Corporate responsibility from a

socio-institutional perspective

The impact of national culture on corporate

social performance

Dimo Ringov and Maurizio Zollo

Abstract

Purpose– This paper sets out to investigate the effect of differences in national cultures on the social and environmental performance of companies around the world.

Design/methodology/approach– Theoretical propositions on how the various dimensions of national culture influence corporate social responsibility are developed and empirically tested.

Findings– The authors propose that companies based in countries characterized by higher levels of power distance, individualism, masculinity, and uncertainty avoidance exhibit lower levels of social and environmental performance. Empirical tests of these propositions are performed via pooled ordinary least squares regression models using a novel proprietary dataset on 463 firms from 23 North American, European and Asian countries. Power distance and masculinity are found to have a significant negative effect on corporate social and environmental performance, whereas cultural differences with respect to individualism and uncertainty avoidance have no significant effect.

Originality/value– The potential contribution of this work lies in offering empirical evidence to test the widely held assumption that corporations’ socially responsible behavior is influenced by the cultural context in their home country. The adoption and the external appreciation of this kind of behavior does appear to be contingent on specific dimensions of national culture, but not on others. Thus, positive social change through voluntary corporate action may be optimized via initiatives that build on specific cultural values in the relevant country.

KeywordsCorporate social responsibility, Business performance, National cultures

Paper typeResearch paper

Introduction

Corporate responsibility has been the subject of intense, and intensifying, debate for at least four decades now. Early on during this period, the question about the role of the corporation in society was discussed in the strategy and business policy domain (Andrews, 1971, 1972). Only recently, however, did it resurface as a problem that extant strategy theories fail to consider explicitly, and on which strategy scholars need to focus their attention.

One of the salient features of the debate has been the question of the cultural specificity of the very notion of corporate responsibility itself. The main line of argument has been that the concept of corporate responsibility is inherently context-specific, with national culture playing an important part in influencing how society expects businesses to behave. This argument is of high strategic relevance, to the extent it should find empirical support, since the content and the tailoring of strategic decisions, especially by multinational companies, will be inherently affected. For example, high levels of cultural-specificity will require correspondingly high investments in understanding and tailoring decisions and actions to

Dimo Ringov is a PhD candidate in the Department of Strategy & Management, INSEAD, Singapore.

Maurizio Zollo is Associate Professor of Strategy in the Department of Strategy & Management, INSEAD, Fontainebleau, France.

The authors would like to express their gratitude to Susan Schneider for her critical comments on previous drafts of the paper and for her collaboration in the following steps on this line of work. Also, Innovest has kindly made the data available for this study, in the context of a multi-year project funded by the European Union’s 6th Framework Program, code-named RESPONSE. The authors are indebted to Innovest and to all the scholars involved in RESPONSE for their contributions to bringing forth that line of work, of which this paper is but a minor

each local context, rather than in developing a standard, homogeneous, approach applicable and upheld in all cultural milieus.

Unfortunately, as of today, we do not have a solid empirical base to link national culture to corporate responsibility, most of the debate being fueled by conceptual arguments or anecdotal evidence from cross-country case studies. This paper attempts to fill this gap by: providing a theoretical argument of precisely how one could expect the various dimensions of national culture to influence corporate responsibility, and an empirical test on a large dataset of the proposed theoretical hypotheses.

Theoretical discussion and hypotheses

We explore the effects of national culture along the dimensions proposed by Hofstede (1980) – power distance, individualism, masculinity, and uncertainty avoidance.

Power distance

Social and environmental initiatives are more likely to emerge and be openly discussed if power distance is low. What is more, low power distance should have a positive impact on the timely recognition and remedy of social and environmental risks. It can make companies safer for truth telling and whistle blowing. There is evidence that people from a high power-distance culture are more likely to view a questionable business practice as ethical than people from a low power-distance culture (Cohenet al., 1996). High levels of power distance are associated with polarization and low employee involvement in decision-making processes, thus, not conducive to a more inclusive, stakeholder-oriented approach to management:

H1. Companies based in higher power distance countries exhibit lower levels of social/environmental performance.

Individualism

Individualism is generally defined as the cultural belief, and corresponding social pattern, that individuals should take responsibility primarily for their own interests and those of their immediate family (Hofstede, 1980; Triandis, 1995). Unless it is in their recognized self-interest, one should expect firms in highly individualistic societies to demonstrate less of a concern about the broader impact of business on society:

H2. Companies based in more individualistic countries exhibit lower levels of social/environmental performance.

Masculinity

Highly masculine societies place low value on caring for others, on inclusion, cooperation, and solidarity. Career advancement, material success and competition are paramount. Cooperation is considered a sign of weakness. In a study of 1,846 entrepreneurs from seven countries Steensmaet al.(2000) find that those from more masculine countries have a lower appreciation for cooperative strategies. Furthermore, experimental evidence from Tice and Baumeister (2004) suggests that masculinity inhibits helping behaviors. This leads us to hypothesize that higher levels of masculinity will have a negative impact on corporate social and environmental responsiveness:

H3. Companies based in more masculine countries exhibit lower levels of social/environmental performance.

Uncertainty avoidance

H4. Companies based in more uncertainty avoiding countries exhibit lower levels of social/environmental performance.

Data and measures

This study is designed to evaluate how national differences in cultural values impact on firms’ social and environmental performance. To address this question we utilize a unique multi-industry proprietary dataset comprising ratings of the social and environmental performance of 1,100 public companies from 34 countries on five continents issued by Innovest Group.

Innovest is the world’s leading international investment research firm specializing in the analysis of ‘‘non-traditional’’ drivers of risk and shareholder value, including companies’ performance on environmental, social, and responsible governance issues. Given the inherent difficulty associated with measuring corporate accountability, corporate social and environmental appraisals by social rating agencies, such as the Innovest Group, provide, we believe, some of the best metrics currently available to management researchers. Out of the group of established social rating agencies, Innovest was chosen for a number of reasons including its largest universe of rated firms, its worldwide coverage, transparent rating methodology and industry leadership position.

The Innovest set of company social and environmental performance ratings was augmented with measures of national cultural values obtained from the Hofstede (1980) and GLOBE (Houseet al., 2004) studies. Hofstede’s (1980) dimensions of national cultural values have become the de-facto standard in cross-cultural research and are being extensively used in a broad spectrum of social science fields. Geert Hofstede analyzed a large database of employee values scores collected by IBM between 1967 and 1973 covering more than 70 countries, from which he first used the 40 largest only and afterwards extended the analysis to 50 countries. Hofstede found that differences in national cultures vary substantially along four dimensions. These dimensions were labeled uncertainty avoidance, individualism, power distance, and masculinity. The global leadership and organizational behavior effectiveness (GLOBE) measures of national cultural values are the outcome of a 11-year research program designed to conceptualize, operationalize, test, and validate a cross-level integrated theory of the relationship between culture and societal, organizational, and leadership effectiveness. An international team of 160 scholars worked together from 1994 to 2004 to study national culture, organizational culture, and attributes of effective leadership in 62 cultures.

Four (out of the nine) dimensions of national culture studied in the GLOBE project – power distance, in-group collectivism, gender egalitarianism, uncertainty avoidance – are conceptually very close to the respective Hofstede dimensions. Thus, the GLOBE data provides a second and more up-to-date set of measures of the dimensions of national culture of theoretical interest to our study. Finally, we collected comprehensive Worldscope firm-level archival data on firm size, growth, financial performance, leverage, productivity, international sales, etc. for all firms in our sample. The final sample contains observations on 457 to 463 firms (depending on the model) from 23 North American, European and Asian countries.

Dependent variable

liabilities as well as a greater ability to capitalize on environmentally or socially driven profit opportunities.

Explanatory variables

The explanatory variables of interest to this study are four dimensions of national culture – power distance, individualism, masculinity, and uncertainty avoidance. Each dimension is measured in two ways – using both the Hofstede (1980) and the corresponding GLOBE (Houseet al., 2004) country scores.

Power distance

This dimension concerns national values with respect to power inequality in the workplace and society at large. It reflects the degree to which an unequal distribution of power and authority in institutions is viewed as legitimate. We measure this cultural dimension using countries’ scores on the Hofstede and GLOBE power distance scales.

Individualism

This dimension of national culture describes prevailing beliefs about the relationship between the individual and the collectivity in a given society. It reflects the relative importance ascribed to individual freedom, individual achievement and personal time as compared to collective effort, collective achievement, cohesiveness and loyalty to organizations and families. This dimension is measured using the corresponding Hofstede country individualism indexes as well as an inverse measure of individualism – the GLOBE ‘‘in-group collectivism’’ country scores.

Masculinity

This dimension concerns the social implications of gender-associated cultural values and beliefs. More ‘‘masculine’’ cultures value achievement, heroism, assertiveness, and material success. More ‘‘feminine’’ cultures tend to emphasize social relationships, modesty, caring for the weak, and interpersonal harmony. This dimension is measured using the corresponding Hofstede masculinity country scores as well as the best available (inverse) proxy from the GLOBE study – the ‘‘gender egalitarianism’’ country scores.

Uncertainty avoidance

This dimension concerns cultural preferences for dealing with uncertainty. The more threatening uncertainty is perceived to be, the more highly valued are beliefs and institutions that provide certainty. Thus, societies scoring high on this dimension strive to avoid uncertainty by relying on stable social norms, highly structured bureaucracies, rules promoting employment security, etc. Our measures for this cultural dimension are the corresponding uncertainty avoidance country indexes as in the Hofstede and GLOBE studies.

Control variables

We control for a number of firm- and industry-level factors that may affect companies’ social and environmental performance while being correlated with our primary independent variables. In particular, we use Worldscope data to control for firm size, growth, financial performance, financial leverage, productivity, and degree of multinationality. Industry-fixed effects are used to control for stable inter-industry unobserved heterogeneity in corporate non-financial performance. All control variables are lagged by one year. Table I provides a detailed description of the control variables used in our analyses.

Results

Table I Control variables description

Variable name Description

Size The natural logarithm of sales revenue in USD

Growth The natural logarithm of growth in sales revenue

Profitability The ratio of EBIT to total sales revenue

Tobin’s Q The sum of the market value of common stock, book value of preferred stock, and book value of debt divided by the book value of total assets

Leverage The ratio of total (long- and short-term) debt to total capital Productivity The ratio of sales revenue in USD to total employees Multinationality Foreign sales as a percentage of total sales

Industry dummies Dummy variables for primary industry (as defined by Innovest)

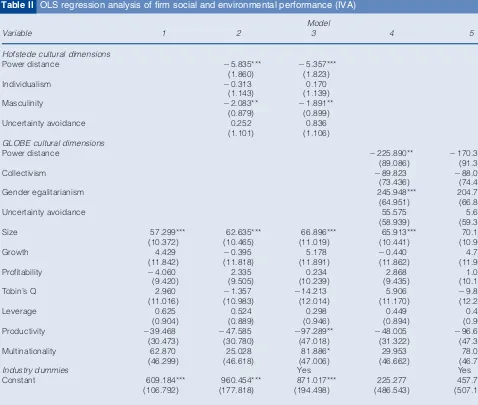

Table II OLS regression analysis of firm social and environmental performance (IVA)

Model

Variable 1 2 3 4 5

Hofstede cultural dimensions

Power distance 25.835*** 25.357***

(1.860) (1.823)

Individualism 20.313 0.170

(1.143) (1.139)

Masculinity 22.083** 21.891**

(0.879) (0.899)

Uncertainty avoidance 0.252 0.836

(1.101) (1.106)

GLOBE cultural dimensions

Power distance 2225.890** 2170.379*

(89.086) (91.309)

Collectivism 289.823 288.052

(73.436) (74.451)

Gender egalitarianism 245.948*** 204.747***

(64.951) (66.860)

Uncertainty avoidance 55.575 5.655

(58.939) (59.380)

Size 57.299*** 62.635*** 66.896*** 65.913*** 70.137***

(10.372) (10.465) (11.019) (10.441) (10.912)

Growth 4.429 20.395 5.178 20.440 4.716

(11.842) (11.818) (11.891) (11.862) (11.922)

Profitability 24.060 2.335 0.234 2.868 1.048

(9.420) (9.505) (10.239) (9.435) (10.166)

Tobin’s Q 2.960 21.357 214.213 5.906 29.821

(11.016) (10.983) (12.014) (11.170) (12.266)

Leverage 0.625 0.524 0.298 0.449 0.416

(0.904) (0.889) (0.946) (0.894) (0.952)

Productivity 239.468 247.585 297.289** 248.005 296.669**

(30.473) (30.780) (47.018) (31.322) (47.371)

Multinationality 62.870 25.028 81.886* 29.953 78.021*

(46.299) (46.618) (47.006) (46.662) (46.743)

Industry dummies Yes Yes

Constant 609.184*** 960.454*** 871.017*** 225.277 457.741

(106.792) (177.818) (194.498) (486.543) (507.127)

Observations 463 462 462 457 457

R-squared 0.07 0.12 0.27 0.11 0.27

In model 2 we introduce the Hofstede measures for our four main explanatory variables – power distance, individualism, masculinity, and uncertainty avoidance. The estimation results provide strong support forH1andH3. Home country national values do affect the perceived level of corporate accountability. Greater home country tolerance of power distance is significantly negatively associated with firms’ social and environmental performance. Likewise, home country bias in favor of masculine values, such as aggressiveness, career progression, and material success, has a significant negative impact on corporate accountability. However, we find no support forH2andH4. Surprisingly, there is no evidence that companies from more collectivist countries exhibit higher levels of social and environmental performance. The impact of home country individualistic values on corporate accountability is essentially zero. In addition, we find no evidence that firms originating from societies with higher levels of uncertainty avoidance score lower in terms of their social and environmental performance. National cultures favoring stronger rule orientation and employment stability do not appear to materially affect companies’ perceived behavior in the domain of corporate accountability.

An even stronger test of our hypotheses is performed in model 3 where we control for persistent unobserved inter-industry heterogeneity in corporate accountability by including fixed-effect intercepts for each industry. The estimated effects of national cultural values on corporate social and environmental performance remain qualitatively unchanged and of virtually the same magnitude. Once again, our evidence demonstrates that corporate accountability is negatively associated with home country power distance and masculinity. At the same time, contrary to our hypotheses, deeply-held societal values regarding individualism and uncertainty avoidance appear to be inconsequential.

To test the sensitivity of our findings to alternative measures of the explanatory constructs in models 4 and 5 we use the GLOBE (Houseet al., 2004) country power distance, in-group collectivism, gender egalitarianism, and uncertainty avoidance scores. Our findings remain robust. Power distance, as measured by the GLOBE score, has a negative and significant effect on firm social and environmental performance, whereas gender egalitarianism (a proxy for a lack of masculinity) has a positive and significant effect. The coefficients for collectivism (an inverse measure of individualism) and uncertainty avoidance are once again insignificant. The totality of the evidence allows us to make a first step towards identifying the cultural roots of corporate accountability. Our results suggest that a responsible role of business in society is fostered by low tolerance for power distance as well as by a high degree of gender egalitarianism. In contrast, and contrary to common wisdom, collectivist societies do not seem more likely than individualistic ones to be the home of socially and environmentally responsible businesses. Finally, the same ‘‘no difference’’ result obtains as regards the impact on responsible corporate behavior of home country attitudes towards uncertainty avoidance.

Conclusions

This paper set out to develop the theoretical linkages between national culture and the general level of social responsibility corporations are perceived to have achieved. We find that two of the four dimensions of national culture analyzed, namely power distance and masculinity, influence in a significant way and in the hypothesized negative direction the perceived quality of corporate behavior. However, no significant effect was borne out in our data for the other two dimensions of national culture – uncertainty avoidance and collectivism.

References

Andrews, K.R. (1971),The Concept of Corporate Strategy, Dow Jones-Irwin, Homewood, IL.

Andrews, K.R. (1972), ‘‘Public responsibility in the private corporation’’,Journal of Industrial Economics, Vol. 20 No. 2, pp. 135-45.

Cohen, J.R., Pant, L.W. and Sharp, D.J. (1996), ‘‘A methodological note on cross-cultural accounting ethics research’’,International Journal of Accounting, Vol. 31 No. 1, pp. 55-66.

Hofstede, G. (1980),Culture’s Consequences: International Differences in Work-Related Values, Sage Publications, Beverly Hills, CA.

House, R.J., Hanges, P.J., Javidan, M. and Gupta, V. (2004),Culture, Leadership, and Organizations: The GLOBE Study of 62 Societies, Sage Publications, Thousand Oaks, CA.

Shane, S. (1993), ‘‘Cultural influences on national rates of innovation’’,Journal of Business Venturing, Vol. 8 No. 1, pp. 59-73.

Shane, S. (1995), ‘‘Uncertainty avoidance and the preference for innovation championing roles’’,Journal of International Business Studies, Vol. 26 No. 1, pp. 47-68.

Steensma, K., Marino, L. and Weaver, K. (2000), ‘‘Attitudes toward cooperative strategies: a cross-cultural analysis of entrepreneurs’’, Journal of International Business Studies, Vol. 31 No. 4, pp. 591-609.

Tice, D.M. and Baumeister, R.F. (2004), ‘‘Masculinity inhibits helping in emergencies: personality does predict the bystander effect’’,Journal of Personality and Social Psychology, Vol. 49 No. 2, pp. 420-8. Triandis, H.C. (1995),Individualism and Collectivism, Westview Press, Boulder, CO.

Appendix. Innovest intangible value assessment (IVA) criteria

The strategic governance assessment criteria

B Strategic capability/direction.

B External stakeholder input/advisory boards.

B Shareholder activism response.

B Board structure.

B Board/management diversity.

B Senior CSR/social officer.

B Social factor in compensation.

B Integration with core business.

B Consistency – all operations/international.

B Performance indicators and targets/accounting.

B Reporting/disclosure/transparency.

B Auditing.

B Social/ethical standards.

B Sustainability charter signatory/council member.

B Codes signatory – global compact, OECD, child labor, UND human rights, SA 8000, ETI, ILO, etc.

B Investment policy/screening.

B Charitable giving policy and performance.

B Bribery policy/enforcement.

B Product social/ethical impact.

B Boycotts.

B Product certification/labels.

B Safety/quality issues.

B IPRs – patents.

The human capital assessment criteria

B Employee retention rate.

B Work policies – job sharing, flexible schedule/location, etc.

B Training and knowledge dissemination.

B Benefits – health care, wellness programs, child care, etc.

B Monitoring of employee satisfaction rates.

B Health and safety policy/auditing.

B Health and safety performance – absentee and injury rates, etc.

B Access to management/grievance procedures/whistleblower protection.

B Union policy/issues.

B Claims/litigation/fines.

The stakeholder capital assessment criteria

1. Community support programs – volunteer, local development, etc.

2. Policy on using local suppliers/contractors.

3. Plant closure policy/impact.

4. Disaster planning/local approval/third party audit.

5. Controversy/protests/claims/litigation/fines.

6. Awards.

7. Stakeholder engagement activities/stakeholder access.

8. Supplier screening policy – CSR performance, ethnicity, gender, size, etc.

9. Required code of conduct.

10. Supplier training and development programs.

11. Supplier social audits.

12. Third party review.

13. Developing country (DC) policy/programs – benefit sharing, local input, etc.

14. DC strategy/market dev. – investment, technology/skills transfer, etc.

15. DC share of production/DC share of revenue.

16. advertising policy/respect for local culture.

17. controversy/protests/claims/litigation/fines.

18. Implementation of policies relating to human rights, child labor, forced labor, equal opportunities.

19. Negative screen:

B Weapons – involvement in manufacture or sale of armaments, weapons systems or critical components thereof.

B Tobacco – involvement in manufacture, distribution or sale of tobacco products.

B Nuclear power – involvement in ownership or operation of nuclear power plants, uranium mining, reprocessing of nuclear fuel, manufacture of nuclear power facilities.

B Contraceptives – involvement in the production, sale or distribution of contraceptives.

B Animal testing – involvement in provision of animal testing services or use of primates, commercialization of xenotransplantation. Animal testing used for development of cosmetics, household products, food additives, chemicals for non-medical products.

B Alcohol – involvement in production, sale and/or distribution of alcohol.

B Pornography – involvement in production or distribution of pornographic material, or ownership/management of ‘‘adult entertainment’’ establishments.

B Gambling – involvement in management or ownership of gambling facilities.

B Other – e.g. Climate change, deforestation, ozone depleting substances, pvc, intensive farming.

The environmental assessment criteria

B Policies.

B Integration with core business.

B Profitability linkages.

B Consistency – all operations/international.

B Board structure.

B Senior environmental officer level.

B Environmental factor in compensation.

B Number and qualifications of environmental staff.

B ISO 14000 or other certified EMS.

B Environmental performance indicators.

B Audit existence.

B Audit adequacy.

B Audit frequency.

B Audit impartiality.

B Environmental reporting.

B Environmental accounting.

B Environmental training and development.

B Use of CERES/GRI guidelines.

B Other outside code.

B Voluntary EPA programs.

B Life cycle analysis.

B Suppliers – environmental screen

B Eco-labels

B Contaminated site liabilities.

B Other historic liabilities.

B Spills and releases.

B Regulatory compliance* scores include NYU data.

B Toxic emissions.

B Hazardous waste.

B Other operating risk.

B Resource use efficiency/recycling.

B Market risk – including environmental sensitivities of customers.

B Regulatory/legal risk.

B Other emissions risk.

B Other sustainability risk – operations.

B Performance improvement vector.

B Strategic competence.

B Environmental opportunity.

B Environmental business development strategy/planning.

B Organizational structure.

B Environmental sensitivity of geographic regions served.

B Environmental sensitivity of demographic groups served.

B Phase-out risk of products and services.

B Environmental improvement potential.

B Environmental positioning within sector.

B Current environmental businesses.

B Environmental businesses under development.

About the authors

Dimo Ringov is a PhD candidate in Strategy at INSEAD (France and Singapore). He is also an MBA holder and a Krannert Scholar from the Krannert School of Management at Purdue University (USA). Dimo Ringov is the corresponding author and can be contacted at: [email protected]

Maurizio Zollo is the Shell Fellow in Business and the Environment and Associate Professor of Strategy at INSEAD. He is also the deputy director of INSEAD’s Business In Society (IBIS) center.