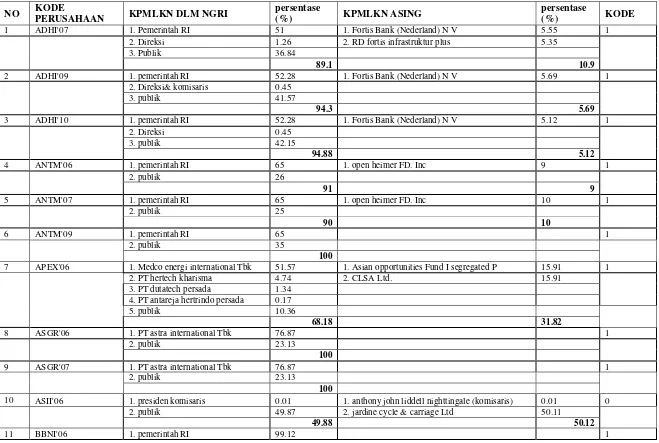

NO KODE

PERUSAHAAN KPMLKN DLM NGRI

persentase

(%) KPMLKN ASING

persentase

(%) KODE

1 ADHI'07 1. Pemerintah RI 51 1. Fortis Bank (Nederland) N V 5.55 1

2. Direksi 1.26 2. RD fortis infrastruktur plus 5.35

3. Publik 36.84

89.1 10.9

2 ADHI'09 1. pemerintah RI 52.28 1. Fortis Bank (Nederland) N V 5.69 1

2. Direksi& komisaris 0.45

3. publik 41.57

94.3 5.69

3 ADHI'10 1. pemerintah RI 52.28 1. Fortis Bank (Nederland) N V 5.12 1

2. Direksi 0.45

3. publik 42.15

94.88 5.12

4 ANTM'06 1. pemerintah RI 65 1. open heimer FD. Inc 9 1

2. publik 26

91 9

5 ANTM'07 1. pemerintah RI 65 1. open heimer FD. Inc 10 1

2. publik 25

90 10

6 ANTM'09 1. pemerintah RI 65 1

2. publik 35

100

7 APEX'06 1. Medco energi international Tbk 51.57 1. Asian opportunities Fund I segregated P 15.91 1

2. PT hertech kharisma 4.74 2. CLSA Ltd. 15.91

3. PT dutatech persada 1.34

4. PT antareja hertrindo persada 0.17

5. publik 10.36

68.18 31.82

8 ASGR'06 1. PT astra international Tbk 76.87 1

2. publik 23.13

100

9 ASGR'07 1. PT astra international Tbk 76.87 1

2. karyawan 0.05

3. Publik 0.83

100

12 BBNI'07 1. pemerintah RI 76.36 1. Badan usaha asing 5.77 1

2. karyawan 0.04

3. Perseroan Terbatas 10.21

4. Publik 7.62

94.23 5.77

13 BBNI'09 1. pemerintah RI 76.36 1. Badan usaha asing 5.77 1

2. karyawan 0.04

3. Perseroan Terbatas 10.21

4. Publik 7.62

94.23 5.77

14 BMRI'06 1. pemerintah RI 67.86 1

2. publik 32.14

100

15 BMRI'07 1. pemerintah RI 67.47 1

2. publik 32.53

100

16 BMRI'08 1. pemerintah RI 66.97 1

2. publik 33.03

100

17 BMRI'09 1. pemerintah RI 66.76 1

2. publik 33.24

100

18 BNGA'06 1. publik 36.87 1. CIMB group Sdn Bhd, malaysia 63.13 0

36.87 63.13

19 BNGA'07 1. publik 35.52 1. bumiputera comeerce holding berhad, malaysia 64.48 0

35.52 64.48

20 BNGA'08 1. publik 6.12 1. CIMB group Sdn Bhd, Malaysia 77.24 0

2. santubong ventures Sdb Bhd, malaysia 16.64

6.12 93.88

21 BNGA'09 1. Publik 6.12 1. CIMB group Sdn Bhd, Malaysia 77.24 0

2. santubong ventures Sdb Bhd, malaysia 16.64

6.12 93.88

22 BNLI'07 1. PT astra international Tbk 44.505 1. standar chartered Bank 44.505 1

2. publik 10.99

55.495 44.505

2. reksa dana 1.51 2. Msci emerging markets index fund 1.99

3. publik 82.13 3. credit suisse international 1.51

93.73 6.27

24 ELSA'08 1. PT pertamina 41.67 1

2. PT tri daya esta 37.67

3. Iin arifin takhyan (komisaris) 0.03

4. harry triono (komisaris) 0.02

5. anton sugiono (komisaris) 0.02

6. eteng ahmad salam (direksi) 0.03

7. eddy sjahbuddin (direksi) 0.04

8. hendri s suardi 0.03

9. publik 20.49

100

25 ELSA'09 1. PT pertamina 41.67 1

2. PT tri daya esta 37.67

3. komisaris 0.02

4. eteng ahmad salam (direksi) 0.03

5. eddy sjahbuddin (direksi) 0.04

6. lucy sicilia (direksi) 0.01

7. muhammad jauzin arif (direksi) 0.01

8. publik 20.55

100

26 ELTY'09 1. PT bakrie and brother tbk 11.2 1. CGMI I client segregated secs 24.38 1

2. publik 64.42

75.62 24.38

27 JSMR'09 1. pemerintah RI 70 1

2. karyawan 1.36

3. PT Jamsostek 2.07

4. publik 26.57

100

28 KLBF'06 1. PT gira sole prima 9.54 1

2. PT santa seha sanadi 9.03

3. PT lucasta murni cemerlang 8.89

4. PT diptanala bahana 8.76

2. PT santa seha sanadi 8.92

3. PT lucasta murni cemerlang 8.74

4. PT diptanala bahana 8.64

5. PT ladang ira panen 8.58

6. PT bina artha charisma 8.54

7. publik 47.17

100

30 PTBA'07 1. pemerintah RI 65.02 1. badan usaha asing 13.36 1

2. direktur utama 0.009

3. direktur umum 0.006

4. direktur operasi 0.003

5. karyawan 0.22

6. reksadana 8.72

7. publik 12.67

86.648 13.36

31 PTBA'09 1. direktur oprasi 0.003 1. badan usaha asing 19.39 1

2. karyawan 0.14

3. reksadana 4.65

4. publik 10.77

5. pemerintah RI 65.02

6. Sukrisno (DIRUT) 0.009

7. mahbub iskandar (direktur umum) 0.006

80.598 19.39

32 TLKM'06 1. pemerintah RI 51.5 1. JPMCB US resident (norbax inc) 8.77 1

2. publik 32.32 2. the bank of new york 7.41

83.82 16.18

33 TLKM'09 1. pemerintah RI 52.47 1. the bank of new york mellon corporation 9.09 1

2. publik 38.44

90.91 9.09

34 UNTR'07 1. astra international tbk 58.45 1

2. publik 41.55

100

35 UNTR'08 1. astra international tbk 59.5 1

2. publik 40.5

100

36 UNTR'09 1. astra international tbk 59.5 1

2. publik 40.5

37 WEHA'09 1. PT panorama sentra wisata Tbk 66.9 1. CIMB GK securities Pte. Ltd 5.88 1

2. Satrijanto tirta wisata 1.71

3. publik 25.51

94.12 5.88

38 WIKA'07 1. PT wika persero Tbk 70.08 1

2. widjaja narko tantono 14.88

3. suprapto 5.12

4. Ir Hastjaryo 9.92

100

39 WIKA'08 1. PT wika persero Tbk 70.08 1

2. widjaja narko tantono 14.88

3. suprapto 5.12

4. Ir Hastjaryo 9.92

100

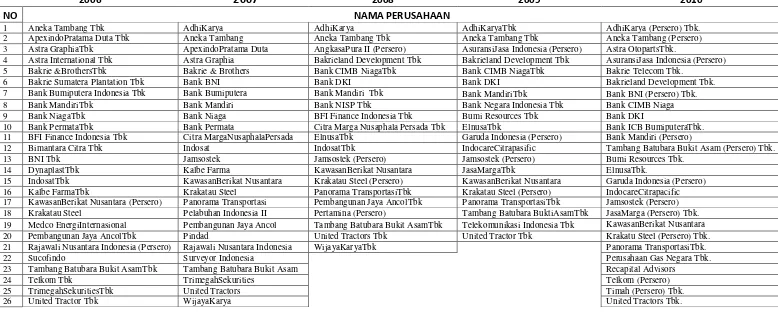

CATATAN

2006

2007

2008

2009

2010

NO

NAMA PERUSAHAAN

1 Aneka Tambang Tbk AdhiKarya AdhiKarya AdhiKaryaTbk AdhiKarya (Persero) Tbk.

2 ApexindoPratama Duta Tbk Aneka Tambang Aneka Tambang Tbk Aneka Tambang Tbk Aneka Tambang (Persero) 3 Astra GraphiaTbk ApexindoPratama Duta AngkasaPura II (Persero) AsuransiJasa Indonesia (Persero) Astra OtopartsTbk.

4 Astra International Tbk Astra Graphia Bakrieland Development Tbk Bakrieland Development Tbk AsuransiJasa Indonesia (Persero) 5 Bakrie &BrothersTbk Bakrie & Brothers Bank CIMB NiagaTbk Bank CIMB NiagaTbk Bakrie Telecom Tbk.

6 Bakrie Sumatera Plantation Tbk Bank BNI Bank DKI Bank DKI Bakrieland Development Tbk.

7 Bank Bumiputera Indonesia Tbk Bank Bumiputera Bank Mandiri Tbk Bank MandiriTbk Bank BNI (Persero) Tbk. 8 Bank MandiriTbk Bank Mandiri Bank NISP Tbk Bank Negara Indonesia Tbk Bank CIMB Niaga

9 Bank NiagaTbk Bank Niaga BFI Finance Indonesia Tbk Bumi Resources Tbk Bank DKI

10 Bank PermataTbk Bank Permata Citra Marga Nusaphala Persada Tbk ElnusaTbk Bank ICB BumiputeraTbk. 11 BFI Finance Indonesia Tbk Citra MargaNusaphalaPersada ElnusaTbk Garuda Indonesia (Persero) Bank Mandiri (Persero)

12 Bimantara Citra Tbk Indosat IndosatTbk IndocareCitrapasific Tambang Batubara Bukit Asam (Persero) Tbk.

13 BNI Tbk Jamsostek Jamsostek (Persero) Jamsostek (Persero) Bumi Resources Tbk.

14 DynaplastTbk Kalbe Farma KawasanBerikat Nusantara JasaMargaTbk ElnusaTbk.

15 IndosatTbk KawasanBerikat Nusantara Krakatau Steel (Persero) KawasanBerikat Nusantara Garuda Indonesia (Persero) 16 Kalbe FarmaTbk Krakatau Steel Panorama TransportasiTbk Krakatau Steel (Persero) IndocareCitrapacific 17 KawasanBerikat Nusantara (Persero) Panorama Transportasi Pembangunan Jaya AncolTbk Panorama TransportasiTbk Jamsostek (Persero) 18 Krakatau Steel Pelabuhan Indonesia II Pertamina (Persero) Tambang Batubara BuktiAsamTbk JasaMarga (Persero) Tbk. 19 Medco EnergiInternasional Pembangunan Jaya Ancol Tambang Batubara Bukit AsamTbk Telekomunikasi Indonesia Tbk KawasanBerikat Nusantara 20 Pembangunan Jaya AncolTbk Pindad United Tractors Tbk United Tractor Tbk Krakatu Steel (Persero) Tbk. 21 Rajawali Nusantara Indonesia (Persero) Rajawali Nusantara Indonesia WijayaKaryaTbk Panorama TransportasiTbk.

22 Sucofindo Surveyor Indonesia Perusahaan Gas Negara Tbk.

23 Tambang Batubara Bukit AsamTbk Tambang Batubara Bukit Asam Recapital Advisors

24 Telkom Tbk TrimegahSekurities Telkom (Persero)

25 TrimegahSekuritiesTbk United Tractors Timah (Persero) Tbk.

26 United Tractor Tbk WijayaKarya United Tractors Tbk.

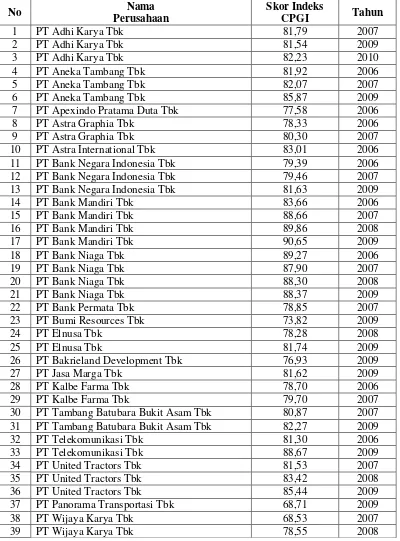

Tabel Daftar Sampel Penelitian

No

Nama

Perusahaan

Skor Indeks

CPGI

Tahun

1

PT Adhi Karya Tbk

81,79

2007

2

PT Adhi Karya Tbk

81,54

2009

3

PT Adhi Karya Tbk

82,23

2010

4

PT Aneka Tambang Tbk

81,92

2006

5

PT Aneka Tambang Tbk

82,07

2007

6

PT Aneka Tambang Tbk

85,87

2009

7

PT Apexindo Pratama Duta Tbk

77,58

2006

8

PT Astra Graphia Tbk

78,33

2006

9

PT Astra Graphia Tbk

80,30

2007

10

PT Astra International Tbk

83,01

2006

11

PT Bank Negara Indonesia Tbk

79,39

2006

12

PT Bank Negara Indonesia Tbk

79,46

2007

13

PT Bank Negara Indonesia Tbk

81,63

2009

14

PT Bank Mandiri Tbk

83,66

2006

15

PT Bank Mandiri Tbk

88,66

2007

16

PT Bank Mandiri Tbk

89,86

2008

17

PT Bank Mandiri Tbk

90,65

2009

18

PT Bank Niaga Tbk

89,27

2006

19

PT Bank Niaga Tbk

87,90

2007

20

PT Bank Niaga Tbk

88,30

2008

21

PT Bank Niaga Tbk

88,37

2009

22

PT Bank Permata Tbk

78,85

2007

23

PT Bumi Resources Tbk

73,82

2009

24

PT Elnusa Tbk

78,28

2008

25

PT Elnusa Tbk

81,74

2009

26

PT Bakrieland Development Tbk

76,93

2009

27

PT Jasa Marga Tbk

81,62

2009

28

PT Kalbe Farma Tbk

78,70

2006

29

PT Kalbe Farma Tbk

79,70

2007

30

PT Tambang Batubara Bukit Asam Tbk

80,87

2007

31

PT Tambang Batubara Bukit Asam Tbk

82,27

2009

32

PT Telekomunikasi Tbk

81,30

2006

33

PT Telekomunikasi Tbk

88,67

2009

34

PT United Tractors Tbk

81,53

2007

35

PT United Tractors Tbk

83,42

2008

36

PT United Tractors Tbk

85,44

2009

37

PT Panorama Transportasi Tbk

68,71

2009

38

PT Wijaya Karya Tbk

68,53

2007

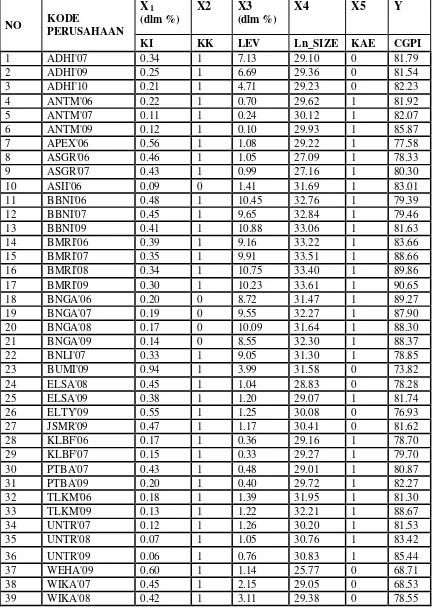

NO

KODE

PERUSAHAAN

X

1(dlm %)

X2

X3

(dlm %)

X4

X5

Y

KI

KK

LEV

Ln_SIZE

KAE

CGPI

1

ADHI'07

0.34

1

7.13

29.10

0

81.79

2

ADHI'09

0.25

1

6.69

29.36

0

81.54

3

ADHI'10

0.21

1

4.71

29.23

0

82.23

4

ANTM'06

0.22

1

0.70

29.62

1

81.92

5

ANTM'07

0.11

1

0.24

30.12

1

82.07

6

ANTM'09

0.12

1

0.10

29.93

1

85.87

7

APEX'06

0.56

1

1.08

29.22

1

77.58

8

ASGR'06

0.46

1

1.05

27.09

1

78.33

9

ASGR'07

0.43

1

0.99

27.16

1

80.30

10

ASII'06

0.09

0

1.41

31.69

1

83.01

11

BBNI'06

0.48

1

10.45

32.76

1

79.39

12

BBNI'07

0.45

1

9.65

32.84

1

79.46

13

BBNI'09

0.41

1

10.88

33.06

1

81.63

14

BMRI'06

0.39

1

9.16

33.22

1

83.66

15

BMRI'07

0.35

1

9.91

33.51

1

88.66

16

BMRI'08

0.34

1

10.75

33.40

1

89.86

17

BMRI'09

0.30

1

10.23

33.61

1

90.65

18

BNGA'06

0.20

0

8.72

31.47

1

89.27

19

BNGA'07

0.19

0

9.55

32.27

1

87.90

20

BNGA'08

0.17

0

10.09

31.64

1

88.30

21

BNGA'09

0.14

0

8.55

32.30

1

88.37

22

BNLI'07

0.33

1

9.05

31.30

1

78.85

23

BUMI'09

0.94

1

3.99

31.58

0

73.82

24

ELSA'08

0.45

1

1.04

28.83

0

78.28

25

ELSA'09

0.38

1

1.20

29.07

1

81.74

26

ELTY'09

0.55

1

1.25

30.08

0

76.93

27

JSMR'09

0.47

1

1.17

30.41

0

81.62

28

KLBF'06

0.17

1

0.36

29.16

1

78.70

29

KLBF'07

0.15

1

0.33

29.27

1

79.70

30

PTBA'07

0.43

1

0.48

29.01

1

80.87

31

PTBA'09

0.20

1

0.40

29.72

1

82.27

32

TLKM'06

0.18

1

1.39

31.95

1

81.30

33

TLKM'09

0.13

1

1.22

32.21

1

88.67

34

UNTR'07

0.12

1

1.26

30.20

1

81.53

35

UNTR'08

0.07

1

1.05

30.76

1

83.42

36

UNTR'09

0.06

1

0.76

30.83

1

85.44

37

WEHA'09

0.60

1

1.14

25.77

0

68.71

38

WIKA'07

0.45

1

2.15

29.05

0

68.53

39

WIKA'08

0.42

1

3.11

29.38

0

78.55

NO KODE PERUSAHAAN

LEMBAR SAHAM NILAI NOMINAL (DALAM Rp)

NILAI RUPIAH (MC) TOTAL EKUITAS MVE=MC/TE SAHAM SERI A SAHAM SERI B SAHAM SERI C SAHAM SERI A SAHAM SERI B SAHAM SERI C

1 ADHI'07 1,801,320,000 100 180,132,000,000 531,234,660,402 0.34

2 ADHI'09 1,801,320,000 100 180,132,000,000 731,199,659,939 0.25

3 ADHI'10 1,801,320,000 100 180,132,000,000 861,113,484,045 0.21

4 ANTM'06 1,907,691,950 500 953,845,975,000 4,281,602,475,000 0.22

5 ANTM'07 9,538,459,750 100 953,845,975,000 8,750,106,229,000 0.11

6 ANTM'09 1 9,538,459,749 100 100 953,845,975,000 8,148,939,490,000 0.12

7 APEX'06 2,623,356,000 500 1,311,725,016,324 2,357,972,499,294 0.56

8 ASGR'06 1,348,780,500 100 134,878,050,000 295,953,593,946 0.46

9 ASGR'07 1,348,780,500 100 134,878,050,000 314,076,374,312 0.43

10 ASII'06 4048355314 500 2,024,177,657,000 22,375,766,000,000 0.09

11 BBNI'06 1 289,341,866 12,992,345,533 7,500 7,500 375 7,042,193,577,375 14,794,269,000,000 0.48

12 BBNI'07 1 289,341,866 14,984,598,643 7,500 7,500 375 7,789,288,493,625 17,219,585,000,000 0.45

13 BBNI'09 1 289,341,866 14,984,598,643 7,500 7,500 375 7,789,288,493,625 19,143,582,000,000 0.41

14 BMRI'06 1 20,631,217,466 500 500 10,315,608,733,500 26,340,670,000,000 0.39

15 BMRI'07 1 20,749,551,741 500 500 10,374,775,871,000 29,243,732,000,000 0.35

16 BMRI'08 1 20,905,647,787 500 500 10,452,823,894,000 30,513,869,000,000 0.34

17 BMRI'09 1 20,970,116,804 500 500 10,485,058,402,500 35,108,769,000,000 0.30

18 BNGA'06 71,853,936 11,992,205,380 5,000 50 958,879,949,000 4,787,095,000,000 0.20

19 BNGA'07 71,853,936 12,250,748,722 5,000 50 971,807,116,100 5,203,398,000,000 0.19

20 BNGA'08 71,853,936 23,863,009,724 5,000 50 1,552,420,166,200 9,302,467,000,000 0.17

21 BNGA'09 71,853,936 23,863,009,724 5,000 50 1,552,420,166,200 11,210,407,000,000 0.14

22 BNLI'09 26,880,234 7,716,245,690 12,500 125 1,300,533,636,250 3,902,676,000,000 0.33

23 BUMI'09 19,404,000,000 500 9,702,000,000,000 10,296,805,176,000 0.94

24 ELSA'08 7,298,500,000 100 729,850,000,000 1,613,833,000,000 0.45

25 ELSA'09 7,298,500,000 100 729,850,000,000 1,909,678,000,000 0.38

26 ELTY'09 1,400,000,000 18,516,859,473 500 100 2,551,685,947,300 4,642,528,114,569 0.55

27 JSMR'09 1 6,799,999,999 500 500 3,400,000,000,000 7,183,378,636,000 0.47

28 KLBF'06 10,156,014,422 50 507,800,721,100 2,994,816,751,748 0.17

29 KLBF'07 10,156,014,422 50 507,800,721,100 3,386,861,941,228 0.15

30 PTBA'07 2,304,131,850 500 1,152,065,925,000 2,675,501,000,000 0.43

31 PTBA'09 1 2,304,131,849 500 500 1,152,065,925,000 5,701,372,000,000 0.20

32 TLKM'06 1 20,159,999,279 250 250 5,039,999,820,000 28,068,689,000,000 0.18

33 TLKM'09 1 20,159,999,278 250 250 5,039,999,819,750 38,989,747,000,000 0.13

34 UNTR'07 2,851,609,100 250 712,902,275,000 5,733,335,000,000 0.12

35 UNTR'08 3,326,877,283 250 831,719,320,750 11,131,607,000,000 0.07

36 UNTR'09 3,326,877,283 250 831,719,320,750 13,843,710,000,000 0.06

37 WEHA'09 428,270,000 100 42,827,000,000 71,713,008,910 0.60

OUTPUT SPSS

1.

Statistik Deskriptif

Tabel 4.3 Hasil Uji Statistik Deskriptif

2.

Hasil Analisis Uji Asumsi Klasik

Tabel 4.4 Uji Normalitas

NPar Test

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 39

Normal Parametersa Mean .0000000

Std. Deviation 2.84402080

Most Extreme

Differences

Absolute .169

Positive .068

Negative -.169

Kolmogorov-Smirnov Z 1.053

Asymp. Sig. (2-tailed) .217

a. Test distribution is Normal

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

KI 39 .06 .94 .3156 .18394

LEV 39 .10 10.88 4.1895 4.07308

SIZE 39 1.55E5 3.39E9 1.4695E8 5.41671E8

CGPI 39 68.53 90.65 81.8133 5.07583

Tabel 4.5 Uji Multikolonieritas

a. Dependent Variable: CGPI

Tabel 4.6 Uji Autokorelasi

NPar Test

Runs Test

Unstandardized Residual

Test Valuea .38285

Cases < Test Value 19

Cases >= Test Value 20

Total Cases 39

Number of Runs 19

Z -.321

Asymp. Sig. (2-tailed) .749

a. Median

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) 69.257 5.942 11.655 .000

KI -12.523 3.377 -.454 -3.708 .001 .635 1.574

KK -1.545 1.688 -.103 -.915 .367 .750 1.333

LEV .187 .188 .150 .993 .328 .417 2.399

Ln_SIZE .953 .382 .378 2.499 .018 .416 2.404

Tabel 4.7 Uji Heterokedastisitas

3.

Hasil Analisis Regresi Berganda

Tabel 4.8 Hasil Pengujian Regresi Berganda

a. Dependent Variable: abs_ut

Coefficientsa

Model

Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 1.910 3.398 .562 .578

KI .019 1.931 .002 .010 .992

KK 1.087 .965 .221 1.126 .268

LEV .075 .108 .184 .698 .490

Ln_SIZE -.060 .218 -.073 -.277 .784

KAE .149 .792 .040 .188 .852

a. Dependent Variable: abs_ut

Coefficientsa

Model

Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 86.587 2.502 34.611 .000

KI -14.362 3.289 -.520 -4.366 .000

KK -3.132 1.812 -.209 -1.729 .093

LEV .071 .209 .057 .341 .735

SIZE 2.177E-14 .000 .458 2.748 .010

4.

Pengujian

Goodness Of Fit Test

Tabel 4.8 Hasil Perhitungan

Adjusted

R

2Model Summaryb

Model R R Square

Adjusted R

Square Std. Error of the Estimate

1 .828a .686 .638 3.05188

a.Predictors: (Constant), KAE, LEV, KK, KI, Ln_SIZE b.Dependent Variable: CGPI

Tabel 4.9 Hasil Perhitungan Uji F

Tabel 4.10 Hasil Uji t

ANOVAb

Model Sum of Squares Df Mean Square F Sig.

1 Regression 671.673 5 134.335 14.423 .000a

Residual 307.361 33 9.314

Total 979.034 38

a. Predictors: (Constant), KAE, LEV, KK, KI, Ln_SIZE

b. Dependent Variable: CGPI

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

B Std. Error Beta

1 Constant) 69.257 5.942 11.655 .000

KI -12.523 3.377 -.454 -3.708 .001

KK -1.545 1.688 -.103 -.915 .367

LEV .187 .188 .150 .993 .328

Ln_SIZE .953 .382 .378 2.499 .018

NO KODE PERUSAHAAN

TOTAL UTANG (dlm rupiah penuh)

TOTAL MODAL (dlm rupiah penuh)

(X3) TOTAL AKTIVA

(dlm rupiah penuh)

(X4) (X5)

LEVERAGE Ln_size KAE

1 ADHI'07 3,787,811,819,628 531,234,660,402 7.13 4,333,167,349,278.00 29.10 0 2 ADHI'09 4,888,581,325,142 731,199,659,939 6.69 5,629,454,335,393.00 29.36 0 3 ADHI'10 4,059,941,228,781 861,113,484,045 4.71 4,927,696,202,275.00 29.23 0 4 ANTM'06 3,010,536,837,000 4,281,602,475,000 0.70 7,292,142,247,000.00 29.62 1 5 ANTM'07 2,130,970,294,000 8,750,106,229,000 0.24 12,043,690,940,000.00 30.12 1 6 ANTM'09 847,590,728,000 8,148,939,490,000 0.10 9,939,996,438,000.00 29.93 1 7 APEX'06 2,551,731,888,834 2,357,972,499,294 1.08 4,909,704,388,128.00 29.22 1 8 ASGR'06 310,480,918,902 295,953,593,946 1.05 584,838,895,959.00 27.09 1 9 ASGR'07 310,480,918,902 314,076,374,312 0.99 624,557,293,214.00 27.16 1 10 ASII'06 31,498,444,000,000 22,375,766,000,000 1.41 57,929,290,000,000.00 31.69 1 11 BBNI'06 154,596,653,000,000 14,794,269,000,000 10.45 169,415,573,000,000.00 32.76 1 12 BBNI'07 166,094,416,000,000 17,219,585,000,000 9.65 183,341,611,000,000.00 32.84 1 13 BBNI'09 208,322,445,000,000 19,143,582,000,000 10.88 227,496,967,000,000.00 33.06 1 14 BMRI'06 241,171,346,000,000 26,340,670,000,000 9.16 267,517,192,000,000.00 33.22 1 15 BMRI'07 289,835,512,000,000 29,243,732,000,000 9.91 358,438,678,000,000.00 33.51 1 16 BMRI'08 327,896,740,000,000 30,513,869,000,000 10.75 319,085,590,000,000.00 33.40 1 17 BMRI'09 359,318,341,000,000 35,108,769,000,000 10.23 394,616,604,000,000.00 33.61 1 18 BNGA'06 41,752,356,000,000 4,787,095,000,000 8.72 46,544,346,000,000.00 31.47 1 19 BNGA'07 49,678,787,000,000 5,203,398,000,000 9.55 103,197,574,000,000.00 32.27 1 20 BNGA'08 93,836,346,000,000 9,302,467,000,000 10.09 54,885,576,000,000.00 31.64 1 21 BNGA'09 95,827,902,000,000 11,210,407,000,000 8.55 107,104,274,000,000.00 32.30 1 22 BNLI'07 35,336,070,000,000 3,902,676,000,000 9.05 39,298,423,000,000.00 31.30 1 23 BUMI'09 41,121,011,659,000 10,296,805,176,000 3.99 51,876,499,738,000.00 31.58 0 24 ELSA'08 1,685,724,000,000 1,613,833,000,000 1.04 3,317,816,000,000.00 28.83 1 25 ELSA'09 2,286,168,000,000 1,909,678,000,000 1.20 4,210,421,000,000.00 29.07 1 26 ELTY'09 5,794,138,576,947 4,642,528,114,569 1.25 11,592,631,487,233.00 30.08 0 27 JSMR'09 8,428,822,898,000 7,183,378,636,000 1.17 16,174,263,947,000.00 30.41 0 28 KLBF'06 1,080,170,510,223 2,994,816,751,748 0.36 4,624,619,204,478.00 29.16 1 29 KLBF'07 1,121,188,133,752 3,386,861,941,228 0.33 5,138,212,506,980.00 29.27 1 30 PTBA'07 1,291,526,000,000 2,675,501,000,000 0.48 3,979,181,000,000.00 29.01 1 31 PTBA'09 2,292,740,000,000 5,701,372,000,000 0.40 8,078,578,000,000.00 29.72 1 32 TLKM'06 38,879,969,000,000 28,068,689,000,000 1.39 75,135,745,000,000.00 31.95 1 33 TLKM'09 47,636,512,000,000 38,989,747,000,000 1.22 97,559,606,000,000.00 32.21 1 34 UNTR'07 7,216,432,000,000 5,733,335,000,000 1.26 13,002,619,000,000.00 30.20 1 35 UNTR'08 11,644,916,000,000 11,131,607,000,000 1.05 22,847,721,000,000.00 30.76 1 36 UNTR'09 10,453,748,000,000 13,843,710,000,000 0.76 24,404,828,000,000.00 30.83 1 37 WEHA'09 81,788,027,584 71,713,008,910 1.14 155,438,315,840.00 25.77 0

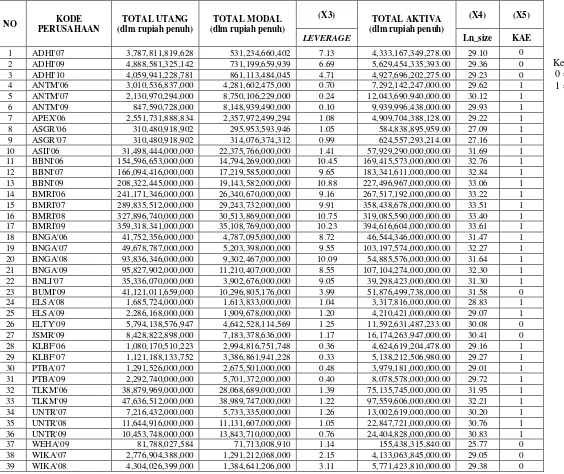

TABEL INPUT DATA LEVERAGE (X3), SIZE (X4) DAN KAE (X5)

Ket: (KAE)

0 = KAP non big four