A

b

s

tr

a

c

t

vol. 3, No. 3, June, 2015, 21-30 ISSN: 2311-326x

Accounting Conservatism and Accounting Information Quality

Farrokh Barzideh

1,

MohammadAli Izadpanah

2, Soroush Lotfi

3his study aimed to examine the relationship between accounting

conservatism and accounting information quality in 120 firms

listed on Tehran Stock Exchange (TSE) during a 6-year period from

2008 to 2013. Using correlation method and multiple linear regression

technique, the results of this study showed that there is a positive

relationship between accounting conservatism and accounting

information quality. Also, research evidences showed that when the

firm size increases, accounting information quality increases too. Also,

the results of this study showed that when the firm’s auditor is from the

private sector, then accounting information quality is high compared to

other firms. There is also a negative relationship between financial

leverage with accounting information quality. The results of this study

emphasized that profitability and loss reporting have not any

relationship with accounting information quality.

Key Words: accounting conservatism, accounting information quality, private

corporate audi

1 professor, Faculty member of Allameh Tabatabai University, C.P.A, Tehran, Iran 2 MSc in Accounting, International Pardis University of Guilan, [email protected]

3 Corresponding author: MSc in Accounting, Allameh Tabatabai University, [email protected]

Introduction

Qualitative characteristics of accounting information have an undeniable role in promoting the quality of financial statements information. One of the qualitative characteristics of accounting information is accounting conservatism. According to the theoretical foundations of International Financial Reporting Standards (IFRS), accounting conservatism is one of the characteristics that promotes the reliability of accounting information (Corporate Audit, 2011). Therefore, it is claimed that accounting conservatism has a vital role in providing useful information for decision-making as well as evaluating managerial stewardship behavior. But, with compiling a common conceptual framework of Financial Accounting Standards Board (FASB), accounting conservatism has been eliminated from qualitative characteristics of accounting (AFAS 8, 2010). Watts (2003) considers accounting conservatism as an important characteristic for promoting the accounting information quality. According to him, non-conservative accounting standards allow managers to predict commercial units of accounting figures (e.g. profits) for their own advantage in order to get more rewards. He believes that managers sacrifice the quality of financial statements information for their personal interests. However, accounting conservatism delays profit identification until its realization and this promotes the quality of financial statements (Watts, 2003). On the other hand, Chen et al. (2007) state that accounting conservatism compared to the non-conservative standards and procedures of accounting has more negative impacts on the accounting information quality (Cheng et al., 2007). Therefore, the main research question of this study is that to what extend accounting conservatism affects the quality of financial statements. The increase of non-conservative standards by FASB as well as the lack of adequate research in this context, have motivated the researchers to investigate the effect of accounting conservatism on the quality of financial statements.

The main purpose of this study is to investigate the relationship between the quality of financial statements and accounting conservatism. The second purpose is to inform analysts, users of accounting information, accounting standards developers, society of CPAs and the stock exchange of the determinants of the financial statements quality. It is expected that the results of this study can bring the following achievements and scientific added value.

First of all, it is expected that the results of this study expand the theoretical foundations of studies in the context of accounting conservatism. Second, the results will show that whether accounting conservatism and the quality of financial statements are two different subjects in analyzing the information of financial statements of firms listed on the stock exchange. This, as a scientific achievement, can provide useful information for financial analysts and users of the financial statements as well as students and professors of accounting. Third, the results of this study can propose new ideas for new investigations in the field of accounting conservatism and the accounting information quality.

Theoretical Framework and Review of Literature

Definition of conservatism

has been required by accounting standards. This means immediate recognition of loss if there are bad news and lack of recognition in situations where there are good news. For example, the use of least cost or net sales in evaluating the inventory is considered as a type of conventional conservatism. This type of conservatism is also called profit and loss conservatism or retrospective conservatism. On the other hand, unconditional conservatism has not been required by adopted accounting standards. This type of conservatism is also known as balance sheet conservatism or prospective conservatism (Banimahd & Baghbani, 2009).

Conventional Interpretation of Accounting Conservatism

Some researchers have filed different interpretations for conservative reporting. All of them have proposed that conservatism has some advantages for the users of financial statements. Until the moment that accounting indexes and standards are used for reporting the performance of management, the problems arising from the opportunistic behavior of managers would be always in financial reporting. In order to increase personal profits, managers would act self-centered in using accounting standards that are the basis of information for investors and share accounting information according to their personal interests. If the limitations that limit this selfish behavior are not available, then accounting information in financial reports would be biased. But, conservatism by requiring the ability to demonstrate and confirm the self, can limit opportunistic and biased behavior of managers. In practice, conservatism neutralizes the biased behavior of managers and delays profit recognition; as a result, net assets and profits are shown lower. In the contracts, aforementioned effects increase the value of the firm; since, conservatism limits opportunistic payments of managers to themselves and other groups such as shareholders. The increased value of the firm divides among all contracting groups and their welfare increases. In this sense, conservatism is an effective contractual mechanism (Watts, 2003).

Review of Literature

Dimitropoulis et al. (2013) examined the effect of using international standards of financial reporting on the accounting information quality in firms listed on the Athens Stock Exchange. They indicated that using these accounting standards increases the accounting information quality in terms of early recognition of loss, reduction of earnings management and increase in information content of accounting figures (Dimitropoulos et al., 2013). Tan (2013) showed that whenever financial reports are used by lenders or lenders give loans to bankrupted firms and appoint people to firm restructuring after bankruptcy, then, accounting conservatism increases. The results of his study state that whenever

firm’s financing is through debt, then, the demand for conservative financial reporting increases (Tan,

2013). Lin et al. (2012) studied the accounting information quality among German firms both before and after implementation of international financial reporting standards. They found that after implementation of the above mentioned standards, the accounting information quality has been increased in terms of early recognition of loss, earnings management reduction and relevant information compared to past (Lin et al., 2012).

Hamdan (2012) conducted several studies in Bahrain and showed that large firms have more accounting conservatism than smaller firms. He found that there is no significant relationship between accounting conservatism and the quality of profit among Bahraini firms. Also, those firms which have more debt, have more conservatism compared to others (Hamdan et al., 2012). Ruch and Taylor (2011) examined the conducted studies in the field of accounting conservatism and encountered different data about the benefits of accounting conservatism for promoting the quality of financial statements. Among them, we can refer to this point that accounting conservatism leads to the management of profit and this is achieved through creating accounting reserves such as saving doubtful receivables. On the other hand, they concluded that conservatism leads to the reduction of information asymmetry and improving the transparency of financial statements information. According to the results of their study, accounting conservatism can be used as an efficient conventional mechanism in order to prevent conflicts of interest between managers and shareholders as well as shareholders and creditors (Ruch & Taylor, 2011). Kravet (2012) showed that accounting

conservatism decreases managers’ incentive for risky investments. He found that those managers who

examined accounting disclosure, accounting quality and conditional/unconditional conservatism. His findings indicate that those firms which have higher disclosure quality, have higher profitability and liquidity as well. Those firms which had change in management or have been supervised by one of the four biggest accounting institutes, tend to have a higher disclosure quality. Higher disclosure quality leads to less profit management. Also, these firms show higher conventional conservatism and lower unconditional conservatism. His findings indicate that conditional conservatism has a negative relationship with unconditional conservatism, in a way that conditional conservatism tends to increase efficiency while unconditional conservatism may facilitate opportunistic behavior of managers. Studies by Iatridis also provide some evidence about asymmetry disclosure of loss in firms with high financial leverage (Iatridis, 2011). Lee (2010) examined the role of accounting conservatism in firms’ financial decisions. He indicated that firms with higher accounting conservatism, show less flexibility in leverage management and decisions related to issuance shares. Generally, the results of his study indicate that although firms benefit from the reduction of related costs through using conservative financial reporting, their flexibility decreases relating to access to capital and this is effective in financial decisions (Lee, 2010). Chi et al. (2009) examined the relationship between conservatism and governance. The results of their study indicate that firms with weak governance tend to be more conservative. These results are consistent with the view that conservatism can be used as an effective mechanism in governance (Chi et al., 2009).

Chi and Wang (2008) examined the effect of accounting conservatism on information asymmetry among minority and majority shareholders. They concluded that conservatism leads to the reduction of information asymmetry and if conservatism is removed from the qualitative characteristics of accounting information, shareholders should closely monitor the information asymmetry (Chi & Wang, 2008). LaFond and Watts (2007) examined the informative role of conservatism. They argued that information asymmetry between factors within the firm and investors from outside the firm lead to conservatism in financial statements. Their experimental tests are based on this idea that conservatism, decreases incentives and capabilities of managers in manipulating accounting figures; therefore, it can decrease information asymmetry. Their findings are inconsistent with IFRS, based on this view that conservatism leads to information asymmetry. They believe that if conservatism is removed from the qualitative characteristics of accounting information, information asymmetry increases that this is in contradiction with the rules of the stock exchange.

Mashayekhi et al. (2009) in order to measure conservatism, first of all, implemented (symmetrical) non-operational accruals; then, implemented adjusted ratio of market net assets to their book value and concluded that with any increase in conservatism, less dividend is distributed. Therefore, conservatism leads to effectiveness of contracts between interest groups in the business units. Also, using adjusted ratio standard of net market value of net assets to book value to measure conservatism, they found that the sustainability of profits decreases by increasing conservatism. Khajavi and Kermani (2010)

examined the effect of conservatism on the stability of firms’ profit listed on the TSE. According to

the results of their study, firms with less conservatism would have more stable profits. It means that there is a negative relationship between conservatism and the stability of profits. Lotfi and Hajipour

(2010) in a study entitled “the impact of conservatism on management error in anticipation of profit”

found that there is a negative relationship between firms’ conservatism and their profit anticipation

profit that indicate high conservatism. Firms which resort to increasing profit management through positive accruals, implement less conservatism in their reporting. Capital structure affects the size of conservatism. Those firms which used more equity, have implemented more conservatism in measuring profit. Mehrabani et al. (2011) studied the relationship between conservatism and unexpected accruals in TSE as the main research question. Since the breakdown of accruals to unexpected accruals and expected accruals can affect the results of study, they used two models of adjusted Jones and adjusted Jones with non-linear flows. Their findings show that unexpected accruals resulted from adjusted Jones model have positive and significant relationship with conservatism. On the other hand, they did not find any positive and significant relationship between the effects of unexpected accruals resulted from adjusted Jones model and non-linear flows on conservatism.

Karami et al. (2010) examined the relationship between firm’s governance mechanism and

conservatism. According to the results of this study, they concluded that there is a positive relationship between the ownership percent of board members and institutional investment with conservatism. Also, they argued that there was a negative relationship between the ratio of outside members of the board and conservatism.

Moradzadehfar et al. (2011) examined the relationship between conservatism and firm’s governance.

According to the results of this study, they found that there is a positive relationship between the institutional ownership percentage of shares and members outside the board. Also, there is a negative relationship between role separation of Chairman of the board from managing director and conservatism. The general conclusion of their study approves the complementary view about the

relationship between conservatism and firm’s governance mechanisms. Khodamipour and TorkZade

Mahani (2010) indicated that those firms which their CFO is larger than their taxable income, have more conservatism compared to other firms, but in the case of firms that their CFO is smaller than their taxable income, it is not possible to argue that they have less conservatism compared to other firms. Moreover, the findings of this study indicate that taxes not only does not decrease the relevance of accounting information firms provide, but increase the relevancy of information. According to a study by Asadi and Jalalian (2012), the relationships between ownership concentrations, the percentage of institutional investors, financial leverage and firm size with conservatism are different. These relationships are with respect to conservatism analysis model. According to the model by Bior and Ryan as well as Givoly and Hayn, there is a significant and direct relationship between conservatism and leverage as a representative of capital structure. On the other hand, no significant

relationship was found between conservatism and ownership concentrations. In Bior and Ryan’s

model, there was no significant relationship between institutional investors and conservatism, but in

Givoly and Hayn’s model, a significant and inverse relationship was found. Ebrahimi, Kordlor and

Shahriari (2009) examined the relationship between political costs and conservatism. According to the results of this study, they concluded that there is a negative relationship between the firm size and investment intensity with conservatism. Also, a positive relationship was found between the degree of competition in industry and state ownership with conservatism. Rezazadeh and Azad (2008) in a study

entitled “the relationship between symmetry and conservatism” found that change in information

asymmetry among investors leads to change in conservatism. Following the increase in information asymmetry among investors, the demand for implementation of conservatism increases. Kordestani and Khalili (2011) indicated that differential information content of cash flows and accruals are less in firms with higher conservatism which is compared to firms with lower conservatism. Also, there is a

positive consistency between differential information content and accruals with firms’ conservatism.

Sample population and methodology

The sample population of this study consists of firms listed on TSE. This sample consists of firms that benefit from the following conditions:

1. Firms that have been listed prior to 2007.

2. Due to consistency, reporting data and removing seasonal effects of the financial period should be until March 20.

3. Due to the specific activities of investment and financial firms, the intended firm should not be among these firms.

According to the above mentioned conditions, only 120 firms (including 720 observations) had these conditions during 2007-2012. Therefore, these firms were considered as the sample population of this study.

The theoretical foundations are extracted from books, articles and theses. The data are collected from the financial statements of firms that are listed on TSE. Due to this fact that this study uses the sources and financial statements of firms listed on TSE, it is considered as library research that the observed financial statements and intended information are obtained. Also, in terms of research questions and data collection, it is considered as a correlational descriptive study that the relationship between variables is examined and the data are quantitative.

Variables

Independent variable

The independent variable in this study is accruals quality index. According to Francis et al. (2005), this index is as follows:

TCAj,t=α0+α1CFOj,t-1+α2CFOj,t+α3CFOj,t+1+α4∆REVj,t+α5PPEj,+ε TCA: total capital accruals in circulation

CFO: cash flow from operating activities that is obtained from cash flow statements

∆REV: changes in sales revenue PPE: properties, plant and equipment

ε: the remainder of regression

All variables have been divided by average total assets. The theoretical justifications of the above model are based on this fact that accruals must explain CFO of previous, present and next periods. The

residual values (εi) from regression accruals represent profit management or profit quality. The lower

the SD of (εi) is, the higher the quality of accruals of accounting quality and vice versa. Therefore, the

SD is multiplied by -1. Accordingly, the SD of the (εi) has been considered as the independent variable in this study during last four years (Francis et al., 2005).

Dependent variables

Accounting conservatism: in order to measure accounting conservatism index in this study, the model by Givoly and Hayn (2000) was used. Based on this model, the conservatism index is calculated as follows:

Accounting conservatism = [operational accruals/total assets in the first period]*(-1)

The operational accruals are obtained from the difference between net income and CFO plus amortization expense. According to Givoly and Hayn (2000), accruals growth can be an index of change in accounting conservatism during a long-term period. In other words, if accruals increase, then conservatism decreases and vice versa. Therefore, in order to determine the change direction of conservatism, accruals are multiplies by -1.

In this study, after calculating the conservatism index, the average of this index during last four years has been used. The reason for selecting the above model for measuring accounting conservatism is as follows:

a) The available models for measuring conservatism such as Basu model that has been used widely, have high degree of errors. For example, Basu model assumes that whenever the stock returns are negative, the reason relates to accounting conservatism, while in Iran capital market, negative stock returns are due to non-accounting information.

b) The information used in this study is based on accounting information and market indexes are not used in it. Due to the availability and access to financial statements, in order to measure conservatism in financial statements, this model is more appropriate compared to other models in developing markets (Banimohammad & Baghbani, 2009).

Firm size: consists of the natural logarithm of each firm’s total assets in each year.

Return on assets: consists of the ratio of total debt to total assets of each firm in each year.

Loss report: is an artificial variable that is shown by 1 and 0. If a firm reports loss in a year, then its value is 1; otherwise, it is 0.

The type of auditor: an artificial variable is shown by 1 and 0. If the auditor of a firm is Corporate Audit, then its value is 1; otherwise, it is 0.

Research Hypothesis

The research hypothesis of this study is as follows:

H1: There is a significant relationship between accounting conservatism and the quality of financial

statements information.

Results:

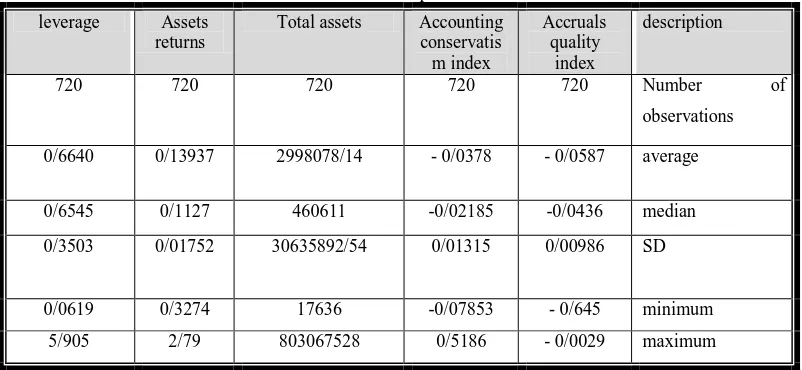

Descriptive data

The descriptive data of this study are mentioned in Table (1). In this table, the average of quantitative variables is shown:

The nearness of median and mean values indicates the normality of variables. Also, 41 observations were related to losing firms and 186 observations had state auditor (Corporate Audit).

Table 2: the number of firms in terms of profit and loss report

Report type

Table 3: the number of firms in terms of audit

auditor

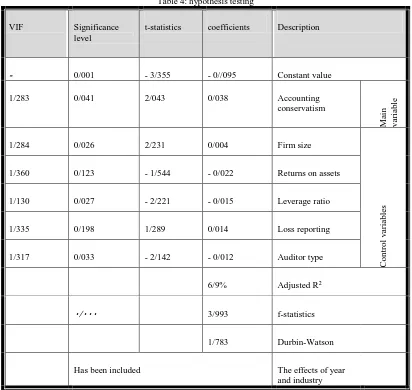

have a negative relationship with the quality of accruals. Whenever the debt ratio increases, the quality of accruals decreases. Also, whenever the auditor is the Corporate Audit, then the quality of accruals decreases. Other independent variables such as loss reports and profitability do not have any significant relationship with the accounting information quality. Also, adjusted regression coefficient of determination (R2) that shows a ratio of explained variance to the total variance, equals to 6/9% which is according to Table (3). This states that 6/9% of dependent variable changes are according to the changes of dependent and control variables and the rest is due to the factors that have not been examined in this research. The Durbin-Watson statistics equals to 1/783. These statistics show that there is not any consistency among residual values of regression. Also, since the value of variance inflation factor (VIF) is less than 5, there is not any intense consistency among independent variables.

Table 4: hypothesis testing

The results of this study indicate that accounting conservatism has a direct relationship with the quality of financial statements information. In other words, with any increase in accounting conservatism, the quality of accruals increases too. This is consistent with the results of studies by Watts (2003), Chi and Wang (2008) and Ruch and Taylor (2011). They claim that accounting conservatism, as qualitative characteristics of information, can increase the accounting information quality. Among the control variables, the firm size has a direct relationship with the quality of

the audit profession and its competitiveness can enhance the accounting information quality. Also, the results indicate that there is not any relationship between assets returns and loss report with the quality of accruals.

Recommendations

In hypothesis testing, it was shown that there is a significant and direct relationship between accounting conservatism and the quality of accruals. Therefore, it is recommended to developers of accounting standards and society of certified public accountants to pay more attention to the procedures of accounting conservatism and as far as accounting conservation will not distort the accounting figures, develop the standards of conservative accounting and implement them in a cautious way. Also, the following recommendations are presented for conducting future studies:

a. Determining the efficient level of accounting conservatism in financial statements in order to access to beneficial information

b. Comparative comparison of the effect of conditional and unconditional conservatism on the quality of financial statements

c. Identifying factors affecting the accounting information quality, except the quality of accruals from the theoretical perspective

d. Classification of private institutes and the quality

References

Asadi, Gh. and Jalalian, R. 2012. Examining the effect of capital structure, stockholders and firm size on conservatism; journal of accounting and auditing. 19 (67).

Banimahd, B., Baghbani, T. (2009). The effect of accounting conservatism, state ownership, firm size and leverage ratio on firm loses. Accounting and auditing; 58: 53-70.

Chen, Q., T. Hemmer, and Y. Zhang. 2007. on the relation between conservatism in accounting standards and incentives for earnings management. Journal of Accounting Research 45 (3) (Jun): 541.

Chi, W. Liu, CH.and T, Wang. 2009. What affects accounting conservatism: A corporate governance perspective? Journal of Contemporary Accounting & Economics.5 (1):47.

Chi, W. and Wang, C.2008. Accounting conservatism in a setting of Information Asymmetry between majority and minority shareholders. The international journal of accounting.45 (4):455

Dimitropoulos P. E., Asteriou D., Kousenidis, D., and Leventis S., (2013) the impact of IFRS on accounting quality: Evidence from Greece, Advances in Accounting, incorporating Advances in International Accounting 29 PP. 108–123

Ebrahimi, A., Shahriari, A. (2009). Examining the relationship between political expenses and conservatism in Tehran stock exchange, Journal of Accounting and Auditing, 16 (4).

Etemadi, H., Dehkordi, H. (2012). The effect of profit management and capital structure on profit conservatism. Accounting and auditing researches; 13.

Financial Accounting Standards Board (FASB). 2010. Statement of Financial Accounting Concepts No. 8, Conceptual framework for financial reporting, Norwalk, CT.

Francis, J., R. LaFond, P. Olsson, and K. Schipper. 2005. The market pricing of accruals quality. Journal of Accounting and Economics, 39(2) (June):295

Givoly, D., and C. Hayn. 2000. The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative? Journal of Accounting & Economics 29 (3) (Jun): 287. Hamdan Allam d (2012) The Accounting Conservatism and Earnings Quality in Bahrain Stock Exchange,

Journal of gulf and Arabic Peninsula Studies, Volume: 38 Issue: 144

Iatridis .2011. Accounting disclosures, accounting quality and conditional and Unconditional conservatism. International Review of Financial Analysis. 20(2) (Apr):88

Karami, Gh., Hoseini, Ali., Hasani, A. (2010). Examining the relationship between firm’s strategic system and conservatism in companies listed on Tehran stock exchange. Journal of accounting studies. 2 (7). Khodamipour, A., Torkzadeh, M. (2010) ownership and conservatism in financial reporting and relevance of

accounting information. Financial accounting journal. 3 (3).

Khajavi, Sh., Valipour, H., Askari, S. (2010). Examining the effect of conservatism on profit stability of firms listed on Tehran stock exchange. Journal of accounting and auditing, 8.

Khosniat, M., Yoosefi, F. (2007). The relationship between information symmetry and asymmetry and conservatism, accounting investigations. 20.

Kordestani, GH, Haddadi, M. (2009). The relationship between conservatism in accounting and capital cost. Financial and accounting journal; 3 (1).

Kravet, T. 2012. Accounting Conservatism and Managerial Risk-Taking: Corporate Acquisitions. Working Paper, University of Texas at Dallas

LaFond, R., and R. Watts. 2008. The information role of conservatism. The Accounting Review 83 (2) (Mar): 447.

Lee, J. 2010. The Role of Accounting Conservatism in Firms’ Financial Decisions. Working Paper,

Northwestern University

Lin, S., Riccardi, W., Wang C., (2012) Does accounting quality change following a switch from U.S.GAAP to IFRS? Evidence from Germany, journal of Accounting and Public Policy 31 PP. 641–657

Lotfi, A., Hajipour, M. (2010). The effect of conservatism on management error in profit prediction. Journal of management accounting. 3(4).

Mashayekhi, B., Mohammadabadi, M. (2009) the effect of accounting conservatism on stability and distribution of profit. Journal of examining accounting and auditing. 56.

Mehrani, K., Hallaj, M., Ebrahimi, A. (2011). The relationship between unexpected accruals and conservatism in accounting in Tehran stock exchange. 63.

Moradzadehfar, M., Banimahd, B., Dindar Yazdi, M. (2011). Examining the relationship between conservatism

and firms’ strategic system in Tehran stock exchange. Journal of management accounting. 4 (8). Rezazadeh, J., Azad, A. (2008). The relationship between accounting symmetry and conservatism in financial

reporting. Accounting and auditing. 54.

Ruch, G. and G, Taylor.2011. Accounting Conservatism and its Effects on Financial Reporting Quality: A Review of the Literature.SSRN

Tan L., (2013) Creditor control rights, state of nature verification, and financial reporting conservatism, Journal of Accounting and Economics 55 PP. 1–22

Tan L., (2013) Creditor control rights, state of nature verification, and financial reporting conservatism, Journal of Accounting and Economics 55 PP. 1–22

Technical committee of corporate audit. (2011) accounting standards. Publication 160.