ANALSIS OF PRESENTATION AND DISCLOSURE OF REVALUATION ASSET BASED ON TAX REGULATION IN THE FINANCIAL STATEMENT 2015

VINGE GUSVRIKA ELANDA1 and DWI MARTANI Universitas Indonesia

This study analyzes the implications of regulatory revaluation issued in 2015, PMK 233/PMK.03/2015. This study discusses the presentation and disclosure of revaluation of fixed assets in the financial statements and analyze the factors that affect the company's decision to revalue assets. This study uses companies that have been listed on the Indonesia Stock Exchange in 2015. The results showed 128 companies are do the asset revaluation and the most of them do the revaluation of fixed assets for land and buildings. Companies do the revaluation for accounting purposes are 37.5%. This study proves that the fixed asset intensity and firm size has a significant influence over company’s decision to do the revaluation.

Keywords :

Revaluation of assets, tax revaluation, fixed assets, disclosure of revaluation, presentation of revaluation.

I. INTRODUCTION

Revaluation of assets is a reassessment of the value of the assets owned by the company. Revaluation use when there is a difference between the recorded value of the company with real value in the marketplace. With assets revaluation, the value of the assets recorded by the company will reflect the actual value. However, treatment of revaluation of assets in Indonesia can be done either in accounting or tax. Revaluation or reappraisal is usually performed on fixed assets or investment properties.

According to accounting, the revaluation of fixed assets is recognized either excess or less the difference between the value of assets recorded in the company with a fair value in the market. Revaluation of fixed assets and investment property is a model in the assessment or selection of accounting policies.

Besides accounting, a problem concerning the revaluation are also regulated in the Income Tax Act Article 4 paragraph (1) letter m stating that the excess of the revaluation of a fixed assets is the object of income tax. Unlike the accounting that recognizes the difference more or less than the difference between the results of revaluation, the tax only recognizes the excess over the revaluation of fixed assets. In other words, only the excess (gain) on revaluation of fixed assets are taxed. Further rules regarding the revaluation of fixed assets in the tax regulated in PMK 79/PMK.08/2008.

PMK 79/PMK.03/2008 accommodated in the old regulation that is PSAK 16 in 1994, accounting standards mention that revaluation is not allowed for assessment under the

acquisition price, but a deviation from this provision may be carried out under the provisions of the Government. In 2007, these accounting standards is change. Changes in accounting standards have led to differences between the tax treatment of fixed assets and accounting. To encourage domestic economy and provide incentives to companies, the government issued a new policy that PMK 191/PMK.010/2015. In the new policy tariff charged only 3% -6%, which was upgraded to PMK 233 / PMK.03 / 2015.

Past research related to the revaluation of assets, performed by Kristi (2012) which describes the impact of income tax for companies that do a revaluation. The study obtained results that the revaluation of the company on the basis of the need to improve the financial performance of the company. In addition, previous research related to factors that affect the company's decision revaluation, conducted by Piera (2007) who found that the company in the Swiss tend to revalue fixed assets because of the leverage and international stakeholders. While more research is done and Su Seng (2010) suggest that the listed company in New Zealand to make the size of the company and the intensity of the assets, as the factors that drive the company revalued.

It distinguishes with previous studies is the research carried out on the basis of PMK 233 in 2015, while previous research refers to the PMK 79 in 2008. The earlier study also only conduct an analysis of the implications of the corporate income tax on revaluation what companies do. Meanwhile, this research focuses on how the revaluation is presented and disclosed in financial statements, as well as the factors on what basis the company revalued.

In the current study found that the new regulations raise the enthusiasm of companies to revalue their fixed assets. Based on the number of samples studied, companies that revaluation is only at 39.4% only. However, from these results, most companies do a revaluation for the majority of fixed assets. Where in previous regulations, companies are not allowed to perform only for partial revaluation of fixed assets, it should be the overall fixed assets. In addition, the study also found that the intensity and size of the company's fixed assets is a significant factor in the company's decision revalued.

This concise manuscript consists of five parts, the first part is an introduction that explains the research background. Then, the second part consists of the theoretical basis and development of hypotheses, the third part is a research methodology that consists of a framework of research and data and samples used. Furthermore, the fourth section is an analysis and discussion of research results, and the fifth part is the conclusion, limitations, suggestions and implications of the research.

II. THEORETICAL AND HYPOTHESIS

According to IAS 16 (2015), the revaluation conducted by the company should be conducted regularly so that the carrying amount and the amount determined using the fair value is not materially different at the end of the period. Where if the carrying amount of the assets of the revaluation company increases will be recognized in other comprehensive income and accumulated in equity in revaluation surplus parts. However, if the carrying amount over the company revalued assets decreased, the impairment is recognized in profit or loss or other comprehensive income during the decline does not exceed the value of the credit balance of the revaluation surplus for that asset.

If the company did revaluation of an asset, then the whole class or group in company-owned assets should be revalued. This is to avoid selective revaluation of these assets and to avoid reporting using a mix of historical cost and fair value for the same asset classes in the financial statements. Means of the same group that has the same uses and same characteristics. As an example of the same classes asset are land, land and buildings, machinery, motor vehicles, aircraft, office equipment, and more.

In accounting treatment, the length of time revaluation of assets depending on changes in the value of fixed assets. If the carrying value of fixed assets of the company to differ materially, then the fixed asset revaluation should be done, so that the value of fixed assets reflects the actual market value. Changes in fair value are very significant influence in the company revalued its frequency. If within one year after the last time revaluation of the value of these assets changed significantly, the asset should be revalued, but if it does not change significantly, the revaluation process is not necessary.

It's about the revaluation of assets was also discussed in the Financial Accounting Standards for Entities Without Public Accountability (SAK ETAP). In general, the revaluation in SAK ETAP is not allowed, because SAK ETAP using the revaluation of assets using the cost or price exchange. Just as IAS 16, 1994, the revaluation allowed by the provisions of the Government and the difference between the value of fixed assets after the revaluation of the carrying amount recognized in equity revaluation surplus parts.

In addition, the revaluation of assets in accounting is also set out in IAS 13 on Investment Property, which in IAS known as the revaluation of the fair value model. Investment property in accordance with accounting standards are the property of the company or tenant (whether in the form of land or building, or both) to earn rentals or capital appreciation, or both, and not for production or supply of goods/services for administrative purposes and not for sale in everyday business activities.

accounting policy. Gains or losses on the results of the change in fair value of investment property are recognized in profit or loss in the period the change occurs. Revaluation of assets performed by the company is used to reflect the current asset value (Martani, 2012).

According to the Tax Revaluation of Assets

According to Law No. 36 of 2008 on Income Tax (Income Tax Law) Article 4 paragraph 1 states that the revaluation is the one that made the object of taxation. The object itself is an income tax or additional or an increase in economic benefits derived by the taxpayer. Revaluation taxable object is mentioned in Article 4 paragraph (1) letter m, which is "the difference from revaluation of assets". In the tax revaluation referred to as over-gap on the revaluation of the assets of a company. As the name suggests, the revaluation of the tax value of the excess is only recognized on the revaluation of company assets. The next problem is made clear through the revaluation of Income Tax Law Article 19, stated that the authorities of the revaluation of assets or the discrepancy between the elements of cost and income for their price development is striking is the Minister of Finance. Minister of Finance makes a regulation to implement its own rates on the excess over a revaluation of the company's assets. Rates set out in the Minister of Finance can not exceed the highest tax rates in the Income Tax Law Article 17 paragraph (1).

Further rules regarding the revaluation of the assets company's is set in the PMK 79 (2008). The types of assets that can be revalued in the PMK 79 (2008) is all tangible fixed assets including land use rights that have certificates and buildings, as well as all fixed assets tangible excluding land located in Indonesia, owned and used to obtain, collect and preserve income into the taxable income. Revaluation according to this taxation can not be done before five years, starting from the fixed asset revaluation made last time. The revaluation must be based on the fair value of the applicable does valued back and performed by expert assessors services or obtain permission from the Government.

To encourage companies revaluation, the Government reset regulations regarding revaluation of fixed assets for tax purposes of the previous regulations. Through the new government regulations that PMK 191/PMK.010/2015, the Government intends to give relief to companies that make application of the revaluation of fixed assets in 2015 and 2016.

Regulations regarding the revaluation for tax purposes do change by the end of 2015 become PMK 233/PMK.03/2015. PMK 233 (2015) is in force for the public to understand the rules regarding the revaluation of fixed assets as well as adding some article previously contained in the PMK 191 (2015).

Technical Bulletin 11 About Assets Revaluation

Issues raised in technical bulletins 11 is about five things, including relationships revaluation of fixed assets between tax and accounting, approval DJP for submission of application for revaluation of fixed assets of the company, the accounting treatment of final income tax charged to revaluation of fixed assets, current tax and deferred results from revaluation of fixed assets, and the tax rate to measure the impact of deferred taxes as a result of the revaluation of fixed assets (either for tax purposes or for the purposes of accounting and taxation).

Companies are allowed to choose a destination revaluation is only for tax purposes, only for accounting purposes or for tax and accounting purposes. Companies that perform only asset revaluation for tax purposes it should get approval from the DJP within a certain time. DJP has the authority to reject or accept the proposal on the revaluation. For companies that have received approval from the DJP in doing the revaluation, if the company revalued assets only for tax purposes, then the current tax expense (3% of the excess of revaluation) arising from these events are recognized in profit or loss. While on the revaluation event temporary differences arise because the tax base is larger than the amount recorded in accounting.

However, if the company revalued for tax and accounting purposes, the amount of taxes paid is recognized in other comprehensive income and accumulated in equity in the revaluation surplus. In contrast to the revaluation for tax purposes only, a revaluation is done for tax and accounting purposes this does not have the temporary differences between the carrying amounts for accounting with their respective tax bases.

Hypothesis

The lenders use accounting information to analyze the company's financial position and assess the risk of the company when the lender will approve the loan to be granted. One major concern of creditors is to reduce or attenuate the risk of the guarantee offered by the company's assets in case of bankruptcy, which is positively correlated with the leverage of the company. Revaluation will increase the book value of total assets that would give effect to the creditors that the company's financial ratios well. With the report's strong financial position will have an impact on the confidence of creditors that the company can pay the debt. The preparation of this hypothesis was based on previous research conducted by (Piera, 2007) and (Seng and Su, 2010).

H1: Companies with high leverage level have a high probability to revalue fixed assets

lenders to be concerned with the company's liquidity. An Australian study by (Cotter and Zimmer, 1995) argues that a revaluation may help to convince debtholders about the company's ability to pay the debt through ownership potential value of the company's assets are largely based on market value. Therefore, the revaluation undertaken will help the company to repay the loan by the company. Then arranged the hypothesis in this study using a previous study conducted by (Seng and Su, 2010), namely

H2: Companies that decreased cash flow operating activities more likely to have a high

probability to revalue fixed assets

Research conducted (Lin and Peasnel, 2000b) found a positive relationship between the intensity of fixed assets by the manager's decision to conduct the revaluation, as well (Tay, 2009) who found the influence of the revaluation of assets with fixed asset intensity. Given these findings, this study aims to find a significant effect of the intensity of the fixed assets of the company will influence the manager's decision to revaluated. Preparation of the hypothesis in this study are based on research conducted (Seng and Su, 2010), so to demonstrate empirically the findings in the study then developed a hypothesis, namely

H3: Companies that have a high intensity of fixed assets that have a high probability to

revalue fixed assets

Government price controls more focused on large companies than in small companies because large companies that are considered to have greater freedom to the observance of the rules, and are more likely to take a leadership role price (Lin and Peasnell, 2000b). To reduce the adverse political influence, companies tend to avoid income/profit companies that are too high (Standish and Ung, 1982). The revaluation of an asset can be an effective way for companies to reduce profits through increased depreciation charges on the rise in assets that were revalued (Lin and Peasnell, 2000b). Wherein the larger the total assets of the company it will be very likely do the revaluation of fixed assets. The preparation of this hypothesis is based on previous research conducted by (Seng and Su, 2010) stating that the company has a large size will tend to revalue fixed assets of the company. So the hypothesis in this study, namely

H4: Companies with large size has a high probability to revalue fixed assets

III. RESEARCH METHODOLOGY

Research framework

influence the company's decision to carry out a revaluation. Based on the research objectives that have been put forward and based on the results of previous studies as described in the previous chapter, then developed a framework of thought as in Figure 1.

Figure 1. Research Framework

The formation of this model is based on research conducted (Seng and Su, 2010) to make adjustments in the calculation of leverage, the use of the calculations in the study (Piera, 2007). The logistic regression equation in this study are:

Y

i

= α + β1LEVi

+ β2DCFFOi

+ β3INTATi

+ β4SIZEi

+i

Where is the explanation of variables:

Y

i

: Revaluation of fixed assets of companies listed on the Stock Exchange in 2015 (using a dummy, one for the revaluation and zero for which no Revaluation)LEV

i

: The level of leverage measured by the ratio of total debt to total financial assetsDCFFO

i

: Decrease in operating cash flow of the company is measured from the ratio of decrease in cash flow from operating activities of the company in year t to the year t-1 to the decline in operating cash flow in year tINTAT

i

: The intensity or the proportion of fixed assets owned by the company measured from the ratio of total fixed assets to total assetsSIZE

i

: The size of the company with natural logarithma measured from natural logarithma on total assets in year tIn this study, which is the dependent variable is revaluation. The dependent variable using a dummy variable that is measured with the number 1 if the company revalued assets in 2015, and 0 if the company does not perform a revaluation of assets in 2015. While the independent variables used is based on research and Su Seng (2010) which is the level the

Policy of Revaluation Leverage

company's leverage, the decline in cash flow from operating activities of the company, the intensity of the fixed assets of the company, and the size of the company (firm size).

Data and Sample

Data from this study are all listed company listed in Indonesia Stock Exchange until 2015. The number of companies listed on the Stock Exchange in 2015 was 525 companies with various types of industries.

The sampling method the researchers did was by purposive sampling, with the characteristics of sampling are companies listed on the Stock Exchange until 2015 and availability of data is a company's financial statements were audited in 2015.

IV. DISCUSSION AND ANALYSIS Sample Selection

Based on the sample selection criteria in this study, acquired 525 companies listed on the Stock Exchange and 406 companies that have financial statements 2015 have been audited. Table 1 shows the translation of the sample to be studied.

Table 1 Data and Sample

No. Description Company

1 Company listed on the Stock Exchange 525 2 The number of samples of the company that has

first and second criteria 406

Less: company data is incomplete (the third criterion)

(83)

The number of samples to be studied 325

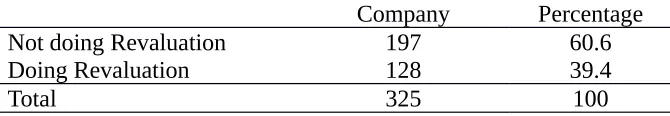

Descriptive statistics

From table 2 it is known that there are 39.4% of the total sample used, revalued assets. This shows that not many companies are using the revaluation model in measuring assets, both for fixed assets or investment properties. Of the 128 companies that perform the revaluation, there are companies that for a long time using the revaluation model in accounting policies, those new companies using the revaluation model in 2015 (changing the cost model into the revaluation model). A company of revalued assets in 2015 comprised of various sectors or industries that can be seen in Table 3.

Table 2. Descriptive Statistics Businesses Doing Revaluation Company Percentage

Not doing Revaluation 197 60.6

Doing Revaluation 128 39.4

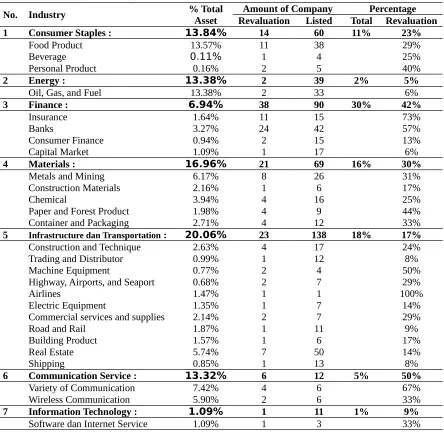

In Table 3 is known that some companies that revaluation is a company engaged in the financial sector, the banking company that dominates (24 companies). Although the amount of fixed assets held by the banking company less than the total fixed assets of another company (only 3.27%).

Table 3 Types of Industrial Businesses Doing Revaluation 2015

No. Industry % TotalAsset RevaluationAmount of CompanyListed TotalPercentageRevaluation

1 Consumer Staples : 13.84% 14 60 11% 23%

Food Product 13.57% 11 38 29%

Paper and Forest Product 1.98% 4 9 44%

Container and Packaging 2.71% 4 12 33%

5 Infrastructure dan Transportation : 20.06% 23 138 18% 17%

Construction and Technique 2.63% 4 17 24%

Trading and Distributor 0.99% 1 12 8%

Machine Equipment 0.77% 2 4 50%

Highway, Airports, and Seaport 0.68% 2 7 29%

Airlines 1.47% 1 1 100%

Electric Equipment 1.35% 1 7 14%

Commercial services and supplies 2.14% 2 7 29%

Road and Rail 1.87% 1 11 9%

Building Product 1.57% 1 6 17%

Real Estate 5.74% 7 50 14%

Shipping 0.85% 1 13 8%

6 Communication Service : 13.32% 6 12 5% 50%

Variety of Communication 7.42% 4 6 67%

Wireless Communication 5.90% 2 6 33%

7 Information Technology : 1.09% 1 11 1% 9%

Software dan Internet Service 1.09% 1 3 33%

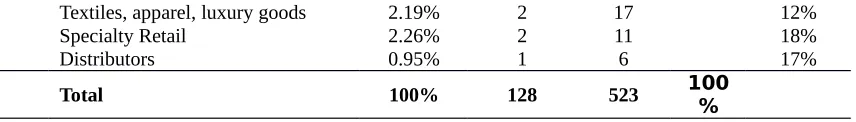

continued

8 Health : 0.71% 3 15 2% 20%

Health care providers 0.71% 3 9 33%

9 Others : 13.71% 20 89 16% 22%

Automobile and auto Components 1.67% 6 11 55%

Media 2.93% 2 14 14%

Hotel, restaurant dan leisure 2.10% 4 7 57%

Textiles, apparel, luxury goods 2.19% 2 17 12%

Specialty Retail 2.26% 2 11 18%

Distributors 0.95% 1 6 17%

Total 100% 128 523 100%

Then, related to any type of asset revaluation by the company can be seen in Table 4. According to Table 4 it is known that 55% of companies revalued their fixed assets for most companies. From a part of the revaluation of fixed assets, 30% of the revaluation of fixed assets of the company is land and buildings. Then 25% of the revaluation of fixed assets by the company is the only form of land. From Table 4 it can be concluded that the majority of companies do a revaluation of land assets.

Table 4. Type Asset revaluation Numbe

r Various Asset Revaluation Company Percentage

Company Most of FixedAssets

1 All of Fixed Assets 28 22%

2 Most of Fixed Assets 71 55%

Land 18 25%

Land and others 2 3%

Building 2 3%

Building and others 7 10%

Land and Building 21 30%

Land, building and others 8 11%

Others 13 18%

3 Investment Property 26 20%

4 Investment Property and Fixed Asset 3 2%

Total 128

Due to differences in the presentation of the revaluation of assets of the company, this research is intended to show how many companies are doing only asset revaluation for tax purposes, only for accounting purposes, and for tax and accounting purposes. From table 5 it can be concluded that most of the companies doing the revaluation for accounting purposes. Companies that perform revaluation for accounting purposes mostly revalued for investment properties. While companies are revalued for tax purposes as well as the revaluation for tax and accounting purposes most have not yet received approval from the DJP on request revaluation.

Table 5. Purpose Revaluation Applied

Company Percentage Cumulative Percentage

Tax Only 35 27.3 27.3

Tax and Accounting 45 35.2 100.0

Total 128 100

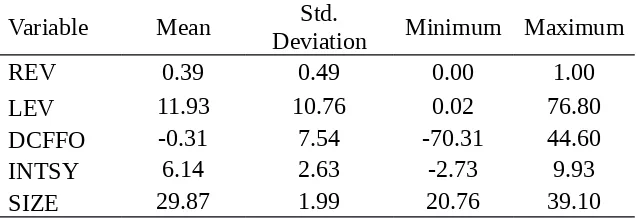

From Table 6, it is known that the average company that does revaluation amounted 0.39. The standard deviation of the revaluation itself has a value of 0.49 and a revaluation of the dependent variable in this study, with a minimum value for the revaluation is 0 and the maximum value for the revaluation is 1. While the average of the highest independent variable in the variable SIZE with a value of 29.87 but this variable has the smallest standard deviation of only 1.99 with a short range of values that is 20.76 to 39.10.

Table 6. Descriptive Statistics

Multocoloniarity Test

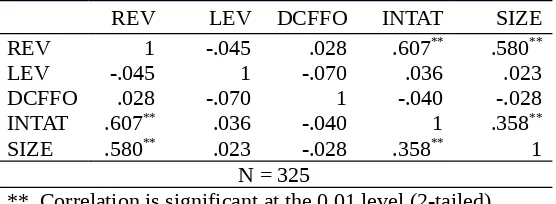

According to the table 7 can be concluded that there is a significant correlation between the intensity of the revaluation of fixed assets of the company with the size of the company. The significant value of fixed assets revaluation with the intensity and size of the company that is equal to 0.000 <0.05. Furthermore, between the intensity of fixed assets with the size of the company also has a significant correlation with a significance value of 0.00<0.05. However, the revaluation with leverage and a decrease in operating cash flow is not significant relationship. Significant value between 0.424 revaluation with leverage is > 0.05 and significant value between revaluation with decreased operating cash flow amounted to 0.618> 0.05.

Based on the results of Pearson correlation (**) note that a significant relationship between the variables is not strong, because the result is <0.8 which identifies that there is no multicoloniarity between these variables.

Table 7 Test Multicoloniarity

Variable Mean DeviationStd. Minimum Maximum

REV 0.39 0.49 0.00 1.00

LEV 11.93 10.76 0.02 76.80

DCFFO -0.31 7.54 -70.31 44.60

INTSY 6.14 2.63 -2.73 9.93

REV LEV DCFFO INTAT SIZE

REV 1 -.045 .028 .607** .580**

LEV -.045 1 -.070 .036 .023

DCFFO .028 -.070 1 -.040 -.028

INTAT .607** .036 -.040 1 .358**

SIZE .580** .023 -.028 .358** 1

N = 325

**. Correlation is significant at the 0.01 level (2-tailed).

Hypothesis Testing

Based on Table 8, it is evident that leverage variable has no significant influence with the dependent variable (revaluation). The results of this study have nothing in common with the research (Piera, 2007) which found a significant effect of the level of leverage of a company with the decision to carry out a revaluation. However, the results of this research together with research conducted (Seng and Su, 2010) found no significant influence between leverage the company revalued its decision. Based on the results of this descriptive study, revaluation is an incentive that will reduce tax payments in the future. Proved that the level of leverage does not affect the company's decision to significantly revalued (0.118> 0.05), the H1 is rejected.

Table 8. Regression Test Results

Variabel Exp. Sig. Coef. Odd Ratio Sig. Level

Constant --- -58.696 0.000 0.000

LEV H1 + -0.030 0.971 0.118

DCFFO H2 + -0.001 0.999 0.949

INTSY H3 + 1.148 3.152 0.000**

SIZE H4 + 1.669 5.307 0.000**

Total (N) 325

** Significant Variable

A second independent variable is declining cash flow from operations also do not have a significant influence on the revaluation. The results of this research have in common with previous studies conducted by (Seng and Su, 2010) found no effect significant between the decline in cash flow from operating activities by the company's decision to revalued their assets. Research conducted (Seng and Su, 2010) were performed on companies listed in New Zealand in 1999-2003, which found that the company's decision in the revaluation is not based on a decrease in cash flows operating activities of the company. Similarly, the variable leverage, the decline in operating cash flow also has no influence on the decision of companies in Indonesia because of the revaluation is done more towards tax incentives in the future. Because it was evident that there was no significant effect of a decrease in cash flows from operating activities by the decision of the company revalued the H2 is rejected.

<0.05. The results of this research have in common with the study by (Seng and Su, 2010), (Lin and Peasnel, 2000b), and (Tay, 2009) which says that the intensity of the fixed assets of the company influence the decisions of significant revaluation of assets. Research (Seng and Su, 2010) states that all companies listed on the New Zealand-influenced revaluation due to the high value of the assets owned by the company, so that the intensity of assets remains a significant factor for the company's decision revalued. With 95% saying that the hypothesis companies that have a high intensity of fixed assets that have a high probability of revaluation of fixed assets received (H3 accepted).

Similarly, the third variable, the fourth variable in this study had a significant influence on the revaluation of fixed assets. The fourth variable in the form of firm size also have the same results with previous studies (Seng and Su, 2010), and (Iatridis, 2012) which found a significant influence between firm size and revaluation of the company's decision. The sample used (Seng and Su, 2010) on a listed company in New Zealand using an independent valuer in measuring the fair value of the company is revalued. Just as the regulations in effect in Indonesia that all companies that want to do a revaluation must use an independent appraiser to measure the fair value of the company's assets in order to reflect the actual market value. With a confidence level of 95% and the regression results for 0.000<0.05, then it can be said that the firm size has a significant influence on the decision of the company revalued or in other words the size of the company determines the company's decision to conduct a revaluation or not. Therefore, the hypothesis of large companies have a high probability to revalue fixed assets received (H4 accepted).

V. CONCLUSION, LIMITATIONS, AND SUGGESTIONS

Based on the results, it can be concluded that not many companies that revaluation is only equal to 39.4% of the sample studied, or as many as 128 companies, which dominate the financial sector. This study also shows that 55% of companies carry out revaluation for the majority of fixed assets or as many as 71 companies and research proves that this type of revaluation of the most widely used by the company is the revaluation for accounting purposes, with a percentage of 37.5% or as many as 48 companies. The study also proves that there are two significant factors that influence the company's decision to revalue the company's assets, namely fixed asset intensity and size of the company. While the factors that have significant influence in this research that the level of leverage and decreased cash flow operating activities. It can be caused by the company's fixed assets revaluation big enough.

The main implication of this study is to give the latest information regarding the presentation and disclosure of asset revaluation in the financial statement and prove that the intensity and size of the company's fixed assets into the factors that affect the company's decision revalued. In addition, the research is expected to provide guidance to the DJP for dissemination to related companies new regulation regarding revaluation of assets, thus increasing the company's desire to do a revaluation of assets. DJP also need to pay attention to the rules in the PMK 79 / PMK.03 / 2008 regarding the need for revaluation of all assets, because the company is revalued, the majority only partially revalue assets.

BIBLIOGRAPHY

Bursa Efek Indonesia. (2015). Laporan Keuangan Perusahaan Tercatat Bursa Efek Indonesia Teraudit Tahun 2015.Laporan Keuangan. Diakses pada tanggal 13 April 2016.

www.idx.co.id

Cotter, J. and Zimmer, I. (1995).Asset revaluations and assessment of borrowing capacity. Journal of Accounting Finance, and Business Studies, 32(2), 136-151.

Dewan Standar Akuntansi Keuangan.(2015). Standar Akuntansi Keuangan. Jakarta: Ikatan Akuntansi Indonesia

Direktorat Jenderal Pajak Kementerian Keuangan. (2016). Revaluasi Aktiva Tetap, Insentif Perpajakan yang Ramah. Artikel. Diakses tanggal 19 Maret 2016.

http://pajak.go.id/content/article/revaluasi-aktiva-tetap-insentif-perpajakan-yang-ramah

Forum Pajak Indonesia. (2015). Perubahan Ketentuan Revaluasi Aset Untuk Perpajakan sesuai PMK 191. Artikel. Diakses tanggal 19 Maret 2016.

http://forumpajak.org/perubahan-ketentuan-revaluasi-aset-untuk-perpajakan-sesuai-pmk-191/

Iatridis, George Emmanuel. (2011). Incentives for Fixed Asset Revaluations: the UK Evidence. Journal of Applied Accounting Research, Vol. 13, No. 1, 5-20

Kementerian Agraria dan Tata Ruang Badan Pertahanan Nasional. (2015). Paket Kebijakan Ekonomi V: Insentif Perpajakan, Revaluasi Aset, dan Mendorong Perbankan Syariah. Artikel. Diakses 3 April 2016. http://www.bpn.go.id/Berita/Siaran-Pers/paket- kebijakan-ekonomi-v-insentif-perpajakan-revaluasi-aset-dan-mendorong-perbankan-syariah-60563

Kristi, Yosseane Widia. (2012). Implikasi Pajak Penghasilan Atas Revaluasi Aktiva Tetap (Studi Kasus Pada PT. XYZ). Tesis, Universitas Indonesia, Depok.

Lin, Y.C & Peasnell, K.V. (2000b). Fixed Asset Revaluation and Equity Depletion in the UK, Jounal of Business Finance and Accounting, 27, 3-4.

Martani, Dwi. (2012). Revaluasi aset merupakan penilaian kembali aset yang dimiliki oleh perusahaan untuk mencerminkan nilai aset sekarang. Artikel.Diakses tanggal 24 April 2016.

http://dwimartani71.blogspot.co.id/2010/03/revaluasi-aset-pajak-vs-akuntansi.html

Piera, F.M. (2007). Motives for Fixed Asset Revaluation : An Empirical Analysis with Swiss Data. The International Journal of Accounting, 42, 186-205.

Republik Indonesia.(2008). Peraturan Menteri Keuangan No 79/PMK.03/2008 tentang Penilaian Kembali Aktiva Tetap untuk Tujuan Perpajakan.

______________. (2015). Peraturan Menteri Keuangan No 191/PMK.010/2015 tentang Penilaian Kembali Aktiva Tetap untuk Tujuan Perpajakan Bagi Permohonan yang Diajukan Pada Tahun 2015 dan Tahun 2016.

______________. (2015). Peraturan Menteri Keuangan No 233/PMK.03/2015 tentang Perubahan atas Peraturan Menteri Keuangan No 191/PMK.010/2015 tentang Penilaian Kembali Aktiva Tetap untuk Tujuan Perpajakan Bagi Permohonan yang Diajukan Pada Tahun 2015 dan Tahun 2016.

______________. (2008). Undang-Undang Nomor 36 Tahun 2008 tentang Perubahan Keempat atas Undang-Undang Nomor 7 Tahun 1984 tentang Pajak Penghasilan. Seng, dan Su. (2010). Managerial Incentives Behind Fixed Asset Revaluations : Evidence

from New Zealand Firms.Working Paper Series, 3, 1-33.