Prepared by:

Fernando & Yvonn Quijano

15

Chapter

Externalities, Public Goods,

Imperfect Information,

APTER

Externalities, Public Goods,

Imperfect Information,

and Social Choice

Externalities and Environmental EconomicsMarginal Social Cost and Marginal-Cost Pricing

Private Choices and External Effects Internalizing Externalities

Public (Social) Goods

The Characteristics of Public Goods Mixed Goods

Income Distribution as a Public Good? Public Provision of Public Goods Optimal Provision of Public Goods

Local Provision of Public Goods: Tiebout Hypothesis

Imperfect Information

Adverse Selection: Asymmetric Information Moral Hazard

Market Solutions Government Solutions

Social Choice

The Voting Paradox

Government Inefficiency: Theory of Public Choice

APTER

EXTERNALITIES, PUBLIC GOODS, IMPERFECT

INFORMATION, AND SOCIAL CHOICE

market failure Occurs when resources are

misallocated or allocated inefficiently.

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

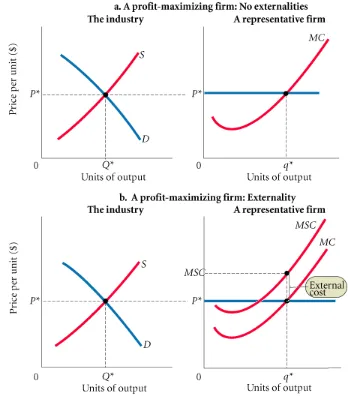

marginal social cost (MSC) The total cost

to society of producing an additional unit of a good or service. MSC is equal to the sum of the marginal costs of producing the

product and the correctly measured damage costs involved in the process of production.

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Acid Rain and the Clean Air Act

Acid rain is an excellent example of an externality and of the issues and conflicts in dealing with

externalities.

The case of acid rain highlights the fact that

efficiency analysis ignores the distribution of gains and losses. That is, to establish efficiency we need only to demonstrate that the total value of the gains exceeds the total value of the losses.

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

PRIVATE CHOICES AND EXTERNAL EFFECTS

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

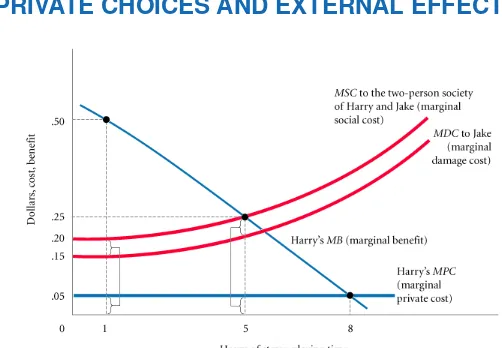

marginal damage cost (MDC) The

additional harm done by increasing the level of an externality-producing activity by one unit. If producing product X pollutes the water in a river, MDC is the additional cost imposed by the added pollution that results from increasing output by one unit of X per period.

When economic decisions ignore external costs, whether those costs are borne by one person or by society, those decisions are likely to be inefficient.

marginal private cost (MPC) The amount

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

INTERNALIZING EXTERNALITIES

Five approaches have been taken to solving the problem of externalities:

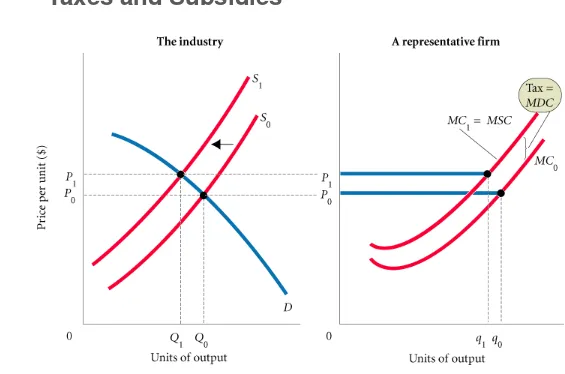

(1) government-imposed taxes and subsidies,

(2) private bargaining and negotiation,

(3) legal rules and procedures,

(4) sale or auctioning of rights to impose

externalities, and

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Taxes and Subsidies

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Bargaining and Negotiation

Coase theorem Under certain conditions,

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Legal Rules and Procedures

injunction A court order forbidding the continuation of behavior that leads to damages.

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Selling or Auctioning Pollution Rights

APTER

EXTERNALITIES AND ENVIRONMENTAL

ECONOMICS

Direct Regulation of Externalities

Taxes, subsidies, legal rules, and public auction are all methods of indirect regulation designed to induce firms and households to weigh the social costs of their actions against their

benefits.

APTER

PUBLIC (SOCIAL) GOODS

public goods (social or collective goods) Goods that are nonrival in consumption

and/or their benefits are nonexcludable.

APTER

PUBLIC (SOCIAL) GOODS

nonrival in consumption A characteristic

of public goods: One person’s enjoyment of

the benefits of a public good does not

interfere with another’s consumption of it.

THE CHARACTERISTICS OF PUBLIC GOODS

APTER

PUBLIC (SOCIAL) GOODS

free-rider problem A problem intrinsic to public goods: Because people can enjoy the benefits of public goods whether they pay for them or not, they are usually

unwilling to pay for them.

drop-in-the-bucket problem A problem

intrinsic to public goods: The good or

service is usually so costly that its provision generally does not depend on whether or not any single person pays.

Consumers acting in their own self-interest have no incentive to contribute voluntarily to the production of public goods. Some will feel a moral responsibility or social pressure to

APTER

PUBLIC (SOCIAL) GOODS

MIXED GOODS

mixed goods Goods that have

characteristics that are part public and part private.

INCOME DISTRIBUTION AS A PUBLIC GOOD?

If we accept the idea that redistributing income generates a public good, private endeavors may fail to do what we want them to do, and government involvement may be called for.

PUBLIC PROVISION OF PUBLIC GOODS

When members of society get together to form a

APTER

PUBLIC (SOCIAL) GOODS

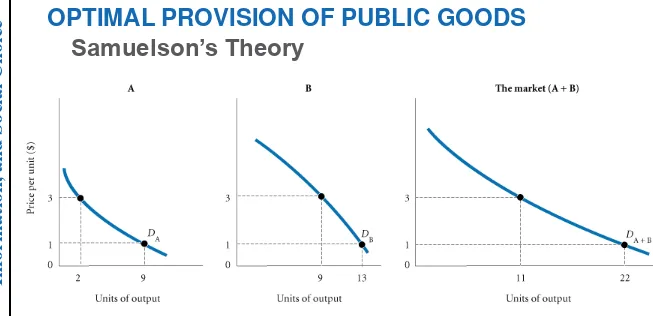

OPTIMAL PROVISION OF PUBLIC GOODS

Samuelson’s Theory

FIGURE 15.4 With Private Goods, Consumers Decide What Quantity to Buy; Market Demand Is the Sum of Those Quantities at Each Price

The price mechanism forces people to reveal what they want, and it forces firms to produce only what people are willing to pay for, but it works this way only because exclusion

APTER

PUBLIC (SOCIAL) GOODS

FIGURE 15.5 With Public Goods, There Is Only One Level of Output, and Consumers Are Willing to Pay Different Amounts for Each Level

For private goods, market demand is the horizontal sum of individual demand

curves—we add the different quantities that households consume (as measured on the

horizontal axis). For public goods, market demand is the vertical sum of individual demand curves—we add the different

APTER

PUBLIC (SOCIAL) GOODS

APTER

PUBLIC (SOCIAL) GOODS

optimal level of provision for public goods The level at which resources are drawn from the production of other goods and services only to the extent that people want the public good and are willing to pay

for it. At this level, society’s willingness to

pay per unit is equal to the marginal cost of producing the good.

At the optimal level, society’s total willingness to pay per unit is equal to the marginal cost of

APTER

PUBLIC (SOCIAL) GOODS

The Problems of Optimal Provision

APTER

PUBLIC (SOCIAL) GOODS

Tiebout hypothesis An efficient mix of public goods is produced when local

land/housing prices and taxes come to reflect consumer preferences just as they do in the market for private goods.

APTER

adverse selection Can occur when a

buyer or seller enters into an exchange with another party who has more

information.

APTER

moral hazard Arises when one party to a contract passes the cost of its

behavior on to the other party to the contract.

MORAL HAZARD

APTER

Like consumers, profit-maximizing firms will gather information as long as the marginal benefits from continued search are greater than the marginal costs.

GOVERNMENT SOLUTIONS

Information is essentially a public good and is nonrival in consumption.

When information is very costly for individuals to collect and disperse, it may be cheaper for

APTER

social choice The problem of deciding what society wants. The process of

APTER

THE VOTING PARADOX

impossibility theorem A proposition demonstrated by Kenneth Arrow

showing that no system of aggregating individual preferences into social

APTER

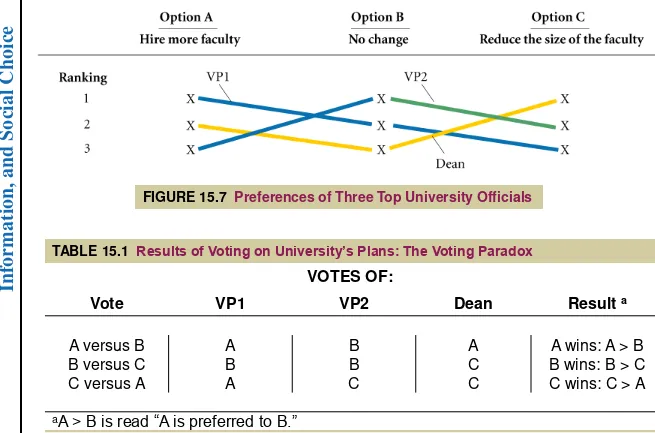

FIGURE 15.7 Preferences of Three Top University Officials

TABLE 15.1 Results of Voting on University’s Plans: The Voting Paradox

APTER

voting paradox A simple demonstration

of how majority-rule voting can lead to seemingly contradictory and inconsistent results. A commonly cited illustration of the kind of inconsistency described in the impossibility theorem.

logrolling Occurs when congressional representatives trade votes, agreeing to help each other get certain pieces of

APTER

GOVERNMENT INEFFICIENCY: THEORY OF PUBLIC CHOICE

To understand the way government functions, we need to look less at the preferences of

individual members of society and more at the incentive structures that exist around public officials.

RENT-SEEKING REVISITED

APTER

GOVERNMENT AND THE MARKET

GOVERNMENT INEFFICIENCY: THEORY OF PUBLIC CHOICE

There is no question that government must be involved in both the provision of public goods and the control of externalities.

The question is not whether we need

government involvement. The question is how much and what kind of government involvement

APTER

oice adverse selection

Coase theorem

marginal damage cost (MDC)

marginal private cost (MPC)

marginal social cost (MSC)

REVIEW TERMS AND CONCEPTS

market failure mixed good moral hazard nonexcludable

nonrival in consumption

optimal level of provision for public goods

public goods (social or collective goods) social choice