REPUBLIC OF INDONESIA

Recent Economic Developments

Published by Investors Relations Unit –Republic of Indonesia

Address Bank Indonesia

International Directorate Investor Relations Unit

Sjafruddin Prawiranegara Building, 5thfloor Jalan M.H. Thamrin 2

Jakarta, 10110 Indonesia

Tel +6221 381 8316

+6221 381 8319 +6221 381 8298 Facsimile +6221 350 1950

E-mail Elsya Chani: elsya_chani@bi.go.id

Firman Darwis: firman_darwis@bi.go.id

Dyah Miranti Wulandari: dyah_mw@bi.go.id

Table of Contents

I. Executive Summary

II. Indonesia Story: as Acknowledged by Rating Agencies

Executive Summary

The economy grew by 5.7% in Q1-2010 and forecasted to grow within the range of 5.5%-6.0% by the end of 2010. Bolstered by Indonesia's external sector performance and investment, BI estimates for Q2/2010, economicgrowthwill reach around 6%.

Economic data up to Q2-2010 supported us to believe that the economy, in line with the development in the global economy, is moving toward better development than we previously expected on the beginning of this year. It bolstered Indonesia's external sector performance and investment, with domestic recovery gaining strength as the economy is no longer reliant solely on consumption. Bank Indonesia estimates Indonesia's Q2/2010 economic growth at about 6%. The optimism also supported by latest development in the perception indicators such as yield spread, sovereign rating, CDS, CRC-OECD, etc. On the backdrops, Bank Indonesia revised economic growth outlook for 2010 and 2011 to be consecutively within the range of 5.5-6.0% and 6.0-6.5%.

The latest Board of Governors' Meeting convened in July 2010, resolved to hold the BI Rateat 6.50%. This decision was taken after a comprehensive evaluation of economic performance and the future outlook of the economy, which is showing steady overall improvement. The Board of Governors believes that the BI Rate at this level is consistent with achievement of the 5%+1% inflation target in 2010 and remains conducive to recovery in the domestic economy amid escalating risks of uncertainty from the debt crisis now besetting Greece and a number of other European nations.

Concerning prices, the Board of Governors takes note of indications of renewed inflationary pressure. CPI Inflationin June 2010 reached 0.97% (mtm), representing an annual rate of increase at 5.05% (yoy). Inflationary pressure was stoked mainly by soaring inflation in the volatile foods category and specifically seasonings, recorded at 11.51% (yoy) due to seasonal uncertainties. However, inflationary pressure from fundamentals, reflected in core inflation, has held at a modest 3.97% (yoy) with support from adequate supply-side response to rising demand and the appreciating exchange rate trend. Similarly, little visible impact has resulted from increases in electricity tariff with inflation in administered prices still at a modest 2.60%. BI will keep a close watch on the rising inflationary pressure and make the necessary adjustments to monetary policy responses to ensure that inflation remains on track with the established targeting range at 5%±1% in 2010.

Executive Summary

By end of 2010,

lending growth

is projected to reach 22%-24%. Up to the first half of 2010, banking industry has reached the remarkable lending growth at 18.6%. Improved market confidence to the economic outlook also bring us more optimism in furtherbanking intermediation function

optimization. Overall, banking industry remains in a stable condition and convinced to be run prudently, which is reflected in the well-maintained Capital Adequacy Ratio (17.8%, as of end of May 2010) and safe level of Non-Performing Loans at 3.6%, as of end of May 2010.

Balance of payments

charted another surplus at a robust US$6.6 billion in Q1-2010, marking significant improvement over the Q4-2009 surplus (US$4.0 billion). Going forward in Q2/2010, improvement in the global economy bolstered Indonesia's external sector performance and investment which reflected on the current account surplus, estimated at USD1.75 billion in Q2/2010 or ahead of the originally forecasted USD1.23 billion. Similarly, the capital and financial account posted a higher estimated surplus at USD3.09 billion compared to the earlier USD1.16 billion forecast. The robust current account surplus and capital and financial account surplus are consistent with the improvement in the global economy along with rising commodity prices and renewed growth in capital inflows in response to the upward revision of the credit rating outlook and more upbeat international perceptions. The policy package launched by Bank Indonesia on 15 June 2010 also met with positive response from domestic and international market actors and is envisaged to provide added reinforcement in monetary management and financial market deepening. In response to these developments, the rupiah

exchange rate

maintained an overall appreciating trend in Q2/2010accompanied by reduced volatility.

International reserves

at end-Q2/2010 reached USD76.3 billion, equivalent to 5.9 months of imports and servicing of official debt.Indonesia Story: as Acknowledged by Rating Agencies

Impressively navigates through the global crisis and as growing confidence in economic outlook, the Republic continued to receive good reviews, especially from Rating agencies

Moody’s Investors Service (June 21, 2010): revised the outlook of Indonesia’s foreign and local-currency Ba2 sovereign debt ratings to positive from stable. The positive outlook broadly reflects the country's capacity for sustained strong growth, the overall stability and effectiveness of its fiscal and monetary policies, and expectations of further improvements in the government's financial and debt position.

OECD (April 2, 2010): upgraded Indonesia’s Credit Risk Classification (CRC) from category 5 to 4. This upgrade was a timely acknowledgement by the developed economies of the consistent economic improvement. This upgrade would significantly improve Indonesia’s credit standing in front of the creditor countries especially the credit exports creditor countries which eventually would decrease the debt burden.

S & P (March 12, 2010): upgraded Indonesia’s long-term foreign currency rating to BB from BB- with positive outlook which indicates that Indonesia has big possibility to be upgraded within a year, even maybe faster. The main factor supporting this decision is steadily improving debt metrics and growing foreign currency reserves which reduced vulnerability to shock with continued cautious fiscal management.

Fitch Ratings (January 25, 2010): upgraded the Republic of Indonesia’s sovereign rating to‘BB+’from‘BB’with stable outlook The rating action reflects Indonesia’s relative resilience to the severe global financial stress test of 2008-2009 which has been underpinned by continued improvements in the country’s public finances.

Indonesia Development Policy is based on a

‘Triple

Track

Strategy’

1st

Pro-Growth:

Increase Growth by prioritizing export and investment

2nd

Pro-Job :

Boost up the real sector in order to create jobs

3rd

Pro-Poor:

Revitalize agriculture, forestry, maritime, and rural economy

to reduce poverty

Real Sector: Indonesia Development Policy

Source: Coordinating Ministry for Economic Affairs

Economic Growth Sustained

(*): Preliminary

Source: Ministry of Finance, BPS.

Indonesia’s economic growth for the whole 2009 reached 4,5% (yoy), better than expected. The major improvement was a resultfrom increase in exports, investment, and government consumption. Going forward in 2010, the Indonesian economy grew by 5.7% in Q1-2010

Economic data up to end of Q1-2010 supported us to believe that the economy, in line with the development in the global economy, is moving toward better development than we previously expected on the beginning of this year. The optimism also supported by latest development in the perception indicators such as yield spread, sovereign rating, CDS, CRC-OECD, etc. On the backdrops, Bank Indonesia revised economic growth outlook for 2010 and 2011 to be consecutively within the range of 5.5-6.0% and 6.0-6.5%.

The domestic economy has sustained only limited impact from the Euro-Crisis due to the robust condition of Indonesia's economic fundamentals. The upbeat conditions and improving outlook for the global economy have benefited Indonesia's exports, which maintained brisk growth during the first four months of 2010 with export performance approaching pre-2008 crisis levels.

Improvement in the domestic economy is visible across a range of indicators. While private consumption maintains brisk growth, exports have mounted steadily on the performance of manufactured exports in response to improvement in global economic conditions, led by advanced economies. Strengthen domestic and external demand is stimulating renewed growth in investment, reflected in rapidly growing imports of raw materials and capital goods. With support from investment as well as consumption and exports, the domestic economy is now in an expansionary stage of the cycle.

Optimistic on growth prospects, it is quite strong compared globally

9 Source: Bank Indonesia.

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0

2006 2007 2008 2009 Q1-2010

5.5

6.3

6.0

4.5

5.7 % yoy

Stable rupiah is expected to damp pressure from higher commodity prices and pave the way for better inflation expectation. From domestic side, in addition to administered price, subtle inflationary pressure would also be the result from higher demand along with higher economic growth as production capacity remain adequate to respond to higher demand. Those conditions is projected to be reflected in inflation rate at 5 1% in 2010.

Renewed inflationary pressure are already noted, which in June resulted in 0.97% (mtm) CPI inflation, representing an annual rate of increase in the CPI at 5.05% (yoy). However, inflationary pressure from fundamentals, reflected in core inflation, has held at a modest 3.97% (yoy) with support from adequate supply-side response to rising demand and the appreciating exchange rate trend. Similarly, little visible impact has resulted from increases in electricity tariff with inflation in administered prices still at a modest 2.60%.

Future inflationary pressure until end of 2010 is predicted mainly from higher electricity tariff, upcoming Ramadhan festivities and higher food prices associated with seasonal uncertainties.

Going forward in 2011, inflationary pressures could be spurred by an increasingly limited supply-side response to the expected sustained growth in demand. BI will keep a close watch on the rising inflationary pressure and make the necessary adjustments to monetary policy responses to ensure that inflation remains on track with the established targeting range at 5% 1% in 2010 and 2011.

Inflation

10 Source: Bank Indonesia

Inflation Inflation Expectation –Consensus Forecast

0.97 5.27 6.71 9.17 5.05 -5 0 5 10 15 20 Ja n F e b M a r A p r M a y Ju n Ju l A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju n Ju l A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju n Ju l A u g S e p O ct N o v D e c Ja n F e b M a r A p r M a y Ju n e Ju ly A u g S e p O k t N o v D e s Ja n F e b M a r A p r M a y Ju n

2006 2007 2008 2009 2010

Monthly (m-t-m)

Annually (y-o-y)

Monetary Policy Stance

BI Rate

11

Since December 2008, BI has slashed BI Rate by 300 bps. The monetary relaxation has offered ample support for the economic recovery process and bank intermediation.

In the latest Board of Governors' Meeting convened in July 2010, BI Rate is kept at 6.50%. This decision was taken after a comprehensive evaluation of economic performance and the future outlook of the economy, which is showing steady overall improvement.

The Board of Governors believes that the current level of BI Rate is consistent with achievement of the 5%+1% inflation target for 2010 and 2011 and remains conducive to recovery in the domestic economy amid the persistently high level of global risks from the debt crisis in some European nations.

Source: Bank Indonesia. 6.5

9.90

6.27

4 5 6 7 8 9 10 11

Balance of Payments: Preliminary Estimates for Q2-2010

Balance of Payments

Improvement in external sector performance is reflected on the current account surplus, estimated at USD1.74 billion in Q2/2010 or ahead of the originally forecasted USD1.23 billion. Similarly, the capital and financial account posted a higher estimated surplus at USD3.09 billion compared to the earlier USD1.16 billion forecast. The surplus are consistent with the improvement in the global economy along with rising world commodity prices and renewed growth in capital inflows in response to the upward revision of the credit rating outlook and more upbeat international perceptions of Indonesia. With positive prospects on those two accounts, overall balance of paymentsin Q2-2010 is estimated to post a surplus of around US$4.3 billion.

Accordingly, international reserves at end-June 2010 mounted to US$76.3 billion, equivalent to 5.9 months of imports and official external debt service payments.

Official BOP statistics for Q2-2010 will be released in mid-August 2010.

Sound Banking Sector

Protected by prudential guidelines and conservative practices, the Banking Sector has weathered the global financial turmoil and posted good performance : strong solvency, contained risk exposure and profitability

financial system stability up to Q2-2010 is well maintained, confirmed by Financial Stability Index (FSI) in June 2010 which was recorded at 1.87 (slightly lower than May 2010 at 1.88). In addition to that, stress test results also indicates that the banking industry is resistant to various risks, particularly credit risk, market risk and liquidity risk.

Banking system stability remains in sound and stable condition, reflected in high CAR level at 17.8% and sound level of NPL ratio at 3.6% (as of May 2010).

Intermediary function is steadily improving reflected from 18.6% (yoy) credit expansion recorded in end of June 2010.Sufficient CAR (%) Sound level of NPLs (%)

13 Source: Bank Indonesia.

3.6

1.9

1.5

0.9 1.0 1 0.9 1

0 0.5 1 1.5 2 2.5 3 3.5 4

Dec-06 Dec-07 Dec-08 Dec-09 Feb-10 Mar-10 Apr-10 May-10

20.5

19.3

16.2

17.4

19.3 19.1 19.2

17.8

-5.0 10.0 15.0 20.0 25.0

14

In 2010, the Indonesian economy is positioned to grow higher

GDP Growth

is forecasted to be at the upper limit of5.5%-6.0% projection

With more upbeat confidence to the economy, exports and investment are expected to keep climbing, providing additional boost to mounting consumption in support of higher levels of economic growth.

2010 Forecast Main Factors Behind The Forecast

14 Source: Bank Indonesia.

Inflation

is estimated to be ontarget at range of 5.0% 1%

Signs of future inflationary pressures until end of 2010 are noted, which mainly predicted from administered prices and volatile food seasonal uncertainties. However, BI is positive to contain the inflation level within the target range, and will keep a close watch on the rising inflationary pressure and make the necessary adjustments to monetary policy responses to ensure that inflation remains on track with the established targeting range at 5% 1% in 2010 and 2011.

Export

is expected to charthigher growth

Global economic recovery will produce renewed acceleration in exports. The global economy is predicted to enter an expansionary phase in 2010. Renewed momentum is predicted in the economies of Indonesia’s major trading partners, such as China. This strengthened performance will position exports as one of the main engines of economic growth in 2010.

Indonesian exports characteristics which is based on primary commodities has also supported export growth acceleration.

Private

Consumption

will remain strong

Banking system stability held firm amid the onset of renewed credit expansion (data as of May 2010)

Main Banking Indicators

15 Source: Bank Indonesia

Overview of Fiscal Policy for 2009 and 2010

Continue an effective fiscal stimulus 2009 (1.4% GDP), 2010 (1.6% GDP)

Reduce debt to GDP ratio: 2009 (28%), 2010 (27%).

Actual fiscal deficit 1.6% of GDP, lower than 2.4% of GDP target deficit projected in 2009 Revised Budget

Target fiscal deficit 1.6% of GDP in 2010 Budget (budget adjustments is in ongoing discussion with the parliament) .Fiscal Stimulus Policies

Tax and

Administrative Reforms

New Feature of Fiscal Policy

Maintain

Social Welfare

Continue welfare programs (PNPM, BOS, Jamkesmas, Raskin) and provide budget for educationsector

Continue tax policy and administration reform, reduce rate for companies, certainty of tax policy for oil companies

Implement the 1st batch of Performance Based Budget (PBB), Civil Service Reform and Remuneration (11 ministries) and multi-years projects

Provide fiscal space for the new government to implement additional priority programs (0.4% of GDP or equal to USD 2.5 billion)

Sufficient fiscal risk for oil and commodity prices, El-Nino, provide guarantee on land acquisition for infrastructure projects, secure financing for power (PLN) and restructuring water services (PDAM), domestic oil price adjustment if necessary

Export promotion (additional capital for Indonesian Exim Bank) and incentives for real sector, climate change projects (geothermal, bio-premium, green funds)Fiscal Policy to Promote Economic Recovery

Provide incentive for geothermal energy through income tax and VAT

Provide tax incentive on imports (both income tax and VAT on imports) for the oil and gas exploration sector

Provide incentive for green energy through for VAT and subsidyEnergy Incentives

Provide custom incentives for select industries

Provide custom incentives for imported capital goods and capexIncentives for Industry

Reduce income tax rate for corporations from 28% to 25%

Reduce income tax rate by 5% for listed companies with 40% public ownership

Provide income tax facilities for businesses in specific industries or areas

Free VAT for primary agriculture products

Eliminate many luxury tax items

Provide tax and custom Incentive for special areas in accordance with law on tax and custom

Eliminate non tax revenue for export and import documentationIncentives on General

Taxation

The fiscal policy aims to promote economic recovery by providing tax incentives to various sectors and businesses which further promotes private consumption and investment spending

Fiscal Policy to Enhance Competitiveness

Guarantee for 10,000 MW electricity program and IPP

Additional funds for land clearing for toll road building

Guarantee obligation for State Water Company and subsidy on interest for clean water, and interest credit for State Water Company, business in Aceh / Nias, and KKPE

Subsidy and VAT for people’s housing (low income housing)

The Indonesian government continues to support the development of infrastructure and enhance the social welfare through the effective fiscal policy and incentives for specific sectors

Infrastructure Development and Social Welfare

Assistance to Support

Specific Sectors

Credit for green fuel development

Credit for farming and cow growers

Subsidy for fertilizers, seeds and inventory

Direct assistance for seeds at competitive pricing in order to revitalize plantation, cocoa and sugar industry

Additional capital for LPEI (Indonesian Exim Bank) to finance export related activities, including for SMEs

Provide incentives for high performance regions (e.g. performance on financial, economics and social welfare)

Resolution for troubled asset at SOEs and SMEs loan

Financing Trend 2005-2010

19 Source: Ministry of Finance

20

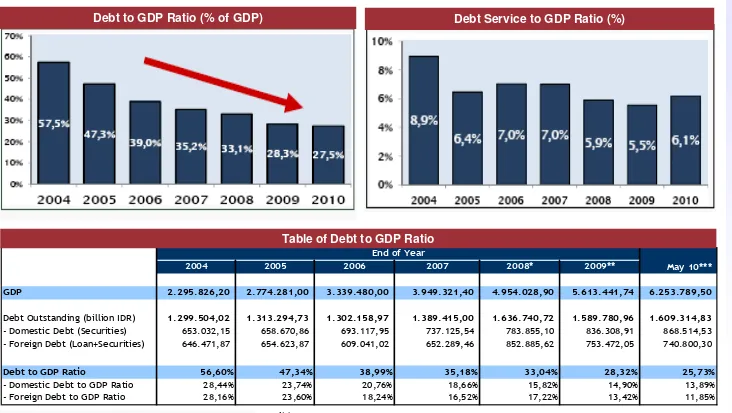

Debt to GDP Ratio (% of GDP) Debt Service to GDP Ratio (%)

Debt Ratio

Source: Ministry of Finance

2004 2005 2006 2007 2008* 2009** May 10***

GDP 2.295.826,20 2.774.281,00 3.339.480,00 3.949.321,40 4.954.028,90 5.613.441,74 6.253.789,50

Debt Outstanding (billion IDR) 1.299.504,02 1.313.294,73 1.302.158,97 1.389.415,00 1.636.740,72 1.589.780,96 1.609.314,83 - Domestic Debt (Securities) 653.032,15 658.670,86 693.117,95 737.125,54 783.855,10 836.308,91 868.514,53 - Foreign Debt (Loan+Securities) 646.471,87 654.623,87 609.041,02 652.289,46 852.885,62 753.472,05 740.800,30

Debt to GDP Ratio 56,60% 47,34% 38,99% 35,18% 33,04% 28,32% 25,73% - Domestic Debt to GDP Ratio 28,44% 23,74% 20,76% 18,66% 15,82% 14,90% 13,89% - Foreign Debt to GDP Ratio 28,16% 23,60% 18,24% 16,52% 17,22% 13,42% 11,85%

End of Year

Notes: * = Preliminary ** = Very Preliminary

*** = Very Very Preliminary, GDP number based on Budget 2010 Assumption [Outstanding as of May, 2010]