Vol. 11. No. 2. September 2015 Issue. Pp. 90

–

103

Do Bank-Specific Characteristics Determine Loan Portfolio

Returns? A Study of Government-owned Banks in Indonesia

Apriani D.R Atahau

1*

This paper analyses the impact of bank-specific characteristics on the loan portfolio returns of government-owned banks (GBs) in Indonesia. The data covers the pre and post GFC periods from 2003-2011 of 30 GBs (270 bank year observations). Using fixed-effect panel data regression, the results show that size, equity and liquidity affect the loan portfolio returns of GBs in Indonesia. This suggests that the lending policies and loan pricing of GBs in Indonesia may differ based on their specific characteristics. These differences could serve as prominent information for Central Bank in the governing of GBs based on their characteristics.

Keywords: Bank-specific characteristics, Loan Portfolio Return, Government-owned Banks, Indonesia

JEL classification: G21

1. Introduction

Lending is a primary activity for banks, notwithstanding the inclusion of other products like insurance or services such as corporate business consulting services, in their operations (Cronje, 2013). Lending generally transforms short-term bank funding sources into short-, medium- and long-term assets, which often results in maturity mismatches. The asset-liability maturity mismatches expose banks to interest rate risk, which again may affect market, product and bank-loan-pricing decisions. As such returns of banks differ. For example, the Indonesian GB with the highest average loan portfolio return exceeds that of the GB with the lowest average loan portfolio return with 43% over the 2003-2011 period. Large banks with larger equity levels tend to survive better in tight monetary conditions characterised by high interest rates. They are also less prone to the sudden withdrawal of funds as a consequence of having higher liquidity and equity levels. As a result, their loan interest income may be more stable compared to the small banks. Therefore, the question arises whether the differences in the loan portfolio returns of banks occur because of internal bank decisions based on specific bank characteristics, such as size (Pasiouras and Kosmidou (2007), level of equity (Bourke, 1989, Demirguc-Kunt and Huizinga,1999, and García-Herrero et al. 2009) and liquidity (Berger and Bouwman (2009).

* Apriani D.R Atahau, a Senior lecturer in Satya Wacana Christian University and completed her PhD from School of Economics and Finance, Curtin University, Kent Street, Bentley, Perth, WA 6102. Email:

91 In Indonesia, GBs play a prominent role as financial intermediaries. Data retrieved from Indonesian Banking Statistics indicate that the GBs retained a dominant market share of almost 50% in the loan market over the period 2003 to 2011 (Appendix 1) although they represent just 25% of the overall number of banks in Indonesia. GBs were the major Indonesian loan providers over the 2003-2011 period (Appendix 2). The total amount of loans provided by GBs in 2011 was almost three times as much as that of other domestic banks, and nearly twice as much as that of foreign-owned Banks.

Researchers like Athanasoglou et al. (2008) and Pasiouras and Kosmidou (2007) examined how specific characteristics of banks and other variables such as macroeconomic conditions affect the profitability of banks in the European Union. Pasiouras and Kosmidou (2007) focused on foreign and domestic-owned banks. Other research has focused on all types of banks and using overall bank returns/profitability instead of loan portfolio returns. Another study conducted by Gambacorta (2001) investigated the relationship between bank-specific characteristics and monetary policy transmission. Furthermore, the weak performance of GBs was researched by La-Porta et al. (2002), Barth et al. (2004), Sapienza (2004), Berger et al. (2005a) and Taboada (2011), without reference to the relationship between bank-specific characteristics and loan portfolio returns.

The literature describing determinants of bank profitability in Indonesia is scarce. Syafri (2012) analysed bank profitability determinants in Indonesia for the 2002-2011 period. Herwany and Anwar (2006) conducted the same research on the profitability of Indonesian commercial banks by comparing provincial government banks and private non-foreign banks. However, this existing literature focus on bank profitability in general as measured by ROA and ROE. None of it refers to loan portfolio returns which are directly related to bank lending decisions.This study is different from others since it uses the ratio of loan interest income to average total loans to measure bank loan profitability. Banks’ interest income from loans (after loan repayment defaults) constitutes the actual achieved return, Therefore, it is considered to be a more relevant measure of loan portfolio return than ROA and ROE. Moreover, for an Indonesian perspective, no research has to date been conducted about government banks as a whole, since Herwany and Anwar (2006) only considered provincial government banks.

To address the existing research gap, the objective of this study is to determine the extent to which the loan portfolio return of GBs in Indonesia is affected by bank-specific bank characteristics. This is based on the financial data of individual banks collected from their annual reports over the 2003 to 2011 research period. Hence, the use of bank-level information contributes to the theoretical significance of this paper.

The findings show that the loan portfolio returns of GBs in Indonesia are affected by bank-specific characteristics (size, equity and liquidity) and support the research of Pasiouras and Kosmidou (2007) conducted in the European Union.

The organisation of this paper is as follows: the literature review is conducted in the second part. Part 3 contains the empirical research methodology applied in this study. The research findings are presented in part 4. The last part concludes the research and provides recommendations for future research.

2. Literature Review

92 in Canada, Western Europe and Japan (Pasiouras and Kosmidou, 2007). This was followed by studies of Bourke (1989) and Molyneux and Thornton (1992) who focused on cross-country analysis and Berger et al. (1987) and Dietrich and Wanzenried (2011) who focused on single countries. Studies dealing with bank-specific characteristics as internal determinants of bank profitability employ variables such as size, equity, capital and credit risk (Bourke, 1989, Athanasoglou et al., 2008, Dietrich and Wanzenried, 2011, Syafri, 2012). Bank size can be regarded as a determinant of bank returns. Pasiouras and Kosmidou (2007) argue that bank size is positively related to bank profitability. This is due to the ability of large banks to benefit from economies of scope by diversifying their products. Larger banks also benefit from economies of scale which increase economic efficiency and reduce risk. Considering the economics of scope and economics of scale benefit enjoyed by large banks, it is hypothesized by Pasiouras and Kosmidou (2007) that size increase is positively related to bank returns. On the other hand, Stiroh and Rumble (2006) state that when the costs arising from being large (agency cost, overhead cost, etc.) exceed the economics of scale and economics of scope benefit, the relationship between large size and bank returns might become negative. Previous research by Smirlock (1985) already found a negative relationship between bank size and profitability. In addition, according to Carter et al. (2004) the lending performance of small banks may be better than that of large banks because of the structure performance (SP), information advantage (IA), and relationship development (RD) theories. The SP theory relates to the industry or market structure in which banks operate. In this regard Gilbert (1984) states that small banks may experience higher interest income when operating in smaller markets with a limited number of competitors. The IA theory refers to the information accessibility and organisational structures of banks. Nakamura (1993, 1994) and Mester et al. (1999) points out that small banks have the advantage of credit information accessibility. Their flat organisational structures also allow better delegated borrower monitoring (Carter et al., 2004). Finally, the RD theory contrasts

the relationship lending conducted by small banks using “soft information” about borrowers

to arms-length lending by large banks using “hard information of borrowers (Berger et al., 2005b). Small banks have the advantage of serving the “soft information” borrowers due to their ability to maintain a close relationship with the borrowers.

To avoid capital risk, banks should maintain a sufficient level of equity. The risk will decrease if the probability of losses decreases or when the proportion of equity increases (Hogan et al., 2004). By reducing the capital risks (maintaining higher equity to total asset ratios), banks experience lower risk and lower return. In this context when banks increase equity to total capital to reduce capital risk, the expected return will decrease because the average cost of equity is generally more than the cost of debt. In contrast, when banks increase their financial leverage (maintaining low equity to total assets ratios), they may achieve higher returns despite the increase in risk. Notwithstanding the theoretical causality differences, Dietrich and Wanzenried (2011) note that empirical evidence by Bourke (1989), Demirguc-Kunt and Huizinga (1999), and García-Herrero et al. (2009) indicate that there is a positive relationship between ratios of equity to total assets and the performance of banks.

93 bank to create liquidity, because the higher equity ratio acts as buffer to absorb the greater risk created by higher liquidity (Distinguin et al., 2013).

In addition to the aforementioned theories, exposure to credit risk by banks can also be associated with bank profitability since a greater exposure to high-risk loans would lead to higher accumulation of unpaid loans thus lowering bank profitability (Athanasoglou et al., 2008). This was supported by the findings of Bourke (1989).

All the retrieved literature describing determinants of bank profitability focus on ROA and ROE. None of it refers to loan portfolio return as part of bank profitability which directly relates to bank lending decisions. This research explicitly employs the ratio of loan interest income to average total loans to measure loan portfolio returns. It has not been used in previous literature due to the data constraints.

In view of the impact of bank-specific characteristics (bank sizes, equity, liquidity and risk) that previous researchers have identified as determinants of bank profitability, it is hypothesized that bank-specific characteristics affect the loan portfolio returns, as part of total bank profitability.

2.1 A Brief History of Government-owned Banks in Indonesia

94

3. Research Methodology

3.1 Sample, Types and Sources of Data

All Indonesian GBs that operated over the total 2003 to 2011 period of time were included in this research. This period encompasses the post-Asian financial crisis period from 2003 to the commencement of the global financial crisis (GFC) in 2007 and the post-GFC situation from 2007 onwards. This constitutes a total observation of 270 (30 banks for 9 years). One large bank (Bank Ekspor Indonesia) that only existed for a part of the research period (from August 1999 to 1 September 2009) was excluded. This research utilised secondary data from The Indonesian Central Bank Library, and the library of The Indonesian Banking Development Institute (LPPI). The central bank library provides individual bank financial statements whereas LPPI provides loan interest income data. All financial data obtained from the central bank and LPPI library were based on audited financial statements provided by individual banks, therefore the data sources are highly creditable. The macroeconomic data were obtained from the Indonesian Financial Statistics accessed from Bank Indonesia website (www.bi.go.id).

3.2 Variable Definitions and Measurement

3.2.1 Measures of Loan Portfolio Returns

To measure the loan portfolio returns, the ratio of loan interest income to average total loans is used in this research since in the broader sense it reflects the comparative pricing applied by banks. The gross loan interest income to total loans, after loan repayment defaults, constitutes the actual achieved returns. The loan portfolio return of GBs serves as the dependent variable.

3.2.2 Measures of Bank- Specific Characteristics

The independent variables representing bank-specific characteristics used in this study are: bank size, bank equity percentage, bank liquidity percentage and the loan repayment default risk. These four variables are used since they are considered as the determinants of bank performance according to literature (Pasiouras and Kosmidou, 2007, Athanasoglou et al., 2008, Sufian, 2011). This research uses the natural logarithm of bank total assets as measure of size. It captures the economy of scale effect on loan portfolio returns that may result from larger loan portfolios. Bank equity percentage is measured by ratio of Total Equity to Total Assets whereas liquidity percentage is measured by the ratio of Total Loans to Total Deposits. The level of bank equity serves as indicator of the deposit safety of banks and also the ability of banks to comply with loan commitments. The liquidity ratio reflects the relative focus of banks on lending versus more liquid investments like securities. Loan portfolio repayment default risk is measured by ratio of Non-Performing Loans (NPLs) to Total Loans. It differs from previous research by Athanasoglou et al. (2008), Sufian (2011), and Dietrich and Wanzenried (2011) where the ratio of Loan Loss Provisions to Total Loans is used as the measure of credit risk. Loan Loss Provision1 is subject to regulation and bank manager subjectivity. NPL gives a good proxy for the level of loan portfolio risk exposure as it serves

95 According to Cronje (2013) loan portfolio risks are classified into two broad categories namely intrinsic- and concentration risk. Within the context of this study intrinsic risk refers to the risk inherent to each sector, and each loan type of a bank. It cannot be measured in this study since comparative risk information like loan defaults for each sector and each loan type is not available. Only loan repayment default information, provided in the form of non-performing loans for the total loan portfolio is available for individual banks and is used as proxy of overall bank loan portfolio risk.

3.2.3 Measures of Macroeconomic Variables

Interest rate and Gross Domestic Product GDP growth serve as the macroeconomic variables. These macroeconomic variables represent the external environment that might affect the lending performance of banks. Appendix 3 reflects all the variables, their definitions and how they are measured.

3.3 Hypothesis

It is hypothesized that bank-specific characteristics affect the loan portfolio returns as part of overall bank profit in view of the impact of bank-specific characteristics (bank sizes, equity, liquidity and risk ) on bank profitability that various researchers have identified.

3.4 Data Analysis

All research data is numerical, therefore quantitative data analysis is conducted. Firstly, descriptive statistics of the variables (means and standard deviations) were calculated to determine data tendency and deviations. Secondly, to determine the impact of bank-specific characteristics (size, equity and liquidity and risk) on portfolio returns, the following panel data regression equation is used:

………..(3.1)

= loan portfolio returns for government-owned bank i in year t

= bank size for government-owned bank i in year t

= bank equity ratio for government-owned bank i in year t

= bank liquidity ratio for government-owned bank i in year t

= loan portfolio default payment risk for bank i at year t

= macroeconomic variables

, = regression coefficients; and

= the disturbance term.

This research employs fixed effects panel data regression. The selection of the fixed effects model instead of the random effects model is based on the Hausman test. The test checks a more efficient model against a less efficient but consistent model to make sure that the more efficient model also gives consistent results. A correct robust setting has been applied in the regression.

3.5 Limitations of this Research

96 banks and therefore unavailable. The availability of such data would have allowed a more comprehensive risk-return analysis.

4. Empirical Results and Findings

4.1 Descriptive Statistics

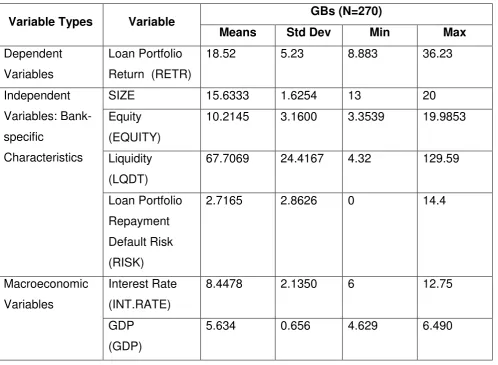

Table 1 contains the summary statistics for the variables in the model. By analyzing the mean and the standard deviation of loan portfolio returns, the loan portfolio returns of GBs are on average 18.5%. However, the distribution of returns is quite dispersed due to a relatively high standard deviation.

The descriptive statistics for the bank-specific characteristics provide interesting results. The average equity to total assets ratio (10.22%) is higher than the Capital Adequacy Ratio benchmark set by the central bank (8%). In terms of liquidity, GBs retain a better level of liquidity (67.8% loan to deposit ratio) than the standard of 80% set by the central bank. The average gross non-performing loan percentage of GBs of 2.314% is low in contrast to regulation PBI 2/11/PBI/2000 jo PBI 15/2/PBI/2013 of the Central Bank that requires a 5% standard for the net non-performing loan ratio (Bank Indonesia, 2013). In essence, the overall bank-specific characteristics of GBs comply totally with central bank regulations.

Table 1 Descriptive Statistics of Research Variables (in %)

Variable Types Variable GBs (N=270)

Means Std Dev Min Max

Dependent Variables

Loan Portfolio Return (RETR)

18.52 5.23 8.883 36.23

Independent Variables: Bank-specific

Characteristics

SIZE 15.6333 1.6254 13 20

Equity (EQUITY)

10.2145 3.1600 3.3539 19.9853

Liquidity (LQDT)

67.7069 24.4167 4.32 129.59

Loan Portfolio Repayment Default Risk (RISK)

2.7165 2.8626 0 14.4

Macroeconomic Variables

Interest Rate (INT.RATE)

8.4478 2.1350 6 12.75

GDP (GDP)

97

4.2 The Effect of Bank-Specific Characteristics on Loan Portfolio Returns: A Multivariate Analysis

The impact of bank-specific characteristics (size, level of liquidity, equity and risk) on loan portfolio returns for GBs is presented in Table 2 below:

Table 2 Panel Data Regression: Relationship between Bank- Specific Characteristics and Loan Portfolio Returns

Loan Portfolio Returns

CONSTANT Coefficient 0.5389***

t-Statistic 5.48

SIZE Coefficient -0.0217***

t-Statistic -3.52

EQUITY Coefficient 0.44872**

t-Statistic 2.19

LQDT Coefficient -0.0006**

t-Statistic -2.32

RISK Coefficient -0.0008

t-Statistic -0.78

INT.RATE Coefficient -0.0008

t-Statistic -0.65

GDP Coefficient -0.1538

t-Statistic -0.39

Number of observations 270

Number of banks 30

R-sq within 0.2390

R-sq between 0.3645

R-sq overall 0.2937

Legend: This table present the fixed effects estimation of equation 3.1. The dependent variable is Loan Portfolio Returns (RETR). The independent variables are bank sizes, bank equity (EQUITY), bank liquidity (LQDT), loan repayment default risk (RISK),. Interest rate (INT.RATE) and GDP serve as macroeconomic variables. The table contains coefficients and t-statistics from fixed effect regression. Definitions of variables are provided in Appendix 1. ***, **, and * respectively correspond to 1%, 5%, and 10% significance levels.

98 the interest rate earned from this segment is, based on data from Indonesian Statistics Bureau (www.bps.go.id), approximately 1.5-2 % higher than that of other types of financing (Atahau and Cronje, 2014). The 1% statistical significance of the size coefficient provides evidence that the size of GBs does affect loan portfolio returns.

The equity to assets (EQUITY) ratio shows a positive relationship with loan portfolio return. This results indicate that GBs with high equity ratios have the capacity to allocate more loans which generate more interest income from loans. This finding is consistent with previous studies of Berger (1995).

On the other hand, the negative and significant relationship between bank liquidity and loan portfolio returns indicates that banks that lends more aggressively when considering liquidity have higher returns on their loan portfolios. Thus GBs that maintain comparable high liquidity levels have lower loan portfolio returns. The result is in line with the findings of Molyneux and Thornton (1992) with regard to the negative relationship between liquidity and overall bank profitability.

The negative coefficient of RISK shows that the more non-performing loans of GBs , the lower their loan portfolio returns. However, the relationship is not statistically significant. The finding differs from the findings of Athanasoglou et.al for the Greek industry where risk significantly affects the profitability of banks.

Finally, the relationship between GDP and loan portfolio returns is negative and insignificant. Therefore, the impact of economic cycles on the portfolio returns from market segments that banks conduct business with seems to constitute minor negative impact .

The overall results in this paper provides interesting new insight about how loan portfolio returns of Indonesian GBs is explained by bank-specific characteristics and the macroeconomic variable. The findings are relevant for several reasons. First, the estimation results confirm findings from former studies on determinants of bank performance. Second, it consider a unique bank-level data set of bank specific characteristics. Third, it focus on the years from 2003-2011 which encompasses the pre and post Global Financial Crisis periods.

5. Conclusions

This paper examined how bank-specific characteristics and macroeconomic factors affect loan portfolio returns of 30 government-owned banks in Indonesia over the period 2003-2011. This research provides empirical evidence that size, equity, liquidity and GDP are determinants of GB loan portfolio return in Indonesia from 2003 to 2011. This longitudinal nature of the evidence serve as major contribution since some prior studies (Acharya et al., 2002, Elyasiani and Deng, 2004) only focused on single cross-sectional periods.

Findings here support the hypotheses that size affect loan portfolio return. The negative coefficient of size indicate that small GBs have higher loan portfolio returns compared to large banks. The result is in line with the findings of Carter et al. (2004) that small banks earn higher returns than large GBs due to their performance structure, information advantage and development of relationships with customers. However, the findings of Carter et al. (2004) are based on the risk adjusted yield of returns, whereas this research uses the loan interest income to average total loans ratio.

99 with high equity ratios have the capacity to allocate more loans which generate more interest income from loans. On the other hand, increasing bank liquidity result in a lower loan portfolio returns. The underlying reasons for this relationship could not be verified, but it may be due to more conservative lending in the case of more liquid banks. This could, based on risk return principles, result in lower returns based on lower risk for the more liquid banks.

The loan portfolio repayment default risk of GBs has a negative relationship with loan portfolio returns and confirms that it results in non-interest income. However, it also serves as indicator that banks do not necessarily price interest rates on average higher to compensate for possible interest rate losses that could be associated with loan defaults.

Finally, the negative and insignificant relationship between GDP and loan portfolio returns indicate that loan portfolio returns of GBs in Indonesia are affected by bank-specific characteristics and not the impact of economic cycles on portfolio returns of market segments with which the banks conduct business.

The findings in this paper may be of considerable interest to banks as a means to explore determinants of bank loan portfolio returns with the purpose of suggesting optimal policies and practices to bank management.

Information about NPLs of the specific loan products or sectors to which banks provide loans could not be retrieved from any secondary data sources. The availability of such data would have allowed a more comprehensive risk-return analysis.

Acknowledgments

The author would like to thank Indonesian government for providing DIKTI scholarship.

Endnotes

1. General provision is set as one percent of the current liquid assets and the special provision varies according to loan collectibility: five percent for the special mention category, 15 percent for the sub standard category, 50 percent for the doubtful category and finally 100 percent for the loss category. It is required that the calculation be done by first deducting the realisable collateral value from the asset under provision in any of the aforementioned categories of collectability

References

Acharya, VV, Hasan, I & Saunders, A 2002, Should Banks Be Diversified? Evidence From Individual Bank Loan Portfolios. Bank For International Settlements, Switzerland

Alijoyo, A, Bouma, E, Sutawinangun, TMN & Kusadrianto, MD 2004, Corporate Governance In Indonesia, Forum For Corporate Governance Indonesia, ADB, Manila

Athanasoglou, PP, Brissimis, SN & Delis, MD 2008, 'Bank-Specific, Industry-Specific And Macroeconomic Determinants Of Bank Profitability', International Financial Markets, Institution And Money, vol.18, pp. 121-36.

Bank Indonesia 2013, 'Peraturan Bank Indonesia Nomor 15/2/PBI/2013 Tentang Penetapan Status Dan Tindak Lanjut Pengawasan Bank Umum Konvensional' [Bank Indonesia Regulation Number 15/2/PBI/2013 On Oversight Status Determination And Oversight Follow-Up Actions For Conventional Commercial Banks], Bank Indonesia, Jakarta. Barth, JR, Caprio, GG & Levine, R 2004, 'Bank Regulation And Supervision: What Works

100 Batunanggar, S 2002, Indonesia's Banking Crisis Resolution: Lessons And The Way

Forward, Bank Of England, London

Bennet, MS 1999, 'Banking Deregulation In Indonesia: An Updated Perspective In Light Of The Asian Financial Crisis', University Of Pennsylvania Journal Of International Economic Law, vol.20, pp. 1-59

Berger, AN 1995, 'The Relationship Between Capital And Earnings In Banking', Journal Of Money, Credit And Bank, vol.27, pp. 432-56.

Berger, AN & Bouwman, CHS 2009, 'Bank Liquidity Creation', Review Of Financial Studies,

vol.22, pp.3779-837.

Berger, AN, Clarke, GRG, Cull, R, Klapper, L & Udell, GF 2005a, Corporate Governance And Bank Performance: A Joint Analysis Of The Static, Selection, And Dynamic Effects Of Domestic, Foreign And State Ownership, World Bank Policy Research Paper, vol. 3632, World Bank, Washington.

Berger, AN, Hanweck, GA & Humphrey, DB 1987, 'Competitive Viability In Banking : Scale, Scope, And Product Mix Economies', Journal Of Monetary Economics, vol. 20, no.3, pp 501–20.

Berger, AN, Miller, NH, Petersen, MA & Rajan, RGS, Jeremy C 2005b, 'Does Function Follow Organizational Form? Evidence From The Lending Practices Of Large And Small

Banks', Journal Of Financial Economics, vol.76, pp.237-69.

Bourke, P 1989, 'Concentration And Other Determinants Of Bank Profitability In Europe, North America And Australia', Journal Of Banking And Finance, vol. 13, pp.65-79. Carter, DA, Mcnulty, JE & Verbrugge, JA 2004, 'Do Small Banks Have An Advantage In

Lending? An Examination Of Risk-Adjusted Yields On Business Loans At Large And Small Banks', Journal Of Financial Services Research, vol.25, pp.233-52.

Claessens, S & Horen, NV 2012, Foreign Banks: Trends, Impact And Financial Stability, International Monetary Fund, <http://ssrn.com/abstract=1107295>

Cronje, T 2013, Bank Lending, Mcgraw Hill, Australia.

Diamond, DW & Rajan, RG 2000, 'A Theory Of Bank Capital', The Journal Of Finance, vol. 55, pp.2431-465.

Dietrich, A & Wanzenried, G 2011, 'Determinants Of Bank Profitability Before And During The Crisis: Evidence From Switzerland', Journal Of International Financial Markets,

Institutions & Money, vol.21, pp. 307-27.

Distinguin, I, Roulet, C & Tarazi, A 2013, 'Bank Regulatory Capital And Liquidity: Evidence From Us Ad European Publicly Traded Banks', Journal Of Banking & Finance, vol. 37, pp. 3295-317.

Elyasiani, E & Deng, S 2004, Diversification Effects On The Performance Of Financial Services Firms, Technical Report, Philadelphia.

Gambacorta, L 2001, Bank-Specific Characteristics And Monetary Policy Transmission: The Case Of Italy, European Central Bank, London

Gilbert, RA 1984, 'Bank Market Structure And Competition: A Survey', Journal Of Money, Credit And Banking, vol.16, pp.617-45.

Herwany, A & Anwar, M 2006, 'The Determinants Of Successful Bank Profitability In

Indonesia: Empirical Study For Provincial Government’s Banks And Private Non -Foreign Banks', Proceedings: 1st International Conference On Business And Management Research, Bali.

Hogan, W, Avram, KJ, Brown, C, Degabriele, R, Ralston, D, Skully, M, Hempel, G,

Simonson, D & Sathye, M 2004, Management Of Financial Institutions, Second Edition, John Wiley & Sons, Australia.

La-Porta, R, Lopez-De-Silanes, F & Shleifer, A 2002, 'Government Ownership Of Banks',

Journal Of Finance, vol. LVII, pp.265-301.

Magalhaes, R, Urtiaga, MG & Tribo, JA 2010, 'Banks' Ownership Structure, Risk And

101 Mcleod, RH 1996, Control And Competition: Banking Deregulation And Re-Regulation In

Indonesia, The Australian National University, Australia.

Mian, A. 2003. Foreign, Private Domestic, And Government Banks: New Evidence From Emerging Markets, <siteresources.worldbank.org/INTMACRO/>.

Molyneux, P & Thornton, J 1992, 'Determinants Of European Bank Profitability: A Note',

Journal Of Banking & Finance, vol.16, pp.1173-178.

Pasiouras, F & Kosmidou, K 2007, 'Factors Influencing The Profitability Of Domestic And Foreign Commercial Banks In The European Union', Research In International Business And Finance, vol.21, pp.222-37.

Sapienza, P 2004, 'The Effects Of Government Ownership On Bank Lending', Journal Of Financial Economics, pp.357-84.

Sato, Y 2005, 'Bank Restructuring And Financial Institution Reform In Indonesia', The Developing Economies, vol. XlII, pp.91-120.

Smirlock, M 1985, 'Evidence On The (Non) Relationship Between Concentration And Profitability In Banking', Journal Of Money, Credit And Banking, vol.1, pp.69-83. Stiroh, KJ & Rumble, A 2006, 'The Dark Side Of Diversification: The Case Of Us Financial

Holding Companies', Journal Of Banking & Finance, vol.30, pp.2131-161.

Sufian, F 2011, 'Profitability Of The Korean Banking Sector: Panel Evidence Of Bank-Specific And Macroeconomic Determinants', Journal Of Economics And Management, vol. 7, pp.43-72.

Syafri 2012, 'Factors Affecting Bank Profitability In Indonesia', Proceeding Of The 2012 International Conference On Business And Management, Thailand, pp.236-42

102 Appendix 1 Market Share of Government-, Foreign-, and Domestic-owned Banks (as Percentage of Total Assets of all Banks)

Source: Indonesian Banking Statistics of Bank Indonesia (2003-2011)

Appendix 2 Proportional Total Loans of Government-, Foreign-, and Domestic-owned Banks

Source: Indonesian Banking Statistics of Bank Indonesia (2003-2011)

0 0.1 0.2 0.3 0.4 0.5 0.6

2003 2004 2005 2006 2007 2008 2009 2010 2011

GB FB DB

0.50 0.51

0.48 0.49 0.49 0.50

0.54 0.53 0.52

0.39 0.40 0.42 0.41 0.39

0.31

0.28

0.26 0.28

0.11 0.09 0.09 0.10 0.11

0.19 0.17 0.20 0.20

0.00 0.10 0.20 0.30 0.40 0.50 0.60

2003 2004 2005 2006 2007 2008 2009 2010 2011

103 Appendix 3 Variables Definition and Measurement