PT PUDJIADI AND SONS Tbk DAN ENTITAS ANAK/ AND SUBSIDIARIES

LAPORAN KEUANGAN KONSOLIDASIAN TANGGAL 31 DESEMBER 2020 SERTA TAHUN YANG BERAKHIR PADA TANGGAL TERSEBUT

DAN LAPORAN AUDITOR INDEPENDEN

CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2020 AND

FOR THE YEAR THEN ENDED AND INDEPENDENT AUDITORS’ REPORT

DAN ENTITAS ANAK

LAPORAN KEUANGAN KONSOLIDASIAN TANGGAL 31 DESEMBER 2020 SERTA TAHUN YANG BERAKHIR PADA TANGGAL

TERSEBUT

DAN LAPORAN AUDITOR INDEPENDEN

DAFTAR ISI Halaman/

Pages

PT PUDJIADI AND SONS Tbk AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2020 AND

FOR THE YEAR THEN ENDED AND INDEPENDENT AUDITORS’ REPORT

TABLE OF CONTENTS

Surat Pernyataan Direksi Director’s Statement Letter

Laporan Auditor Independen Independent Auditors’ Report

Laporan Posisi Keuangan Konsolidasian 1 - 3 Consolidated Statement of Financial Position Laporan Laba Rugi dan Penghasilan

Komprehensif Lain Konsolidasian 4 - 6

Consolidated Statement of Profit or Loss and Other Comprehensive Income Laporan Perubahan Ekuitas Konsolidasian 7 - 8 Consolidated Statement of Changes in Equity

Laporan Arus Kas Konsolidasian 9 Consolidated Statement of Cash Flows

The original report included herein is in Indonesian language. Laporan Auditor Independen

Laporan No. 00599/2.1051/AU.1/10/0929-3/1/V/2021 Pemegang Saham, Dewan Komisaris, dan Direksi

PT PUDJIADI AND SONS Tbk

Independent Auditor’s Report

Report No. 00599/2.1051/AU.1/10/0929-3/1/V/2021 Shareholders, Board of Commissioners, and Directors

PT PUDJIADI AND SONS Tbk

Kami telah mengaudit laporan keuangan konsolidasian PT Pudjiadi and Sons Tbk dan entitas

anaknya terlampir yang terdiri atas laporan posisi keuangan konsolidasian tanggal 31 Desember 2020, serta laporan laba rugi dan penghasilan komprehensif lain, laporan perubahan ekuitas, dan laporan arus kas konsolidasian untuk tahun yang berakhir pada tanggal tersebut, dan suatu ikhtisar kebijakan akuntansi signifikan dan informasi penjelasan yang lain.

We have audited the accompanying consolidated financial statements of PT Pudjiadi and Sons Tbk and its subsidiaries which comprise the consolidated statement of financial position as of December 31, 2020, and the consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information.

Tanggung jawab manajemen atas laporan keuangan konsolidasian

Management’s responsibility for the consolidated financial statements

Manajemen bertanggung jawab atas penyusunan dan penyajian wajar laporan keuangan konsolidasian tersebut sesuai dengan standar akuntansi keuangan di Indonesia dan atas pengendalian internal yang dianggap perlu oleh manajemen untuk memungkinkan penyusunan laporan keuangan konsolidasian yang bebas dari kesalahan penyajian material, baik yang disebabkan oleh kecurangan maupun kesalahan.

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with financial accounting standards in Indonesia and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Tanggung jawab auditor Auditor’s responsibility

Tanggung jawab kami adalah untuk menyatakan suatu opini atas laporan keuangan konsolidasian tersebut berdasarkan audit kami. Kami melaksanakan audit kami berdasarkan standar audit yang ditetapkan oleh Institut Akuntan Publik Indonesia. Standar tersebut mengharuskan kami untuk mematuhi ketentuan etika serta merencanakan dan melaksanakan audit untuk memperoleh keyakinan memadai tentang apakah laporan keuangan konsolidasian tersebut bebas dari kesalahan penyajian material.

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with standards on auditing established by the Indonesian Institute of Certified Public Accountants. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

The original report included herein is in Indonesian language

Tanggung jawab auditor (lanjutan) Auditor’s responsibility (continued)

Suatu audit melibatkan pelaksanaan prosedur untuk memperoleh bukti audit tentang angka-angka dan pengungkapan dalam laporan keuangan. Prosedur yang dipilih bergantung pada pertimbangan auditor, termasuk penilaian atas risiko kesalahan penyajian material dalam laporan keuangan, baik yang disebabkan oleh kecurangan maupun kesalahan. Dalam melakukan penilaian risiko tersebut, auditor mempertimbangkan pengendalian internal yang relevan dengan penyusunan dan penyajian wajar laporan keuangan entitas untuk merancang prosedur audit yang tepat sesuai dengan kondisinya, tetapi bukan untuk tujuan menyatakan opini atas keefektivitasan pengendalian internal entitas. Suatu audit juga mencakup pengevaluasian atas ketepatan kebijakan akuntansi yang digunakan dan kewajaran estimasi akuntansi yang dibuat oleh manajemen serta pengevaluasian atas penyajian laporan keuangan secara keseluruhan.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management as well as evaluating the overall presentation of the financial statements.

Kami yakin bahwa bukti audit yang telah kami peroleh adalah cukup dan tepat untuk menyediakan suatu basis bagi opini audit kami.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opini Opinion

Menurut opini kami, laporan keuangan konsolidasian terlampir menyajikan secara wajar, dalam semua hal

yang material, posisi keuangan konsolidasian PT Pudjiadi and Sons Tbk dan entitas anaknya pada

tanggal 31 Desember 2020, serta kinerja keuangan, dan arus kas konsolidasiannya untuk tahun yang berakhir pada tanggal tersebut sesuai dengan standar akuntansi keuangan di Indonesia.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of PT Pudjiadi and Sons Tbk and its subsidiaries as of December 31, 2020 and their consolidated financial performance, and cash flows for year then ended in accordance with financial accounting standards in Indonesia.

Penekanan suatu hal Emphasis of matters

Kami mengarahkan perhatian pada Catatan 37 atas laporan keuangan konsolidasian terlampir yang terdapat pengungkapan bahwa PT Pudjiadi and Sons Tbk dan entitas anaknya mengalami penurunan pendapatan, kerugian komprehensif berulang, liabilitas lancar yang melebihi aset lancarnya, serta kekurangan arus kas yang signifikan. Kondisi tersebut, yang antara lain disebabkan oleh terjadinya pandemi COVID-19, yang juga telah diungkapkan dalam Catatan tersebut di atas, mengindikasikan ada suatu ketidakpastian material yang dapat menyebabkan keraguan signifikan atas kemampuan PT Pudjiadi and Sons Tbk dan entitas anaknya untuk mempertahankan kelangsungan usahanya. Rencana manajemen untuk mengatasi kondisi tersebut juga telah diungkapkan dalam Catatan 37 atas laporan keuangan konsolidasian. Laporan keuangan konsolidasian terlampir tidak mencakup penyesuaian yang berasal dari kondisi ketidakpastian tersebut. Opini kami tidak dimodifikasi sehubungan dengan hal tersebut.

We bring attention to Note 37 to the accompanying consolidated financial statements where it is disclosed that PT Pudjiadi and Sons Tbk and its subsidiaries experienced decrease in revenue, recurring comprehensive losses, current liabilities exceeding their current assets, and significant cash flow shortages. This condition, which is caused among others by the COVID-19 pandemic, which is also disclosed in the abovementioned Note, indicates the existence of a material uncertainty that may cast significant doubt on the ability of PT Pudjiadi and Sons Tbk and its subsidiaries to continue as a going concern. Management’s plans in regards of this matter has also been disclosed in Note 37 to the consolidated financial statements. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this material uncertainty. Our opinion is not modified in respect of such matter.

KOSASIH, NURDIYAMAN, MULYADI, TJAHJO & REKAN

Drs. Emanuel Handojo Pranadjaja, CA, CPA

Nomor Registrasi Akuntan Publik/Public Accountant Registration Number AP. 0929 11 Mei 2021/May 11, 2021

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole. 1 KONSOLIDASIAN Tanggal 31 Desember 2020 POSITION As of December 31, 2020 Catatan/ Notes 2020 2019 ASET ASSETS

ASET LANCAR CURRENT ASSETS

2d,2q,

Kas dan setara kas 2u,4,34 16.008.303.771 41.673.451.985 Cash and cash equivalents

Investasi jangka pendek 2u,5,34 Short-term investment

Pihak ketiga 1.415.825.533 4.490.824.605 Third parties

Pihak berelasi 2e,7a - 38.841.000 Related party

Piutang usaha - pihak ketiga - neto 2u,6,27,34 11.187.254.479 16.752.740.394 Trade receivables - third parties - net

Piutang lain - lain 2u,34 Other receivables

Pihak ketiga 3.525.228.092 3.423.439.651 Third parties

Pihak berelasi 2e,7b 922.666.922 487.876.168 Related parties

Persediaan - neto 2f,8,27 11.688.377.679 13.375.578.892 Inventories - net

Beban dibayar dimuka 2g,9 1.886.321.797 1.907.845.988 Prepaid expenses

Total Aset Lancar 46.633.978.273 82.150.598.683 Total Current Assets

ASET TIDAK LANCAR NONCURRENT ASSETS

Uang muka pembelian aset dan Advances purchase of fixed assets

properti investasi 10 119.300.109 5.565.744.994 and property investment

2h,2k,

Aset tetap - neto 11,20 333.865.441.675 346.446.922.566 Fixed assets - net

Properti investasi - neto 2i,2k,12,20 2.854.671.074 4.460.469.517 Property investment - net

Investasi pada Entitas Asosiasi 2j,13 2.393.310.342 3.414.569.353 Investment on Associates

Beban tangguhan - hak atas Deferred expenses - land

tanah - neto 2h,14 3.285.741.776 3.242.596.552 rights - net

Aset pajak tangguhan 2r,18d 11.922.406.328 12.844.916.825 Deferred tax assets

Aset tidak lancar lainnya 2.107.566.590 2.348.524.410 Others non-current assets

Taksiran restitusi pajak penghasilan 2r,18c 658.495.810 15.338.649 Estimated income tax refund

Total Aset Tidak Lancar 357.206.933.704 378.339.082.866 Total Noncurrent Assets

TOTAL ASET 403.840.911.977 460.489.681.549 TOTAL ASSETS

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole.

LAPORAN POSISI KEUANGAN KONSOLIDASIAN Tanggal 31 Desember 2020

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of December 31, 2020

Catatan/

Notes 2020 2019

LIABILITAS DAN EKUITAS LIABILITIES AND EQUITY

LIABILITAS JANGKA PENDEK CURRENT LIABILITES

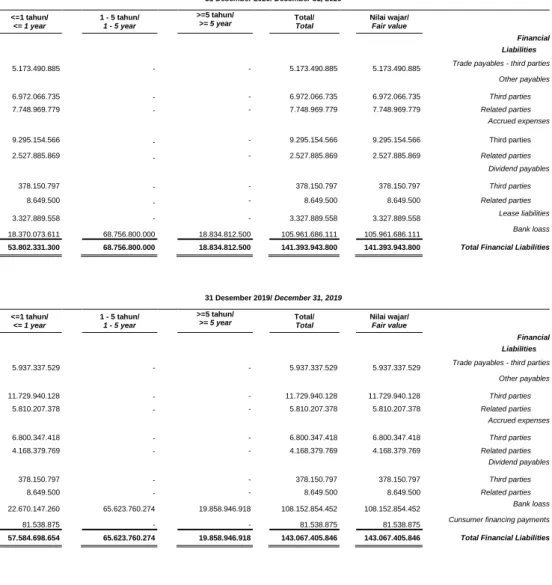

Utang usaha - pihak ketiga 2u,15,34 5.173.490.885 5.937.337.529 Trade payables - third parties

Utang lain-lain 2u,34 Other payables

Pihak ketiga 16 6.972.066.735 11.729.940.128 Third parties

Pihak berelasi 2e,7c 7.748.969.779 5.810.207.378 Related parties

Beban masih harus dibayar 2u,17,34 Accrued expenses

Pihak ketiga 9.295.154.566 6.800.347.418 Third parties

Pihak berelasi 2e,7d 2.527.885.869 4.168.379.769 Related parties

Utang pajak 2r,18a 3.054.029.354 4.246.558.556 Taxes payable

Utang deviden 2m,2u,34 Dividend payables

Pihak ketiga 378.150.797 378.150.797 Third parties

Pihak berelasi 2e,7e 8.649.500 8.649.500 Related parties

Pendapatan diterima dimuka 2p,19 9.186.673.310 14.520.142.111 Unearned revenues

Penyisihan untuk penggantian Allowance for hotel furniture

perabotan dan peralatan hotel 2l 505.216.746 449.363.060 and equipment replacement

Liabilitas sewa 2o,2u,22,34 3.327.889.558 - Lease liabilities

Bagian liabilitas jangka panjang

yang jatuh tempo dalam Current maturities

waktu satu tahun : 2u of long-term loans:

Utang bank 11,20,34 10.050.000.000 13.500.000.000 Bank loans

Utang pembiayaan konsumen 21,34 - 80.573.581 Consumer financing payables

Total Liabilitas Jangka Pendek 58.228.177.099 67.629.649.827 Total Current Liabilities

LIABILITAS JANGKA PANJANG NONCURRENT LIABILITIES

Liabilitas pajak tangguhan 2r,18d 503.116.536 566.188.614 Deferred tax liabilities

Liabilitas imbalan kerja karyawan 2n,23 64.147.399.582 63.178.497.817 Employee benefits liabilities

Bagian liabilitas jangka panjang

setelah dikurangi bagian yang

jatuh tempo dalam waktu Long-term loans - net of

satu tahun: 2u current maturities:

Utang bank 11,20,34 66.075.000.000 65.875.000.000 Bank loans

Total Liabilitas Jangka Panjang 130.725.516.118 129.619.686.431 Total Noncurrent Liabilities

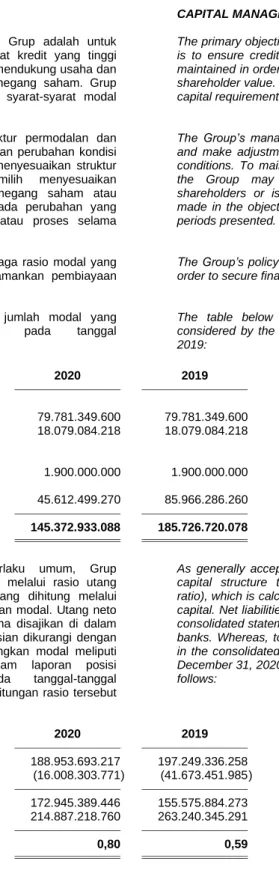

TOTAL LIABILITAS 188.953.693.217 197.249.336.258 TOTAL LIABILITIES

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole.

3 DAN ENTITAS ANAK

LAPORAN POSISI KEUANGAN KONSOLIDASIAN Tanggal 31 Desember 2020

AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of December 31, 2020

Catatan/

Notes 2020 2019

EKUITAS YANG DAPAT

DIATRIBUSIKAN EQUITY ATTRIBUTABLE

KEPADA PEMILIK TO THE OWNERS OF

ENTITAS INDUK THE COMPANY

Modal saham - nilai nominal Share capital - par value

Rp 100 per saham Rp 100 per share

Modal dasar - Authorized share capital -

2.480.000.000 saham 2,480,000,000 shares

Modal ditempatkan dan disetor Issued and fully paid share

penuh - 797.813.496 saham 24 79.781.349.600 79.781.349.600 capital - 797,813,496

Tambahan modal disetor - neto 2b.25 18.079.084.218 18.079.084.218 Additional paid-in capital - net

Saldo laba Retained earnings

Dicadangkan 1.900.000.000 1.900.000.000 Appropriated

Belum dicadangkan 45.612.499.270 85.966.286.260 Unappropriated

EKUITAS YANG DAPAT EQUITY ATTRIBUTABLE

DIATRIBUSIKAN KEPADA TO THE OWNERS OF THE

PEMILIK ENTITAS INDUK 145.372.933.088 185.726.720.078 THE COMPANY

Kepentingan nonpengendali 2b,31 69.514.285.672 77.513.625.213 Noncontrolling interest

TOTAL EKUITAS 214.887.218.760 263.240.345.291 TOTAL EQUITY

TOTAL LIABILITAS DAN TOTAL LIABILITIES

EKUITAS 403.840.911.977 460.489.681.549 EQUITY

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole.

LAPORAN LABA RUGI DAN

PENGHASILAN KOMPREHENSIF LAIN KONSOLIDASIAN Tahun Yang Berakhir Pada Tanggal

31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

For the Year Ended December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/

2020 Notes 2019

PENDAPATAN DEPARTEMENTAL 2p DEPARTMENTAL REVENUES

Kamar 43.276.794.714 128.290.846.909 Rooms

Makanan dan minuman 26.499.033.517 74.676.092.470 Food and beverages

Lain-lain 6.736.098.097 12.663.090.649 Others

TOTAL PENDAPATAN TOTAL DEPARTEMENTAL

DEPARTEMENTAL 76.511.926.328 215.630.030.028 REVENUES

BEBAN DEPARTEMENTAL DEPARTMENTAL EXPENSES

Beban pokok penjualan 2p Cost of sales

Kamar 8.046.605.076 20.641.795.394 Rooms

Makanan dan minuman 11.143.133.830 27.587.105.673 Food and beverages

Lain-lain 2.462.510.516 4.558.763.618 Others

Total beban pokok penjualan 21.652.249.422 52.787.664.685 Total cost of sales

Gaji, upah dan tunjangan lainnya 32.741.293.740 44.770.932.942 Salaries, wages and allowances

TOTAL BEBAN TOTAL DEPARTEMENTAL

DEPARTEMENTAL 54.393.543.162 97.558.597.627 EXPENSES

LABA BRUTO 22.118.383.166 118.071.432.401 GROSS PROFIT

BEBAN USAHA 2p OPERATING EXPENSES

Equipment, maintanance

Peralatan, pemeliharaan dan energi 16.464.466.647 26 31.510.434.045 and energy

Gaji, upah dan tunjangan lainny 22.251.444.359 30.410.134.394 Salaries, wages and allowances

General and administrative

Beban umum dan administrasi 9.534.794.654 2p,6,8,27 8.935.638.253 expenses

Beban pemasaran 1.824.794.355 28 3.728.362.725 Marketing expenses

Total Beban Usaha 50.075.500.015 74.584.569.417 Total operating expenses

LABA (RUGI) USAHA (27.957.116.849) 43.486.862.984 OPERATING INCOME (LOSS)

PENDAPATAN (BEBAN) TOTAL OTHER INCOME

LAIN - LAIN 2p (EXPENSES)

Penyusutan aset tetap (19.265.966.748) 2h,11 (17.732.225.113 ) Depreciaton of fixed assets

Bunga (7.847.644.426) 20,21 (9.479.638.689 ) Interest

Pajak bumi dan bangunan (2.124.515.664) (2.635.340.702 ) Property taxes

Asuransi (1.656.950.763) (1.570.952.520 ) Insurance

Amortisasi perangkat lunak (327.003.196) (193.101.423 ) Software amortization

Laba (rugi) investasi jangka Gain (loss) on short-term

pendek - neto (318.755.882) 2u,5 54.382.609 investment - net

Amortisasi beban tangguhan - Amortization deferred expenses -

hak atas tanah (231.854.776) 2h,14 (218.104.776 ) land rights

Denda pajak (567.948) (280.373.092 ) Tax penalties

Gain on property

Laba penjualan properti investasi 338.541.667 2i,12 - investment disposal

Penghasilan bunga 138.766.668 164.778.990 Interest income

Laba (rugi) selisih kurs - neto 70.207.480 2q (306.283.378 ) Gain (loss) on exchange rate - net

Laba penjualan aset tetap 6.000.000 2h,11 19.794.494 Gain on fixed asset disposal

Sewa kendaraan (2.801.810.000 ) Leases

Lain-lain - neto 3.547.762.159 289.141.540 Others - net

Total Beban Lain-lain - Neto (27.671.981.429) (34.689.732.060 ) Total Other Expenses - Net

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole.

5 PENGHASILAN KOMPREHENSIF LAIN KONSOLIDASIAN

Tahun Yang Berakhir Pada Tanggal 31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

AND OTHER COMPREHENSIVE INCOME For the Year Ended,

December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/

2020 Notes 2019

LABA (RUGI) SEBELUM INCOME (LOSS) BEFORE

BEBAN JASA MANAJEMEN, MANAGEMENT FEES,

INSENTIF DAN INCENTIVE AND

PEMASARAN (55.629.098.278) 8.797.130.924 MARKETING EXPENSES

Beban jasa manajemen, insentif Management fees, incentives

dan pemasaran (1.713.603.138) 36 (5.656.662.226 ) and marketing expenses

LABA (RUGI) SEBELUM BEBAN INCOME (LOSS) BEFORE

KANTOR PUSAT (57.342.701.416) 3.140.468.698 HEAD OFFICE EXPENSES

PENDAPATAN (BEBAN) TOTAL HEAD OFFICE

KANTOR PUSAT 2p INCOME (EXPENSES)

Pendapatan klaim asuransi 15.758.436.681 19 - income from insurance claim

Gaji, upah dan tunjangan lainnya (7.754.973.828) (10.503.965.734 ) Salaries, wages and allowances

Umum dan administrasi (2.208.421.388) 29 (4.658.332.976 ) General and administrative

Bagian atas laba (rugi) neto

Entitas Asosiasi (827.787.897) 2j,13 241.164.103 Net gain (loss) on Associates

Penyusutan aset tetap (457.840.369) 2h,11 (455.629.958 ) Depreciation of fixed assets

Penyusutan property investasi (344.340.110) 2i,12 (358.923.441 ) Depreciation of property investment

Rugi investasi jangka pendek - neto (128.084.000) 2u,5 (120.700.556 ) Loss on short-term investment - net

Pendapatan bunga 233.684.268 548.811.571 Interest income

Lain-lain - neto 2.714.470.435 571.626.426 Others - net

Total Pendapatan (Beban) Total Head Office Income

Kantor Pusat - Neto 6.985.143.792 (14.735.950.565 ) (Expenses) - Net

RUGI SEBELUM MANFAAT LOSS BEFORE TAX

(BEBAN) PAJAK (50.357.557.624) (11.595.481.867 ) BENEFIT (EXPENSES)

MANFAAT (BEBAN) PAJAK 2r,18b INCOME TAX BENEFIT

PENGHASILAN (EXPENSES)

Kini - (3.439.608.000 ) Current

Tangguhan (247.323.481) 1.334.077.765 Deferred

Total Beban Pajak - Neto (247.323.481) (2.105.530.235 ) Total Tax Expenses - Net

RUGI NETO TAHUN BERJALAN (50.604.881.105) (13.701.012.102 ) NET LOSS FOR THE YEAR

PENGHASILAN (RUGI) OTHER COMPEHENSIVE

KOMPREHENSIF LAIN INCOME (LOSS)

Pos yang tidak akan Item that will not be

direklasifikasi ke laba rugi reclassified to profit or

pada periode berikutnya : loss in subsequent period

Pengukuran kembali Remeasurement of employee

liabilitas imbalan kerja 2.782.340.626 2n,23 (6.801.430.595 ) benefits liabilities

Bagian atas penghasilan (rugi)

komprehensif lain Entitas Portion of other comprehensive

Asosiasi 20.278.886 2j,13 (3.905.968 ) income (loss) from Associates

Efek pajak terkait (612.114.938) 2r,18d 1.700.357.649 Related tax effect

Penghasilan (rugi) komprehensif Other comprehensive income

lain 2.190.504.574 (5.104.978.914 ) (loss)

TOTAL RUGI KOMPREHENSIF (48.414.376.531) (18.805.991.016 ) TOTAL COMPREHENSIVE LOSS

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial statements

taken as whole.

LAPORAN LABA RUGI DAN

PENGHASILAN KOMPREHENSIF LAIN KONSOLIDASIAN Tahun Yang Berakhir Pada Tanggal

31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

For the Year Ended, December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/

2020 Notes 2019

LABA (RUGI) NETO TAHUN NET INCOME (LOSS)

BERJALAN YANG DAPAT FOR THE YEAR

DIATRIBUSIKAN KEPADA ATTRIBUTABLE TO :

Pemilik Entitas Induk (40.628.111.375) (16.735.641.291 ) Owners of the Company

Kepentingan Nonpengendali (9.976.769.730) 2b,31 3.034.629.189 Noncontrolling Interest

TOTAL (50.604.881.105) (13.701.012.102 ) TOTAL

LABA (RUGI) KOMPREHENSIF COMPREHENSIVE INCOME

YANG DAPAT (LOSS)

DIATRIBUSIKAN KEPADA : ATTRIBUTABLE TO :

Pemilik Entitas Induk (40.353.786.990) (20.988.195.692 ) Owners of the Company

Kepentingan Nonpengendali (8.060.589.541) 2b.31 2.182.204.676 Noncontrolling Interest

TOTAL (48.414.376.531) (18.805.991.016 ) TOTAL

RUGI PER SAHAM YANG LOSS PER SHARE

DAPAT DIATRIBUSIKAN ATTRIBUTABLE TO

KEPADA PEMILIK OWNERS OF THE

ENTITAS INDUK (51) 2t,30 (21 ) COMPANY

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these

consolidated financial statements taken as whole.

LAPORAN PERUBAHAN EKUITAS KONSOLIDASIAN Tahun Yang Berakhir Pada Tanggal

31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY For the Year Ended

December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/ Notes Modal Saham Ditempatkan dan Disetor Penuh/

Issued and Fully Paid Share Capital

Tambahan modal disetor/Addition

paid-in capital

Saldo Laba/

Retained Earnings

Ekuitas yang Dapat Diatribusikan Kepada Pemilik Entitas Induk/ Equity Attributable to Owners of The Company Kepentingan Nonpengendali/ Noncontrolling Interest Total Ekuitas/ Total Equity Dicadangkan/ Appropriated Belum Dicadangkan/ Unappropriated Saldo 31 Desember 2018 79.781.349.600 18.079.084.218 1.900.000.000 106.954.481.952 206.714.915.770 75.733.033.537 282.447.949.307 Balance as of December 31, 2018

Total rugi neto

tahun 2019 - - - (16.735.641.291 ) (16.735.641.291 ) 3.034.629.189 (13.701.012.102 ) Total net loss for the 2019

Penghasilan komprehensif lain Other comprehensive income Pengukuran kembali liabilitas imbalan kerja 22 - - - (4.249.767.687 ) (4.249.767.687 ) (851.305.259 ) (5.101.072.946 ) Remeasurement of employee benefit liabilities Bagian penghasilan komprehensif lain Entitas Asosiasi - - - (2.786.714 ) (2.786.714 ) (1.119.254 ) (3.905.968 ) Portion of other comprehensive income from Associates

Dividen Entitas Anak - - - - - (481.238.000 ) (481.238.000 )

Dividend from Subsidiaries Dividen Entitas Asosiasi - - - - - 79.625.000 79.625.000 Dividend from Associates Saldo 31 Desember 2019 79.781.349.600 18.079.084.218 1.900.000.000 85.966.286.260 185.726.720.078 77.513.625.213 263.240.345.291 Balance as of December 31, 2019

Catatan atas laporan keuangan konsolidasian terlampir The accompanying notes to the consolidated financial statements

PT PUDJIADI AND SONS Tbk

LAPORAN PERUBAHAN EKUITAS KONSOLIDASIAN Tahun Yang Berakhir Pada Tanggal

31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

PT PUDJIADI AND SONS Tbk

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY For the Year Ended

December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/

Notes

Modal Saham Ditempatkan dan

Disetor Penuh/

Issued and Fully Paid Share Capital

Tambahan modal disetor/Addition

paid-in capital

Saldo Laba/

Retained Earnings

Ekuitas yang Dapat Diatribusikan Kepada Pemilik Entitas Induk/ Equity Attributable to Owners of The Company Kepentingan Nonpengendali/ Noncontrolling Interest Total Ekuitas/ Total Equity Dicadangkan/ Appropriated Belum Dicadangkan/ Unappropriated Saldo 31 Desember 2019 79.781.349.600 18.079.084.218 1.900.000.000 85.966.286.260 185.726.720.078 77.513.625.213 263.240.345.291 Balance as of December 31, 2019

Total rugi neto

tahun 2020 - - - (40.628.111.375 ) (40.628.111.375 ) (9.976.769.730 ) (50.604.881.105 ) Total net loss for the 2020

Penghasilan komprehensif lain Other comprehensive income Pengukuran kembali liabilitas imbalan kerja 22 - - - 259.856.408 259.856.408 1.910.369.280 2.170.225.688 Remeasurement of employee benefit liabilities Bagian penghasilan komprehensif lain Entitas Asosiasi - - - 14.467.977 14.467.977 5.810.909 20.278.886 Portion of other comprehensive income from Associates Dividen Entitas Asosiasi - - - - - 61.250.000 61.250.000 Dividend from Associates Saldo 31 Desember 2020 79.781.349.600 18.079.084.218 1.900.000.000 45.612.499.270 145.372.933.088 69.514.285.672 214.887.218.760 Balance as of December 31, 2020

Catatan atas laporan keuangan konsolidasian terlampir merupakan bagian yang tidak terpisahkan dari laporan

keuangan konsolidasian secara keseluruhan.

The accompanying notes to the consolidated financial statements form an integral part of these consolidated financial

statements taken as whole.

DAN ENTITAS ANAK

LAPORAN ARUS KAS KONSOLIDASIAN Tahun Yang Berakhir Pada Tanggal

31 Desember 2020

(Disajikan dalam Rupiah, kecuali dinyatakan lain)

AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS For the Year Ended

December 31, 2020

(Expressed in Rupiah, unless otherwise stated)

Catatan/

2020 Notes 2019

ARUS KAS DARI CASH FLOWS FROM

AKTIVITAS OPERASI OPERATING ACTIVITIES

Penerimaan kas dari pelanggan 75.322.918.073 214.931.413.912 Cash receipt from customers

Pendapatan klaim asuransi 11.767.079.761 2.464.687.500 Insurances claim

Penghasilan bunga 372.450.936 713.590.561 Interest income

Pembayaran kas untuk gaji, upah Cash payment for

dan tunjangan lainnya (58.996.469.534) (82.174.110.503 ) salaries, wages and allowances

Pembayaran kas kepada pemasok, Cash payment to suppliers,

pihak ketiga dan pemerintah (50.225.236.026) (107.682.271.982 ) third parties and goverment

Pembayaran beban keuangan (6.847.026.185) (9.479.638.689 ) Payment for financial expenses

Penerimaan (pengeluaran) untuk Receipt (payment) for other

kegiatan usaha lainnya 1.386.444.773 (7.853.047.737 ) operating activities

Kas Neto Diperoleh dari Net Cash Flows Provided by

(Digunakan untuk) (Used for)

Aktivitas Operasi (27.219.838.202) 10.920.623.062 Operating Activities

ARUS KAS DARI CASH FLOWS FROM

AKTIVITAS INVESTASI INVESTING ACTIVITIES

Penerimaan pengalihan uang muka Receipt of transfer of advance Advances for acquisition

pembelian properti investasi 4.750.000.000 - purchase of property investment

Pengambilan dana investasi Receipt of short-term Advances for acquisition

jangka pendek 2.000.055.000 - investment

Hasil penjualan properti investasi 1.600.000.000 - Disposal of property investment

Hasil penjualan investasi

jangka pendek 282.789.320 1.024.576.328 Disposal of short-term investment

Penerimaan deviden dari Dividend receipt from

Entitas Asosiasi 275.000.000 357.500.000 Associate Entities

Hasil penjualan aset tetap 6.000.000 72.000.000 Disposal of fixed assets

Perolehan aset tetap (3.086.423.384) (8.489.027.643 ) Acquisition of fixed assets

Perolehan investasi jangka pendek - (1.070.609.384 ) Acquisition of short-term investment

Kas Net Diperoleh dari (Digunakan Net Cash Flows Provided by

untuk) Aktivitas Investasi 5.827.420.936 (8.105.560.699 ) (Used for) Investing Activities

ARUS KAS DARI CASH FLOWS FROM

AKTIVITAS PENDANAAN FINANCING ACTIVITIES

Pembayaran utang Payment for long-term

bank jangka panjang (3.250.000.000) (38.000.000.000 ) bank loans

Pembayaran utang Payment for consumer

Pembiayaan konsumen (80.573.581) (457.457.745 ) financing payables

Pembayaran liabilitas sewa (942.157.367) - Payment for lease laibilities

Perolehan utang Proceed from long-term

bank jangka panjang - 45.000.000.000 bank loans

Pembayaran dividen - (481.238.000 ) Dividend payment

Kas Bersih Diperoleh dari Net Cash Flows

(Digunakan untuk) Provided by (Used for)

Aktivitas Pendanaan (4.272.730.948) 6.061.304.255 Financing Activities

KENAIKAN (PENURUNAN) NET INCREASE (DECREASE)

NETO KAS DAN IN CASH AND

SETARA KAS (25.665.148.214) 8.876.366.618 CASH EQUIVALENTS

CASH AND BAN

KAS DAN SETARA KAS CASH AND CASH EQUIVALENTS

AWAL TAHUN 41.673.451.985 32.797.085.367 AT BEGINNING OF YEAR

KAS DAN SETARA KAS CASH AND CASH EQUIVALENTS

AKHIR TAHUN 16.008.303.771 41.673.451.985 AT END OF YEAR

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

1. UMUM 1. GENERAL

a. Pendirian dan Informasi Umum Entitas Induk a. The Company’s Establishment and General

Information PT Pudjiadi And Sons Tbk ("Entitas Induk") didirikan

dalam kerangka Undang-Undang Penanaman Modal Dalam Negeri No. 6 tahun 1968, juncto Undang-Undang No. 12 tahun 1970 berdasarkan Akta Notaris Ridwan Suselo, S.H., Notaris di Jakarta, No. 34 tanggal 17 Desember 1970. Akta pendirian ini telah disahkan oleh Menteri Kehakiman Republik Indonesia melalui Surat Keputusan No. Y.A.5/278/16 tanggal 2 Agustus 1973 dan telah diumumkan dalam Berita Negara Republik Indonesia No. 67 Tambahan No. 405 tanggal 20 Agustus 1974.

PT Pudjiadi And Sons Tbk ("Company") was established within the framework of the Domestic Investment Law No. 6 of 1968, juncto Law No. 12 of 1970 based on Notarial Deed Ridwan Suselo, S.H., Notary in Jakarta, No. 34 dated December 17, 1970. This deed of establishment was approved by the Minister of Justice of the Republic of Indonesia through Decision Letter No. Y.A.5/278/16 dated August 2, 1973 and has been announced in the State Gazette of the Republic of Indonesia No. 67 Additional No. 405 dated August 20, 1974.

Anggaran Dasar Entitas Induk telah mengalami beberapa kali perubahan, yang terakhir berdasarkan Akta Notaris Fathiah Helmi, S.H., No. 66 tanggal 14 Juni 2013 mengenai perubahan modal saham ditempatkan dan disetor penuh dan jumlah saham beredar karena pembagian dividen saham (Catatan 1b). Perubahan Anggaran Dasar tersebut telah mendapat persetujuan dari Menteri Hukum dan Hak Asasi Manusia Republik Indonesia melalui Surat Keputusan No. AHU-0074575.AH.01.09.Tahun 2013 tanggal 2 Agustus 2013 dan telah diumumkan dalam Berita Negara Republik Indonesia No. 26 Tambahan No. 3138/L tanggal 1 April 2014.

The Articles of Association of the Company have been amended several times, the latest being based on Notary Deed of Fathiah Helmi, S.H., No. 66 dated June 14, 2013 concerning changes in issued and fully paid capital stock and the number of outstanding shares due to the distribution of share dividends (Note 1b). Amendment to the Articles of Association has been approved by the Minister of Law and Human Rights of the Republic of Indonesia through Decision Letter No. AHU-0074575.AH.01.09. Tahun 2013 dated 2 August 2013 and has been announced in the State Gazette of the Republic of Indonesia No. 26 Additional No. 3138 / L on April 1, 2014.

Sesuai dengan pasal 3 Anggaran Dasar Entitas Induk, ruang lingkup kegiatan Entitas Induk adalah di bidang perhotelan dengan segala fasilitas dan sarana penunjang lainnya, antara lain jasa akomodasi, perkantoran, perbelanjaan, apartemen, sarana rekreasi dan hiburan yang berada di lokasi hotel. Entitas Induk berkedudukan di Jakarta dan kantor berlokasi di Jalan Hayam Wuruk No. 126, Jakarta. Entitas Induk mulai melakukan kegiatan usaha secara komersial pada tahun 1970.

In accordance with article 3 of the Company's Articles of Association, the scope of activities of the Company is in the hotel sector with all other supporting facilities and facilities, including accommodation, office, shopping, apartment, recreational, and entertainment facilities located in the hotel location. The Company is domiciled in Jakarta and its office is located at Jalan Hayam Wuruk No. 126, Jakarta. The Company commenced commercial operations in 1970.

Entitas Induk memiliki 4 (empat) unit hotel, sebagai berikut:

The Company has 4 (four) hotel units, as follows:

Kegiatan Perusahaan/ Lokasi/ Total Kamar/

Activities of The Company Location Total Rooms

The Jayakarta SP Hotel & Spa Jakarta 337

The Jayakarta Bandung Suites, Boutique

Suites & Spa Bandung 210

The Jayakarta Anyer Villas Beach Resort, Boutique

Suites & Spa Anyer 48

The Jayakarta Cisarua Inn & Villas Mountain

Resort & Spa Cisarua 33

Entitas induk langsung dan entitas induk utama adalah PT Istana Kuta Ratu Prestige, yang didirikan di Indonesia.

The direct and ultimate shareholders of the Company is PT Istana Kuta Ratu Prestige, which was established in Indonesia.

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

1. UMUM (lanjutan) 1. GENERAL (continued)

b. Penawaran Umum Perdana Saham Entitas Induk b. Initial Public Offering of the Company

Kegiatan Perusahaan/ Jumlah Saham/ Tanggal/

Business activities Number of Shares Date

Penawaran umum perdana dan pencatatan sebagian

saham perusahaan/ Initial public offering and partial listing 8 Maret 1990/

of the company stock 2.000.000 March 8, 1990

Pencatatan saham Perusahaan di Bursa Efek Jakarta

(sekarang Bursa Efek Indonesia)/ Listing of the Company's

shares on the Jakarta Stock Exchange (now the Indonesia 14 Agustus 1991/

Stock Exchange) 4.000.000 August 14, 1991

Pembagian saham bonus di Bursa Efek Jakarta

(sekarang Bursa Efek Indonesia)/ Distribution of bonus

shares on the Jakarta Stock Exchange (now the Indonesia 14 Februari 1992/

Stock Exchange) 1.350.000 February 14, 1992

Pencatatan saham Perusahan di Bursa Efek Jakarta

(sekarang Bursa Efek Indonesia)/ Listing of the Company's

shares on the Jakarta Stock Exchange (now the Indonesia 18 Oktober 1994/

Stock Exchange) 7.500.000 October 18, 1994

Pembagian saham bonus di Bursa Efek Jakarta

(sekarang Bursa Efek Indonesia)/ Distribution of bonus

shares on the Jakarta Stock Exchange (now the Indonesia 17 Desember 1994/

Stock Exchange) 8.910.000 December 17, 1994

Pembagian saham bonus/ Distribution of bonus 1.188.000 21 Agustus 1995/

August 21, 1995

Perubahan nilai nominal saham dari Rp 1.000 menjadi

Rp 500 per saham (stock split)/ Changes in the par value 14 April 1997/

of shares from Rp 1,000 to Rp 500 per share (stock split) 24.948.000 April 14, 1997

Penawaran umum terbatas/ 24 Desember 1997/

Limited public offer 74.844.000 December 24,1997

Eksekusi waran menjadi saham/ Execution of 19 Agustus 1999/

warrants becomes a stock 3.000 August 19, 1999

Eksekusi waran menjadi saham/ Execution of 24 Desember 2002/

warrants becomes a stock 4.982.771 December 24, 2002

Pembagian dividen saham/ 16 Juli 2012/

Distribution of stock dividend 25.945.155 July 16, 2012

Perubahan nilai nominal saham dari Rp 500 menjadi

Rp 100 per saham (stock split)/ Changes in the par value 2 Oktober 2012/

of shares from Rp 500 to Rp 100 per share (stock split) 622.683.704 October 2, 2012

Pembagian dividen saham/ 24 Desember 2012/

Distribution of stock dividend 19.458.866 December 24,2012

Total 797.813.496

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

1. UMUM (lanjutan) 1. GENERAL (continued)

c. Struktur Entitas Induk dan Entitas Anak c. The structure of the Company and Subsidiaries

Laporan keuangan konsolidasian pada tanggal 31 Desember 2020 dan 2019 meliputi laporan keuangan Entitas Induk dan Entitas Anaknya (secara kolektif disebut sebagai Grup), yang dikendalikan secara langsung oleh Entitas Induk dan secara tidak langsung melalui PT Hotel Juwara Warga, Entitas Anak, dengan rincian sebagai berikut:

The consolidated financial statements as of December 31, 2020 and 2019 include the financial statements of the Company and its Subsidiaries (collectively referred to as the Group), which are controlled directly by the Company and indirectly through PT Hotel Juwara Warga, a subsidiary, with the following details :

Total Aset/ Total Assets *)

(dalam jutaan Rupiah/

in million Rupiah)

Total Pendapatan/ Total

Revenues *)

(dalam jutaan Rupiah/ in

million Rupiah) Entitas Anak/ Subsidiaries Kegiatan Utama/ Scope of Activity Domisili/ Domicile Persentase Pemilikan/ Percentage of Ownership 2020 2019 2020 2019

Langsung melalui Entitas Induk/ Directly through the Company PT Hotel Juwara Warga

Perhotelan/

Hospitality Bali 51,00% 230.097 262.118 34.804 140.962

PT Bali Realtindo

Benoa**)

Real Estate/

Real Estate Bali 99,99% 47.399 47.341 - -

PT Jayakarta Realti

Investindo**)

Perhotelan/

Hospitality Jakarta 99,99% 40.883 42.437 - -

PT Hotel Jaya Cikarang**)

Perhotelan/

Hospitality Cikarang 99,99% 15.708 15.743 - -

Tidak langsung melalui HJW, Entitas Anak/ Indirectly through HJW, subsidiary PT Hotel Jayakarta Flores Perhotelan/ Hospitality Flores 99,99% 35.350 42.307 6.606 17.001

PT Hotel Jaya Bali

Perhotelan/ Hospitality Bali 90,00% 78.742 81.181 745 3.720 PT Jayakarta Padmatama Pengelolaan properti/ Property management Bali 99,80% 2.421 3.125 1.167 8.869

PT Bali Boga Rasa

Jasa boga/

Catering services Bali 95,00% 915 1.354 120 789

*) Total aset dan pendapatan Entitas Anak pada table merupakan angka-angka sebelum eliminasi dalam proses konsolidasi/

The total assets and income of the Subsidiaries in the table are the numbers before elimination in the process of consolidation

**) Entitas Anak belum beroperasi secara komersial/ The entity not yet operate commercially

PT Hotel Juwara Warga (HJW) PT Hotel Juwara Warga (HJW)

Entitas Induk memiliki 51% hak kepemilikan atas

HJW dengan biaya perolehan sebesar

Rp 43.350.000.000 (Catatan 24). Modal dasar HJW sebesar Rp 75.000.000.000. Dari modal dasar tersebut, telah ditempatkan dan disetor penuh sebesar Rp 20.000.000.000. Sesuai dengan Anggaran Dasar, ruang lingkup kegiatan HJW adalah bergerak dalam bidang perhotelan. HJW memulai operasi komersialnya pada tahun 1983.

The Company has a 51% ownership in HJW with an acquisition cost of Rp 43,350,000,000 (Note 24). The authorized capital of HJW is Rp 75,000,000,000. From this authorized capital, Rp 20,000,000,000 has been issued and fully paid. In accordance with the Articles of Association, the scope of HJW activities is to engage in hospitality. HJW began its commercial operations in 1983.

Sesuai Akta Notaris Weliana Salim, S.H., No. 8 tanggal 9 Mei 2011, HJW membagikan dividen saham sebesar 1,5 lembar saham kepada setiap pemilik 1 lembar saham dengan jumlah pembagian dividen saham sebesar Rp 30.000.000.000 atau 30.000.000 lembar saham. Atas dividen saham tersebut, Entitas Induk memperoleh tambahan saham sebanyak 15.300.000 lembar saham atau sebesar Rp 15.300.000.000, sedangkan persentase pemilikannya tetap sebesar 51%.

In accordance with the Notary Deed of Weliana Salim, S.H., No. 8 dated May 9, 2011, HJW distributed a dividend of 1.5 shares to each owner of 1 share with a total share dividend of Rp 30,000,000,000 or 30,000,000 shares. For that stock dividend, the Company obtained additional shares of 15,300,000 shares or amounting to Rp 15,300,000,000, while the percentage of ownership remained 51%.

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

1. UMUM (lanjutan) 1. GENERAL (continued)

c. Struktur Entitas Induk dan Entitas Anak

(lanjutan)

c. The structure of the Company and Subsidiaries (continued)

PT Hotel Juwara Warga (HJW) (lanjutan) PT Hotel Juwara Warga (HJW) (continued)

Sesuai Akta Notaris Weliana Salim, S.H., No. 18 tanggal 19 Juni 2013, HJW membagikan dividen saham sebesar 1 lembar saham kepada setiap pemilik 2 lembar saham dengan jumlah pembagian dividen saham sebesar Rp 25.000.000.000 atau 25.000.000 lembar saham, sehingga jumlah modal ditempatkan dan disetor HJW menjadi sebesar Rp 75.000.000.000. Atas dividen saham tersebut,

Entitas Induk memperoleh tambahan saham

sebanyak 12.750.000 lembar saham atau sebesar

Rp 12.750.000.000, sedangkan persentase

pemilikannya tetap sebesar 51%.

In accordance with the Notary Deed of Weliana Salim, S.H., No. 18 on June 19, 2013, HJW distributed a dividend of 1 share to each owner of 2 shares with a total share dividend of Rp 25,000,000,000 or 25,000,000 shares, so that the amount of HJW's issued and paid up capital was equal to Rp 75,000,000,000. With respect to the stock dividend, the Company obtained additional

shares of 12,750,000 shares or amounting to Rp 12,750,000,000, while the percentage of

ownership remained 51%.

Sesuai Akta Notaris Weliana Salim, S.H., No. 9 tanggal 6 Juni 2014, HJW membagikan dividen saham sebesar 1 lembar saham kepada setiap pemilik 3 lembar saham dengan jumlah pembagian dividen saham sebesar Rp 25.000.000.000 atas 25.000.000 lembar saham, sehingga jumlah modal

ditempatkan dan disetor HJW menjadi Rp 100.000.000.000. Atas dividen saham tersebut,

Entitas Induk memperoleh tambahan saham

sebanyak 12.750.000 lembar saham atau sebesar

Rp 12.750.000.000, sedangkan persentase

pemilikannya tetap sebesar 51%.

In accordance with the Notary Deed of Weliana Salim, S.H., No. 9 on June 6, 2014, HJW distributed a dividend of 1 share to each owner of 3 shares with a total share dividend of Rp 25,000,000,000 for 25,000,000 shares, bringing the total issued and paid-up capital to Rp 100,000,000,000. With respect to the stock dividend, the Company obtained additional shares of 12,750,000 shares or amounting to Rp 12,750,000,000, while the percentage of ownership remained 51%.

Sesuai Akta Notaris Weliana Salim, S.H., No. 19 tanggal 16 Juni 2016, HJW membagikan dividen saham sebesar 1 lembar saham kepada setiap pemilik 3 lembar saham dengan jumlah pembagian dividen saham sebesar Rp 30.000.000.000 atas 30.000.000 lembar saham, sehingga jumlah modal

ditempatkan dan disetor HJW menjadi Rp 130.000.000.000. Atas dividen saham tersebut,

Entitas Induk memperoleh tambahan saham

sebanyak 15.300.000 lembar saham atau sebesar

Rp 15.300.000.000, sedangkan persentase

pemilikannya tetap sebesar 51%.

In accordance with the Notary Deed of Weliana Salim, S.H., No. 19 on June 16, 2016, HJW distributed a dividend of 1 share to each owner of 3 shares with a total share dividend of Rp 30,000,000,000 for 30,000,000 shares, bringing the total issued and paid up capital to Rp 130,000,000,000. For the said stock dividend, the Company obtained additional shares of 15,300,000 shares or amounting to Rp 15,300,000,000, while the percentage of ownership remained 51%.

HJW memiliki tiga unit hotel sebagai berikut: HJW has three hotel units as follows:

Nama Hotel/ Lokasi/ Total Kamar/

Hotel Name Location Total Rooms

The Jayakarta Bali Beach Resort & Spa Bali 278

The Jayakarta Lombok Hotel & Spa Lombok 171

The Jayakarta Yogyakarta Hotel & Spa Yogyakarta 129

Selain itu, HJW memiliki 21 unit serviced apartment yang dikelola oleh PT Jayakarta Padmatama, Entitas Anak (Catatan 12).

In addition, HJW has 21 serviced apartments managed by PT Jayakarta Padmatama, a Subsidiary (Note 12).

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

1. UMUM (lanjutan) 1. GENERAL (continued)

c. Struktur Entitas Induk dan Entitas Anak

(lanjutan)

c. The structure of the Company and Subsidiaries (continued)

PT Bali Realtindo Benoa (BRB) PT Bali Realtindo Benoa (BRB)

Sesuai Akta Notaris No. 38 tanggal 7 April 1997 yang dibuat di hadapan Achmad Bajumi, S.H., pengganti Notaris Imas Fatimah, S.H., Notaris di Jakarta, Entitas Induk mendirikan PT Bali Bagus Benoa. Anggaran Dasar PT Bali Bagus Benoa telah mengalami perubahan melalui Akta Notaris No. 149 tanggal 30 Juni 1997, yang dibuat di hadapan Imas Fatimah, S.H., Notaris di Jakarta, mengenai perubahan nama semula PT Bali Bagus Benoa menjadi PT Bali Realtindo Benoa. Perubahan ini telah mendapatkan pengesahan dari Menteri Kehakiman Republik Indonesia melalui Surat Keputusan No. C2-5990.HT.01.01.TH.97 tanggal 2 Juli 1997.

In accordance with Notarial Deed No. 38 dated April 7, 1997 made before Achmad Bajumi, S.H., substitute for Notary Imas Fatimah, S.H., Notary in Jakarta, the Company established PT Bali Bagus Benoa. PT Bali Bagus Benoa's Articles of Association have been amended through Notarial Deed No. 149 dated June 30, 1997, which was made before Imas Fatimah, S.H., Notary in Jakarta, regarding the change of the original name of PT Bali Bagus Benoa to PT Bali Realtindo Benoa. This amendment was approved by the Minister of Justice of the Republic of Indonesia through Decision letter No. C2-5990.HT.01.01.TH.97 dated July 2, 1997.

BRB didirikan dengan modal dasar sebesar Rp 6.000.000.000. Dari modal dasar tersebut, telah

ditempatkan dan disetor penuh sebesar

Rp 1.500.000.000, dengan kepemilikan Entitas Induk sebesar 99,993% atau sebesar Rp 1.499.999.999. Sesuai dengan Anggaran Dasar, ruang lingkup kegiatan BRB adalah bidang pemborongan dan pembangunan perumahan.

BRB was established with an authorized capital of Rp 6,000,000,000. Of the authorized capital, Rp 1,500,000,000 has been issued and fully paid,

with ownership of the Company of 99.993% or Rp 1,499,999,999. In accordance with the Articles of

Association, the scope of BRB's activities is the area of housing construction and construction.

Sesuai Akta Notaris Adam Kasdarmadji, S.H., No. 114 tanggal 20 Juni 1998, Entitas Induk meningkatkan penyertaannya pada BRB dari sebesar 99,93% menjadi 99,99% dengan jumlah

tambahan modal disetor sebesar

Rp 36.500.000.000, sehingga jumlah modal ditempatkan dan disetor BRB menjadi sebesar Rp 38.000.000.000. Penyertaan Entitas Induk menjadi sebesar Rp 37.999.000.000.

In accordance with Notarial Deed of Adam Kasdarmadji, S.H., No. 114 dated June 20, 1998, the Company increased its investment in BRB from 99.93% to 99.99% with an additional paid up capital of Rp 36,500,000,000, bringing the total issued and paid up capital of BRB to Rp 38,000,000,000. Participation of the Company is Rp 37,999,000,000.

Sebagaimana dinyatakan dalam Akta Notaris Fathiah Helmi, S.H., No. 4 pada tanggal 6 Juni 2001, BRB mengeluarkan 7.000 lembar saham baru dengan nilai sebesar Rp 7.000.000.000 yang seluruhnya disetor oleh Entitas Induk, sehingga jumlah modal ditempatkan dan disetor BRB menjadi sebesar Rp 45.000.000.000 dan jumlah kepemilikan saham Entitas Induk di BRB meningkat menjadi sebesar Rp 44.999.000.000, dengan persentase kepemilikan sebesar 99,99%. Sampai saat ini, BRB belum memulai kegiatan operasi komersialnya.

As stated in the Notary Deed of Fathiah Helmi, S.H., No. 4 on June 6, 2001, BRB issued 7,000 new shares with a value of Rp 7,000,000,000, which were entirely paid up by the Company, so that the total issued and paid up capital of BRB amounted to Rp 45,000,000,000 and the number of shares of the Company in BRB increased to in the amount of Rp 44,999,000,000, with a percentage of ownership of 99.99%. Until now, BRB has not yet started its commercial operations.

PT Jayakarta Realti Investindo (JRI) PT Jayakarta Realti Investindo (JRI)

Sesuai Akta Notaris No. 36 tanggal 7 April 1997, yang dibuat di hadapan Notaris Achmad Bajumi, S.H., pengganti Imas Fatimah, S.H., Notaris di Jakarta, Entitas Induk mendirikan JRI yang berkedudukan di Jakarta. Akta pendirian tersebut telah mendapat pengesahan dari Menteri Kehakiman Republik Indonesia melalui Surat Keputusan No. C2-14452.HT.01.01.TH.98. tanggal 22 September 2000. JRI didirikan dengan modal dasar sebesar Rp 6.000.000.000. Dari modal dasar tersebut, telah

ditempatkan dan disetor penuh sebesar Rp 1.500.000.000, dengan persentase kepemilikan

Entitas Induk sebesar 99,99% atau sebesar Rp 1.499.999.999.

In accordance with Notarial Deed No. 36 dated April 7, 1997, made before the Notary Achmad Bajumi, S.H., successor to Imas Fatimah, S.H., Notary in Jakarta, the Company established a JRI domiciled in Jakarta. The deed of establishment was approved by the Minister of Justice of the Republic of Indonesia through Decree No. C2-14452.HT.01.01.TH.98. September 22, 2000. JRI was established with an authorized capital of Rp 6,000,000,000. Of the authorized capital, Rp 1,500,000,000 has been issued and fully paid, with a percentage of ownership of the Company of 99.99% or Rp 1,499,999,999.