1

ACCOUNTING FOR SMALL AND MEDIUM ENTERPRISES (SMEs)

Elisabeth Penti Kurniawati Findi Esa Putri Hermawan

Faculty of Economics and Business Satya Wacana Christian University Diponegoro Street No 52-60 Salatiga, 50711

Central Java, Indonesia Phone 62 298 321212

Fax 62 298 311881 bet@staff.uksw.edu fiendy_eza@yahoo.com

ABSTRACT

Small and Medium Enterprises (SMEs) have important role in the development of Indonesian economics. In general, SMEs face many weaknesses in accounting implementation caused by several factors. This research aimed to analyse accounting application on SMEs in Magelang, Central Java, Indonesia with obstacles they face.

Data taken in this research were from 46 SMEs using convenience sampling method. Data were gathered through interview and questionnaire. The analysis technique is descriptive qualitative analysis technique.

Results show that 69.56% of SMEs had done recording, but only 34.78% of them made financial statements. Transactions recorded include sales transactions (69.57%), purchase transactions (65.22%), cash inflows and cash outflows (91.30%), inventories (63.04%), salary (56.52%), and other operational expenses (50.00%). Reports which were made by the managers were sales reports (45.65%), purchase reports (30.43%), income statements (52.17%), statement of owner's equity (17.39%), and balance sheet (28.26%).

The obstacles which hindered accounting application in SMEs were the education factor and the lack of understanding about accounting and its importance. Therefore, it is better to create a simple accounting information system for SMEs. The government should cooperate with high education institutions to improve the comprehension of the SMEs about accounting application in managing their business.

PREFACE

Small and Medium Enterprises (SMEs) has an important role in the economic development in Indonesia. The global finance crisis in 1998 caused a lot of companies to shut down, and lead to the dismissal of many employees. Although the crisis also hit SMEs, they could overcome the pressure and survive up to this day. SMEs, in fact, provide job opportunities so significant that the unemployment rate can be reduced. This is the point that stands out from SMEs compared to big companies, because the bigger the company the bigger the risk it has to face during the crisis.

By considering the importance of SMEs for Indonesian economy, it needs more serious management. SMEs need comprehensive information to support their business management. SMEs need qualified accounting information to support their decision making. Data from “Economic Sector” 2000-2006 showed that more than 99% business units in Indonesia were small scale business, and even, the majority of them were micro business (Karyawati, 2008).

SMEs need accounting to improve their business, because they ussually have great ideas, yet do not know how to manage finance records, and to seek finance information they need (Prasetyo, 2007). By practising accounting such as making finance report can help small business to evaluate company's performance, so that they can get bank loan and make business decisions (Tugiman, 1996). Warren, et all. (2005) stated that by doing accounting process, information is produced for the sake of the interested parties to make decisions regarding the company's activities and condition. Accounting information is needed to formulate various decisions to solve problems faced by the company (Soemarso, 1992).

To small business, finance accounting information has an important role in recording and reporting process related to transactions that happen, to discover the company's development, its capital structure, and its profit in a certain period of time (Hidayat, 2004). Eventhough accounting has an important role for SMEs, the application still has many weaknesses and troubles. Besides, most small companies consentrate on every aspect of organization such as production, marketing, and cooperation in new business, but forgeting important accounting such as making finance report (Tunggal, 1997). This research aimed to analyse accounting application on SMEs in Magelang, Central Java, Indonesia with obstacles they face.

LITERATURE REVIEW

Accounting

Warren, et all, (2005) defined accounting as information system that produces reports to the interesting parties about economic activities and company's condition. Accounting serves as a process to identify, measure, and communicate information to help the user make right decision or judgment (American Accounting Association, 1996). Warren, et all, (2005) stated that the objective of accounting is simply to produce information used by managers to run company's operation. Accounting also gives information to the interesting parties about economic performance and company's condition.

towards the finance data, we can find out company's ability to fulfill its obligations, its property, and its ability in business.

Small business usually does a simple accounting, which is called bookkeeping. Bookkeeping is a process of recording transactions in manual books such as notebooks, agenda, or even in other papers. Accounting in small business serves as a tool to plan and to judge performance for the company's internal affairs, while getting fund from finance organizations such as banks for the company's external affairs (Karyawati, 2008).

Accounting in small scale business activities almost resemble to bookkeeping system, it is a single book arrangement where only important notes have full records. In single book arrangement, transactions in small or medium enterprises are recorded in logbooks, and subsidiary books. Logbooks contain of cash receipts, cash disbursements, sales ledger, buying ledger, and memorial ledger. Subsidiary ledger contain of account receivable subsidiary ledger, account payable subsidiary ledger, and inventory subsidiary ledger. Those books are replacement for account (ledger) in normal accounting (Tunggal, 1997).

Small or medium enterprises use three financial measurements which include statement of cash flow, income statement, and balance sheet. Statement of cash flow describes the inflows and the outflows of cash or cash equivalent (Iien, 2009). Income statement reports revenues and expenses during a certain period of time. Balance sheet report the total assets, liabilities, and owner's equity during a certain period of time (Warren, et all, 2005).

Small and Medium Enterprises

The definitions of small and medium enterprises according to Indonesian Regulation Number 20, 2008 about Micro, Small, and Medium Enterprises are:

a) Small enterprises is a productive economic activity which is private and owned by an individual, or a business entity that is not a subsidiary or a branch of a company not owned, ruled, or become, directly or indirectly, a part of medium or large business that fulfills the criteria of small business as mentioned in this act.

b) Medium enterprises is a productive economic activity which is private and owned by an individual, or a business entity that is not a subsidiary or a branch of a company not owned, ruled, or become, directly or indirectly, a part of medium or large business with net worth or amount of annual sales as provided in this act.

The criteria for small and medium enterprises according to the same act are: a) Small Enterprises:

1. Net asset is more than IDR 50,000,000 to IDR 500,000,000, but land and building are not included.

2. Annual sale is more than IDR 300,000,000 to IDR 2,500,000,000. b) Medium Enterprises:

1. Net asset is more than IDR 500,000,000 to IDR 10,000,000,000, but land and building are not included.

RESEARCH METHOD

Population of this research was Small and Medium Enterprises in Magelang, Central Java, Indonesia. The samplings used convenience sampling method by choosing SMEs according to Indonesian Regulation number 20, 2008 as the samples and are willing to be interviewed and given questionnaires. From 70 respondents chosen, 5 companies refused an interview and questionnaires, 19 companies did not meet the criteria which stated in the regulation, and so, there were 46 others left which will be researched furthermore. The sampling was based on rules of the thumb mentioned by Roscoe, that is the adequate sample measurement ranges from 30-500 (Supramono and Utami, 2003).

Data which was used in this research was primary data from interview and questionnaires results which were given to the SMEs managers (owners or employees). The analysis technique is descriptive qualitative analysis technique.

DATA ANALYSIS AND DISCUSSION

Description of the Research Objects

SMEs in Magelang consist of various businesses from service, trading, to manufacture business. The amount of SMEs in Magelang is 9.736 companies (Biro Pusat Statistik, modified data, 2008). This research took 46 companies as the samples. Most of SMEs managers (80.43%) were the owners (See table 1).

Table 1. Business Managers

Number Explanation Amount of the

Respondent Percentage

1 Run by owners 37 80.43%

2 Run by employees 9 19.57%

Total 46 100%

source: modified primary data, 2010

Most of SMEs managers were high school graduates (43.38%), some were mid-school graduates or below (21.75%). Most of the companies had been established for 6-10 years. This research observed the accounting application in recording and reporting of these SMEs.

Accounting Records

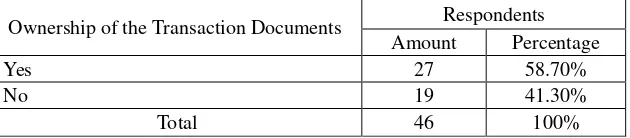

The result showed that not all of the managers kept records of their transactions. Only 58.70% managers had transaction documents and 41.30% of them did not have any (See table 2).

Table 2. Ownership of the Transaction Documents

Ownership of the Transaction Documents Respondents Amount Percentage

Yes 27 58.70%

No 19 41.30%

Total 46 100%

The result which was related to transaction documents used by the managers is in table 3. Most of the managers (43.48%) used sales notes as the transaction documents. In general, these notes also served as receipts for the customers. They were also used as the basic for calculating the cash amount from sales transactions.

Table 3. Transaction Documents being Used

Transaction Documents being Used Respondents Amount Percentage

Sales notes 20 43.48%

Purchase notes 1 2.18%

Sales notes and purchase notes 6 13.04%

Total 27 58.70%

source: modified primary data, 2010

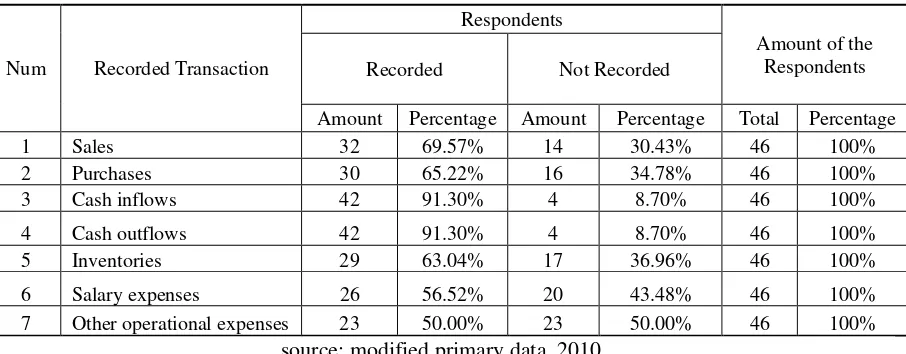

For business managers who keep records of their transactions, the results showed that most of them (91.30%) recorded cash inflows and cash outflows (see table 4). Almost all managers have recorded cash inflows and cash outflows, because managers simply assume that the profit can be estimated from the difference between cash inflows and cash outflows. This is possible since most of their transactions made in cash.

Table 4. Transaction Records

Num Recorded Transaction

Respondents

Amount of the Respondents Recorded Not Recorded

Amount Percentage Amount Percentage Total Percentage

1 Sales 32 69.57% 14 30.43% 46 100%

2 Purchases 30 65.22% 16 34.78% 46 100%

3 Cash inflows 42 91.30% 4 8.70% 46 100%

4 Cash outflows 42 91.30% 4 8.70% 46 100%

5 Inventories 29 63.04% 17 36.96% 46 100%

6 Salary expenses 26 56.52% 20 43.48% 46 100%

7 Other operational expenses 23 50.00% 23 50.00% 46 100%

source: modified primary data, 2010

Table 5. Transaction Records According to Types of Business

Num Recorded Transaction

Manufacture Companies Trading Companies Sevice Companies Amount Percentage Amount Percentage Amount Percentage

1 Sales 4 100% 25 80.64% 3 27.27%

2 Purchases 3 75% 24 77.42% 3 27.27%

3 Cash inflows 3 75% 28 90.32% 11 100%

4 Cash outflows 3 75% 28 90.32% 11 100%

5 Inventories 3 75% 21 67.74% 5 45.45%

6 Salary expenses 3 75% 15 48.39% 8 72.72%

7 Other operational expenses 3 75% 9 29.03% 11 100%

Total 4 100% 31 100% 11 100%

source: modified primary data, 2010

All service companies managers also had to made records of operational expenses such as electricity, water, and phone bills. The amount of these expenses helped them to set the price for their service to the customers.

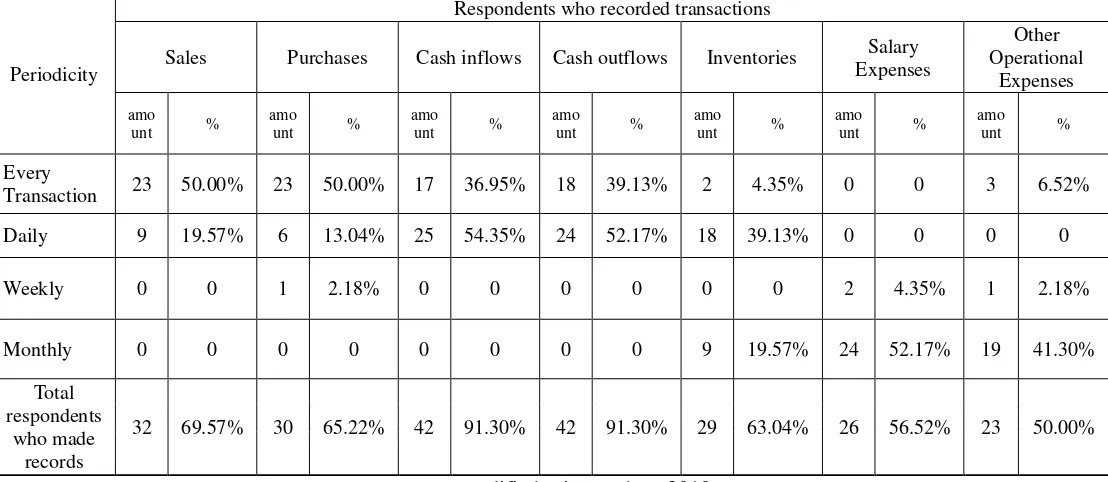

Periodicity of Transaction Recording

The result concerning periodicity of transaction recording showed that most of the managers (50%) made records of sales and purchase transactions during the transactions (See table 6). It was done because sales and purchase transactions connected directly to customers and suppliers who needed records every time a transaction took place. Cash inflows and cash outflows recording were usually done daily (52-54%). Inventories were also recorded daily (39%) to know the amount of ending inventories by the end that day. By doing so, if the inventories ran low, an immediate order will be done. Salary expenses and operational expenses recording were usually done monthly (52%), because they were usually paid monthly.

Table 6. Periodicity of Transaction Records

Periodicity

Respondents who recorded transactions

Sales Purchases Cash inflows Cash outflows Inventories Salary Expenses

Other Operational

Expenses

amo

unt %

amo

unt %

amo

unt %

amo

unt %

amo

unt %

amo

unt %

amo

unt %

Every

Transaction 23 50.00% 23 50.00% 17 36.95% 18 39.13% 2 4.35% 0 0 3 6.52%

Daily 9 19.57% 6 13.04% 25 54.35% 24 52.17% 18 39.13% 0 0 0 0

Weekly 0 0 1 2.18% 0 0 0 0 0 0 2 4.35% 1 2.18%

Monthly 0 0 0 0 0 0 0 0 9 19.57% 24 52.17% 19 41.30%

Total respondents

who made records

32 69.57% 30 65.22% 42 91.30% 42 91.30% 29 63.04% 26 56.52% 23 50.00%

Recording Technique

Most of the managers (76.09%) still used manual method to make records, because they were used to it. Besides, small scale businesses were not so complex that a computerized records system was not necessarily needed (See table 7).

Table 7. Technology of Recording

Num Explanation Amount of

Respondents Percentage

1 Computerized 11 23.91%

2 Manual 35 76.09%

Total 46 100%

source: modified primary data, 2010

Accounting Reports

Managers compiled their reports which were usually related to the records. 52.17% managers made income statement which showed total revenues and expenses for one period of time, 28.26% managers made the balance sheet and 17.39% of them made statement of owner's equity (See table 8). Besides financial statement, manufacture and trading companies also made sales report (45.65%) and purchase report (30.43%). Both reports were usually used for daily business management needs.

Table 8. Reports

Reports Make Reports Not Make Reports

Amount of Respondents Amount Percentage Amount Percentage Total Percentage

Income statement 24 52.17% 22 47.83% 46 100%

Statement of owner's equity 8 17.39% 38 82.61% 46 100%

Balance sheet 13 28.26% 33 71.74% 46 100%

Sales report 21 45.65% 25 54.35% 46 100%

Purchase report 14 30.43% 32 69.57% 46 100%

source: modified primary data, 2010

Periodicity of Reports

Table 9. Periodicity of Reports

Periodicity

Reports Income

Statement

Statement of

Owner's Equity Balance Sheet Sales Report Purchase Report

amount % amount % amount % amount % amount %

Daily 0 0 0 0 0 0 19 41.30% 11 23.91%

Weekly 0 0 0 0 0 0 0 0 0 0

Monthly 24 52.17% 8 17.39% 13 28.26% 2 4.35% 3 6.52%

Total respondents who

make reports

24 52.17% 8 17.39% 13 28.26% 21 45.65% 14 30.43%

source: modified primary data, 2010

The Objective of Reports

Most managers (89.13%) made reports for internal management needs, that was for daily business management. Only 4.35% managers made records and at the same time, applied for bank loan and paid taxes, in addition to internal management needs (See table 10).

Table 10. The Objectives of Reports

Objectives Respondents

Amount Percentage

Management 41 89.13%

Bank loans 0 0

Taxes 0 0

Management and bank loans 3 6.52%

Management and taxes 0 0

Management, bank loans, and taxes 2 4.35%

Total 46 100%

source: modified primary data, 2010

Obstacles

A person's education is very influential on their understanding about something, including their understanding of accounting. SMEs managers need to have an adequate knowledge about accounting, so that they can apply it in their business. Most of the managers' background were high school graduates (43.48%) and some were mid-school graduates or below (21.75%). In Indonesia, accounting is not taught in all high schools. Only high schools which have economic as their major, put accounting in their curriculum. Besides, accounting is not in mid-schools' curriculum. Therefore, it is not uncommon to see that many SMEs managers do not apply accounting in their business. Even perhaps, it is not crossed their minds to apply it because they do not understand accounting.

The research result showed that most SMEs managers felt that they did not need accounting training (84.78%). They thought that it was enough to them to manage the business in their own fashion. Derived from their own experiences that the companies still ran well without an adequate accounting system, they came to a conclusion that they did not need it anyway. Most SMEs were run by the owners (80.43%), thus they could control the business directly, although they did not apply accounting in their business management.

CLOSING

Conclusion

From the research result, it can be concluded that 69.56% of SMEs had done recording, but only 34.78% of them made financial statements. Records which were made included sales transactions (69.57%), purchase transactions (65.22%), cash inflows and cash outflows (91.30%), inventories (63.04%), salary (56.52%), and other operational expenses (50.00%). Meanwhile, reports which were made by the managers were sales reports (45.65%), purchase reports (30.43%), income statements (52.17%), statement of owner's equity (17.39%), and balance sheet (28.26%).

The obstacles which hindered accounting application in SMEs were the education factor, and the lack of understanding about accounting and its importance.

Suggestion

The research suggests, it is better to create a simple accounting information system for SMEs, it is a single book where transactions are recorded in subsidiary books, contain of sales subsidiary book, purchases subsidiary book, cash inflows and cash outflows subsidiary book, inventories subsidiary book, salary expenses and other operational expenses subsidiary book. Based on these subsidiary books SMEs can create simple reports that used for daily business management needs.

The government should cooperate with high education institutions to improve the knowledge, understanding, and the awareness of the SMEs managers about accounting application in managing their business. By applying accounting in their business, it is hoped that it will improve the decision making quality, help the business management, and facilitate SMEs to get fund source from the third party to expand their business. It is hoped also that accounting will improve the SMEs performance in Indonesian economics.

Research limitation

REFERENCES

American Accounting Association. (1996). Statement of Basic Accounting Theory. Evanston, III: AAA.

Biro Pusat Statistik. (2008). Sensus Ekonomi Tahun 2008. Biro Pusat Statistik, Jakarta.

Hidayat, Iman P. (2004). Akuntansi untuk Usaha Kecil Menengah. http://imanph.wordpress.com, 21 Oktober 2008.

Iien. (2009). Metode Akuntansi untuk UKM; Strategi Bisnis, Pembukuan dan Administrasi. http://www.impacctusa.com, 27 Juni 2009.

Karyawati, Golrida. (2008). Akuntansi Usaha Kecil Untuk Berkembang. PT Raja Grafindo Persada, Jakarta.

Prasetyo, Hendro. (2007). Akuntansi untuk UKM dan Orang Awam; Step by Step Membuat Laporan Keuangan. Wissen-Sistem Consulting.

Soemarso, S.R. (1992). Akuntansi Suatu Pengantar. Edisi keempat. Rineka Cipta, Jakarta. Supramono & Utami, Intiyas. (2003). Desain Proposal Penelitian Studi Akuntansi dan

Keuangan. Penerbit Fakultas Ekonomi Universitas Kristen Satya Wacana, Salatiga. Tugiman, Hiro. (1996). Akuntansi untuk Badan Usaha Koperasi. Kanisisus, Jakarta.

Tunggal, Amin Widjaja. (1997). Akuntansi Untuk Perusahaan Kecil dan Menengah. PT Rineka Cipta, Jakarta.

Indonesian Regulation Number 20 (2008) about Micro, Small, and Medium Enterprises (Undang-Undang Republik Indonesia No. 20 Tahun 2008 Tentang Usaha Mikro Kecil Menengah).

Warren, Carl S., Reeve, James M., & Fess, Philip E. (2005). Accounting. 21st edition. South Western.