Prepared by:

Fernando & Yvonn

Quijano

11

Chapter

Input Demand:

The Capital Market

1:

The Capital Market

and the Investment Decision

Capital, Investment, and Depreciation

Capital

Investment and Depreciation

The Capital Market

Capital Income: Interest and Profits

Financial Markets in Action

Capital Accumulation and Allocation

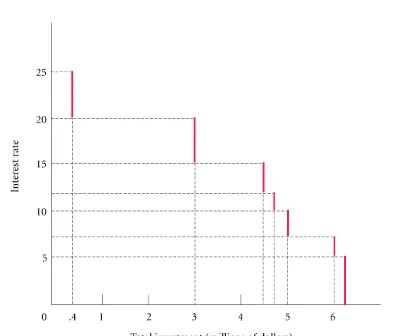

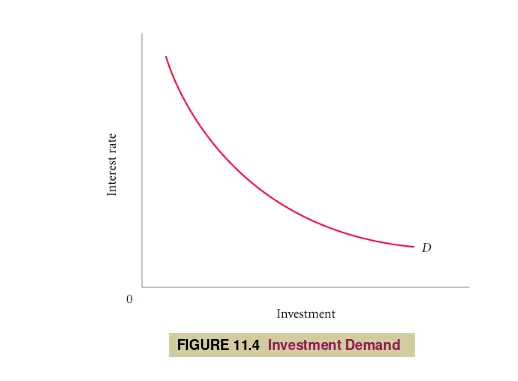

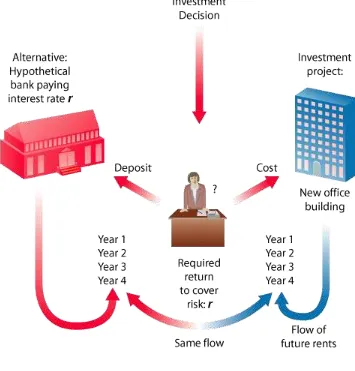

The Demand for New Capital and the Investment Decision

PT

CAPITAL, INVESTMENT, AND DEPRECIATION

CAPITAL

capital

Those goods produced by the

economic system that are used as inputs

to produce other goods and services in the

future.

1:

CAPITAL, INVESTMENT, AND DEPRECIATION

Tangible Capital

physical, or tangible, capital

Material

things used as inputs in the production of

future goods and services. The major

categories of physical capital are

nonresidential structures, durable

PT

CAPITAL, INVESTMENT, AND DEPRECIATION

Social Capital: Infrastructure

social capital, or infrastructure

Capital

that provides services to the public. Most

social capital takes the form of public works

(roads and bridges) and public services

1:

CAPITAL, INVESTMENT, AND DEPRECIATION

Intangible Capital

intangible capital

Nonmaterial things that

contribute to the output of future goods and

services.

human capital

A form of intangible capital

that includes the skills and other knowledge

that workers have or acquire through

PT

CAPITAL, INVESTMENT, AND DEPRECIATION

The Time Dimension

The value of capital is only as great as the value of the services it will render

over time.

Measuring Capital

When we speak of capital, we refer not to money or to financial assets such as bonds and

stocks, but instead to the firm’s physical plant, equipment, inventory, and intangible assets.

capital stock

For a single firm, the current

market value of the firm’s plant, equipment,

1:

CAPITAL, INVESTMENT, AND DEPRECIATION

investment

New capital additions to a

firm’s capital stock. Although capital is

measured at a given point in time (a stock),

investment is measured over a period of

time (a flow). The flow of investment

increases the capital stock.

PT

CAPITAL, INVESTMENT, AND DEPRECIATION

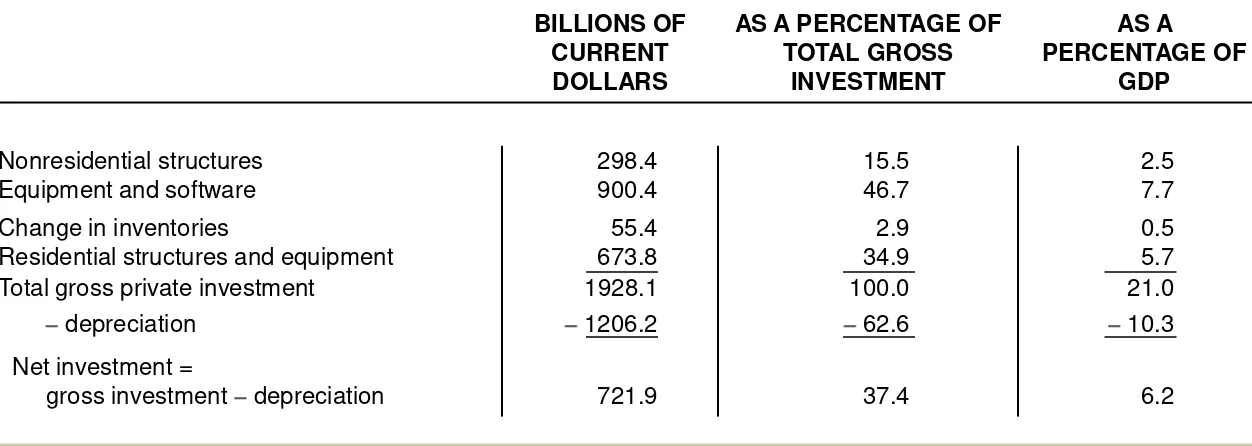

TABLE 11.1

Private Investment in the U.S. Economy, 2004

GDP = 11,734.3

Gross private domestic investment = 1,928.1

BILLIONS OF CURRENT DOLLARS

AS A PERCENTAGE OF TOTAL GROSS

INVESTMENT

AS A

PERCENTAGE OF GDP

Nonresidential structures 298.4 15.5 2.5 Equipment and software 900.4 46.7 7.7 Change in inventories 55.4 2.9 0.5 Residential structures and equipment 673.8 34.9 5.7 Total gross private investment 1928.1 100.0 21.0 depreciation 1206.2 62.6 10.3 Net investment =

gross investment depreciation 721.9 37.4 6.2