July 2010

Consumer Confidence Index remained on the optimistic

level, albeit down slightly by 5.7 points to 105.7 in July 2010.

The deterioration in confidence was broad base, all

components measuring current economic condition and

expectation for the next 6 months registering a decline. The

index dropped by 5.4 and 6.0 points respectively.

Consumers believe that inflationary pressure will continue

to increase over the next 3 and 6 months, as the indexes

were raised by 13.7 and 6.9 points each againts previous

month. The highest pressure was attributable to the increase

in the price of housing, electricity, gas and fuels group and

foodstuff group.

Consumer Confidence Index

Consumer confidence index (CCI) in July 2010 remained stand at

optimistic level, although it slightly slipped down over previous

month

. The survey encountered that CCI stood at optimistic area of 105.7

down 5.7 points against previous month survey. The lower CCI was due to

respondent’s dwindle perception on current economic condition and the

expectation for the next 6 months. The perception index plummeted by 5.4

and 6.0 points each.

Graph 1. Consumer Confidence Index

60.0

70.0

80.0

90.0

100.0

110.0

120.0

130.0

140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7

2008 2009 2010

(Index)

Current Economic Condition Index

Consumer Expectation Index

Consumer Confidence Index

Optimistic

Pessimistic

Fuels Hike

Global Economic

Crisis

CONSUMER SURVEY

Consumer Confidence Index

moved down

Methodology

The downwarding CCI was indicated to be correlated with enhancing

basic electricity rate by 18% on July 1

st2010 and rising some basic need

commodities that feared could increasing the living expenses so that

weakened consumer confidence on economic condition.

Compared to the same period on last year, consumer’s

confidence index on economic condition also grew weaker.

CCI on the

reporting period declined 9.7 points over previous year. Deteriorating

consumer expectation index by 17.0 points and current economic condition

index by 2.5 points were attributable to the downwarding CCI.

Current Economic Condition Index

Respondent’s perception on current economic condition went

down from optimistic area to pessimistic level against previous month.

Respondent’s pessimism on current economic condition was seen on Current

Economic Condition Index (CECI) which slipped off 5.4 points over previous

month and plummeted 2.5 points against previous year touching pessimistic

level of 96.1.

The survey revealed that all current economic condition indicators

moved down. The highest declined was at household income in July 2010

that could push consumers to hold their desire to consume durable goods.

Moreover, consumers also considered that there were lack on job availability

at current time over previous month.

Higher consumer’s expenditure on education related to new school

year and rising price on some basic need commodities in July 2010 was

attributable to declining consumer’s income that finally could hold consumers

desire to consume durable goods.

Compared to the same period in last year, consumer’s current income

and job availability were become lower.

Graph 2. Current Economic Condition Index (CECI)

0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7

2008 2009 2010

Index

Current economic condition

Consumer Expectation Index

This month survey confirmed that consumer’s expectation in

the next 6 months remained at optimistic area, although it was lower

than previous month and over the same period in last year.

Consumption for the next 6 months was predicted to accelerate since CEI

remained at the optimistic area of 115.3 down 6.0 points from the previous

month.

The declining index was attributable by reducing optimism on

economic condition (9.7 points), future income (4.8 points), and job prospects

(3.5 points) in the next 6 months. Together with the basic electricity rate hike

applied since July 1

st2010 by 18%, respondents considered that pressure on

economic condition is strengthening as the economic condition expectation

moved down. Eventually, it will lighten respondents’ optimism over income in

the next 6 months.

CEI in this period survey was 17.0 points lower than previous

year.

Consumer’s had negative view on the economic prospect edged down

by 26.3 points, followed by income expectation by 10.3 points and job

availability by 14.4 points.

Graph. 3

Consumer Expectation Index (CEI)

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

160.0

1

2

3

4

5

6

7

8

9 10 11 12 1

2

3

4

5

6

7

8

9 10 11 12 1

2

3

4

5

6

7

2008

2009

2010

Index

Consumer Expectation Index Incomes Expectation Economic Expectation Job Availability Expectation

Income Expectations

Respondent were less optimistic on their income in the next 6

months.

The deteriorating optimism was indicated by income expectation

index which down 4.8 points over previous month. Classified by respondents’

category, a downward on income expectation encountered in all categories

Respondent’s optimism on

economic expectation

jumped down

especially those who graduated from high school as the index dropped by 8.9

points.

Price Expectations

Respondents envisaged that pressure on prices over

goods/services in the next 3 months will be higher than in the next 6

months.

The survey revealed that there was soaring pressure on prices in the

next 3 and 6 months as the index moved up by 13.7 and 6.9 points.

Respondents acknowledged the highest leap at housing, electricity, gas and

fuels for the next 3 and 6 months expectation which rose by 13.8 and 8.5

points. Food stuff commodity was believed to be the main factor which could

push prices upward in the next 3 and 6 months ahead by 13.3 points and 6.8

points respectively. Rising basic electricity rate that applied on July 1

st2010 has

apparently given substantial effect on respondent’s expectations on those

commodity groups.

Graph 4.

Price Expectation Index for the next 3 and 6 months

‐

1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

130.0

140.0

150.0

160.0

170.0

180.0

190.0

200.0

1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1

2008

2009

2010

2011

Price

Expectation

Index

3

months

ahead

Price

Expectation

Index

6

months

ahead

Cummulative

inflations

in

3

months

(Index)

(

%

)

Notes

: Index = 100 indicates that consumer expect prices will still be stable, index > 100 indicates

consumer expect prices will increase, and index < 100 indicates consumer expect prices will decrease

Expectations of Savings and Interest Rates

Based on survey, expectation on prices pressure has apparently

not given any significant influenced yet to the interest rate

expectation.

Interest rate expectation index in the next 6 months was

predicted to be relatively unchanged, only moved up by 0.2 point over previous

month. Nevertheless, worsening respondent’s expectation on economic

condition in the next 6 months has impacted consumer’s expectation on saving

in the next 6 months as the index dropped 2.9 points over previous month.

Pressure on prices in the

future is strengthening

Graph. 5

Expectation Indexes on Interest Rates and Total Savings in the next 6 months

0

5

10

15

20

25

90

100

110

120

130

140

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1

2008

2009

2010

2011

Savings

Growth

in

6

months

Interest

Rates

Expectation

Index

in

6

months

ahead

Savings

Expectation

Index

in

6

months

ahead

Index

(%)

Notes

: Index = 100 indicates that consumer expect saving deposit and interest rate will still be

stable, index > 100 indicates consumer expect saving deposit and interest rate will increase, and

index < 100 indicates consumer expect saving deposit and interest rate will decrease

Expectations on Economic Conditions

Respondent’s expectations on economic condition on the next 6

months continue to down. However, it was still on optimistic level

.

Weakening expectations was evidenced by declining index by 9.7 points over

previous month. Significant loose of economic expectations by those who

expenses more than Rp 5 million could be the main reason of worsening

economic condition in the next 6 months to the level of 112.6.

Respondents were

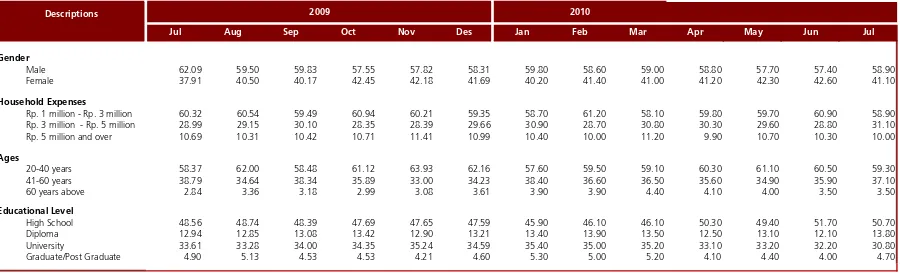

Table 1. Consumer Confidence, Price Expectations, Consumption Plans, and Economic Indicators (Index)

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul

A Consumer Confidence Index (CCI) 115.44 114.33 110.84 110.01 111.00 108.66 110.5 105.3 107.4 110.7 109.9 111.4 105.7 Present Situation (CECI) 98.55 100.49 96.59 96.78 97.71 96.67 98.4 94.7 96.4 99.6 100.0 101.4 96.1 Expectations (CEI) 132.34 128.17 125.09 123.24 124.28 120.65 122.6 115.9 118.5 121.7 119.8 121.3 115.3 Appraisal of Present Situation

Current Incomes 129.46 127.52 123.97 124.93 124.11 123.13 125.5 118.6 121.7 126.1 124.4 126.2 120.6 Buying durable goods Conditions 83.66 87.64 81.28 82.21 84.90 81.12 85.2 87.3 85.3 87.5 89.6 91.4 86.8 Employment Conditions 82.53 86.31 84.53 83.20 84.13 85.76 84.5 78.0 82.1 85.3 85.9 86.7 80.9 (before Oct 2004: Unemployment Condition)

Expectations for 6 Months Hence of

Incomes 142.93 138.34 138.48 137.32 139.28 136.75 141.1 132.5 135.3 136.7 134.7 137.4 132.6 Economic Conditions 138.94 135.44 130.35 127.28 128.77 122.11 122.7 114.4 117.7 122.2 119.5 122.3 112.6 Employment Conditions 115.14 110.71 106.42 105.11 104.81 103.10 103.9 100.8 102.4 106.3 105.2 104.2 100.7 (before Oct 2004: Unemployment Expectation)

B Price Expectations for 3 Months Hence of

Prices 154.76 163.75 165.21 158.76 159.89 161.00 160.60 160.20 155.10 158.60 164.30 166.8 180.5 Foodstuff 158.24 168.18 167.00 160.80 160.64 162.97 163.50 163.40 156.00 159.60 164.20 167.8 181.2 Food, beverages, cigarettes and tobacco 151.28 160.99 161.00 154.94 155.77 157.15 156.40 155.00 149.90 153.50 156.50 160.1 170.4 Housing, electricity, gas and fuel 141.57 148.85 155.20 155.96 156.58 156.32 152.00 151.50 148.10 155.30 158.10 161.2 175.1 Clothing 142.47 152.65 150.16 138.56 139.34 137.95 135.50 136.40 131.20 133.70 142.10 148.8 155.9 Health 132.07 139.61 140.64 135.38 136.63 137.91 135.90 136.10 133.90 133.60 138.80 141.0 146.6 Transportations, communications and financial ser 136.71 145.62 146.85 142.60 142.25 141.35 137.50 137.90 134.30 136.40 142.00 149.6 157.4 Education, recreation, and sports 135.34 141.12 141.34 137.28 138.96 140.05 138.00 137.20 138.20 141.40 145.90 149.4 154.9 C Price Expectations for 6 Months Hence of

Prices 152.23 156.46 156.95 156.24 157.92 158.80 161.20 164.30 161.10 159.30 162.50 163.1 170.1 Foodstuff 154.18 160.01 158.23 158.42 158.39 160.51 162.10 166.00 161.70 160.50 163.00 164.1 171.0 Food, beverages, cigarettes and tobacco 149.88 155.05 153.36 154.25 154.44 154.89 156.90 158.90 156.70 154.50 158.00 157.9 163.5 Housing, electricity, gas and fuel 141.95 148.55 150.84 154.32 155.72 155.40 153.20 153.10 148.60 154.10 157.30 157.3 165.8 Clothing 138.97 144.01 141.71 137.41 140.52 139.90 140.10 144.40 143.10 140.30 145.20 147.1 148.4 Health 132.55 139.03 140.19 136.73 138.06 138.87 140.00 140.80 136.70 137.20 139.10 141.2 146.5 Transportations, communications and financial ser 136.95 143.20 143.37 143.86 142.59 143.90 142.80 145.50 143.60 144.90 147.30 148.3 153.0 Education, recreation, and sports 134.87 139.80 140.98 138.61 143.10 144.73 146.20 147.70 145.30 144.20 146.10 146.1 150.8 D Economic Indicator within 6 Months

Avaibility of Goods & Services 137.18 139.97 138.59 136.40 132.70 133.48 138.30 134.20 135.50 137.60 138.70 141.5 140.0 Interest Rate 115.76 117.71 115.20 113.34 115.44 116.31 117.90 114.90 117.00 116.20 117.10 117.8 117.9 Current savings 107.50 107.85 104.44 104.70 106.58 105.94 106.40 105.20 106.90 105.00 105.80 106.5 103.7 Savings for 6 months hence 129.87 127.63 124.99 125.93 128.21 126.75 129.80 125.60 126.20 127.00 125.00 127.3 124.3

2010

Descriptions 2009

Table 2. Respondent Figures (percentages)

Jul Aug Sep Oct Nov Des Jan Feb Mar Apr May Jun Jul

Gender

Male 62.09 59.50 59.83 57.55 57.82 58.31 59.80 58.60 59.00 58.80 57.70 57.40 58.90

Female 37.91 40.50 40.17 42.45 42.18 41.69 40.20 41.40 41.00 41.20 42.30 42.60 41.10

Household Expenses

Rp. 1 million - Rp. 3 million 60.32 60.54 59.49 60.94 60.21 59.35 58.70 61.20 58.10 59.80 59.70 60.90 58.90 Rp. 3 million - Rp. 5 million 28.99 29.15 30.10 28.35 28.39 29.66 30.90 28.70 30.80 30.30 29.60 28.80 31.10 Rp. 5 million and over 10.69 10.31 10.42 10.71 11.41 10.99 10.40 10.00 11.20 9.90 10.70 10.30 10.00 Ages

20-40 years 58.37 62.00 58.48 61.12 63.93 62.16 57.60 59.50 59.10 60.30 61.10 60.50 59.30 41-60 years 38.79 34.64 38.34 35.89 33.00 34.23 38.40 36.60 36.50 35.60 34.90 35.90 37.10

60 years above 2.84 3.36 3.18 2.99 3.08 3.61 3.90 3.90 4.40 4.10 4.00 3.50 3.50

Educational Level

High School 48.56 48.74 48.39 47.69 47.65 47.59 45.90 46.10 46.10 50.30 49.40 51.70 50.70 Diploma 12.94 12.85 13.08 13.42 12.90 13.21 13.40 13.90 13.50 12.50 13.10 12.10 13.80 University 33.61 33.28 34.00 34.35 35.24 34.59 35.40 35.00 35.20 33.10 33.20 32.20 30.80 Graduate/Post Graduate 4.90 5.13 4.53 4.53 4.21 4.60 5.30 5.00 5.20 4.10 4.40 4.00 4.70

2010

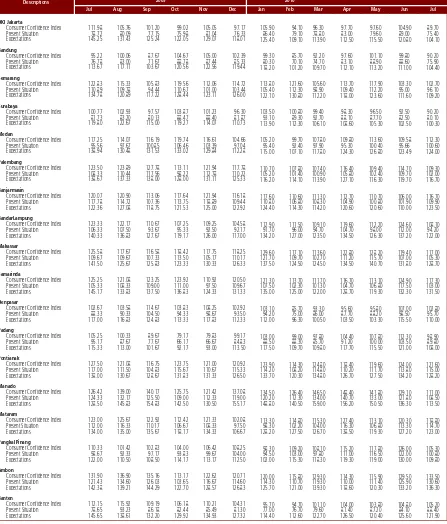

Table 3. Consumer Confidence by Region (Index)

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul

DKI Jakarta

Consumer Confidence Index 111.98 105.76 101.20 99.02 105.05 97.17 105.90 94.10 96.30 97.70 97.60 104.90 89.70 Present Situation 78.72 80.09 77.15 75.98 81.04 76.33 86.40 79.10 78.80 83.00 79.60 89.00 75.40 Expectations 145.25 131.43 125.24 122.05 129.07 118.01 125.40 109.10 113.90 112.50 115.50 120.80 104.10 Bandung

Consumer Confidence Index 95.22 100.06 87.67 104.67 105.00 102.39 99.30 85.70 92.20 97.60 101.10 99.80 90.20 Present Situation 76.78 83.00 71.67 88.78 87.44 85.33 80.30 70.10 74.70 83.10 88.90 88.60 75.90 Expectations 113.67 117.11 103.67 120.56 122.56 119.44 118.20 101.20 109.70 112.10 113.20 111.00 104.40 Semarang

Consumer Confidence Index 122.83 115.33 105.83 119.56 112.06 114.72 113.80 121.60 105.60 113.70 117.90 103.30 102.70 Present Situation 110.89 109.78 94.44 110.67 101.00 103.44 105.40 112.30 98.90 109.40 112.20 95.00 96.10 Expectations 134.78 120.89 117.22 128.44 123.11 126.00 122.10 130.80 112.20 118.00 123.60 111.60 109.20 Surabaya

Consumer Confidence Index 100.77 102.93 97.57 103.87 101.23 96.30 103.50 100.80 99.40 98.30 96.50 92.50 90.20 Present Situation 81.73 83.20 80.13 88.47 88.40 81.87 93.10 89.30 92.70 88.10 87.70 82.50 80.10 Expectations 119.80 122.67 115.00 119.27 114.07 110.73 113.90 112.30 106.10 108.60 105.30 102.50 100.30 Medan

Consumer Confidence Index 117.25 114.07 116.19 119.74 116.61 104.66 105.20 99.70 107.80 109.80 113.60 109.58 112.30 Present Situation 95.56 97.67 100.85 106.46 103.39 97.04 95.40 92.40 97.90 95.30 100.40 95.66 100.60 Expectations 138.94 130.48 131.53 133.02 129.84 112.28 115.00 107.10 117.80 124.30 126.80 123.49 124.00 Palembang

Consumer Confidence Index 123.50 123.89 127.78 113.11 121.94 117.78 110.70 107.80 107.40 116.40 109.40 114.70 109.30 Present Situation 108.33 110.44 117.56 98.22 112.78 110.22 105.20 101.40 100.90 105.80 102.40 109.70 102.00 Expectations 138.67 137.33 138.00 128.00 131.11 125.33 116.20 114.10 113.90 127.10 116.30 119.70 116.70 Banjarmasin

Consumer Confidence Index 120.07 120.90 113.06 117.64 121.94 116.18 117.60 110.60 111.30 112.70 110.70 106.00 116.70 Present Situation 117.78 114.72 107.36 113.75 118.89 109.44 110.80 106.80 108.30 104.90 100.80 101.90 109.90 Expectations 122.36 127.08 118.75 121.53 125.00 122.92 124.40 114.30 114.20 120.60 120.60 110.00 123.50 BandarLampung

Consumer Confidence Index 123.33 122.17 110.67 107.25 109.25 104.58 112.90 111.50 109.10 119.60 112.20 124.60 108.10 Present Situation 106.33 107.50 93.67 95.33 92.50 92.17 91.70 96.00 94.70 104.70 98.00 112.00 94.20 Expectations 140.33 136.83 127.67 119.17 126.00 117.00 134.20 127.00 123.50 134.50 126.30 137.20 122.00 Makassar

Consumer Confidence Index 125.58 117.67 116.58 118.42 117.75 118.25 129.60 117.10 113.60 122.80 128.20 119.40 117.00 Present Situation 109.67 109.67 107.33 113.50 105.17 110.17 121.70 109.70 102.70 111.20 115.70 107.00 105.30 Expectations 141.50 125.67 125.83 123.33 130.33 126.33 137.50 124.50 124.50 134.50 140.70 131.80 128.70 Samarinda

Consumer Confidence Index 125.25 121.08 123.25 123.92 110.92 120.50 121.30 113.70 111.70 116.70 113.10 124.90 117.30 Present Situation 105.33 108.33 109.00 111.00 97.50 109.67 107.50 102.30 101.30 104.70 106.80 117.50 103.00 Expectations 145.17 133.83 137.50 136.83 124.33 131.33 135.00 125.00 122.00 128.70 119.30 132.30 131.50 Denpasar

Consumer Confidence Index 102.67 103.58 114.67 103.83 108.25 102.92 103.10 85.70 93.30 95.60 95.80 107.00 102.80 Present Situation 88.33 90.33 104.50 94.33 98.67 93.50 94.20 75.00 86.00 87.70 88.20 98.50 95.70 Expectations 117.00 116.83 124.83 113.33 117.83 112.33 112.00 96.30 100.50 103.50 103.30 115.50 110.00 Padang

Consumer Confidence Index 105.25 100.33 89.67 79.17 79.83 99.17 103.00 99.00 97.80 104.40 107.80 112.30 98.90 Present Situation 95.17 87.67 77.67 66.17 66.67 84.83 88.50 88.30 85.70 91.20 100.00 103.50 89.80 Expectations 115.33 113.00 101.67 92.17 93.00 113.50 117.50 109.70 109.80 117.70 115.50 121.00 108.00 Pontianak

Consumer Confidence Index 127.50 121.08 116.75 123.75 121.00 120.92 123.90 114.30 124.80 118.40 119.60 124.00 121.60 Present Situation 117.00 111.50 104.83 115.67 110.67 115.33 114.20 108.20 114.80 110.20 111.70 113.80 115.00 Expectations 138.00 130.67 128.67 131.83 131.33 126.50 133.70 120.30 134.80 126.70 127.50 134.20 128.20 Manado

Consumer Confidence Index 126.42 139.00 140.17 125.75 121.42 137.08 134.50 126.40 146.50 148.40 141.80 129.10 111.00 Present Situation 124.33 132.17 125.50 109.00 112.33 119.00 120.20 112.30 134.00 140.70 133.00 121.80 108.50 Expectations 128.50 145.83 154.83 142.50 130.50 155.17 148.80 140.50 159.00 156.20 150.50 136.30 113.50 Mataram

Consumer Confidence Index 123.00 125.67 122.92 112.42 121.33 102.08 113.30 114.80 115.30 127.40 113.10 120.30 118.80 Present Situation 112.00 116.33 110.17 106.67 108.33 97.50 98.30 102.20 104.00 116.30 106.80 113.30 114.70 Expectations 134.00 135.00 135.67 118.17 134.33 106.67 128.20 127.50 126.70 138.50 119.30 127.20 123.00 Pangkal Pinang

Consumer Confidence Index 110.33 101.42 102.83 104.00 106.42 108.25 98.30 109.20 108.10 115.20 117.80 126.00 105.30 Present Situation 98.67 92.33 97.17 93.83 99.67 104.00 94.50 103.00 97.80 111.00 116.50 122.00 100.80 Expectations 122.00 110.50 108.50 114.17 113.17 112.50 102.00 115.30 118.30 119.30 119.00 130.00 109.80 Ambon

Consumer Confidence Index 131.90 136.90 135.16 113.17 122.62 120.71 120.00 115.80 129.30 114.30 115.90 129.50 133.50 Present Situation 121.43 134.60 126.03 103.65 116.67 114.60 114.30 110.70 119.30 110.00 111.40 125.90 130.60 Expectations 142.38 139.21 144.29 122.70 128.57 126.83 125.70 121.00 139.30 118.60 120.30 133.20 136.30 Banten

Consumer Confidence Index 112.15 115.92 109.19 106.18 110.21 104.31 95.70 94.70 101.10 104.00 103.80 104.80 105.20 Present Situation 78.65 93.23 86.18 82.44 85.49 81.30 77.00 76.70 79.60 81.40 87.20 84.10 88.40 Expectations 145.65 138.61 132.20 129.92 134.93 127.32 114.40 112.60 122.70 126.50 120.40 125.60 121.90

2010