29 THE ANALYSIS OF CORPORATE SOCIAL RESPONSIBILITY OF ISLAMIC BANKS IN THE INDONESIA BY USING ISLAMIC SOCIAL REPORTING INDEX

MUHAMMAD ARFAN, FUTRI MULIYATI HISDA

1Faculty of Economics, Syiah Kuala University, Banda Aceh; 2Faculty of Economics, Syiah Kuala University, Banda Aceh.

Correspondingauthor: arfan_was@yahoo.com

ABSTRACT

The purpose of this research is to analyze the corporate social responsibility of islamic bank by using islamic social reporting (ISR) index.The research was conducted on Islamic banks listed at Bank Indonesia in 2009, 2010, and 2011. The reaserch type used is descriptive reasearch by using content analysis method.The population of this research are islamic banks listed at Bank Indonesia in 2009-2010. After being observed, the total population are26 islamic banks for three years observation.The source of data is secondary data which is obtained from annual report for the book year ended December 31, 2009, 2010, and 2011. The results of this research showthatthe corporate social responsibility of islamic banks in Indonesia is so variative.Generally, based on themes of ISR index, the corporate social responsibility of 5 islamic banks is low in 2009. While in 2010, the corporate social responsibility of 10 islamic banks is among medium-high, and also it was happened in 2011. There are six themes in ISR index i.e. funding/investment, product/service, employee, society, environment,and good corporate governance.ISR index for product/service andgood corporategovernance are the highest theme each year. While, funding/investment and environment are stabil. Then, employee andsociety increase 10% in 2010. It means that the social activity of islamic banks is organized consistently and going sustainability.

Keywords: Corporate social responsibility, islamic social reporting index, and islamic banks.

Introduction

The study of CSR(Corporate Social Responsibility) measuring methodshas been widely applied in various countries due to issues of CSR becomes aimportant matter in the past few decades. Sofyani et al. (2012) stated that the concept of CSR is preferred in Islam. Institutions that do business based on sharia is essentially based on the fundamental Qur'an and the Sunna philosophy, which is the basic for good interaction with the environment and each other.

Along with the rapid development of Islamic banking, financial institutions have done CSR in some publicsectors. The amount of CSR funds from Islamic banking in 2009 was Rp 1.45 trillion. In 2010 a large total of Islamic banking’s CSR funds reached Rp 1.74 trillion. In this case iB (Islamic Bank) will distribute the CSR funds to tree parts; 50 percent for micro-economic entrepreneurs, 25 percent for education, and 25 percent for natural disaster relief and other social activities (Vivanews, 2009).

30 the social performance of Islamic banking that listed in Bank Indonesia by using the ISR index during the period 2009-2011. This research aims to determine the social performance of Islamic Banking by using ISR index.

Literatatures Review

Definition of CSR by WBCSD (World Business Council for Sustainable Development) in Watts and Holme (1999) is "corporate social responsibility is the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large". CSR is a company's commitment as a business to behave ethically and contribute to economic development of the country.

Islam is a complete religion which govern all aspects of human life on the earth. Siwar and Hossain (2009) stated that the basic foundation of the religion of Islam is belief and faith, worship, and morality and ethics. One form of accountability in Islamic perspective is the implementation of social performance and social performance reporting that according to Islamic principles.

According to Haniffa (2002) that takes a special framework for social accountability reporting as a social performance measurement of a company in accordance with Islamic principles. This framework is known as ISR index (Islamic Social Reporting index). Islamic principles inISR index is generating aspects of the material, moral, and spiritual that became the main focus of this form of social performance and corporate social responsibility reporting. There are six themes in ISR index disclosure framework is used in this research refers to Sofyani et al. (2012) such as financing and investment, products and services, employees, community, environment, and corporate governance. Each theme consists of several items such as attached in Appendix 1.

Othman and Thani (2010) in their research of Islamic Social Reporting of the listed companies in stock exchange of Malaysia concluded that the Islamic Social Reporting in the annual report index companies listed in stock exchange of Malaysia is still relatively low. While, Zubairu et al. (2011) in their research of social performance disclosure of Islamic Banks in Saudi Arabia concluded that Islamic Banks have a lot in common with a conventional bank located in Saudi Arabia, the Islamic Banks should carry out various forms of activities based on sharia, but in reality between Islamic Banks and conventional banks have not clearly visible differences. Sofyani et al. (2012) in their research of Islamic Social Reporting as an index of social performance measurement model of Islamic banking (comparative study of Bank Malaysia and Bank Indonesia) concluded that the overall social performance train-average Islamic banking in Malaysia is higher than in Indonesia. Social performance of Islamic banking in Indonesia in 2010 has increased significantly, about 10% of the earlier (2009). While social performance in the Malaysian Islamic banking system is stable because it does not increase or decrease. However, of all the Islamic banks, both Indonesian and Malaysia banking, none of which reach very good performance levels.

Research Methodology

31 Bank Indonesia during the period 2009-2011. Data collection techniques in this research are conducted through library research and field study.

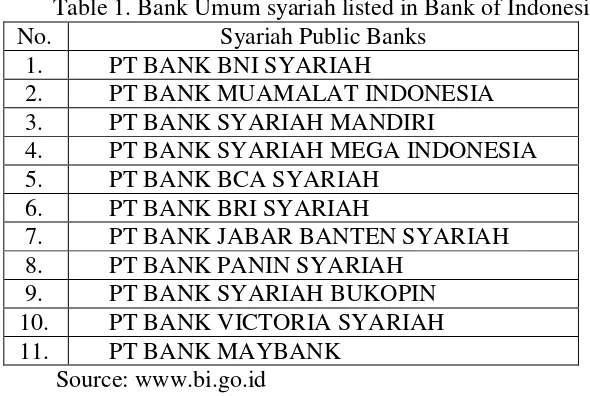

Table 1. Bank Umum syariah listed in Bank of Indonesia

No. Syariah Public Banks

1. PT BANK BNI SYARIAH

2. PT BANK MUAMALAT INDONESIA

3. PT BANK SYARIAH MANDIRI

4. PT BANK SYARIAH MEGA INDONESIA 5. PT BANK BCA SYARIAH

6. PT BANK BRI SYARIAH

7. PT BANK JABAR BANTEN SYARIAH 8. PT BANK PANIN SYARIAH

9. PT BANK SYARIAH BUKOPIN 10. PT BANK VICTORIA SYARIAH

11. PT BANK MAYBANK

Source: www.bi.go.id

In accordance with the purpose of this research, the method of measurement used is the Islamic Social Reporting (ISR) Index which is obtained from each company every year. The index value is obtained by using the method of content analysis. Content analysis is a method of analysis that is often used to identify contents in the annual report (Othman and Thani, 2010). ISR Index in this research consisted of 38 items that organized into 6 themes. ISR index items are presented in Appendix 1. The first step is checklist on each item which reveals the social activity on the financial statements of Islamic banks (Sofyani et al., 2012). The second step, give a score for each item. If there is one item that disclosed it will get score "1" and if not then it will get score "0". These values will be summed according to both individual and overall theme. According to the total value of each theme will show what the main focus of each company. Thus, the largest value is 38 and the smallest value is 0 for each company every year.

The third step is to calculate the percentage of the social performance of each Islamic Banks annually either by theme or as a whole. Then the percentages might be considered a social performance levels suggested by Othman et al. (2009) (see Table 2).

Table 2. The social value categoriesl

Percentage Category

0-20% Very low

21-40% Low

41-60% Moderate

61-80% High

81-100% Very high

Source: Othman et al. (2009)

Results and Discussion

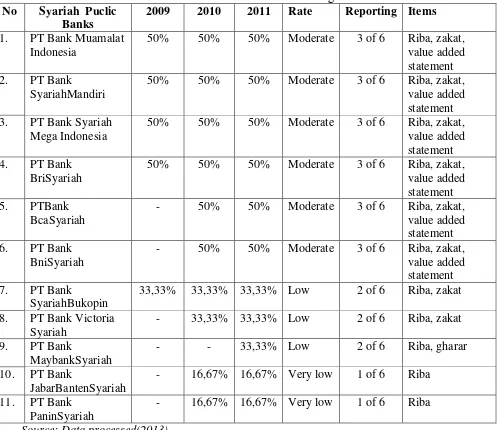

Funding and Investment

32 themes period 2009-2011 are shown in Table 3.

Table 3. The Rate of Islamic Bank’s CSRin Funding and Investment No Syariah Puclic

Banks

2009 2010 2011 Rate Reporting Items

1. PT Bank Muamalat Indonesia

50% 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 2. PT Bank

SyariahMandiri

50% 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 3. PT Bank Syariah

Mega Indonesia

50% 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 4. PT Bank

BriSyariah

50% 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 5. PTBank

BcaSyariah

- 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 6. PT Bank

BniSyariah

- 50% 50% Moderate 3 of 6 Riba, zakat, value added statement 7. PT Bank

SyariahBukopin

33,33% 33,33% 33,33% Low 2 of 6 Riba, zakat

8. PT Bank Victoria Syariah

- 33,33% 33,33% Low 2 of 6 Riba, zakat

9. PT Bank

MaybankSyariah

- - 33,33% Low 2 of 6 Riba, gharar

10. PT Bank

JabarBantenSyariah

- 16,67% 16,67% Very low 1 of 6 Riba

11. PT Bank PaninSyariah

- 16,67% 16,67% Very low 1 of 6 Riba

Source: Data processed(2013)

Products and Services

33 during 2009-2011 are shown in Table 4.

34 No Syiah Pyblic

Bank 2009 2010 2011 Category Reporting Items

1.

PT Bank Muamalat Indonesia

75% 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

2. PT Bank

Syariah Mandiri 75% 75% 75% High 3 of 4

halal status, safety and product quality, and customer service 3. PT Bank Syariah Mega Indonesia

75% 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

4. PT Bank Bri

Syariah 75% 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

5. PTBank Bca

Syariah 75% 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

6. PT Bank Bni

Syariah - 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

7. PT Bank

Syariah Bukopin - 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

8. PT Bank

Victoria Syariah - 75% 75% High 3 of 4

halal status, safety and product quality, and customer service 9. PT Bank Maybank Syariah

- 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

10 PT Bank Jabar

Banten Syariah - 75% 75% High 3 of 4

halal status, safety and product quality, and customer service

11. PT Bank Panin

Syariah - - 75% High 3 of 4

halal status, safety and product quality, and customer service

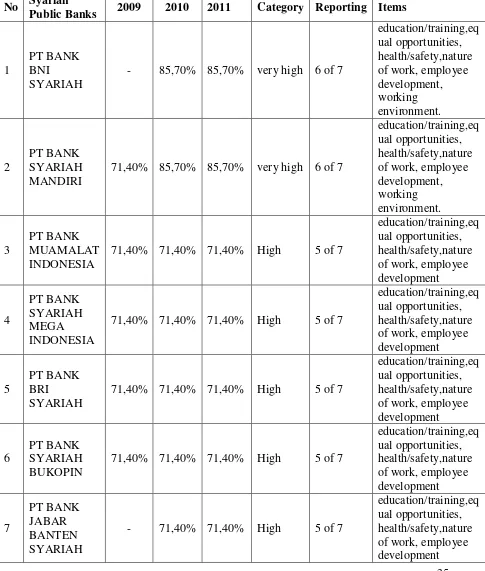

35 Percetage rate of Islamic Banks social performance of employees theme during 2009-2011 are shown in Table 5.

Table 5. The Rate of Islamic Bank’s CSR in Employee Theme

No Syariah

Public Banks 2009 2010 2011 Category Reporting Items

1

PT BANK BNI SYARIAH

- 85,70% 85,70% very high 6 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development, working environment. 2 PT BANK SYARIAH MANDIRI

71,40% 85,70% 85,70% very high 6 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development, working environment. 3 PT BANK MUAMALAT INDONESIA

71,40% 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development 4 PT BANK SYARIAH MEGA INDONESIA

71,40% 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

5

PT BANK BRI

SYARIAH

71,40% 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

6

PT BANK SYARIAH BUKOPIN

71,40% 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development 7 PT BANK JABAR BANTEN SYARIAH

- 71,40% 71,40% High 5 of 7

36

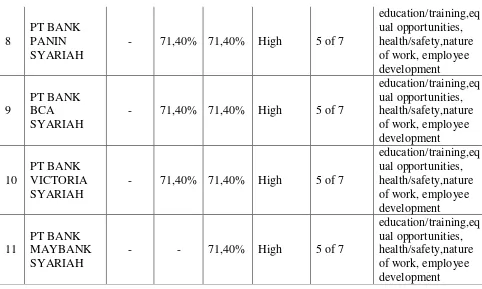

Community

Percentage rate of Islamic Banks social performance ofcommunity theme during 2009-2011 are shown in Table 6.

Table 6. The Rate of Islamic Bank’s CSRin Community Theme 8

PT BANK PANIN SYARIAH

- 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

9

PT BANK BCA SYARIAH

- 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

10

PT BANK VICTORIA SYARIAH

- 71,40% 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

11

PT BANK MAYBANK SYARIAH

- - 71,40% High 5 of 7

education/training,eq ual opportunities, health/safety,nature of work, employee development

No Syariah Public

Bank 2009 2010 2011 Category Reporting Items

1

PT BANK MUAMALAT INDONESIA

100% 100% 100% very high 10 of 10

Sadaqah, waqaf, qardhasan, employee volunteerism,scholarship, graduate

employment,Underprivila ge Community, youth development, children care, sponsoring publiic health

2

PT BANK SYARIAH MANDIRI

90% 100% 100% very high 10 of 10

Sadaqah, waqaf, qardhasan, employee volunteerism,scholarship, graduate

37

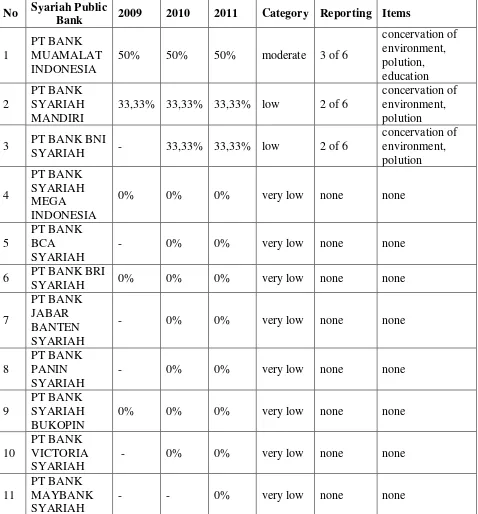

Environment

Percentage rate ofIslamic Banks social performance of environment theme during 3 PT BANK BNI

SYARIAH - 90% 90% very high 9 of 10

Sadaqah, qardhasan, employee

volunteerism,scholarship, graduate

employment,Underprivila ge Community, youth development, children care, sponsoring publiic health

4

PT BANK SYARIAH MEGA INDONESIA

60% 70% 70% High 7 of 10

Sadaqah, waqaf, qardhasan, employee volunteerism,

Underprivilage Community, children care, sponsoring publiic health

5 PT BANK BCA

SYARIAH - 70% 70% High 7 of 10

Sadaqah, waqaf, qardhasan, employee volunteerism,

Underprivilage Community, children care, sponsoring publiic health

6 PT BANK BRI

SYARIAH 50% 50% 50% moderate 5 of 10

Sadaqah, qardhasan, employee volunteerism, Underprivilage

Community, children care

7

PT BANK SYARIAH BUKOPIN

50% 50% 50% moderate 5 of ten

Sadaqah, qardhasan, employee volunteerism, Underprivilage

Community, children care

8

PT BANK JABAR BANTEN SYARIAH

- 20% 20% very low 2 of 10 sadaqah, qardhasan

9

PT BANK VICTORIA SYARIAH

- 20% 20% very low 2 of 10 sadaqah, qardhasan

10

PT BANK PANIN SYARIAH

- 10% 10% very low 1 of 10 graduate employment

11

PT BANK MAYBANK SYARIAH

38 2009-2011 are shown in Table 7.

Table 7. The Rate of Islamic Bank’s CSRin Environment Theme

No Syariah Public

Bank 2009 2010 2011 Category Reporting Items

1

PT BANK MUAMALAT INDONESIA

50% 50% 50% moderate 3 of 6

concervation of environment, polution, education

2

PT BANK SYARIAH MANDIRI

33,33% 33,33% 33,33% low 2 of 6

concervation of environment, polution

3 PT BANK BNI

SYARIAH - 33,33% 33,33% low 2 of 6

concervation of environment, polution

4

PT BANK SYARIAH MEGA INDONESIA

0% 0% 0% very low none none

5

PT BANK BCA SYARIAH

- 0% 0% very low none none

6 PT BANK BRI

SYARIAH 0% 0% 0% very low none none

7

PT BANK JABAR BANTEN SYARIAH

- 0% 0% very low none none

8

PT BANK PANIN SYARIAH

- 0% 0% very low none none

9

PT BANK SYARIAH BUKOPIN

0% 0% 0% very low none none

10

PT BANK VICTORIA SYARIAH

- 0% 0% very low none none

11

PT BANK MAYBANK SYARIAH

- - 0% very low none none

Corporate Governance

39 during 2009-2011 are shown in Table 8.

40 No Syariah Public

Bank 2009 2010 2011 Category Reporting Items

1 PT BANK BNI

SYARIAH - 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

2

PT BANK MUAMALAT INDONESIA

100% 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

3

PT BANK SYARIAH MANDIRI

100% 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

4

PT BANK SYARIAH MEGA INDONESIA

100% 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

5 PT BANK BCA

SYARIAH -

100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

6 PT BANK BRI SYARIAH

100% 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

41 7

PT BANK JABAR BANTEN SYARIAH

- 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

8

PT BANK PANIN SYARIAH

- 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

9

PT BANK SYARIAH BUKOPIN

100% 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

10

PT BANK VICTORIA SYARIAH

- 100% 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

11 PT BANK MAYBANK

- - 100% very high 5 of 5

Sharia Compliance, Ownership Structure, BOD, Declaration of Forbidden

Activities,anti-corruption policies

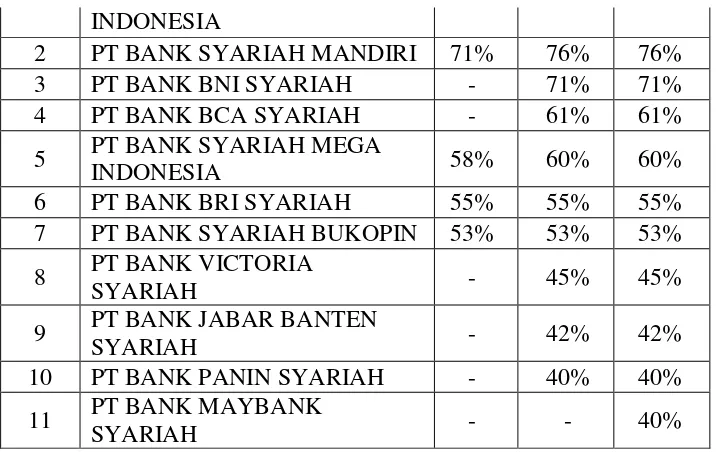

Based on 6 theme of ISR index that has been shown previously, the results of reporting score on the social performance of Islamic banking by using ISR index models can be seen in Table 9.

Table 9. Social PerformanceRate ofIslamic Banks By Using ISR Index

No Syariah Public Bank 2009 2010 2011

42 Table 9 shows that in 2009, Bank Muamalat exists at the level of social performance by 76% (high), Bank SyariahMandiri amount to 71% (high), Bank Syariah Mega Indonesia by 58% (moderate), Bank Syariah BRI by 55% (moderate ), and Bank SyariahBukopin by 53% (moderate).

Based on Table 9 it can be seen that in 2010 the Bank Muamalat (76%), Bank SyariahMandiri (76%), Bank BNI Syariah (71%) and Bank BCA Syariah (61%) with high social performance, while Islamic Banks with moderate levels of social performance (41-60%) are Bank Syariah Mega Indonesia (60%), BRI Syariah (55%), SyariahBukopin (53%), Victoria Syariah (45%), and Bank JabarBantenSyariah (42%). Meanwhile, Islamic Banks with low social performance (21-40%) are Bank PaninSyariah (40%). During the years 2009-2010, there were 3 Islamic Banksconsistenlydo social performance with the previous year, such as Bank Muamalat, BRI Syariah and BukopinSyariah. While two others; Bank SyariahMandiri and Bank Syariah Mega Indonesia with social performance that increase in 2010.

Table 9 shows that in 2011, all of Islamic Banks have same percentage of social performance in 2010 and MaybankSyariah as a new object in this year has social performance by 40% (low). Based on the Table 9, it can be seen that all of Islamic banks have fixed performance percentage during 2010-2011. It means that social responsibility activities undertaken by banks wasorganizedconsistently. In addition, it is also an illustration that social activity by Islamic Banks oriented for long-term (sustainability).

Overall, neither Islamic banks in Indonesia are carrying out social activities completely (100%) based on the model of index ISR. This is consistent with the results of research conducted by Sofyani et al. (2012) which states that there are 2 important factors why Islamic Banks do not have a 100% social performance index based on ISR index. First, because Islamic banks did not actually carry out social activities that they are able to implement such reporting ghararactivities and clients who have problems with almost all Islamic banks and Islamic banks in Indonesia, in this case, do not report it unless MaybankSyariah. Second, influenced by the presence of measurement items of ISR index models that did not implement as bank's activities, such as environmental audit and produce natural commodities (Green Product). The existence of these items because ISR index not only for Islamic banking, but also for other companies

INDONESIA

2 PT BANK SYARIAH MANDIRI 71% 76% 76%

3 PT BANK BNI SYARIAH - 71% 71%

4 PT BANK BCA SYARIAH - 61% 61%

5 PT BANK SYARIAH MEGA

INDONESIA 58% 60% 60%

6 PT BANK BRI SYARIAH 55% 55% 55%

7 PT BANK SYARIAH BUKOPIN 53% 53% 53%

8 PT BANK VICTORIA

SYARIAH - 45% 45%

9 PT BANK JABAR BANTEN

SYARIAH - 42% 42%

10 PT BANK PANIN SYARIAH - 40% 40%

11 PT BANK MAYBANK

43 either trading company, services company, and manufacturing (Sofyani et al., 2012).

Conclusions

Based on the results of this research, it can be concluded that the corporate social responsibility of islamic bank in Indonesia by using islamic social reporting (ISR) index for the year 2009-2011 on average was 58.9% (moderate).This research was conducted with only one method of measuring the social performance by using ISR indexwhich is developedbySofyani et al. (2012). This allows the latest indicators are being developed in a comprehensive manner by subsequent studies. In addition, this study is only conducted to observe the activities of Islamic banking, while the index of ISR is not only devoted to the bank, but also for manufacturing, trade, and services company.

Then, the researchers suggest to Islamic Banking which have high social performance in order to perform consistently over the long term social performance that can be a model for other Islamic banks.Islamic Banking which have moderate, low, and very low (not reported) social performance in order to improve their social performance as an accountability to Allah and the community. And also Islamic banking is supposed to continuing improve their performance in social aspects such material, moral, and spiritual aspect.

Further, we recommend to add the observation period to identify Islamic Banks that carrying out long-term social performance, and identify manufacturing, trade and servicescompany as the objects of observation of social performance by using ISR index.

References

Haniffa, R. 2002. Social Reporting Disclosure-An Islamic Perspective.Indonesian Management and Accounting Research, Vol. 1: 128-146.

Othman, R., & A. M. Thani. 2010. Islamic Social Reporting Of Listed Companies InMalaysia. International Business & Economics Research Journal, 12: 135-144.

Othman, R., A. M. Thani, & E. K. Ghani. (2009). Determinants of Islamic Social Reporting Among Top Shariah Approved Companies in Bursa Malaysia. Research Journal of International Studies, 9: 4-20.

Sekaran, U., & R. Bougie. 2010. Research Methods for Business Fifth Edition.Chicester: John Willey & Sons.

Siwar, C., & M. T. Hossain. 2009. An analysis of Islamic CSR concept and the opinions of Malaysian managers. Management of Environmental Quality: International Journal, Vol. 20: 290-298.

Sofyani, Hafiez.,IhyaniUlum, Daniel S., Sri Wahyuni L. 2012. Islamic Social Reporting Index sebagai Model PengukuranKinerjaSosialPerbankanSyariah (Studi Komparasi Indonesia dan Malaysia).Jurnal Dinamika Akuntansi, Vol. 4, No. 1: 36-46.

Vivanews. 2009. Bank SyariahKucurkan CSR Rp 1,45Triliun. Melalui <http://beta.analisis.vivanews.com>[7/11/12].

Watts, P, Holme, L. 1999. CSR: Meeting Changing Expectation.WBCSD Publication.Melalui <http://www.businessrespect.net>[10/11/12].