October 2010

Consumers’ confidence towards economic condition in October

2010 regained as CCI scaled up by 4.4 points to 112.0. Enhancing

consumer confidence was boosted by higher consumers’

expectation index particularly on economic condition and job

availability over the next 6 months.

On the other hand, consumers considered that inflation pressure

in the next 3 months will decelerate. Price pressures were

predicted to move higher in the next 6 months especially on

foodstuff, clothing, beverages, cigarette and tobacco.

Consumer Confidence Index

Consumer confidence over economic condition continued to

stay at the highly favorable level in October 2010

as

the Consumer

Confidence Index (CCI) escalated 4.4 points to the level of 112.0. The

ascending CCI was attributed by consumer’s wide perception on current

economic condition and the expectation for the next 6 months as the index

grew by 3.6 and 5.3 points respectively.

Graph 1. Consumer Confidence Index

60.0

70.0

80.0

90.0

100.0

110.0

120.0

130.0

140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10

2008 2009 2010

(Index)

Current Economic Condition Index

Consumer Expectation Index

Consumer Confidence Index

Optimistic

Pessimistic

Fuels Hike

Global Economic

Crisis

CONSUMER SURVEY

Consumer Confidence Index

moved higher

Methodology

Consumer Survey-Bank Indonesia (CS-BI) is a monthly survey that has been conducted since October 1999. Since January

2007, the survey is done to more or less 4,600 households as respondents

(stratified

random sampling)

in 18 cities: Jakarta, Bandung,

This month’s survey showed that consumers’ optimism over both

current and next 6 months job availability was rose significantly. Moreover,

strengthening expectations on income and saving in the next 6 months has

lifted consumers’ optimism over economic condition in 6 months ahead.

In annual basis, consumer showed a wider confidence over

economic condition.

The CCI in this reporting month mounted by 2.0 points

against the same period in previous year. The upward index was due to

vigorous consumers’ optimism on spending durable goods and wider job

availability.

Current Economic Condition Index

Respondents were more optimistic over current economic

condition.

Higher respondents’ optimism was revealed on Current Economic

Condition Index (CECI) which climbs 3.6 points to the level of 100.7 over

previous month.

Graph 2. Current Economic Condition Index (CECI

0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10

2008 2009 2010

Index

Current Economic Conditions Index Current Incomes Buying Durable Goods Conditions Job Availability

This period survey also confirmed that all current economic indicators

posted escalation. Improved on saving and reduced prices pressure after Eid ul

Fitr celebration stimulate consumers intention to consume durable goods.

Consumers also acknowledged that job availability was spread out as many

disclosure civil officer job vacancies in certain government institution.

Consumer’s perception on

Compared to the same period in the previous year, consumers stated

that economic condition expanded, as showed by higher consumers’ appetite

to buy durable goods as well as considerable job availability.

Consumer Expectation Index

Consumers had more confident toward the prospect for

economic condition over the next 6 months.

Stronger consumers’

optimism was emphasized on Consumer Expectation Index (CEI) which

advanced 5.3 points to 123.4 over previous month.

Enhancing CEI was encouraged by strengthening consumer’s optimism

on job availability in the next 6 months following the better expectation on 6

months ahead economic prospect. The higher optimism on the prospect of

economic condition was triggered by consumers who have post-graduated

and get more than Rp 5 million income per month.

Graph. 3 Consumer Expectation Index (CEI)

0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10

2008 2009 2010

Index

Consumer Expectation Index Incomes Expectation Economic Expectation Job Availability Expectation

Meanwhile, in annual, CEI laid at 123.4, slightly increase from 123.2 in

previous. Increasing optimism encountered on job availability and income

expectation index by 3.5 and 2.7 points respectively. On the other side,

economic condition expectation decelerated by 5.7 points.

Income Expectations

Consumers also more optimistic over their income in the next 6

months.

The optimism was seen on income expectation index which

increased 3.6 points to 140.0. The survey also noted that respondents with

Respondent’s more optimistic

over condition in the next 6

months

expenditure above Rp 5 million per month showed the stronger optimism

towards income in the next 6 months.

Price Expectations

Respondents believed that inflationary pressures will soften in the

3 months ahead.

The survey revealed that price expectation index in the next

3 months edged down by 4.6 points. Respondents believed that diminishing

pressure on prices in the next 3 months will occurred on all good/service groups,

primarily on clothing & transport, and communication & financial services each

by 5.6 and 5.4 points.

Meanwhile, pressure on prices in the next 6 months

predicted to

increase

with the highest increase primarily on food and clothing, beverages,

cigarette and tobacco groups.

Graph 4. Price Expectation Index for the next 3 and 6 months

‐

1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

130.0

140.0

150.0

160.0

170.0

180.0

190.0

200.0

1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1 2 3 4

2008

2009

2010

2011

Price

Expectation

Index

3

months

ahead

Price

Expectation

Index

6

months

ahead

Cummulative

Inflations

in

3

months

Index

Notes

: Index = 100 indicates that consumer expect prices will still be stable, index > 100 indicates

consumer expect prices will increase, and index < 100 indicates consumer expect prices will decrease

Expectations of Savings and Interest Rates

In line with the rising on saving interest rate in the next 6

months, consumers show a higher optimistic on saving amount in the

next 6 months.

The survey revealed that saving interest rate expectation in

the next 6 months will go up by 5.7 point to the level of 125.0. However, in

line with higher consumers’ income, respondents optimistic that their saving

will arise as shown by the mounting index by 6.0 points over previous month.

Pressure on prices in the

next 3 months slowing

down, while prices

predicted to move higher

in the next 6 months

Graph. 5

Expectation Indexes on Interest Rates and Total Savings in the next 6 months

0

5

10

15

20

25

90

100

110

120

130

140

1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1 2 3 4 5 6 7 8 9 101112 1 2 3 4

2008

2009

2010

2011

Savings

Growth

in

6

months

Interest

Rates

Expectation

Index

in

6

months

ahead

Savings

Expectation

Index

in

6

months

ahead

Index

(%)

Notes

: Index = 100 indicates that consumer expect saving deposit and interest rate will still be

stable, index > 100 indicates consumer expect saving deposit and interest rate will increase, and

index < 100 indicates consumer expect saving deposit and interest rate will decrease

Expectations on Economic Conditions

Respondents had greater confidence toward the economic

condition over the next 6 months.

The optimism was revealed on rising

index measuring sentiment on future economic condition in October 2010 that

edged up by 5.5 points to the level of 121.6. Higher optimism was mainly

shown by respondent who has post-graduated educational background.

Optimism on future

Table 1. Consumer Confidence, Price Expectations, Consumption Plans, and Economic Indicators (Index)

Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

A Consumer Confidence Index (CCI) 110.8 110.0 111.0 108.7 110.5 105.3 107.4 110.7 109.9 111.4 105.7 104.0 107.6 112.0 Present Situation (CECI) 96.6 96.8 97.7 96.7 98.4 94.7 96.4 99.6 100.0 101.5 96.1 93.3 97.1 100.7

Expectations (CEI) 125.1 123.2 124.3 120.7 122.6 115.9 118.5 121.7 119.8 121.3 115.3 114.8 118.1 123.4

Appraisal of Present Situation

Current Incomes 124.0 124.9 124.1 123.1 125.5 118.6 121.7 126.1 124.4 126.2 120.6 117.7 121.6 122.7

Buying durable goods Conditions 81.3 82.2 84.9 81.1 85.2 87.3 85.3 87.5 89.6 91.4 86.9 80.5 85.8 91.0

Employment Conditions 84.5 83.2 84.1 85.8 84.5 78.0 82.1 85.3 85.9 86.8 80.9 81.7 83.8 88.3

(before Oct 2004: Unemployment Condition)

Expectations for 6 Months Hence of

Incomes 138.5 137.3 139.3 136.8 141.1 132.5 135.3 136.7 134.7 137.4 132.6 133.6 136.4 140.0

Economic Conditions 130.4 127.3 128.8 122.1 122.7 114.4 117.7 122.2 119.5 122.3 112.6 110.0 116.1 121.6

Employment Conditions 106.4 105.1 104.8 103.1 103.9 100.8 102.4 106.3 105.2 104.2 100.7 100.7 101.7 108.6

(before Oct 2004: Unemployment Expectation)

B Price Expectations for 3 Months Hence of

Prices 165.2 158.8 159.9 161.0 160.6 160.2 155.1 158.6 164.3 166.8 180.5 175.4 167.6 163.0

Foodstuff 167.0 160.8 160.6 163.0 163.5 163.4 156.0 159.6 164.2 167.8 181.1 177.2 168.7 164.9

Food, beverages, cigarettes and tobacco 161.0 154.9 155.8 157.2 156.4 155.0 149.9 153.5 156.5 160.2 170.5 170.2 161.7 157.7

Housing, electricity, gas and fuel 155.2 156.0 156.6 156.3 152.0 151.5 148.1 155.3 158.1 161.2 175.0 167.8 160.7 156.2

Clothing 150.2 138.6 139.3 138.0 135.5 136.4 131.2 133.7 142.1 148.9 155.9 156.3 145.9 140.3

Health 140.6 135.4 136.6 137.9 135.9 136.1 133.9 133.6 138.8 141.0 146.6 146.0 140.2 138.5

Transportations, communications and financial services 146.9 142.6 142.2 141.4 137.5 137.9 134.3 136.4 142.0 149.7 157.4 155.6 150.5 145.1

Education, recreation, and sports 141.3 137.3 139.0 140.0 138.0 137.2 138.2 141.4 145.9 149.4 154.9 151.0 143.0 139.5

C Price Expectations for 6 Months Hence of

Prices 156.9 156.2 157.9 158.8 161.2 164.3 161.1 159.3 162.5 163.2 170.1 161.5 156.9 159.1

Foodstuff 158.2 158.4 158.4 160.5 162.1 166.0 161.7 160.5 163.0 164.1 170.9 162.5 157.7 160.6

Food, beverages, cigarettes and tobacco 153.4 154.3 154.4 154.9 156.9 158.9 156.7 154.5 158.0 158.0 163.5 157.9 153.1 154.9

Housing, electricity, gas and fuel 150.8 154.3 155.7 155.4 153.2 153.1 148.6 154.1 157.3 157.3 165.8 156.0 153.1 154.8

Clothing 141.7 137.4 140.5 139.9 140.1 144.4 143.1 140.3 145.2 147.2 148.3 145.2 139.4 139.9

Health 140.2 136.7 138.1 138.9 140.0 140.8 136.7 137.2 139.1 141.2 146.4 139.2 138.9 139.3

Transportations, communications and financial services 143.4 143.9 142.6 143.9 142.8 145.5 143.6 144.9 147.3 148.3 152.9 147.9 143.7 145.4

Education, recreation, and sports 141.0 138.6 143.1 144.7 146.2 147.7 145.3 144.2 146.1 146.1 150.8 144.2 141.9 142.0

D Economic Indicator within 6 Months

Avaibility of Goods & Services 138.6 136.4 132.7 133.5 138.3 134.2 135.5 137.6 138.7 141.6 140.0 136.4 135.2 138.1

Interest Rate 115.2 113.3 115.4 116.3 117.9 114.9 117.0 116.2 117.1 117.7 117.9 119.8 119.3 125.0

Current savings 104.4 104.7 106.6 105.9 106.4 105.2 106.9 105.0 105.8 106.5 103.7 103.0 106.1 108.6

Savings for 6 months hence 125.0 125.9 128.2 126.7 129.8 125.6 126.2 127.0 125.0 127.2 124.3 123.0 126.0 132.0

2010

Descriptions 2009

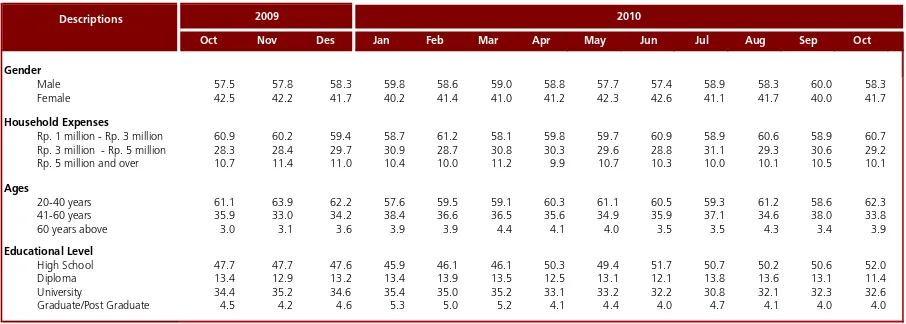

Table 2. Respondent Figures (percentages)

Oct Nov Des Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Gender

Male 57.5 57.8 58.3 59.8 58.6 59.0 58.8 57.7 57.4 58.9 58.3 60.0 58.3 Female 42.5 42.2 41.7 40.2 41.4 41.0 41.2 42.3 42.6 41.1 41.7 40.0 41.7

Household Expenses

Rp. 1 million - Rp. 3 million 60.9 60.2 59.4 58.7 61.2 58.1 59.8 59.7 60.9 58.9 60.6 58.9 60.7 Rp. 3 million - Rp. 5 million 28.3 28.4 29.7 30.9 28.7 30.8 30.3 29.6 28.8 31.1 29.3 30.6 29.2 Rp. 5 million and over 10.7 11.4 11.0 10.4 10.0 11.2 9.9 10.7 10.3 10.0 10.1 10.5 10.1 Ages

20-40 years 61.1 63.9 62.2 57.6 59.5 59.1 60.3 61.1 60.5 59.3 61.2 58.6 62.3 41-60 years 35.9 33.0 34.2 38.4 36.6 36.5 35.6 34.9 35.9 37.1 34.6 38.0 33.8 60 years above 3.0 3.1 3.6 3.9 3.9 4.4 4.1 4.0 3.5 3.5 4.3 3.4 3.9 Educational Level

High School 47.7 47.7 47.6 45.9 46.1 46.1 50.3 49.4 51.7 50.7 50.2 50.6 52.0 Diploma 13.4 12.9 13.2 13.4 13.9 13.5 12.5 13.1 12.1 13.8 13.6 13.1 11.4 University 34.4 35.2 34.6 35.4 35.0 35.2 33.1 33.2 32.2 30.8 32.1 32.3 32.6 Graduate/Post Graduate 4.5 4.2 4.6 5.3 5.0 5.2 4.1 4.4 4.0 4.7 4.1 4.0 4.0

2009 2010

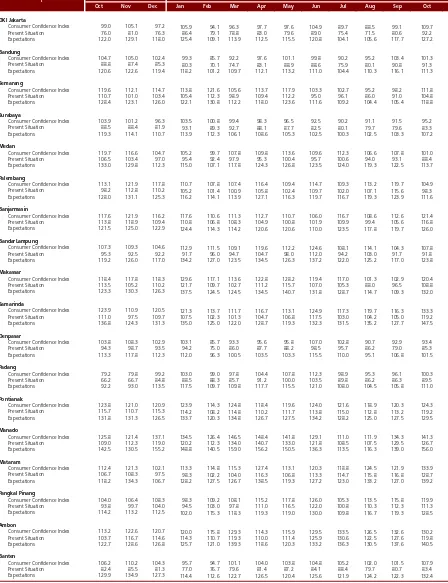

Table 3. Consumer Confidence by Region (Index)

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

DKI Jakarta

Consumer Confidence Index 99.0 105.1 97.2 105.9 94.1 96.3 97.7 97.6 104.9 89.7 88.5 99.1 109.7

Present Situation 76.0 81.0 76.3 86.4 79.1 78.8 83.0 79.6 89.0 75.4 71.5 80.6 92.2

Expectations 122.0 129.1 118.0 125.4 109.1 113.9 112.5 115.5 120.8 104.1 105.6 117.7 127.2

Bandung

Consumer Confidence Index 104.7 105.0 102.4 99.3 85.7 92.2 97.6 101.1 99.8 90.2 95.2 103.4 101.3

Present Situation 88.8 87.4 85.3 80.3 70.1 74.7 83.1 88.9 88.6 75.9 80.1 90.8 91.3

Expectations 120.6 122.6 119.4 118.2 101.2 109.7 112.1 113.2 111.0 104.4 110.3 116.1 111.3 Semarang

Consumer Confidence Index 119.6 112.1 114.7 113.8 121.6 105.6 113.7 117.9 103.3 102.7 95.2 98.2 111.8 Present Situation 110.7 101.0 103.4 105.4 112.3 98.9 109.4 112.2 95.0 96.1 86.0 91.0 104.8 Expectations 128.4 123.1 126.0 122.1 130.8 112.2 118.0 123.6 111.6 109.2 104.4 105.4 118.8

Surabaya

Consumer Confidence Index 103.9 101.2 96.3 103.5 100.8 99.4 98.3 96.5 92.5 90.2 91.1 91.5 95.2

Present Situation 88.5 88.4 81.9 93.1 89.3 92.7 88.1 87.7 82.5 80.1 79.7 79.6 83.3

Expectations 119.3 114.1 110.7 113.9 112.3 106.1 108.6 105.3 102.5 100.3 102.5 103.3 107.2

Medan

Consumer Confidence Index 119.7 116.6 104.7 105.2 99.7 107.8 109.8 113.6 109.6 112.3 106.6 107.8 101.0 Present Situation 106.5 103.4 97.0 95.4 92.4 97.9 95.3 100.4 95.7 100.6 94.0 93.1 88.4 Expectations 133.0 129.8 112.3 115.0 107.1 117.8 124.3 126.8 123.5 124.0 119.3 122.5 113.7 Palembang

Consumer Confidence Index 113.1 121.9 117.8 110.7 107.8 107.4 116.4 109.4 114.7 109.3 113.2 119.7 104.9 Present Situation 98.2 112.8 110.2 105.2 101.4 100.9 105.8 102.4 109.7 102.0 107.1 115.6 98.3 Expectations 128.0 131.1 125.3 116.2 114.1 113.9 127.1 116.3 119.7 116.7 119.3 123.9 111.6

Banjarmasin

Consumer Confidence Index 117.6 121.9 116.2 117.6 110.6 111.3 112.7 110.7 106.0 116.7 108.6 112.6 121.4 Present Situation 113.8 118.9 109.4 110.8 106.8 108.3 104.9 100.8 101.9 109.9 99.4 105.6 116.8 Expectations 121.5 125.0 122.9 124.4 114.3 114.2 120.6 120.6 110.0 123.5 117.8 119.7 126.0

BandarLampung

Consumer Confidence Index 107.3 109.3 104.6 112.9 111.5 109.1 119.6 112.2 124.6 108.1 114.1 104.3 107.8 Present Situation 95.3 92.5 92.2 91.7 96.0 94.7 104.7 98.0 112.0 94.2 103.0 91.7 91.8 Expectations 119.2 126.0 117.0 134.2 127.0 123.5 134.5 126.3 137.2 122.0 125.2 117.0 123.8 Makassar

Consumer Confidence Index 118.4 117.8 118.3 129.6 117.1 113.6 122.8 128.2 119.4 117.0 101.3 102.9 120.4 Present Situation 113.5 105.2 110.2 121.7 109.7 102.7 111.2 115.7 107.0 105.3 88.0 96.5 108.8 Expectations 123.3 130.3 126.3 137.5 124.5 124.5 134.5 140.7 131.8 128.7 114.7 109.3 132.0

Samarinda

Consumer Confidence Index 123.9 110.9 120.5 121.3 113.7 111.7 116.7 113.1 124.9 117.3 119.7 116.3 133.3 Present Situation 111.0 97.5 109.7 107.5 102.3 101.3 104.7 106.8 117.5 103.0 104.2 105.0 119.2 Expectations 136.8 124.3 131.3 135.0 125.0 122.0 128.7 119.3 132.3 131.5 135.2 127.7 147.5

Denpasar

Consumer Confidence Index 103.8 108.3 102.9 103.1 85.7 93.3 95.6 95.8 107.0 102.8 90.7 92.9 93.4

Present Situation 94.3 98.7 93.5 94.2 75.0 86.0 87.7 88.2 98.5 95.7 86.2 79.0 85.3

Expectations 113.3 117.8 112.3 112.0 96.3 100.5 103.5 103.3 115.5 110.0 95.1 106.8 101.5 Padang

Consumer Confidence Index 79.2 79.8 99.2 103.0 99.0 97.8 104.4 107.8 112.3 98.9 95.3 96.1 100.3 Present Situation 66.2 66.7 84.8 88.5 88.3 85.7 91.2 100.0 103.5 89.8 86.2 86.3 89.5 Expectations 92.2 93.0 113.5 117.5 109.7 109.8 117.7 115.5 121.0 108.0 104.5 105.8 111.0

Pontianak

Consumer Confidence Index 123.8 121.0 120.9 123.9 114.3 124.8 118.4 119.6 124.0 121.6 118.9 120.3 124.3 Present Situation 115.7 110.7 115.3 114.2 108.2 114.8 110.2 111.7 113.8 115.0 112.8 113.2 119.2 Expectations 131.8 131.3 126.5 133.7 120.3 134.8 126.7 127.5 134.2 128.2 125.0 127.5 129.5

Manado

Consumer Confidence Index 125.8 121.4 137.1 134.5 126.4 146.5 148.4 141.8 129.1 111.0 111.9 134.3 141.3 Present Situation 109.0 112.3 119.0 120.2 112.3 134.0 140.7 133.0 121.8 108.5 107.5 129.5 126.7 Expectations 142.5 130.5 155.2 148.8 140.5 159.0 156.2 150.5 136.3 113.5 116.3 139.0 156.0 Mataram

Consumer Confidence Index 112.4 121.3 102.1 113.3 114.8 115.3 127.4 113.1 120.3 118.8 124.5 121.9 133.9 Present Situation 106.7 108.3 97.5 98.3 102.2 104.0 116.3 106.8 113.3 114.7 115.8 116.8 128.7 Expectations 118.2 134.3 106.7 128.2 127.5 126.7 138.5 119.3 127.2 123.0 133.2 127.0 139.2

Pangkal Pinang

Consumer Confidence Index 104.0 106.4 108.3 98.3 109.2 108.1 115.2 117.8 126.0 105.3 113.5 115.8 119.9 Present Situation 93.8 99.7 104.0 94.5 103.0 97.8 111.0 116.5 122.0 100.8 110.3 112.3 111.3 Expectations 114.2 113.2 112.5 102.0 115.3 118.3 119.3 119.0 130.0 109.8 116.7 119.3 128.5

Ambon

Consumer Confidence Index 113.2 122.6 120.7 120.0 115.8 129.3 114.3 115.9 129.5 133.5 126.5 132.6 130.2 Present Situation 103.7 116.7 114.6 114.3 110.7 119.3 110.0 111.4 125.9 130.6 122.5 127.6 119.8 Expectations 122.7 128.6 126.8 125.7 121.0 139.3 118.6 120.3 133.2 136.3 130.5 137.6 140.5

Banten

Consumer Confidence Index 106.2 110.2 104.3 95.7 94.7 101.1 104.0 103.8 104.8 105.2 102.0 101.5 107.9

Present Situation 82.4 85.5 81.3 77.0 76.7 79.6 81.4 87.2 84.1 88.4 79.7 80.7 83.4

Expectations 129.9 134.9 127.3 114.4 112.6 122.7 126.5 120.4 125.6 121.9 124.2 122.3 132.4 2010