LAMPIRAN

A. Sampel Penelitian

Daftar Perusahaan Property dan Real Estate 2009-2011

35 Danayasa Arthatama Tbk SCBD SAMPEL28 36 Suryainti Permata Tbk SIIP -

B. Data Penelitian

Tabulasi Data Variabel Penelitian (Sebelum Transformasi) 2009-2011

No Sampel DER DAR LDER ROE GR PER EPS DPS HARGA SAHAM

Tabulasi Data Variabel Penelitian (Setelah Transformasi) 2009-2011

No Sampel LNDER LNDAR LNLDER LNROE LNGR LNPER LNEPS LNDPS LNHARGA SAHAM 1 ASRI 2009 -0.17 -0.80 -0.67 1.81 -2.66 1.09 1.89 -1.47 4.65

C. Hasil Output SPSS Statistik Deskriptif

Descriptive Statistics

N Minimum Maximum Mean

Std.

Deviation Variance

DER 90 -1.82 3.83 .8172 .84303 .711

DAR 90 .04 2.24 .4306 .38895 .151

LDER 90 .01 3.01 .3571 .45560 .208

ROE 90 -20.04 60.40 9.8498 11.92670 142.246

GR 90 -.84 1.73 .2256 .51113 .261

PER 90 -131.57 166.66 9.7080 36.71382 1347.905

EPS 90 -42.54 243.73 22.1105 43.30126 1874.999

DPS 90 .00 95.43 9.2285 16.42341 269.728

HARGA

SAHAM

90 50.00 2900.00 485.7222 621.43404 386180.270

Valid N

(listwise)

Histogram

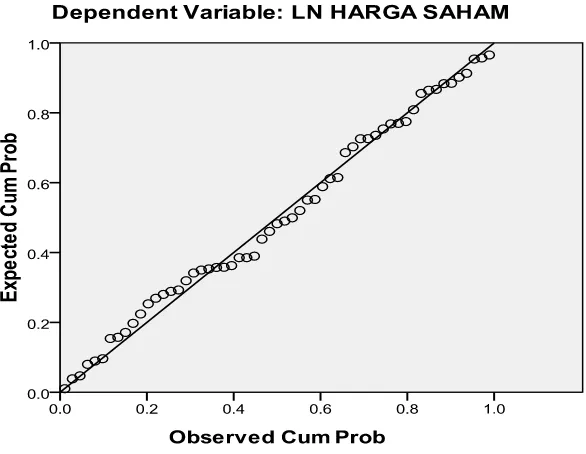

Grafik P-P Plot

Mean=1.496-15 Std Dev =0.926

Uji Autokorelasi

Uji F

ANOVAb

Model

Sum of

Squares df Mean Square F Sig.

1 Regression 24.880 8 3.110 5.564 .000a

Residual 26.827 48 .559

Total 51.707 56

a. Predictors: (Constant), LN DPS, LN LDER, LN ROE, LN GR, LN EPS, LN PER, LN DER, LN DAR