THE ENHANCEMENT DECISION THROUGH INVESTMENT

OPPORTUNITY SET (IOS): EVIDENCE TO LEVERAGE,

DEBT MATURITY, AND PROTECTIVE COVENANT

UNDERGRADUATE THESIS

SUBMITTED FOR PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR UNDERGARDUATE DEGREE OF ACCOUNTING

DEPARTEMENT OF ACCOUNTANCY ACCOUNTING STUDY PROGRAM

SUBMITTED BY:

YULLIANA EKANINGRUM

NIM: 040913021

FACULTY OF ECONOMIC AND BUSINESS

AIRLANGGA UNIVERSITY

ACKNOWLEDGMENT

By all praise and thanks for Allah SWT, for all the plenty of rahmat and

hidayah, protection, rescue, and blessings to me so that I can finish this

undergraduate thesis on time, and also the accompaniment of salam and sholawat

for the Prophet Muhammad SAW. Alhamdulillah I finally able to finish my

undergraduate thesis entitled “THE ENHANCEMENT DECISION THROUGH

IOS: EVIDENCE TO LEVERAGE, DEBT MATURITY, AND PROTECTIVE

COVENANT” as partial fulfillment of the requirement to obtain bachelor degree

of economics in accounting major at Airlangga University.

In the completion process of this undergraduate thesis, a lot of supports,

assistance, and motivation has been given to me. I would like to gratefully

acknowledge with gratitude to:

1. Mr. Prof. Dr. Muslich Anshori, SE., Msc., Ak., as the Dean of Economics

and Business Faculty, Airlangga University.

2. Mr.. Drs. Agus Widodo Mardijuwono, M.Si., Ak. As the Head of

Accounting Study Program, Economic and Business Faculty, Airlangga

University.

3. Dr. H. Zaenal Fanani, SE., MSA., Ak. as great supervisor, for the invaluable

assistances, supports, directions, advises, and time given in this completion

of undergraduate thesis. I do really deeply thanks for all the aids and

supports.

4. Drs. H. Djoko Dewantoro, MSi., Ak., who has been guiding me in college

5. All lectures in Airlangga University, for valuable teachings that have been

given that helped me to improve my knowledge and thought in many ways.

6. My beloved parents, Mitro Hadi Seputro and Wilarni, who always

understand, give me huge supports, loves and the best wishes for me. And

my lovely brothers, Muhammad Dwikurniawan and Mahendra Triatmaja for

always cheering me up.

7. My beloved Herlambang Setiadi, thank you for the aid in looking for

references, supports, great loves, understandings, and wishes.

8. All of the great and super English Class students, thank you for the

wonderful moments that occurred in the past few years and thanks for

helping me in shaping up my idea and research.

9. To whom has important role to the completion of my undergraduate thesis,

as well as expressing my apology that I could not mention personally.

May Allah SWT gives protection and blessing to all of the party. Hopefully,

this research can give contribution for the development of accounting knowledge.

Surabaya, February 2013

ABSTRACT

The existences of investment opportunity that lead to deal in financing decisions are potential appearing agency conflicts. Some of the former empirical evidences revealed that the consideration of investment opportunity in the choice of leverage, debt maturity and protective covenant can be one of efforts in controlling agency conflict respectively. This study investigates the influence of investment opportunity set (IOS) towards leverage, debt maturity and protective covenant. The sample of the research is non-financial companies that are listed in Indonesia Stock Exchange, issuing and publishing bond instrument, and having positive equity for the year 2009 until 2011. This research uses confirmatory factor analysis (CFA) in the measurement of IOS and protective covenant in accordance providing more accurate and comprehensive measurement in these variables. By using linear regression method, the findings of this research are, IOS has a negative significant effect towards leverage. Meanwhile, IOS has no significant effect towards debt maturity. Moreover, IOS has a positive influence towards protective covenant.

LIST OF CONTENTS

Title Page ... i

Validation Sheet ... ii

Thesis Originality Declaration... iii

Acknowledgment ... iv

Abstract... vi

List of Contents. ... vii

List of Tables ... xii

List of Figures... xiii

List of Appendix ... xiv

CHAPTER 1: INTRODUCTION 1.1. Research Background ... 1

1.2. Problem Formulation ... 7

1.3. Research Objectives ... 7

1.4. Research Contributions ... 7

1.5. Research Systematic ... 8

CHAPTER 2: LITERATURE REVIEW 2.1. Theoretical Review ... 10

2.1.1. Theory of Agency ... 10

2.1.1.1. Agency Theory of Outside Equity ... 12

2.1.1.2. Agency Theory of Debt ... 14

2.1.2. Theory of Investment Opportunity Set ... 15

2.1.3.1. Leverage... 18

2.1.3.2. Debt Maturity... 19

2.1.3.3. Protective Covenants ... 20

2.1.3.3.1. Definition of Protective Covenants... 20

2.1.3.3.2. Classification of Protective Covenants ... 22

2.1.3.4. Investment Opportunity Set (IOS) ... 28

2.1.3.4.1. Proxy Variables for Firm’s Investment Opportunity . 28 2.1.3.4.1.1. The Market-to-Book Assets Ratio ... 29

2.1.3.4.1.2. Market-to-Book Equity Ratio ... 30

2.1.3.5. Fixed Asset Ratio ... 30

2.1.3.6. Profitability ... 31

2.1.3.7. Firm Size ... 32

2.2. Previous Research ... 33

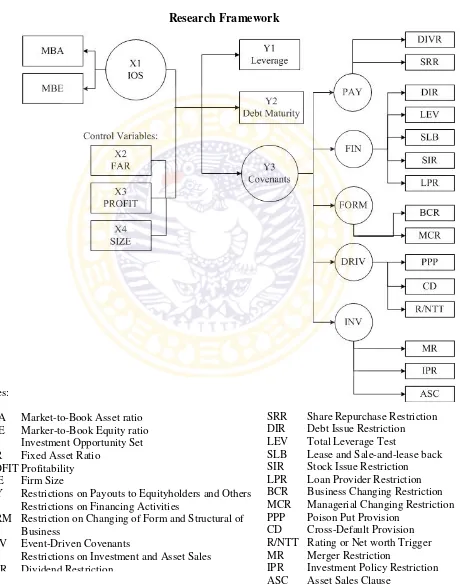

2.3. Conceptual Framework ... 47

2.4. Hypothesis... 49

2.4.1. The Influence of Investment Opportunity Set towards Leverage ... 49

2.4.2. The Influence of Investment Opportunity Set towards Debt Maturity . 51 2.4.3. The Influence of Investment Opportunity Set towards Protective Covenants ... 52

CHAPTER 3:RESEARCH METHODOLOGY 3.1. Research Approach ... 54

3.2. Variable Identification ... 54

3.2.2. Dependent Variables ... 55

3.2.3. Control Variables ... 55

3.3. Operational Definition and Measurement... 55

3.3.1. Investment Opportunity Set ... 55

3.3.2. Leverage... 58

3.3.3. Debt Maturity... 59

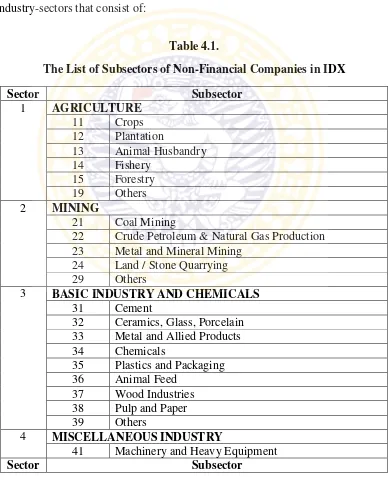

3.3.4. Protective Covenant ... 60

3.3.5. Fixed Assets ... 62

3.3.6. Profitability ... 63

3.3.7. Firm Size ... 63

3.4. Type and Source of Data... 64

3.5. Population and Sampling Method... 64

3.6. Data Technique Analysis ... 65

3.6.1. Steps of Data Technique Analysis ... 65

3.6.2. Confirmatory Factor Analysis (CFA) ... 66

3.6.3. Model of Analysis... 68

3.7. Criteria of Hypothesis Testing ... 68

3.8. Classical Assumption Test ... 69

3.8.1. Multicollinearity Test... 69

3.8.2. Autocorrelation Test ... 70

3.8.3. Heteroscedasticity Test ... 70

3.8.4. Normality Test ... 71

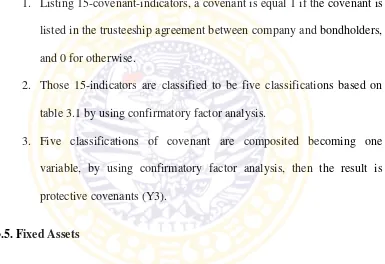

4.1. Description of Research’s Object ... 72

4.1.1. Indonesia Stock Exchange ... 72

4.1.2. Non-Financial Company ... 73

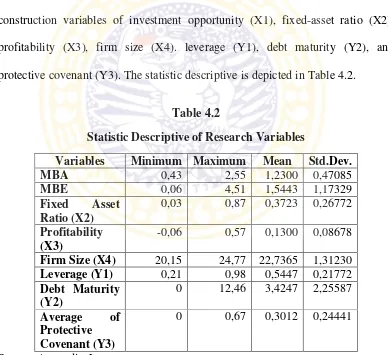

4.2. Description of Research’s Result... 75

4.2.1. Descriptive Statistic ... 75

4.2.1.1. Market-to-book Asset Ratio... 75

4.2.1.2. Market-to-book Equity Ratio ... 76

4.2.1.3. Fixed Assets Ratio ... 76

4.2.1.4. Profitability ... 77

4.2.1.5. Firm Size ... 77

4.2.1.6. Leverage... 77

4.2.1.7. Debt Maturity... 78

4.2.1.8. Protective Covenant ... 78

4.2.2. The Result of Investment Opportunity Set Confirmatory Factor Analysis ... 79

4.2.3. The Result of Protective Covenant Confirmatory Factor Analysis ... 80

4.3. Classical Assumption Test ... 84

4.3.1. Multicollinearity Test... 84

4.3.2. Autocorrelation Test ... 85

4.3.3. Heteroscedasticity Test ... 86

4.3.4. Normality Test ... 87

4.4. Analysis of Hypothesis Testing ... 87

4.5.1. The Influence of Investment Opportunity Set towards Leverage ... 90

4.5.2. The Influence of Investment Opportunity Set towards Debt Maturity . 92 4.5.3. The Influence of Investment Opportunity Set towards Protective Covenants ... 94

CHAPTER 5:CONCLUSIONS, SUGGESTIONS AND IMPLICATIONS 5.1. Conclusions... 95

5.2. Limitations ... 96

5.3. Suggestions ... 96

5.4. Implications... 96

LIST OF REFERENCES ... 98

LIST OF TABLES

Table 2.1. Classification of Covenants ... 24

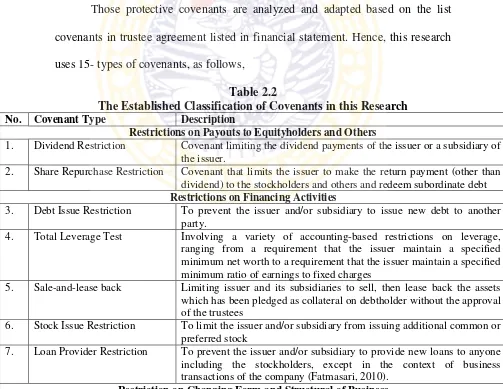

Table 2.2.The Established Classification of Covenants in this Research ... 27

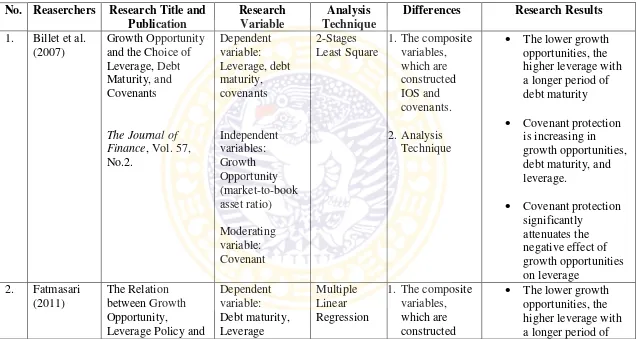

Table 2.3. Previous Research Results ... 40

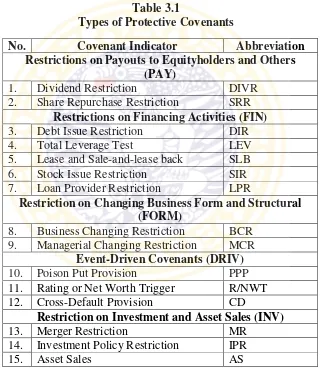

Table 3.1. Types of Protective Covenants ... 61

Table 3.2. The Determination of Sampling ... 65

Table 4.1. The List of Subsectors of Non-Financial Companies in IDX... 73

Table 4.2. Statistic Descriptive of Research Variables... 75

Table 4.3. Confirmatory Factor Analysis of IOS... 79

Table 4.4. Confirmatory Factor Analysis for 5-Classifications of Covenant Indicators ... 82

Table 4.5. Confirmatory Analysis Factor of Protective Covenants ... 83

Table 4.6. Multicollinearity Test ... 85

Table 4.7. The Result of Durbin-Watson Test ... 85

Table 4.8. White’s Test ... 86

Table 4.9. Kolmogorov-Smirnov Z Test... 87

LIST OF FIGURES

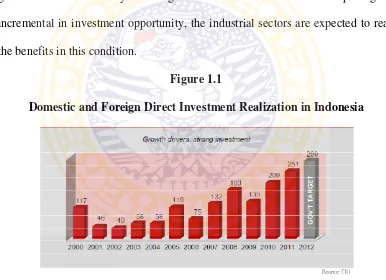

Figure 1.1. Domestic and Foreign Direct Investment Realization in Indonesia ... 1

Figure 2.1. Research Framework ... 48

Figure 4.1. The Result of Confirmatory Factor Analysis of Event-Driven

LIST OF APPENDIX

APPENDIX A: List of Companies Sample ... xv

APPENDIX B: Market-to-Book Assets Ratio ... xvi

APPENDIX C: Market-to-Book Equity Ratio... xix

APPENDIX D: Leverage Ratio ... xxii

APPENDIX E: Resuming of Weighted Average of Debt Maturity ... xxv

APPENDIX F: Index of Protective Covenant ... xxvi

APPENDIX G: Fixed-Assets Ratio ... xxviii

APPENDIX H: Profitability Ratio... xxxii

APPENDIX I: Firm Size... xxxix

APPENDIX J: Descriptive Statistic... xlii

APPENDIX K: Confirmatory Factor Analysis of Investment Opportunity Set . xliii

APPENDIX L: Confirmatory Factor Analysis of Restriction of Payouts to

Equityholders and Others... xliv

APPENDIX M: Confirmatory Factor Analysis of Restriction of Payouts

Financing Activities ... xlv

APPENDIX N: Confirmatory Factor Analysis of Restriction of Changing

Business Form and Structural... xlvii

APPENDIX O: Confirmatory Factor Analysis of Event-Driven Covenants .... xlviii

APPENDIX P: Confirmatory Factor Analysis of Restriction of Investment Policy

and Asset Sales ... xlviii

APPENDIX R: Regression of Investment Opportunity Set towards Leverage .... lvi

APPENDIX S: Regression of Investment Opportunity Set towards Debt Maturity

... lx

APPENDIX T: Regression of Investment Opportunity Set towards Protective

Covenants ... lx

CHAPTER 1

INTRODUCTION

1.1. Research Background

The main company goal is increasing the value of the company. The

investment decision and financing decision have the important role in the

enhancement of company value. Recent years, Indonesia is increasingly balancing

investment growth with domestic consumption which has been the primary

growth driver in recent years. A good incremental in investment depicts good

incremental in investment opportunity, the industrial sectors are expected to reap

the benefits in this condition.

Figure 1.1

Domestic and Foreign Direct Investment Realization in Indonesia

Source: (Economist Intelligence Unit (2012) in Sitorus and Avianti (2012))

Generally, company needs funds to finance the investment decision. The

numerous financing decisions are vital for the financial welfare of the company.

An incorrect decision about the capital structure may lead to significant financial

Concerning the financing activities of a company, it can obtain the fund

whether from internal and external source. First, it comes from the internal

sources, such as the issuance of stock and retained earnings. Second, it is derived

from external sources of the company in the form of a debt from a third party.

Regardless the size of the company, usually the companies choose to use the fund

from outside the company in the form of debt because it is cheaper than equity.

Debt is being a cheaper source of fund as compared to equity. Generally,

by dealing on debt through issuance of bonds is cheaper than raising equity

through a share issue. A major advantage is that the return on debt (interest) is

tax-deductible, whereas the return on equity (dividends) is paid out of a

company’s profits, which are taxed before dividend payments can be made to

stockholders. Financing by raising debt is a useful way of monitoring a

corporation’s overall health, as the ability to repay the debt reflects the overall

financial stability of the company (QFinance, 2012).

Regarding investment decision, if the company has improper decision in

dealing investment opportunity, then it can cause overinvestment problem or

underinvestment problem. Generally, overinvestment problem occurs in the

company that has low investment opportunity have low growth level, but have

large free cash flow and assets in place. The main problem is in the different

perspectives between manager and stockholder in allocating the capital excess

(Myers, 1977). The agency conflict of outside equity between manager and

stockholder has appeared. Manager tends to invest the capital excess to risky

dividends (Jensen 1986). The improper decision in exercising the investment

opportunities and financing the investment could bring harmful for the company.

These faults could stimulate the agency conflict within company that can decrease

the firm value and leads to financial distress.

Otherwise, underinvestment problem generally occur in the company that

has high investment opportunities, high growth rates, active conducting

investment, low cash flow and smaller assets in place. Myers (1977) explains that

the underinvestment problem occurs when firm with high investment

opportunities is facing opportunities to invest in positive NPV projects that

require the higher usage of funds, whereas the company only has low cash flow

and assets in place. In addition, if company takes the new project by dealing on

debt as financing, that is also susceptible in appearing agency conflict of debt

between stockholders and bondholders. Stockholders insist that profits should be

distributed as dividend, while bondholders want that profits should be used to pay

off debt. As consequences, the mix of assets in place and investment opportunities

influences a firm’s capital structure, especially for debt policy.

This research investigate the influence of investment opportunity towards

debt policy that is classified into three components: leverage, the debt maturity

and covenant structure of its debt contracts. Leverage is commonly described as

the use of borrowed money to make an investment (Bhatti et al., 2010). Debt

maturity is the period of time for which a bond remains outstanding

(Investorwords, 2012).Covenants are contracts aimed at borrowers by creditors to

2001). In Indonesia, covenants must be involved in trusteeship agreement,

trusteeship agreement is agreement between the issuers (companies that issue the

bonds) and trustee regarding the issuance of bond in the form of notary deed

(Kep-412/BL/2010). The trustees act as a party representing the interests of

bondholders as well as providing protection to them (UU No. 8 Year. 1995 about

Capital Market, article 1).

Some researchers have investigated the enhancement decision in financing

and controlling the agency conflicts. Billett et al. (2007) and Fatmasari (2010)

investigates the influence of growth opportunity towards the choice of leverage,

debt maturity and covenants. They also observe whether covenant could attenuate

the relation between investment opportunity and leverage as well as debt maturity.

Billett et al. (2007), Fatmasari (2011), Goyal et al. (2002), Sari (2011), as

well as Singhania and Seth (2010) find that direct effect of growth opportunities

on leverage is negative. In addition, Awan et al. (2010) and Bulan (2008)

investigate that there is a positive correlation between the growth opportunities

and debt levels for the segments of firms with low and medium growth

opportunity, and negative relation between debt level in high growth opportunity.

Barclay and Smith (1995), Barclay et al. (2001), Billett et al. (2003) and

Fatmasari (2011) find that investment opportunity has strong negative influence

towards debt maturity, this concludes that firms with high investment opportunity

use larger proportions of short-term debt in their capital structures. Otherwise,

Dang (2010), Abdullah (2005), Childs, et al (2005) find that investment

al. (2007), Fatmasari (2011) and Sari (2011) find a positive relation between

growth opportunities interacted with covenant protection.

This research is encouraged by the reasons of there are inconsistencies in

the research finding, hence the researcher want to reexamine the influence of

investment opportunity set (IOS) towards leverage, debt maturity, and protective

covenants by using more accurate and comprehensive indicators through

confirmatory factor analysis (CFA). The sample of this research is non-financial

companies listed in Indonesia Stock Exchange (IDX) for 2009 until 2011.

This research uses confirmatory factor analysis in measuring investment

opportunity set and protective covenant in accordance confirming the measured

variables for a latent variable. It is a statistical approach involving finding a way

of condensing the information contained in a number of original variables into

smaller set of dimensions (factors) (Jairo, 2008). Thus, in measuring investment

opportunity set and protective covenants, these research models use more than one

indicator in construction of a variable in accordance obtaining results that are

more accurate. Ecker et al. (2006) asserts that any various single measurements

can be the less accurate measurement in research settings. By using various

indicators through confirmatory factor analysis, hence the measurement be more

accurate and comprehensive.

Investment opportunity set is typically unobservable by outsiders, hence

investment opportunity rely on various proxy variables (Adam and Goyal, 2007).

The proxy of investment opportunity set is different among researches. Billett et

and Fatmasari (2010) used capital-expenditures-to-total-assets (CAXBVA) ratio.

Moreover, Adam and Goyal (2007) used four investment opportunity

measurements, which are market-to-book asset (MBA) ratio, market-to-book

equity (MBE) ratio, earnings-price ratio, and

capital-expenditure-to-plant-property-and-equipment (CAXNPPE) ratio. From those proxies, this research is

strongly motivated to use market-to-book asset ratio and market-to-book equity

ratio, because these are the most of two significant proxies related to growth

opportunity (Adam and Goyal, 2007). Then, MBA and MBE ratio are composited

to construct investment opportunity set as independent variable.

Moreover, most of companies also involve many covenants in their

trusteeship agreement. Billett et al. (2007) list 15-covenants, moreover Fatmasari

(2010) lists 24-covenants. This research use 15-covenants that are adapted from

the combination of Billett et al. (2007) and the covenant listed in trusteeship

agreement. These 15-covenants are composited become five classifications: 1)

Restrictions on Payouts to Equityholders and Others, 2) Restrictions on Financing

Activities, 3) Restriction on Changing Business Form and Structural, 4)

Event-Driven Covenant, 5) Restriction on Investment and Asset Sales. If all

classifications fill the requirement of confirmatory factor analysis, hence the five

classifications are composited to construct protective covenant as dependent

variable (Y3.)

The difference economic conditions in different countries motivate the

also wants to examine the consistency of the prior research result with take the

research object from non-financial companies. Hence, this research is expected

can obtain results that applicable in Indonesia.

1.2. Problem Formulation

Based on the problems background described above, the formulation of the

problem are:

1. Does the investment opportunity set have an influence towards leverage?

2. Does the investment opportunity set have an influence towards debt

maturity?

3. Does the investment opportunity set have an influence towards covenants?

1.3. Research Objectives

In accordance with the identification of problems that have been described, the

author intends to obtain data and information relating to research the issue to

achieve the purpose of the study as follows:

1. To investigate the influence of investment opportunity set towards

leverage.

2. To investigate the influence of investment opportunity set towards debt

maturity.

3. To investigate the influence of investment opportunity set towards

covenants.

1.4. Research Contributions

By doing this research, there are several beneficial contributions expected

1. Contribution for Theory.

This research enhances the theory about the effect of investment

opportunity set (IOS) towards leverage, debt maturity, and covenants. In

this case, the author improves by using more accurate and comprehensive

indicators through confirmatory factor analysis (CFA).

2. Contribution for Empirical

These research results are going to be expected can provide information to

corporation, in accordance the measurement of investment opportunity set

within company shall be considered in enhancing the capital structure,

specifically for debt. This research is also expected can be reference for

the next research within a field.

3. Contribution for Policy

The results of this research aim to provide information to the companies

that the certain conditions of investment opportunity set within company

can be considered as one of the necessary factor in arrangement of

leverage policy, debt maturity and covenant, in accordance enhancing

decision in financing.

1.5. Research Systematic

This research is systematically compiled in the following order:

CHAPTER 1: INTRODUCTION

This part contains of elucidation the research background, problem

formulations, which construct what is going to be the specific

the logical reason and urgency of the choice to investigate this

topic.

CHAPTER 2: THEORETICAL REVIEW

This section contains of theories and previous research results used

to support the topic discussion and examine the developed

hypotheses. Moreover, the conceptual framework is built in this

chapter to elucidate the brief flows of logical thinking of the

research

CHAPTER 3: RESEARCH METHODOLOGY

This chapter explains the method approached, operational

definition of variables and measurement, determination of

population and sample, as well as the data analysis technique

which are used to examine the hypotheses which provide assurance

for the validity of research results.

CHAPTER 4: RESULTS AND ANALYSIS

The description of the result will be explained in this chapter,

together with research data, model analysis, interpretation,

hypotheses testing and discussion.

CHAPTER 5: CONCLUSION AND SUGGESTION

This last chapter contains the summary of research conclusion

including the research limitation and suggestion for the next

CHAPTER 2

LITERATURE REVIEW

2.1. Theoretical Review

Agency theory is the grand theory that elucidates the conflicts potentially

to be happened among manager, stockholder, and bondholder, which can

influence the financial structure of the company. Moreover, the investment

opportunity set (IOS) comes up as supporting theory that explains the investment

opportunities within certain conditions in company regarding its influence

towards debt structure and agency conflict of the company.

2.1.1. Agency Theory

This research examines the influence of investment opportunity towards

leverage, debt maturity and protective covenants. This theory explores the

divergence of opportunistic behavior among manager, stockholder, and

bondholder, which potentially raise the agency conflict and potentially influence

the debt structure of the company.

According to Jensen and Meckling (1976),

Jensen and Meckling (1976) argue that the divergences of interest between

principal and agent can be reduced, when principal is establishing appropriate

incentives for the agent and by incurring monitoring costs, which are designed to

reduce deviation activities of the agent that may be able harm the principal.

In agency relationship, the principal and the agent will incur positive

monitoring and bonding costs. Jensen and Meckling (1976) define agency costs in

general as the sum of:

1. The Monitoring Expenditures by the Principal,

Monitoring cost is such as cost for writing provisions, costs to restrict

deviation activities of the agent.

2. The Bonding Expenditures by the Agent,

Bonding cost is the cost incurred to pay the agent to expend resources to

guarantee that the principal will be compensated if the agent does take

such actions. The example is bondholder paying manager to agree

incurring the cost of providing financial reports and to have their accuracy

testified by an independent outside auditor.

3. The Residual Loss.

The dollar equivalent of the reduction in welfare experienced by the

principal because of this divergence and the covenants that restrict

management’s ability to take optimal actions on certain issues is also a

cost of the agency relationship.

The agency conflict might be happened among stockholder, manager and

appearance of agency conflict. Those agency relationships will be explored in

detail.

2.1.1.1. Agency Theory of Outside Equity

Separation of ownership and control are closely associated with the

general problem of agency between stockholder and manager. This subchapter

explores of why and how the agency costs of outside equity are generated by the

corporate.

Jensen and Meckling (1976) observe that when an owner-manager owns

100 percent of residual claims, there will be no separation between corporate

ownership and control. This means that the owner-manager bears all the cost and

generates all the pecuniary returns and non-pecuniary returns of his actions such

as, the attractiveness of the office staff, the level of employee discipline, the kind

and amount of charitable contributions, personal relations with employees.

If the owner-manager sells the part of his equity claims on the corporation

to stockholders, then agency costs will be appeared by the divergence between his

interest and those stockholders. This due to the owner-manager also has worked to

bear the entire wealth effects in accordance increasing firm value while the

owner-manager’s fraction of the equity falls and induces his fractional claim on

the outcomes falls too. Thus, this will encourage him to appropriate larger

amounts of the corporate resources in the form of perquisites consumption.

Singhania and Seth (2010) elucidate that owner-manager is expected to act

as taking decisions on behalf of prospective stockholders. In actuality, managers

from the overall organizational goal of maximization of company value, such as

higher bonuses, job position safety and security, etc. Managers because of formal

powers may try to lever decisions to meet their own goals, which may potentially

meet with disapproval from stockholders. In this way, owner or stockholders may

succeed in discouraging the relatively selfish motives of managers. Moreover,

shareholder and manager try to achieve a balance for these divergent goals to not

hinder the daily operational of the company. However, this entire process involves

considerable monitoring and control and thereby results in this so called agency

costs.

Explicitly, agency cost against malfeasance on the part of the manager,

and contractual limitations on the manager’s decision-making power, which

impose costs on the firm because stockholder limit manager’s ability to take full

advantage of some profitable opportunities as well as limiting manager’s ability to

harm the stockholders while making himself better off. In practice, it is usually by

expending resources to alter the opportunity the owner-manager has for capturing

benefits. These methods include auditing, formal control systems, budget

restrictions, the establishment of incentive compensation systems, which serve to

identify the manager’s interests more closely with those of the outside equity

holders, and so forth. In order to carry out their functions properly, management

should be given incentives and adequate supervision. Control can be done through

ways such as binding agents, examination of financial statements, and restrictions

Generally, when the agency costs are engendered by the existence of

outside owners are positive, the company will pay the outside owners to sell back

their equity claims to an owner-manager who can avoid these costs. Other ways,

debt and less external equities can reduce the agency cost of outside equity.

Jensen and Meckling (1976) stated that the usage of debt aims to

overcome the agency cost of outside equity. Regarding this argument, the interests

of managers and stockholders are likely to diverge in industries that generate

abundant free cash flow. Managers supposedly have a stronger preference for

retaining free cash flow within the firm, while stockholders have a stronger

preference for using free cash flow for financing higher payouts in the form of

dividends and share repurchases. Debt is one means of resolving this tension. It

can be understood from two perspectives. First, using debt means a firm can sell

less external equity and still finance its operations. If agency cost of outside equity

rise more than proportionally, then minimizing outside equity sales will reduce the

deadweight agency cost. Second, the benefit of using debt is that it reduces

managerial perquisite consumption. The need to make regular debt-service

payments effectively disciplines managers.

2.1.1.2.Agency Theory of Debt

This theory recognizes when a firm has debt that potentially increase the

conflict interest between stockholders and bondholders. The conflict arises

because of the different mechanism of revenue receipt between stockholders and

bondholders. Bondholders earn a fixed income of interest and repayment of

used to meet obligations to bondholders. This causes the incentives of corporate

managers to act in the interests of stockholders. However, those conditions show

that debt arise the conflict between shareholder and bondholder. According to

Megginson et al. (2007: 491) and Ross et al. (2008: 464), these actions include but

are not limited to:

1. Unauthorized asset disposition – Stockholder may attempt to transfer

corporate assets to themselves by liquidating the firm’s assets and

distributing the proceeds as a dividend or repurchasing shares at a

premium.

2. Claim dilution – Stockholder may attempt to dilute the claim of

existing bondholder by issuing debt of higher priority than existing

debt.

3. Asset substitution – Acceptance of substituting a riskier asset

promising a higher return than that had been anticipated by

bondholders when bondholders were purchasing their bonds.

In principle, bondholders involve of various covenants in the indenture

provisions, to limit the managerial behavior. The covenants impose voluntary

constraints on management’s activities that prevent corporate managers from

taking certain actions and require them to take others. At the same time, these

covenants provide bondholders assurance that the firm’s management will not

expropriate their wealth. Consequently, bondholders would be willing to pay more

for a debt contract that includes protective covenants. All costs associated with

to agree in incurrence the cost of providing financial reports and to have their

accuracy testified to by an independent outside auditor. This is an example of

bonding costs.

2.1.2. Investment Opportunity Set (IOS) Theory

Investment opportunity set plays an important role in financing corporate.

The mix of assets in place and investment opportunities influence a firm’s capital

structure, the maturity and covenant structure of its debt contracts (Billett et al.,

2007). IOS theory enhances the decision in which the investments in place have

been financed, whether with debt or with equity, and if debt, whether with short or

long-term debts, which influences the profits stockholders make from exercising

growth options.

Myers (1977) states that the essence of growth for a company is generating

profit from investment opportunities, in accordance increasing the firm’s value.

The greater the profitable investment opportunity, the investment will increase.

Regarding IOS theory, the company is a combination of assets in place that it is

tangible and investment opportunities that intangible. The combination of both

assets in place and investment opportunities will affect the capital structure and

firm value.

Regarding to Jensen (1986) companies with high investment opportunities

have high growth rates, active conducting investment, have low cash flow and

smaller assets in place. In these circumstances, firms potentially suffer

underinvestment problem. In addition, Myers (1977) explains that the

facing opportunities to invest in positive NPV projects that also require the higher

usage of funds. In the low free cash flow condition, the company will take on debt

to take investment opportunities that exist. However, it is susceptible in appearing

conflict between stockholders and bondholders. Stockholders insist that profits

should be distributed as dividend. While bondholders assume that profits should

be used to pay off debt. In such circumstances, the company will choose to leave

the project with a positive NPV and lost investment opportunities. If the company

wants to continue the positive NPV projects, companies with high investment

opportunities have some alternatives such as using internal funds, using a small

amount of debt with shorter debt maturity, or involving protective covenants.

Moreover, according to Myers (1977), companies with lower investment

opportunity have a low growth level, and have large free cash flow and asset in

place. In these circumstances, the company is potential to overinvestment

problem. Overinvestment problem is caused by the excess capital, which will lead

to conflict due to the divergence perspectives between the managers and

stockholders. Managers argue that the excess in capital shall be used to invest in

project and currently they tend to invest the capital excess on the risky projects.

Managers consider that this action would raise the investment opportunity above

the optimal level. Otherwise, stockholders insist to distribute the capital excess as

dividends.

By using debt this problem can be solved, the managers can carry out a

new project, while managers able to provide assurance to stockholders that

put the company on the part of external oversight, thereby reducing tendency of

managers to invest in projects that are not profitable. Hereby, company will be

more effective to deal with debt when the company has low investment

opportunity (Jensen, 1986).

2.1.3. Variables in this Research

2.1.3.1. Leverage

Applying leverage means using borrowed money to earn a return greater

than the cost of borrowing (Megginson et al., 2008: 655). Leverage is commonly

described as the use of borrowed money to make an investment and return on that

investment (Bhatti et al., 2010). Thus, leverage can be defined as the proportion

usage of debt, which will be used as financing sources for which predicted as

profitable projects, then it is expected to increase the value of the company by

reflecting incremental in its actual earnings.

This research use debt to total assets as measurement of leverage. Bhatti et

al. (2010) argue that this ratio emphasizing the importance role of financing by

measuring the amount of debt used to fund assets that used by the company in its

operational activities.

Jensen (1986) argues that the usage of debt (leverage) is the most severe

for firms with low growth opportunities, this due to this company needs debt as

investment financing sources for new projects. Debt also becomes the guarantee

that high free cash flow will be used to pay off the dividends. By using debt, firms

likelihood that managers will squander free cash flow on value-reducing

investments.

2.1.3.2. Debt Maturity

Debt Maturity is the period of time for which a debt instrument remains

outstanding. Maturity refers to a finite time-period at the end of which the

financial instrument will cease to exist and the principal is repaid with interest

(Investorwords, 2012).

Regarding debt maturity, the company has tradeoff between the

transactions costs of issuing debt and the gains from adjusting debt level

dynamically, this means the firm should issue short-maturity debt and therefore

affords itself the opportunity to issue new debt optimally, depending on the firm

value when the old debt matures. On the other hand, if new debts are issued too

often, transactions costs will become too large. When the firm behaves optimally,

in addition to an optimal capital structure, an optimal maturity structure emerges.

Myers (1977) argues if debt matures after the expiration of the firm's

investment option, it reduces the incentives of the shareholder-management

coalition in control of the firm to invest in positive net-present-value investment

projects since the benefits accrue, at least partially, to the bondholders rather than

accruing fully to the stockholders. Hence, compared to firms with shorter debt

maturities, firms with long-term debt are less likely to exploit valuable growth

opportunities. The extant literature focuses on ways in which firms can resolve the

underinvestment problem, including the shortening of the maturity of debt to

opportunity sets contain more growth options should employ a higher proportion

of short-term debt (Barnea et al., 1980). Since when short-term debt matures

before growth options are exercised, there is an opportunity for firms to

re-contract and for debt to be re-priced, so that gains from new investment do not

accrue to bondholders.

2.1.3.3. Protective Covenants

2.1.3.3.1. Definition of Protective Covenants

When the stockholders must pay higher interest rates as insurance against

their own selfish strategies, then they frequently make agreements with

bondholders in hopes of lower interest rates. These agreements, called protective

covenants, are incorporated as part of the loan document (or indenture) between

stockholders and bondholders (Ross et al., 2008:463). In addition, covenants are

contracts aimed at borrowers by creditors to limit activities that may damage the

value of loans and recovery loans (Cochran, 2001). In Indonesia, covenants must

be involved in trusteeship agreement, trusteeship agreement is agreement between

the issuers (companies that issue the bonds) and trustee regarding the issuance of

bond in the form of notary deed (Kep-412/BL/2010). The trustees act as a party

representing the interests of bondholders as well as providing protection to them

(UU No. 8 Year. 1995 about Capital Market, art. 1).

It is true that lenders may demand such covenants before lending money at

a given interest rate, but the choice of covenants is fundamentally in the

shareholders decision (Myers, 1977). Hence, the covenant is agreement between

for protecting the loan value and help the stockholders to meet with the lower

interest rates payment for the bond.

Company with high investment opportunity often face underinvestment

problem that can stimulate the agency conflict between stockholders and

bondholders. To reduce stockholder-bondholder conflict, loans are more likely to

include protective covenants when the borrower is small and has high growth

opportunities (Bradley and Roberts, 2004). Based on the analysis of Myers

(1977), high growth firms are more likely to include covenants that restrict what

they do with the funds they obtain. By involving more covenants in high

investment opportunity, it can increase the value of the firm at the time bonds are

issued by reducing the opportunity loss caused by the results when stockholders

follow a policy, which does not maximize the value of the firm, such as the claim

dilution problem (which involves only a wealth transfer), asset substitution, etc

(Bradley and Roberts, 2004). Although firms with high growth opportunities are

more likely to face stockholder–bondholder conflicts and thereby benefit the most

from restrictive covenants, it is easy to argue that these same firms would seek to

preserve future financing and investment flexibility by having few if any

restrictive covenants.

Covenants are expecting to reduce the agency cost and increase the value

of the firm. Ross et al. (2008: 464) considered three choices by stockholders to

reduce agency cost:

1. Issuing no debt. Due to the tax advantages to debt, this is very costly

2. Issuing debt with no restrictive and protective covenants. In this case,

bondholders will demand high interest rate to compensate for the

unprotected status of their debt.

3. Writing protective and restrictive covenants into the loan contracts. If

the covenants are clearly written, the creditors may receive protection

without large costs being imposed on the stockholders. The creditors

will gladly accept a lower interest rate.

Thus, involving the covenants in a contract can be the lowest cost solution

to the stockholders-bondholders conflict. Based on the analysis of Myers (1977),

firms with significant growth opportunities will include covenants in their

indenture agreements.

2.1.3.3.2. Classification of Protective Covenants

According to Ross et al. (2008:463) protective covenants can be classified

into two types: negative covenants and positive covenants. A negative covenant

prohibits activities that the company may take. The type of negative covenants

such as: (1) The firm may not pledge any of its assets to other lenders, (2) The

firm may not sell or lease its major assets without approval by the lender. A

positive covenant specifies an action that the company agrees to take or a

condition that the company must abide by. The type of positive covenants such as:

The company agrees to maintain its working capital at a minimum level and the

The list and the type of covenants in bond agreement are varied. Fatmasari

(2010) used 24 of covenants in her research. Billet et al. (2007) found 15 of

covenants.

Table 2.1

Classification of Covenants

No. Covenant Type Description

Restrictions on Payouts to Equityholders and Others

1. Dividend Restriction Covenant limiting the dividend payments of the issuer or a

subsidiary of the issuer.

2. Share Repurchase Restriction Covenant that limits the issuer to make the return payment (other than dividend) to the stockholders.

Restrictions on Financing Activities

3. Funded Debt Issue

Restriction

To prevent the issuer and/or subsidiary to issue new debt with maturity of 1-year or longer

4. Subordinate Debt Restriction To prevent the issuer and/or subsidiary to issue subordinate debt

5. Senior Debt Restriction To prevent the issuer and/or subsidiary to issue senior debt 6. Secured Debt Restriction To prevent the issuer and/or subsidiary to issue secured debt

7. Total Leverage Test Involving a variety of accounting-based restrictions on

leverage, ranging from a requirement that the issuer maintain a specified minimum net worth to a requirement that the issuer maintain a specified minimum ratio of earnings to fixed charges

8. Sale-and-lease back Limiting issuer and its subsidiaries to sell, then lease back the assets which has been pledged as collateral on debtholder without the approval of the trustees

9. Stock Issue Restriction To limit the issuer and/or subsidiary from issuing additional common or preferred stock

Event-Driven Covenants

10. Poison Put Provision A provision, which makes the instrument puttable to the

issuer following a change of control or a restructuring which reduces the credit quality of the issue

11. Rating or Net Worth Trigger Certain provision, which are triggered when either the credit rating or net worth of the issuer falls below specified level 12. Cross-default Provision If default (or acceleration of payments) is triggered in the

issue when default (or acceleration of payments) occurs for any other debt issue

Restrictions on Investment Policy

13. Merger Restriction Limiting the issuer and/or subsidiary in conducting merger,

consolidation, or acquisition.

14. Investment Policy Restriction Proscribe certain risky investments for the issuer and/or subsidiary.

15. Asset Sale Clause Limit the ability of the issuer to sell assets or limit the

Restrictions on payouts prohibit managers from paying out proceeds from

liquidating firm assets to stockholders. Black (1976) in Reisel (2010) states that

there is no easier way for a company to escape the burden of debt than to pay out

all of its assets in the form of a dividend, and leave the creditors holding a

worthless obligation. Myers (1977) argues that restrictive covenants on dividends

provide a partial solution to the warped incentives created by risky debt. If

dividends are restricted, then the firm cannot raise money and pay it all out to

stockholders. He warns however, that restrictions on dividends may, also force the

firm to invest in negative present value projects, as stockholders may prefer risky

assets to safe ones, hence, risk-shifting may be escalated. Within this framework,

payouts to stockholders represent a wealth transfer from bondholders.

Restrictions on financing activities directly mitigate the claim dilution

problem. The claim dilution is harmful in, at least, two ways: additional debt may

increase the likelihood of bankruptcy and reduce the recovery amount. Covenants

restricting financing activities may also mitigate agency problems arising from

sub-optimal investment decisions. This highlights the importance of restrictions

on financing activities to bondholders (Reisel, 2010).

Restriction on changing form and structural of business mitigate the firm’s

management to change the form of business, to prevent the changing the group’s legal

form, articles of association, members of its boards of directors and commissioners and

stockholders.

Event-driven covenant is provision, which triggered as the consequences when

The merger covenant states that a consolidation, acquisition, or merger of

the issuer with another entity is restricted. In some cases, the covenants place

certain requirements on the profitability and leverage of the new entity. The

restrictions on asset sales limit the ability of the issuer to sell assets or limit the

issuer’s use of the proceeds from the sale of assets. Such restrictions may require

the issuer to apply some or the entire sale proceeds to the repurchase of debt

through a tender offer or call. Restrictions on mergers and asset sales are often

cited in the literature as a means of mitigating the risk-shifting problem

(sometimes referred to as the asset substitution problem or over-investment).

Those protective covenants are analyzed and adapted based on the list

covenants in trustee agreement listed in financial statement. Hence, this research

uses 15- types of covenants, as follows,

Table 2.2

The Established Classification of Covenants in this Research

No. Covenant Type Description

Restrictions on Payouts to Equityholders and Others

1. Dividend Restriction Covenant limiting the dividend payments of the issuer or a subsidiary of

the issuer.

2. Share Repurchase Restriction Covenant that limits the issuer to make the return payment (other than dividend) to the stockholders and others and redeem subordinate debt

Restrictions on Financing Activities

3. Debt Issue Restriction To prevent the issuer and/or subsidiary to issue new debt to another

party.

4. Total Leverage Test Involving a variety of accounting-based restrictions on leverage,

ranging from a requirement that the issuer maintain a specified minimum net worth to a requirement that the issuer maintain a specified minimum ratio of earnings to fixed charges

5. Sale-and-lease back Limiting issuer and its subsidiaries to sell, then lease back the assets

which has been pledged as collateral on debtholder without the approval of the trustees

6. Stock Issue Restriction To limit the issuer and/or subsidiary from issuing additional common or preferred stock

7. Loan Provider Restriction To prevent the issuer and/or subsidiary to provide new loans to anyone including the stockholders, except in the context of business transactions of the company (Fatmasari, 2010).

8. Business Changing Restriction To prevent the issuer and/or subsidiary to change its business (Fatmasari, 2010).

9. Managerial Changing

Restriction

To prevent the changing the group’s legal form, articles of association, members of its boards of directors and commissioners and stockholders (Fatmasari, 2010).

Event-Driven Covenants

10. Poison Put Provision A bond indenture that gives the bondholder the right to demand

redemption before maturity at its high par value in case certain event happen (Investorwords, 2012).

11. Rating or Net Worth Trigger Certain provision, which are triggered when either the credit rating or net worth of the issuer falls below specified level

12. Cross-default Provision A provision that allows a trustee or lender to require full payment

on all loans in a group, if any single loan in the group is in default (Investorwords, 2012).

Restrictions on Investment and Asset Sales

13. Merger Restriction Limiting the issuer and/or subsidiary in conducting merger,

consolidation, or acquisition.

14. Investment Policy Restriction Proscribe certain risky investments for the issuer and/or subsidiary.

15. Asset Sales Limit the ability of the issuer to sell assets or limit the issuer’s use

of the proceeds from the sale of assets

2.1.3.4. Investment Opportunity Set (IOS)

Investment Opportunity Set (IOS) is all of the investments that a company

is able to make at a given point in time. The determinants of a company

investment opportunity set is largely depend on its financing ability to deal with

new project, whether through equity financing, debt financing or even personal

savings (Farlex Financial Dictionary, 2012).

Investment opportunities play an important role in corporate finance. The

mix of assets in place and investment opportunities affect a firm’s capital

structure, the maturity and covenant structure of its debt contracts (Billett et al.,

2007). Despite the important role that investment opportunities play in the

corporate finance literature, there is no consensus on how to measure the value of

2.1.3.4.1. Proxy Variables for Firm’s Investment Opportunity

As investment opportunities are typically unobservable by outsiders, a

common practice is to rely on proxy variables. Adam and Goyal (2007) classified

the proxy variables for investment opportunity become four; market-to-book asset

ratio, market-to-book equity ratio, earning-price ratio, and capital expenditures

ratio. From the four ratios, market-to-book asset ratio and market-to-book equity

ratio are the proxy that used to measure investment opportunity in this research.

Both ratios are most commonly used as investment opportunity proxy.

Moreover, Adam and Goyal (2007) point out that EP ratio has been

interpreted as an earnings growth indicator, as a risk measure, or as an earnings

capitalization rate. An EP ratio does not always indicate its firm investment

opportunities because current earnings sometimes deviate temporarily from their

long-run expected values. The motivation for the

Capital-Expenditures-to-Net-Plant-Property-and-Equipment ratio is that capital expenditures are largely

discretionary and lead to the acquisition of new investment opportunities. Firms

that invest more acquire more investment opportunities relative to their existing

assets than do firms that invest less, but capital expenditures may or may not lead

to the acquisition of investment opportunities, and it is not clear whether the

relationship between expenditures and the value of the acquired investment

options is even linear.

2.1.3.4.1.1. The Market-to-Book Assets Ratio

According to Adam and Goyal (2007) the market-to-book assets (MBA)

this is the most commonly used proxy for investment opportunities. The book

value of assets is a proxy for assets in place, whereas the market value of assets is

a proxy for both assets in place and investment opportunities. Hence, a high MBA

ratio indicates that a firm has many investment opportunities relative to its assets

in place. Otherwise, MBA ratio (or Tobin’s q) is also used as a proxy for many

other variables such as corporate performance, intangibles, the quality of

management, agency problems, and firm value. Billett et al. (2007) use this proxy

to measure growth opportunity in association towards leverage, debt maturity, and

covenants.

2.1.3.4.1.2. Market-to-Book Equity Ratio

Market to book equity (MBE) ratio is the market value of equity divided

by the book value of equity, this ratio is the second commonly used proxy for

investment opportunities.

Adam and Goyal (2007) elucidated that the market value of equity

measures the present value of all future cash flows to equity holders, from both

assets in place and future investment opportunities, whereas the book value of

equity represents the accumulated value generated from existing assets only.

Therefore, the MBE ratio measures the mix of cash flows from assets in place and

future investment opportunities.

However, like the MBA ratio, the MBE ratio proxies for other variables

too, such as corporate performance. Another concern is that the MBE ratio is

influenced by leverage. If low-growth firms choose more debt in their capital

growth opportunities alone. Finally, a concern with the MBE ratio is that firms

with negative equity values must be omitted from the analysis since negative

MBE ratios are not meaningful in measuring investment opportunities.

2.1.3.5. Fixed Asset Ratio

Fixed Asset Ratio (FAR) or also known as asset tangibility is the ratio of

fixed assets to total assets (its assets). Assets show the capacity of operating

activities in a company. The greater the asset is expected to yield the greater

operational products, which are produced by the company. The incremental of

assets, which are followed by an incremental in operational products, will raise

the convenience of outside party to the company. Company that has a large

amount of assets can gain larger debt because the company has the larger assets,

which can be used as collateral (Korner, 2007).

Firms with a higher share of collateralizable assets can pledge these assets

in favor of the long-term debt (Korner, 2007). Moreover fixed asset ratio is

expected to be consistent with investment opportunity set theory. This theory

elucidates that the company with high investment opportunity, will have small

free cash flow and small assets in place. Consequently, this certain conditions are

potentially to suffer underinvestment problem and to control this problem, the

company usually involves more protective covenant as constraint for

management. Hence there is an inverse relation between FAR and protective

2.1.3.6. Profitability

Profitability is the ability of the firm to generate earnings (Gibson, 2009).

Increased profits can cause a rise in market price, leading to capital gains. Profits

are also important to creditors because profits are sources of funds for debt

coverage. Management uses profit as a performance measurement.

Empirically, the opposite relation often has been found. Elliot et al. (2008)

document a negative relation between leverage and profitability, higher profits

will increase retained earnings, which mechanically reduces leverage. Thus,

without making a strong prediction on the sign of the relation, this research

includes profitability, which be measured as EBITDA divided by book assets, as a

control variable. Debt maturity is also increasing with firm profitability, as firms

that are more profitable are better able to commit to long-term payments (Agca et

al., 2007). Profitability is expected to be positively related to debt maturity,

because profitable firms have higher taxable income, and thus receive greater tax

benefits from long-term debt (Deesomsak et al., 2012). Since bondholders face a

lower default risk when a firm is very profitable, they do not have any incentive to

set more covenants (Inamura, 2009).

2.1.3.7. Firm Size

Firm size is a measure of the size of the companies as measured by the

natural logarithm of total assets (Ln total assets). Firm size (which is measured as

the natural log of assets) to be an important determinant of both the leverage and

debt maturity. Large firms tend to have more collateralizable assets and more

of default, which suggests that large firms would be expected to carry more debt.

Diamond (1992) also argues that large established firms have better reputations in

the debt markets, which also allows them to carry more debt.

Korner (2007) document that debt maturity increases with firm size. These

larger firms are believed to have easier access to capital markets, they can more

easily overcome the transaction costs and greater negotiation power due to they

have a stronger position in debt negotiation than smaller firms. This is so because

larger firms have the ability to reduce the unsystematic risk via diversification

(Taleb and Shubiri, 2011). The literature in this area suggests that larger,

well-established firms have reputations in the market and hence are subject to more

analysis than smaller firms. Their investment opportunity set is considered to be

available public information. The market has shown trust in the firm by allowing

it to grow, thus that packages of covenants with higher levels of protection are

more likely the smaller the size of the issuing firm (Carter et al., 2004). Large

firms may have sufficient assets that can be sold to meet obligations. Therefore,

bondholders face lower default risks with large firms (Inamura, 2009).

2.2. Previous Research

Previous researches are summarized, as follow:

1. Billett et al. (2007)

Billett et al. (2007) investigates the relation of growth opportunity and

the choice of leverage, debt maturity and covenants. This research uses a sample

of over 15,000 debt issues during the period from 1960 to 2003 that obtain from

protection is increasing in leverage and the market-to-book ratio, and decreasing

in the proportion of a firm’s debt that is short-term. These results are consistent

with the predictions that firms use covenants to control stockholder–bondholder

conflicts over the exercise of growth options, and that short-term debt and

restrictive covenants are substitutes in controlling these conflicts. Although the

direct effect of growth opportunities on leverage is negative, they find a positive

relation between leverage and growth opportunities interacted with covenant

protection. Importantly, this supports the prediction that covenants attenuate the

negative effect of growth opportunities on leverage. Billet et al. (2007) also find

that short-term debt can similarly attenuate the negative effect of growth

opportunities on leverage for riskier borrowers.

2. Fatmasari (2011)

Fatmasari (2011) observes the relation among growth opportunity with

debt maturity and leverage policy moderated by covenants. The sample is from

manufacturing company that listed in Indonesia Stock Exchange.

By using panel data regression model and data observation for over

six-years, this research finds that, firms with high growth opportunity tend to use low

leverage policies with short maturity to control the agency conflict between

stockholders and bondholders. On the other hand, firms with low growth

opportunity tend to use higher leverage policies with a longer period of debt

maturity. Moreover, covenant as a moderating variable, could lower the negative

relation between growth opportunity and leverage, but it could not diminish the

and covenant also could not be use as substitution variable in solving the

investment problem.

3. Sari (2011)

This research investigates the influence of growth opportunity towards

leverage and moderated by debt covenants. The sample which is used in this

research is non-financial company which issued bond in 2006 until 2010 and

drafting its bond covenant. The sample is analyzed using regression.

This research finds that growth opportunity influences negative

significantly towards leverage. Covenant as the moderating variable has

significant to weaken the negative effect of growth opportunity towards leverage.

4. Taleb et al. (2011)

This study examines the capital structure decisions and debt maturity

structure of 60 industrial companies listed in Amman Stock exchange. This is the

first time such study has been attempted for a multi-country emerging market

sample. To achieve this objective the study was set to test a number of hypotheses

regarding the determinants of capital structure decisions and debt maturity

structure.

These hypotheses were related to the effects of profitability, growth

opportunities, asset maturity, size, liquidity and age. Total debt ratio was found to

be positively and significantly related to the percentage growth in total assets and

negatively and significantly related to liquidity and asset structure. A growth

-term debt and was negatively and significantly related to long -term debt. The

relationship between asset maturity and long term debt was found to be negative

and significant. Therefore, there is no support of the hypothesis that debt maturity

decreases as the proportion of growth potentials increase. Size was found to be

positively and significantly related to long term debt and negatively and

significantly related to short term debt implying that larger firms borrow on long

term and small ones borrow on short term. Profitability, age and liquidity

appeared to have no statistical significance on the different types of debt.

5. Goyal et al. (2002)

The U.S. defense industry provides a natural experiment for examining

how changes in growth opportunities affect the level and structure of corporate

debt. Compared with other firms, the growth opportunities of defense firms

increased substantially during the Reagan defense buildup of the early 1980s, but

then declined significantly with the end of the cold war and associated defense

budget cuts in the late 1980s and early 1990s.

The author examine how the level and structure of corporate debt changed

for a sample of 61 defense firms and a benchmark sample of 61 manufacturing

firms during 1980-1995, a period spanning the changes in growth opportunities.

The debt levels of weapons manufacturers, which were most affected by the

changes in growth opportunities, increased significantly as their growth

opportunities declined. In addition, these firms lengthened the maturity structure

of their debt, decreased the ratio of private to public debt, and decreased the use of

studies that have found cross-sectional relations between proxies for growth

opportunities and leverage variables and validate the prominent role played by

growth opportunities in the theory of corporate finance.

6. Barclay et al. (2003)

This research titled The Joint Determination of Leverage and Maturity,

which examine theories of leverage and debt maturity, focusing on the impact of

firms’ investment opportunity sets and regulatory environments in determining

these policies. Using results on strategic complementarities, Barclay et al. (2003)

identify sufficient conditions for the theory to have testable implications for

reduced-form and structural-equation regression coefficients. Obtaining testable

implications form structural equations requires less from the theory but more from

the data than the reduced-form specification because it requires an

instrumental-variables approach. This research examines this trade-off between theory and

statistical methods and provides tests using two decades of data for over 5000

industrial firms. The analysis provides reasonably compelling evidence that they

are not complements. Incentive contracting theory suggests that they are

substitutes.

7. Awan et al. (2010)

The purpose of this study is to find out how growth opportunities in Pakistan are

related to leverage decisions for the listed manufacturing corporate concerns. This

research uses financial data from a sample of 110 manufacturing companies listed

along with estimation of fixed-effects regression analysis to assess the subject

relationship.

There is a positive relationship between the growth opportunities and debt

levels of the corporate firms. This positive relationship is highly significant for the

segments of firms with ‘low’ and ‘medium’ growth opportunities. The reason for

this finding may be that the owners of these firms view the available growth

opportunities as unsustainable and more risky and intend to pass on that higher

risk to the creditors. Another important finding of this study is that industry type

is also a relevant variable which influences the relationship between growth

opportunities and leverage.

8. Singhania and Seth (2010)

The primary objective of this paper is to isolate the company

characteristics that determine capital structure, in the context of Indian companies.

The sample consists of 963 companies that are listed on the Bombay Stock

Exchange (BSE) for the period 2004-2008. The data has been collected through

the information available on the Prowess database of Center for Monitoring

Indian Economy (CMIE). The company characteristics are analyzed as

determinants of capital structure according to different explanatory theories.

The hypothesis that has been tested is that the debt ratio at timet depends

on the size of the company at time t, the liquidity of the company at time t, the

growth of the company at time t and the interest coverage ratio at time t. The

companies that have a high ratio of debt are examined using a dummy variable.