Economics Letters 68 (2000) 85–88

www.elsevier.com / locate / econbase

The Feldstein–Horioka puzzle revisited

*

Adolfo Sachsida , Marcelo Abi-Ramia Caetano

´

Institute for Applied Economic Research(IPEA) and University of Brasılia (UnB), Sala 705,

SBS Quadra10 Ed BNDES, Plano Piloto 70076-900, Brasilia, Brazil Received 24 May 1999; accepted 19 January 2000

Abstract

This paper confirms the evidence that the Feldstein–Horioka test does not reflect capital mobility in the real side world economy, but only the variability between external and domestic saving. 2000 Elsevier Science S.A. All rights reserved.

Keywords: Feldstein–Horioka puzzle; Capital mobility

JEL classification: F21

1. Introduction

In a controversial paper, Feldstein and Horioka (1980) (F–H) elaborated an econometric model to test the degree of capital mobility. Surprisingly, econometric results have indicated a low degree of capital mobility. F–H have proposed a new method for testing capital mobility. The basic idea was that in a country with a low degree of capital mobility, like a closed economy, all domestic saving would be used to finance domestic investment. On the other hand, in a country with a high degree of capital mobility, domestic saving would be used worldwide as it should look for better return. Thus, domestic and external savings would be uncorrelated. The F–H regression leads to an extensive debate in the literature on the correlation between investment and domestic saving rates and its relation with capital mobility (Hussein, 1998).

This paper proposes a general explanation for the Feldstein–Horioka puzzle. The F–H coefficient does not reflect capital mobility, but domestic and external savings substitutability. Section 2 proposes a general explanation for the puzzle and Section 3 presents general comments.

*Tel.:155-61-315-5382; fax: 155-61-315-5448.

E-mail address: [email protected] (A. Sachsida)

86 A. Sachsida, M.A.-R. Caetano / Economics Letters 68 (2000) 85 –88

2. The Feldstein–Horioka puzzle and the substitutability between domestic and external savings

This section proposes a general and simple explanation of the F–H puzzle. The F–H test indicates a low degree of capital mobility whenever any mechanism which limits the variance of external saving is present. Formally:

Se Sd I

]]GNP5external saving rate; ]]GNP5domestic saving rate; ]]GNP5investment rate

I Sd

]]GNP5a1b]]GNP (Feldstein–Horioka equation) (3.1)

I Sd Se

]]GNP5]]GNP1]]GNP (identity) (3.2)

Replacing Eq. (3.1) into the identity:

Sd Sd Se

The algebra in Eq. (3.5) shows that the constant in the F–H equation, a, is the same as in the substitutability equation. Moreover, the coefficient of F–H regression is equal to the coefficient of substitutability equation plus one, i.e.b5g11. In other words, the F–H parameters and those in the substitutability equation are equivalent to each other.

Two hypothetical cases will be presented in order to illustrate this point. In these two cases the F–H coefficient is not necessarily related to capital mobility, but actually to external saving variance.

The first case (Table 1) shows a null correlation between external and domestic savings, consequently the F–H coefficient is unity. Nevertheless, it is not correct to suppose that there is no capital mobility, since the amount of external saving is greater than domestic saving.

If Table 1 reflects a cross-section analysis, countries would have investment financed mainly for external savings. However, F–H test would consider them as low capital mobility countries.

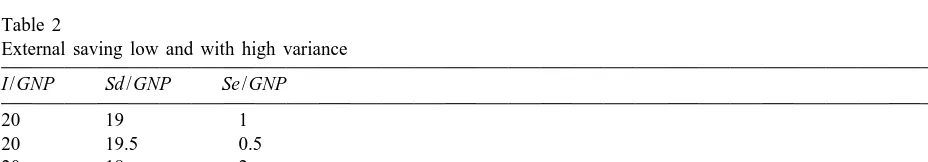

The second case (Table 2) shows the opposite. Domestic savings finance a great part of investment. However, external savings show a high variance. The econometric results of Table 2 areg5 21 and

b50. The F–H interpretation of case 2 implies accepting perfect capital mobility in a world that has almost all investment financed by domestic savings.

A. Sachsida, M.A.-R. Caetano / Economics Letters 68 (2000) 85 –88 87

substitutability coefficient (g). The F–H regression tests substitutability between domestic and external savings. In this way, whenever the correlation between external and domestic savings goes to zero, F–H coefficients goes to unity. Formally:

cov(Se,Sd )

]]]]]] rSe,Sd5 ]]]]]

var(Se) var(Sd )

œ

A null correlation between savings generates an F–H unity coefficient, which represents no capital mobility in F–H sense.

A curious result of interpreting F–H parameters as a measure of savings substitutability happens when the F–H coefficient is taken as a proxy for current account solvency. Coakley et al. (1996) argue that a no ponzi condition generates an F–H unity coefficient. However, the substitutability equation shows that the F–H unity coefficient is a particular result of null correlation between savings. In other words, a no ponzi condition implies an F–H unity coefficient. The reverse is not true, that is, an F–H unity coefficient does not imply sustainability of current account.

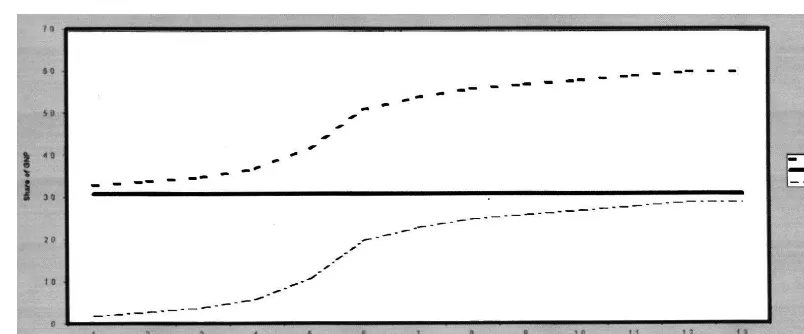

As an illustration, imagine a country which maintains external savings constant. This path, independently of sustainability, will imply that the F–H equation co-integrates with unity coefficient. The fact of null savings correlation generates an F–H unity coefficient independently of the solvency of current account. Coakley et al. (1996) propose a necessary, but not sufficient condition for current account solvency. Fig. 1 clears the point.

In Fig. 1, as external saving is constant, there will be no relation between external and domestic saving. Thus, the F–H coefficient will be unity. However, analyzing Fig. 1, it is not clear that the current account is solvent.

Table 2

External saving low and with high variance

88 A. Sachsida, M.A.-R. Caetano / Economics Letters 68 (2000) 85 –88

Fig. 1. An illustration between investment, domestic and external savings.

3. Conclusions

This paper proposes a general explanation for the F–H puzzle based on an equation of external and domestic savings substitutability. In this view, the F–H coefficient does not represent capital mobility. Instead, it is a substitutability relation between external and domestic savings. Furthermore, this new interpretation of F–H regression shows the inability of using the F–H unity coefficient to infer current account solvency.

Acknowledgements

˜

We are grateful to Joaquim P. de Andrade, Joao Ricardo Faria and Francisco G. Carneiro. All remaining errors are ours.

References

Coakley, J., Kulasi, F., Smith, R., 1996. Current account solvency and the Feldstein–Horioka puzzle. Economic Journal 106 (May), 620–627.

Feldstein, M., Horioka, C., 1980. Domestic saving and international capital flows. Economic Journal 90 (358), 314–329. Hussein, K.A., 1998. International capital mobility in OECD countries: The Feldstein–Horioka ‘puzzle’ revisited. Economics