DETERMINANTS OF STOCK MARKET REACTION TOWARD LEGAL

REQUIREMENT OF CSR IN INDONESIA

*Gatot Soepriyanto

Accounting Department Bina Nusantara (BINUS) University Email: [email protected]

**Rudy Suryanto

Accounting Department - Muhammadiyah University Yogyakarta (UMY) Email:[email protected]

Abstract

Prior study on stock market reaction toward mandatory Corporate Social Responsibility (CSR) implementation law in Indonesia (article 74, Law No. 40/2007 on Limited Liability Company) present evidence that the equity investors from firms whose deal with or related to the management of natural resources, reacted positively to the passage of the law. This suggests that investors view mandatory CSR implementation law as “a good news” which in the long run may increase firm values. This study, therefore, aims to investigate the economic determinants that drive positive market reactions, as we found that the magnitude of the reactions were vary among companies taken as sample. We address five hypotheses that investor reaction is explained by: (a) size of firms, (b) profitability of firms, (c) leverage of firms, (d) how long the firm has been established and (e) whether the firms in are engaged in mining or non-mining industry. These hypotheses are investigated through cross-sectional regression analysis on firms that directly affected by the CSR law. We conclude that the stock market reaction toward the law is determined by size, leverage, age of firms and whether firms are engaged in mining industry or not. It also concludes that investors react more (less) positive to small (big) firms and high (low) leverage firms, suggesting that the investor consider the law as “insurance” for company to sustain their operation.

1. Introduction

After a heated debate on whether mandatory corporate social responsibility (CSR)

implementation would benefit or harm the company, the House Representative (DPR)

finally approved the bill on July 20, 2007 – which require a company whose activities

deal with or related to the management of natural resources to carry out a CSR program.

This mandatory rule is enacted under article 74 of Law no. 1, 2007 on Limited Liability

Company (PT). Based on such research setting, Soepriyanto and Suryanto (2008)

examine stock price reactions to the passage of the bill – specifically to the share price of

firms that directly affected by the law (i.e. seven sub industries whose activities deal with

or related to the management of natural resources) and find some evidence that on

average, equity investors react positively to the approval of mandatory CSR

implementation law. Their result consistent with prior studies which suggested that CSR

will help investor to minimize exposed risk of the companies (Heugens, 2007, Chih. et.al,

2007, Sarre, 2001) and maintain companies’ reputation (Rowe, 2007). In summary, their

result supports the view that CSR program will contribute positively to the firm value.

Their study, however, posit another interesting question – what factors determined

the positive market reaction? Further examination into the magnitude of abnormal return

and three-day cumulative abnormal returns around the event date of their sample

companies also demonstrate a wide variation. We speculate that market did not take for

granted the information related to CSR, but they will relate the information to the

economic characteristic of each company such as size, profitability and leverage. This

research, therefore, aims to investigate the economic determinants that drive the market

In general, we find that market consider company’s size, leverage, age and

industry in determining their response to legal requirement of CSR. Company’s age is

proved to be a significant determinant factor of market reactions, as well as company’s

size, leverage and type of industry. We find no significant association of profitability to

the market reactions, suggesting that the consequence of the legal requirement of CSR is

not related to company’s profitability.

This study is significant for a number of reasons. First, to seek the pattern of

investor’s reaction toward CSR practice and disclosure, since prior studies provide mix of

positive and negative association of CSR disclosure and share price performance.

Second, our study will be useful for regulator and policymaker to answer the question

whether mandatory CSR implementation law is beneficial or not beneficial to investors.

As such, our result lends a support to the view that mandatory requirement of certain

companies to carry out CSR will give investor “insurance” from any adverse effect of

environment and social issues.

The reminder of this paper is organised as follows; section 2 presents a brief

review on what prior studies have done, section 3 provides hypothesis development,

section 4 develop research methodology and explain sample data, section 5 discusses the

result and section 6 conclusion and limitation of this study.

2. Literature Review

The demand for companies to act in socially and environmentally manner had

started to emerge since 1970’s (Hines, 1991: 41). The demand now is getting stronger, as

pollution, natural resource destruction, dangerous wastes, products safety and limitation

of workers’ right (Gray et.al, 1995). Many view that the irresponsible manners of the big

corporations above were partly caused by a narrow focus of the companies to maximize

its shareholder value, and neglecting the other stakeholders’ interest.

The narrow focus of companies is supported by neo classic economist’s

perspective that stated manager’s main objective is to make decisions in maximising

shareholders value, and let the government and other parties to take care of community

(Friedman, 1970). This argument then challenged by Freeman (2004) with his

“stakeholder theory” which states that management can only maximise shareholders

value by maintaining a good relationship with other stakeholders (Freeman, 2004). The

effort to balance the role of company to pursue profit and to contribute to its environment

is known as Corporate Social Responsibility (CSR).

In 1970, AICPA thought that there is a need for companies Social Accounting to

incorporate CSR in company annual report (Hacston & Milne, 1996). However till date,

there is no a generally accepted framework for such accounting. Though, some

international bodies had formulated the guidelines for companies to perform and report

CSR, such as UN Compact released by the United Nations, the Global Reporting

Initiative released by Sustainability Accounting International (SAI) but there is no

binding rule for the guidelines. Therefore, CSR programs and reporting remain voluntary.

Interestingly more companies now adopt CSR programs and report them in their

annual report (Stigson, 2002). Companies willing to invest in CSR and report them in

annual report, since they believe CSR programs are inline with their business objectives

Indonesia had moved forward by enacted Law no 40/2007 in which mandated for

certain companies to budget and allocate some money in CSR programs. By this law,

Indonesia might be the first country to regulate CSR practice so it’s become mandatory.

Wilmhurst (2000) stated that government might intervene to the business process through

regulation, whenever community safeties are in danger. Indonesian public recently had

outraged by a number of pollution and major natural destruction done by companies, such

as the case of Inti Indo Rayon in North Sumatera, Newmont in Minahasa and Lapindo

Brantas in Sidoarjo. By examining news related to the passage of the mandatory CSR

implementation law, Soepriyanto and Suryanto (2008) find that in general investor

response positively to the regulation suggesting that investor views the CSR law as “good

news”.

Study on firm characteristic that may affect firms CSR program is categorized

into 2 streams. First stream is evaluating what factors determine the amount and nature of

CSR disclosures and second streams is revealing what CSR impact to company

performance, usually in term of profitability or market price (Kusumawati, 2007).

For the first stream studies, in general, researchers found that there is a low

commitment of Indonesian companies to perform CSR. Henny and Murtanto (2001)

found that CSR disclosures in Indonesia were relatively low, only 42.32% of total items

in the CSR disclosure checklist. That finding is far below the level of CSR disclosure in

developed countries revealed by Guthrie and Parker (1990). Guthrie and Parker (1990)

found level of CSR disclosure in UK (98%), US (85%) and Australia (56%). Although,

countries, there is a consistent finding of factors determined the amount and nature of

CSR disclosure in various countries as summarized below.

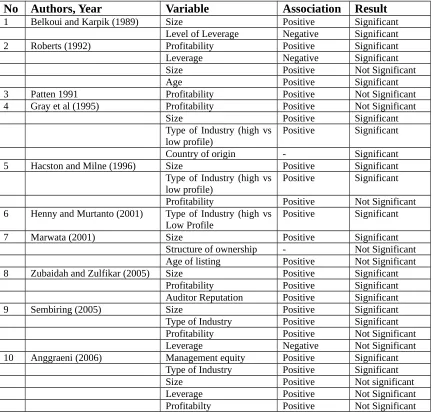

TABLE 1:

Summary of Empirical Evidence on Factors Determined the Amount and Nature of CSR Disclosure

No Authors, Year Variable Association Result

1 Belkoui and Karpik (1989) Size Positive Significant

Level of Leverage Negative Significant

2 Roberts (1992) Profitability Positive Significant

Leverage Negative Significant

Size Positive Not Significant

Age Positive Significant

3 Patten 1991 Profitability Positive Not Significant

4 Gray et al (1995) Profitability Positive Not Significant

Size Positive Significant

Type of Industry (high vs low profile)

Positive Significant

Country of origin - Significant

5 Hacston and Milne (1996) Size Positive Significant

Type of Industry (high vs

low profile) Positive Significant

Profitability Positive Not Significant 6 Henny and Murtanto (2001) Type of Industry (high vs

Low Profile

Positive Significant

7 Marwata (2001) Size Positive Significant

Structure of ownership - Not Significant Age of listing Positive Not Significant

8 Zubaidah and Zulfikar (2005) Size Positive Significant

Profitability Positive Significant

10 Anggraeni (2006) Management equity Positive Significant Type of Industry Positive Significant

Size Positive Not significant

Leverage Positive Not Significant

Profitabilty Positive Not Significant

From Table 1 above, it shows that there is strong association between size and type of

industry with CSR practice and disclosures, and there is a weak association between

In contrast, there are variations in the result of second stream studies of CSR

impact to company’s performance as summarized in Table 2 below:

TABLE 2:

Summary of Empirical Evidence on CSR Impact to Company’s Performance

No Authors, Year Measurement Result

1 Belkoui (1976) in Ahmed et.

al (2000) Stock Price Significant

2 Shane and Spicer (1983) Abnormal Return Significant

3 Luthfi (2001) Stock Price Not Significant

4 Purwanti (2001) Stock Trade Volume Not Significant

5 Rasmiati (2001) Stock Trade Volume Not Significant

6 Zuhroh & Sukmawati (2003) Stock Trade Volume Significant

Luthfi (2001), Purwanti (2001) and Rasmiati (2001) findings are in consistent with the

other result. Zuhroh & Sukmawati (2003) explained in their research that the difference

was due to Luthfi (2001), Purwanti (2001) and Rasmiati (2001) used annual reports of

1998 and 1999 in which Indonesia had financial crisis, therefore, there were potential

biases in their findings.

3. Hypotheses Development

Prior study (Soepriyanto & Suryanto, 2008) finds that market react positively to

legal requirement stipulated in article 74, Law 40/2007 which mandates Indonesian

companies whose activities deal with or related to the management of natural resources to

carry out CSR programs. The market respond positively to the regulation as illustrated by

abnormal return and three-day cumulative abnormal returns that significantly different

from zero, on the event date related to the passage of the regulation.

Some explanations on why market reacted positively to the regulation are (1)

more CSR programs are conducted and reported by companies in mining and other

natural-resource related companies might lowered companies’ expose risk (Sarre, et. al

addition CSR cost will lower claims from community and NGO (Mackey, et al. 2007,

Bird et al, 2007) , (3) some mining companies (high-profile industry) have undergone

some CSR projects voluntarily, so they will have no problems when CSR becomes

mandatory (4) the additional activities and reporting required by the law will increase the

accuracy of market expectation, lower information asymmetry, and lower market surprise

(Na’im & Rakhman, 2000).

The implication of mandatory CSR implementation, however, is addition of cost.

The addition of cost on CSR may have an impact toward company performance. Hence,

investor will determine their decision by looking how company manages the additional

cost. The better company manages the additional cost, the better market will react. Thus,

in mandatory CSR implementation law event day, one could expect that the strength and

the direction of the abnormal returns would be determined by several contextual factors

a. Size

Previous studies suggest that companies with bigger size tend to disclose more of

CSR information. The bigger company size will make company exposure to social and

environmental risks are higher, since the company will deal with many parties through its

activities and products (Hackston & Milne, 1996). The bigger size also made companies

to be more politically visible (Belkoui & Karpik, 1989). Hence, the bigger size

companies have to make more effort to build their image and be perceived have concerns

to community, otherwise the companies will expose to political and social sanctions.

Based on that argument, the mandatory CSR law will not affect much to the companies

which have bigger size, since they’ve already experienced to perform and report

and lower market surprise (Na’im & Rakhman, 2000). Smaller companies, on the other

hand, do not have such experience and expertise or probably they never conduct any CSR

program before. Therefore, the first hypothesis for this study is:

H1: In response to mandatory CSR implementation law, the stock market will react more positively to smaller firms whose activities deal with or related to the management of natural resources.

b. Profitability

The implication of CSR legislation may incur additional costs. Companies which

have high profitability may not be affected much by such additional cost. The high

profitability will provide a company more flexibility to manage and report CSR programs

(Hackston & Milne, 1996). Therefore, more profitable firms are more likely to be able to

afford to implement the CSR programs. As such, the second hypothesis in this study is:

H2: In response to mandatory CSR implementation law, the stock market will react more positively to more profitable firms whose activities deal with or related to the management of natural resources.

c. Leverage

Leverage is used as a proxy for firm’s riskiness. Mandatory CSR implementation

law is claimed to provide benefit in the form of “social and environment license” by

maintaining a good relationship with other stakeholders (Freeman, 2004). As discussed in

preceding section, more companies now implement CSR programs and report it in their

annual report. Companies willing to invest in CSR, since they believe CSR programs are

inline with their business objectives (Stigson, 2002) that may create long term

their business processes, it is expected that the risk of the firm will also reduce.

Therefore, the third hypothesis in this study is:

H3: In response to mandatory CSR implementation law, the stock market will react

more positively to higher leverage firms whose activities deal with or related to the management of natural resources.

d. Age

The relationship between the age of company and the market reaction toward

CSR legislation can be seen from two aspects, which are political visibility and CSR

experience. The older company age, the more political visibility the company has

(Belkoui and Karpik, 1989). The company with political visibility is expected to

performed more CSR programs than the company which is not. On the other hand, the

older companies are expected to have more experience in performing CSR, so when CSR

programs become mandatory they are relatively prepared than the newer companies.

Thus, the fourth hypothesis on this study is:

H4: In response to mandatory CSR implementation law, the stock market will react more

positively to older firms whose activities deal with or related to the management of natural resources.

d. Industry

As stipulated by article 74, Law no 40/2007 on PT, the obligation to carry out

CSR program is for Indonesian companies whose activities deal with or related to the

management of natural resources. As the mining firms often associated with the

exploitation to the natural resources that may cause a significant environmental damage,

hence we would like to know specifically whether those firms experience more positive

market reaction toward mandatory CSR implementation news. Therefore, the fifth

H4: In response to mandatory CSR implementation law, the stock market will react more

positively to mining firms whose activities deal with or related to the management of natural resources.

4. Research Design and Methodology

4.1 Empirical Model

4.1.1 The Cross Sectional Regression Model

As the objective of this study is to investigate the determinant of market reaction

upon the obligation of CSR implementation as prescribed by article 74 of Law no. 40,

2007, a cross sectional analysis is employed. The cross sectional regression model was

used to examine the relationship between stock price movements represented by

abnormal return or cumulative abnormal returns (CAR) from the event window and the

range of variables outlined in the hypothesis development section that were predicted to

influence price reaction. The models used were as follows:

it

In the model above, the dependent variables are the abnormal return (AR) and CAR,

while the independent variables are the firm’s specific characteristics such as LOGTA,

ROE, LEV, AGE and IND. All statistical tests use White’s (1980) consistent covariance

estimator. Table 3 summaries the variable interests in this research, which are described

below:

a. LOGTA

LOGTA is the natural logarithm of the total assets of the firm. LOGTA is used as a proxy

of a firm’s size. The coefficient of LOGTA is expected to be negative.

b. ROE

The second hypothesis was tested with the estimated coefficient of ROE. ROE is a proxy

variable for profitability of the firm. It is the state of financial health of the firm. ROE is

calculated by dividing the firms’ earnings after interest and tax by the shareholders

equity. The coefficient of ROE is expected to be positive.

c. LEV

The third hypothesis was tested with the estimated coefficient of LEV. LEV is the level of

leverage of the firm. LEV is used as a proxy for firm risk as measured by dividing the

long term debt and total assets of the firm. The coefficient LEV is expected to be positive.

d. AGE

The fourth hypothesis was tested with the estimated coefficient of AGE. AGE is the age

of firms and used as a proxy for a firm’s political visibility and experience in conducting

CSR. It is calculated by deducting current year (2007) with the firm’s establishment year.

The coefficient AGE is expected to be positive.

The fifth hypothesis was tested with the estimated coefficient of IND. IND is a dummy

variable for type of firms in our sample. The dummy variable is coded 1 if the firm is a

mining firm and 0 otherwise. The coefficient IND is expected to be positive.

4.1.2 The Standard Market Model

In order to examine the hypothesis, we also used the standard market model to

calculate AR and CAR as our dependent variable in Equation (1). This model allows us to

measure the effect of a particular event on the share return of the firms. To estimate the

abnormal return for the day related to the approval of mandatory CSR implementation

law, a standard market model is used (see Equation 2).

it

estimation period used in this study covers 200 days prior to day -1. The abnormal returns

surrounding each event are determined based on Equation 3.

) ( i i mt it

it R R

AR 3 (3)

In addition to a daily event window, a 3-day event window (-1 to +1) is calculated. It is

assumed that the length of the event window is enough to capture possible expectation or

information leakage before the event, while not being too long to face problems with

confounding events falling within the event window. Cumulative abnormal returns

(CARit) for each firm are computed by summing up the firm’s abnormal return during the

event window (Equation 4).

Table 4 shows the sample selection procedure. We started with 35 firms listed in

IDX that categorized as firms whose activities deal with or related to the management of

natural resources. Then we filtered out 1 firm due to inactive share price movement, 9

firms because of insufficient share price data and 4 firms with confounding events. This

finally limits our sample into 19 firms. Our share price data is obtained from Indonesia

Share Market Database (ISMD) while accounting data is collected from OSIRIS

database. To calculate LOGTA, ROE and LEV we use the year data immediately prior to

Chemical industry (38%), 1 firm from Infrastructure, Utility and Transportation industry

(5%) and 2 firms from Agriculture industry (10%).

5. Empirical Results

5.1 Descriptive Statistics

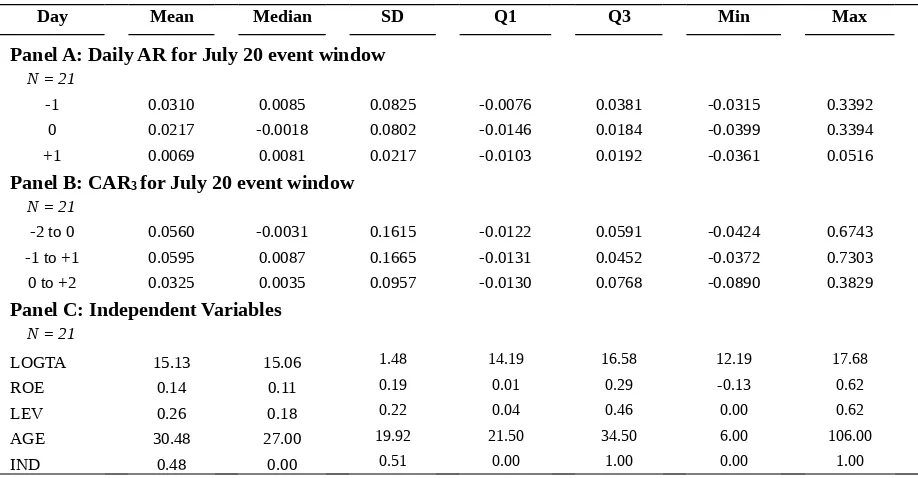

Table 6 reports descriptive statistics for abnormal returns and selected firm

characteristics for the 21 sample firms. Panel A and B show the descriptive statistics for

daily abnormal return (AR) and 3-day cumulative abnormal returns (CAR) surrounding

the passage of CSR mandatory implementation law. Meanwhile, Panel C describes the

descriptive statistics for independent variables.

Panel A in Table 6 suggests that the daily AR from day -1 to day +1 for July 20

event window (the approval of the PT bill that included mandatory CSR implementation)

is positive. The AR also remained positive when the returns are accumulated for 3 days as

illustrated in Panel B. Panel C in table 4 depicts the independent variables for our sample.

In terms of size as shown by the LOGTA variable, firms in the sample are quite similar in

size as indicated by mean (median) of sample LOGTA is 15.13 (15.06). Furthermore, the

sample consists of quite profitable firms as mean (median) of ROE variable is 0.14

(0.11). Moreover, Panel C in table 4 illustrates that the sample primarily consists of

medium leverage firms as shown by LEV variable with mean (median) of 0.26 (0.18),

which means that the firms in the sample have approximately 26% long term debt in

proportion to its total equity. In terms of AGE the company’s age mean (median) is 30.48

(27.00) year.

Table 7 reports the Pearson correlation matrix for independent variables used in

the cross sectional model. It shows that there is a positive correlation between variable

LOGTA and ROE. This indicates that larger firms in the sample reports higher ROE than

smaller firms suggesting that larger firms are more profitable than smaller firms.

Meanwhile, the correlation between variable ROE and LEV is negative. This suggests

that more profitable firms have less leverage and thus less risky firms.

5.3 Empirical Results

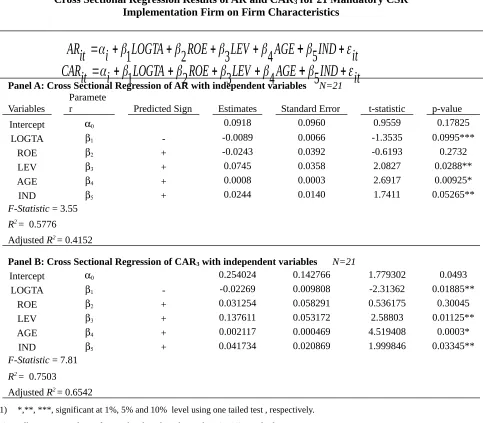

Table 8 Panel A and Panel B reports the cross sectional regression results of daily

Abnormal Return (AR) and the 3-day CAR (CAR3) on independent variables. The test

variables are LOGTA which is measured by the natural logarithm of the total assets of the

firms, ROE represents the profitability of the firms measured by profitability; LEV

represents riskiness of the firms, measured by the long term debt divided by the total

assets; AGE represents age of the firm measured by current year (2007) deducted by

firm’s date of establishment and IND as representation for type of industry – whether

mining firms or non mining firms, which is a dummy variable that is coded as 1 for

mining firm and 0 otherwise.

In Panel A table 8, the results of the cross sectional regression with AR as

dependent variable indicate that all tested variables move as predicted, with different

level of significance. The coefficient of LOGTA is negative with t-statistic (p-value) of

-1.35 (0.09) that is significant at 10% level using one tailed test. The coefficient of LEV is

positive with t-statistic (p-value) of 2.08 (0.03) and significant at conventional level of

at with t-statistic (p-value) of 2.69 (0.009) and significant at 1% level using one tailed

test. Meanwhile, the coefficient of IND is positive and significant with t-statistic

(p-value) of 1.74 (0.05) and significant at 5% level using one tailed test. Finally, the

coefficient of variable ROE is not significant with t-statistic (p-value) of -0.61 (0.273),

suggesting that no profitability effect influence the variation in the abnormal return.

Panel B in table 8 shows the cross sectional regression results of CAR3 on the

firm’s characteristics variables. The results suggest of the CAR3regression on all tested

variables (LOGTA, LEV, AGE and IND) move in the same manner as the results of

regression, where AR is the dependent variable, without major different in the

significance level except for LOGTA. The coefficient of LOGTA variable is still negative

with higher t-statistic (p-value) of -2.31 (0.019) and significant at 5% level (one-tailed),

while the coefficient of variable LEV is still positive with t-statistic (p-value) of 2.59

(0.011) and stays significant at 5% level (one tailed). The coefficient of variable AGE

remains positive with t-statistic (p-value) of 4.52 (0.000) and remains significant at 1%

level using one tail test. Meanwhile, the coefficient of IND is still positive and significant

with t-statistic (p-value) of 1.99 (0.033) and significant at 5% level using one tailed test.

Finally, the coefficient of ROE became positive and insignificant with t-statistic of 0.53.

Therefore, both for AR and CAR3 cross sectional model, the results provide support for

5.4. Diagnostic Checks

Several statistical problems may impair the inferences drawn from the results

reported in Tables 8. Therefore, diagnostic tests are performed to determine if reported

results are affected by the statistical problems.

Heteroscedasticity

It has been assumed in the classical linear regression model (CLRM) that the variance of

the errors is constant. If the errors do not have a constant variance, then the errors are

heteroscedastic. If this happen, the standard errors could be wrong, hence, any inferences

could be misleading. Using White Heteroskedasticity test (1980) it is found that the

results do not seem to be influenced by heteroscedasticity problem (F-stat = 0.50).

Autocorrelation

It has been implicit that the disturbance error terms in the CLRM are not correlated with

one another. If the errors are correlated with one another, it would be known as

autocorrelation. Using the Breusch-Godfrey Serial Correlation LM test, it is found that

the residual of the test in Table 8 of this study are not correlated with one another (F-stat

= 1.81), therefore the results do not seem to be effected by autocorrelation.

Multicolinearity

In ordinary least square (OLS) estimation, one implicit assumption is that the dependent

variables are not correlated with one another. By observing the correlation matrix in

Table 7 it can be seen that there is no serious multicolinearity problem that may affect the

Normality

It is important to note that in order to conduct single or joint hypotheses; the normality

assumption on residuals is required. For this purposes, the Bera-Jarque test is conducted

to detect whether or not the models used in this study violate the normality assumption.

The results suggest that the residual of the model is normally distributed as the

Jarque-Bera statistics show 1.05 which insignificant at the 0.05 percent level.

6. Conclusion and Limitation

The purpose of this research was to examine the determinant and contextual factor

of market reaction to the news related to the passage of mandatory CSR implementation

law as stipulated in article 74, Law no. 40/2007 on PT. This study extends Soepriyanto

and Suryanto (2008) study who find a positive stock market reaction to the approval of

mandatory CSR law. The variation of abnormal return is expected to be differed based on

a several firm’s characteristics and contextual factor, such as the size, the profitability, the

leverage level, age of the firms and whether firms engaged in mining industry or not. It is

hypothesised that the abnormal return will be more positive for firms that profitable, high

leverage, older firms and engaged in mining industry. It is also hypothesised that the

abnormal return will be more positive to smaller firms. Using cross sectional regression

analysis, the results of this study provide support for the hypothesis.

The results of the cross sectional regression, then, shows that there is strong

company’s age. Market react more positively to older companies, as market perceived

that the older companies have better experience in conducting CSR program.

We also document that market used company’s size, leverage and type of industry

as determinant factors in responding to the legal requirement of CSR. Interestingly,

market reacts more positively in smaller firms, suggesting that market expect smaller

firms to perform CSR. In general, previous studies show that bigger firms have more

CSR practice and disclosure. This result does not oppose that general views, but

somewhat complete them. As market expects that bigger firms have already performed

and disclosed CSR programs, such regulation would not affect much. On the other hand,

given the low practice and disclosure of CSR in smaller firms, market view that such

regulation will give smaller firms a pressure to conduct and disclose CSR, which is

valued by market.

The similar explanation is given to why market reacts more positively to higher

leverage firms. Previous studies show that higher leverage firms will disclose less CSR

information in their annual report, suggesting that higher leverage firms view CSR as an

expense that should be minimised. The legal requirement of CSR, therefore, will give

pressure to higher leveraged firms to also perform CSR. Hence, this result suggests that

market also expect higher leverage firms to perform CSR.

We also find that type of industry, which is whether firms are in mining industry

or not, is significant as determinant factor. The law explicitly mentions companies in

whose deal with natural resources to perform CSR (e.g. mining firms), while also

natural resource. The last category is less clear therefore, market reaction to the

companies in last category is less strong than in first category.

We find that there is no significant association between market reaction and

profitability, suggesting that market view the consequence of the legal requirement of

Reference

Ahmed, Riai, Belkoui (2000) Teori Akuntansi. Buku Satu. Edisi Pertama. Salemba

Empat. Jakarta

Anggraeni, F. R. R. (2006). Pengungkapan Informasi Sosial dan Faktor-Faktor yang

Mempengaruhi Pengungkapan Informasi Sosial dalam Laporan Keuangan

Tahunan (Studi Empiris pada Perusahaan-perusahaan yang terdaftar di BEI).

Simposium Nasional Akuntansi 9, Padang.

Belkoui, A. and P. G. Karpik (1989). "Determinants of the Corporate Decision to

Disclose Social Information." Accounting , Auditing and Accountability Journal

2(1): 36-51.

Bird, R., A. D. Hall, et al. (2007). "What Corporate Social Responsibility Activities are

Valued by the Market?" Journal of Business Ethics 76: 189-206.

Chih, H.-L., C.-H. Shen, et al. (2007). "Corporate Social Responsibility, Investor

Protection, and Earnings Management: Some International Evidences." Journal of

Business Ethics 79: 179-198.

Friedman, M.: (1970) “The Social Responsibility of Business Is to Increase Its Profits”,

The New York Times Magazine 33, 122–126.

Freeman, R. E., A. C. Wick, et al. (2004). "Stakeholder Theory and The Corporate

Objective Revisited." Organization Science 15 (3): 364-369.

Gray, R., R. Kouhy, et al. (1995). "Corporate Social and Environmental Reporting: A

Review of Literature and a Longitudinal Study of UK Disclosure." Accounting,

Guthrie, J. and L. D. Parker (1990). "Corporate Social Disclosure Practice: A

Comparative International Analysis." Advances in Public Interest Accounting 3:

159-175.

Hacston, D. and M. J. Milne (1996). "Some Determinants of Social and Environmental

Disclosure in New Zealand Companies." Accounting, Auditing and

Accountability Journal 9(1): 77-108.

Heugens, P. and N. Dentchev (2007). "Taming Trojan Horses: Identifying and Mitigating

Corporate Social Responsibility Risks." Journal of Business Ethics(75): 151-170.

Henny and Murtanto (2001). "Analisis Pengungkapan Sosial pada Laporan Tahunan."

Media Riset Akuntansi, Auditing dan Informasi 1(2): 1-20.

Hines, T. (1991). "The Wider Issues." Certified Accountant April: 38-41.

Jensen, M. C. and Meckling (1976). "Theory of the Firm: Managerial Behaviour, Agency

Costs, and Owneship Structure." Journal of Financial Economics 3(2): 305-360.

Kusumawati, D. N. (2007). "Profitability and Corporate Governance Disclosure an

Indonesian Study." Jurnal Riset AKuntansi Indonesia 10(2): 131-146.

Luthfi, I. (2001). "Analisis Pengaruh Praktek Pengungkapan Sosial Terhadap Perubahan

Harga Saham Pada Perusahaan yang terdaftar di BEJ." Thesis - unpublished FE

UB Malang.

Mackey, A., T. B. Mackey, et al. (2007). "Corporate Social Responsibility and Firm

Performance: Investor Preference and Corporate Strategies." Academy of

Marwata (2001). Hubungan Antara Kharakteristik Perusahaan dan Kualitas Ungkapan

Sukarela dalam Laporan Tahunan Perusahaan Publik di Indonesia. Simposium

Nasional Akuntansi IV.

Na'im, A. and F. Rakhman (2000). "Analisis Hubungan Antara Kelengkapan

Pengungkapan Laporan Keuangan dengan Struktur Modal dan Tipe Kepemilikan

Perusahaan." Jurnal Ekonomi dan Bisnis Indonesia 15(1): 70-82.

Patten, D. M. (1991). "Exposure, Legitimacy and Social Disclosure." JOurnal of Public

Policy 10: 297-308.

Purwanti, I. (2001). "Analisis Pengaruh Luas Pengungkapan Sosial dalam Laporan

Tahunan terhadap Reaksi Investor." Thesis - unpublished FE UB Malang.

Rasmiati (2001). "Hubungan Pengungkapan Sosial Pada Laporan Tahunan Perusahaan

Dengan Volume Penjualan Saham (Studi Kasus Pada Perusahaan High Profile di

BEJ)." Thesis - unpublished FE Universitas Merdeka Malang.

Roberts, R. W. (1992). "Determintants of Corporate Social Responsibility Disclosures:

An Application of Stakeholder Theory." Accounting, Organizations and Society

27: 297-308.

Rowe, M. (2007). "Reputation Relationships and Risk : A CSR Primer for Ethics

Officers." Business and Society Review(111:4): 441-455.

Sarre, R., M. Doig, et al. (2001). "Reducing the risk of corporate irresponsibility : the

trend to corporate social responsibility." Accounting Forum 25(3): 300 - 318.

Sembiring, Eddy Rismanda, 2005, Karakteristik Perusahaan dan Pengungkapan

Tanggung Jawab Sosial, Simposium Nasional Akuntansi VIII Solo, 15-16

Soepriyanto, Gatot., Suryanto, Rudy (2008) “Mandatory CSR Implementation Law In

Indonesia: Does It Impact Share Price Of The Firm?”, Simposium Nasional

APTIK, Upcoming

Stigson, B. (2002) “Corporate Social Responsibility: A New Business Paradigm”

www.isuma.net/v03n02/stigson_e.shtml, diakses 20 Februari 2008.

Wilmshurst, Trevor D (2000). “Corporate environmental reporting A test of legitimacy

theory”, Accounting, Auditing, & Accountability Journal Vol 13 No 1, 2000 pp

10-26 University Press

Zubaidah, S. and Zulfikar (2005). "Pengaruh Faktor-Faktor Keuangan dan Non Keuangan

terhadap Pengungkapan Sukarela Laporan Keuangan." Jurnal Akuntansi dan

Keuangan 4(1): 48-83.

Zuhroh, Diana, dan I Putu Pande Heri Sukmawati (2003), “Analisis Pengaruh Luas

Pengungkapan Sosial dalam Laporan Tahunan Perusahaan terhadap Reaksi

TABLE 3

Summary of the Independent Variables in the Cross Sectional Model

Variables Predicted

Sign

Description

LOGTA - A proxy variable for size. It is measured by the natural logarithm of a firm’s total asset.

ROE + A proxy variable for profitability. It is measured by Return on Equity Ratio (Net Income/Total Shareholder Equity).

LEV + A proxy variable for leverage. It is measured by long term debt/total asset.

AGE + A proxy for a firm’s political visibility and experience in conducting CSR. It is measured as the age of firms IND + Dummy variable, which indicates the type of firms that

require conducting CSR in our sample. It is coded as a 1 for mining firms and 0 otherwise.

TABLE 4:

Sample Selection Procedure Sample Size

Initial Sample 35 firms

Less: Firms with inactive share price movement 1 firms

Firms with insufficient share price data 9 firms

Firms with confounding events (pre and post 3 days of

announcement day) 4 firms

Total Sample for H1-H5 21 firms

TABLE 5: Sample Distribution

Industry Mining Basic materials &chemical Infrastructure,utility and transportation

Agriculture

Sub

Industry Coal Oil &Gas Metal Timber Pulp &Paper Energy Plantation

3 4 3 4 4 1 2

TABLE 6:

Descriptive Statistics for Abnormal Return and CAR of 21 Sample Firm on Event Window

Day Mean Median SD Q1 Q3 Min Max

Panel A: Daily AR for July 20 event window

N = 21

-1 0.0310 0.0085 0.0825 -0.0076 0.0381 -0.0315 0.3392

0 0.0217 -0.0018 0.0802 -0.0146 0.0184 -0.0399 0.3394

+1 0.0069 0.0081 0.0217 -0.0103 0.0192 -0.0361 0.0516

Panel B: CAR3 for July 20 event window N = 21

-2 to 0 0.0560 -0.0031 0.1615 -0.0122 0.0591 -0.0424 0.6743

-1 to +1 0.0595 0.0087 0.1665 -0.0131 0.0452 -0.0372 0.7303

0 to +2 0.0325 0.0035 0.0957 -0.0130 0.0768 -0.0890 0.3829

Panel C: Independent Variables

N = 21

LOGTA 15.13 15.06 1.48 14.19 16.58 12.19 17.68

ROE 0.14 0.11 0.19 0.01 0.29 -0.13 0.62

LEV 0.26 0.18 0.22 0.04 0.46 0.00 0.62

AGE 30.48 27.00 19.92 21.50 34.50 6.00 106.00

IND 0.48 0.00 0.51 0.00 1.00 0.00 1.00

Where LOGTA is the natural logarithm of total asset of the firms as a proxy for firms’ size, ROE is the return on equity of the firms as a proxy of profitability, LEV is the leverage level of the firms, AGE is the age of the firms and IND is the Dummy Variable, which coded as 1 for mining firms and 0 for non-mining firms.

TABLE 7:

Correlation Matrix for Independent Variables in the Cross Sectional Model

LOGTA ROE LEV AGE IND

TABLE 8

Cross Sectional Regression Results of AR and CAR3 for 21 Mandatory CSR

Implementation Firm on Firm Characteristics

Panel A: Cross Sectional Regression of AR with independent variables N=21

Variables Parameter Predicted Sign Estimates Standard Error t-statistic p-value

Intercept 0.0918 0.0960 0.9559 0.17825

LOGTA - -0.0089 0.0066 -1.3535 0.0995***

ROE + -0.0243 0.0392 -0.6193 0.2732

LEV + 0.0745 0.0358 2.0827 0.0288**

AGE + 0.0008 0.0003 2.6917 0.00925*

IND + 0.0244 0.0140 1.7411 0.05265**

F-Statistic = 3.55

R2 = 0.5776

Adjusted R2= 0.4152

Panel B: Cross Sectional Regression of CAR3 with independent variables N=21

Intercept 0.254024 0.142766 1.779302 0.0493

LOGTA - -0.02269 0.009808 -2.31362 0.01885**

ROE + 0.031254 0.058291 0.536175 0.30045

LEV + 0.137611 0.053172 2.58803 0.01125**

AGE + 0.002117 0.000469 4.519408 0.0003*

IND + 0.041734 0.020869 1.999846 0.03345**

F-Statistic = 7.81

R2 = 0.7503

Adjusted R2= 0.6542

1) *,**, ***, significant at 1%, 5% and 10% level using one tailed test , respectively. 2) All t-statistic and significance level are based on White (1980) standard errors.

Where AR is the abnormal return at day 0, CAR3 is the 3 days cumulative abnormal return at day -1 to day +1, LOGTA is the

natural logarithm of total asset of the firms as a proxy for firms’ size, ROE is the return on equity of the firms as a proxy of profitability, LEV is the leverage level of the firms, AGE is the age of the firms and IND is the Dummy Variable, which coded as 1 for mining firms and 0 for non-mining firms.