MANAGERIAL OVERCONFIDENT AND

FIRMFINANCING DECISION: AN INDONESIAN CASE Werner R. Murhadi

Abstract

Purpose – This research aims to determine the effect of managerial overconfidence and firm characteristics on financing decision of a firm.

Design/methodology/approach – This research uses panel data to follow the panel model testing by using Common Effect (CE), Fixed Effect Model (FEM), and Random Effect Model (REM), to test the effect of managerial overconfidence and firm characteristic onfinancing decision of firms listed in Bursa Efek Indonesia in the period of 2006 – 2015.

Findings – Researcher founds: First, the higher the confidence of an executive, judged by the profile photo, the smaller the debt used by the firm; Second, the higher the past performance of a ratio, measured from the cash flow on operational activity to total asset, the debt used by the firm tends to decrease. Third, a higher education level of the executive tends to increase the usage of debt by the firm; Fourth, the past working experience ofa CEO will make him able to face many situationsby using the available information and likely to be unbiased. These abilities will formhis confidence, resulting in less usage of debt by the firm. Finally, gender does not have a significant effect on the size of debt in a firm.

Practical Implications – the finding indicates that behavioral factor, such as managerial overconfidence, can explain the reason of the usage of debt in a firm.

Originality/Value – the research that uses behavioral finance aspect to explain the financing decision in a firm is still relatively rare conducted in Indonesia.

Keywords: Financing decision, behavioral finance, managerial overconfidence, firm characteristics.

Paper Type – Research Paper

1. Introduction

and the firm’s internal, such as tax, bankruptcy cost, and asymmetric information level in the firm. This research is done through a different perspective, which is through behavioral finance, specifically intertwined with management characteristics. Behavioral finance combines neoclassical economic theory with psychology insight and neuroscience to describe the explanation behind the deviation of the previous basic assumption, that is rational/efficient (Scheinert, 2014),done by individuals, firms, and markets. Individuals are no longer seen to always think rationally, but they are also affected by emotional factors and cognitive bias in taking decisions.

that is related to overconfidence (Wei et al., 2011). Li et al (2009) in Kiong Ting et al. (2016) explains that overconfidence is a miscalibration ofconfidence. Overconfidence people tend to overestimate their self-confidences, or underestimate variety of risks. Nofsinger (2003) stated that overconfidence will encourage managers to invest using more debts than doing many acquisitions.

There are different views on the effect of managerial overconfidence towards firm’s debt financing decision.Rechner and Dalton (1991) explained that overconfident managers tend to use more debts. Hambrick and Cannella (2004) made few decisions related to the implication of decision making by overconfident managers: (1) managers tend to invest more; (2) The investment is done by using debt; (3) Firm has bigger default risk. While Almeida et al. (2005) interviewed CFO and found that overconfident CFO tends to use more debts, particularly long term debt.

Malmendier and Tate (2005) showed different result, whereas overconfident managers choose to use internal funding first, then debt, and stock. This happens because managers overestimate their abilities to increase the firm’s value, therefore they also tend to overestimate the future cash inflow of a project. Abor (2007) supported the result from Malmendier and Tate (2005), that optimistic managers show a strong relevancy between debt utilization and deficit financing, compared to non-optimistic managers.

This researchfocuseson discussing the effect of management behaviors, particularly managerial overconfidence that will affect firm’s financing decision making. A confident management will believe in their abilities to generate cash and value to the firm, therefore, it tends to be bolder in taking risk by utilizing more debts. Control variables such as firm profitability, firm size, asset tangibility, and firm growth, will be taken into this research as these variables have been used in many studies as an influential factors to a firm’s financing decision. Based on the identification, a major research questionhas been developed: is managerial overconfidence affecting firm’s debt positive significance. From the major research question, minor research question using proxy from Managerial Overconfidence proxies, such as CEO profile photo in annual report, CEO level of education, CEO level of experience, CEO gender, and CEO past working performance have been developed. Furthermore, these are the detail of minor research questions:

1. Does Managerial Overconfidence that uses CEO profile photo as proxy have a positive effect on a firm debt financing policy? 2. Does Managerial Overconfidence that uses CEO level of

education have a positive effect on a firm debt financing policy? 3. Does Managerial Overconfidence that uses CEO level of

experience have a positive effect on a firm debt financing policy?

4. Does Managerial Overconfidence, that uses CEO gender, particularly man, have a positive effect on a firm debt financing policy?

2. Theories Discussion and Literature Review

Behavioral finance is a study that combining Financial Management and Psychology. Shefrin (2002) in Prasetyo (2009) explained that behavioral finance is an interaction from psychology with financial act and performance from all types of investor/decision maker categories. Shefrin suggested that investor/decision maker must be cautious in making mistake during the investment, for example, making judgment. Shefrin (2000) in Prasetyo (2009) stated that the mistake made by investor/decision maker might be advantageous to another investor/decision maker. Behavioral finance enriches the comprehension on economy by integrating human natural aspect into financial model.

Wendy (2012) stated that rationality assumption has begun taking critics despite the fact that it has been the main streamin explaining individual decision making. More economists interpret literature; conclude that market phenomenon is consistent with irrationality, which is the characteristic of individuals who take complicated decision. Several empirical studies also prove that not only the factor of ratio is taken into account while taking decision, but also the factor of emotion and behavior (KahnemanadTversky, 1979; Kahneman, 1992; Shefrin, 1985; Statman, 1999; Hirshleifer, 2001; and Ritter, 2003 in Wendy, 2012). The results of the studies show that besides of responding rationally/cognitively, individual is also able to respond emotionally while taking financial decision. This situation emerges 2 perspectives in financial theory, particularly in analyzing capital market phenomenon, such as rational and irrational perspectives.

used OLS regression, FEM, and Tobit method. The dependent variable usedto measure debt is debt ratio (total asset divided by total asset) and as replacement to debt ratio, debt-to-equity ratio is used to test the robustness. As for the proxy of managerial overconfidence measurement, it is done using personal characteristics of the management, such as CEO’s profile photo in annual report, CEO’s education level, CEO’s level of experience, CEO’s gender, CEO’s business network, and CEO’s past working experience. The moderation variable in the paper is the government ownership percentage, while the control variable is the concentrated 5 biggest shareholders ownership, profitability, firm size, asset tangibility, investment in research and development, and firm growth. In the early model, a test without moderation is done by dividing into 2 subsets, they are government linked companies (GLC) and non-government linked companies (NGLC), while the second model was involving moderation. In the GLC sample, the result generated was a CEO managerial overconfidence is contributing a significant role in the financing decision-making. Besides that, the result also states that the higher the managerial overconfidence of a CEO, the lower is the debt utilized in the firm. As for the NGLC sample, it showsa contrary results to the GLC sample; a managerial overconfidence is proved not to significantly affect to the debt utilized by the firm. Therefore, the conclusion is managerial overconfidence encourages lower debt utilization, and this relation depends on the government ownership.

that prefers to raise debt financing to fund its investment. The purpose of this act is to allow management to have complete control to the firm and its financing decision, and is also supported by Ben-David et al. (2007) research; argued that overconfident managerialrecommends using debt to repurchase stock. For the dependent variable of financing decision, the research uses the percentage change in the number of shares outstanding measurement. Fedyk (2014) also used “strictly firm specific optimistic press percentage” as the control variable. The result of the research shows that Fedyk (2014) could not make a certain conclusion on the effect of an overconfident CEO to a firm financing decision.

The next research comes from Ben-David et al. (2007), studied the effect of managerial overconfidence to firm policy. The study is done using survey method with more than 6.500 CFO or Financial Vice President in USA for the sample. The control variables in the research are past market condition and financial performance. As for theconcernedfirm policies are investment policy, financing/capital structure policy, dividend policy, market timing activity, and executive compensation. The result shows that firm with overconfident CFO will have more investments and acquisitions, and the market reacts negatively to the acquisition activities. Ben David et al. (2007) also find a positive impact of managerial overconfidence and financing structure, in which a firm with overconfident CFO tends to have more debts, depends on long-term debt and low dividend payment. Finally, Ben-David et al. (2007) also found that compensation payment to executives in a firm with overconfident CFO is based on the performance.

fundamentals and rationality to explain financing decision, while behavioral traits show a significant contribution to understand many decision aspects in finance and accounting field. Therefore, behavioral bias must not, in general, be negatively viewed, but can be considered as a context that will affect decision-making process. Managerial optimism encourages taking a decision exposed to risk-taking, which might affect stakeholders negatively, but also might positively affect stakeholders on the other hand.

Fairchild (2007) studied the effect of managerial overconfidence on financing decision and firm value when investor is faced to hazard moral of a management team. The research is divided to 2 groups. The first group is for the manager who operates the firm in a low efficiency (managerial shrinking), in which he will use debt to motivate the business. Overconfident management is likely to overestimate its ability and underestimate the expense of financial distress. Therefore, in this condition, Fairchild (2007) predicted a positive effect of managerial overconfidence to debt. In the next group, manager has incentive to use free cash flow to invest in new projects that might decrease firm value (the free cash flow problem). In the second group, managerial confidence has a negative effect on debt. The results are that the first group (managerial shrinking) is able to prove managerial overconfidence positive affect on debt; meanwhile, the second group (the free cash flow problem) is proven to have a negative effect on debt. However, the effect of managerial overconfident to the firm value is still ambiguous.

3. Data and Methodology

structure. Research period is taken from 2006-2015. The sample characteristics are: (1) the firm is listed in Indonesia Stock Exchange (BEI) for the entire period, (2) does not have negative equity because a negative equity will result in an undefined debt to equity ratio.

As for the dependent variable, this research uses debt measured by long-term debt to total asset, and long-term debt to total equity for the robustness test.

variable is CEO past working performance. A CEO good working performance encourages CEO confidence. This research measures CEO past working performance based on operational performance in the past. Past working performance proxy is measuring operating cash flow to total asset ratio (Balafas, and Florackis, 2014).

Control variables in this research are firm profitability, firm size, asset tangibility, and firm growth. Firm profitability will employ return on asset (R0A) ratio. Firm size will be measured by natural logarithm of total sales. Asset tangibility will be generated from fixed asset to total asset ratio. Finally, firm growth will be measured through the current year sales growth compared to the previous year.

As for the model to be tested is:

Where: PP is the profile photo for firmiat time t, pend stands for the level of education for firmi at time t, Gend is gender for firmIattime t, peng is the experience for firmi at time t, prof is the profitability for firmiat time t, KML is past working performance for firmi at time t, Tan is for tangibility of firmi at time t, Uk is the firm size for firmi at time t, and Gr stands for growth of firmi at time t.

Next, for the robustness test, we undertake by using second model as shown below:

Random Effect Model (REM). Out of these 3 models, Chow and Haussman test will be used to choose one best method.

4. Empirical Results and Analysis

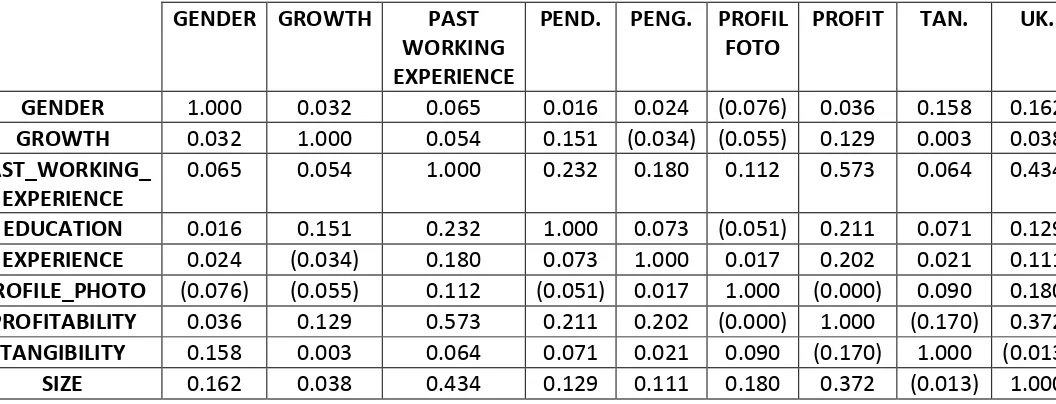

Sample used in this research that has met the criteria is 470 years of observation. On the first phase, we will do multicollinearity test between variables by undertaking Pearson correlation analysis as shown in table 1.

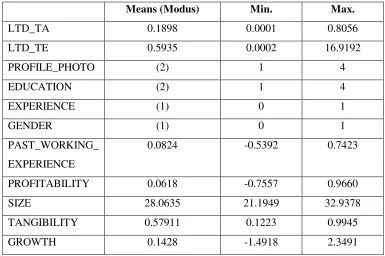

After seeing the correlation between independent variables, the result of the data processed must be analyzed through descriptive statistic as shown in table 2. From table 2, it is seen that the average debt to totalasset is less than 20%, and the firm debt to equity ratio is reaching the average of 60%.

Table 2

Descriptive Statistic

Means (Modus) Min. Max.

LTD_TA 0.1898 0.0001 0.8056

LTD_TE 0.5935 0.0002 16.9192

PROFILE_PHOTO (2) 1 4

EDUCATION (2) 1 4

EXPERIENCE (1) 0 1

GENDER (1) 0 1

PAST_WORKING_

EXPERIENCE

0.0824 -0.5392 0.7423

PROFITABILITY 0.0618 -0.7557 0.9660

SIZE 28.0635 21.1949 32.9378

TANGIBILITY 0.57911 0.1223 0.9945

GROWTH 0.1428 -1.4918 2.3491

performance. The average of past working performance, which is shown by the ability to generate cash flow from operational activity, is reaching the range of 8% to the total asset.

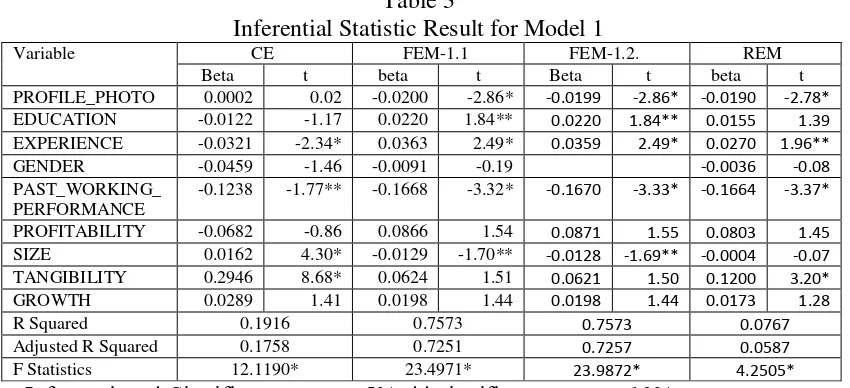

Furthermore, further discussion to the main model will be made. After applying Chow and Hausmann test to 3 models of data panel, such as CE, FEM, and REM, the Chow test generates significant result, where FEM gives more estimation than CE. After that, Haussman test is done to choose either REM or FEM is the best model. The chosen model to be interpreted is FEM.

Table 3

Inferential Statistic Result for Model 1

Variable CE FEM-1.1 FEM-1.2. REM

Adjusted R Squared 0.1758 0.7251 0.7257 0.0587 F Statistics 12.1190* 23.4971* 23.9872* 4.2505*

Information: * Significance on α = 5%; ** significance onα = 10%

From the F test, we can see that FEM model 1 is significant, which

means that altogether the independent variable is affecting the firm financing

decision. In table 3, especially model 1 that uses FEM as seen from 5

measurements of managerial overconfidence, 4 proxies are found to be

significant, such as profile photo, education, experience, and past working

performance. This result implies that managerial overconfidence variables in the

executive will determine a firm financing decision. Two of 5 managerial

overconfidence approaches, such as profile photo and past working performance

appear to be negative significance, while education and experience are positive

Table 3 shows that the result of profile photo is different from the

hypotheses, where apparently, the higher the confidence of an executive, the

lower the debt used. This result is consistence to the research done by Kiong-Ting

et al. (2016), which means that the more confident the executive, the less is the

debt used by the firm. Therefore, this result explains that overconfident executive

chooses to utilize internal funding for its new projects in expectation to give

additional value for the shareholders.

Meanwhile, education variable is found to be positive significance,

which means that the higher the level of education, the higher the confidence of

the executive will likely to raise the usage of debt. The confident executive will

have high assurance that the new project invested is a right choice, which is why

the executive is certain on its ability to pay-off the debt. Likewise to the working

experience, it also shows a positive significance result. It appears that by having a

working experience, a CEO will be able to encounter many situations by using

existing information and tends to be unbiased, and this will form its confidence.

CEO experience at its previous specific position (CEO, CFO, COO, CIO, and

other equivalent positions) either at the current firm or the previous firm, will be

useful in overcoming problems that might appear at new projects, so CEO tends

to use debt financing. From table 3, we can see that gender has no effect on the

firm financing decision. With the education and experience owned by CEO, and

by focusing on the past working experience, the firm will be the main factor in

shaping CEO confidence when it comes to choose whether to use debt or not. It is

also presented in table 3, the second FEM model by removing gender variable

that is not significant. By removing insignificant factor like gender, the result of

the test showsconsistency on both sides; direction and significance.

This research also does robustness test by using long term debt to total

equity as dependent variable. The result of this test can be seen on table 4. FEM

2.1 model is a model that uses all independent variables as used in FEM 1 on

table 3. The generated result from the test is education, experience, and past

working experience are proven to be affecting, while gender is consistently

been a shift, where profile photo that is previously significant, has now become

insignificant. The test is said to be robust because 3 out of 5 managerial

overconfidence measurements, have direction and significance that suit the main

model.

Table4

Inferential Statistic Result for Model 2

Variable FEM 2.1. FEM 2.2. FEM2.3

Adjusted R Squared 0.2951 0.2967 0.2944

F Statistics 4.5704* 4.6640* 4.6921*

Information: * Significant on α = 5%; ** significant onα = 10%

first model, it is proven to be insignificant, yet on the second model, it turns out to be negative significant.

5. Conclusion

The result generated from this research shows 4 proxies out of 5 managerial overconfidence measurements whichare proven to be significant, they are profile photos, education, experience, and past working performance. This result means that managerial overconfidence variable in an executive characteristic will determine firm financing decision. Out of 5 managerial confidence approaches, 2 variables, profile photo and past working performance, are showing negative significant results, while education and experience show positive significant results, and gender does not have significant impact. Managerial overconfidence in this research only based on the data presented in the firm annual report. In the future, a better questionnaire method or interview is expected to generate a better result to reflect managerial overconfidence.

References

Abor, J., 2007, Corporate governance and financing decisions of Ghanaian listed firms, The International Journal of Effective Board Performance, Vol. 7(1): 83-92

Adam, Tim R., Valentine Burg , Tobias Scheinert, Daniel Streitz, 2014, Managerial Optimism and Debt Contract Design, Dissertation, Humboldt University.

Balafas, N. dan Florackis, C., 2014, CEO compensation and future shareholder returns: evidence from the London stock exchange, Journal of Empirical Finance, Vol. 27: 97-115.

Barros, L.A.B.C., dan da Silveira, A.D.M., 2009, Overconfidence, managerial optimism, and the determinants of capital structure, Brazilian Review of Finance, Vol. 6(3): 293-335.

Ben-david, I., Graham, J. R., & Harvey, C. R., 2007. Managerial Overconfidence and Corporate Policies. NBER working paper, December, 1-57.

Indonesia Stock Exchange During Period 2007-2011, Proceedings, International Symposiun on Management X, Bali.

Fairchild, Richard, 2007, Managerial Overconfidence, Agency Problem, Financing Decision, and Firm Performance, Working Paper Series, University of Bath School of Management.

Fedyk, Valeria, 2014, CEO Overconfidence: An Alternative Explanation for Corporate Financing Decisions, Working Papers, Stanford University.

Hambrick, D.C., dan Cannella, A., 2004, CEOs who have COOs: contigency analysis of an unexplored structural form, Strategic Management Journal, Vol. 25(10): 959-979

Huang, J. dan Kisgen, D.J., 2013, Gender and corporate finance: are male executives overconfident relative to female executives?, Journal of Financial Economics, Vol. 108 No. 3, pp. 822-839.

Kiong Ting, IW, Hooi Hooi Lean, Qian Long Kweh, dan Noor Azlinna Azizan, 2016, Managerial overconfidence, government intervention and corporate financing decision, International Journal of Managerial Finance, Vol. 12 (1): 4 - 24

Li, Z.L., Zhao, H.P., dan Song, Y.F., 2009, Empirical research on managerial overconfidence and corporate financing behavior of pecking-order,

Proceedings IEEE 16th International Conference on Industrial Industrial Engineering and Engineering Management, p. 1496-1500.

Lichtenstein, S. dan Fischhoff, B., 1977, Do those who know more also know more about how much they know?, Organizational Behavior and Human Performance, Vol. 20(2):159-183.

Malmendier, U., dan Tate, G., 2005, CEO overconfidence and corporate investment, The Journal of Finance, Vol. 60(6): 2661-2700.

Malmendier, Ulrike, Geoffrey Tate, dan Jon Yan, 2011, Overconfidence and early‐life experiences: the effect of managerial traits on corporate financial policies, The Journal of Finance, Vol. 66(5): 1687-1733.

Nofsinger, J., 2003, Social mood and financial economics, The Journal of Behavioral Finance, Vol.6(3):144-160.

Prasetyo, E., 2009, Price Limit, Fakultas Ekonomi Universitas Indonesia.

Rakhmayil, S. dan Yuce, A., 2013, Executive qualification and firm value,

Journal of Applied Business and Economics, Vol. 14(5): 52-70.

Rechner, P.L. dan Dalton, D.R., 1991, CEO duality and organizational performance: a longitudinal analysis, Strategic Management Journal, Vol. 12(2): 155-160

Scheinert, T., 2014, Managerial Optimism and Corporate Financial Policies,

Dissertation, Humboldt University.

Schrand, C.M. dan Zechman, S.L., 2012, Executive overconfidence and the slippery slope to financial misreporting, Journal of Accounting and Economics, Vol. 53 (1): 311-329.

Wei, J., Min, X. dan Jiaxing, Y., 2011, Managerial overconfidence and debt maturity structure of firms: analysis based on China’s listed companies,