Refer to Important disclosures on the last of this report

Stock DataTarget price (Rp) Rp1,600

Prior TP (Rp) Rp2,700

Shareprice (Rp) Rp1,380

Upside/downside (%) +15.9

Sharesoutstanding (m) 3,561

Marketcap. (US$ m) 329

Government of Indonesia 51.0%

Public 49.0%

Estimate Change; Vs. Consensus 2018 2019

PT Indo Premier Sekuritas joey.faustian@ipc.co.id +62 21 5793 1168

Strong 2H18 result, slightly above

Strong 1H18 result of Rp213bn (+62% yoy), above historical average

Major new contract of Rp9tn from toll road concession

Expect higher DER from investment in several unsolicited toll roads

Maintain Buy with lower TP of Rp1,600 (target P/E of 7.8x)

Strong result with margin expansion all across the board. ADHI reported

relatively strong earnings of Rp213bn in 1H18 (+62% yoy), which came above

expectation forming 29% of our FY18F earnings forecast (Consensus: 26%). The

strong earnings was above ADHI’s 5-year 1H’s achievement average of 25%,

which mainly supported by margin expansion all across the board due to better

margin from LRT Jabodebek and TOD projects. ADHI booked gross margin of

15.8% in 1H18, which was company best performance ever. In quarterly basis,

ADHI booked a strong earnings of Rp139bn in 2Q18 (+90% qoq, +24% yoy),

supported by high net margin of 4.7% in 2Q18 (2Q17:3.8%; 1Q18 2.3%).

Concession holder for Solo-Yogyakarta-Kulonprogo toll road

.

ADHI formed

a consortium with Gama Group and PT Daya Mulia Turangga as the initiator for

the development of Solo-Yogyakarta-Kulonprogo toll road with total investment of

Rp22.5tn. ADHI will take 40% ownership on the consortium, which will contribute

at least Rp9tn construction work which accounts to 39% of ADHI’s FY18 new

contract guidance of Rp23tn (Ours: Rp21tn). We believe making a direct

investment in a toll road project will hurt operating cash flow position and

exposing company to higher debt & financing cost. Assuming 30:70

debt-to-equity financing scheme, ADHI will need total fund of Rp6.3tn of debt-to-equity. However

we are still positive towards the investment in the long run as

Solo-Yogyakarta-Kulonprogo toll road is perceived as a high density track, which will provide

attractive IRR as well as provide construction work for ADHI for the next 3 years.

Aggressive investment in unsolicited toll projects leads to higher DER.

ADHI is currently working on taking minority stakes in two unsolicited toll-road

projects, namely Cikunir-Ulujami (JORR III) and Bandung Outer Ring Road with

investment of Rp22.5tn and Rp6.3tn, respectively. Despite high investments

amount, we believe these project would be a huge contribution for ADHI’s new

contract post LRT Jabodebek completion in 3Q19. We forecast ADHI to increase it

DER ratio to 1.7-7.8x in FY18/19F (FY17: 1.4x) in order to fund this major

investment in these toll road projects.

Maintain Buy on ADHI with lower TP of Rp1,600 (from Rp2,700).

We

continue to like ADHI given its better margin and robust earnings growth of 25%

CAGR FY17-FY20FAs. However we forecast higher DER in FY18F going forward,

which led our DCF-based TP to decreased to Rp1,600, representing target PE of

7.8x. Key risk to our call might come from higher than expected debt issuance.

Adhi Karya

(

ADHI IJ

)

Source: ADHI, IndoPremier Share Price Closing as of : 26-Sept-2018

ADHI IJ Results Note

2

Refer to Important disclosures in the last page of this report

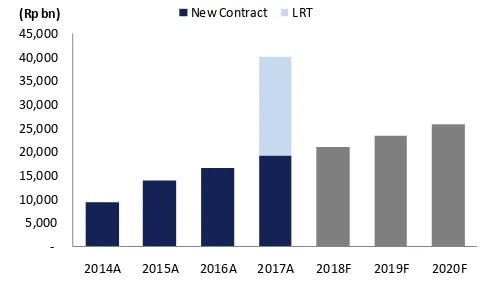

Fig. 1: 8M18 contract achievement Fig. 2: New contract trend FY12-FY20F

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Revenue by segment Fig. 4: LRT Jabodebek reached 43.87% progress

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Expect higher DER FY18F onwards Fig. 6: Margin trend FY14-FY20F

Source: Company, IndoPremier Source: Company, IndoPremier

48% 48%

(Rp bn) New contract % of FY target (Non LRT)

-2014A 2015A 2016A 2017A 2018F 2019F 2020F

(Rp bn) New Contract LRT

Construction

Cawang-Cibubur Cawang-Dukuh Atas Cawang-East Bekasi

LRT Progress as of 9M18

1.3

2014A 2015A 2016A 2017F 2018F 2019F 2020F

3

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 11,064 15,156 18,434 20,344 23,313

Cost of Sales (9,949) (13,098) (16,034) (17,677) (20,347)

Gross Profit 1,115 2,058 2,400 2,667 2,966

SG&A Expenses (456) (581) (772) (799) (927)

Operating Profit 659 1,477 1,628 1,868 2,039

Net Interest (95) (341) (453) (448) (492)

Forex Gain (Loss) 64 7 0 0 0

Others-Net (15) (185) 93 91 156

Pre-Tax Income 613 957 1,268 1,510 1,703

Income Tax (298) (440) (538) (602) (692)

Minorities (2) (2) (2) (3) (3)

Net Income 313 515 727 905 1,008

Balance Sheet

Cash & Equivalent 3,365 4,131 4,815 4,272 4,316

Receivable 3,970 3,739 4,170 4,610 5,228

Inventory 131 3,683 3,677 3,887 4,247

Other Current Assets 9,368 13,264 15,040 16,984 19,101

Total Current Assets 16,835 24,818 27,702 29,752 32,893

Fixed Assets - Net 1,814 1,876 3,677 4,850 5,434

Goodwill 0 0 0 0 0

Non Current Assets 1,446 1,639 1,696 1,847 2,025

Total Assets 20,095 28,333 33,076 36,450 40,352

ST Loans 2,344 3,537 5,069 5,595 6,411

Payable 8,373 11,611 0 13,976 16,136

Other Payables 1,828 2,235 2,531 2,758 3,239

Current Portion of LT Loans 500 250 250 500 0

Total Current Liab. 13,044 17,633 19,792 22,829 25,786

Long Term Loans 1,428 4,665 6,625 6,242 6,423

Other LT Liab. 180 164 215 247 273

Total Liabilities 14,653 22,463 26,632 29,318 32,482

Equity 3,415 3,413 3,413 3,413 3,413

Retained Earnings 1,997 2,446 3,004 3,691 4,428

Minority Interest 10 11 12 13 14

Total SHE + Minority Int. 5,422 5,869 6,428 7,116 7,854

Total Liabilities & Equity 20,075 28,332 33,060 36,434 40,337

ADHI IJ Results Note

4

Refer to Important disclosures in the last page of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 315 517 730 908 1,011

Depr. & Amortization 66 131 208 332 421

Changes in Working Capital 2,074 191 (223) 1,378 1,259

Others (301) (3,124) (3,381) (872) (1,140)

Cash Flow From Operating 2,154 (2,285) (2,667) 1,745 1,550

Capital Expenditure (1,257) (386) (2,066) (1,656) (1,183)

Others 163 104 145 169 150

Cash Flow From Investing (1,094) (283) (1,922) (1,488) (1,034)

Loans 1,153 4,181 3,492 392 497

Equity 1 0 0 0 0

Dividends (94) (94) (155) (218) (272)

Others (195) (447) (559) (594) (626)

Cash Flow From Financing 866 3,640 2,778 (421) (400)

Changes in Cash 1,926 1,072 (1,810) (163) 117

Financial Ratios

Gross Margin (%) 10.1 13.6 13.0 13.1 12.7

Operating Margin (%) 6.0 9.7 8.8 9.2 8.7

Pre-Tax Margin (%) 5.5 6.3 6.9 7.4 7.3

Net Margin (%) 2.8 3.4 3.9 4.4 4.3

ROA (%) 1.7 2.1 2.4 2.6 2.6

ROE (%) 5.9 9.1 11.8 13.4 13.5

ROIC (%) 5.2 5.2 5.3 5.7 5.8

Acct. Receivables TO (days) 84.8 70.2 60.9 60.9 59.3

Acct. Receivables - Other TO (days) 35.4 22.6 17.4 17.8 17.7

Inventory TO (days) 67.8 6.9 4.4 4.7 5.0

Payable TO (days) 272.6 278.4 268.1 267.6 270.1

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 78.8 144.0 185.8 173.4 163.4

Interest Coverage Ratio (x) 0.4 0.3 0.4 0.3 0.3

Net Gearing (%) 16.7 73.6 110.9 113.3 108.4

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS