Chapter 2

2

Introduction

• Many management decisions involve trying to make the most effective use of an organization’s resources.

• Resources typically include machinery, labor, money, time, warehouse space, or raw materials.

• Resources may be used to produce products (such as

machinery, furniture, food, or clothing) or services (such as schedules for shipping and production, advertising policies, or investment decisions).

• Linear programming (LP) is a widely used mathematical technique designed to help managers in planning and

decision making relative to resource allocation.

• Despite the name, linear programming, and the more general category of techniques called “mathematical programming”, have very little to do with computer programming.

• In the world of Operations Research, programming refers to

modeling and solving a problem mathematically.

Most of the deterministic OR models can be formulated as mathematical programs.

"Program," in this context, has to do with a “plan,” not a computer program.

General form of Linear programming model

Maximize / Minimize z = f(x1, x2 ,…, xn)

Subject to

{

}

b i i =1,…,m

xj ≥ 0, j = 1,…,n

Linear Programming Model

4

• xj are called decision variables. These are

things that you control and you want to determine its values

{

}

biare called structural

(or functional or technological) constraints

• xj ≥ 0 are nonnegativity constraints

Model Components

• f(x1, x2 ,…, xn) is the objective function

Example: Giapetto woodcarving Inc.,

• Giapetto Woodcarving, Inc., manufactures two types of wooden toys: soldiers and trains. A soldier sells for $27 and uses $10 worth of raw materials. Each soldier that is manufactured increases Giapetto’s variable

labor and overhead cost by $14. A train sells for $21 and uses $9 worth of raw materials. Each train built increases Giapetto’s variable labor and overhead cost by $10. The manufacture of wooden soldiers and

trains requires two types of skilled labor: carpentry and finishing. A soldier requires 2 hours of finishing labor and 1 hour of carpentry labor. A train requires 1 hour of finishing and 1 hour of carpentry labor. Each week, Giapetto can obtain all the needed raw material but only 100 finishing hours and 80 carpentry hours. Demand for trains is unlimited, but at most 40

soldiers are bought each week. Giapetto wants to maximize weekly profit. Formulate a linear

6

Solution: Giapetto woodcarving Inc.,

• Step 1: Model formulation

1. Decision variables: we begin by finding the

decision variables. In any LP, the decision variables should completely describe the decisions to be made. Clearly, Giapetto

must decide how many soldiers and trains should be manufactured each week. With this in mind, we define:

X1 = number of soldiers produced each

week

X2 = number of trains produced each

7

Solution: Giapetto woodcarving Inc.,

2. Objective function: in any LP, the decision

maker wants to maximize (usually revenue or profit) or minimize (usually costs) some function of the decision variables. The

function to be maximized or minimized is called the objective function. For the

Giapetto problem, we will maximize the net profit (weekly revenues – raw materials cost – labor and overhead costs).

Weekly revenues and costs can be expressed in terms of the decision variables, X1 and X2

8

Solution: Giapetto woodcarving Inc.,

• Weekly revenues = weekly revenues from soldiers + weekly revenues from trains

= 27 X1 + 21 X2

Also,

Weekly raw materials costs = 10 X1 + 9 X2

Other weekly variable costs = 14 X1 + 10 X2

Therefore, the Giapetto wants to maximize:

(27 X1 + 21 X2) – (10 X1 + 9 X2) – (14 X1 + 10 X2)

= 3 X1 + 2 X2

Hence, the objective function is:

Solution: Giapetto woodcarving Inc.,

3. Constraints: as X1 and X2 increase,Giapetto’s objective function grows larger. This means that if Giapetto were free to

choose any values of X1 and X2, the

company could make an arbitrarily large profit by choosing X1 and X2 to be very

large. Unfortunately, the values of X1 and X2

are limited by the following three

restrictions (often called constraints):

Constraint 1: each week, no more than 100

hours of finishing time may be used.

Constraint 2: each week, no more than 80

hours of carpentry time may be used.

Constraint 3: because of limited demand, at

10

Solution: Giapetto woodcarving

Inc.,

• The three constraints can be expressed in terms of the decision variables X1 and X2 as

follows:

Constraint 1: 2 X1 + X2 100

Constraint 2: X1 + X2 80

Constraint 3: X1 40

Note:

The coefficients of the decision variables in the constraints are called technological

coefficients. This is because its often reflect

the technology used to produce different

products. The number on the right-hand side of each constraint is called Right-Hand Side

(RHS). The RHS often represents the quantity

11

Solution: Giapetto woodcarving Inc.,

• Sign restrictions: to complete the formulation

of the LP problem, the following question

must be answered for each decision variable: can the decision variable only assume

nonnegative values, or it is allowed to

assume both negative and positive values?

If a decision variable Xi can only assume a

nonnegative values, we add the sign

restriction (called nonnegativity constraints) Xi 0.

If a variable Xi can assume both positive and negative values (or zero), we say that Xi is

unrestricted in sign (urs).

12

Solution: Giapetto woodcarving Inc.,

• Combining the nonnegativity

constraints with the objective function

and the structural constraints yield the

following optimization model (usually

called LP model):

Max Z = 3 X1 + 2 X2 (objective function)

subject to (st)

2 X1 + X2 100 (finishing constraint)

X1 + X2 80 (carpentry constraint)

X1 40 (soldier demand constraint)

X1 0 and X2 0 (nonnegativity constraint)

The optimal solution to this problem is :

13

What is Linear programming

problem (LP)?

• LP is an optimization problem for which we do the

following:

1. We attempt to maximize (or minimize) a linear

function of the decision variables. The function that is to be maximized or minimized is called objective function.

2. The values of decision variables must satisfy a set of constraints. Each constraint must be a linear

equation or linear inequality.

3. A sign restriction is associated with each variable. for any variable Xi, the sign restriction specifies

either that Xi must be nonnegative (Xi > 0) or that Xi

14

Linear Programming Assumptions

(i) proportionality

(ii) additivity linearity

(iii) divisibility

(i) activity j’s contribution to objective function is

cjxj

and usage in constraint i is aijxj

both are proportional to the level of activity j

(volume discounts, set-up charges, and nonlinear efficiencies are potential sources of violation)

(ii) “cross terms” such as x1x5 may not appear in the objective or constraints.

16

(iii) Fractional values for decision variables are permitted

(iv) Data elements aij , cj , bi , uj are known with certainty

• Nonlinear or integer programming models should be used when some subset of assumptions (i), (ii) and (iii) are not satisfied.

• Stochastic models should be used when a problem has significant uncertainties in the data that must be explicitly taken into account [a relaxation of assumption (iv)].

Applications Of LP

1. Product mix problem 2. Diet problem

3. Blending problem

4. Media selection problem 5. Assignment problem

6. Transportation problem

7. Portfolio selection problem 8. Work-scheduling problem

9. Production scheduling problem 10. Inventory Problem

18

1. Product Mix Problem

Example

Formulate a linear programming model for this problem, to determine how many containers of each product to produce tomorrow in order to maximize the profits. The company makes four types of juice using orange, grapefruit, and

pineapple. The following table shows the price and cost per quart of juice (one container of

juice) as well as the number of kilograms of fruits required to produce one quart of juice.

Product Price/quart Cost/quart Fruit needed

Orange juice 3 1 1 Kg.

Grapefruit juice 2 0.5 2 Kg.

Pineapple juice 2.5 1.5 1.25 Kg.

Example (cont.)

On hand there are 400 Kg of orange, 300 Kg. of grapefruit, and 200 Kg. of pineapples.

The manager wants grapefruit juice to be used for no more than 30 percent of the

number of containers produced. He wants the ratio of the number of containers of orange

juice to the number of containers of pineapples juice to be at least 7 to 5.

pineapples juice should not exceed one-third of the total product.

20

Product Mix Problem

Solution

Decision variables

X1 = # of containers of orange juice X2 = # of containers of grapefruit juice X3 = # of containers of pineapple juice X4 = # of containers of All-in-one juice Objective function

Ratio of orange to pineapple Max. of pineapple

21

2. Diet problem

Example

My diet requires that all the food I eat come from one of the four “basic food groups” (chocolate cake, ice cream, soda, and cheesecake). At present, the

following four foods are available for consumption: brownies, chocolate ice cream, cola, and pineapple cheesecake. Each brownie costs 50 cents, each

scoop of chocolate ice cream costs 20 cents, each bottle of cola costs 30 cents, and each piece of

pineapple cheesecake costs 80 cents. Each day, I must ingest at least 500 calories, 6 oz of chocolate, 10 oz of sugar, and 8 oz of fat. The nutritional

content per unit of each food is shown in the

following table. Formulate a linear programming model that can be used to satisfy my daily

22

Diet problem

Calories Chocolat

e Sugar Fat

Brownie 400 3 ounce 2 ounce 2 ounce

Chocolate ice cream (1 scoop)

200 2 2 4

Cola (1 bottle) 150 0 4 1

Pineapple cheesecake

23

Diet

problem

Solution

• Decision variables: as always, we begin by

determining the decisions that must be made by the decision maker: how much of each

food type should be eaten daily. Thus, we define the decision variables:

X1 = number of brownies eaten daily

X2 = number of scoops of chocolate ice cream

eaten daily

X3 = number of bottles of cola drunk daily

X4 = number of pieces of pineapple cheesecake

24

Diet problem

• Objective function:

my objective

function is to minimize the cost of my

diet. The total cost of my diet may be

determined from the following relation:

Total cost of diet = (cost of brownies) +

(cost of ice cream) + (cost of cola) +

(cost of cheesecake)

Thus, the objective function is:

25

Diet problem

• Constraints: the decision variables must satisfy the following four constraints:

Constraint 1: daily calorie intake must be at least 500 calories.

Constraint 2: daily chocolate intake must be at least 6 oz.

Constraint 3: daily sugar intake must be at least 10 oz.

Constraint 4: daily fat intake must be at least 8 oz. To express constraint 1 in terms of the decision

variables, note that (daily calorie intake) = (calorie in brownies) + (calories in chocolate ice cream) +

(calories in cola) + (calories in pineapple cheesecake) Therefore,

the daily calorie intake = 400 X1 + 200 X2 + 150 X3 +

500 X4 must be greater than 500 ounces

26

Diet problem

The four constraints are:

400 X

1+ 200 X

2+ 150 X

3+ 500 X

4

500

3 X

1+ 2 X

2

6

2 X

1+ 2 X

2+ 4 X

3+ 4 X

4

10

2 X

1+ 4 X

2+ X

3+ 5 X

4

8

Nonnegativity constraints:

it is clear that

all decision variables are restricted in

sign, i.e., X

i

0, for all i = 1, 2, 3, and

Diet problem

• Combining the objective function,

constraints, and nonnegativity constraints, the LP model is as follows:

Min Z = 50 X1 + 20 X2 + 30 X3 + 80 X4

st.

400 X1 + 200 X2 + 150 X3 + 500 X4 500

3 X1 + 2 X2 6

2 X1 + 2 X2 + 4 X3 + 4 X4 10

2 X1 + 4 X2 + X3 + 5 X4 8

Xi 0, for all i = 1, 2, 3, and 4

The optimal solution to this LP is X1 = X4 = 0,

28

3. Blending problem

Example

The Low Knock Oil company produces two grades of cut rate gasoline for industrial distribution. The grades, regular and economy, are

produced by refining a blend of two types of crude oil, type X100 and type X220. each crude oil differs not only in cost per barrel, but in composition as well. The accompanying table indicates the

percentage of crucial ingredients found in each of the crude oils and the cost per barrel for each. Weekly demand for regular grade of Low Knock gasoline is at least 25000 barrels, while demand for the

economy is at least 32000 barrels per week. At least 45% of each barrel of regular must be ingredient A. At most 50% of each barrel of economy should contain ingredient B. the Low Knock management must decide how many barrels of each type of crude oil to buy each week for blending to satisfy demand at minimum cost .

Crude oil

type Ingredient A % Ingredient B % Cost/barrel ($)

X100 35 55 30

Blending problem

Solution

Let

X1 = # of barrels of crude X100 blended to produce the refined regular

X2 = # of barrels of crude X100 blended to produce the refined economy

X3 = # of barrels of crude X220 blended to produce the refined regular

X4 = # of barrels of crude X220 blended to produce the refined economy

Min Z = 30 X1 + 30 X2 + 34.8 X3 + 34.8 X4

St.

X1 + X3 25000

X2 + X4 32000

-0.10 X1 + 0.15 X3 0

0.05 X2 – 0.25 X4 0

Xi 0, i = 1, 2, 3, 4

The optimal solution is: X1 = 15000, X2 = 26666.6, X3 = 10000,

30

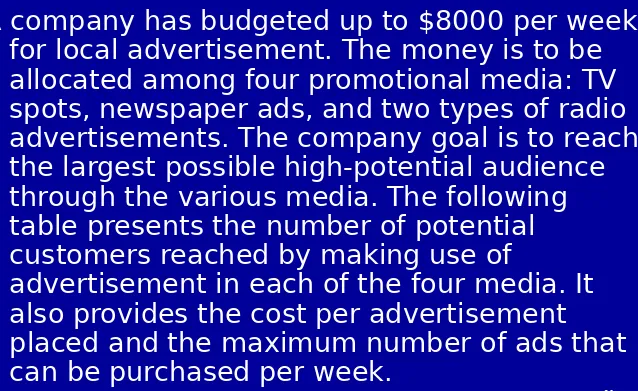

4. Media selection problem

Example

A company has budgeted up to $8000 per week for local advertisement. The money is to be

allocated among four promotional media: TV spots, newspaper ads, and two types of radio advertisements. The company goal is to reach the largest possible high-potential audience through the various media. The following

table presents the number of potential customers reached by making use of

advertisement in each of the four media. It also provides the cost per advertisement

31

TV spot (1 minute) 5000 800 12

Daily newspaper

The company arrangements require that at least five radio spots be placed each week. To ensure a board-scoped promotional

32

Media selection

Solution

Let

X1 = number of 1-miute TV spots taken Each week

X2 = number of full-page daily newspaper ads taken each week.

X3 = number of 30-second prime-time radio spots taken each week.

X4 = number of 1-minute afternoon radio spots taken each week.

Max Z = 5000 X1 + 8500 X2 + 2400 X3 + 2800 X4

st

X1 12 (maximum TV spots/week)

X2 5 (maximum newspaper ads/week)

X3 25 (maximum 30-second radio spots/week)

X4 20 (maximum 1-minute radio spots/week)

800 X1 + 925 X2 + 290 X3 + 380 X4 8000 (weekly budget)

X3 + X4 5 (minimum radio spots contracted)

290 X3 + 380 X4 1800 (maximum dollars spent on radio)

X1, X2, X3, X4 0

33

5. Assignment problem

Example

A law firm maintains a large staff of young attorneys who hold the title of junior partner. The firm

concerned with the effective utilization of this

personnel resources, seeks some objective means of making lawyer-to-client assignments. On march 1, four new clients seeking legal assistance came to the firm. While the current staff is overloads and identifies four junior partners who, although busy, could possibly be assigned to the cases. Each young lawyer can handle at most one new client.

Furthermore each lawyer differs in skills and specialty interests.

Seeking to maximize the overall effectiveness of the new client assignment, the firm draws up the

following table, in which he rates the estimated

34

Assignment problem

Client case

Lawyer Divorce Corporate

merger embezzlement exhibitionism

Adam 6 2 8 5

Brook 9 3 5 8

Carter 4 8 3 4

Assignment problem

Solution

Decision variables:

1 if attorney i is assigned to case j Let Xij =

0 otherwise

Where : i = 1, 2, 3, 4 stands for Adam, Brook, Carter, and Darwin respectively

j = 1, 2, 3, 4 stands for divorce,

merger, embezzlement, and exhibitionism respectively.

36

Assignment problem

Max Z = 6 X11 + 2 X12 + 8 X13 + 5 X14 + 9 X21 + 3 X22 +

5 X23 + 8 X24 + 4 X31 + 8 X32 + 3 X33 + 4 X34 +

6 X41 +7 X42 + 6 X43 + 4 X44

St.

X11 + X21 + X31 + X41 = 1 (divorce case)

X12 + X22 + X32 + X42 = 1 (merger)

X13 + X23 + X33 + X43 = 1 (embezzlement)

X14 + X24 + X34 + X44 = 1 (exhibitionism)

X11 + X12 + X13 + X14 = 1 (Adam)

X21 + X22 + X23 + X24 = 1 (Brook)

X31 + X32 + X33 + X34 = 1 (Carter)

X41+ X42 + X43 + X44 = 1 (Darwin)

The optimal solution is: X13 = X24 = X32 = X41 = 1. All other variables are equal to zero.

6. Transportation problem

Example

The Top Speed Bicycle Co. manufactures and markets a line of 10-speed bicycles nationwide. The firm has

final assembly plants in two cities in which labor costs are low, New Orleans and Omaha. Its three major

warehouses are located near the larger market areas of New York, Chicago, and Los Angeles.

The sales requirements for next year at the New York warehouse are 10000 bicycles, at the Chicago

warehouse 8000 bicycles, and at the Los Angeles warehouse 15000 bicycles. The factory capacity at each location is limited. New Orleans can assemble and ship 20000 bicycles; the Omaha plant can

produce 15000 bicycles per year. The cost of shipping one bicycle from each factory to each warehouse

38

Transportation problem

New

York Chicago AngeleLos

s

New Orleans $2 3 5

Omaha 3 1 4

39

Transportation problem

Solution

To formulate this problem using LP, we again employ the concept of double subscribed variables. We let the

first subscript represent the origin (factory) and the second subscript the destination (warehouse). Thus, in general, Xij refers to the number of bicycles shipped

from origin i to destination j. Therefore, we have six

decision variables as follows:

X11 = # of bicycles shipped from New Orleans to New York

X12 = # of bicycles shipped from New Orleans to Chicago

X13 = # of bicycles shipped from New Orleans to Los Angeles

X21 = # of bicycles shipped from Omaha to New York X22 = # of bicycles shipped from Omaha to Chicago

40

Transportation problem

Min Z = 2 X11 + 3 X12 + 5 X13 + 3 X21 + X22 + 4

X23

St

X11 + X21 = 10000 (New York demand)

X12 + X22 = 8000 (Chicago demand)

X13 + X23 = 15000 (Los Angeles demand)

X11 + X12 + X13 20000 (New Orleans Supply

X21 + X22 + X23 15000 (Omaha Supply)

Xij 0 for i = 1, 2 and j = 1, 2, 3

The optimal solution is: X11 = 10000, X12 = 0, X13 = 8000, X21 =

7. Portfolio selection

Example

The International City Trust (ICT) invests in short-term trade credits, corporate bonds, gold

stocks, and construction loans. To encourage a diversified portfolio, the board of directors has placed limits on the amount that can be

committed to any one type of investment. The ICT has $5 million available for immediate

investment and wishes to do two things: (1) maximize the interest earned on the

42

Portfolio selection

Investment Interest

earned %

Maximum investment

($ Million)

Trade credit 7 1

Corporate bonds 11 2.5

Gold stocks 19 1.5

Construction loans 15 1.8

In addition, the board specifies that at least 55% of the funds invested must be in gold

Portfolio selection

Solution

To formulate ICT’s investment problem

as a linear programming model, we

assume the following decision

variables:

X

1= dollars invested in trade credit

X

2= dollars invested in corporate bonds

X

3= dollars invested in gold stocks

X

4= dollars invested in construction

44

Portfolio selection

Max Z = 0.07 X1 + 0.11 X2 + 0.19 X3 + 0.15 X4

St.

X1 1

X2 2.5

X3 1.5

X4 1.8

X3 + X4 0.55(X1 + X2 + X3 + X4)

X1 0.15(X1 + X2 + X3 + X4)

X1 + X2 + X3 + X4 5

Xi 0 , i = 1, 2, 3, 4

The optimal is: X1 = 75,000, X2 = 950,000, X3 =

1,500,000, and X4 = 1,800,000, and total interest

45

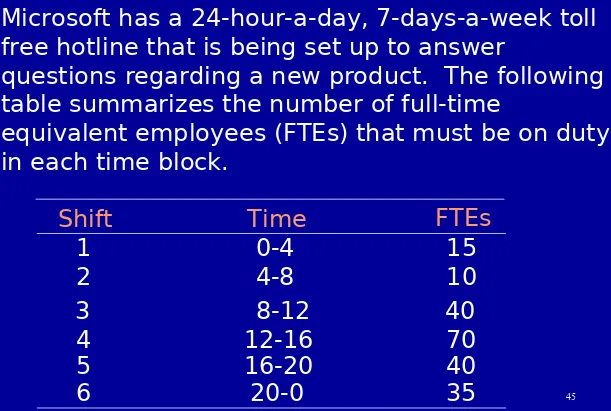

8. Work Scheduling Problem

Example

Microsoft has a 24-hour-a-day, 7-days-a-week toll free hotline that is being set up to answer

questions regarding a new product. The following table summarizes the number of full-time

equivalent employees (FTEs) that must be on duty in each time block.

Shift Time FTEs

1 0-4 15

2 4-8 10

3 8-12 40

4 12-16 70

5 16-20 40

46

• Microsoft may hire both full-time and part-time

employees. The former work 8-hour shifts and the latter work 4-hour shifts; their respective hourly

wages are $15.20 and $12.95. Employees may start work only at the beginning of one of 6 shifts.

Part-time employees can only answer 5 calls in the time a full-time employee can answer 6 calls. (i.e., a part-time employee is only 5/6 of a full-time

employee.)

Formulate an LP to determine how to staff the hotline at minimum cost.

Decision Variables

PT employee is 5/6 FT employee

48

Terminology for solution of LP

• A feasible solution is a solution for which all the constraints are satisfied.

• A corner point feasible solution (CPF) is a feasible solution that lies at a corner point. • An infeasible solution is a solution for which

at least one constraint is violated.

• The feasible region is the collection of all feasible solution.

• An Optimal solution is a feasible solution that has the most favorable value of the objective function. (it is always one of the CPF solution • The most favorable value is the largest

Graphical solution

A Graphical Solution Procedure (LPs with 2 decision variables can be solved/viewed this way.)

1. Plot each constraint as an equation and then decide which

side of the line is feasible (if it’s an inequality).

2. Find the feasible region.

3. find the coordinates of the corner (extreme) points of the feasible

region.

4. Substitute the corner point coordinates in the objective

function

50

Example 1: A Minimization Problem

• LP Formulation

Min

z

= 5

x

1+ 2

x

2s.t. 2

x

1+ 5

x

2> 1

4

x

1-

x

2> 12

x

1+

x

2> 4

Example 1: Graphical Solution

• Graph the Constraints

• Constraint 1: When x1 = 0, then x2 = 2; when x2

= 0, then x1 = 5. Connect (5,0) and (0,2). The

">" side is above this line.

• Constraint 2: When x2 = 0, then x1 = 3. But

setting x1 to 0 will yield x2 = -12, which is not on

the graph. Thus, to get a second point on this

line, set x1 to any number larger than 3 and

solve for x2: when x1 = 5, then x2 = 8. Connect

(3,0) and (5,8). The ">" side is to the right.

• Constraint 3: When x1 = 0, then x2 = 4; when x2

= 0, then x1 = 4. Connect (4,0) and (0,4). The

52

Example 1: Graphical Solution

53

Example 1: Graphical Solution

• Solve for the Extreme Point at the Intersection of the second and third Constraints

4x1 - x2 = 12

x1+ x2 = 4

Adding these two equations gives:

5x1 = 16 or x1 = 16/5.

Substituting this into x1 + x2 = 4 gives: x2 = 4/5

• Solve for the extreme point at the intersection of the first and third constraints 2x1 + 5x2 =10

x1 + x2= 4

Multiply the second equation by -2 and add to the first equation, gives 3x2 = 2 or x2 = 2/3

Substituting this in the second equation gives x1 = 10/3

Point Z

(16/5, 4/5) 88/5

(10/3, 2/3) 18

54

Example 2: A Maximization Problem

Max

z

= 5

x

1+ 7

x

2s.t.

x

1< 6

2

x

1+ 3

x

2< 19

x

1+

x

2< 8

56

58

Example 2: A Maximization Problem

60

Example 2: A Maximization Problem

• The Five Extreme Points

Example 2: A Maximization Problem

• Having identified the feasible region for the problem, we now search for the optimal

solution, which will be the point in the

feasible region with the largest (in case of maximization or the smallest (in case of

minimization) of the objective function. • To find this optimal solution, we need to

62

Example 2: A Maximization Problem

Extreme Points and the Optimal Solution

• The corners or vertices of the feasible region are referred to as the extreme points.

• An optimal solution to an LP problem can be found at an extreme point of the feasible

region.

• When looking for the optimal solution, you do not have to evaluate all feasible solution

points.

64

Feasible Region

• The feasible region for a two-variable linearprogramming problem can be nonexistent, a single point, a line, a polygon, or an unbounded area.

• Any linear program falls in one of three categories: – is infeasible

– has a unique optimal solution or alternate optimal solutions

– has an objective function that can be increased without bound

Special Cases

• Alternative Optimal SolutionsIn the graphical method, if the objective function line is parallel to a boundary constraint in the

direction of optimization, there are alternate optimal solutions, with all points on this line segment being optimal.

• Infeasibility

A linear program which is overconstrained so that no point satisfies all the constraints is said to be infeasible.

• Unbounded

For a max (min) problem, an unbounded LP occurs in it is possible to find points in the feasible

66

Example with Multiple Optimal

Solutions

1 0

0 1

x

1

x

2

2 3 4 2

3 4

z

1 z2 z3

Maximize z = 3x1 – x2

subject to 15x1 – 5x2 30 10x1 + 30x2 120

Example: Infeasible Problem

• Solve graphically for the optimal solution:

Max z = 2x1 + 6x2

s.t. 4x1 + 3x2 < 12

2x1 + x2 > 8

68

Example: Infeasible Problem

• There are no points that satisfy both

constraints, hence this problem has no feasible region, and no optimal solution.

x

x22

x

x11

4

4xx11 + 3 + 3xx22 << 12 12 2

2xx11 + + xx22 >> 8 8

3

3 44 4

4

8

Example: Unbounded Problem

• Solve graphically for the optimal solution:

Max z = 3x1 + 4x2

s.t. x1 + x2 > 5

3x1 + x2 > 8

70

Example: Unbounded

Problem

• The feasible region is unbounded and the objective function line can be moved parallel to itself without bound so that z can be increased infinitely.

Solve the following LP graphically

Where x1 is the quantity produced

72

The graphical solution

( 1 )

Assignment: Complete the

problem to find the optimal solution E

Possible Outcomes of an LP

1. Infeasible – feasible region is empty; e.g., if the constraints include

x1+ x2 6 and x1+ x2

7

2. Unbounded - Max 15x1+ 7x2 (no finite optimal solution)

s.t.

3. Multiple optimal solutions - max 3x1 + 3x2

s.t. x1+ x2 1

x1, x2 0

4. Unique Optimal Solution

Note: multiple optimal solutions occur in many practical (real-world) LPs.

x1 + x2 1