The Influence of Status of Individual, Inland Revenue Service, and

Psychological Factor towards Tax Evasion in Indonesia

By:

Andrea Elok Horaga

Vania Kartika Sari

Wenny Kartika Susanto

President University

i

ABSTRACT

Tax is one of the financial burdens for the individuals because tax has to be paid to government

periodically. However, tax has become one of the important revenue streams for state expenditure,

both for regular expenditure and infrastructure development (Hanum, 2005). Based on the data in

2004, there was a tax deviation for IDR 40 trillion in Indonesia (Hanum, 2005). From the total

population of 220 million people in Indonesia, only 2,3 million people have the individual Tax

Identification Number (TIN). It shows that the level of people awareness to pay tax is still low.

Tax avoidance is different from tax evasion. According to Prebble & Prebble (2010), most of tax

evasion cases are regarded as criminal fraud. Therefore, tax evasion is an act against the law. Tax

evasion can be done by failing declare income, claiming deduction for expenses that were not

really incurred, and not lodging a tax return in an attempt to avoid paying tax (www.taxpayer.com,

2014). This research uses 3 factors as guiding variables inspired by Venter (2011) from his research

regarding tax evasion. Those 3 factors are status of individual, Inland Revenue service, and

psychological factor. Status of individual involves age, gender, marital status, education, and

income level. Inland Revenue service involves penalties, audits, and personal contact.

Psychological factor involves attitude, tax morale, and government. The researchers want to

investigate the influence of those 3 factors toward the tax evasion in Indonesia. The target

respondent is individual taxpayer (self-employed, entrepreneur) in Jababeka, Cikarang Baru,

Bekasi.

ii

TABLE OF CONTENTS

ABSTRACT ... i

TABLE OF CONTENT ... ii

LIST OF TABLES ... iii

LIST OF FIGURE ... iv

A. BACKGROUND OF THE STUDY ...1

B. LITERATURE REVIEW ...4

1. Status of Individual ...4

2. Inland Revenues Service ...5

3. Psychological Factors ...6

C. CONCEPTUAL FRAMEWORK ...8

D. RESEARCH DESIGN ...11

REFERENCES ...26

iii

LIST OF TABLES

Table 1 The Tax Gap in Indonesia ...2

Table 2 Developing Case Study Research Question ...14

Table 3 Types of Case Study Method ...15

Table 4 Overview of Triangulation Procedure ...20

iv

LIST OF FIGURE

1

A. BACKGROUND OF THE STUDY

Tax is one of the financial burdens for the individuals because tax has to be paid to government

periodically. However, tax has become one of the important revenue streams for state

expenditure, both for regular expenditure and infrastructure development (Hanum, 2005).

There are many types of tax, such as income tax, add value tax, etc. Tax can be classified based

on faction, characteristic, and collector institution. Based on the faction, tax is divided into 2

types, which are direct and indirect tax. Direct tax is a tax that has to be paid directly by the

taxpayer (such as income tax), while indirect tax means the tax can be burdened or shifted to

other people (such as value added tax). Based on the characteristic, tax is also divided into 2

types, which are subjective and objective tax. Subjective tax concerns on who pays the tax

(taxpayer), while objective tax concerns on the object instead on taxpayer (such as value added

tax). Based on collector institution, tax is also classified into 2 types, which are central tax and

regional tax. Central tax is collected by the central government to pay the state expenditure

(such as income tax, value added tax, etc.). Regional tax is a tax collected by regional

government to pay the regional expenditure. The regional tax itself is classified into province

tax (such as vehicle tax) and district/city tax (such as hotel tax, restaurant tax, etc.).

Nobody wants to pay tax voluntarily because tax will only reduce the individual economic

capability and profits. Most of the individual tax payers do not feel they are getting any mutual

benefits from paying certain amount of tax to the government. That is one of the reasons that

make most of individual taxpayers do tax evasion. However, tax has become one of the most

important revenue streams for the government to pay the state expenditure, both regular

expenditure and infrastructure development. People can reduce the amount of tax paid to the

state through tax avoidance. Tax avoidance does not against the law. Tax avoidance uses the

hole in taxation rules and regulations to reduce the amount to be paid. In contrast, tax evasion

is an act against the law. There are many reasons why people do not want to pay tax and choose

to do tax evasion, such as tax is considered as a burden, people do not trust the government,

irresponsible tax man, tax man can be easily bribed, no guarantee the tax will be used for the

2 lack of knowledge about the importance of tax for the people welfare, lack of information

about the tax, lack of people awareness to up to date the newest taxation rule and regulation,

weak control from the government, etc. (Sari, 2011).

Based on the data in 2004, there was a tax deviation for IDR 40 trillion in Indonesia (Hanum,

2005). From the total population of 220 million people in Indonesia, only 2,3 million people

have the individual Tax Identification Number (TIN). It shows that the level of people

awareness to pay tax is still low. People also do not believe that the government can manage

the tax money well since there is no published tax cash flow financial statement. Due to the

many corruption cases done by the tax man, such as Gayus Tambunan case, people become

more distrust the government. The control from the government regarding the taxation is still

weak. It can be seen from the tax deviation happened in Indonesia. Aside from that, there is no

sanction for those who do not pay the tax. Fuest and Riedel (2009) define the tax gap as the

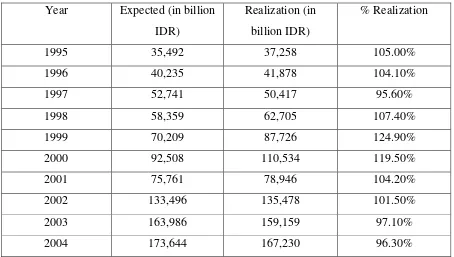

differences in total amount of revenue expected by the government and the realization amount collected by the government. The data of tax gap in Indonesia from year 1995 – 2004 can be seen through table 1.

Table 1

The Tax Gap in Indonesia

Year Expected (in billion

IDR)

3 Table 1 shows that from 2003 to 2004, the %realization is decreasing which means the tax gap

in Indonesia from 2003 to 2004 is widen. According to Prebble & Prebble (2010), most of tax

evasion cases are regarded as criminal fraud. In addition, Feinstein (1991) states when individual’s income level increase, the individual tends to do tax evasion. In his research regarding the tax evasion, Venter (2011) classified the factors that influence taxpayer’s decision to do tax evasion into 3 factors, which are status of individual and psychological factor.

Tax evasion can be done by failing declare income, claiming deduction for expenses that were

not really incurred, and not lodging a tax return in an attempt to avoid paying tax

(www.taxpayer.com, 2014). These 3 factors will be more thoroughly discussed in the next

4

B. LITERATURE REVIEW

During 2011, Venter conducted the research regarding factors influencing tax evasion in

Pretoria. Based on his research, it was found that there are 3 factors that influence people to do

tax evasion, which are status of individual, inland revenue services, and psychological factor.

1. Status of Individual

There are some factors with regard to the status of the individual influencing tax evasion

such as age, gender, marital status, education and income level.Feinstein (1991) states that

young people tend to increase tax evasion compared to the older taxpayer. This statement

was supported by Richardson (2006), who states that young taxpayers tend to live on the

edge and they are not easily scared by the punishment of tax authority (as cited by Venter,

2011). It means that the older the taxpayer becomes, the less the taxpayer is willing to take

the risk of getting caught. Feinstein (1991) also said that the older taxpayers to be less

likely to evade tax could be due to the additional exemption for 65 years old and above.

The additional exemption could be used to lower the tax amount payable or completely.

Some studies showed that gender play a role in whether to evade tax or not. Baldry (in

Venter, 2011) states generally men tend to evade tax more than women. This statement

was supported up by Torgler and Valev (2010) that women are more dependent and

compliant than men. Women tend to not agree to evade and avoid tax. Andreoni and

Vesterlund (2001) show that gender also influences some things such as negotiating, make

some family decision making and making a contribution and giving to charity.

Feinstein (1991) studied that marital status also influence the people’s decision in evading the tax. He states that married individuals prefer to evade tax than unmarried people. This

phenomena could be influenced by financial decision making in household. Clotfelter

(1983) also support with the statement that tax evasion would be taken by the taxpayer who

lives among other people which also does. If someone lives in and surrounded by

5 According to Feinstein (1991), tax evasion increases due to level of income. The income

level of taxpayers influence on their decision making process. Middle income taxpayers

prefer to be compliant with the tax regulation compared to both lower and higher income

taxpayers (Wille & Woodbury in Venter, 2009). Christian (in Slemrod, 2007) mention that

rich people are more likely to reduce their taxes through legal avoidance than people with

a lower income who will try some illegal evasion.

Education can be divided into two categories which are broad education and education in

taxation. Some studies found there is a negative association between broad education and

tax evasion. While education in taxation tend to increase the level of tax evasion as the

taxpayers could use their knowledge regarding taxation to evade tax successfully (Jackson

and Milliron in Venter, 2006).

Another factor is the source of income. Taxpayers who live depend on income will less

likely to evade the tax (Richardson, 2006 as cited by Venter, 2011). It seems to easier for

people to obey the role if they involved in farming activities or self-employed. This

statement is supported by Schmölder (in Venter, 2009) who state that the taxation would

not work in the country which has main activities such as farming and informal trading.

Allingham and Sandmo (in Venter, 2009) states that the taxpayer’s decision to obey and

compliant tax depends on the possibility of getting caught by doing illegal activity against

the expected advantage or profit the taxpayer could obtain from it. Slemrod (2007)

observes that the most influencing factors of tax evasion is the taxpayers’ probability of

getting caught and some punishment or penalties that is imposed for evading tax.

2. Inland Revenues Service

One of factors that influencing decision making of taxpayers is inland revenues. It consist

of marginal tax rate, detection, penalties and tax administration. Feinstein (1991) says that

the marginal tax rates cause the negative impact on tax compliance. It means that the higher

the marginal tax rate, the less taxpayers are to be compliant to pay tax. This statement was

6 negatively to tax rates and also, The Economist (in Lin & Yang, 2001) state that the best

strategy to reducing tax evasion is by lowering the tax rates (as cited Betherncourt & Kunze,

2013). Jackson and Milliron (in Venter, 2009) study that tax systems become more

complicated and this phenomena becomes the most significant determinants of tax evasion.

Various tax forms and the complication of the tax system are related due to underreporting

in non-business returns. (Feinstein 1991)

3. Psychological Factors

The fairness of taxes have a negative association with tax evasion (Jackson & Milliron in

Venter, 2009). This statement means that when the taxpayer feels being unfairly taxed, it

will lead to tax evasion. Sandmo (in Venter, 2009) mentions that the important things is

too understand the perceptions of the taxpayer, which will influence on the behavior of

other people. It was found that citizens in the USA were more compliant to tax laws than

citizens in Spain because of the higher norm (Alm & Torgler, 2006).

Another things that can influence tax evasion regarding psychological factors are tax

morale, the ethics of tax evasion, and religion. Those factors can affect the decision of

taxpayer. McGee (2006:17) states three different views on the ethics of tax evasion, they

are:

1. Never ethical to evade tax.

2. Always ethical or never unethical to evade tax.

3. Tax evasion might be ethical depends on the conditions and facts.

People may decide to avoid tax if they think that the government regulation and policy is incorrect (Andreoni in Slemrod, 2007). Dell’Anno (2009) also mentions the efforts and successes of government to lead and maintain some problems will affect the taxpayers view the government’s contribution and basically reduce tax evasion (as cited by Bethencourt & Kunze, 2013). The confidence of government has a positive effect on tax compliance. It

was proven by studies conducted in the USA and in Germany. A study found that a

7 services and effort of government are below average (Hanousek and Palda, in Slemrod,

8

C. CONCEPTUAL FRAMEWORK

Conceptual framework is a scheme of ideas, assumptions, beliefs and theories that supported

in this study. It explained the main things to be studied and the relationships between the things.

The conceptual framework was developed for some objectives: (a) classifying who will and

will not be involved in this study; (b) explaining the connections based on logic, theory or

experience; and (c) provide the basis for the researchers by getting the general construct

gathered into intellectual "bins" (Miles & Huberman, 1994).

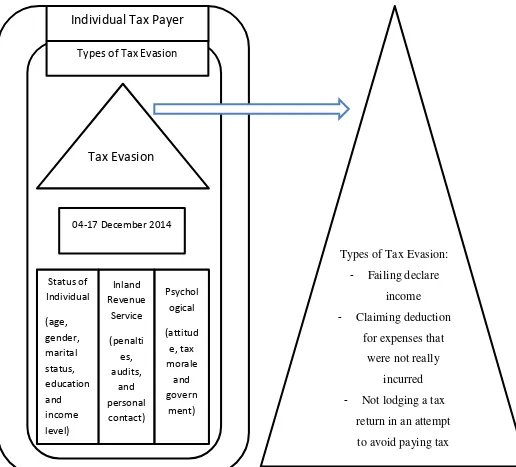

In this research, the researchers use conceptual framework to discuss the relations between

status individual, inland service, and psychological factor to tax evasion. The researchers

would like to know why and how individual taxpayers who are the target respondents evade

the tax. To find the answer, the researchers use 3 factors which are status of individual, Inland

Revenue service, and psychological factor as the basis questions. Status of individual involves

age, gender, marital status, education, and income level of the target respondents. Inland

Revenue service involves the penalties, audits, and personal contact from the tax man. Last but

not least is psychological factor which involves attitude, tax morale, and feeling about

government from target respondent’s perspective. The research was conducted from 4-17

10 Andreoni, J., et. al. (1998) says that a younger age tax payer is liable to enhance tax evasion

compared to the older. Other researcher had also proven it. Richardson (2006) says that

younger tax payer tends to live on the edge and they are not smoothly frightened by the penalty

inflicted by the tax authority (as cited by Venter, 2011). This study will try to settle the factors

influences status individuals on tax evasion. The result of this research will show the relations

between statuses of individual towards tax evasion.

Some people will avoid taxes if the notification of the evasion tends to be strict as also the

penalties (Fjeldstad & Semboja, 2001). The statement also supported by Gcabo and Robinson

(2007) who states that the proceeds of the detection and penalties inflicted were classified as

an important factor to avoiding tax or not. However tax evasion is a breakdown of the

government regulation (Sandmo, 2005). The result of this research will show the relations

between Inland Revenue services towards tax evasion.

It has been proven by Kusumawati (2005) that an obedience for paying taxes is affected by the

belief that owned by a person. If someone has a negative understanding about taxes, he or she

will have a negative intention about paying taxes and avoid to paying tax. In line with the

statement, Hidayat & Nugroho (2010) says that people who considered taxes as an important

and giving a lot of profit, he or she will have a positive attitude towards taxes and would be

obliged to pay taxes. Moreover, Andreoni, J., et. al. (1998) has proven that a person possibly

come to avoiding taxes if he or she expect that the government regulation is inaccurate. The

11

D. RESEARCH DESIGN

Qualitative research method points with powerful contact directly to the respondents by

interviewing which groups, societies, and organization illustrating the real life of respondents

(Miles & Huberman, 1994). According to Amaratunga et al. (2002), this type of research

method studies permit to declare the real situation in the real life. The data from this research

method has many varieties of respondent comments that can show the researchers more ideas.

However, it takes time to read all the comments or statements one by one. Furthermore,

qualitative research method study is used exactly for invention.

Most exploratory research designs produce qualitative data which are not characterized by

numbers and instead are textual, visual, or oral. The focus of qualitative research is not on

numbers but on stories, visual portrayals, meaningful characterizations, interpretations, and

other expressive descriptions (Zikmund & Babin, 2010). Exploratory research, which often

involves qualitative methods, can be an essential first step to a more rigorous, conclusive,

confirmatory study by reducing the chance of beginning with an inadequate, incorrect, or

misleading set of research objectives.

According to Zikmund & Babin (2010), qualitative research design has 4 types of basic

categories of orientation, which are:

1. Phenomenology

Phenomenology is originating in philosophy and psychology. Phenomenology is a

philosophical approach to studying human experiences based on the idea that human

experience itself is inherently subjective and determined by the context in which people

live.

2. Ethnography

Ethnography is originating in anthropology. Ethnography represents ways of studying

cultures through methods that involve becoming highly active within that culture.

Ethnography usually involves participant-observation for concept-testing.

Participant-observation means the researcher becomes involved within the culture that he or she is

12 3. Grounded theory

Grounded theory is originating in sociology. Grounded theory represents an inductive

investigation in which the researcher poses questions about information provided by

respondents or taken from historical records; the researcher asks the questions to him or

herself and repeatedly questions the responses to derive deeper explanations.

4. Case studies

Case studies are originating in psychology and in business research. Case studies are the

documented history of a particular person, group, organization, or event. Case studies are

the most appropriate for a qualitative approach designed to better define a marketing

situation in business before conducting a confirmatory research.

Case studies are defined as the research conditions where the number of interest variables far

exceeds the number of data points (Yin, 1994). The data collection in the case study method

are collected by multiple means and consist of qualitative research techniques such as

document analysis, interviews, various modes of observation, including ethnographical and

anthropological strategies as well as the use of quantitative data (Benbasat, 1984; Yin, 1994).

As such, case studies enable researchers to study contemporary phenomena in a real-life

condition where boundaries between phenomenon and context tend to be blurred (Yin, 1994;

Stake, 1995). The most influential model used to confirm the rigor of case study research called as “natural science model” (Eisenhardt & Graebner, 2007). According to this model, natural science is the ideal of social science which can try to emulate. The natural science model

groups a number of research actions under four criteria: construct validity, internal validity,

external validity and reliability (Cook & Campbell, 1979).

Construct Validity

The construct validity refers to the extent to which a study observes what it claims to observe,

for example the extent to which a procedure leads to an accurate reality-observation (Denzin

& Lincoln, 1994). The main obstacles for case study researchers is to develop a

well-considered set of actions, rather than using the subjective judgments (Yin, 1994). Construct

validity and this objective knowledge represents the one criterion where definition,

13 literature provides the concrete research actions which need to be considered for ensuring

construct validity. The main strategies have been suggested they are triangulate (adopt different

point of view and angles to look at the same phenomenon) by using different data sources and

different collection strategies (Stake, 1995; Yin, 1994) and to establish a clear chain of

evidence as the purpose to allow the reader to reconstruct research from the initial research

questions to final conclusions (Yin, 1994). The example of triangulate using different data

source such as archival sources, interview data, and participatory or direct observation.

Internal Validity

Internal validity also called as “logical validity” (Cook & Campbell, 1979; Yin, 1994) and it refers to the causal relationships between variables and result of research. Same with construct

validity which relevant during the data collection phase, internal validity also applies mainly

to the data analysis phase, even though many decisions of it are made in the design phase (Yin,

1994). Here, the issue is whether the researcher manages to construct a plausible causal

argument which strong enough to defend the research conclusions.

External Validity

External validity is grounded in the intuitive belief that theories must be shown to interpret for

phenomena. Neither single nor multiple case studies gives allow for statistical generalization

such as inferring conclusions about a population (Yin, 1994). The key is the differentiation

between statistical generalization and analytical generalization. Statistical generalization refers

to the generalization from observation to the population, while analytical generalization is a

process that refers to the generalization from empirical observations to theory (Yin, 1994).

Eisenhardt (1989) argued that case studies can be a starting point for theory development and

suggests a cross-case analysis involving from 4 - 10 case studies may provide a sound basis

for analytical generalization. Instead of conducting and analyzing multiple case studies of

different organizations, researchers may also conduct different case studies within one

organization (Yin, 1994). The rationale for the selection of a case study should also be reported.

14 case study selection, and details on the case study context in order to allow the reader to appreciate the researchers’ sampling choices (Cook & Campbell 1979).

Reliability

Reliability refers to the absence of random error, enabling subsequent researchers to arrive at

the same insights if they conducted the study along the same steps again (Denzin & Lincoln, 1994). Silverman defines reliability as “the degree of consistency with which instances are assigned to the same category by different observers or different occasions” (Silverman, 2005). With regard to interview data, Silverman suggests a number of means for increasing reliability,

including: tape-recording, face-to-face interviews, transcribing these tapes, use of fixed-choice

answers. The main key of reliability are transparency and replication. Transparency can be

ensured through strategies such as documentation and clarification of research procedures.

Authors are also encouraged to make reference to a case study database such as preliminary

conclusions, interview transcripts and the narratives collected during the study (Yin 1994).

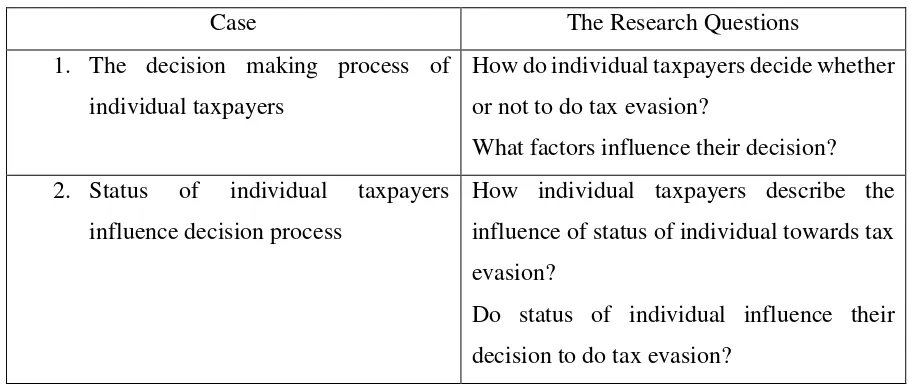

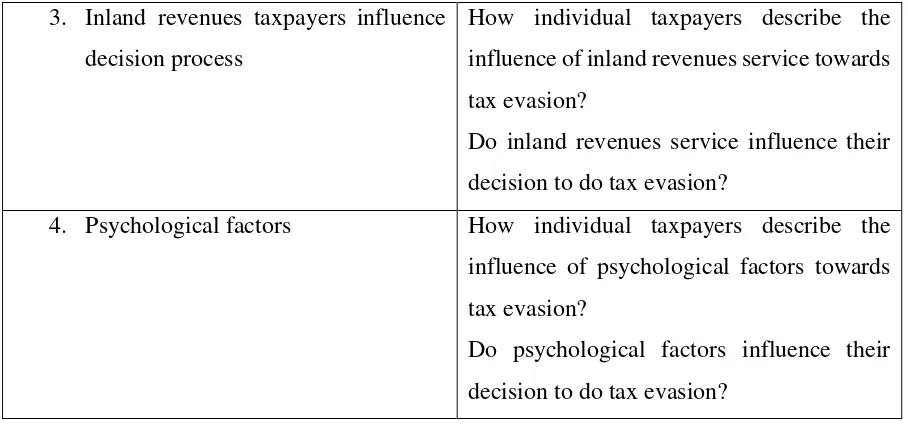

Determining the Case

Table 2

Developing Case Study Research Question

Case The Research Questions

1. The decision making process of

individual taxpayers

How do individual taxpayers decide whether

or not to do tax evasion?

What factors influence their decision?

2. Status of individual taxpayers

influence decision process

How individual taxpayers describe the

influence of status of individual towards tax

evasion?

Do status of individual influence their

15 3. Inland revenues taxpayers influence

decision process

How individual taxpayers describe the

influence of inland revenues service towards

tax evasion?

Do inland revenues service influence their

decision to do tax evasion?

4. Psychological factors How individual taxpayers describe the

influence of psychological factors towards

tax evasion?

Do psychological factors influence their

decision to do tax evasion?

Table 3

Types of Case Study Method

Case Study Type Definition

Explanatory This type of case study would be used if you

were looking for to answer a question that

needed to explain the presumed causal links

in real-life interventions which are too

complex for the survey or experimental

strategies. The explanations would link

program implementation with program

effects (Yin, 2003).

Exploratory This type of case study is used for exploring

some situations in which the intervention

being evaluated has no clear, single set of

16 Multiple-case studies A multiple case study enables the researcher

to explore differences within and between

cases. The goal is to replicate findings across

cases. Because comparisons will be drawn, it

is imperative that the cases are chosen

carefully so that the researcher can predict

similar results across cases, or predict

contrasting results based on a theory (Yin,

2003).

Intrinsic Stake (1995) uses the term intrinsic and

suggests that researchers who have a genuine

interest in the case should use this approach

when the purpose is to better understand the

case. The case represents other cases it

illustrates a particular trait or problem, but

because in all its particularity and

ordinariness, the case itself is of interest. The

purpose is not to come to understand some

abstract construct or generic phenomenon

17 Instrumental This type is used to accomplish something

other than understanding a particular

situation. It provides insight into an issue or

helps to repair a theory. The case is of

secondary interest; it plays a supportive role,

facilitating the understanding of something

else. The case is often looked at in depth, its

contexts scrutinized, its ordinary activities

detailed, and because it helps the researcher

pursue the external interest. The case may or

may not beseen as typical of other cases

(Stake, 1995).

Collective Collective case studies are similar in nature

and description to multiple case studies (Yin,

2003).

Source: Baxter & Jack, 2008.

For this qualitative research, the researchers use descriptive – explanatory case study. The reason

is because the researchers describe respondent profile before asking for further questions. As for

explanatory, researchers try to look for the answers of the questions in real-life interventions which

are too complex for the survey or experimental strategies regarding tax evasion in Indonesia.

Research Methodology

1. Sampling Size

Researchers used case study methods and it requires one case or one person (Miles and

Huberman, 1994). After considering some aspects, researchers choose 5 person to find the

best results.

2. Target Respondent

18 (2014), Indonesia had experienced difficulties in collecting income tax from individual tax

payers. Only 40% of individual taxpayers are registered in Indonesia.

3. Research Location and Time Framework

The research will be conducted in Jababeka, Cikarang Baru, Bekasi on 4 – 17 December

2014.

4. Research Technique

Researchers use depth interview during the research. A depth interview is a face-to-face

interview between a highly-skilled researcher and respondent. Depth interviews are similar

with a psychological and clinical interview, while it has a different purpose.

Concepts of Triangulation

Gliner (1994) defines triangulation as a method of highest priority in determining internal validity

in qualitative research (as cited by Meijer, et. al., 2002). Miles and Huberman (1994) classified

triangulations into 5 types:

1. Triangulation by data source

It means the data is collected from different person, different place, and different time.

2. Triangulation by method

It means the data is collected through different method, such as observation, interviews,

documents, etc.

3. Triangulation by researcher

It means the data will be compared to the reliability data in quantitative research done by other

researchers.

4. Triangulation by theory

It means the result will be explained by using different theories.

5. Triangulation by data type

It means the data is classified into quantitative, qualitative, or the mix of quantitative and

qualitative.

In this qualitative research, the researchers use triangulation by data source which means the

researchers interview 5 different respondents at different place and different time. The research

19 different place and different time and then do a one-on-one interview using the guiding questions.

The interview process is recorded using tape recorder for the evidence of reliability test. After done with the interview, the researchers rewrite the points according to respondent’s answer and then confirm the answers to the respondent. After choosing the triangulation type, the next step is to do

data analysis.

According to Smaling (1987) as cited by Meijer, et. al. (2002), there are 3 approaches to the

analysis of qualitative data, which are:

1. Intuitive approach

This approach means the researcher relates the data from various instruments to each other.

2. Procedural approach

This approach means the researcher focuses on documenting each step that is taken in the

triangulation by data source procedure and make it transparent and replicable.

3. Intersubjective approach

This approach means the group of researchers tries to reach agreement about steps to be taken

in the triangulation by data source

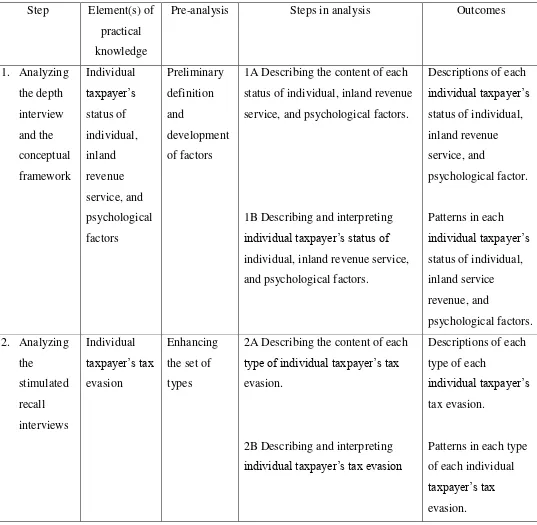

20 Table 4

Overview of the Triangulation Procedure

Step Element(s) of

practical

knowledge

Pre-analysis Steps in analysis Outcomes

1. Analyzing

1A Describing the content of each

status of individual, inland revenue

service, and psychological factors.

21

3A Describing the content of each factors of individual taxpayer’s status of individual, inland revenue

service, and psychological factors

tax evasion, and consulting the

result to the experts (tax planner)

Descriptions of each

Step 1: Analyzing the depth interview and the conceptual framework

The analysis of data involved a preliminary definition of categories and two stages of actual data

analysis. Once the researchers establish and define the categories, the data could be used for the

three stages in the process of actual data analysis. Those three stages involve:

1. The preliminary definition and development of categories

The goal of this stage is to establish categories that could be used both to describe the data and

serve as a basis for the analysis. The preliminary stage began with an intensive reading for the literature review and study of all the individual taxpayer’s answer as the data gained from conducting depth interview and conceptual framework. The researchers want to find out

whether the 3 factors (status of individual, inland service revenue, and psychological factor)

22 describe the factors influencing individual taxpayer’s tax evasion in Jababeka, Cikarang Baru, Bekasi, and also could identify the differences the influences from each factor.

2. Stage A of the Step-One analysis

Stage 1A in the analysis consists of a close examination of each factor that influences the decision of individual taxpayer’s tax evasion separately. The descriptions of 5 respondents’ answer are compared and then summarized. The description in this step emphasizes the

similarities and differences within each of 3 factors towards the decision of individual taxpayer’s tax evasion.

3. Stage B of the Step-One analysis

Stage 1B in the analysis is to find the similarities and differences from the answer of each factor that influence the decision of individual taxpayer’s tax evasion. Pattern is referring to the groups associated statements that give insight (a) into the way individual taxpayer’s status of individual, inland revenue service, and psychological factor are interviewed, and (b) into

the similarities and differences in status of individual, inland revenue service, and

psychological factor of individual taxpayer.

Step 2: Analyzing the Stimulated Recall Interviews

Step 2 has the purpose to gain insight into the decision and type of tax evasion done by individual

taxpayer. The procedure on this step is also divided into 3 stages which are:

1. Enhancing the set of type

Based on the relationships between individual taxpayer’s status of individual, inland revenue service, and psychological factor towards the decision of individual taxpayer’s tax evasion as described in previous section, the researchers started the study of the individual taxpayer’s tax

evasion with the 3 types of tax evasion. To establish and find to what extent those 3 types of tax evasion influence the decision of individual taxpayer’s tax evasion, the researchers read the stimulated-recall transcripts and compared the types to these data in order to assess the data

validity, reformulate the types or generated new types from the data, return to the data to assess

the validity, and went on doing so until the type match the data satisfactory. The researchers

23 deduction for expenses that were not really incurred; and not lodging a tax return in an attempt

to avoid paying tax.

2. Stage A of Step-Two analysis

Stage 2A in the process requires an in-depth analysis of each the 3 factors (status of individual,

inland revenue service, and psychological factor). In order to describe the variety and range of the decision of individual taxpayer’s tax evasion in each of the factor, each factor is divided into subcategories. Status of individual is divided into age, gender, marital status, education,

and income level. Inland revenue service is divided into penalties, audits, and personal contact.

Psychological factors are divided into attitude, moral, and government. The researchers can

gain more detailed insights and describe the data more detailed by using those subcategories in researching the decision of individual taxpayer’s tax evasion in each category.

3. Stage B of Step-Two analysis

The researchers want to find out whether and in what way the subcategories are related to each

other, so the researchers needs to describe the relationships between subcategories for each

respondent. Therefore, the second main stage in the analysis procedure (stage 2B) consists of

a close examination of the relationship between the subcategories. The researchers want to identify the pattern in individual taxpayer’s tax evasion, each of which indicated the relationship between subcategories of 3 factors and 3 types of tax evasion.

Step 3: Combining Results of the Previous Steps

The purpose of the step 3 (final step) is to match the results of the analysis of the data provided by

3 independent variables (status of individual, inland revenue service, and psychological factor) and

1 dependent variable (type of tax evasion) used in the previous steps for getting a deeper level of insight into decision of individual taxpayer’s tax evasion. This final step also involves 3 stages which are:

1. Establishing the final set of factors

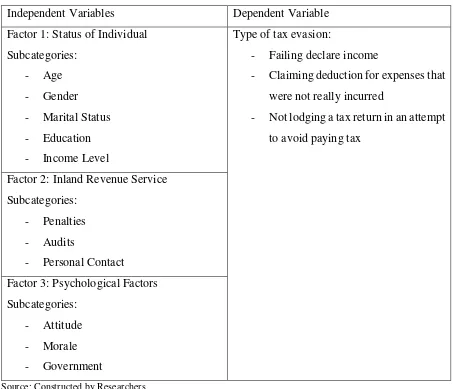

24 Table 5

Classification of Factors

Independent Variables Dependent Variable

Factor 1: Status of Individual

Subcategories:

- Claiming deduction for expenses that

were not really incurred

- Not lodging a tax return in an attempt

to avoid paying tax

Factor 2: Inland Revenue Service

Subcategories:

2. Stage A of the Final-Step analysis

This stage has purpose to describe the answers from each respondent regarding the independent variables and dependent variable. A comparison of each respondent’s answer is summarized based on the factors.

3. Stage B of the Final-Step analysis

Stage B has purpose to gain a comprehensive insights into the decision of individual taxpayer’s

25 The results are also consulted to the experts (tax planner) to find out whether the answer from

26

REFERENCES

BOOKS

Bethencourt, C. & Kunze, L. (2013). Tax evasion, social norms and economic growth. TU Dortmund: Universidad de La Laguna.

Cook, T. D. & Campbell, D. T. (1979). Quasi-Experimental design: Design and Analysis Issues for Field Settings. Skokie, Il: Rand McNally.

Denzin, N. K. & Lincoln, Y. S. (1994). Handbook of qualitative research. Thousand Oaks & London: Sage.

Hanum, A. N. (2005). Permasalahan Pajak Indonesia. Semarang: Fakultas Ekonomi Universitas Muhammadiyah Semarang.

Meijer, P. C., Verloop, N., & Beijaard, D. (2002). Multi-Method Triangulation in a Qualitative

Study on Teachers’ Practical Knowledge: An Attempt to Increase Internal Validity. Netherlands: Leiden University.

Miles, M. B. & Huberman, A. M. (1994). Qualitative data analysis: An expanded source book (2nd ed.). Thousand Oaks, CA:Sage.

Silverman, D. (2005). Doing qualitative research. London: Sage.

Stake, R. E. (1995). The art of case study research. Thousand Oaks: Sage.

Yin, R. K. (2003). Case Study Research: Design and Methods (3rd ed.). Thousand Oaks, CA: Sage.

JOURNALS

Alm, J. & Torgler, B. 2006. Culture Differences and Tax Morale in the United States and Europe. Journal of Economic Psychology, 27(2).

Andreoni, J & Vesterlund, L. (2001). Which is the Fair Sex? Gender Differences in Altruism. Quarterly Journal of Economics, 116.

Andreoni, J., et. al. (1998). Tax Compliance, Journal of Economic Literature.

Baxter, P. & Jack, S. (2008). Qualitative Case Study Methodology: Study Design and Implementation for Novice Researchers. The Qualitative Report, 13(4), 544-559.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532-550.

27 Fuest, C. & Riedel, N. (2009). Tax evasion, tax avoidance and tax expenditures in developing countries: A review of the literature. Oxford University Centre for Business Taxation, June 2009, 1 – 77.

Gcabo, R. & Robinson, Z. (2007). Tax compliance and behavioral response in South Africa: an alternative investigation. South African Journal of Economic and Management Sciences, 10(3), 357 – 370.

Hidayat, W. & Nugroho, A.A. (2010). Kewajiban Moral pada Perilaku Ketidakpatuhan Pajak Wajib Pajak Orang Pribadi, Journal Fakultas Ekonomi, Universitas Erlangga.

Kusumawati, I. (2005). Analisis Perilaku Wajib Pajak Orang Pribadi. Simposium Riset Ekonomi II.

McGee, R.W. (2006). Three Views on the Ethics of Tax Evasion. Journal of Business Ethics, 67(1).

Prebble, Z. & Prebble, J. (2010). The morality of tax avoidance. Creighton Law Review, 43 (3), 693 – 745.

Sandmo, A. (2005). The theory of tax evasion: a retrospective view. National Tax Journal, 58(4), 643 – 663.

Slemrod, J. (2007). Cheating Ourselves: The Economics of Tax Evasion. Journal of Economic Perspectives, 21(1).

Torgler, B. & Valev, N.T. (2010). Gender and Public Attitudes toward Corruption and Tax. Contemporary Economic Policy, 28.

Venter, J. H. (2011). FACTORS INFLUENCING TAX EVASION. Pretoria: University of Pretoria.

WEBSITES

Sari, E. N. (2011). Faktor-Faktor yang mempengaruhi tingkah laku WP dalam melaksanakan kewajibannya. Retrieved at 11th December 2014, from http://emilianovitasari.blogspot.com/2011/04/faktor-faktor-yang-mempengaruhi-tingkah. html

28

APPENDIX

Guiding Questions:

I. Respondent Profile

1. What is your name?

2. How old are you?

3. What is your occupation?

4. Are you married?

5. What is your last education background?

6. How much is your income level? Above 5 million or below that?

II. Types of Tax Evasion

7. There are some types of tax evasion such as failing declare income, claiming

deduction for expenses, and not lodging tax return.

8. Have you ever done tax evasion? Why?

9. What type of tax evasion did you do? Why?

10.What factors influence your decision making to evade the tax?

III. Status of Individual Factors

11.There is an observation which relates age and tax evasion and mentions that young

taxpayers tend to evade the tax because they live on the edge and they are not easily

scared by the punishment of tax authority. Do you agree with this statement? Is

there any consideration between age and tax evasion?

12.There is statement that women are more dependent and compliant to pay tax

compared than men. Do you agree? What is your opinion regarding this statement?

13. You know that marriage people have different financial decision making compared

than single people. Is this phenomena also influence their decision making

regarding evading the tax?

29 15.Based on your observation from your friends, colleagues, family and acquaintances,

do the higher their income level is will make them evade the tax? Which income

level will lead them to evade the tax? Above 5 million or below 5 million?

IV. Inland Revenues Service

Prolog: in our research, we found factors influencing tax evasion, including inland

revenues service. It consist of penalties, audits and personal contacts. Do you familiar

with those terms? If yes, we may ask you to the next questions:

16.Do you think by imposing penalties for evading the tax would influence the

decision of tax evasion? Why?

17.Do you think low quality and seldom audits from tax office would influence the

decision of tax evasion? Why?

18.Do you think personal contact with the tax man influence the decision of tax

evasion? Why?

V. Psychological Factors

19.There is statement said that when the taxpayer feels being unfairly taxed, it will lead to tax

evasion. What is your opinion regarding this statement? Is there any relation between being

unfairly taxed and tax evasion?

20.Based on your observation from your surroundings, do you think the morale of

taxpayers and compliant to religion would influence the decision making of tax

evasion? Why?

21.Do you think weak control from the government would influence the decision of