ANALYSIS

Property rights issues involving plant genetic resources:

implications of ownership for economic efficiency

Timothy Swanson

a,*, Timo Go¨schl

a,baDepartment of Economics,School of Public Policy and CSERGE,Uni6ersity College London,Gower Street, London WCIE6BT,UK

bFaculty of Economics and Politics,Cambridge Uni6ersity,Cambridge CB3 9DD,UK Received 4 August 1998; received in revised form 19 January 1999; accepted 18 May 1999

Abstract

The economic theory of property rights is applied to the issue of the conservation of plant genetic diversity, an issue often discussed in terms of benefit sharing, in order to demonstrate that the assignment of property rights is important for reasons of efficiency as well as for equity. Given the existence of transaction costs within an industry, the location of a property rights assignment is a crucial factor determining the incentives for efficient levels of investment at various levels of that industry. In the context of plant genetic resources, this means that property rights that are located at the retail end of the pharmaceutical and plant breeding industries may not have sufficient effect to generate the incentives to supply adequate amounts of plant genetic resources to the research and development sectors at the base of these industries. © 2000 Elsevier Science B.V. All rights reserved.

Keywords:Economics of property rights; Biodiversity; R&D

www.elsevier.com/locate/ecolecon

1. Introduction

This article applies some of the economic the-ory of property rights and industrial structure to the issues concerning the conservation of plant genetic resources. First it outlines the role of property rights in the determination of the incen-tives for the continuing supply of plant germ plasm to the industries which rely upon it. It

assesses the adequacy of the current system of rights in providing these incentives. There is an already-existing literature examining the issues of property rights and plant genetic resource, many of these analyses primarily concerned with the important issues of benefit sharing and commu-nity/farmers rights (see e.g. Shiva, 1991; Posey, and Dutfield, 1996). This article takes a different approach to the same issue. If it is agreed that one of the primary functions of plant genetic resources is to supply the informational inputs required by basic human industries such as agriculture, then

* Corresponding author.

there are important efficiency, as well as equity, considerations involved in the specification of property rights in these resources. This article focuses upon the need for efficiently constructed property right regimes, so that society will receive the appropriate levels of investment in the re-source base that supports some of its most funda-mental industries. It then examines the current system of property rights in regard to plant ge-netic resources in light of this theory, in order to assess the efficiency of that system. By efficiency here we mean allocative efficiency within two specific sectors of the economy, namely the plant breeding and the pharmaceutical industry.1

It is the capacity of the economic system for allocating resources between activities in proportion to their marginal social values in these activities. Specifi-cally, we are interested in whether the existing system of property rights is able to attract the appropriate quantities of inputs required to sus-tain R&D in agriculture.

The article proceeds as follows. In Section 2 it reviews some of the basic economies of property rights, and some of the economics of industry and research and development (R&D). In Section 3 it begins to apply this theory to the area of plant genetic resources by discussing the nature of the R&D processes that are most reliant upon these resources. In Section 4 the role of property right regimes as instruments for providing incentives for investing in R&D is discussed, and the nature of intellectual property right systems is described. In Section 5, the impact of such property right regimes on investments in the supply of genetic resources is surveyed. In Section 6 the efficiency of the existing regime is analysed. In Section 7 the scale of the problem is indicated. Section 8 concludes.

2. Economics of property rights: right allocation and efficient Investment

The economic theory of property rights com-menced with the seminal article by Coase (1960) in which he demonstrated that the social desirabil-ity of the outcome was invariant to the initial distribution of property rights, so long as the various participants in an industry were able to contract with one another to move property rights to their most efficient location. For example, he discussed how two neighbouring property owners might agree to discontinue an inefficient use of one of the properties (such as the operation of heavy machinery next to a residential area)e6en if

the person undertaking the inefficient use had the right to do so. All that was required, argued Coase, was for the two individual property own-ers to agree to coordinate the use of their proper-ties together in order to maximise their joint value, and then compensate any additional injury from the additional value obtained from pursuing the first-best activity. Essentially, the so-called Coase Theorem stated that the attainment of maximum social welfare (efficiency) was invariant to the initial assignment of property rights, so long as property rights were well defined and the individuals involved were able to transact with one another to re-allocate the property rights efficiently.

The unrealistic nature of these assumptions led to the initiation of a field of study known as ‘transactions cost’ economics, in which the focus was not on the efficiency of market outcomes but rather on the frictions within market economies that led to inefficient outcomes (Williamson, 1985). When the activity that required coordina-tion involved many individuals rather than two, or individuals separated by space or time, then the costs of transacting between them might be too high for efficiency to be obtained. Then the final outcome would be crucially dependent upon the specific nature of the initial allocation of rights.

The literature then turned to the question of who should receive the property right when the assignment mattered for efficiency reasons. The initial exploration of this issue occurred within the realm of law and economics and in the context of

conflicts between uses of neighbouring properties. In this context the various proponents argued for assignment of property rights to the ‘least-cost abater’ (Michelman, 1971) and then the ‘best briber’ (Calabresi and Melamed, 1972). These criteria were based on the idea that the assign-ment should either assist the achieveassign-ment of the market solution (through assigning the right to the individual best able to organise the activity via market transactions) or mimic its outcome (by assigning it in the most efficient manner). See Swanson and Kontoleon (1998) for a general dis-cussion of this literature.

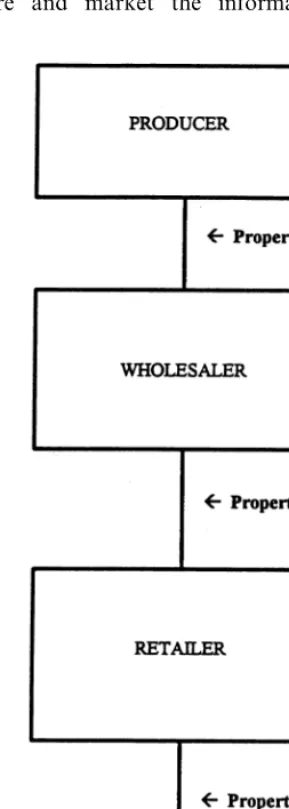

These same concepts were placed within the context of an industry by Grossman and Hart (1986) who argued that the property right should be assigned to the agent who could use it most productively. They undertook their analysis in the context of a6ertical industry(stereotypically,

pro-ducer – wholesaler – retailer), asking at which levels of such an industry should the property right in the good be held for efficiency purposes. For example, would the good be supplied most effi-ciently if it were owned by a single entity (such as its producer) with the hiring of the specific ser-vices supplied by others (retailers, transporters) further downstream in the industry? Or, would it be more efficient for each level of the industry to have the property right in the good when it passed through its hands? Grossman and Hart (1986) argued that this depended upon the need for property rights, as an incentive system, at any particular level of the industry. They used the example of the insurance industry (underwriter-sales agent) to illustrate their point. In the US life insurance industry the underwriters owned the policies throughout the chain, and hired sales agents to act as their employees in marketing them, while in the motor insurance industry the underwriters sold the policies to independent agents whom then sold them on to their clients. Grossman and Hart argued that this property right allocation to motor insurance agents was important for efficiency reasons because motor insurers were dependent upon repeat purchasers of their products (while life insurers clearly were not) and repeat purchases were highly dependent upon the quality of service that was received from

the agent. Hart and Moore (1990) further refined the idea of the efficiency of property rights alloca-tion in their concept of the best in6estor, the

individual or entity best able to make a produc-tive investment in the asset concerned.

In summary, the economics of property rights has developed a very basic framework for under-standing the importance of property right assign-ments forefficiency purposes; basically, it provides that the property right assignments matter very much if contracting within the industry is costly, and that the property rights should then be placed at those levels that are most effective at investing in the assets concerned. When considering the delivery of a final product to a consumer market, all of the stages of the industry that were required to generate that product are potential ‘rights holders’. If it is costly to contract across levels of a vertical industry, then there is a prima facie argument for the creation of a property right at all those levels where it is important for the maintenance of and investment in the asset.

3. Industries dependent upon genetic resources

In order to apply these ideas concerning prop-erty rights to plant genetic resources, it is first important to outline how and why certain indus-tries make use of these resources. This involves a short exposition on the role of the information generated by genetic resources in supplying the research and development sectors of certain of our fundamental industries. R&D is the term used to describe the process by which new ideas are developed for application to common problems. When a new solution concept is successfully de-veloped within the R&D process, it will then be marketed, usually embodied within some novel product. The industries that rely upon genetic resources are usually those that use R&D to solve certain recurring problems at the interface be-tween human technology and the biological world.

usually represented as a production process itself dependent upon the application of various factors of production (machinery, labour, etc.) for the production of useful ideas. Certain industries by their nature expend substantial proportions of their total available resources on the R&D pro-cess. These are industries that have the creation of new information at the core of their functions. For example, the computer software, plant breed-ing and pharmaceutical industries are all R&D intensive industries, with over 10% of their gross revenues invested in the development of solution concepts. In a recent survey of the plant breeding industry, the surveyed breeders allocated, on aver-age, 18% of annual turnover to breeding and research activities (Swanson and Luxmoore, 1998).

It is this industry and one other, pharmaceuti-cals, where the industrial R&D process most clearly depends upon the use of genetic resources in its search for solution concepts. Agriculture and medicine may be conceived of as living de-fence systems rather than static technologies. That is, these fields of human activity consist of contin-uing efforts to combat the erosion of human-erected defences against the background of a continuously changing biological world. In agri-culture we continue to maintain a system that attempts to keep at bay the always-evolving pests and predators of our primary food crops. In medicine we continue in our efforts to defend against the same as they impact upon human beings more directly. In both cases the defences are neither absolute nor perpetual; they are con-stantly eroding under the pressure of the forces of natural selection. The R&D processes in these industries are focused on providing solution con-cepts to the problems that arise in these contexts. Genetic resources are crucial inputs into this R&D process. The same forces that are at work against the human domain are also opening against all other extant life forms. Any organism that persists must do so because it has evolved ‘successful strategies’ in the sense that they are successful in a contested environment, i.e. resis-tance. Genetic resources are important inputs to R&D in these industries simply because they con-tain information which has been generated within

the relevant crucible. It is not any biological diversity per se that is the most useful input into important human industries, but rather it is the information to be gained from the characteristics which have evolved within a living environment that is most likely to make a contribution. Biodi-versity is useful to our industries because of the manner in which the existing set of life forms have been selected (within a living, contested system similar to our own), which provides us with an already-vetted library of successful strategies.

It is the information in the genetic resource that is valuable in the R&D process, not so much the tangible resource itself. In the context of agricul-ture and pharmaceuticals, biodiversity is one of the primary sources of a stock of information that may be accessed for possible solution concepts to industrial problems. This information may be brought into commercial use in one of two ways, either in the incorporation of the explicit informa-tion that specific genetic resources represent (the observed characteristic or phenotype) or alterna-tively by the use of the implicit, biological coding of that information (its genotype). That is, indus-try can either take note of the explicit information and make use of that information to develop new products incorporating that information without translocating the biological material, or the indus-try can make actual use of the coded (genetic) material that produces that effect and transplant it to the desired purpose.

past. Much of the R&D process in these indus-tries has been focused on the screening of the strategies that are operational in nature, and their development for specific applications in the indus-trial context.

In certain circumstances biodiversity operates as a sort of alternative to the standard R&D process. It provides a solution concept that is already known to apply to an important problem. The identification of medicinal plants and their applications gives a good example of this form of biodiversity input. Other times the information within nature requires substantial analysis and modification before it is incorporated within a final product. In this case the information from biodiversity is best considered as a raw informa-tional input into the R&D process. That is, it is only after it is combined with other forms of capital (scientists, specialised machinery) that the naturally generated information can be developed into useful applications. An example of this form of biodiversity input into R&D would be the range of crops used in plant agriculture and plant genetic resources exposed to environmental shifts and changes, thereby revealing which are the most successful in the current environment.

In summary, the R&D process is the essence of industries such as agriculture and pharmaceuticals because the primary purpose of these industries is now to address the problem of recurring resis-tance to previously successful products. R&D is the process by which the information that will be useful against these biological phenomena is iden-tified. Biological resources are essential ingredi-ents of this R&D process in that they themselves embody successful strategies within a contested environment. They have long been used as a sort of alternative R&D process, and they also remain an important form of input to more standard forms of R&D processes in the agricultural and pharmaceutical industries.

4. Informational property rights: intellectual property rights and the incentives to supply R&D

There is one very special form of property right regime that is often used when the industry is

focused on the production of useful information through a process of R&D. When R&D is a significant part of the production process within an industry, it is not always possible to obtain a reasonable rate of return on the product without an extended right of control over its subsequent use and marketing. This is because the end result of the R&D process is an idea, and this idea is then embodied in the products in which it is sold, and potentially lost on first sale. For example, a computer program that balances a bank state-ment is first an idea, and then a specific list of computer instructions created to effect that idea. If there is no exclusive right to control the subse-quent marketing of the good (or close facsimiles thereof), then the first purchaser of that good would have the right to produce competitive products without expending all of the R&D re-sources required to produce it initially. The first sale of the computer code in the previous example would enable the purchaser to make a similar program and set up in competition with the first. This is problematic if the first seller invested years in the construction of the program while the second only invested the few minutes (and dollars) required to copy it. In industries in which a substantial amount of the value produced is at-tributable to the information it contains (gener-ated through R&D), there would be no incentive to invest in this R&D in the absence of the capacity to control the marketing of its goods even after their transfer to others. Intellectual property right regimes are analysed by economists as incentive mechanisms which give extended rights of control over the marketing of certain goods in order to provide incentives for the infor-mation generating investments (R&D) that re-sulted in them (Arrow, 1962; Swanson, 1995a).

There is a great variety of rights denominated ‘intellectual property’: trade marks, copy rights, patents, plant variety rights, etc. The most impor-tant feature that all of these rights have in com-mon is that they allow the holder to control some of the uses of the good subject to these rightse6en

able to sell the machine while retaining the exclu-sive right to manufacture it. A person with a registered plant variety certificate is able to sell that plant while retaining the exclusive right to reproduce it for re-sale.

The function of this extended right of control is to vest the holder with an exclusive marketing right in the particular good, usually for a limited period of years. This allows the holder to obtain a reasonable rate of return on the book machine, plant variety or other good that is subject to the recognised right. Note that this rate of return is only available to the extent to which users recog-nise and enforce this right after the good has already left the possession of the right-holder. To the extent that the other users are willing to purchase from prior purchasers, the right-holder’s exclusive marketing right will be of little value. There is a substantial increase in the rate of return afforded by allowing right-holders to control the uses of their rights outside of their possession. Right-holders term the unwillingness of other users to enforce their exclusive marketing rights ‘piracy’.

Exclusive marketing rights are not required to earn a reasonable rate of return on the manufac-ture and sale of most goods. The vast majority of goods are sold without being subject to any such rights; the purchaser is usually within its rights to purchase the good and then commence producing similar goods after its purchase. For example, in the U.K. the patent-intensive industries produce only about 4.2% of GDP and the copyright-inten-sive industries produce only about 3.7% of GDP. Most goods and services do not require any ex-tended right of control after sale; a reasonable rate of return is acquired although all rights to use and production are transferred with the sale. However, in those industries where the primary product is informational (as in R&D intensive industries), the use of the intellectual property system is deemed to be necessary in order to reward the production of the efficient amount of information. It is a method for inducing invest-ments in the factors required for the R&D to produce the desired information, by promising enhanced rewards to the successful outputs from R&D (Swanson, 1995b).

5. Impact of a new property right regime on industry: industrial structure, industrial output and factor demands

This section is intended to illustrate how the incentives within the industries dependent upon genetic resources (e.g. plant breeding) are affected by the introduction of a property rights regime (e.g. plant breeders’ rights). It would be expected that the impact of the introduction of a new property right system would be seen in: (i) an increase in the investment in R&D in the affected industries; and (ii) an increase in the investment in the inputs required to undertake R&D in these industries. Since genetic resources constitute both a form of R&D process in themselves as well as an input into other R&D processes in the agricul-tural and pharmaceutical industries, it would be anticipated that the introduction of a property right system over the outputs from the R&D processes within these industries would have a substantial impact on the rates of investment in these resources (Sedjo, 1992; Sedjo and Simpson, 1995).

Concrete examples are available in an area where a new property right system has recently been introduced in relation to genetic resources. The Union International pour la Protection des Obtentions Vegetales (UPOV) was established in 1961 and came into force in 1968. This interna-tional convention established for the first time internationally recognised rights in registered plant varieties, so called ‘plant breeders’ rights’. This is an excellent case study of the impact of IPR systems on investments in R&D and its associated inputs. Further research is required but preliminary analysis indicates that the benefits from the introduction of this IPR system have reached only part way down this industry.

5.1. The 6ertical structure of the R&D in the

plant breeding industry

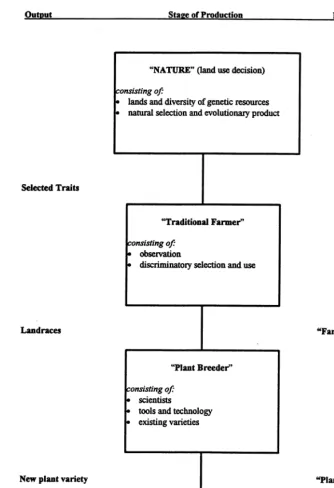

In industrial economics, the term6ertical indus

the vertical structure of the industry developing new plant varieties for agriculture (the ‘plant breeding industry’). It depicts (starting from the bottom upwards) how a flow of information orig-inates within the natural environment by reason of the investment in certain inputs (lands and diversity) and that this flow of information is then channelled towards the market via the farmers (the intermediate stage of the industry) and finally to the plant breeders. These plant breeders then prepare and market the information to

con-sumers. Each level of the industry must invest in certain forms of R&D activities in order to gener-ate and approprigener-ate the information flowing from the previous level; this consists of land use invest-ments at the base of the industry and investinvest-ments in scientists and laboratories at the market-end of the industry. In this schematic there is no produc-tion at the end of this pipeline without flows occurring throughout its entire length.

At its base, effective characteristics for new plant varieties develop naturally through the pro-cess of ‘natural selection’: only those which are able to survive existing threats (pests and patho-gens) remain and reproduce. Since the set of threats is constantly changing, the natural envi-ronment continuously produces new information on the characteristics that are relatively fit under current conditions. The maintenance of a rela-tively greater diversity of genetic resources and the dedication of greater amounts of lands to the retention of that diversity are the investment choices which determine the amount of informa-tion flowing out of this stage of the industry on the nature of the plants that work effectively in the prevailing environments.

The next stage of the industry consists of the individuals who observe the natural process of selection and aid in the dissemination of its infor-mation. ‘Traditional farmers’ have themselves sur-vived by means of a process of observing this naturally produced information and the dispro-portionate use and transport of those plant char-acteristics which have aided survivability. They invest in the production of this information both by means of their land use decisions (as men-tioned above) and by dedicating their time and resources to the observation and discriminatory use of those genetic resources which are revealed by nature to be of greater fitness. Their choices each year result in the capture of some of the flow of information on what was successful in the environment prevailing in the current year. This information also accumulates as a ‘stock’: tradi-tional plant varieties (landraces) encapsulate the accumulated history of the information which na-ture has generated that farmers have observed

and used disproportionately (Swanson and

Goeschl, 1998).

Fig. 2. Vertical industry for plant breeding.

At the end of this process, the ‘plant breeding industry’ has collected the set of varieties that farmers have created over millennia and hence the stock of naturally produced information that is

possi-ble variety for current environmental conditions. The modern plant breeder has then used its in-vestments to create a variety that is an amalgam of some subset of the traditional varieties.2

To what extent is the stock of information within agriculture (represented by the accumu-lated set of landraces in storage) adequate to deal with the problems arising in agriculture at present and in the future? Although the past 30 years have seen an unprecedented rate of investment in the storage and general availability of landraces, it is interesting to note that the plant breeding in-dustry has continued during this period to make use of ‘new information’, i.e. information that is coming in from the natural environment (Swan-son, 1996). Hence the entirety of the vertical industry remains relevant to the maintenance of agriculture; it is not simply a matter of using the stock of information that we have accumulated, but also a matter of managing the flow of infor-mation that is currently arriving.

Fig. 2 also indicates at which levels of this industry property rights systems have (and have not) been developed. As mentioned above, a large number of countries recognise the existence of plant breeders rights. The registration of a plant variety by a seed producer under national plant registration legislation gives exclusive rights to the marketing of that variety internationally by all countries that are members of UPOV. The value of the information generated by the R&D process is appropriable by companies marketing a final product under this system of rights. Other rights at other levels of the industry are necessary to aid appropriability by the suppliers of other factors (or inputs) into this industry. However, at the very base of the industry, there has been until

recently little or no recognition of the need to reward the flow of information that results simply from retaining a diversity of genetic resources on lands dedicated to that purpose. These sorts of land use decisions also provide inputs into this R&D process but there has been no attempt to create a property rights mechanism that would reward this factor for this output.3

5.2. E6idence of impact of new property right

regime on in6estments in information

There is some evidence that the recent introduc-tion of the new property right systems affecting genetic resources, and the expansion of others, has had some positive effect on the flow of infor-mation within these industries. The US was the first jurisdiction to afford IPR protection to a living organism. The well-known case involved a bacterium useful in the petroleum industry that was the subject of the US patent ruling in 1980 which first allowed the patenting of human-modified natural organisms (Chakraborty vs. Dia-mond). The screening of microorganisms has been occurring at unprecedented rates in recent years, partially in response to the anticipated increase in appropriability of any information discovered in this process and partially in response to the re-duced costliness of the screening process (Ayl-ward, 1995). It is clear that the expansion of IPR systems into this area has increased private invest-ment in R&D relating to these organisms, but further research is required to assess and analyse this link.

3In this regard, the International Undertaking on Plant Genetic Resources propounded by the FAO Commission on Plant Genetic Resources has attempted to stake a claim to a return for the traditional farmer, but this remains to be implemented. In June 1998, the World Intellectual Property Organisation (WIPO) declared that it plans to extend the 1PR system to — what is termed — ‘new beneficiaries’, i.e. to create protection of rights of holders of traditional knowledge, indigenous peoples and local communities. WIPO remains unclear, however, about the nature of these rights and the mechanism through which claims would be assessed and set-tled (WIPO, 1998). Many of the benefit sharing mechanisms being discussed elsewhere also concern this level of the indus-try, and the need to share benefits with those individuals who have created the stock of information on which we rely. 2There are exogenous factors inherent in the nature of plant

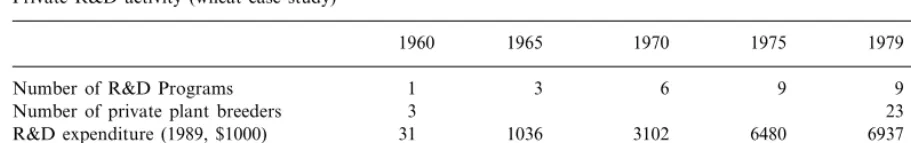

Table 1

Private R&D activity (wheat case study)a

1979 1975

1970 1965

1960 1991

Number of R&D Programs 1 3 6 9 9 11

3 23 25

Number of private plant breeders

31 1036 3102 6480 6937 4241

R&D expenditure (1989, $1000)

61

Number of PVPCs (5-year period) 17 35 41

aPray and Knudsen (1994).

There is clear evidence that the introduction of IPR systems in the plant breeding industry (de-scribed above) expanded private sector R&D in this area. Studies in the US indicate that R&D expenditures in just one field of research (small grains) increased in real terms by more than a factor of one hundred between 1960 and 1991 (Perrin et al., 1983; Butler and Marion, 1985; Pray and Knudsen, 1994). In the US, passage of the implementing legislation for UPOV occurred in 1970, and Table 1 below demonstrates how R&D increased in anticipation of the receipt of the exclusive marketing rights acquirable since 1970. The number of R&D programmes in this area, the total number of plant breeders, and the aggregate amount of R&D expenditure all rose dramatically since 1970.

5.3. Impact of IPR structure on in6estment into

inputs (especially genetic resources)

It is also clear that investment in some of the inputs required for plant breeding expanded with the introduction of plant breeders’ rights. There was an expansion in the number of scientists trained and operating in the field, and as men-tioned previously a marked increase in the amount of genetic resource stocks in storage (Huffman and Evenson, 1993). In general, in-creased investment was directed at methods of preserving genetic resources that were of known usefulness. This evidence indicates the increased importance placed upon R&D in this field once IPR protection became available.

Investment was not increased for all of the R&D inputs potentially affected by this IPR regime. At the same time that R&D was

expand-ing, generally from the introduction of plant breeders’ rights, there has been little evidence of increased investment in the other essential inputs — those which would maintain a flow of genetic resources into the future. Although there is very little precise information available, it is widely believed that this same period (1960 – 1990) has been an era during which plant diversity in agri-culture has been in decline throughout the devel-oping world (see, e.g. Table 2 from WCMC, 1992). This decline in the investment in diversity in agriculture during this period was occurring despite the introduction of the IPR system regard-ing plant varieties.4

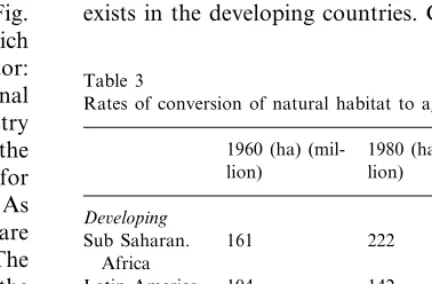

Any decline in diversity at the aggregate level is attributable to changes in land use at the global level. Global land use patterns were being shifted away from diversity-based uses and toward mod-ern agriculture. The only means by which ‘nature’ can supply its inputs to the production system is by means of land use decisions that retain ‘natural systems’ across large areas of land. In fact, the trend during this period was toward the conver-sion of lands in the developing countries away from pre-existing uses. Between 1960 and 1980 the total amount of land in modern agriculture within developing societies increased by over a third (Table 3).

Table 2

The decline in diversity at the level of varietiesa Crop Country Number of varieties

Rice Sri Lanka From 2000 varieties in 1959 to five major varieties today. 75% of varieties descended from one maternal parent

Rice India From 30 000 varieties to 75% of production from less than ten varieties Rice Bangladesh 62% of varieties now descended from one maternal parent

74% of varieties now descended from one maternal parent Indonesia

Rice

aWorld Conservation Monitoring Centre (WCMC, 1992).

Have IPR systems had any positive impact upon the supply of genetic resources to the plant breeding industry? Clearly, there must be a coun-tervailing force within the developing world. The developing countries should have perceived an increased incentive to maintain the diversity they hold (in order to supply the demands for informa-tion of the plant breeding firms), but at the same time they must also be perceiving the benefits to be derived from switching to the use of the products from these same plant breeders. The aggregate figures indicate that the incentives to switch to-ward modern agriculture have overwhelmed the IPR-based incentives to maintain diversity in the developing world over the past few decades.

In summary there is clear evidence that the adoption of IPR protection for plant varieties increases investments in the development of new plant varieties in one sector of this industry: the plant breeding sector. However, as set forth in Fig. 2, there are two other parts to this industry which are often precursors to the plant-breeding sector: the roles of natural selection and the traditional farmer. In order for these sectors of this industry to continue to generate their flow of inputs to the modern plant-breeding sector, it is necessary for land to continue to be dedicated to these uses. As indicated in Table 3, global land use patterns are moving rapidly in the opposite direction. The amounts of land available for and dedicated to the generation of a flow of genetic resources for use in modern R&D activities has been reduced dramat-ically. Existing IPR systems create incentives to invest in R&D at the end of the industry (the plant-breeding sector) but are not generating in-vestments in the earlier parts of the industry (the genetic resource providers). Why is this the case?

6. Efficiency: the importance of ownership

Why is it that the existing IPR regimes do not generate incentives for the in situ conservation of genetic resources in order to supply these sectors? The introduction of IPR systems for plant vari-eties had no positive impact on the incentives for in situ conservation of agricultural diversity in developing countries as a whole because: (a) the farmers in the developing world receive no return from the use of their varieties in the plant breeding industry (because the farmers have no recognised property rights in their genetic resources) and hence they have no direct incentive to invest in diversity, and (b) the plant breeding industry lo-cated primarily in the developed world) does not feel that it can achieve sufficiently reliable control over these inputs to justify their own independent investments in the retention of the diversity that exists in the developing countries. Given that this

Table 3

Rates of conversion of natural habitat to agriculturea % 1960 (ha) (mil- 1980 (ha)

(mil-lion) lion)

De6eloping

37.8 Sub Saharan. 161 222

Africa

104 36.5

Latin America 142

153 37.2

South Asia 210

37.5

40 55

S.E. Asia De6eloped

205

North America 203 −0.1

151 137 −0.0

Europe

225

U.S.S.R 233 −2.0

is the case, there are two options: either develop a plant breeding sector in those countries with sub-stantial genetic resources or develop a property rights system that assigns rights across several different stages of the industry. This section ex-plains the nature of the problem facing this indus-try, and why these are the only possible solution concepts.

As mentioned in Section 2, the theory of prop-erty rights initially posited that there was no link between the allocation of property rights and the efficiency of resource allocation that resulted. This was the essence of the so-called Coase Theorem (Coase, 1960). The idea behind the theorem is that the allocation of the property rights at some level of the industry will be sufficient to generate the efficient distribution of those rights, simply because the current rights holder will value the rights less than the most efficient rights holder. Society wants the rights to be in the hands of the agent who is best able to generate a flow of highly valued goods and services from them, and it is this value that will warrant the highest bid. There-fore, the initial location of the rights is irrelevant, so long as the costs of moving them toward the highest bidder are not prohibitive.

In the case of plant genetic resources, the UPOV convention places the property rights in the information generated within the industry at the plant breeder stage of the industry, where they are implicit within the exclusive marketing rights to new plant varieties given to plant breeders. According to the Coase Theorem, this should not matter so long as the transaction costs between the various stages of the industry are not too high. The predicted outcome would be that the plant breeders would become the ‘managers’ of the entire vertical industry by distributing the property rights across the industry in a manner that creates incentives for the efficient supply of inputs at each level of the industry. This is what occurs in other vertical industries. As the rights holder sees the necessity of sharing property rights as a mechanism for generating incentives, the rights holder allocates property rights at those levels of the industry that are seen as important to the maximisation of the value of the vertical industry. For this reason, some industries hire

their retailers as employees (when their holding of property rights is unnecessary) and other indus-tries deal with them as independent contractors (when their holding of property rights is impor-tant) (Grossman and Hart, 1986).

This option is not available in the case of the management of information through exclusive marketing rights, such as the information embed-ded within a new plant variety. This is because (as described in Section 3) this property right in information is given effect only by means of the universal recognition of an exclusive marketing right in the product in which it is embedded. It is impossible to redistribute the property right in information across the vertical industry without first creating a new universally recognised prop-erty right in an intermediate good in which it would be embedded Such an option does not currently exist.5 This disjunction between the

valuable resource (information) and the property right (in the marketed product) renders the straightforward application of the Coase Theorem inappropriate in this context.

There remain two other, more indirect, ways in which the property rights holder might respond to incentives to manage genetic resources. In effect, if the property rights are not able to be allocated efficiently across a decentralised industry, then there should be significant incentives for the in-dustry to become centralised or vertically inte-grated. This would occur by means of one of two possible changes in the resulting enterprises: (1) the existing rights holders might attempt to merge downwards across the vertical stages of the indus-try to gain control of their suppliers (integrating downstream); or (2) the supplier stages of the industry might attempt to move into stages of production nearer to the market in order to be able to use these rights systems (integrating upstream).

First, why is it that we do not observe plant breeders integrating their enterprises downstream

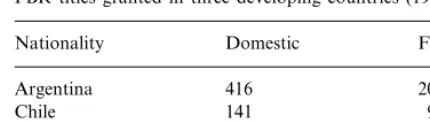

Table 4

PBR titles granted in three developing countries (1968–1994)a

Nationality Domestic Foreign

416 206

Argentina

Chile 141 90

Uruguay 16 9

aJaffe and van Wijk (1995).

holder in the land uses needed to provide an ongoing supply of genetic resources represent this sort of problematic property rights assignment. The local population would not perceive the ‘banking’ of large tracts of genetic resources to be the first-best (most productive) use of those lands. It is this sort of conflict between global and local optima in land use that renders the transfer of property rights across boundaries problematic.6

The second option for integration is to encour-age the ‘transfer of technology’ — in the sense of the establishment of fully integrated industries within the countries that host most of the genetic resources which these industries require. This would imply the development of high technology sectors (of plant breeding, pharmaceutical screen-ing etc.) in precisely those countries where they are currently least likely to be located. It is some-thing like the approach taken in the case of INBio in Costa Rica, where the government has at-tempted to invest in a national laboratory for plant screening focused primarily upon its own genetic resources. To what extent can this strategy be generalised or should it be generalised in order to address the problem of genetic resource management?

First, consider the extent to which the adoption of the IPR regime in plant breeding has resulted in such investments in the developing world. As of 1995, there were seven developing countries that had enacted IPR regimes regarding plant vari-eties: Argentina, Chile, Uruguay, Colombia, Mex-ico, Zimbabwe and Kenya (Jaffe and van Wijk, 1995). At least three of the Latin American coun-tries have developed sectors making significant investments in the R&D necessary to secure regis-tered plant varieties (see Table 4). At present only two of these countries (Uruguay and Chile) have significant seed exports. Only one of these coun-tries (Chile) had a trade surplus in seed and plant varieties (Jaffe and van Wijk, 1995).

Note the nationality of the various concerns involved in plant breeding registrations in the into earlier stages of the industry by the

acquisi-tion of lands in other countries, for example? The earlier survey also asked this question of the plant breeding industry: What were the reasons that plant breeders could identify for not investing in diversity in other countries? (Swanson and Lux-moore, 1998). The dominant factor cited by plant breeders in determining the low level of such investments was insecurity; the plant breeders prefer to maintain their own ex situ collections on account of concerns about future supplies. The fact that most breeders would like to maintain diversity in in situ areas, but felt that they must conserve it instead in gene banks, is an indicator of the perceived inability to invest in these other countries for this purpose. Around 55% of breed-ers believed that ensuring a stable supply of high quality breeding material was the top priority of in-house collections. Some 44% of the breeders felt cost to be an important determinant of their supply decisions.

Why do firms feel insecure about the possible returns from investing in property rights in for-eign lands? Clearly many firms hold large portions of their assets in many different countries, and this indicates that there is not this sort of insecu-rity about returns flowing generally from invest-ments across national boundaries. The insecurity must depend upon the nature of such investments. The answer to this paradox is that property rights are creations of domestic regimes, and they are only secure to the extent that they are seen to create benefits that redound to the benefit of the domestic population. This is not the case if the absentee owner is seen to pursue strategies at odds with the interests of the local population, then the continuing viability of that property rights system becomes less secure. The investments by a rights

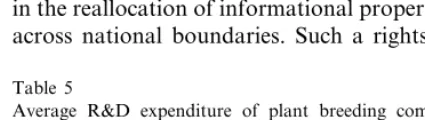

most important countries in the field. In each of these countries the market in hybrid varieties is dominated by multinational firms while the self-pollinating varieties are dominated by domestic operations. It is the former group that has experi-enced most of the growth in R&D expenditure in these countries (see Table 5). This demonstrates that the domestic plant breeding sector in these countries is not really competing with the multina-tionals, but dealing in a completely distinct set of resources which are of much less interest to that industry. The industry that focuses on the develop-ment of solutions in modern agriculture through the application of R&D continues to be the exclu-sive field of the multinationals specialising in this endeavour.

This makes sense. It should not be necessary for a country with a comparative advantage in the provision of raw genetic resources to become inte-grated into the high technology sector of the industry in order to claim a return to its invest-ments. This is especially the case if we wish to encourage alternative pathways and approaches to development (Swanson, 1999). Countries that are heavily invested in natural capital and diversity should be able to earn a reasonable return from these investments, while countries that are heavily invested in human capital and modern agriculture should be able to earn a return from theirs as well. This exhausts the range of possibilities for the efficient management of the industry under the current rights regime. This analysis leads to the conclusion that it is not possible to manage the entire vertical industry efficiently under this regime on account of the high transactions costs involved in the reallocation of informational property rights across national boundaries. Such a rights

assign-ment problem is known in the literature as a ‘property rights failure’ and it exists whenever the best investor in an asset is not the property rights holder (Hart and Moore, 1990). For the reasons cited above, the existing property rights regime generates a property rights failure in the manage-ment of the flow of genetic resources within this industry.

The inability of the existing property rights regime to translate into efficient management indi-cates that a new universally recognised mechanism for the creation of these rights at intermediate levels is required on efficiency grounds alone. This property right mechanism must be developed multinationally because it requires the agreement of all of the market for the recognition and en-forcement of the exclusive marketing right. The current property right regime (outlined in Fig. 2) is probably inadequate for the efficient manage-ment of the flow of information within this indus-try, and property right regimes at the intermediate and supplier levels must be considered as ways of redressing this inefficiency.

7. The scale of the problem

Does this inefficiency matter? That is, would any reform to the property rights regime generate an adequate improvement in efficiency to compensate for the costs of the new legal regimes? The question concerns the magnitude of the contribution of the genetic resources to these industries, and the poten-tial losses from having inadequate incentive sys-tems in place in regard to supply of this factor of production. One important group of commenta-tors has written extensively on the subject of the role of property rights as an incentive system regarding genetic resources, but then concluded that the correction of this inefficiency would make little impact upon the loss of biodiversity7

(Sedjo et al., 1995; Simpson and Sedjo, 1998).

Table 5

Average R&D expenditure of plant breeding companies in Argentinaa

1986

Specialisation of firm 1992 %

Hybrids 1286 1900 48

Self-pollinating 180 186 3

Diversified 370 851 130

aJaffe and van Wijk (1995).

This specific question may be addressed empiri-cally by segregating between the returns at-tributable to the various factors of production in an industry such as plant breeding A monopoly in marketing rights (IPR) provides the holder with the capability to receive a return on all of the new information embodied within the product, irre-spective of its source. This means that an IPR system gives a rate of return on information that was produced by the right-holder’s R&D process as well as on any other source providing informa-tion that is incorporated within the product. For example, in the context of the plant breeding industry (Fig. 2), a plant variety certificate would provide a rate of return on all of the new informa-tion contained within a new plant variety, irre-spective of whether it is generated by: (a) the plant breeder’s R&D process; (b) the traditional farmer’s observation and selection process; or (c) the natural environment’s selection process.

The denomination of the property rights holder will determine the identity of the person receiving the return to the information contained within the product. For example, even if the plant breeder does nothing other than incorporate the informa-tion developed through other processes (e.g. by crossing a landrace with a modern variety to incorporate its desired characteristics), the full value of this information will be captured by the holder of the property right. This section assesses the extent to which it is possible to ascertain the distinct contributions from these various factors of production within the plant breeding industry. This is done by specifying an ‘R&D production function’, and then estimating the extent to which its various component parts have contributed to the past production of new information. An R&D production function in the context of plant breed-ing, for example, would have to consist of at least: (i) the scientific input (human capital); (ii) the technological input (physical capital); (iii) the ge-netic resource input (natural capital). The theory of a production function states that increases in these various inputs would result in increases in the desired output: new modern plant varieties (Evenson and Gollin, 1991).

There has been at least one empirical study which has made an attempt to estimate the

rela-tive contribution of genetic resources in the R&D process in plant breeding (Evenson, 1995). This study specified the R&D production function as follows:

New varieties=f(L, K,G)

where L is the level of input from human capital (scientists); K is the level of input from physical capital (technology, machinery); G is the level of input from genetic capital (biological diversity).

The empirical study was based upon the record of plant breeding at the International Rice Re-search Institute since 1960, and estimated the extent to which new varieties of rice were at-tributable to the various forms of investments. This study estimated that approximately 35% of the production of modern new rice varieties has been attributable to the genetic resource input into the R&D function (Evenson, 1995). This implies that the inputs supplied by plant breeders in rice breeding (human and technological) gener-ated no more than 65% of the useful information within modern plant varieties. The imputed present value of a single landrace accession ac-cording to this study was $86 – 272 million. The imputed present value of one thousand accessions with no known history of use was $100 – 350 million. Given that the initial stock of rice germ plasm (in 1960) was 20 000 accessions, the added stock of germ plasm since that time (about three times as many accessions) have been estimated to be responsible for fully 20% of the green revolu-tion in rice producrevolu-tion8 (Evenson, 1995).

This study gives an indication of the scale of the property rights failure outlined in the previous section. In the context of rice production, diverse germ plasm contributes 35% of the total inputs required for the production of a new plant vari-ety. Since the existing commercial varieties lose their resistance rapidly in the context of

scale monocultural production, this implies that a large proportion of rice production is attributable to this one factor. The loss of this factor through inadequate investment would not constitute a small-scale inefficiency.9

It is also important to note that property rights systems are capable of creating the right to a payment for informational contributions occur-ring at intermediate levels of this industry (i.e. levels other than the final producer/marketer of the plant variety). That is, it is possible to grant property rights in genetic resources that then provide the basis for benefit sharing within the industry. There is now a market-based indicator of the method by which such benefits would be shared, should property rights be established in unmodified genetic resources. Since UPOV has been in place for almost 30 years, there is now a substantial stock of plant varieties for which peo-ple and firms have proprietary rights. Contracts have developed within the marketplace which li-cense these proprietary plant varieties to plant breeders for use in the R&D process. For exam-ple, in the UK, the total royalty income earned in 1995 from the use of proprietary lines in plant breeding R&D was approximately £20 million ($30 million) (Personal communication, British Society of Plant Breeders). Standard contractual terms for these royalties range from 0.5 – 3.0%, depending upon the degree of representation of the proprietary line within the new plant variety, as follows:

Royalty (%) Relationship

0.5 Second degree (grandparent)

First degree 1.0

2–3 Hybrid

(Sam Johnston, personal communication and viewing of standard form contract).

The studies of the contribution of plant genetic diversity within the plant breeding industry demonstrate the extent to which genetic resources are important inputs into the R&D process. It is apparent that the scale of the inefficiency war-rants consideration of intermediate property right mechanisms. The royalties being earned on the licensing of proprietary plant varieties for use in other firms’ R&D indicates that the returns from plant breeding can be shared across the various inputs (genetic, scientific). The feasibility and im-portance of the property right reform indicates that it should be considered seriously.

8. Conclusion

Ownership is important for purposes of effi-ciency. Property rights systems are important mechanisms for creating incentives for obtaining the efficient levels of investment within society. For that reason, it is important to consider the efficiency aspects of property rights in plant ge-netic resources, in addition to the equity aspects. This analysis of the role of property rights systems in managing the supply of genetic re-sources to the plant breeding industries indicates that the current system is in need of reform, and that the scale of the resulting inefficiency probably warrants careful consideration of the nature of those reforms. Genetic resources clearly play an important role in the plant breeding industry and it is essential that investments are made now to provide for their continuing availability for future societies. The existing property rights mechanism was analysed here, and found to be inefficient on account of high transactions costs. It is when reassignments within a vertical industry are difficult to achieve that the public reallocation of property rights must be considered.

There are two further points that should be emphasised as interesting implications from this analysis and points for further study and research. One is that the monetary values flowing into a resource under a poorly constructed property rights system are no indicator of the value of that resource. If the property rights are misallocated, and there exist frictions that prevent their

ment, then the flow of value into supplying that resource may be minimal when the actual value is enormous. The existing studies on the private valuation of biodiversity as inputs into R&D may reflect nothing more than this inefficiency within the property rights system.

The second point is that this will always be the case when a resource is systemic in nature, such as an environmental or informational system. These resources are very difficult to break down into discrete commodities that fit neatly into a prop-erty rights system, and then alternative forms of provision must be considered. It will be important in the context of resources such as biodiversity to recognise that a wide range of supply mechanisms must be taken into consideration, but that each existing supply mechanism (such as property rights regimes) must be analysed for its own effi-ciency implications.

Acknowledgements

The authors are grateful to three anonymous referees of this journal for helpful comments on earlier drafts of this paper.

References

Arrow, K., 1962. Economic welfare and the allocation of resources for invention. In: Nelson, R. (Ed.), The Rate and Direction of Inventive Activity. Harvard University Press, Cambridge, MA.

Aylward, B., 1995. The role of plant screening and plant supply in biodiversity conservation, drug development and health care. In: Swanson, T. (Ed.), Intellectual Property Rights and Biodiversity Conservation. Cambridge Univer-sity Press, Cambridge.

Butler, L.J., Marion, B., 1985. The Impacts of Patent Protec-tion on the U.S. Seed Industry. North Central Region Department of Agriculture Research Publication, p. 304. Calabresi, G., Melamed, D., 1972. Property rules, liability

rules and inalienability. Harvard Law Review 85, 1089 – 1128.

Coase, R, 1960. The Problem of Social Costs. Journal of Law and Economics

Evenson, R., Gollin, D., 1991. Priority Setting for Genetic Improvement. Research International Rice Research Insti-tute, Los Banˇos, Laguna, Phillipines.

Evenson, R., 1995. The Valuation of Crop Genetic Resource Preservation, Conservation and Use. Paper prepared for the Commission on Plant Genetic Resources, Rome. Grossman, S., Hart, O., 1986. The costs and benefits of

ownership: a theory of vertical and lateral integration. Journal of Political Economy 94 (4), 691 – 719.

Hart, O., Moore, J., 1990. Property rights and the nature of the firm. Journal of Political Economy 98, 1119 – 1158. Huffman, W., Evenson, R., 1993. Science for Agriculture.

Iowa State University Press, Ames, IA.

Jaffe, W., van Wijk, J., 1995. The Impact of Plant Breeders Rights in Developing Countries. Technical Paper of the Special Programme on Biotechnology and Development Cooperation. Ministry of Foreign Affairs of the Nether-lands, The Hague.

Michelman, F., 1971. Property, utility and fairness. Harvard Law Review 80, 1165 – 1258.

Perrin, R., Kunnings, K., Ihnen, L., 1983. Some Effects of the US Plant Variety Protection Act of 1970. Economic Re-search Report No. 46. Department of Economics, North Carolina State University.

Posey, D., Dutfield, G., 1996. Beyond Intellectual Property. International Development Research Centre, Ottawa, Ont. Pray, C., Knudsen, W., 1994. Impact of intellectual Property Rights on Genetic Diversity: The Case of Wheat, Contem-porary Economic Policy, XII, p. 102.

Repetto, R., Gillis, M., 1988. Public Policies and the Misuse of Forest Resources. Cambridge University Press, Cambridge.

Sedjo, R., Simpson, D., 1995. Property rights, externalities and biodiversity. In: Swanson, T. (Ed.), Intellectual Property Rights and Biodiversity Conservation. Cambridge Univer-sity Press, Cambridge.

Sedjo, R., Simpson, D., Reid, J., 1995. Valuing Biodiversity for Use in Pharmaceutical Research, Resources for the Future Working Paper.

Sedjo, R., 1992. Property Rights, Genetic Resources and Bio-technological Change. Journal of Law and Economics 35, 199 – 213.

Shiva, V., 1991. The Violence of the Green Revolution: Third World Agriculture, Ecology and Politics. Zed, London. Simpson, D., Sedjo, R., 1998. The value of genetic resources

for use in agricultural improvement. In: Evenson, R.E., Gollin, D., Santaniello, V. (Eds.), Agricultural Values of Genetic Resources. FAO, Rome.

Smale, M., 1997. The green revolution and wheat genetic diversity: some unfounded assumptions. World Develop-ment 25 (8), 1257 – 1269.

Swanson, T. and Goeschl, T., 1998. Optimal management of genetic resources for agriculture: ex situ and in situ. Jour-nal of Agricultural Economics, in preparation.

Swanson, T., Kontoleon, A., 1998. The economics of nuisance disputes. In: New Encyclopaedia of Law and Economics. Kluwer, Dordrecht.

Swanson, T., Luxmoore, R., 1998. Industrial Reliance Upon Biodiversity. WCMC, Cambridge.

Swanson, T., 1995b. Uniformity in development and the de-cline of biodiversity. In: Swanson, T. (Ed.), The Economics and Ecology of Biodiversity Decline: The Forces Driving Global Change. Cambridge University Press, Cambridge. Swanson, T., 1996. Biodiversity as information. Ecological

Economics 17, 1 – 8.

Swanson, T., 1999. Biodiversity conservation via alternative pathways to development. Biodiversity and Conservation 8 (1), 29 – 44.

WCMC, 1992. Global Biodiversity. Chapman and Hall, Lon-don.

Weitzman, M., 1998. Recombinant growth. Quarterly Journal of Economics 113 (2), 331 – 360.

Williamson, O., 1985. The Economic Institutions of Capital-ism. Fire Press, New York.

WIPO, 1998,. Documentation of the WIPO Roundtable on Intellectual Property and Indigenous Peoples, June 23 and 24, 1998. WIPO/INDIP/RT/98/1 4. World Intellectual Property Organisation, Geneva.