period, BI rate, the

policy rate, was sustained at the level of 6.5%, lower

than the preceding period (7%), but higher than the

Fed Fund rate (almost 0%).

Chart 16

BI Rate and Fed Fund Rate

In general, SUN market performance showed an

ongoing improvement during the reporting period,

albeit experiencing a decline in August 2009. The

consistent foreign investment inflows were able to

support high activities in SUN market. This development

generated an average decline to SUN yield of all types

of tenor by 54 bps thus reaching the lowest point in

2009 of 10.4% (at average).

Pertaining to this development, the amount of SUN

owned by foreign investors experienced an increase at

the end of the reporting period to USD9.6 billion from 0 2 4 6 8 10 12 14 16 18

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep

2008 2009

Yield Global Bond Indonesia Yield US T Note

% 0 1 2 3 4 5 6 7 8 9 10 Ja n Fe b Ma r Apr Ma y Ju n Ju l

Aug Sep Oc

t No v De c Ja n Fe b Ma r Apr Ma y Ju n Ju l

Aug Sep Oc

t No v De c Ja n Fe b Ma r Apr Ma y Ju n Ju l Aug Sep

2007 2008 2009

%

BI Rate

USD8.5 billion in Q2/2009. The same trend underwent

with SBI climbing from USD2.0 billion in Q2/2009 to

USD3.8 billion in Q3/2009.

Chart 17

SUN & SBI Owned by Foreign Investors

During the reporting period, for the first time the

government issued Samurai Bond in Japanese financial

market. The issuance volume was ¥35 billion (USD370

million) for 10 year’s tenor and 2.73% coupon (at par).

The issuance was implemented using private placement

method to Qualified Institutional Buyers, such as

insurance companies and banks in Japan.

The volume of Samurai Bond issuance was relatively

small despite the high interest showed by investors due

to several considerations, among others: (i) the objective

of this issuance was to expand SUN investor-based in

Japanese financial market, (ii) domestic market

condition was still conducive to absorp the targeted

SUN issuance in 2009 and in line with government’s

effort to concentrate on domestic financing, (iii) optimal

use of JBIC’s guarantee facility available until 2010.

Other Investment

Public sector’s other investment transaction

recorded a USD3.0 billion surplus in Q3/2009, in

contrast with the USD2.0 billion deficit posted in

Q2/2009. This surplus was due to the descending

foreign debt repayments and the increasing external

loan disbursement compared to the preceding period.

The government external debt repayment

decreased to USD1.0 billion from USD2.3 billion in

Q2/2009. The loan disbursement increased to USD1.3

billion compared to USD0.3 billion in the previous

quarter.

Chart 18

Disbursement and Repayment of Government Loan

The growing foreign loan disbursement was related

to both program loan and project loan. Program loan

disbursement rose to USD554 million from USD11

million in the preceding quarter. USD300 million of this

amount was obtained from France through the second

phase loan of Agence Française de Développement

(AFD). This long-term loan was part of Climate Change

Program Loan (CCPL) which was aimed at supporting

policy reformation in sectors related to climate change

issue, such as forestry, energy, agriculture and water.

In the reporting quarter, the government received

program loan amounting to USD254 million from the

World Bank (IBRD). This loan was a part of USD500

million World Bank commitments to be allocated for the

financing of the National Program for Community

Empowerment (PNPM Mandiri) 2009. 0 2 4 6 8 10 12 14 Ja n Fe b Mar Ap r Ma y Ju n Ju l Au g Se p Oc t No v De c Ja n Fe b Mar Ap r Ma y Ju n Ju l Au g Se p 2008 2009 Billion USD

SUN Foreign Ownership SBI Foreign Ownership

0 500 1000 1500 2000 2500 3000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008* 2009*

million USD

Chart 19

Program Loan Disbursement

Project loan disbursement increased to USD709

million compared to USD276 million in the preceding

period. Most of this project loan was obtained from

former CGI member countries reaching USD656 million,

higher than USD213 million in the preceding quarter.

The entire loans were under ODA scheme and mostly

were implemented in the form of bilateral loan

(USD462 million). The government also received loan

from countries outside former CGI members amounting

to USD54 million, lower than the loan disbursement in

the previous quarter (USD63 million).

Chart 20

Project Loan Disbursement

Chart 21

Government Foreign Loan Position

With this development, the outstanding

government external debt (excluding SUN and SBI

owned by foreign investors) rose to USD80.5 billion

from USD77.7 billion in the preceding period. With

reference to creditors, Japan/JBIC was still the biggest

donor for Indonesia (representing 36.2% of total

external debts). The Japanese outstanding loan grew

from USD27.1 billion to USD29.1 billion in Q3/2009

while the outstanding debts from the US (share

19.3%), ADB (share 13.2%) and IBRD (share 8.2%)

were relatively constant at respectively USD15.6 billion,

USD10.6 billion and USD6.6 billion.

Chart 22

Government Foreign Loan Position by Major Creditor Countries 0 200 400 600 800 1000 1200

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008* 2009*

million USD

ADB IBRD Japan (JBIC) Others

0 50 100 150 200 250 300 350 400 450 500

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008* 2009*

million USD

Bilateral-CGI Multilateral-CGI Non CGI

50000 55000 60000 65000 70000 75000 80000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008* 2009*

million USD 0 5000 10000 15000 20000 25000 30000 35000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2007 2008* 2009*

Million USD

By currency, the USD loans still dominated the

government external debts (46.6%) while the Yen and

Euro-denominated reached respectively 35.8% and

11.5% of share. The USD loan was USD37.5 billion,

relatively the same as the preceding quarter while Yen

and Euro-denominated loans rose to USD28.8 billion

and USD9.3 billion from respectively USD26.8 billion

and USD9.0 billion in Q2/2009.

Chart 23

Government Foreign Loan Position by Major Currencies

The government continued its effort to lessen the

dependency on foreign financing and improve the

structure of financial balance. One of the efforts was

debt swap on various projects in Indonesia. During the

reporting period, the government was negotiating with

creditor countries on forestry-related debt swap (known

as debt for nature). One of the examples was debt swap

from Germany amounting to €20 million. The

government has also negotiated with Australia on

conservation project amounting to AUD75 million. The

same effort had also been implemented with the Italian

government.

2.2.Private Sector

The deficit on private sector financial account rose

in Q3/2009 to USD2.6 billion from USD2.0 billion in

Q2/2009. The highest deficit underwent on other

credit on assets side and domestic bank and non-bank

placements in overseas banks. The increase on asset