Lampiran i

Sampel Penelitian

No Nama Perusahaan

Kode

Emiten

Kriteria

Sampel

1

2

3

4

Lampiran ii

Data Penelitian

Data Variabel Independen –

Good Corporate Governance

No

Nama Perusahaan

Nilai Komposit GCG

2009

2010

2011

6

PT. Bank Internasional Indonesia Tbk

1.5500

1.2250

1.2250

7

PT. Bank Swadesi Tbk

1.3600

1.6800

1.6800

8

PT. Bank Windu Kentjana International Tbk

2.2800

2.0500

2.7100

9

PT. Bank Mega Tbk

1.7000

1.7000

2.4300

10

PT. Bank OCBC NISP Tbk

1.1750

1.1000

1.2500

11

PT. Bank Pan Indonesia Tbk

1.5000

1.6500

1.6000

Data Variabel Dependen –

Loan to Deposit Ratio (LDR)

No

Nama Perusahaan

LDR

6

PT. Bank Internasional Indonesia Tbk

82.93

89.03

95.07

7

PT. Bank Swadesi Tbk

81.10

87.36

85.72

8

PT. Bank Windu Kentjana International Tbk

65.58

81.29

79.30

9

PT. Bank Mega Tbk

57.08

56.03

63.75

10

PT. Bank OCBC NISP Tbk

77.64

80.00

87.04

Data Variabel Dependen –

Net Interest Margin (NIM)

8

PT. Bank Windu Kentjana International Tbk

4.48

4.61

4.62

9

PT. Bank Mega Tbk

6.74

4.88

5.40

10

PT. Bank OCBC NISP Tbk

5.66

5.04

4.80

11

PT. Bank Pan Indonesia Tbk

4.76

4.202

4.64

Data Variabel Dependen –

Return On Assets (ROA)

No

Nama Perusahaan

ROA

8

PT. Bank Windu Kentjana International Tbk

1.00

1.11

0.96

9

PT. Bank Mega Tbk

1.77

2.45

2.29

10

PT. Bank OCBC NISP Tbk

1.65

1.29

1.91

Data Variabel Dependen –

Return On Equity (ROE)

8

PT. Bank Windu Kentjana International Tbk

6.03

7.24

6.94

9

PT. Bank Mega Tbk

18.72

27.20

26.74

10

PT. Bank OCBC NISP Tbk

10.53

8.12

12.90

11

PT. Bank Pan Indonesia Tbk

10.40

12.81

80.36

Lampiran iii

Data Variabel Setelah Transformasi

No

Nama Perusahaan

LN_NIM

2009

2010

2011

1

PT. Bank Central Asia Tbk

,34043

-,75957

-,65801

2

PT. Bank Bukopin Tbk

-1,69112

-1,16035 -1,38166

3

PT. Bank Danamon Indonesia Tbk

6,23888

5,17648

3,86834

4

PT. Bank Kesawan Tbk

-,32028

,02972

,11182

5

PT. Bank CIMB Niaga Tbk

,32726

,18726

-,63422

6

PT. Bank Internasional Indonesia Tbk

,20097

-,27616

-,94616

7

PT. Bank Swadesi Tbk

-,64104

,04182

,61182

8

PT. Bank Windu Kentjana International Tbk

-,78656

-,85268

-,27989

9

PT. Bank Mega Tbk

,97888

-,88112

,26135

No

Nama Perusahaan

LN_ROE

2009

2010

2011

1

PT. Bank Central Asia Tbk

12,77206

14,27206

11,47511

2

PT. Bank Bukopin Tbk

,48901

2,16054

2,35647

3

PT. Bank Danamon Indonesia Tbk

-4,83099

-1,17014

-,24353

4

PT. Bank Kesawan Tbk

-6,12487

-8,62487

-9,95928

5

PT. Bank CIMB Niaga Tbk

-4,93862

2,71138

1,11701

6

PT. Bank Internasional Indonesia Tbk

-18,11539

-12,93828

-11,36828

7

PT. Bank Swadesi Tbk

-5,58231

-4,51224

-,94224

8

PT. Bank Windu Kentjana International Tbk

-5,03461

-5,79403

-,44263

9

PT. Bank Mega Tbk

2,68901

11,16901

16,95980

10

PT. Bank OCBC NISP Tbk

-9,99642

-13,04862

-6,98421

11

PT. Bank Pan Indonesia Tbk

-7,34353

-3,64912

63,47274

Lampiran iv

Statistik Deskriptif

1)

Total skor penerapan struktur GCG

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

GCG 33 1.0000 2.7100 1.616667 .4660249

Valid N (listwise) 33

2)

Total LDR Tranformasi

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

LDR 33 50.3000 98.3000 77.861212 12.8266896

3)

Total NIM Sebelum Transformasi

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

NIM 33 4.0700 12.0000 5.832182 1.8344552

Valid N (listwise) 33

Total NIM Sesudah Transformasi

5)

Total ROE sebelum Transformasi

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

ROE 33 -.8000 80.3600 16.744545 14.6397419

Valid N (listwise) 33

Total ROE sesudah Transformasi

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

LN_ROE 12 -,72 4,15 1,6708 1,37841

Valid N (listwise) 12

Lampiran v

Uji Normalitas

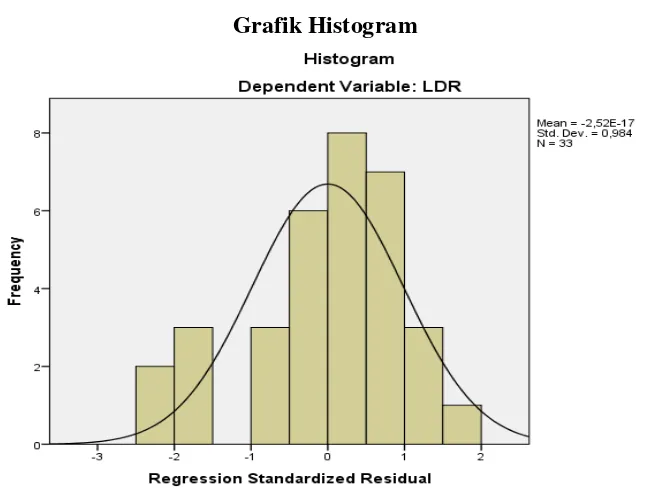

1)

Variabel dependen LDR

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 33

Normal Parametersa,b Mean 0E-7

Std. Deviation 12,21799357

Most Extreme Differences

Absolute ,124

Positive ,101

Negative -,124

Kolmogorov-Smirnov Z ,710

Asymp. Sig. (2-tailed) ,694

a. Test distribution is Normal.

2)

Variabel dependen NIM Sebelum Tranformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 33

Normal Parametersa,b Mean 0E-7

Std. Deviation 1,79089776

Most Extreme Differences

Absolute ,273

Positive ,273

Negative -,173

Kolmogorov-Smirnov Z 1,569

Asymp. Sig. (2-tailed) ,015

a. Test distribution is Normal.

b. Calculated from data.

Variabel dependen NIM Sesudah Tranformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 13

Normal Parametersa,b Mean 0E-7

Std. Deviation 1,56009608

Most Extreme Differences

Absolute ,134

Positive ,134

Negative -,121

Kolmogorov-Smirnov Z ,483

Asymp. Sig. (2-tailed) ,974

a. Test distribution is Normal.

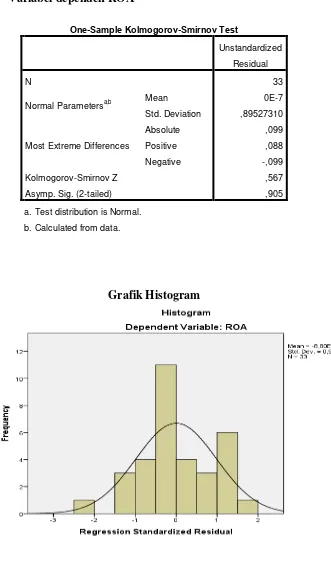

3)

Variabel dependen ROA

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 33

Normal Parametersa,b Mean 0E-7

Std. Deviation ,89527310

Most Extreme Differences

Absolute ,099

Positive ,088

Negative -,099

Kolmogorov-Smirnov Z ,567

Asymp. Sig. (2-tailed) ,905

a. Test distribution is Normal.

b. Calculated from data.

4)

Variabel dependen ROE Sebelum Tranformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 33

Normal Parametersa,b Mean 0E-7

Std. Deviation 14,08539720

Most Extreme Differences

Absolute ,242

Positive ,242

Negative -,147

Kolmogorov-Smirnov Z 1,389

Asymp. Sig. (2-tailed) ,042

a. Test distribution is Normal.

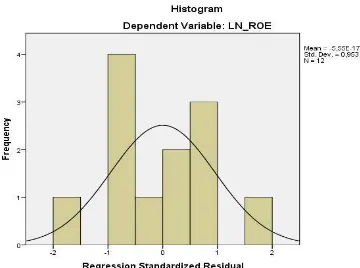

Variabel dependen ROE Sesudah Tranformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 12

Normal Parametersa,b Mean 0E-7

Std. Deviation 1,35540977

Most Extreme Differences

Absolute ,158

Positive ,141

Negative -,158

Kolmogorov-Smirnov Z ,548

Asymp. Sig. (2-tailed) ,925

a. Test distribution is Normal.

b. Calculated from data.

Lampiran vi

Uji Heteroskedastisitas

2)

Variabel dependen NIM

4)

Variabel dependen LDR

Lampiran vii

Uji Autokorelasi

1)

Variabel Dependen LDR

Model Summaryb

Model R R Square Adjusted R

a. Predictors: (Constant), GCG

2)

Variabel Dependen NIM

Model Summaryb

Model R R Square Adjusted R

a. Predictors: (Constant), GCG

b. Dependent Variable: LN_NIM

3)

Variabel Dependen ROA

Model Summaryb

Model R R Square Adjusted R

a. Predictors: (Constant), GCG

b. Dependent Variable: ROA

4)

Variabel Dependen ROE

Model Summaryb

Model R R Square Adjusted R

a. Predictors: (Constant), GCG

Lampiran viii

Hasil Regresi

1)

Variabel Dependen LDR

Variables Entered/Removeda

Model Variables

Entered

Variables

Removed

Method

1 GCGb . Enter

a. Dependent Variable: LDR

b. All requested variables entered.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 ,304a ,093 ,063 12.4134939

a. Predictors: (Constant), GCG

b. Dependent Variable: LDR

ANOVAa

a. Dependent Variable: LDR

b. Predictors: (Constant), GCG

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

Residuals Statisticsa

Minimum Maximum Mean Std. Deviation N

Predicted Value 68.701088 83.027748 77.861212 3.9044334 33

Residual -29.7953892 19.4613361 0,E-7 12.2179936 33

Std. Predicted Value -2,346 1,323 ,000 1,000 33

Std. Residual -2,400 1,568 ,000 ,984 33

a. Dependent Variable: LDR

2)

Variabel Dependen NIM

Variables Entered/Removeda

Model Variables

Entered

Variables

Removed

Method

1 GCGb . Enter

a. Dependent Variable: LN_NIM

b. All requested variables entered.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 ,407a ,165 ,089 1,62947

a. Predictors: (Constant), GCG

b. Dependent Variable: LN_NIM

ANOVAa

a. Dependent Variable: LN_NIM

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

T Sig.

B Std. Error Beta

1 (Constant) 1,630 1,757 ,928 ,373

GCG -1,490 1,009 -,407 -1,476 ,168

a. Dependent Variable: LN_NIM

Residuals Statisticsa

Minimum Maximum Mean Std. Deviation N

Predicted Value -2,0569 -,0088 -,8756 ,69420 13

Residual -2,30161 2,73329 ,00000 1,56010 13

Std. Predicted Value -1,702 1,249 ,000 1,000 13

Std. Residual -1,412 1,677 ,000 ,957 13

a. Dependent Variable: LN_NIM

3)

Variabel Dependen ROA

Variables Entered/Removeda

Model Variables

Entered

Variables

Removed

Method

1 GCGb . Enter

a. Dependent Variable: ROA

b. All requested variables entered.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 ,512a ,263 ,239 .9095984

a. Predictors: (Constant), GCG

ANOVAa

a. Dependent Variable: ROA

b. Predictors: (Constant), GCG

\

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

a. Dependent Variable: ROA

Residuals Statisticsa

Minimum Maximum Mean Std. Deviation N

Predicted Value .670316 2.630682 1.923727 .5342566 33

Std. Predicted Value -2,346 1,323 ,000 1,000 33

Standard Error of Predicted

Value ,158 ,409 ,215 ,065 33

Adjusted Predicted Value .596849 2.606502 1.925676 .5372645 33

Residual -2.0701547 1.8088789 0,E-7 .8952731 33

Std. Residual -2,276 1,989 ,000 ,984 33

Stud. Residual -2,312 2,020 -,001 1,013 33

Deleted Residual -2.1362560 1.8665173 -.0019492 .9484752 33

Stud. Deleted Residual -2,500 2,133 -,001 1,042 33

Mahal. Distance ,001 5,504 ,970 1,294 33

Cook's Distance ,000 ,167 ,030 ,037 33

Centered Leverage Value ,000 ,172 ,030 ,040 33

4)

Variabel Dependen ROE

Variables Entered/Removeda

Model Variables

Entered

Variables

Removed

Method

1 GCGb . Enter

a. Dependent Variable: LN_ROE

b. All requested variables entered.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 ,182a ,033 -,064 1,42157

a. Predictors: (Constant), GCG

b. Dependent Variable: LN_ROE

ANOVAa

a. Dependent Variable: LN_ROE

b. Predictors: (Constant), GCG

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

Residuals Statisticsa

Minimum Maximum Mean Std. Deviation N

Predicted Value 1,3387 2,2783 1,6708 ,25076 12

Std. Predicted Value -1,324 2,423 ,000 1,000 12

Standard Error of Predicted

Value ,410 1,117 ,547 ,202 12

Adjusted Predicted Value ,9856 2,0998 1,6006 ,28525 12

Residual -2,51402 2,41765 ,00000 1,35541 12

Std. Residual -1,768 1,701 ,000 ,953 12

Stud. Residual -1,871 1,782 ,018 1,024 12

Deleted Residual -2,81514 2,65360 ,07024 1,58347 12

Stud. Deleted Residual -2,202 2,046 ,012 1,116 12

Mahal. Distance ,000 5,869 ,917 1,655 12

Cook's Distance ,011 ,317 ,089 ,098 12

Centered Leverage Value ,000 ,534 ,083 ,150 12