The 13th UBAYA International Annual Symposium on Management MARKET INTEGRATION IN ASEAN:

SUSTAINABLE GROWTH AND CROSS CULTURAL ISSUES

Editors:

Dudi Anandya, PhD. Edithia Ajeng P, SE.

Phan Thi Hong Xuan, Prof. PhD. Nguyen Ngoc Tho, PhD.

Do Hoang Phuong An, M.A.

Reviewers:

Candra S. Chayadi, Ph.D. (School of Business, Eastern Illinois University) Dudi Anandya, Dr (University of Surabaya)

Joniarto Parung, Ph.D, Prof. (Universitas Surabaya) Ning Gao, Ph.D. (Manchester Business School)

Wahyu Soedarmono, Ph.D. (Research Analyst, the World Bank, Jakarta) Yuanto Kusnadi, Ph.D. (City of Hong Kong University)

Tran Nam Tien, Dr. Prof. (USSH, VNU-HCM) Huynh Ngoc Thu, Dr. (USSH, VNU-HCM) Tran Anh Tien, Dr. (USSH, VNU-HCM)

Published by:

Department of Management, Faculty of Business & Economics, University of Surabaya

Jl. Raya Kalirungkut

Surabaya, Indonesia 60293

Phone: +62-31-2981139; Fax : +62-31-2981239

University of Social Sciences and Humanities, Vietnam National University Ho Chi Minh City, Vietnam

10-12 Dinh Tien Hoang, Ben Nghe Ward, District 1, HCMC Phone: (84 - 8) 38293828; Fax: (84 - 8) 38221903

ISBN (Indonesia): 978-602-73852-0-7 ISBN (Vietnam): 978-604-73-4020-0

CONTENTS

FOREWORD ... iii

CONTENTS ... v

FINANCE & ACCOUNTING

1. RISK TAKING AND PROFITABILITY: EVIDENCES FROM INDONESIA

Abdul Mongid, Muazaroh ... 3

2. CAPITAL ADEQUACY RISK AND SYSTEMIC RISK: AN EFFORT TO ANTICIPATE BANKING CRISIS WITH SYSTEMIC IMPACT

Alfiana ... 17

3. CD INDEX, A NEW METHODS FOR MEASURING BANKING CRISIS

Amir Ambyah Zakaria, Musdholifah ... 33

4. THE EFFECT OF GOOD CORPORATE GOVERNANCE TO STOCK RETURN IN INDONESIAN MOST TRUSTED COMPANY FOR 2006 – 2013 PERIOD

Andreas Kiky, Michael Chris Ardhitya ... 46

5. THE DETERMINANT OF INDONESIA’S ISLAMIC RURAL BANKING RISK TAKING

Anggraeni ... 56

6. FREEDOM OF CONTRACT: RISK MANAGEMENT PRACTICES IN MANAGING FRANCHISE BUSINESS

Aris Armuninggar ... (Abstract only)

7. BUSINESS STUDENT’S FINANCIAL LITERACY IN SURABAYA: ARE THEY GOOD ENOUGH?

Aulia Imiaf ... (Abstract only)

8. THE IMPACT OF TRADE LIBERALISATION ON THE ECONOMIC PERFORMANCE OF ASEAN COUNTRIES

Awan Setya Dewanta ... 70

9. FINANCIAL PERFORMANCE IMPACTS OF CORPORATE ENTREPRENEURSHIP

Bertha Silvia Sutejo ... 85

10. FRAMING EFFECT TO INVESTOR REACTION BASED ON GENDER PERSPECTIVE: AN EXPERIMENTAL STUDY

11. THE INFLUENCE OF ENVIRONMENTAL MANAGEMENT ACCOUNTING TOWARD THE COMPANY PERFORMANCE AND STAKEHOLDERS

Candra Sinuraya ... 111

12. GENDER COLLABORATION ROLE IN ANALYZING AND MANAGING RISKS AT BODY REPAIR “X” IN MALANG

Debby Andriani, Fidelis Arastyo Andono ... 120

13. A SIMPLE STRESS TEST ON INDONESIAN ISLAMIC BANKING INDUSTRY

Dece Kurniadi, Sutan Emir Hidayat ... 135

14. THE INFLUENCES OF INVESTMENT OPPORTUNITIES AND PROFITABILITY ITS POLICIES DIVIDEND AT LQ45 COMPANY

Dede Hertina ... 153

15. INVESMENT OPPORTUNITY SET BASED INDUSTRIAL GROWTH IN INDONESIAN MANUFACTURE

Eka Handriani ... 169

16. ILLIQUIDITY, MARKET CHARACTERISTIC AND STOCK RETURN (A STUDY AT INDONESIA STOCK EXCHANGE)

Erman Denny Arfinto, Putri Nur Rositawati ... 188

17. THE EFFECT OF CORPORATE GOVERNANCE MECHANISM ON FINANCIAL PERFORMANCE WITH AGENCY COST AS

INTERVENING VARIABLE

Finda Selli Anditya, Sutrisno ... 201

18. BANKING INTEGRATION AMONG EMERGING AND DEVELOPED MARKET COUNTRIES: EVIDENCE FROM SOUTH EAST ASIA

Ghalih R Viratama, Harjum Muharam ... 215

19. IMPACT OF INTERNAL AND EXTERNAL FACTORS ON STOCK RETURN IN INDONESIA STOCK EXCHANGE

Gusni ... 229

20. THE EXAMINING CAPITAL STRUCTURE DETERMINANTS:

EMPIRICAL ANALYSIS OF REGIONAL DEVELOPMENT BANKS IN INDONESIA

Hamdi Agustin, Detri Karya, Suyadi ... 252

21. ANALYSIS OF FACTORS AFFECTING THE PREDICTING BANKRUPTCY PRIVATE BANKS IN INDONESIA

Hasrizal Hasan , Hamdi Agustin, Eva Sundari, Yul Efnita ... 266

INDONESIAISTOCK EXCHANGE)

Ifada Diah Ayu Rizka, Zaenal Arifin ... 277

23. ANALYSIS OF FACTORS AFFECTING THE CAPITAL STRUCTURE IN INDONESIA STOCK EXCHANGE

Indira Kurniasari, Werner R. Murhadi, Mudji Utami ... 290

24. STUDY OF FINANCIAL LITERACY ON MAGISTER MANAGEMENT

XTUDENTS: DEMOGRAPHIC REVIEW (not abstract)

Rr. Iramani ... 299

25. ASYMMETRY INFORMATION AND CREDIT RISK EFFECT ON LOAN PRICING IN ASIA PACIFIC

Ivana Alim, Deddy Marciano, Liliana Inggrit Wijaya ... 312

26. ANALYSIS OF THE DAY OF WEEK EFFECT, WEEK FOUR EFFECT, ROGALSKY EFFECT, AND JANUARY EFFECT ON STOCK RETURN IN INDONESIA STOCK EXCHANGE

Kartini, Meilya Dian Santika ... 326

27. PERFORMANCE AND RISK ANALYSIS BETWEEN JAKARTA ISLAMIC INDEX AND LQ45

Luluk Kholisoh, Sulistyani Rahmah Indah, Untara ... (Abstract only)

28. THE EFFECT OF INTERNATIONALIZATION TO RISK IN

INDUSTRIAL MANUFACTURING COMPANY THAT LISTED ON THE INDONESIA STOCK EXCHANGE 2010-2014 PERIOD

Mechiko, Deddy Marciano, Arif Herlambang ... 344

29. BIAS REPRESENTATIVENESS WITH TREND AND SEQUENCES APPROACH: THE OVERVALUE/UNDERVALUE, MOMENTUM

AND REVERSAL RETURN TEST

Putu Anom Mahadwartha, Bertha Silvia Sutejo ... 359

30. RISK MANAGEMENT IN INDONESIA TO CREATE HEALTHY COMPANY IN ASEAN ECONOMIC COMUNITY

Rosemarie Sutjiati ... 383

31. FINANCIAL LITERACY STUDY OF MAGISTER MANAGEMENT STUDENTS: DEMOGRAPHIC REVIEW

Rr. Iramani ... (Abstract only)

32. CORPORATE GOVERNANCE AND FIRM PERFORMANCE: THE MODERATING ROLE OF INVESTMENT

Siti Puryandani, Hartati Hadady ... 394

33. FINANCIAL PERFORMANCE ANALYSIS OF PRE AND POST MERGER ON INDONESIAN COMMERCIAL BANK WHICH REGISTERED ON INDONESIAN STOCK EXCHANGE

34. ANALYSIS OF READINESS FOR ISA (INTERNATIONAL STANDARD AUDITING) BASED IN AUDIT PLANNING (CASE STUDY AT LOCAL PUBLIC ACCOUNTANT “X” IN SURABAYA)

Steffi Sunur, WiyonoPontjoharyo, Senny Harindahyani ... 430

35. MEASUREMENT OF ISLAMIC BANK HEALTH USING SHARIA COMPLIENCE ANDIPERFORMANCE

Sutrisno, R. Agus Basuki ... 450

36. INTELLECTUAL CAPITAL DISCLOUSURE AND FIRM VALUE: AN ANALYSIS WITH NON RECURSIVE MODEL

Toni Heryana ... 461

37. THE NEW CORPORATE GOVERNANCE MEASUREMENT AND ITS IMPACT ON FIRM VALUE

Ulil Hartono, Musdholifah ... (Abstract only)

38. REAL EXCHANGE RATE MISALIGNMENT AND CURRENCY CRISIS: CASE OF INDONESIA

Unggul Heriqbaldi ... (Abstract only)

39. THE INFLUENCE OF ENTERPRENEURSHIP ON FINANCIAL

PERFORMANCE MEDIATED BY NON-FINANCIAL PERFORMANCE

Uswatun Hasanah, Saniman, Faidal ... 487

40. THE ROLE OF CORPORATE GOVERNANCE IN FAMILY CONTROL FIRMS: EVIDENCE FROM INDONESIA

Yie Ke Feliana, Suwenda Liantina ... 499

41. E-PAYMENT SYSTEMS IN SUPPORT ONLINE TRANSACTIONS (USER CASE STUDIES OF E-PAYMENT SERVICES IN MAKASSAR)

Zikra Supri, Andi Rahmatullah Mangga, Mediaty ... 510

HUMAN RESOURCES

42. THE EFFECT OF COMMITMENT CAREER TO THE SUCCESSFUL CAREER WITH EMOTIONAL PERCEPTION AS VARIABLE MODERATOR AT PT. PJB PUSAT SURABAYA

Aninda Tri Cahyaningrum, M.E Lanny Kusuma Widjaja ... 525

43. THE INFLUENCE OF THE ISLAMIC BUSINESS ETHICS AND SPIRITUAL INTELLIGENCE OF ISLAMIC LEADERSHIP AND PERFORMANCE MANAGER SHARIA BANK IN SURABAYA

A Rochim Sidik ... 546

44. EVALUATION OF EFFECTIVENESS ON DESIGN THINKING METHOD FOR THE DERGRADUATE STUDENTS(CASE STUDY ON

UNIVERSITY)

Annisaa Novieningtyas, Triyana Iskandarsyah,

Rizka Nugraha Pratikna, Ivan Prasetya Tanimukti ... 562

45. OPTION-BASED MODEL AND PROJECT-BASED CAREER MODEL AFFECT EMPLOYEE’S INTENTION TO STAY IN

PROFESSIONAL SERVICES ORGANIZATION: KNOWLEDGE AND SKILLS AS MODERATOR

Bagus Suripto, Gugup Kismono ... 575

46. THE IMPACT OF KKNI (INDONESIAN QUALIFICATION NETWORK) IMPLEMENTATION TO HIGHER EDUCATION GRADUATES’

QUALITY: A STUDY OF UNDERGRADUATE ALUMNI AT TANGERANG, BANTEN

Dewi Wahyu Handayani, Anthony Halim ... 598

47. ORGANISATIONAL CHANGE IN PUBLIC SERVICE:

DECONSTRUCTING SECTORIAL EGO IN PUBLIC COLLABORATION

Dian Ekowati ... 617

48. WORKLOAD ANALYSIS FOR GOOD HUMAN RESOURCE PLANNING AT FACULTY Y IN UNIVERSITY X

Endang Ernawati, Elsye Tandelilin ... 635

49. THE APPLICATION OF INTERNAL CONTROL FOR THE WOMEN COOPERATIVE PERFORMANCE IN EAST JAVA

Eni Wuryani, Dewi Prastiwi ... 649

50. THE INFLUENCE OF THE QUALITY OF WOMEN’S COOPERATIVE PERFORMANCE TO GOOD CORPORATE GOVERNANCE (STUDI ON WOMEN’S COOPERATIVES IN EAST JAVA)

Erlina Diamastuti, Ni Nyoman Alit Triani ... 661

51. SUSTAINABLE GROWTH AND ETHICS A STUDY OF BUSINESS MANAGEMENT STUDENTS IN SURABAYA

Erna Andajani ... 674

52. REPUTATION ORGANIZATION DEVELOPMENT MODEL TO CREATE COMPETITIVE ADVANTAGE – A CASE STUDY IN TRANSMEDIA

Indrianawati Usman ... 682

53. PERFORMANACE MANAGEMENT APPROACH AS THE BEST CHOICE IN THE IMPLEMENTATION OF INDONESIAN NATIONAL QUALIFICATIONS FRAMEWORK

Joseph L. Eko Nugroho ... 693

54. ORGANIZATIONAL HEALTH AS A CORPORATE CULTURE AND FOUNDATION OF ORGANIZATIONAL DEVELOPMENT

55. ANALYSIS OF JOB COMPETENCIES ADVERTISED IN NEWSPAPERS AND THE CURRICULUM OF MANAGEMENT DEPARTMENT OF A SCHOOL OF BUSINESS

Laila Saleh Marta ... (Abstract only)

56. EMPLOYER BRANDING AND THE MEANING OF WORKING THEIR EFFECTS ON WORK PLAVE PREFERENCE - A COMPARATIVE STUDY ON WORK PERCEPTION BETWEEN LOCAL WORKERS AND EXPATRIATES WORKING WITHIN LOCAL AND MULTINATIONAL FIRMS IN BANDUNG AND EXTENDED AREAS

Maman Kusman, Dwinto Martri Aji Buana, Nugroho Hardiyanto ... (Abstract only)

57. COMPARISON OF CULTURAL VALUES IN THREE INDONESIAN SUB-CULTURES

Mirwan Surya Perdhana, Devia Arda... 717

58. INFLUENCE OF WORK FAMILY CONFLICT, JOB SATISFACTION, AND TURNOVER INTENTION – THE CASE OF CV. STAR

INTERNATIONAL

Mochamad Rizki Sadikin, Debby Ulfah ... 726

59. THE EFFECT OF INVOLVEMENT OF WORK AND DEMANDS OF WORK ON WORK-FAMILY CONFLICT WITH THE SOCIAL SUPPORT AS A MODERATING VARIABLE EMPLOYEES

Ninin Prastiwi, Dwiarko Nugrohoseno ... 734

60. THE ROLE OF MANAGEMENT SUPPORT ON CORPROATE ENTREPRENEURSHIP AND EMPLOYEE WORK OUTCOME

Nuri Herachwati, Yohana Dewi Anggur ... (Abstract only)

61. ASEAN ECONOMIC COMMUNITY IMPACT TO SOCIO-CULTURE TO INDONESIA BORDER AREA RIAU STATE

Nurman, Detri Karya, Zulkifli Rusby, Evizal Abdul Kadir ... 756

62. CONTRIBUTION LANGUAGE (ENGLISH) AND CULTURE TO MARKET INTEGRATION IN ASEAN

Seno H Putra, Desy Mardianti ... 768

63. THE INFLUENCE OF MOTIVATION AND WORK ENVIRONMENT TO LECTURER PERFORMANCE IN BATAM CITY

Sri Langgeng Ratnasari ... 773

64. THE IMPACT OF WORK FAMILY CONFLICT TOWARDS THE

EMPLOYEE PERFORMANCE OF DEPARTMENT OF FORESTRY AND ESTATE CORPS IN BATANG REGENCY, CENTRAL JAVA, WITH THE JOB SATISFACTION AS THE INTERVENING VARIABLE

65. ANALYSIS OF FACTORS AFFECTING THE INFORMATION TECHNOLOGY USER PERFORMANCE IN MAKASSAR GOVERNMENT’S PUBLIC BANKS

Suhartono, Dewi Arvini Wisudawaty, Grace T. Pontoh ... 795

66. CONCEPTUAL REVIEW ON THE NEEDS FOR COMPREHENSIVE INTEGRATED CASE STUDIES OF ORGANIZATION DEVELOPMENT, WHICH SUPPORT TALENT DEVELOPMENT

AND LEADERSHIP PROGRAM

T. Soemarman ... 812

67. JOB AUTONOMY, SELF-EFFICACY, JOB PERFORMANCE AND RESISTANCE TO CHANGE (EMPIRICAL STUDY ON EMPLOYEE PT. UNITED WARU BISCUIT MANUFACTORY SIDOARJO)

Tri Siwi Agustina, Nidya Ayu Arina ... 833

68. ASEAN ECONOMIC COMMUNITY CHALLENGING AND OPPORTUNITY FOR INDONESIAN GRADUATE

Zulkifli Rusby, Nurman, Hasrizal Hasan, Evizal Abdul Kadir ... 848

MARKETING

69. THE EFFECT OF BRAND EQUITY ON PURCHASE INTENTION AND ITS IMPACT ON PURCHASE DECISION (CASE STUDY: MITSUBISHI MIRAGE BRAND)

Aam Bastaman, Ilmi Dimas Rahma Pradana ... 863

70. ANTECEDENTS AND CONSEQUENCE OF CUSTOMER SATISFACTION IN GLOBAL FAST FOOD RESTAURANT Anas Hidayat, Aulia Arifatu Diniyya,

Muhammad Saifullah, Asmai Ishak ... (Abstract only)

71. DOES MESSAGE FRAMING MATTER? THE ROLE OF MESSAGE FRAMING AND INVOLVEMENT IN INFLUENCING ATTITUDES AND RESERVATION PRICE TOWARD ORGANIC PRODUCTS

Andhy Setyawan ... 886

72. THE IMPACT OF INSTITUTIONAL IMAGE AND STUDENT

SATISFACTION ON ATTITUDINAL AND BEHAVIORAL LOYALTY – THE CASE OF UNIVERSITAS TERBUKA

Andy Mulyana, Devi Ayuni ... 895

73. THE CONSUMER INTEREST OF KEDAI MANGKOK MANIS BANDUNG: A STORE ATMOSPHERE PERSPECTIVE

Ayuningtyas Y. Hapsari ... 905

74. THE IMPACT OF FAIRNESS ON SERVICE RECOVERY

ON PEMALANG BRANCH OF CENTRAL JAVA

Chandra Arief Mauriat, Budi Astuti ... 917

75. ACHIEVING STUDENTS LOYALTY THROUGH QUALITY OF SERVICES, STUDENTS SATISFACTION, AND REPUTATION

Devi Ayuni, Andy Mulyana ... 930

76. EFFECT OF LOW-PRICE AND HIGH-PRICE PRODUCTS DEPTH AND PROMOTION OPTIONS ON MESSAGE FRAMING AND NOMINAL PERCENTAGE DISCOUNT

Dian Ambarwati, Dudi Anandya, Indarini ... 943

77. CAUSE RELATED MARKETING: THE IMPORTANCE OF BRAND ENGAGEMENT TO WIN THE COMPETITION IN ASEAN ECONOMIC COMMUNITY

Dorien Kartikawangi, Avianto Nugroho ... 950

78. EFFECT OF PRODUCT INNOVATION, CORPORATE IMAGE AND QUALITY OF SERVICE TO CONSUMER SATISFACTION AND LOYALTY CATERING CUSTOMERS IN SURABAYA

Eny Rochmatulaili ... 968

79. MAYOR’S PERSONAL BRAND ACCELERATES THE EMERGENCE OF CITIZEN’S BRAND ATTITUDE

Eriana Astuty, Sri Astuti Pratminingsih ... 984

80. THE EFFECT OF LOYALTY FORMING FACTORS AMONG VISITOR AT BANDUNG CULINARY TOURISM

Etik Ipda Riyani, Devi Ayuni, Andy Mulyana ... 994

81. IMPLEMENTATION OF E-COMMERCE ON THE USE OF GOJEK SERVICE IN MAKASSAR

Fajriani Azis, Nurlaila Hasmi, Mediaty ... 1011

82. ANALYSIS INTENTION TO USERS OF ONLINE SHOPPING ON E-COMMERCE: REVIEW OF THEORY OF PLANNED BEHAVIOR

Grace T. Pontoh, Ibrahim, Satriani ... 1029

83. GENDER DIFFERENCES ON THE RELATION OF SATISFACTION-LOYALTY

Gregorius Stanley Pratomo, Christina Rahardja Honantha,

Liliana Inggrid Wijaya ... 1047

84. MARKETING ANALYSIS, EXPERIENTIAL AND MARKETING CUSTOMER RELATION TO REALIZE CUSTOMER VALUE, AND IMPLICATIONS FOR CUSTOMER LOYALTY

(SURVEY ON CUSTOMER STAR HOTELS 3, 4, AND 5 IN BANDUNG AREA)

85. ANALYSIS OF FACTORS QUALITY OF SERVICE E-COMMERCE AND ITS EFFECT ON CUSTOMER LOYALTY (SURVEY ON E-COMMERCE CUSTOMER IN WEST JAVA)

Heppy Agustiana Vidyastuti ... 1101

86. THE IMPACTS OF TRI HITA KARANA AWARD ON HOTEL ROOM RATES PERFORMANCE: AN EXAMINATION OF ITS APPLICATIONS ON HOTELS IN BALI BASED ON SEASONS AND RESORT AREAS

I Ketut Surata, I Nyoman Sudiksa, Ida Bagus Made Wiyasha ... 1129

87. THE IMPLEMENTATION OF THE STAKEHOLDER PERSPECTIVE TO SUPPORT SUSTAINABILITY ACTIVITIES AND THE ENABLING FACTORS

Iin Mayasari, Devi Wulandari, Iyus Wiadi, Anita Maharani ... 1151

88. THE EFFECT OF COUNTRY OF ORIGIN IMAGE ON BRAND EQUITY THROUGH THE MEDIATION OF BRAND ASSOCIATIONS, BRAND LOYALTY AND BRAND AWARENESS ON LG AIR CONDITIONER (AC) IN SURABAYA

Ivana Haryanto, Silvia Margaretha, Dudi Anandya ... 1177

89. ARE GENDER AND ETHNICITY MATTER IN IMPULSIVE BUYING BEHAVIOUR? A STUDY ON YOUNG ADULT CONSUMERS IN AUSTRALIA AND INDONESIA

Made Pranadatha Gunawan, Mahestu N Krisjanti ... (Abstract only)

90. PASSPORT SERVICE QUALITY DEVELOPMENT BASED E-GOVERNMENT (E-PASSPORT) ON SATISFACTION USERS

Mediati, Purnama Sari, Kartini, Muslimin ... 1191

91. THE INFLUENCE OF CORPORATE SOCIAL RESPONSIBILITY AND SERVICE QUALITY TO PURCHASE INTENTION

IN ISLAMIC BANKING

Muchsin Muthohar, Merlin Rahmawati ... 1206

92. EFFECT OF COUNTRY OF BRAND TO

QUALITY PERCEPTION AND BRAND TRUST

Muhammad Hasbi Zaidi, Nurman, Azmansyah ... 1218

93. THE INFLUENCE OF CREATIVITY, PRODUCT

INNOVATION,CUSTOMERS RELATIONSHIP MANAGEMENT TO THE PRICE DETERMINATION WHICH GRABS THE SUCCESS (THE

RESEARCH ON SMALL MEDIUM BUSINESS UNITS (UKM) OF BATIK IN CENTRAL JAVA AND D.I. YOGYAKARTA PROVINCES)

R. Adjeng Mariana Febrianti ... 1233

94. ATTITUDE TOWARDS CIGARETTE ADVERTISEMENT

95. CRITICAL ANALYSIS ON MARKETING ACTIVITIES OF MUSEUMS IN BALI

Rizal Hari Magnadi... (Abstract only)

96. THE IMPACT OF THE QUALITY OF INTRINSIC AND EXTRINSIC ATTRIBUTES IN CREATING LOYALTY AND PURCHASE INTENTION

Sofiana Dewi, Albari ... 1262

97. DOES SOCIAL ADVERTISING IN TWITTER AND FACEBOOK WORK DIFFERENTLY?

THE ROLE OF PROFIT ORIENTATION OF THE ORGANIZATION

Sony Kusumasondjaja ... 1278

98. ANALYSIS OF INTERNET BANKING BASED ON RISKS, BENEFITS, AND SIMPLICITIES ON THE CUSTOMERS TRUST

Sri Nirmala Sari, Juniaty Ismail, Grace T. Pontoh ... 1287

99. DETERMINANTS OF BRAND PRODUCTS SWITCHING ON SMARTPHONE (CASE STUDY ON WIDYATAMA UNIVERSITY)

Sri Wiludjeng SP, Rudi Gunawan ... 1300

100. INFLUENCE ON AWARENESS, PERCEIVED QUALITY,

UNIQUENESS, SOCIAL IMAGE, AND HOME COUNTRY ORIGIN TO PRICE PREMIUM AND LOYALTY ON

HÄAGEN DAZS PREMIUM PACKAGED ICE CREAM

Sutrisno Hamdany, Indarini, Dudi Anandya ... 1309

101. THE INFLUENCE OF SERVICE QUALITY AND TRUST ON LOYALTY CONSUMER OF CICENDO EYE HOSPITAL PERIOD 2014

Taufik Rachim, Adam Apriyadi Putra ... 1324

102. STUDENT INTEREST TO PRESERVE DRAGON AND LION TRADITIONAL DANCE (AN INTERNAL FACTOR

AND IMAGE OF BANDUNG SANTO CLUB PERSPECTIVE)

Tezza Adriansyah Anwar, Galuh Boga Kuswara ... 1332

103. THE EFFECT SERVICE QUALITY AND CORPORATE IMAGE ON LOYALTY WITH CUSTOMER TRUST AS A MODERATOR: A STUDY IN A PRIVATE UNIVERSITY

Yasintha Soelasih, Efendi... 1341

104. EFFECT ATTRIBUTES SERVICES TO SATISFACTION USER SERVICES AND ITS IMPACT ON WORD OF MOUTH

(STUDIES IN WIDYATAMAUNIVERSITY BANDUNG - INDONESIA)

Yenny Maya Dora ... 1349

AT PT.BERJAYA ABADI TOUR AND TRAVEL)

Zulganef, Sri Astuti Pratminingsih, Santy Hepty Hexiawaty ... 1373

OPERATION

106. IMPROVING SERVICE QUALITY OF SECRETARIAL AND OFFICE MANAGEMENT STUDY PROGRAM,

FACULTY OF VOCATIONAL, UNIVERSITAS AIRLANGGA BY INTEGRATING MATRIX IMPORTANCE PERFORMANCE ANALYSIS AND FISHBONE DIAGRAM

Febriana Wurjaningrum, Ida Setya Dwi Jayanti ... 1385

107. PERBAIKAN KUALITAS LAYANAN “CALL CENTER”

MENGGUNAKAN METODE “DMAIC” DAN “SERVICE BLUEPRINT”

Fino Wahyudi Abdul, Nining P. ... 1401

108. RESTAURANT ATTRACTIVENESS AND PSYCHOLOGICAL EFFECT OF UPLOADING FOOD PICTURE ON INSTAGRAM

TO WILLINGNESS TO DINE OUT

Hanz Christianto, Siti Rahayu, Prita Ayu Kusumawardhany ... 1416

109. RISK AND MITIGATION ANALYSIS OF SUPPLY CHAIN WITH HOUSE OF RISK APPROCH FOR A BUSINESS IN FREE TRADE ERA

Indrianawati Usman, Rudati Ariani ... 1430

110. THE FOOTWEAR SMES VALUE ORCHESTRATION IN MOJOKERTO

Juliani Dyah Trisnawati ... 1442

111. IMPROVING QUALITY OF SERVICES USING IMPLEMENTATION OF QFD TO WIN MARKET COMPETITION

Ratna Widiastuti... 1449

112. SUPPLIER SELECTION USING ANALYTICAL HIERARCHY PROCESS IN PT PELITA MEKAR SEMESTA

Sharon Audrey Madeline Vriso, Stefanus Budy Widjaja, A. Budhiman S. ... 1456

113. THE EFFECTS OF DINING ATMOSPHERICS ON BEHAVIORAL INTENTIOS THROUGH SERVICE QUALITY AND FOOD QUALITY IN GOJUMONG RESTAURANT SURABAYA

Shelli Rustam Moidady, Fitri Novika Widjaja, Dudi Anandya... 1462

114. THE EFFECT OF SUPPLY CHAIN MANAGEMENT PRACTICES ON PERFORMANCE OF SMEs IN YOGYAKARTA

Siti Nursyamsiah, Ninoury Ardaiva ... 1474

115. MOTIVATION OF STUDENTS IN HOSPITALITY AND TOURISM MANAGEMENT PROGRAMS

116. THE IMPLEMENTATION OF SEVEN QUALITY MANAGEMENT TOOLS: EXPERIENCES FROM THREE ENTERPRISES

IN EAST JAVA, INDONESIA

Stefanus Budy Widjaja, Anthonius Budhiman Setyawan... 1503

117. IMPLEMENTATION OF QUALITY CONTROL BY USING PDCA AND STATISTICS TOOLS

IN BREAD STORES OLIVIA BAKERY AT MOJOKERTO

Steven Anggriawan, Stefanus Budy Widjaja, Prita Ayu Kusumawardhany ... 1516

118. THE DEVELOPMENT OF EDUCATIONAL TOURISM IN THE AREA OF MOUNT PENANGGUNGAN

THROUGH COMMUNITY EMPOWERMENT Veny Megawati,Edna Sri Redjeki, Gunawan,

Yoan Nursari Simanjuntak, Nanang Krisdinanto ... 1531

119. GREEN COMPANIES SCORECARD

Zainur Hidayah ... 1543

STRATEGIC & ECONOMICS

120. E-ASEAN JOB AS STRATEGY TOWARDS FREE LABOUR MARKET IN ASEAN ECONOMIC COMMUNITY (CASE STUDY INDONESIA)

Alfina Rahmatia, Resky Izzati Afiah, Nida’ Al-Ulfah Untoro ... 1557 121. AN ANALISYS WORLD OIL PRICE MOVEMENTS

AND THE G7 CAPITAL MARKETS

Dian Surya Sampurna ... (Abstract only)

122. BUILDING ASEAN EXCHANGE RATE UNIT (AERU)

FOR MONETARY INTEGRATION IN ASEAN-5 COUNTRIES Dimas Bagus Wiranatakusuma, Masyhudi Muqorobin,

Imamudin Yuliadi, Alif Supriyatno ... 1569

123. THE ANALYSIS OF FACTORS INFLUENCING DEMAND

FOR IMPORTED COFFEE MALAYSIA FROM INDONESIA 1993-2013

Eko Atmadji, Afik Beny Adam ... 1601

124. THE EFFECT OF CORPORATE SOCIAL RESPONSIBILITY ON COMPANY REPUTATION AND MARKET RISK

Fitri Ismiyanti ... 1612

125. INTERNATIONAL BUSINESS RELATION OF EMERGING INDONESIA WITH ASIAN NEIGHBOURS

126. ASEAN ECONOMIC COMMUNITY (AEC) AND ECONOMIC STABILITY: A REVIEW FROM INDONESIA’S SIDE

Hersugondo, Robiyanto, Gatyt Sari Chotijah ... 1629

127. BUSINESS STRATEGY ANALYSIS AND IMPLEMENTATION TO WIN COMPETITION (CASE STUDY AT SSM)

Idris Gautama So, Fransisca Chatarina, Natalia ... 1638

128. ANALYSIS OF THE STRATEGY TO DEVELOP THE OLD TOWN ARRANGEMENT (SUNDA ETHNIC) USING THE CONCEPT OF THE NEW CITY IN BANDUNG WEST JAVA

Keni Kaniawati ... 1647

129. DRIVERS OF COUNTRY’S EXPORT PERFORMANCE

Masmira Kurniawat ... 1662

130. IMPROVING COMPETITIVENESS OF MICRO AND SMALL BUSINESS PRODUCT FACING GLOBAL MARKET (CASE ON MICRO AND SMALL BUSINESS FOOD AGROINDUSTRY IN GIANYAR REGENCY)

Ni Wayan Sukartini, Ni Ketut Lasmini, Ni Made Sudarmini ... 1670

131. TIERED SME TRAINING IN SURABAYA: STRATEGY FOR STRENGTHENING SME COMPETITIVENESS

TO FACE MARKET INTEGRATION IN ASEAN

Noviaty Kresna Darmasetiawa ... 1681

132. ACCELERATING ECONOMIC DEVELOPMENT IN SURABAYA CITY TOWARDS ASEAN SINGLE MARKET

Nurul Istifadah ... 1691

133. CORPORATE SOCIAL RESPONSIBILITY AND CULTURE: THE STUDY IN HOSPITALITY

Nyoman Indah Kusuma Dewi,

I Gusti Agung Bagus Mataram, I Wayan Siwantara ... 1702

134. THE ROLE OF THE STATE MANAGEMENT IN THE LABOR EXPORT IN SOUTHEAST ASIAN NATIONS TOWARDS THE ASEAN VISION 2025 (THE CASE-STUDYOF LABOR EXPORT IN VIETNAM

AND THE ASEAN COUNTRIES)

Phan Thi Hong Xuan ... 1712

135. CHARACTERISTICS AND IDENTIFICATION OF

OBSTACLES FACED SMES, BASED SWOT ANALYSIS IN MALANG (CENTER FOR STUDIES IN INDUSTRIAL CERAMICS DINOYO)

Ririt Iriani Sri Setiawati, Tri Mujoko ... 1723

ECONOMIC COMMUNITY (AEC) (CASE STUDY IN INDONESIA)

Sumandi, Farhan Fabilallah, Heni Rahmawati, Mia Rosmiati ... 1730

137. REGIONAL TOURISM DEVELOPMENT STRATEGY

(STUDIES ON DEVELOPMENT OF LOCAL GOVERNMENT TOURISM MADIUN COUNTY)

Tatik Mulyati, Saraswati Budi Utami, Choirum Rindah Istiqaroh ... 1752

138. BUSINESS DEVELOPMENT OF SMALL AND MEDIUM ENTERPRISES (SMEs) IN THE CREATIVE INDUSTRY IN SUPPORTING

REGIONAL ECONOMIC IMPROVEMENT THROUGH GROSS DOMESTIC REGIONAL PRODUCT (GDRP) REGION IN BANDUNG

Wien Dyahrini ... 1776

139. TAX COMPLIANCE AND COMPLIANCE CONTINUUM: REVIEW OF CONCEPTS AND SOME SUGGESTIONS FOR THE MODEL OF

COMPLIANCE MANAGEMENT IN SOUTHEAST ASIAN NATIONS IN THE CONTEXT OF ASEAN COMMUNITY

Vo Tien Dung ... 1790

VIETNAM'S ECONOMIC, SOCIAL AND CULTURAL ISSUES

IN THE ERA OF INTEGRATION

140. POST-MODERN MANAGEMENT

AND MANAGEMENT CULTURE IN EAST ASIA

Nguyen Ngoc Tho ... 1801

141. ORGANIZATIONAL DEVELOPMENT

Nhor Sanha ... 1817

142. SOME ISSUES RELATED TO THE CONSTRUCTION OF REGIONAL IDENTITIES IN THE DEVELOPMENT OF ASEAN COMMUNITY FROM CROSS-CULTURAL PERSPECTIVES

Tran Thi Thu Luong ... 1838

143. CROSS-CULTURAL MANAGEMENT AND EXCHANGES IN THE VIETNAMESE HIGHER EDUCATION IN THE INTEGRATION ERA

Nguyen Duy Mong Ha ... 1851

144. EXPANDING THE ROLE OF UNOFFICIAL CULTURAL INSTITUTIONS IN THE CULTURAL ACTIVITIES

Ngo Van Le ... 1858

145. RAISING THE AWARENESS OF SOUTHEAST ASIAN IDENTITY IN REALIZING THE ASEAN COMMUNITY

146. CONSTRUCTING THE ASEAN POLITICAL-SERCURITY COMMUNITY THEORETICAL AND PRACTICAL PERSPECTIVE

Tran Nam Tien ... 1881

147. UNIVERSITIES AND ENTERPRISES: SUSTAINABLE COOPERATION IN TRAINING AND RECRUITING QUALITY HUMAN RESOURCES IN THE ERA OF INTEGRATION AND DEVELOPMENT

Nguyen Nhu Binh ... 1895

148. PERCEPTION OF VIETNAMESE FEMALE SEX WORKERS ON QUALITY OF CARE IN CERVICAL CANCER SCREENING

Le Thi Ngoc Phuc ... 1911

149. NEAKTA BELIEF IN THE SOUTHERN KHMER CULTURE: TRANSFORMATION FROM STONE TO HUMAN FIGURES

Phan Anh Tu ... 1924

150. THE VIETNAMESE RELIGIOUS BELIEF OF FOUR DAI CAN LADIES (TỨ VỊ ĐẠI CÀN NƯƠNG NƯƠNG) IN SOUTHWESTERN VIETNAM – A CASE STUDY OF DIEU HOA COMMUNAL HOUSE

(MY THO, TIEN GIANG)

Nguyen Thi Le Hang, Tran Thi Kim Anh ... 1935

151. A STUDY OF THIEN HAU THANH MAU IN THE FISHERMEN COMMUNITY IN SONG DOC (CA MAU PROVINCE)

Duong Hoang Loc ... 1947

152. THE ROLE OF EDE (RADE) WOMEN IN MARRIAGE AND FAMILY LIFE THROUGH CUSTOMARY LAWS

Ngo Thi Minh Hang ... 1959

153. TEACHING TEOCHEW AND THE STATE OF VIETNAMESE-CHINESE (TEOCHEW DIALECT) LINGUISTIC ADAPTATION (A CASE STUDY IN VINH HAI VILLAGE, VINH CHAU TOWN,

SOC TRANG PROVINCE)

Truong Anh Tien ... 1974

154. INCORPORATING TOURISM ACTIVITIES INTO THE VALUES OF KHMER PEOPLE’S COMMUNITY CULTURE IN TRA VINH

Son Ngoc Khanh, Pham Thi To Thy ... 1981

155. ASEAN COMMUNITY’S IMPACTS ON MARKETS IN SOUTHEAST VIETNAM

Le Quang Can ... 1996

156. CHALLENGES, OPPORTUNITIES, ADVANTAGES, AND DISADVANTAGES OF VIETNAM’S TOURISM IN

INTEGRATION WITH ASEAN AND ITS SOLUTIONS

157. ROLES OF INDONESIA AND VIETNAM IN SOUTHEAST ASIA’S SECURITY

Le Thi Lien ... 2012

158. COMPARING VIETNAM’S AND INDONESIA’S CURRENT DEVELOPMENT INDICES

Nguyen Quang Giai ... 2032

159. ASEAN COMMUNITY : ADVANTAGES AND DIFFICULTIES IN EDUCATIONAL MANAGEMENT

Nguyen Thi Huyen Thao ... 2042

160. THE ROLE OF AGRICULTURAL FESTIVALS IN THE DEVELOPMENT OF TOURISM IN LAOS

Phan Thi Hong Xuan, Quach Dua Tai ... 2052

161. HO CHI MINH CITY’S TOURIST DESTINATION PRODUCTS IN ASEAN INTEGRATION TRENDS THROUGH SWOT MATRIX

Nguyen Cong Hoan ... 2067

162. COLLABORATIVE DEVELOPMENT OF CULTURAL TOURISM IN CENTRAL VIETNAM WITH SOUTHERN LAOS AND

NORTHEASTERN CAMBODIA

344 ISBN (Vietnam): 978-604-73-4020-0

THE EFFECT OF INTERNATIONALIZATION TO RISK IN

INDUSTRIAL MANUFACTURING COMPANY THAT LISTED ON

THE INDONESIA STOCK EXCHANGE 2010-2014 PERIOD

Mechiko Deddy Marciano Arif Herlambang

Management Departement, Faculty of Business and Economics, University of Surabaya, Indonesia

[email protected] [email protected]

Abstract

The objective of this study is to examine the effect of internationalization to risk in industrial manufacturing company that listed on the Indonesia Stock Exchange 2010-2014 period. This study uses 3 regression analysis model, which is model of linear, quadratic, and cubic to test the hypothesis. The number of observation used in this study is 385 observations. The result shows that internationalization has a significant positive effect on systematic risk, total risk, and unsystematic risk of the company. At the level of internationalization of less than 10%, there is an inverted S-shaped pattern between internationalization and total risk, as well as between internationalization and unsystematic risk as there is no significant effect on systematic risk of the company. While the level of internationalization is more than or equal to 10%, internationalization has a significant positive effect on systematic risk, and there is an inverted U-shaped pattern between internationalization and the total risk, as well as between internationalization and unsystematic risk.

Keywords: internationalization, systematic risk, total risk, unsystematic risk

JEL CLASSIFICATION: G32

INTRODUCTION

346 ISBN (Vietnam): 978-604-73-4020-0

foreign countries (Numb) (Olibe et al., 2008), and geographical segment (GEO) (Olibe et al. 2008; Krapl , 2015) as a proxy internationalization. Furthermore, the company's risk is measured using a beta that shows the systematic risk (Krapl, 2015; Hughes et al., 1975; Mikhail and Shawky, 1979; Fatemi, 1984; Michel and Shaked, 1986; Goldberg and Heflin, 1995; Reeb et al., 1998), stock volatility indicates risk of total (Goldberg and Heflin, 1995; Aabo et al., 2014), and idiosyncratic volatility indicates unsystematic risk (Krapl 2015).

LITERATURE REVIEWS

Internationalization

Al-Obaidan and Scully (1995) in Thomsen (2012) states that there are two causes companies internationalize, the Modern Portfolio Theory and Internationalization Theory. Portfolio Theory states that multinational companies are a collection of some domestic companies. Markowitz (1952) stated that the company's risk can be reduced by expanding internationally. Each country has a market mover different, such as product life cycle (product life cycles), inflation, business cycles, and government regulations, so that the correlation between companies in each country will tend to be imperfect, and companies can reap the benefits of the overall profit less volatile (Miller and Pras, 1980; Qian, 1996 in Thomsen, 2012).

Internationalization Modern Theory focuses on the company's ability to obtain economic benefits (economical profit) through the company's competitiveness in foreign markets. In line with this theory, Dunning (1977) stated that the company will enter into foreign markets will make the company has a competitive keungguluan larger than domestic companies, as long as the cost to reduce entry barriers and the complexity is still within reasonable limits.

Risk

Risk can be defined as uncertainty or deviation from the expected results (Megginson, 1997). According to Weston and Copeland (1992) risk is divided into two parts: systematic risk and unsystematic risk. Summing these risks referred to the total risk.

1. Systematic Risk

Systematic risk is the sensitivity between the company and macro markets. Measurement of systematic risk is measured using a beta of a single index model (Bodie et al., 2008).

2. Total Risk

3. Unsystematic Risk

Unsystematic risk is business risk can be reduced through the establishment of a portfolio diversification or market changes and are not affected (Megginson, 1997). Unsystematic risk can be measured using the idiosyncratic volatility, derived from the standard deviation of the residuals from non-systematic risk or idiosyncratic risk.

Internationalization and Risk

Eiteman et al. (2010) stated that the internationalization raises benefits and cost that would affect the risk. If the benefits arise more than cost, it will reduce the risk of internationalization of the company. Conversely, if the benefit arises less than cost, internationalization will increase the risk of the company. Furthermore, when the benefit and the cost incurred balanced/equal, then the internationalization has no significant impact on the company's risk.

Diversification

Diversification can be defined as an asset allocation in some places that aim to reduce risk (Gitman and Zutter, 2015). Each country has a market mover different, such as product life cycle (product life cycles), inflation, business cycles, and government regulations, so that the correlation between companies in each country will tend to be imperfect. The lower the correlation between the markets in which the company operates is, the greater the reduction in the risk of internationalization process. Operational Flexibility International operational flexibility can be defined as a company's ability to adjust in the country where the company produces or sells products and can demonstrate business benefits operationally. Aside from the potential to earn high profits, operational flexibility also potentially reduces the downside risk, such as changes in exchange rates (exchange rate). Just like the theory of diversification, the value of operational flexibility depending on market conditions correlation between countries. The lower the correlation is, the higher the difference, the more valuable economic flexibility (Thomsen, 2012).

348 ISBN (Vietnam): 978-604-73-4020-0

potential differences in values and perceptions between individuals and companies in different countries. Great cultural differences between countries of origin and foreign countries cause conflicts interest and spur the agency cost, thus reducing the overall assurance business (Roth and O'Donnell, 1996).

Economic and financial risks derived from fluctuations in the economic environment in the country, such as inflation, exchange rates, unemployment, and so on, are all potentially affect the size and value of cash flows of foreign direct investment (Miller, 1992).

Transaction Costs Theory

According to Williamson (1975) in Thomsen (2012), transaction costs can be defined as the managerial costs, legal fees, and other expenses resulting from inefficient to complete the transaction. Currency exposures and risks associated with exchange rate fluctuations are taken into account as a transaction fee. Industrial Organization Theory Industrial Organization Theory focuses more on internal point. This theory suggests three causes of the rise in risk because of the internationalization: (1) Along with the growth of the company, the complexity of the company is also getting higher. The increasing complexity complicates both operational and strategic decision-making, and can cause a variety of operational efficiency as well as a decrease in the company's ability to adapt to changes in the external environment (Grant, 2010). (2) The international expansion is a decision to maximize their personal welfare CEO regardless of the potential losses to shareholders or other stakeholders to improve the agency/monitoring costs because there are different interests (conflict of interest). Thus, from the perspective of shareholders, any increase in the level of internationalization can potentially destroy the value of incentives, which may lead to increased volatility in the company's stock price. (3) The asymmetry of information between management and investors. Jin and Myers (2006) say that the lack of transparency will only create value for internal investors.

Control Variables

Liquidity

Some researches reveal that companies are liquid and have enough cash to cover all short-term obligations and have a low risk (Beaver et al., 1970; Logue and Merville, 1972; Krapl, 2015). Instead, Jensen (1986) in Krapl (2015) says that “high levels of corporate liquidity lead to moral hazard problems the which in turn increase of agency costs.” The company's liquidity is measured using the Quick Ratio.

Leverage

study also state that companies with high leverage will increase the risk. Leverage companies measured using Debt Ratio.

Profitability

Previous studies found a negative relationship between profitability and risk (Schemer and Mathison, 1996; Kim et al., 2002; Lee and Jang, 2006; Rowe and Kim, 2010 in Iqbal and Shah, 2009). Companies that have high profit can improve a company's ability to reduce financial instability, so as to reduce the risk. Meanwhile, Borde et al. (1994) in Iqbal and Shah (2009) found out the positive relationship between profitability and risk of the insurance company, because the company's high profitability of the financial sector that have a high credit risk as well. It also fits with the concept of “High Risk, High Return” by Gitman and Zutter (2015), which means companies that have a profit or a high return, high risk anyway. The company's profitability is measured by using a Return on Assets.

Operating Efficiency

Logue and Merville (1972) in Krapl (2015) say that the company is more efficient when its operations benefit and reduce the potential of loss. Kim et al. (2002) and Eldomiaty et al. (2009) in Krapl (2015) also found a negative relationship between operating efficiency and risk. Operating efficiency can be measured by using Asset Turnover Ratio.

Market to Book Value

Beaver et al. (1970) in Krapl (2015) found "unexpected profits Arising from growth opportunities as competition erode Enters the market place". As a result, revenue windfall that comes from growth opportunities are riskier than normal profit, resulting in a positive relationship between growth and risk. La Porta (1996) in Krapl (2015) provides empirical evidence that “the expected high-growth stocks have higher standard deviations of returns and higher expected market betas than low-growth firms.” Internationalization is closely connected with high growth opportunities.

Dividend Payout

Agency costs can be reduced with high dividends (Ang et al., 1985). The effect of high dividend distribution is negative towards risk as investors consider the certainty of return than cash flow from dividends from the stock price is high (Logue and Merville, 1972; Beaver et al, 1970; Kim et al, 2002 in Krapl, 2015). The dividend distribution may be measured using the Dividend Payout Ratio.

Size

350 ISBN (Vietnam): 978-604-73-4020-0

impact of economic changes. Titman and Wessels (1988) in Krapl (2015) also said that large companies will tend to be diversified and reduce the possibility of bankruptcy.

Methodology

Target population used in this study is an industrial manufacturing company listed on the Indonesia Stock Exchange period 2010 to 2014. The number of samples used in this study is 77 companies manufacturing industry with the observation period from the period 2010 to 2014. Thus, in this study there were 385 observation points. The study also divides the sample into sub-samples by looking at the ratio of foreign sales to total sales. According to Singh and Nejadmalayeri (2004), the company with FSTS ratio <10% is still regarded as domestic companies, while companies with FSTS≥10% ratio of new to say as a multinational corporation (MNC). Then there are 29 companies that became sample FSTS <10%, and 48 companies that are sub-samples FSTS≥10%.

Testing data uses regression test that takes into account the value of the f-statistic, t-statistic, and the coefficient of determination (R2). To ensure that the regression equation was inaccurate, biased, and consistently then performed classical assumption that includes normality test, multicollinearity, autocorrelation, and heteroscedasticity test.

In previous studies, the regression model is used only multiple linear regression model (Krapl, 2015; Olibe et al., 2007; Aabo et al., 2014). This research seeks to analyze further by adding a nonlinear model is a model quadratic and cubic models in order to determine the effect deeper. This model was used to test all samples, subsamples FSTS <10%, and sub-samples FSTS ≥10%.

Beta and FSTS

Linear model (Model 1):

Quadratic models (Model 2):

Stock Volatility and FSTS

Linear model (Model 4):

Quadratic models (Model 5):

Cubic Model (Model 6):

Idiosyncratic Volatility and FSTS

Linear model (Model 7):

Quadratic models (Model 8):

Cubic Model (Model 9):

where:

BETA = systematic risk (beta) companies

STOCK VOL = volatility of stock prices / stock volatility

I_VOL = idiosyncratic volatility

FSTS = foreign sales to total sales

LIQ = the company's liquidity, measured using the quick ratio

LEV = leverage, measured using the debt ratio

PROF = the company's profitability, measured using return on assets

EFF = the company's operational efficiency, measured using the total asset turnover

MB = market to book ratio

DPR = dividend payout ratio

352 ISBN (Vietnam): 978-604-73-4020-0

Results

All samples

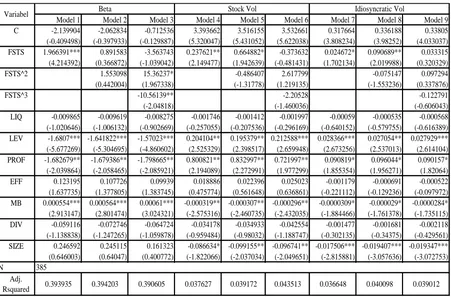

Table 1. Results of Regression All Samples

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 Model 8 Model 9 C -2.139904 -2.062834 -0.712536 3.393662 3.516155 3.532661 0.317664 0.336188 0.33805 (-0.409498) (-0.397933) (-0.129887) (5.320047) (5.431052) (5.622038) (3.808234) (3.98252) (4.033037) FSTS 1.966391*** 0.891583 -3.563743 0.237621** 0.664882* -0.373632 0.024672* 0.090689** 0.033315 (4.214392) (0.366872) (-1.039042) (2.149477) (1.942639) (-0.481431) (1.702134) (2.019988) (0.320329) FSTS^2 1.553098 15.36237* -0.486407 2.617799 -0.075147 0.097294 (0.442004) (1.967338) (-1.31778) (1.219135) (-1.553236) (0.337876)

FSTS^3 -10.56139** -2.20528 -0.122791

(-2.04818) (-1.460036) (-0.606043)

LIQ -0.009865 -0.009619 -0.008275 -0.001746 -0.001412 -0.001997 -0.00059 -0.000535 -0.000568 (-1.020646) (-1.006132) (-0.902669) (-0.257055) (-0.207536) (-0.296169) (-0.640152) (-0.579755) (-0.616389) LEV -1.6807*** -1.641822*** -1.57023*** 0.204104** 0.195379** 0.212588*** 0.028366*** 0.027054** 0.027929*** (-5.677269) (-5.304695) (-4.860602) (2.525329) (2.398517) (2.659948) (2.673256) (2.537013) (2.614104) PROF -1.682679** -1.679386** -1.798665** 0.800821** 0.832997** 0.721997** 0.090819* 0.096044* 0.090157* (-2.039864) (-2.058465) (-2.085921) (2.194089) (2.272991) (1.977299) (1.855354) (1.956271) (1.82064) EFF 0.123195 0.107726 0.09939 0.018886 0.022396 0.025023 -0.001179 -0.000691 -0.000522 (1.637735) (1.377805) (1.383745) (0.475774) (0.561648) (0.636861) (-0.221112) (-0.129236) (-0.097972) MB 0.000554*** 0.000564*** 0.00061*** -0.000319** -0.000307** -0.000296** -0.0000309* -0.000029* -0.0000284* (2.913147) (2.801474) (3.024321) (-2.575316) (-2.460735) (-2.432035) (-1.884466) (-1.761378) (-1.735115) DIV -0.059116 -0.072746 -0.064724 -0.034178 -0.034933 -0.042554 -0.001477 -0.001681 -0.002118 (-1.138838) (-1.247265) (-1.059878) (-0.959484) (-0.98032) (-1.188747) (-0.302135) (-0.34375) (-0.429561) SIZE 0.246592 0.245115 0.161323 -0.086634* -0.099155** -0.096741** -0.017506*** -0.019407*** -0.019347*** (0.646003) (0.64047) (0.400772) (-1.822066) (-2.037034) (-2.049651) (-2.815881) (-3.057636) (-3.072753) N

0.039172 0.043513 0.036648 0.040098 0.039012 385

Adj.

Rsquared 0.393935 0.394203 0.390605 0.037627

Variabel Beta Stock Vol Idiosyncratic Vol

FSTS and Beta

sensitivity of the company to the market will increase. At this level, the costs result from the process of internationalization of higher than profits. However, when the high level of internationalization of the company, which is already more than 80%, beta companies will decrease, which shows the advantages of international diversification return greater than the cost of the company.

FSTS and Stock Volatility

Demonstrated a significant positive relationship model 4 means that internationalization will increase the company's total risk. When companies make the process of internationalization, the complexity in managing the company will be higher. The increasing complexity will be difficult for both operational and strategic decision-making, and can increase the agency cost for stockholders because of the difficulty in monitoring the company. So any increase in the level of internationalization, could potentially destroy the incentive value and will increase the volatility of the stock price. In addition to the model 4, 5 models also showed significant results between FSTS and stock volatility. There is a U-shaped pattern which indicates that there is positive when the level of internationalization of the company below 68%, but when the level of internationalization of the company is more than or equal to 68%, the company's total risk will decrease. This is because the company's main market is no longer the domestic market, so that managers, investors / shareholders, and other stakeholders are already capable of and used to manage and monitor multinational companies.

FSTS and Idiosyncratic Volatility

354 ISBN (Vietnam): 978-604-73-4020-0

Subsample FSTS <10% (Early Stage)

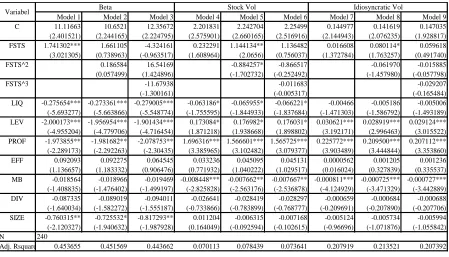

Table 2. Results of Regression Subsample FSTS < 10%

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 Model 8 Model 9

C -2.358717 -2.617365 -2.660285 3.544111 3.615086 3.595266 0.229643 0.256399 0.255679

(-0.950986) (-1.02428) (-1.022344) (5.490129) (5.426414) (5.412641) (3.196643) (3.485224) (3.535458)

FSTS -1.844131 -8.354934 -0.469256 -1.284898 0.170229 9.433949 -0.137599 0.403314 1.475286***

(-0.449827) (-0.823501) (-0.022804) (-1.057615) (0.053916) (1.620564) (-1.207280) (1.292068) (2.833572)

FSTS^2 58.71638 -108.3027 -13.51854 -205.9732* -5.106498* -27.96462***

(0.69836) (-0.28299) (-0.495328) (-1.908768) (-1.850374) (-2.963767)

FSTS^3 842.2312 978.4678* 121.9568**

(0.450022) (1.797389) (2.476457)

LIQ -0.016166 -0.01544 -0.015282 -0.003443 -0.003434 -0.003622 -0.000372 -0.000369 -0.000418

(-0.944964) (-0.897889) (-0.882209) (-0.556758) (-0.555566) (-0.597217) (-0.479574) (-0.483394) (-0.557856)

LEV -1.510172* -1.529474* -1.533473* 0.177412 0.190547 0.136724 0.026083 0.029413 0.017933

(-1.920432) (-1.919122) (-1.900267) (0.765471) (0.81821) (0.585444) (1.061415) (1.195144) (0.727642)

PROF -2.338997 -2.515663 -2.361409 0.131926 0.179398 0.311632 0.006372 0.023667 0.033926

(-1.370737) (-1.434632) (-1.309151) (0.307025) (0.407927) (0.711628) (0.155570) (0.563019) (0.8258)

EFF -0.151473 -0.149078 -0.162956 0.069076 0.060156 0.04844 0.007047 0.003123 0.002731

(-0.515963) (-0.496515) (-0.532507) (0.849921) (0.723817) (0.590675) (0.894745) (0.391722) (0.349764)

MB 0.000294 0.000348 0.000336 -0.000159* -0.00017* -0.000179** -0.00000699 -0.0000112 -0.0000123

(0.757606) (0.866313) (0.821848) (-1.893251) (-1.964559) (-2.128337) (-0.889141) (-1.427498) (-1.647066)

DIV -0.267689 -0.307176 -0.317709 -0.170845 -0.159407 -0.16767 -0.026035** -0.021149* -0.019161*

(-0.70292) (-0.788794) (-0.806108) (-1.491359) (-1.344173) (-1.432472) (-2.536031) (-1.968043) (-1.835141) SIZE 0.354466* 0.386124* 0.384599* -0.098642** -0.106291** -0.10979** -0.011843** -0.014571*** -0.014998*** (1.760998) (1.842691) (1.801754) (-2.01269) (-2.051439) (-2.116824) (-2.249597) (-2.633941) (-2.749152) N

Adj. Rsquared 0.022289 0.017367 0.010912 0.135348 0.132119 0.154829 0.141406 0.160701 0.205307

145

Variabel Beta Stock Vol Idiosyncratic Vol

FSTS and Beta

In model 1, 2, and 3 was not found significant results between FSTS and beta. So that when the level of internationalization of the company is still in the stage of early stage, there is no effect on the risk of the company.

FSTS and Stock Volatility

Model 6 showed a significant result between FSTS and stock volatility companies that have shown inverted S-shaped pattern. FSTS has a positive influence on stock volatility when new companies internationalize (FSTS <3%) due to the complexity of the company's first time doing internationalization. Furthermore, when the company made the process of internationalization at the level of higher than 3%, FSTS will negatively affects the company's stock volatility, which means that the company benefits from internationalization in accordance with the portfolio theory of Markowitz (1957). However, when the international diversification of the company has more than 12%, stock volatility will rise again, which shows the cost of international diversification return is greater than the benefit received by the company.

FSTS and Idiosyncratic Volatility

the new company to diversify internationally (FSTS <3%) will decrease when the company diversified its international higher than 3%, which the company benefits from international diversification in accordance with the theory portfolio of Markowitz (1957). Model 9 showed a significant result between FSTS and idiosyncratic volatility shows inverted S-shaped pattern. FSTS has a positive influence on the idiosyncratic volatility when the new company to diversify internationally (FSTS <3%) due to increased sales of business risks such as risk, additional taxes, transaction costs. Furthermore, when the company diversified its international higher than 3%, FSTS will negatively affect the company's idiosyncratic volatility, which means that the company benefits from international diversification portfolio accordance with the theory of Markowitz (1957). However, when the international diversification of the company has more than 12%, idiosyncratic volatility will rise again, which shows the cost of international diversification return is greater than the benefit received by the company. Subsample FSTS≥10% (Mature Stage)

Table 3. Regression Results Subsample FSTS≥10%

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 Model 8 Model 9

C 11.11663 10.6521 12.35672 2.201831 2.242704 2.25499 0.144977 0.141619 0.147035

(2.401521) (2.244165) (2.224795) (2.575901) (2.660165) (2.516916) (2.144943) (2.076235) (1.928817)

FSTS 1.741302*** 1.661105 -4.324161 0.232291 1.144134** 1.136482 0.016608 0.080114* 0.059618

(3.021305) (0.738963) (-0.963517) (1.608964) (2.0656) (0.756037) (1.372784) (1.763257) (0.491740)

FSTS^2 0.186584 16.54169 -0.884257* -0.866517 -0.061970 -0.015885

(0.057499) (1.424896) (-1.702732) (-0.252492) (-1.457980) (-0.057798)

FSTS^3 -11.67938 -0.011683 -0.029207

(-1.300161) (-0.005317) (-0.165484)

LIQ -0.275654*** -0.273361*** -0.279005*** -0.063186* -0.065955* -0.066221* -0.00466 -0.005186 -0.005006

(-5.693277) (-5.663866) (-5.548774) (-1.755595) (-1.844933) (-1.837684) (-1.471303) (-1.586792) (-1.493189) LEV -2.000173*** -1.956954*** -1.901434*** 0.173084* 0.176982* 0.176031* 0.030621*** 0.028919*** 0.029124*** (-4.955204) (-4.779706) (-4.716454) (1.871218) (1.938668) (1.898802) (3.192171) (2.996463) (3.015522) PROF -1.973855** -1.981682** -2.078753** 1.696316*** 1.566601*** 1.565725*** 0.225772*** 0.209500*** 0.207112*** (-2.289173) (-2.292263) (-2.30435) (3.385965) (3.102482) (3.079377) (3.903489) (3.444844) (3.353860)

EFF 0.092093 0.092275 0.064545 0.033236 0.045095 0.045131 0.0000562 0.001205 0.001236

(1.136657) (1.183332) (0.906476) (0.771932) (1.040222) (1.029517) (0.016024) (0.327839) (0.335537) MB -0.018564 -0.018966 -0.019469 -0.008448*** -0.007662** -0.007667** -0.000811*** -0.000725*** -0.000727*** (-1.408835) (-1.476402) (-1.499197) (-2.825828) (-2.563176) (-2.536878) (-4.124929) (-3.471329) (-3.442889)

DIV -0.087335 -0.089019 -0.094011 -0.026641 -0.028419 -0.028297 -0.000659 -0.000684 -0.000688

(-1.640034) (-1.582272) (-1.555187) (-0.733866) (-0.783899) (-0.768777) (-0.209691) (-0.207890) (-0.207706)

SIZE -0.760315** -0.725532* -0.817293** 0.011204 -0.006315 -0.007168 -0.005124 -0.005734 -0.005994

(-2.120327) (-1.940632) (-1.987928) (0.164049) (-0.092594) (-0.102615) (-0.96696) (-1.071876) (-1.055842) N

Adj. Rsquared 0.453655 0.451569 0.443662 0.070113 0.078439 0.073641 0.207919 0.213521 0.207392

240

Variabel Beta Stock Vol Idiosyncratic Vol

FSTS and Beta

Demonstrated a significant positive relationship model 1 means that internationalization will increase the systematic risk of the company, the higher the level of internationalization, companies are increasingly sensitive to changes in the market.

FSTS and Stock Volatility

356 ISBN (Vietnam): 978-604-73-4020-0

risk when the level of internationalization of the company below 86% (FSTS <86). This is due to the uncertainty, the higher the complexity, and difficulty in monitoring in the foreign market. However, when the level of internationalization of the company is more than or equal to 86%, the company's total risk will tend to be stable / falling. This is because the company's main market is no longer the domestic market, so that managers, investors / shareholders, and other stakeholders are already capable of and used to manage and monitor multinational companies.

FSTS and Idiosyncratic Volatility

Model 8 showed a significant result between FSTS and idiosyncratic volatility companies that have shown an inverted U-shaped pattern. There is a positive influence on the risk of non-systematic company when the company's internationalization level below 65% (FSTS <65). This is due to the additional costs that must be incurred by the company as well as the lack of information and experiences that increase the risk of the company's business. However, when the level of internationalization of the company is more than or equal to 65%, the unsystematic risk companies will decline. This is because the company is already getting knowledge in managing international markets.

CONCLUSION

Based on the results of testing the hypothesis, it is known that the level of internationalization for all samples, independent variables FSTS has a significant positive effect on systematic risk, total risk, and the unsystematic risk enterprises described linearly. At the level of internationalization of less than 10% (subsample FSTS <10%), are inverted S-shaped pattern between internationalization and total risk or unsystematic risk, whereas no significant effect on systemic risk. While the level of internationalization is more than or equal to 10% (subsample FSTS≥10%), internationalization has a significant positive effect on systematic risk, and there is an inverted U-shaped pattern between internationalization and total risk, are also at unsystematic risk.

company when the internationalization process so that companies can develop better risk management.

This study has limitations that can be used as an opportunity for the next researcher to conduct research next. Limitations of this study include: (1) This study assumes that the integration of capital markets that are not described in the study; (2) This study uses monthly beta is considered normal distribution, so the monthly beta equal to the annual beta, and can be paired with the annual data. For subsequent researchers, researchers can add a period of research and study sample that research results more valid and less biased. Subsequent researchers can also conduct research in sectors other than manufacturing. It would be very useful for companies in sectors other than manufacturing because it will provide new information to determine the risk of the company when the process of internationalization. In addition, researchers can observe the effect of internationalization on the risk through different proxies, such as the ratio of foreign assets to total assets, the ratio of foreign cost to total cost, the amount of investment destination, as well as the geographical segments in order to provide more accurate information on their internationalization.

REFERENCES

1. Aabo, T., Pantzalis, C., Sorensen, H., dan Teilmann T.M., 2014, Corporate Risk and External Sourcing from Foreign Suppliers: A Scandinavian Stock Market, Working Paper, Aarhus University and University of South Florida.

2. Ang, J., Peterson, P., Peterson, D., 1985, Investigations into the Determinants of Risk: A New Look, Quarterlu Journal of Business and Economics, Vol. 24(1): 3-20.

3. Bodie, Z., dkk., 2008, Essentials of Investments, 7th Edition, McGraw-Hill.

4. Bowman, R.G., 1979, The Theoretical Relationship between Systematic Risk and Financial (Accounting) Variables, The Journal of Finance, Vol. 34: 617-630.

5. Dunning, J.J., 1977, Trade, Location of Economic Activity and the MNEs: A Search for an Ecletic Paradigm, The International Allocation of Economic Activity, p. 395-418.

6. Eiteman, D.K., Stonehill, A.I., dan Moffett, M.H., 2010, Multinational Business Finance, 12th edition, Pearson Education.

7. Fama, Eugene F., 1978, The Effect of a Firm’s Investment and Financing Decision on the Welfare of its Security Holders, American Economic Review, Vol: 68: 272-28.

8. Giri, R., 2012, Local Costs of Distribution, International Trade Costs and Micro Evidence on the Law of One Price, Journal of International Econoics, Vol. 86(1): 82-100.

9. Gitman, L.J. dan Zutter, C.J., 2015, Principles of Managerial Finance, 14th Edition, Pearson Education.

358 ISBN (Vietnam): 978-604-73-4020-0

11. Grant, R., 1987, Multinationality and Performance among British Manufacturing Companies, Journal of International Business Studies, Vol. 18(3): 79-89.

12. Grant, R.M., 2010, Contemporary Strategy Analysis, 7th Edition, United Kingdom: Wiley. 13. Hamada, R.S., 1972, The Effect of the Firm’s Capital Structure on the Systematic Risk of

Common Stocks, The Journal of Finance, Vol. 27: 435-452.

14. Iqbal, M.J. dan Shah, S.Z.A., 2009, Determinants of Systematic Risk, The Journal of Commerce. Vol.4(1).

15. Jin, L. dan Myers, S.C., 2006, R 2 Around the World: New Theory and New Tests, Journal of Financial Economics, Vol. 79(2): 257-292.

16. Joliet, R. dan Hubner, G., 2003, Firm Internationalization and Systematic Risk: A Multidimensional Approach, Working Paper, University of Liege dan Maastricht University.

17. Krapl, A.A., 2015, Corporate International Diversification and Risk, International Review of Financial Analysis, Vol. 37: 1-13.

18. Markowitz, H.M., 1952, Portfolio Selection, The Journal of Finance, Vol: 7(1): 77-91. 19. Megginson, W.L., 1997, Corporate Finance Theory, Addison-Wesley.

20. Modigliani, F. dan Miller, M., 1958, The Expected Cost of Equity Capital, Corporation Finance, and the Theory of Investment, American Economic Review, p. 261-297.

21. Olibe, K.O., Michello, F.A., dan Thorne, J., 2008, Systematic Risk and International Diversification: An Empirical Perspective, International Review of Financial Analysis, Vol. 17: 681-698.

22. Reeb, D.M., Kwok, C.C., dan Baek, H.Y., 1998, Systematic Risk of the Multinational Corporation, Journal of International Business Studies, p. 263-279.

23. Riaz, L., Hunjra, A.I., Rauf-i-Azam, 2012, Impact of Psychological Factors on Investment Decision Making Mediating by Risk Perception: A Conceptual Study, Middle-East Journal of Scientific Research, Vol. 12 (6): 789-795.

24. Roth, K. dan O’Donnell, S., 1996, Foreign Subsidiary Compensation Strategy: An Agency Theory Perspective. Academy of Management Journal, Vol. 39(3): 678-703.

25. Singh, M. dan Nejadmalayeri, A., 2004, Internationalization, Capital Structure, and Cost of Capital: Evidence from French Corporations, Journal of Multinational Finance, Vol. 14: 153-169.

26. Thomsen, A.H., Risk and Internationalization: An Empirical Study of Large Firms in the Euro Countries 2006-2011, Thesis, Aarhus University.

27. Weston, J.F. dan Copeland, T.E., 1992, Managerial Finance, 9th Edition, Forth Worth: The Dryden.

28. www.finance.yahoo.com

1 GENERAL INSTRUCTIONS

1.1 Type area

The text should fit exactly into the type area of 187

× 272 mm (7.36" × 10.71"). For correct settings of margins in the Page Setup dialog box (File menu) see Table 1.

1.2 Typefont, typesize and spacing

Use Times New Roman 12 point size and 13 point line spacing (Standard;text tag). Use roman type ex-cept for the headings (Heading tags), parameters in mathematics (not for log, sin, cos, ln, max., d (in dx), etc), Latin names of species and genera in botany and zoology and the titles of journals and books which should all be in italics. Never use bold, except to denote vectors in mathematics. Never underline any text. Use the small font (10 points on 11 points) for tables (Table tags), figure captions (Figure cap-tion tag) and the references (Reference text tag).

Never use letterspacing and never use more than one space after each other.

2 GETTING STARTED

2.1 Preparing the new file with the correct template

Copy the template file B2ProcA4.dot (if you print on

per) to the template directory. This directory can be found by selecting the Tools menu, Options and then by tabbing the File Locations. When the Word pro-gramme has been started open the File menu and choose New. Now select the template B2ProcA4.dot or B2ProcLe.dot (see above). Start by renaming the document by clicking Save As in the menu Files. Name your file as follows: First three letters of the file name should be the first three letters of the last name of the first author, the second three letters should be the first letter of the first three words of the title of the paper (e.g. this paper: balpcc.doc). Now you can type your paper, or copy the old ver-sion of your paper onto this new formated file.

2.2 Copying old text onto new file

Open your old file and the new file. Switch between these two with the Window menu. Select all text of the old file (excluding title, authors, affiliations and abstract) and paste onto bottom of new file, after having deleted the word INTRODUCTION (see also section 2.5). Check the margin setting (Page Setup dialog box in File menu) and column settings (see Table 1 for correct settings). After this copy the texts which have to be placed in the frames (see sections 2.3 and 2.4 ). In order to avoid disruption of the text and frames, copy these texts paragraph by paragraph without including the first word (which includes the

A.T. Balkema & G. Westers

A.A. Balkema Publishers, Rotterdam, Netherlands

B. Unknown

New Institute, Gouda, Netherlands

paper. * Column dialog box in Format menu.

old tag). It is best to first retype the first words man-ually and then to paste the correct text behind. When the new file contains all the text, the old tags in the text should be replaced by the new Balkema tags (see section 3). Before doing this apply automatic formatting (AutoFormat in Format menu).

2.3 Title, author and affiliation frame

Place the cursor on the T of Title at the top of your newly named file and type the title of the paper in lower case (no caps except for proper names). The title should not be longer than 75 characters). Delete the word Title (do not delete the paragraph end). Place the cursor on the A of A.B.Author(s) and type the name of the first author (first the initials and then the last name). If any of the co-authors have the same affiliation as the first author, add his name af-ter an & (or a comma if more names follow). Delete the words A.B. Author etc. and place the cursor on the A of Affiliation. Type the correct affiliation (Name of the institute, City, State/Province, Coun-try). Now delete the word Affiliation. If there are au-thors linked to other institutes, place the cursor at the end of the affiliation line just typed and give a re-turn. Now type the name(s) of the author(s) and after a return the affiliation. Repeat this procedure until all affiliations have been typed.

All these texts fit in a frame which should not be changed (Width: Exactly 187 mm (7.36"); Height: Exactly 73 mm (2.87") from top margin; Lock an-chor).

2.4 Abstract frame

If there are no further authors place the cursor one space behind the word ABSTRACT: and type your abstract of not more than 150 words. The top of the first line of the abstract will be 73 mm (2.87") from the top of the type area. The complete abstract will fall in the abstract frame, the settings of which should also not be changed (Width: Exactly 187 mm (7.36"); Height: Automatic; Vertical 73 mm (2.87") from margin; Lock anchor).

If your text starts with a heading, place the cursor on the I of INTRODUCTION and type the correct text for the heading. Now delete the word INTRODUC-TION and start with the text after a return. This text should have the tag First paragraph.

If your text starts without a heading you should place the cursor on the I of INTRODUCTION, change the tag to First paragraph and type your text after deleting the word INTRODUCTION.

3 LAYOUT OF TEXT

3.1 Text and indenting

Text is set in two columns of 9 cm (3.54") width each with 7 mm (0.28") spacing between the col-umns. All text should be typed in Times New Ro-man, 12 pt on 13 pt line spacing except for the paper title (18 pt on 20 pt), author(s) (14 pt on 16 pt), and the small text in tables, captions and references (10 pt on 11 pt). All line spacing is exact. Never add any space between lines or paragraphs. When a column has blank lines at the bottom of the page, add space above and below headings (see opposite column).

First lines of paragraphs are indented 5 mm (0.2") except for paragraphs after a heading or a blank line (First paragraph tag).

3.2 Headings

Type primary headings in capital letters roman (Heading 1 tag) and secondary and tertiary headings in lower case italics (Headings 2 and 3 tags). Head-ings are set flush against the left margin. The tag will give two blank lines (26 pt) above and one (13 pt) beneath the primary headings, 1½ blank lines (20 pt) above and a ½ blank line (6 pt) beneath the sec-ondary headings and one blank line (13 pt) above the tertiary headings. Headings are not indented and nei-ther are the first lines of text following the heading indented. If a primary heading is directly followed by a secondary heading, only a ½ blank line should be set between the two headings. In the Word pro-gramme this has to be done manually as follows: Place the cursor on the primary heading, select Para-graph in the Format menu, and change the setting for spacing after, from 13 pt to 0 pt. In the same way the setting in the secondary heading for spacing before should be changed from 20 pt to 7 pt.

3.3 Listing and numbering

Use the equation editor of the selected word pro-cessing programme. Equations are not indented (Formula tag). Number equations consecutively and place the number with the tab key at the end of the line, between parantheses. Refer to equations by these numbers. See for example Equation 1 below:

From the above we note that sin θ = (x + y)z or:

interface; and k1 = shear stiffness number.

For simple equations in the text always use super-script and subsuper-script (select Font in the Format menu). Do not use the equation editor between text on same line.

The inline equations (equations within a sen-tence) in the text will automatically be converted to the AMS notation standard.

3.5 Tables

Locate tables close to the first reference to them in the text and number them consecutively. Avoid ab-breviations in column headings. Indicate units in the line immediately below the heading. Explanations should be given at the foot of the table, not within the table itself. Use only horizontal rules: One above and one below the column headings and one at the foot of the table (Table rule tag: Use the Shift-minus key to actually type the rule exactly where you want it). For simple tables use the tab key and not the ta-ble option. Type all text in tata-bles in small type: 10 on 11 points (Table text tag). Align all headings to the left of their column and start these headings with an initial capital. Type the caption above the table to the same width as the table (Table caption tag). See for example Table 1.

3.6 Figure captions

Always use the Figure caption style tag (10 points size on 11 points line space). Place the caption un-derneath the figure (see Section 5). Type as follows: ‘Figure 1. Caption.’ Leave about two lines of space between the figure caption and the text of the paper.

3.7 References

In the text, place the authors’ last names (without in-itials) and the date of publication in parentheses (see examples in Section 5). At the end of the paper, list all references in alphabetical order underneath the heading REFERENCES (Reference heading tag). The references should be typed in small text (10 pt

works by the same author are cited, entries should be chronological:

Larch, A.A. 1996a. Development ... Larch, A.A. 1996b. Facilities ... Larch, A.A. 1997. Computer ...

Larch, A.A. & Jensen, M.C. 1996. Effects of ... Larch, A.A. & Smith, B.P. 1993. Alpine ...

3.7.1 Typography for references

Last name, First name or Initials (ed.) year. Book title. City: Publisher.

Last name, First name or Initials year. Title of article. Title of Journal (series number if necessary) volume number (issue number if necessary): page numbers.

3.7.2 Examples

Grove, A.T. 1980. Geomorphic evolution of the Sahara and the Nile. In M.A.J. Williams & H. Faure (eds), The Sahara and the Nile: 21-35. Rotterdam: Balkema.

Jappelli, R. & Marconi, N. 1997. Recommendations and preju-dices in the realm of foundation engineering in Italy: A his-torical review. In Carlo Viggiani (ed.), Geotechnical engi-neering for the preservation of monuments and historical sites; Proc. intern. symp., Napoli, 3-4 October 1996. Rot-terdam: Balkema.

Johnson, H.L. 1965. Artistic development in autistic children. Child Development 65(1): 13-16.

Polhill, R.M. 1982. Crotalaria in Africa and Madagascar. Rot-terdam: Balkema.

3.8 Notes

These should be avoided. Insert the information in the text. In tables the following reference marks should be used: *, **, etc. and the actual footnotes set directly underneath the table.

3.9 Conclusions

Conclusions should state concisely the most im-portant propositions of the paper as well as the au-thor’s views of the practical implications of the re-sults.

4 PHOTOGRAPHS AND FIGURES