DETERMINANTS OF THE EFFECTIVENESS OF ACCOUNTING

INFORMATION SYSTEMS IN DISTRICTS/CITIES IN NORTH

SUMATERA– INDONESIA

Nurzaimah

(Universitas Sumatera Utara (USU) /Indonesia/+62618214545

Salbiah

(Universitas Sumatera Utara (USU) /Indonesia/+62618214545

IskandarMuda

(Universitas Sumatera Utara (USU) /Indonesia/+

ABSTRACT

The purpose of this research is to determine the effect of the use of information technology, the service quality of accounting information systems and knowledge on the effectiveness of accounting information systems in Districts/Cities in North Sumatra. The type of this research is causal study. The research location was in several Districts/Cities in North Sumatra consisting of District of Batubara, District of Simalungun, District of Asahan, District of Labura, District of Labusel and City of TanjungBalai with a sample of 78 respondents who were willing to be interviewed of 201 populations using purposive sampling method. Dependent variable was the effectiveness of accounting information system and the independent variables used were the use of information technology, information technology advancement, the service quality of accounting information system and knowledge. Mediating variable used was Habit. This variable was used to analyze using path analysis test in order to obtain direct and indirect causal values. The results showed that the use of information technology, the service quality of accounting information systems and knowledge has effect on the effectiveness of accounting information systems in Districts/Cities in North Sumatra. Habit variable serves as mediating variable for the relationship between the independent variable on the dependent variables.

Keywords :Habit, The Use of Information Technology, Service Quality of Information

System and Knowledge.

1. INTRODUCTION

carried out by several researchers. Dirgayusa, Atmadja and Nyoman (2014) found that the knowledge of employees in division of accounting and the use of information technology influenced simultaneously and significantly to the effectiveness of accounting information systems. Istiningsih (2009), in her research found that the service quality of has significant and positive effect on the effectiveness of accounting information systems. Researchers Kouser, et al (2011) found that the knowledge of accounting manager and the manager participation in the implementation and development of accounting information system have a strong relationship with the effectiveness of the accounting information system. Komala (2012) in his research found that knowledge of accounting manager affects the effectiveness of accounting information system and has a significant impact on the quality of information. There are some similarities and differences between this research and the previous researches. The difference is that there are independent variables used namely: the use of information technology, the quality service of accounting information system and knowledge. The differences between this research with the previous researches are on the location, time and number of the population and sample to be studied.

2. LITERATURE REVIEW

2.1. Efficiency and Effectiveness of Accounting Information System

Marshal and Romney (2015) in Hla and Teru (2015) alleged that developing an internal control system requires a thorough understanding of information technology (IT) capabilities and risk s as well as how to use IT to achieve an organizational control objectives. Accountant and systems developers help management achieve their control objectives by (1) designing effective control systems that take a proactive approach to eliminating systems and detect , correct , and recover from threats when they occur .(2) making it easier to build controls into systems at the initial design stage than to add them after the facts. They also alleged that internal control perform the following important functions;Preventive controls: which deter problems before they arise. Examples include hiring qualified personnel, segregating employee duties, and controlling physical access to assets and information.

There are many factors that affects the efficiency and effectiveness of accounting information systems such as qualified human resources, software and hardware and data bases (Ramly, 2011).Thus, the accounting information systems combined from these three factors, if any system has to be effective it should include a combination of well qualified human resources, the best software, and hardware and databases.

2.2.Conceptual Framework

Fig.1Conceptual Framework

An effective system can provide positive influences to the users' behaviors. Once a system is operated for a period of time, post-implementation shall be reviewed, inter-alia, to determine the extent to which the system achieve the specified objectives and whether or not

the system can be reused or continued , and if it can be continued, whether modifications is required in order to achieve the specified objectives better. The correct use of information technology and supported with the personnel expertise in operating it can improve the corporate and the concerned personnel performances.An information system can be said as having good quality if such system is designed to meet users' satisfaction through the ease in using such information system. In addition, the higher the knowledge and the greater experience , the more effective a system will be. All of these can run optimally when it is mediated by daily habits in carrying out activities.

2.3. Previous Studies

Maksum et al (2014) This study aims to determine therole of treasurer’s experienceand knowledge on Permendagri (Minister Regulation) No. 55/2008 to create the effectiveness of administration and preparation of the accountability reporting system. The study founds that the experience variable does not affect the effectiveness of the administration and preparation of the accountability reporting system; meanwhile, the knowledge variable has an effect on the effectiveness of the administration and preparation of the accountability reporting system. Rasdianto et al (2014) This study aims to analyze the role of treasurer capacity on human resources and its tenure of services, facilities and infrastructures, the regulation, intensity of training administration and accountability of each of the task forces (SKPD) in North Sumatera on the timeliness of the regional government’s financial report. The result of the study has revealed that simultaneously and partially the variables of treasurer’s human resources and tenure of service, facilities and infrastructure, the regulation and intensity of the training administration and the accountability of the treasurers in North Sumatera are significantly affect to the timeliness of the regional government’s financial report. Rowe et al,. (1995) and Ramdhani (2011) also suggests the measurement of effectiveness consisting of, among others, the achievement level of the following aspects such as market share, growth, and stakeholder expectation. McLeod & Schell, 2007: 16 &Laudon&Laudon (2005) in AdehRatnaKomala (2012) state that the measurement dimension of accounting managerial knowledge is knowledge and experience.Komala (2012) states that accounting manager (controller) is an executive coordinating the participation of management in planning and controlling to achieve the company target, especially to determine the effectiveness of policy implementation and to develop the organizarion structures and procedures. Furthermore, a research was also conducted by Windha and Ida (2013) on the factors that influence the effectiveness of accounting information systems. This research concludes that the education level, training, work experience and incentives has positive and significant influences to the effectiveness of the use of accounting information systems. A research by Ni Putu et al (2015) shows that those two variables have positive and significant influences on the effectiveness of accounting information systems.Muda (2014) and Muda and Dharsuky (2015) finding of this study are expected to be able to give suggestions and recommendation of improvement on SIKD managers in North Sumatera so that they can support good government system. By identifying the management of SIKD, then at least it can obtain unqualified opinion. The result of this study concludes that Quality significantly influences at level of 5% on Precision of Financial Statement of Local Government Presentation. Role Ambiguity significantly influences Precision of Financial Statement of Local Government Presentation and training significantly influences Precision of Financial Statement of Local Government Presentation.

3. METHODOLOGY

sample of 78 respondents who were willing to be interviewed of 216 populations using purposive sampling method. Dependent variable was the effectiveness of accounting information system and the independent variables used were the use of information technology, information technology advancement, the service quality of accounting information system and knowledge. Mediating variable used was Habit. This mediating variable was used to analyze using path test in order to obtain direct and indirect causal values:

Y = b1X1 + b2X2 + b3X3 + ɛ1

Y2 = b1X1 + b2X2 + b3X3 + b4Z+ ɛ2

Where:

Y = Effectiveness of accounting information system

Z = Habits

X1 = The use of information technology

X2 = Service quality of accounting information system

X3 = Knowledge of accounting staffs

b1,...,b3 = Regression line coefficient ɛ1, ɛ2 = Residuals/ error

4. RESULTS

4.1 Research Result

4.1.1. Descriptive Analysis

The description in this research is as follows:

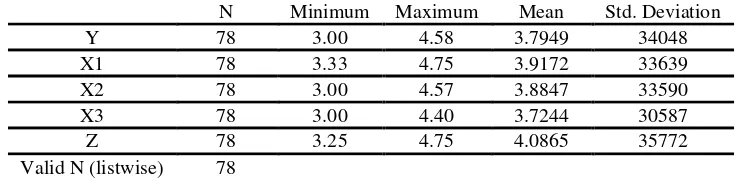

Table 1. Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Source : Secondary Data, 2016 (Processed data).

The descriptive results of the variables of the use of information technology for all observation shows an average value of 3.9172. The maximum value is 4.75 and minimum value is 3.33. The descriptive results of the variable of service quality of accounting information system shows an average value of 3.8847 with a minimum value of 3.00 and maximum value of 4.57. Knowledge variable shows descriptive result with an average value of 4.40 with a minimum value of 3.00 and maximum value of 4.40. The descriptive results of variable of the effectiveness of accounting information system shows an average value of 3.7949 with a minimum value of 3.00 and maximum value of 4.58. Habit variable shows an average value of 4.0865. The minimum value is 3.25 and the maximum value is 4.75. The standard deviation obtained is 0.583.

4.1.2.Hypothesis Testing Results

Standardized-beta coefficient value in the output table is the regression coefficient value for data that has been standardized and it constitutes path coefficient values as presented in the following table:

Table 2. Determination Coefficient Value (R2)

Model R R Square Adjusted R

Square

Std. Error of the Estimate

1 .635a .403 .379 .26834

Source : Secondary Data, 2016 (Processed data).

The value means that the effect of the use of information technology, the service quality of accounting information systems and knowledge on the effectiveness of accounting information systems together is 40.3%. In other words, the variable of effectiveness of accounting information system that can be described using variables of the use of information technology, service quality of accounting information systems and knowledge is amounted to 40.3%. To test the hypothesis substructure 1, values listed in Table 3 are used.

Table 3.Simultant Test

b. Predictors: (Constant), X3, X2, X1

Source : Secondary Data, 2016 (Processed data).

Table 3 is testing simultaneous with substructure 1. In that anova table, probability value (significant) = 0.000 <0.05 is obtained, thus Ha is received. It means that variables of

the use of information technology, service quality of accounting information system and knowledge simultaneously affect the effectiveness of accounting information system in North Sumatra.To see the effects in partial, beta numbers are used as shown in Table 4.

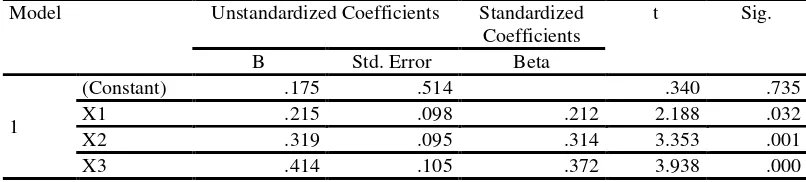

Table 4. Partial Test Value Model Unstandardized Coefficients Standardized

Coefficients

Source : Secondary Data, 2016 (Processed data).

Based on the table, the regression equation standardized in this research is Y = 0,175 + 0,212 X1 + 0,314 X2 + 0,372 X3, thuse it can be interpreted as follows:

a. The effect of the use of information technology on the effectiveness of accounting information systems, it is obtained beta value of 0,212 ≠ 0 and probability (significant) = 0.032 < 0.05. It means that the use of information technology has no significant effect on the effectiveness of accounting information systems. The effect of X1 on Y is (0.212)2 ×

100% = 4.49%.

b. The effect of the service quality of accounting information system on the effectiveness of accounting information systems, it is obtained beta value of 0,314 ≠ 0 and probability (significant) = 0.001 < 0.05. It means that the service quality of accounting information system has effect on the effectiveness of accounting information systems. The effect of X2

on Y is (0.314)2 × 100% = 9.85%.

c. The effect of knowledge on the effectiveness of accounting information systems, it is obtained beta value of 0,212 ≠ 0.372 and probability (significant) = 0.000 < 0.05. It means that knowledge has significant effect on the effectiveness of accounting information systems. The effect of X3 on Y is (0.372 × 100%) = 13.83%.

The calculation of direct and indirect effects of variables of the use of information technology, the service quality of accounting information systems and knowledge on variable of effectiveness of accounting information system can be seen in Table 5.

Table 5.Direct and Indirect Effect

Variables Direct Effects Indirect Effects Total Remarks

X1 to Y (0.212)2 x 100% 4.5% 28.1% Weak effect

2(0.314 x 0.372 x-0.161)x100% -3.7% Weak effect

Simultaneous Effect 32.6% Strong Effect

Other Variables 67.4% Error term

Source : Processed data (2016).

Based on Table 5, it shows that X1 to Y has weak direct effect of 0.212 or 4.5%, X2 to

Y also has weak affect of 0.314, or 9.8%, while X3 to Y has medium effect of 0.372 or

13.8%.The calculation of direct and indirect effects of variables of the use of information technology, the service quality of accounting information systems and knowledge on the effectiveness of accounting information system and the impacts on the habits can be seen in Table 6.

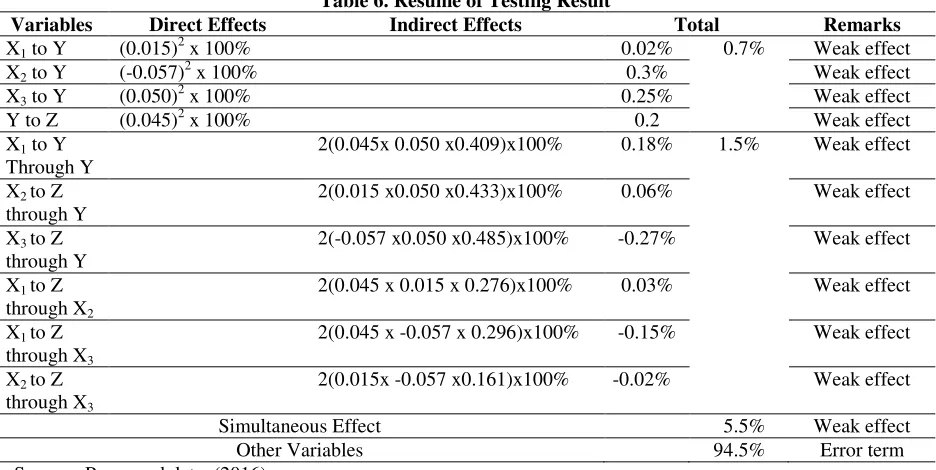

Table 6. Resume of Testing Result

Variables Direct Effects Indirect Effects Total Remarks

X1 to Y (0.015)

2(0.045x 0.050 x0.409)x100% 0.18% 1.5% Weak effect

X2 to Z

through Y

2(0.015 x0.050 x0.433)x100% 0.06% Weak effect

X3 to Z

through Y

2(-0.057 x0.050 x0.485)x100% -0.27% Weak effect

X1 to Z

2(0.015x -0.057 x0.161)x100% -0.02% Weak effect

Simultaneous Effect 5.5% Weak effect

Other Variables 94.5% Error term

Source : Processed data (2016).

Based on the table, it shows that :

a. The use of information technology (X1) has weak effect on habits (Z), it is obtained direct

b. The service quality of accounting information system (X2) has weak effect on habits (Z), it

is obtained direct value of -0.057 or 0.3% and indirect weak effect through Y of 0.06%. This condition is fully mediated where independent variables affect the dependent variables only through mediation. Indirectly, the service quality of accounting information system has greater effects compared to the direct effects.

c. Knowledge (X3) has weak effect on habits (Z), it is obtained direct value of 0.050 or

0.25% and indirect weak effect of -0.27%. This condition is fully mediated where independent variables affect the dependent variables only through mediation. Indirectly, knowledge has greater effects compared to the direct effects.

Based on the aforementioned explanation, the result of path analysis obtained from data processing is shown in the path diagram in Figure 2.

ρ=0.015 (sig.0.911) 𝜀𝜀10.268 𝜀𝜀2 0.366

ρ= 0.446 (sig.0.000)

ρ= -0.196 (sig.0.000) ρ= 0.177 (sig.0.004)

ρ = 0.082 (sig.0.079)

ρ= 0.045 (sig.0.769)

ρ= 0.050 (sig.0.712)

Fig.2 Flow Diagram Result

5. DISCUSSION

Based on the calculation results in Table 6, it can be concluded that there are indirect effects between the use of information technology on habits with the effectiveness of accounting information system as intervening variable of 0.18% and positive effect. Indirectly, the use of information technology has positive effect on habit by taking into account the effectiveness of accounting information system as mediating variable that also has effect of 0.18% which is greater than the effect obtained directly i.e 0.02%. The effect given through variable of effectiveness of accounting information systems is weak effect.Based on the calculation results in Table 6, it can be concluded that there are indirect effects between the service quality of accounting information system on habits with the effectiveness of accounting information system as intervening variable of 0.06% and positive effect. Indirectly, the service quality of accounting information system has positive affects on habit by taking into account the effectiveness of accounting information systems as intervening variable. Effects obtained indirectly greater is greater than effects obtained directly, i.e 0.3%. The effect given through variable of effectiveness of accounting information systems is weak effect. Based on the calculation results, the indirect effects between the knowledge on habits with the effectiveness of accounting information system as intervening variable is -0.27% and negative effect. Indirectly, knowledge has negative affects on habit by taking into account the effectiveness of accounting information systems as intervening variable.

6. CONCLUSION

6.1 Conclusion

The results showed that the use of information technology, the service quality of accounting information systems and knowledge has effect on the effectiveness of accounting

(X1)

(X2)

(X3)

information systems in Districts/Cities in North Sumatra. Habit variable served as mediating variable for the relationship between the independent variable on the dependent variables.

6.2.Limitation

The limitations in this research are the limited previous researches, especially for habit variable are used mediating variable. It is because this research is a recent research performed to see to what extend habit variable can be used as mediating variable.

6.3.Suggestion

1. According to the results of this research, it is expected that government, especially Government of North Sumatra Indonesia Countries pay attention to their performance quality in terms of financial management.

2. This research was only performed on the local work unit in North Sumatra, therefore, further research can be conducted in other sectors because it allows the difference in results and conclusions if it is performed to the different subjects.

3. It is expected that future research add some other factors that can affect habits.

4. This research only used internal indicators of effectiveness factors. It is suggested that the future researches uses external indicators in order to obtain good conclusions.

7. ACKNOWLEDGEMENTS

This study is dedicated to the University of North Sumatra that has been providing assistance funding for this research.

REFERENCES

Averse, Idagu Joseph.(2008). An Evaluation of the Relevance of Accounting Decision Management Systems as a Tool in Union Bank of Nigeria Plc, Uyo Branch of AkwaIbom. Greener Journal of Business and Management Business Study, 3 (1), pp: 38-45.

DeLone, W. H., and Mclean, E. R. (1992). Information System Success: The Quest for the Dependent Variable. Information Systems Research, 3 (1): 60-95.

DeLone, W. H., and Mclean, E. R. (2003). The DeLone McLean Model Of Information System Success: A Ten-Year Update. Journal of Management Information, 19 (4): 9-30.

Ekayani, Ni NengahSri.,Ghozali, Imam, and Zulaekha. (2005). Analysis of Contributions Value of Information Technology and Business Process Effectiveness Against Competitive Dynamics. National Symposium set Material Accounting VIII. h: 820-835.

Ghozali, Imam. (2002). Applications Multivariate Analysis With SPSS Program. Semarang: Diponegoro University Publishing Board.

Goodhue, D.L. (1995). Understanding User Evaluation of Information Systems Journal.Management Science.2(2), 1827 -1844.

Ismail, N.A. and King.M. (2007). Factors Influencing the Alignment of Accounting Information Systems in Small and Medium Sized Malaysian Manufacturing Firms. Journal of Information Systems and Small Business, 1 (1-2), pp: 1-19.

Jumaili, Salman. (2005). Faith Against the Current Information Systems Technology In Individual Performance Evaluation. National Symposium set Material Accounting VIII, Solo, 15 to 16 September, 2005.

Komala, AdehRatna. (2012). The Influence Of The Accounting Manager Knowledge And The Top Management Support To The Accounting Information System And It's Impact On The Quality Of Accounting Information: Survey In Management Institution of Zakat In Bandung. 3rd International Conference On Business And Economic Research (3rd Icber 2012) Proceedings.

Mahendra, (2008). The success of Academic Libraries Electronic catalog: Fear Effect Computer, User and Service Quality Librarian With Quality and Quality Information For Variable.

Maksum, A., Hamid, R., &Muda, I. (2014). The Impact of Treasurer’s Experience And Knowledge on The Effectiveness of The Administration and Preparation of The Accountability Reporting System in North Sumatera. Asian Journal of Finance & Accounting, 6(2), 301-31

Muda, I., &Rasdianto, M. S. L. (2014). Implementation of the Cash Revenue System: A Case Study in the Local Government Task Forces’ Units of North Sumatera Province, Indonesia. Information Management & Business Review, 6(2).pp. 96-108.

Muda, Iskandar and AbykusnoDharsuky (2015). Impact Of Region Financial Information System (SIKD) Quality, Role Ambiguity And Training on Precision of Financial Statement of Local Government Presentation In North Sumatra. International Journal of Applied Business And Economic Research, 13(6). pp. 4283-4304.

Nopalia, W. Eka Putra, and DewiFitriani.(2012). Influence of Accounting Information Management and Entrepreneurial Personality Of Managerial Performance: Survey On Motorcycle Dealers in Jambi. Journal of Accounting Faculty of Economics, University of Edinburgh, 1 (1), pp: 42-49.

OnaolapoA.A., and Odetayo FY (2012). Effect of Accounting Information System on Organisational effectiveness.American Journal of Business and Management, 1 (4), pp: 183-189.

Ramly, F. (2011). Computerize Accounting InformationSystem. Decision making. 16(1), pp: 12-31.

Rasdianto, Nurzaimah and IskandarMuda.(2014). Analysis on the Timeliness of the Accountability Report by the Treasurer Spending in Task Force Units in Indonesia.International Journal of Academic Research in Accounting, Finance and Management Sciences. 4(4), pp. 176

Raymond, L. and Pare, G. (1992).Measurement of Information Tecnology Sophistication in Small Manufacturing Business.Information Resourses Management of the Journal, 5 (2), pp. 4-16.

Septriani, Evy.(2010). Effect on System Performance User Satisfaction InPT.BankMuamalat Indonesia (PT). Scientific journals.Gunadarma University, Jakarta.

Simatupang, Patar and Akib, Haedar. (2007). Portrait Public Organizational Effectiveness: Review of Research Results. Entrepreneurs Management Indonesia.No. 01.Th.XXXVI.

Susanto, Azhar. 2013. Accounting Information Systems. Bandung: Lingga Jaya.

Susilastri.,Tanjung, AmrisRusli., Pebrina, Surya. (2010). Factors Affecting Accounting Information System Performance At Government Commercial Bank in the city of Pekanbaru.Journal of Economics, 18 (2), pp: 121-132.