Sail to the Port

to Tie-up in the Land

of Hope

ECONOMIC OUTLOOK AND BANK

INDONESIA’S POLICY DIRECTION

CHAPTER

Economic Outlook and Bank

Indonesia’s Policy Direcion

Amid severe pressures stemming from the global economic crisis, a number of posiive achievements in Indonesian economy during 2009 boosted opimism over the sustainability of an ongoing economic recovery. The posiive economic performances include the recovery of inancial system stability, the strengthening of rupiah, the low inlaion pressure, and the fairly high economic growth. Opimism on an improvement in economic prospects was strengthened further by a more conducive global economic outlook.

With a solid foundaion built on the strength of robust economic performance of the previous year and in line with improving global economic projecions, as well as support from an array of policies that will be taken to address various challenges in the economy, the Indonesian

economic prospect is expected to be beter. Strong macroeconomic performance is also supported by preserving price and inancial system stability, which represent the main foundaions of overall economic resilience. In 2010, the economy will regain its momentum with GDP growth forecasted in the range of 5.5% - 6.0% (yoy). Despite expansive economic growth, inlaionary pressure is expected to remain under control within the 2010 inlaion target range of 5% ± 1% (yoy). Meanwhile, the global economic recovery will bring posiive impact on the balance of payments in 2010. The current account will again run a surplus, primarily driven by strong export performance for goods and services. The capital and inancial account will also record a surplus, accompanied by improvement in the structure of capital inlows. The foreign direct investment will surge in line with greater opimism regarding future economic prospects. The short-term inlows will also persist, however, on a more limited scale compared to previous periods. Against this propiious backdrop, the overall balance of payments in 2010 is projected to record a surplus of USD12.5 billion, with foreign exchange reserves at the end of 2010 expected to reach USD78.5 billion; equivalent to 6.4 months of imports and foreign debt repayments. In accordance

with the posiive forecast for the balance of

payments, the exchange rate in 2010 is expected to remain stable with a tendency to appreciate slightly compared to 2009.

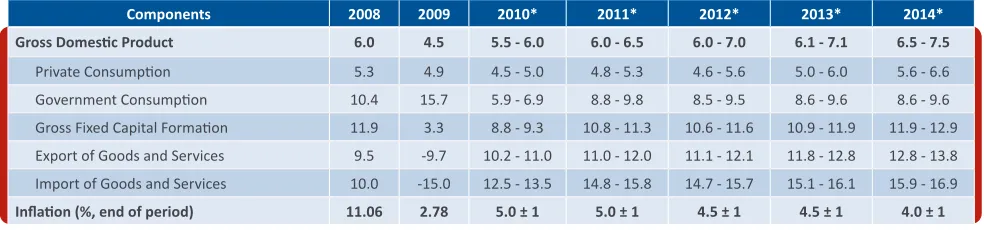

Looking ahead over a longer horizon, economic projecions will improve in line with the increase in capital accumulaion as well as improvements in producivity and eiciency. Increased capital accumulaion will simultaneously boost economic capacity and generates income. Meanwhile, increased economic producivity, relected by TFP, will ulimately catalyze higher economic growth in the long run. Support from the sources of economic growth will enable eforts to expedite economic growth, followed by managed inlaionary pressures and preserved inancial system stability. Under these circumstances, economic growth is projected to expand in the range of 6.5% - 7.5% (yoy) by 2014, bolstered by an inlaion rate maintained within the medium-term inlaion target corridor of 4% + 1% (yoy).

and the inadequate quality of human resources, have received special government atenion as set out in the Medium-Term Development Plan (RPJMN) 2010-2014. In the short term, various policy measures are expected to overcome the botlenecking that had undermined investment acivity. In the longer term, various breakthroughs in the real sector are expected to increase economic compeiiveness as a whole, paricularly by amelioraing human

6.1

Economic Prospects

g

Assumpions

Indonesian economic projecions are based upon a number of assumpions, both externally and domesically. Externally, assumpions relate to forecasts of several global economic variables that afect Indonesia, for example global trade volume as well as oil/gas and non-oil/gas prices. Domesically, assumpions relate to the iscal deicit as well as various policies adopted in terms of amelioraing the investment climate.

Global Economic Assumpions

Global Economic Growth and Trade Volume

Signs of a global economic recovery began to appear upon entering the second half of 2009. The downturn in global economic growth as a result of the crisis ended in the irst quarter of 2009 and, subsequently the global economy is projected to grow posiively in 2010. These projecions are supported by a variety of factors, including a recovery in the global inancial sector coupled with macroeconomic policy that is expected to remain accommodaive unil the recovery process is suiciently stable.

Against this backdrop, growth in developed countries, namely the US, Europe and Japan in 2010, is projected to reach about 2.7%, 1.0% and 1.7%112 respecively. In the meanime, countries in Asia are expected to be the main engine of the global economic recovery led

by China and India. In 2010, China’s economic growth is projected to achieve 10.0% and India 7.7%. The rapid pace of economic recovery in China and India is expected to simulate imports to these countries, and simultaneously will increase exports from other Asian countries. This improvement in external performance will be accompanied by a recovery in consumpion that could potenially accelerate the Asian economic recovery further, outpacing that of other regions.

In the medium term, economic growth in developed countries is expected to return to levels before the global crisis. The US economy is esimated to grow toward the range of 2.1%, while European countries is expected to grow by 2.1% in 2014, approaching levels in 2007113.

Meanwhile, developing countries especially China and India, that have so far been able to maintain solid economic growth, are projected to grow at 9.5% and 8.1% respecively in 2014.

Looking at the posiive correlaion between global economic growth and trade volume, as relected by the historical data, Bank Indonesia predicts that the volume of global trade will expand by about 8.0% (yoy) in 2010. Subsequently, the world trade volume will coninue to increase gradually to around 9.2% in 2014 (Chart 6.1).

Global Commodity Prices

In accordance with the global economic recovery, the downward trend in commodity prices is expected to cease in 2010. The price of Minas crude oil in 2010 is expected to coninue to rise and reach a level of around USD80

113 World Economic Outlook, IMF, October 2009

per barrel. This concurs with IMF114 projecions that the average global oil price in 2010 will increase by 22.6% to a level of USD76.0 per barrel. In addiion to a surge in demand, the dynamic of the global oil price is oten inluenced by speculaive acivity on the global commodity market.

Looking ahead, the oil price is expected to follow an upward trend in line with stronger global economic growth. However, the anicipated increase in oil supply capacity in the following periods is expected to rein in any exorbitant hikes in the global oil price. The Energy Informaion Administraion (EIA) esimates the global oil price using three scenarios over a longer horizon (2009 to 2030), namely high prices, the reference price (baseline) and low prices115. A high oil price trajectory relects a global oil market beset with various constraints, including poliical issues, producion quotas and naionalizaion issues, that drive the price towards USD132.8 per barrel in 2014. A low oil price trajectory, that is in the range of USD52.7 per barrel, describing a global oil market supported by addiional producion of non-OPEC oil and greater private paricipaion in developing oil resources. Notwithstanding, the baseline global oil price in 2014 is projected to reach USD90.9 per barrel (Chart 6.2). Based on these informaions, Bank Indonesia predicts that the oil price will increase to nearly USD100 per barrel by 2014.

Meanwhile, non-oil commodity prices in 2010 are also esimated to rise in line with stronger global demand and higher oil prices. The industrial sector expansion in the majority of all countries will boost demand for

114 World Economic Outlook Update, IMF, January 2010 115 Annual Energy Outlook, December 2009, EIA

Chart 6.1 World GDP Growth and Trade Volume Chart 6.2 World Oil Price Forecast

Source: Annual Energy Outlook, December 2009, EIA USD/barrel

Reference Price Highest Price Lowest Price

90.9

132.8

52.7

Source: WEO update January 2010, WEO October 2009, Bank Indonesia Projecion

percent percent

commodiies, paricularly raw materials such as coal, crude palm oil (CPO), nickel and other minerals, which in turn will drive up commodity prices. In addiion to raw materials, food commodity prices are also esimated to rise. However, future inlaionary pressures on food commodity prices is expected to be moderate considering that the elasicity of demand of such produce is relaively insensiive to the business cycle, as well as the forecast of good global crop in the short-term. However, medium-term inlaionary pressures on food commodity prices will remain due to the possibility of adverse weather condiions that could undermine global food stock amid rising global demand. Based on such condiions, Bank Indonesia predicts non-oil commodity prices to re-enter an increasing phase in 2010 by rising about 13% (yoy). Non-oil price pressures are expected to ease slightly and tend to be more stable in the long run.

Global Inlaion

The expected recovery in global demand, which in turn simulate the increase in prices of various commodiies, will ulimately trigger global inlaionary pressures. In 2010, inlaion in developed countries are forecast to reach 1.3% (yoy), from around 0% in 2009116. Despite the support of lower wage trends in developed countries, soaring commodity prices, especially oil, will push up the rate of inlaion. In developing countries, inlaion is projected to reach about 6.2% (yoy) in 2010 from 5.2% in 2009. The surge of inlaion in developing countries is primarily triggered by limited economic capacity and a surge in capital inlows. In the medium term, inlaion in developed countries is esimated to gradually return to the range recorded prior to the global crisis. In the US, inlaionary pressures are expected to steadily reach around 2.0% in 2014. Meanwhile, inlaion is projected to decline in developing countries to roughly 4.0% by 2014117.

The expected global inlaionary pressures encourages central banks in various countries to begin considering a ighter monetary policy stance in the following periods. However, high uncertainty coninues to prevail and the economic recovery process is not yet well sustained provide a challenge for policymakers around the world118. In the short term, the priority for policymakers will sill aimed at maintaining the inancial system stability while

116 World Economic Outlook Update, IMF, January 2010

117 World Economic Outlook, IMF, October 2009

118 More details are available in Chapter 2 - Global Economic Recovery and Future Challenges

remain accommodaive to support economic recovery process. In this context, the global interest rate in the short term is esimated to remain low. A ighter monetary policy stance is expected to emerge in the middle of 2010 in line with projecions of a more stable economic recovery in many countries.

Global Foreign Direct Investment (FDI)

In line with the global economic recovery, survey results indicate that short-term global FDI lows are sill experiencing the negaive impacts of the crisis119. However, global FDI lows will gradually recover and grow posiively in 2011 in accordance with improvements in the domesic economy, which is the target of global FDI, and the increasing in global investor interest to reinvest capital in a number of countries.

For Indonesia, an increasingly conducive domesic investment climate and infrastructural improvements will atract global FDI. This is conirmed by survey results in which Indonesia is ranked of 9th out of the 15 most desirable regions for foreign investors to invest their capital (Chart 6.3).120 Indonesia’s appeal includes growth and size of market, access to natural resources and inexpensive labor costs (Chart 6.4).

Global FDI inlows as an alternaive form of investment inancing will enhance capital accumulaion. Furthermore, global FDI is also expected to pave the way for technology and innovaion that will, in turn, increase economic producivity and eiciency.

119 World Investment Prospects 2009 – 2011, UNCTAD. 120 Ibid

Chart 6.3 The Most Atracive Economies

for The Locaion of FDI 2009-2011

Domesic Economic Assumpions

Fiscal Policy

In line with expectaions of an economic recovery in 2010, the State Budget (APBN) 2010 will support eforts to boost the naional economic recovery while maintaining the sustainability of improvement programs and protecing public welfare. Expectaions of an economic recovery are relected in the assumpion used for the 2010 State Budget. The Government assumes that the economy will grow by 5.5%, surpassing that in 2009 at 4.5%. Furthermore, inlaion in 2010 is assumed at a level of 5% and the average interest rate of 3-month SBI is 6.5%. Externally, the global crude oil price is projected to reach USD65 per barrel.

The assumpion of stronger economic expansion in 2010 will improve the structure of the Budget compared to condiions in 2009. The improved Budget will enable the Government to provide a variety of simulus to the economy, both in terms of revenues and spending. The Government will coninue several iscal incenives introduced during 2009 to catalyze industrial and business revitalizaion. The iscal incenives will be provided in the form of corporate income tax reducions, the provision of a corporate income tax facility for unlisted companies and government-borne tax (DTP) policy.

Regarding spending, the Government will roll out a variety of programs designed to simulate economic acivity. The programs include the coninuaion of welfare programs such as the Naional Community Empowerment Program (PNPM), School Operaional Assistance, Public Health Insurance, Rice for the Poor Household (Raskin) and

the Family Hope Program. In addiion, the Government will also coninue the infrastructures development and bureaucracy reforms, increase the military budget, maintain educaion spending at a minimum of 20% of Naional spending, as well as maintaining the real income of civil servants and pensions. Real income is maintained through a 5% increase in the basic salaries and pensions of civil servants as well as the provision of a 13th-month salary.

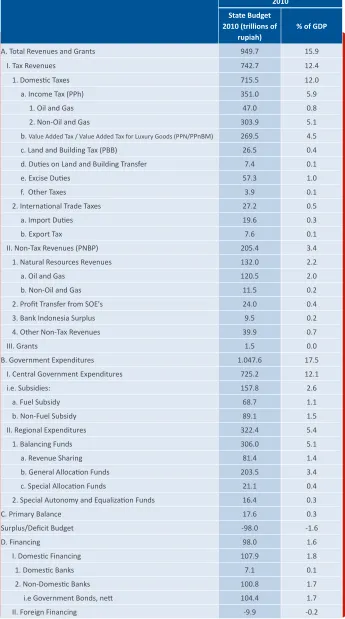

With the macroeconomic assumpions set up above as well as the various programs planned on the revenue and spending sites, the iscal deicit for 2010 is esimated to be around Rp98 trillion, or 1.6% of GDP (Table 6.1). The deicit will be funded by debt and non-debt inancing. Debt inancing includes the issuance of net SBN, loans to domesic banks, and net repayments on foreign loans. Meanwhile, the non-debt inancing is primarily sourced from the use of government deposits held at Bank Indonesia.

In the medium term, the iscal deicit will decline gradually to 1.2% of GDP by 2014 (Chart 6.5). This is based on a number of external assumpions such moderate global economic growth, relaively stable crude oil prices in the range of USD70-85 per barrel, rising inlaion and interest rates in US, and relaively stable inlaion in trading partner countries.121 In addiion, domesic economic condiions are also assumed to be conducive supported by ongoing iscal consolidaion under a framework of maintaining iscal sustainability, raising absorpion of

121Based on the Medium-Term Naional Budget Framework published in the Financial Notes and Naional Budget 2010

Chart 6.4 Factor favouring Investment Chart 6.5 Realizaion and Forecasts of Fiscal Deicit

Source: UNCTAD (processed)

Source: Financial Note and State Budget 2010, Ministry of Finance percent

Table 6.1 State Budget 2010

Source : State Budget 2010, Ministry of Finance

2010 State Budget 2010 (trillions of

rupiah)

% of GDP

A. Total Revenues and Grants 949.7 15.9

I. Tax Revenues 742.7 12.4

1. Domesic Taxes 715.5 12.0

a. Income Tax (PPh) 351.0 5.9

1. Oil and Gas 47.0 0.8

2. Non-Oil and Gas 303.9 5.1

b. Value Added Tax / Value Added Tax for Luxury Goods (PPN/PPnBM) 269.5 4.5

c. Land and Building Tax (PBB) 26.5 0.4

d. Duies on Land and Building Transfer 7.4 0.1

e. Excise Duies 57.3 1.0

f. Other Taxes 3.9 0.1

2. Internaional Trade Taxes 27.2 0.5

a. Import Duies 19.6 0.3

b. Export Tax 7.6 0.1

II. Non-Tax Revenues (PNBP) 205.4 3.4

1. Natural Resources Revenues 132.0 2.2

a. Oil and Gas 120.5 2.0

b. Non-Oil and Gas 11.5 0.2

2. Proit Transfer from SOE's 24.0 0.4

3. Bank Indonesia Surplus 9.5 0.2

4. Other Non-Tax Revenues 39.9 0.7

III. Grants 1.5 0.0

B. Government Expenditures 1.047.6 17.5

I. Central Government Expenditures 725.2 12.1

i.e. Subsidies: 157.8 2.6

a. Fuel Subsidy 68.7 1.1

b. Non-Fuel Subsidy 89.1 1.5

II. Regional Expenditures 322.4 5.4

1. Balancing Funds 306.0 5.1

a. Revenue Sharing 81.4 1.4

b. General Allocaion Funds 203.5 3.4

c. Special Allocaion Funds 21.1 0.4

2. Special Autonomy and Equalizaion Funds 16.4 0.3

C. Primary Balance 17.6 0.3

Surplus/Deicit Budget -98.0 -1.6

D. Financing 98.0 1.6

I. Domesic Financing 107.9 1.8

1. Domesic Banks 7.1 0.1

2. Non-Domesic Banks 100.8 1.7

i.e Government Bonds, net 104.4 1.7

Source: Staisics Indonesia * Bank Indonesia’s Projecion **End of period

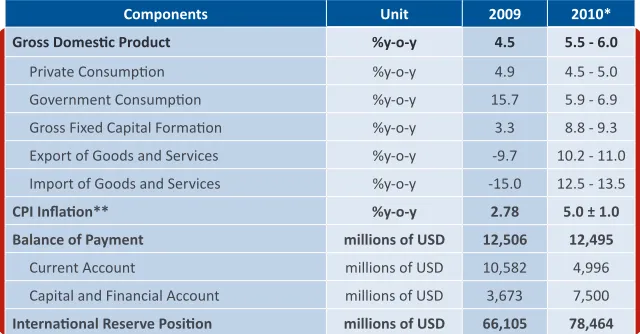

Components Unit 2009 2010*

Gross Domesic Product %y-o-y 4.5 5.5 - 6.0

Private Consumpion %y-o-y 4.9 4.5 - 5.0

Government Consumpion %y-o-y 15.7 5.9 - 6.9

Gross Fixed Capital Formaion %y-o-y 3.3 8.8 - 9.3

Export of Goods and Services %y-o-y -9.7 10.2 - 11.0

Import of Goods and Services %y-o-y -15.0 12.5 - 13.5

CPI Inlaion** %y-o-y 2.78 5.0 ± 1.0

Balance of Payment millions of USD 12,506 12,495

Current Account millions of USD 10,582 4,996

Capital and Financial Account millions of USD 3,673 7,500

Internaional Reserve Posiion millions of USD 66,105 78,464

Table 6.2 Forecast of Main Economic Indicators 2010

the Budget Implementaion Entry List (DIPA), declining raio of debt to GDP and increasing in infrastructures development.

Real Sector Policy

Improved economic performance will be diicult to achieve without solving a number of structural issues that have not been opimally handled to date. These structural constraints received special Government atenion as sipulated in the 2010-2014 RPJMN. To this end, economic development for the next 5 (ive) years will focus on 6 (six) direcions, namely infrastructures development, food security, energy security, SME development, revitalizaion of industry and services, and transportaion development. These six direcions of development are outlined in a variety of programs and acion plans with their respecive schedules and implementaion deadlines.122

The various programs and acion plans menioned, if implemented well, will signiicantly contribute to the economic development process in future. In the short term, these measures are expected to overcome the various botlenecks that are hampering investment aciviies. In the longer term, many breakthroughs in the real sector are projected to boost economic producivity and compeiiveness as a whole. In an era where the dynamics of the domesic economy are inseparable from the global economy, improving domesic economic

122 Quoted from minutes of the RPJMN Meeing 2010-2014, December 2009 (source: Indonesian Ministry for Economic Coordinaion).

compeiiveness is pivotal in order to ensure that Indonesia can reap the beneits of increasing integraion between the domesic and global economies. At the regional level, increasing economic compeiiveness is required to face the era of the ASEAN Economic Community (AEC) in 2015 (Box 6.1: Preparaions for AEC). Regarding the issue of increasing human capital, the Government is expected to opimize its role in providing fundamental aspects, such as broadening access to educaion and health services, in paricular for the most needed community.

g

Economic Prospects in 2010

Indonesian economy in 2010 is predicted to return to a phase of rising economic growth. The indicaions that the global recovery is proceeding sooner than previously expected have boosted opimism over Indonesian economic outlook. Such opimism is also supported by domesic economic resilience that endured the efects of the global crisis. The increased opimism over Indonesian economic outlook is conirmed by the raised in Indonesia’s raing by internaional raing agencies in early 2010.123

Economic growth is projected to reach 5.5% - 6.0% (yoy) in 2010. From a demand side, improved export performance

123 Internaional raing agency Fitch on 25th January 2010 raised

and increased investment acivity will drive expansive economic growth. This is in line with stronger sectoral performance, especially in the main sectors contribuing to GDP. Signiicant improvements are predicted to take place in the manufacturing sector, which its performance over the last ive years is in a downward trend, and further exacerbated by the onset of the global crisis in the fourth quarter of 2008. Important indicaions that support this improving trend for the manufacturing sector include increasing capacity uilizaion, expanding imports of raw materials and higher electricity consumpion in the corporate and industrial sectors. However, a number of challenges remain, in paricular those related to structural problems, such as infrastructure, less contestable market structure that undermines compeiiveness, and so forth. The challenges faced by the manufacturing sector in 2010 will be magnify with the implementaion of the ASEAN-China Free Trade Agreement (AC-FTA) in early 2010.

The ongoing of global economic recovery has posiive impact on the forecast of Indonesia’s balance of payments (BoP) in 2010. The current account will again record a surplus on the back of increased exports of goods and services. Regarding the inancial and capital account, the deleveraging process that expected to abate and the global monetary that expected to remain accomodaive, will spur short-term inlows in the form of porfolio, although on a more limited scale compared to previous periods. Consequently, BoP is projected to run a USD12.5 billion surplus in 2010, with foreign exchange reserves amouning to USD78.5 billion, equivalent to 6.4 months of imports and foreign debt repayments. Accordingly, the exchange rate in 2010 is expected to remain stable with a slight tendency to appreciate compared to 2009.

Exchange rate stability coupled with the assumpion that the Government will not impose strategic administraive

price adjustments, will be some factors that inluence the domesic price performance. Against these backdrops, inlaionary pressure is expected to remain under control, within the 2010 target inlaion range of 5% ± 1% (yoy), amid growing economic acivity. Furthermore, improvements in macroeconomic performance will be supported by inancial system stability, which has become the foundaion of economic resilience as a whole. A solid inancial system will also enhance the intermediaion funcion of inancial insituions, enabling them to eiciently mobilize funds. The enhancing banking intermediaion is relected in a projected 17-20% increase in bank credit in 2010.

Economic Growth Outlook

Aggregate Demand Outlook

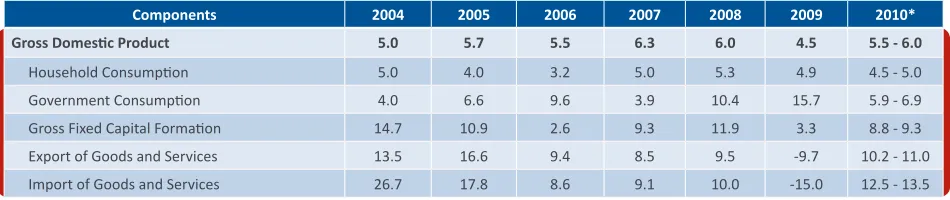

From a demand side, economic growth in 2010 (Table 6.3) will primarily be driven on the back of strong exports and a surge in investment acivity.

The ongoing global economic recovery will enhance exports performance in 2010 with the growth projected in the range of 10.2% -11.0%. The expansion of Indonesia’s exports will be supported by exports of primary

commodiies such as palm oil, agricultural produce as well as mining products such as coal and copper. Consequently, Indonesian exports are projected to experience a fairly rapid recovery buoyed by stronger demand in trading partner countries because of the raw materials’s role in the iniial phase of the industrial producion process.

Meanwhile, opimism over economic recovery is expected to encourage investment to grow in the range of 8.8% - 9.3% in 2010. This is backed up by several indicators such as increasing material imports to various sectors as well as industrial electricity consumpion. Business

Table 6.3 Economic Growth Outlook by Expenditure

percent yoy, price 2000

Source: Staisics Indonesia *Bank Indonesia’s Projecion

Components 2004 2005 2006 2007 2008 2009 2010*

Gross Domesic Product 5.0 5.7 5.5 6.3 6.0 4.5 5.5 - 6.0

Household Consumpion 5.0 4.0 3.2 5.0 5.3 4.9 4.5 - 5.0

Government Consumpion 4.0 6.6 9.6 3.9 10.4 15.7 5.9 - 6.9

Gross Fixed Capital Formaion 14.7 10.9 2.6 9.3 11.9 3.3 8.8 - 9.3

Export of Goods and Services 13.5 16.6 9.4 8.5 9.5 -9.7 10.2 - 11.0

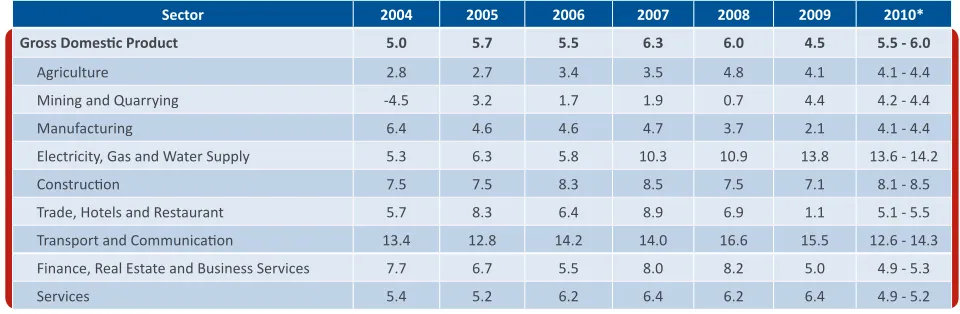

Sector 2004 2005 2006 2007 2008 2009 2010*

Gross Domesic Product 5.0 5.7 5.5 6.3 6.0 4.5 5.5 - 6.0

Agriculture 2.8 2.7 3.4 3.5 4.8 4.1 4.1 - 4.4

Mining and Quarrying -4.5 3.2 1.7 1.9 0.7 4.4 4.2 - 4.4

Manufacturing 6.4 4.6 4.6 4.7 3.7 2.1 4.1 - 4.4

Electricity, Gas and Water Supply 5.3 6.3 5.8 10.3 10.9 13.8 13.6 - 14.2

Construcion 7.5 7.5 8.3 8.5 7.5 7.1 8.1 - 8.5

Trade, Hotels and Restaurant 5.7 8.3 6.4 8.9 6.9 1.1 5.1 - 5.5

Transport and Communicaion 13.4 12.8 14.2 14.0 16.6 15.5 12.6 - 14.3

Finance, Real Estate and Business Services 7.7 6.7 5.5 8.0 8.2 5.0 4.9 - 5.3

Services 5.4 5.2 6.2 6.4 6.2 6.4 4.9 - 5.2

Table 6.4 Economic Growth Outlook by Industry

investment such as machinery and transportaion equipment is projected to record high growth in 2010, for which one of the key drivers is more afordable credit due to declining interest rates. Indicaions of improved investment performance has been conirmed by the increasing in producion capacity uilizaion by the industrial sector. Furthermore, construcion investment in 2010 is forecasted to also expand in line with the ongoing of government simulus for infrastructure projects and rampant property development. Indicaions of increased construcion investment are relected in higher cement consumpion and soaring stock prices for companies engaged in the infrastructure sector.

Household consumpion is expected to remain strong to support domesic economic acivity. This is supported by sustained level of consumer conidence measured by the Consumer Conidence Index from Bank Indonesia’s Consumer Survey. Other factors that bolster strong household consumpion include a rise in income driven by, among others, improved export performance. The non-food consumpion such as retail goods and motor vehicles, is projected to strengthen. This is supported by the Retail Sales Index that shows an upswing in sales of food, clothing, appliances and others. Therefore, household consumpion in 2010 is esimated to grow in the range of 4.5% - 5.0%.

Government consumpion is expected to grow slower at around 5.9% - 6.9% in 2010, atributable to a lower adjustment of basic salary of civil servants in 2010 compared to previous years. In addiion, limited

government consumpion is also related with the balanced distribuion of funds to local regions that will not increase signiicantly.

Demand for imported goods is projected to rise to bring imports to grow at around 12.5% - 13.5% in 2010. The expansion in imports will be driven by stronger performance in export, beter purchasing power as well as stronger investment acivity, among others.

Aggregate Supply Outlook

The global economic recovery process will trigger

opimism in domesic economic acivity, which will further encourage economic sectors in Indonesia towards a phase of increasing growth (Table 6.4).

In 2010, industrial sector performance is projected to improve in line with the domesic and global economic recovery. The industrial sector is predicted to grow by 4.1% - 4.4% in 2010 supported by a variety of breakthroughs in real sector policy, among others, the Government’s plan to provide incenives for raw material suppliers of domesic industry. The incenive package is expected to atract foreign investors to Indonesia, paricularly in terms of developing naional downstream industries. In addiion, the Government also plans to revitalize several industrial sectors such as the cement industry, ferilizer, sugar and CPO. This revitalizaion plan is intended to anicipate demand for products from these industries. In 2010, the industrial sector will face challenges stemming from the implementaion of AC-FTA. Products from ASEAN countries and China will become

percent yoy, Price 2000

strong compeitors to the domesic market, especially the iron-steel industry, petrochemicals, yarns and fabrics, horiculture, food and beverages, footwear, electronics, cables, syntheic ibers, and toys. In anicipaion of a less favorable climate post-AC-FTA, the Government will coninue to promote measures to enhance the compeiiveness of naional industries through policies that are essenially designed to overcome botlenecks (obstrucions) in the industrial sector. However, in the short term there is a discourse on the Government to use the non-tarif policy to protect naional industries. Such policies include regulaions to comply to the Indonesian Naional Standards (INS) for products available in Indonesia, the use of the halal label as well as labels in the Indonesian language, ighter controls on imports of manufacturing products at six ports, the harmonizaion on tarif to ensure that customs duies on imports of inished goods are greater than the raw materials, especially for products included on the High Sensiive List (HSL) such as sugar, rice, corn and soybean. In addiion, the government also sought to delay the implementaion of a proposed 0% import duty at 228 tarif posts that are considered suiciently sensiive.

In accordance with the strengthening global and domesic economic recovery in 2010, the trade, hotels and

restaurants sector is projected to grow by 5.1% - 5.5%, encouraged primarily by stronger public purchasing power as relected by robust household consumpion. Stronger public purchasing power provides a posiive impetus to manufacturing industry performance and, in turn, boosts wholesale and retail trade acivity. In addiion, lower lending rates serve as a inancing incenive for this sector. Meanwhile, performance of the hotels and restaurants sub-sector will also increase in line with the global economic recovery, supported by various eforts to improve the tourism organized by the Government. The Government targets 7 million foreign tourists in 2010; up from 6.5 million in 2009.

The agricultural sector in 2010 is projected to grow in the range of 4.1% - 4.4%. Delays in the 2010 cropping season as a result of a stronger El Nino is expected to afect agricultural sector performance, in paricular rice. Despite the delays, the food stock is expected to be maintained. Surplus food producion in 2009 will be used to cover the addiional food requirement in 2010. In order to support agricultural sector development, especially in the context of maintaining food stock and food self-suiciency, the Government will promulgate an array of

regulaions on agrarian reform in 2010. Through agrarian reform, the Government aims to increase farmers’ land to a minimum of two hectares per family. The area of land available amounted to totals 7.13 million hectares, which is designated for the expansion of crop farming.

The transportaion and communicaions sector is projected to record relaively expansive growth in the range of 12.6% - 14.3% in 2010, in line with the beter economic prospects. In anicipaion of increased trade acivity (exports and imports) due to improving economic condiions, the Government will implement a 24-hour service for the 13 irst-class ports in Indonesia. The irst phase of this program will be implemented at four major ports, namely Tanjung Priok (Jakarta), Tanjung Perak (Surabaya), Belawan (Medan) and Makassar. The new 24-hour service will facilitate the low of goods in and out of Indonesia and reduce waiing ime for docked and unloading ships. For air transport, the Government has made arrangements for pioneers air transportaion service as well as reining the contract system from one year to three years. In addiion, the Department of Transportaion will also increase the pioneering air service subsidy in 2010 serving 118 routes in 15 provinces. In the communicaions sub-sector, internet development is projected to grow rapidly, considering the large

potenial internet market in relaion to the relaively small percentage of domesic internet users (around a mere 2.5 million) compared to the total populaion of Indonesia.

In 2010, growth in the construcion sector is projected to surpass that of 2009, which is in the range of 8.1% - 8.5%. Strong government support for infrastructure will drive construcion sector performance. This is in line with the Government commitment to support infrastructure development in order to catalyze economic development. Infrastructure development projects are included in the RPJMN priority program 2010-2014. To this end, the Government is planning to roll out economic simulus packages to promote the development of naional infrastructure. The acceleraing development program of electricity infrastructure Phase II of the 10,000 MW project will commence in 2010.

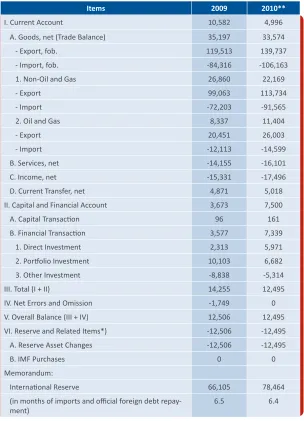

Items 2009 2010**

I. Current Account 10,582 4,996

A. Goods, net (Trade Balance) 35,197 33,574

- Export, fob. 119,513 139,737

- Import, fob. -84,316 -106,163

1. Non-Oil and Gas 26,860 22,169

- Export 99,063 113,734

- Import -72,203 -91,565

2. Oil and Gas 8,337 11,404

- Export 20,451 26,003

- Import -12,113 -14,599

B. Services, net -14,155 -16,101

C. Income, net -15,331 -17,496

D. Current Transfer, net 4,871 5,018

II. Capital and Financial Account 3,673 7,500

A. Capital Transacion 96 161

B. Financial Transacion 3,577 7,339

1. Direct Investment 2,313 5,971

2. Porfolio Investment 10,103 6,682

3. Other Investment -8,838 -5,314

III. Total (I + II) 14,255 12,495

IV. Net Errors and Omission -1,749 0

V. Overall Balance (III + IV) 12,506 12,495

VI. Reserve and Related Items*) -12,506 -12,495

A. Reserve Asset Changes -12,506 -12,495

B. IMF Purchases 0 0

Memorandum:

Internaional Reserve 66,105 78,464

(in months of imports and oicial foreign debt

repay-ment) 6.5 6.4

Table 6.5 Balance of Payments Outlook in 2010

* (-) surplus; (+) deicit ** Bank Indonesia’s projecion

millions of USD

to enliven business sector. Consequently, the related industries that engaged in the growing sector will also expand as well as their contribuion to the sector. Against this backdrop, growth of the inancial sector, leasing and services in 2010 is forecast to achieve 4.9% - 5.3%.

Balance of Payments (BoP)

Outlook

The rapid global economic recovery brings posiive impact to the balance of payments projecion in 2010. Coninuing its performance in 2009, the balance of payments is projected to maintain a surplus. On the commodiies market, a combinaion of strong external demand and rising commodity prices will sustain the export

Current Account

The current account is expected to record a surplus of USD5.0 billion in 2010, which is about 0.8% of GDP. This is mainly atributable to strong exports that are projected to increase in line with an upswing in external demand and soaring global commodity prices. Exports of goods are projected to reach USD140 billion in 2010. By the type of commodiies, the export performance is derived from natural resource-based commodiies, as well as manufacturing commodiies, which is in line with the recovery in economic condiions in developed countries. Meanwhile, the posiive global economic growth will also be transmited to the domesic economy by increasing absorpion of the economy. Increased economic acivity will encourage the use of raw materials, capital goods and consumpion, including goods that cannot be provided domesically. As a result, imports of goods are forecasted to reach 106 billion US dollars in 2010.

Meanwhile, the transacion on service, income and current transfers in 2010 will record a deicit of USD29 billion. Rising oil prices and trading aciviies will inluence the deicit in the balance of services, paricularly transportaion services. Rising oil prices will also escalate the deicit in income account, in line with increased producion sharing revenue for foreign companies engaged in the oil and gas sector. The deicit in income account will be exacerbated by the increased of government foreign debt interest payments. Meanwhile, the surplus in current transfers will slightly increase compared to the previous period. Amid improving global economic condiions, the foreign exchange earnings from foreign tourists and remitances from Indonesian workers overseas (TKI) will become a potenial alternaive source of foreign exchange.

Capital and Financial Account

The capital and inancial account will record a surplus of about 7.5 billion US dollars in 2010 supported by the upbeat domesic economic outlook and accommodaive global monetary policy. Opimism on future economic prospects, which is also supported by rising commodity prices, will atract capital inlows in the form of direct investment, to the oil/gas sector and non-oil/gas sector.

In terms of porfolio investment, the surplus is projected to persist. Porfolio investment will coninue to surge due to the accommodaive global monetary policy and posiive economic outlook. Furthermore, government plans to

issue internaional bonds in 2010 will also posiively support the porfolio investment.

The last component in the capital and inancial accounts, that is, other investment, is predicted to be remain in deicit although lower than the deicit in 2009. In accordance with the increase in government spending and investment in 2010, domesic inancing and funding that stems from foreign debt in the form of credit programs and projects will exceed that of 2009. Likewise in the private sector, credit in the form of non-FDI is expected to surpass that of 2009, in line with the growing requirement for domesic inancing. The improving economic outlook and soaring commodity prices may further encourage a larger low of private funds.

Rupiah Exchange Rate

Outlook

In general, the Rupiah during 2010 will remain stable in a range that is slightly stronger than during 2009. Rupiah appreciaion will be bolstered by solid economic fundamentals amid more conducive external condiions. Rupiah stability in 2010 will be supported by the balance of supply and demand in the foreign exchange market, in line with improving risk appeite of global investors for domesic inancial assets as well as increasing in non-oil exports.

However, potenial pressures will remain on the rupiah in 2010, both externally and domesically. From the external side, improving global economic condiions and rising commodity prices will increase the potenial risk of inlaionary pressures in 2010, which in turn can afect rupiah performance. From the domesic side, the beter economic outlook will spur import demand, resuling in stronger demand for US dollars. In this regard, Bank Indonesia will coninue to monitor the various risk factors that can put pressure on the rupiah as well as managing rupiah exchange rate volaility by balancing demand and supply on the foreign exchange market. In addiion, Bank Indonesia will also enhance the efeciveness of prudenial regulaions and monitoring foreign exchange transacions.

Inlaion

Outlook

oil price. From the domesic side, inlaionary pressures in 2010 will originate from expansive economic growth in 2010, which is indicated by a slight increase in total capacity uilizaion. Meanwhile, the inlaion expectaion in 2010 will sill decline, associated with the low

realizaion on inlaion in 2009, the stable rupiah and the absent of the strategic administraive price adjustment from the government.

In terms of non-fundamentals aspects, higher inlaionary pressures are predicted to emerge from hikes in several non-strategic administered prices. The rise in administered inlaion is associated with the government plans to adjust the prices of non-strategic goods and services. Meanwhile, the volaile food inlaion is projected to increase compared with that of 2009, but remain below its historical average. The threat of El Nino, which is feared will raise internaional food commodity prices, is esimated to have a minimal impact on domesic food prices. This is conirmed by fairly wide discrepancies in several domesic food prices compared to internaional prices, which implies that domesic commodity prices are not elasic to changes in internaional prices. The relaively low volaile food inlaion is also supported by manageble supply and distribuion of food, paricularly staples.

Banking Outlook

In general, the Indonesian banking prospect is posiive, due to robust domesic economic growth which exceeds that of most other countries. In terms of capital adequacy, the banking which dominate Indonesia’s inancial sector, is projected to be suicently resilience. In terms of bank intermediaion, the banks commitment to coninue adjusing lending and saving rates coupled with improving economic prospects will precipitate an increase in bank lending. Accordingly, bank credit will grow by around 17-20% in 2010. Bank Indonesia will coninue to monitor the banking system and coninue eforts to enhance the banking eiciency, which in turn will ameliorate the bank intermediary funcion.

In terms of risk, the banking resilience in 2010 will remain adequate to absorb the various potenial risks. This is supported by the products of naional banking which are relaively convenional, which in turn will minimize problems to a lesser extent compare to those faced by their foreign counterparts. However, external factors can sill negaively afect the banking system if not fully anicipated and prevenive measures are not taken.

The posiive bank outlook will also enhanced by the implementaion of several future agendas such as operaional risk under the Basel II framework and the implementaion of PSAK No. 50 and 55, which are considered to potenially improve market conidence. Concerning the implementaion of Basel II, one of the key issues is the impact of applying capital charges for operaional risk on bank capital. PSAK No.50 and 55 relate to among others the implementaion of marking to market for all assets and liabiliies of inancial insituions, including banks. In general, the implementaion of those agendas will heighten market conidence on Indonesia in the future. To ensure the smooth implementaion of Basel II and the two accouning standards, efecive communicaion with stakeholders and other relevant paries is necessary to harmonize all viewpoints regarding the beneits to inancial system stability as a whole.

Non-Bank Financial Market

Outlook

In line with the ongoing global economic recovery and a relaively sound domesic macro and micro indicators, non-bank inancial market performance in 2010 is expected to coninue improving. Concomitantly, growth and innovaion in inancial product will enliven non-bank inancial market development in the future.

In the stock market, the Jakarta Composite Index (JCI) has the potenial to reach its highest historical level in 2010. This is based on the beter inancial reporing prospects, the larger capital spending plan and higher foreign interest related to a more conducive economic performance. Due to the growing composiion of commodity-based sectors on the stock market, soaring global commodity prices will have a posiive impact on the stock market. Consequently, stock trading aciviies as a whole are also projected to increase.

In the bond market, the SUN market in 2010 is projected to coninue its posiive performance. The high foreign interest in state bonds, exchange rate stability and the managed iscal risk are the driving factors for strengthening Goverment Bond performance.

g

Medium-Term Economic Outlook

From a longer perspecive, the economic prospects will be beter in line with increasing capital accumulaion and improving in producivity and eiciency.

Increased capital accumulaion will simultaneously expand economic capacity and generate income. However, eforts to increase capital accumulaion must be supported by suicient domesic saving. The support from domesic savings is an important factor given the relaively limited sources of funds stemming from foreign investment. In this context, the future demographic structure of Indonesia which si dominated by people in producive age (therefore a declining dependency raio), is a disinct advantage because it has the potenial to increase public savings.124

In addiion, various improvements in the real sector as a result of government endeavors will contribute signiicantly in improving the investment climate. Success in creaing a more conducive investment climate will also provide other posiive efects, namely a surge in global FDI inlows, which in turn will inherently bring innovaion and new technology. These factors, supported by the availability of funding from domesic savings are expected

124 In the context of demography, dependency age is for persons in the populaion who are younger than 15 years and over the age of 60 or 65 years (deiniion of age is adjusted to the demographic structure of a country). The populaion aged between 15 years to 60 or 65 years are those of producive age. The dependency raio is, therefore, the raio of populaion aged <15 years against those aged > 60 or 65 years. Several studies, including Goeltom, Miranda S. & Solikin M. Juhro (2006) and Adioetomo, Sri M. (2004) predict that the next decade is a ”window of opportunity” in which Indonesia will enjoy a demographic bonus, namely a period when the dependency raio is at its minimum.

to drive investment acivity to be the main engine of economic growth. Investment acivity will begin to grow rapidly in 2010 and subsequently will accelerate to achieve 11.9% - 12.9% in 2014.

However, growth that relies solely on capital accumulaion will be hampered to be sustainable in the long-term, given the phenomenon of diminishing returns on capital. Therefore, the role of economic producivity (total factor producivity) is very important in future economic growth and should be coninually improved.125 The improvement in producivity and eiciency could be achieved from the technology transfer process and improvement in managerial quality, that could be carried along with the inlux of foreign investment. In addiion, increased producivity and eiciency will also be strived through various government policies to improve the quality of human capital. In this case, the government is expected to increase its acive role, especially in the most fundamental aspects such as increasing access to educaion and health faciliies. For Indonesia, an increase in TFP is not impossible to achieve given the government’s commitment to provide extra simulus in improving human quality through various welfare programs, both in urban and remote areas, as sipulated in RPJMN 2010-2014.

A rise in investment acivity, coupled with improvement in producivity, will in turn increase economic capacity, which

125 Conceptually, the Total Factor Producivity (TFP) is one of the components of economic growth sources described in the Growth Theory. Empirically, the role of TFP in enhancing economic growth has been largely proven. One was reported in the World Development Report (2005) where based on a study of various countries in the period of 1960-2000, the dominant factor (45-90%) atributable for cause diferences in growth rates among countries was diferences in TFP.

Table 6.6 Medium - Term Indonesia Economic Outlook (2010 - 2014)

percent yoy, Price 2000

Source: Staisics Indonesia *Bank Indonesia’s projecion

Components 2008 2009 2010* 2011* 2012* 2013* 2014*

also means the beter condiions of domesic supply. This supply-side improvement is expected to balance strong domesic demand driven by household consumpion, thus allowing the miigaion of future inlaionary pressures. Furthermore, acceleraion in investment acivity will contribute to increasing labor absorpion, which in turn will gradually reduce the unemployment rate. From the external side, export performance will improve in accordance with the global economic recovery and improved compeiiveness of domesic products. Accordingly, Indonesia’s export growth is projected in the range of 12.8% - 13.8% by 2014 (Table 6.6). Improvements in the external sector is one of important factors in sustaining Rupiah stability, so Rupiah in the medium-term is expected to remain stable.

With the large domesic market bolstered up by the ability to increase sustainable income generaing capacity, and supported by rapid capital accumulaion acivity as well as maintaned inancial system stability, private consumpion

in the long-run is predicted to remain strong and reach growth of 5.6% - 6.6% by 2014.

Strong domesic demand that can be balanced by increased economic capacity with support from capital accumulaion as well as increased producivity and eiciency, will in turn catalyze economic growth without causing domesic price instability.

6.2

Looking ahead, Indonesian economic performance will have to deal with a challenging dynamic environment,

both in globally and domesically. Considering the challenges faced that could potenially undermine economic recovery eforts in the future, it is necessary to formulate an integrated naional economic policy agenda designed to strengthen domesic economic resilience and encourage sustainable economic recovery momentum. From the perspecive of government policy, an economic

policy agenda will be implemented extensively in

various economic sectors in accordance with eforts to boost economic compeiiveness. The strategic agenda to be followed has been set forth in RPJM 2009-2014.

Meanwhile, Bank Indonesia policies will aim to maintain

macroeconomic stability and inancial system stability, and encourage bank intermediaion in support of catalyzing sustainable economic growth. Coordinaion between the Government and Bank Indonesia will coninue by opimizing various forums centrally and in rural areas such as TPI/TPID.

g

Bank Indonesia Future Policy

Direcion

As the economy moves into recovery in the atermath

of the global economic crisis, Bank Indonesia policies will remain focused on maintaining macroeconomic

stability and inancial system stability, and promoing the bank intermediaion funcion in support of sustainable economic growth. Learning from the past two year

inancial sector and the global economic crisis, it can be

generally concluded that macroeconomic stability is not only associated with price stability, but also interacts

with inancial system stability. In this context, monetary policy will be directed to achieve low and stable inlaion, while maintaining closed atenion to inancial system stability. Banking policy, on the other hand, will not

only focus on support for the banking industry, but will also uphold macroeconomic stability and provide

support for economic acivity. In a broader perspecive, coordinaion with iscal policy and real sector policy will be strengthened further to build solid foundaions for sustainable economic development.

g

Monetary Policy

Bank Indonesia monetary policy in 2010 will be aimed to

achieve the inlaion target of 5% ± 1%, while maintaining closed atenion to inancial system stability as well as promoing economic growth momentum.

In the medium term, Bank Indonesia will drive inlaion to reach a low rate and comparable to the inlaion rate

of countries in the region that has been in the range of

3%. Eforts to achieve a low inlaion rate is criical in the medium term in order to maintain the compeiiveness of domesic economy, especially in the face of an ASEAN Economic Community (MEA) in 2015. In this context,

the BI Rate will be steered based on a comprehensive

underlying assessment to achieve the inlaion target,

but keeping the rate at a level conducive to improvement

in the banking intermediaion funcion and domesic economic recovery. In the medium to long term, the BI Rate level that is required to keep domesic inlaion comparable with the inlaion rate in the region is expected to decrease if the various eforts to improve supply-side capacity in responding to rising domesic demand can be properly implemented.

At the operaional level, Bank Indonesia will coninue its policy of managing liquidity in the money market.

In the rupiah money market, these policies include infrastructure improvements to facilitate the repo market, encourage banks to place funds in longer-tenor monetary instruments, and expand the base of

paricipant in the money market. Eforts will be done gradually by considering the condiion of inancial markets experiencing excess liquidity. In the forex market, Bank

Indonesia policy is essenially aimed at minimising

volaility in the rupiah exchange rate. This strategy will

permit gradual adjustment in the exchange rate consistent with developments in fundamentals, in so doing avoiding

excessive luctuaion. In addiion, Bank Indonesia will facilitate Government’s eforts to improve the

management of foreign exchange earnings from exports of

oil and gas and non-oil and gas products.

g

Banking Policy

In learning from the experience of dealing with the global economic crisis during the past two years, banking policy

in 2010 will be implemented through four key incenive and disincenive-based policies to strengthen banking resilience and increase the role of the intermediaion funcion.

The irst is to build greater resilience into the banking system. This policy will be pursued by implemening

measures involving the strengthening of the regulatory framework, development of a more robust system for bank supervision, restructuring the compeiion

within the Indonesian banking industry and inancial market deepening. The regulatory framework will be strengthened through changes in capital regulaions designed to improve bank resilience to risks, regulaion of inancial report transparency, improved quality in organizaional governance and greater efeciveness of risk management. The development of more

robust bank supervision will be achieved through

improvements and revamping of methods and pracice in risk-based supervision, stronger operaional rules for bank supervision, improvements to the it and proper test and increase cooperaion with non-bank inancial insituion supervisors in Indonesia and other countries. The restructuring of compeiion in Indonesia’s banking

industry will involve strengthening of banking structures with capital requirements aligned to the scale of business

to increase capacity to absorb business risks. In addiion, Bank Indonesia will improve the regulaions covering such areas as mergers, consolidaion, funding sources for bank acquisiions, requirements for eniies eligible

to acquire banks, role of individual/family owners and

business development requirements. The policy for inancial market deepening will focus on promoing the development of inancial products that banks will be able to use simultaneously and producively as alternaives

for fund channelling and earning asset placements in the

expected to build a more liquid money market with banks less reliant on revenues earned on placements in Bank

Indonesia instruments.

The second is a more vigorous banking intermediaion

through improvements in regulaions and provision of supporing infrastructure. The regulaions slated for

improvement cover the minimum reserve requirement,

opimizaion and eiciency of bank operaions and streamlined requirements in foreign exchange aciviies aimed at promoing bank lending. Bank Indonesia will also support the establishment of an insituion managing a

database of credit per sector and per region to help banks

measure risks.

The third is an increased role for Islamic banking in

the Indonesian economy with strengthened resilience.

The sharia-compliant banking policies slated for

implementaion include greater incenive for increasing capital, facilitaion for expansion of sharia divisions and subsidiaries and facilitaion for fullilment of competent personnels for Islamic banks.

The fourth is an expanded role for rural banks in

microinance with improved resilience. This policy will involve provision of incenives to increase capital, facilitaion for fullillment of competent personnels for rural banks and establishment of the rural bank posiion as community banks.

To strengthen the bank role as intermediary insituions,

Bank Indonesia will encourage the banking system to

improve banking industry eiciency. Acions to this end

will include the issuance of benchmarks for cost of funds,

overhead cost, risk premium and proit margins. In this way, banks will be able to idenify sources of ineiciency and seek ways of raising eiciency in order to set interest rates at more reasonable levels. Banking industry eiciency will also be improved through inancial market deepening. Examples of acions include cooperaion with

other agencies to study and promote short-term money

market instruments capable of compeing with short-term credit from the banking system.

To strengthen overall inancial system resilience, Bank

Indonesia envisages a role as systemic regulator with

oversight of the soundness and stability of the inancial system as a whole. The need for a systemic regulator has taken on added urgency ater lessons learned from

the experience of the global economic crisis in the last

two years. The role of the insituion will extend to collecion, analysis and reporing of informaion related to signiicant interacions in the market and risks among inancial insituions; examinaion of the possibility of a inancial insituion causing the inancial system inadequately protected against systemic risk; design and implementaion of regulaions; and coordinaion with other regulators, including the iscal authoriies, in the management of any systemic crisis that may arise.

g

Payment System Policy

Future policy for the naional payment system will coninue to focus on support for inancial system resilience and promoion of eiciency in naional economic aciviies. This policy will be implemented through three key acions: increasing the reliability and capability in risk miigaion in large value payments, improving eiciency in the retail payments infrastructure

and enhancing security in the card-based payment

instrument industry.

To improve infrastructure reliability and ability to miigate

risk in the large value payment system, Bank Indonesia will

develop the Bank Indonesia Real Time Gross Setlement (BI-RTGS) Generaion II. This is intended to build added funcionality into the BI-RTGS system with the objecive of enhancing eiciency in use of liquidity, eiciency and miigaion of risks in cross-border transacions and eiciency in support of monetary and iscal policy transmission. The advanced development of the BI-RTGS system is intended to put into place a BI-RTGS system infrastructure capable of supporing the future growth in cross-border transacions anicipaing the iniiaives

for development of an integrated regional economy

and inancial markets, such as the ASEAN Economic Community to be launched in 2015. In the future, the BI-RTGS system will therefore no longer operate purely as a gross to gross setlement mechanism, but will be combined with neing system, which is more commonly described as a hybrid system. The system will be able to support more eicient use of liquidity among system paricipants.

of retail payment infrastructure in the Naional Payment Gateway (NPG) format.The SRO is envisaged as a partner for Bank Indonesia in regulaing and safeguarding the smooth operaion of the payment system, with the industry seing its own rules from the industry side

as long as these rules do not contravene the general

policy governing the payment system. The underlying reasoning is that industry actors in essence have a beter

understanding of the nature of their business, including

the risk appeite of each industry. The NPG, on the other hand, is a naional switching system for various interbank transacions conducted through front end

delivery channels such as ATMs, internet, telephone and

mobile payments. Bank Indonesia’s development of the NPG will involve formulaion of a development strategy, preparaion of a development schedule and facilitaion of NPG development by deliberaing accurate policy and regulaion without neglecing the condiion and capacity of the industry. When launched, the NPG is expected

to bring immediate improvements in payment system

operaion eiciency in Indonesia. Industry paricipants

will no longer need to develop their own infrastructure for

their payment system aciviies. Instead, these aciviies will be able to operate more eiciently through sharing of the infrastructure with other industry actors.

In other acions, Bank Indonesia will work coninually to

improve security in the card-based payment instrument industry by encouraging industry members to use chip-based instruments, now considered more secure than the

magneic stripe technology. By the end of 2009, nearly

all credit card issuers had completed the changeover to

chip technology. Development of ATM and debit card

technology in 2009, however, had progressed as far as

exploraion of possibiliies for instrument standardisaion,

with trials planned for selected major issuers prior to full

implementaion.

g

Policy Coordinaion

Looking forward, Bank Indonesia will take further measures to strengthen macroeconomic policy

coordinaion with the Government. In an economy sill fraught with uncertainty, the limited scope of the inluence of macroeconomic policies has reinforced the importance of policy coordinaion between Bank Indonesia and the Government in supporing

macroeconomic policy objecives to improve social welfare.

The importance of policy coordinaion is related to

the persistence of fundamental issues in the economy

that have deied speedy resoluion, such as structural problems on the supply side and support for MSMEs. Policy coordinaion between Bank Indonesia and the Government will prioriise measures to strengthen economic insituions in support of accelerated construcion of infrastructure to expand producion capacity and economic acivity on a broad scale. In addiion to monetary and iscal policy coordinaion for macroeconomic stabilisaion, other acions will involve improvement of foreign investor relaions and Indonesia’s raing, support for banking intermediaion, and deepening of the domesic inancial sector. The Bank Indonesia Regional Oices (KBI) will also coninue

their work of producing studies of economic sectors and

mainstay commodiies uilising informaion from surveys and Regional Economic Studies (KER). This is expected to contribute to lexible supply-side behaviour in responding

to the demand-side, enabling economic policy support

for the economic recovery process to deliver opimum results. Furthermore, policy coordinaion will be directed at making more support available to MSME actors in order to secure MSMEs greater access to the banking system.

Bank Indonesia will also maintain acive coordinaion

with the Government to address issues of structural

rigidity in the economy that could potenially hamper monetary policy efeciveness. At the naional level, Bank

Indonesia and the Government have established the Team

of Inlaion Targeing, Monitoring and Control (TPI). At the regional level, Bank Indonesia will intensify inlaion control measures in the regions by empowering the KBI to play a more acive role in driving the work of the Regional Inlaion Control Teams (TPIDs). Cooperaion with regional governments will be key to idenifying and seeking soluions to the various structural problems that exist.

In most regions, structural shocks are an endemic factor

driving inlaion. Looking forward, the TPIDs are expected to deliver improved performance in curbing inlaion

surges in local regions and operate within an expanded scope to support higher quality economic growth at the

Box 6.1 Preparaions for AEC

Two years since the signing of the ASEAN Economic Community blueprint (AEC) 2015 and ASEAN Charter 2007, the implementaion of the agreement towards the establishment of AEC 2015 coninues on going. One important step that has been successfully accomplished is the raiicaion of a treaty to support the realizaion of the free-low of goods, services, investment, labor and a free capital lows (the ive elements of free low). Such developments have further foriied determinaion in the ASEAN region to achieve greater integraion among its members as stated in the “Cham-am Hua Hin Declaraion on the Roadmap for the ASEAN Community (2009-2015)” agreement at the 14th ASEAN Summit in March 2009.1 The declaraion conirms that AEC is one of the

pillars of the ASEAN Community based on the AEC 2015 blueprint that replaces the Vieniane Acion Program. The accomplishment of such agreements also relects recent developments in the ASEAN region towards a more efecive and rules-based cooperaive organizaion, in line with the raiicaion of ASEAN Charter by all member countries in 2008.

At the naional level, preparaions for the achievement of Indonesia’s commitment in AEC 2015 for the irst two years (2008-2009) are set forth in the Presidenial Instrucion (Inpres) No. 5 dated 2008 regarding the Economic Program Focus (EDF) 2008-2009. The legislaion focuses on monitoring ASEAN’s goal as a single market and common producion base; one of the objecives of AEC 2015. The three other AEC objecives are to establish ASEAN as i) a region with high compeiiveness, ii) a region with equitable economic

growth and iii) a region that integrates with the global

economy. The three AEC objecives are interrelated and mutually support one another. In general, Indonesia has met its commitments through the accomplishment of

strategic target schedule set in the AEC 2015 blueprint

for 2008-2009. In addiion, the Government has also issued policies and regulaions to boost naional compeiiveness through increased trade program and improvement in investment climate.

1 ASEAN Community is comprised of three pillars namely the ASEAN Poliical-Security Community, ASEAN Economic Community and the ASEAN Socio-Cultural Community.

AEC 2015 Blueprint Implementaion

Implementaion of the AEC 2015 blueprint at the naional level is coordinated by the Government, as sipulated in Presidenial Instrucion (Inpres) No. 5 dated 22nd May 2008 regarding Economic Program Focus (EPF) 2008-2009. The Inpres states that the Government will monitor the implementaion of Indonesia’s commitment towards the ASEAN single market and common

producion base in AEC 2015. The agency to act as coordinator and take responsibility for 2015 AEC related commitments is the Ministry for Coordinaing Economic Afairs, while the oicial in charge of ‘Disseminaion of AEC 2015 Commitment’ is the Minister of Trade.

Ater implemening the Inpres, Indonesia has met its commitments in all ive elements of the free low of goods. With respect to the free low of goods, the Government has promulgated regulaions regarding the eliminaion of tarifs for products in the Priority Integraion Sectors (PIS)2, transparency of non-tarif AEC

sures (NTMs), reforms and expansion of rules of origin (ROO), and simpliicaion of ROO operaional ceriicaion procedures. AEC nwhile, concerning the free low of services, the Government has successfully fulilled its commitment threshold for all 7 packets of the ASEAN Framework Agreement Services (AFAS) for 68 sub-sectors, from the minimum 65 sub-sectors agreed upon.

Regarding the free low of investment, the Government is preparing a blueprint for the Capital Investment Development Strategy as part of the ASEAN

Comprehensive Investment Agreement (ACIA) in 2015, which includes Priority Acion and follow-up associated with the liberalizaion of capital lows. AEC nwhile, in order to achieve the free low of labor, legislaion is currently being drawn up about competence levels and job qualiicaions as well as the training required, especially in sectors to be liberalized (professional workers in the ield of medical pracioners, dental pracioners and accountancy services).

2 Priority Integraion Sectors are established from products based