Determining the factors which affect the stock

investment decisions of potential female

investors in Indonesia

Linda Ariany Mahastanti* and Edy Hariady

Management Department,

Satya Wacana Christian University, Salatiga, Indonesia

E-mail: [email protected] E-mail: [email protected] *Corresponding author

Abstract: In recent years, the increasing number of career women has become a new phenomenon in Indonesia. Women do not only become housewives, but they can also work to earn additional income for the family. It encouraged Jakarta Stock Exchange (JSX) to have a special programme to create a promotion for potential female investors, since there have not been many females who have become investors in the stock market. The purpose of this paper is to look for the factors which influence the investments’ intentions, especially for women in Indonesia, by applying the theory of planned behaviour (TPB). This research used the TPB in order to describe more deeply about the relationships between beliefs and behaviour. The theory states that attitudes towards behaviour, subjective norms and perceived behavioural control, shape an individual’s behavioural intentions altogether. The study used self-administered questionnaires which were distributed to the samples of female lecturers in a university. The data was analysed with multiple regression technique. This result indicated that the intention to buy financial products was influenced by perceived behavioural control and risk preference, but it was not affected by subjective norms and attitudes.

Keywords: theory of planned behaviour; TPB; financial literacy; risk preference; Indonesia.

Reference to this paper should be made as follows: Mahastanti, L.A. and Hariady, E. (2014) ‘Determining the factors which affect the stock investment decisions of potential female investors in Indonesia’, Int. J. Process Management and Benchmarking, Vol. 4, No. 2, pp.186–197.

Biographical notes: Linda Ariany Mahastanti graduated from Satya Christian University (Bachelor degree) and Gajah Mada University (Master degree). Now, she has become a Lecturer in Satya wacana Christian University since 2004. Her interest research areas are behavioural finance and stock market.

Edy Hariady is a student of Linda Ariany Mahastanti and graduated with a Bachelor degree at Satya Wacana Christian University since 2013.

1 Introduction

Indonesia has a potency to target women as potential new investors in capital market. In term of population, the number of women in Indonesia is very high. Based on data from the Central Statistics Agency, from the total amount of population (217 millions), the number of females reached 49.8% or approximately 108 millions. The large number of females indicates that they are potential as target markets of product investments, because in Indonesian’s family culture, women are positioned as the ‘financial managers’. Indonesian stock exchange is targeting two millions of investors in the capital market during two or three years. Indonesian stock exchange has a breakthrough to achieve that target with the women who closely step on it appropriately.

In general, women have some special abilities. Firstly, women are naturally worried about their safety. Therefore, they are not reluctant to ask for directions or advice and also like to absorb a lot of information. The natural impulse is closely aligned with the strategy of investing in the stock market, where investors are required to seek investment advice and gather a lot of information before deciding to buy or sell the stocks. Secondly, women also have intuitions or higher sensitivity and are able to understand the cycle better. This ability is also very important to do the investment in the stock market. In addition, to analyse the stock market, the investors must be sensitive and good at understanding the trends. Stock market investors must keep on tracks and understand the cycle of stock price fluctuations (Graham et al., 2002).

Indonesian women have beliefs and norms that would be different with the women from other countries. In Indonesian culture, people always think that women only have the second position in the society. Women do not have power to make decision in their families. Women usually always follow the men or their husbands to make decisions. If they want to make decisions in investment, it will be difficult, because they do not have any experiences and the courage to make huge decisions in investment in the capital market. It happens because women are more risk averse to manage their money. Women usually make investment in real assets, like property, gold, but not in financial products which are sold by the capital market. Al-Ajmi (2011) said that in emerging markets (Bahrain), the male investors particularly tended to be more risk-tolerant than the female investors. Investors with low level of education and wealth would like to take higher risk. However, investors who have higher ages would like to reduce the level of risk and more likely to think about retirement. Graham et al. (2002) revealed that there are gender differences in taking a risk; women are more risk aversion (dislike risks) than men. Barber and Odean (2001) found in his research that women have different attitudes towards money and investing than men.

This research would extend most former studies towards the phenomenon in Indonesia and literature review results. By using the theory of planned behaviour (TPB) in this research, the researchers wanted to know about the women’s intentions to invest their money in financial products in Indonesia. Women’s intentions to buy financial products are not only influenced by their financial literacies and risk preferences, but also their norms, beliefs and perceived behavioural control (according to TPB). This theory would be useful in explaining the behavioural investments of women, especially in Indonesia, a country which has many kinds of norms and beliefs. Chen and Volpe (1998) deduce that an individual’s level of financial knowledge influences his/her opinions and affects his/her decisions. Lusardi and Mitchell (2006) and Alleyne and Broome (2011) argue that their review revealed that many persons do not have adequate knowledge of basic economic concepts which are required to make investment decisions. Thus, there is a need to conduct a research to analyse the factors, other than knowledge, that might also influence investment decisions.

The purpose of this paper is to look for the factors influencing the investment intentions by applying the TPB. It used behavioural psychology and management theory to explore the investment decisions of future investors. We assume that the investors are desirous of constructing portfolios of investments that suit their return requirements and risk propensity best. Investors can be risk-averse, risk-neutral or risk-seeking. Thus, we would like to understand how risk affects investment decision-making. On the other hand, this research added some of demographic characteristics, like income, major and marital status. Those variables became the controlling variables which explain some other influences of investment decisions.

2 Literature review

This study would find out women’s interests in investing in financial products more deeply. Previous research Barber and Odean (2001) said that women tend to be afraid of taking risks more than men, so they are not willing to make any decisions in investing. There is an emerging evidence that women are ‘shy away from competition’ to quote Niederle and Vesterlund (2007). This pattern has also been found for example by Gneezy et al. (2003) or Chen and Volpe (1998). As it has already seemed to exist among young children (Niederle and Vesterlund, 2007), the less competitive behaviour of women may be seen as a typical behaviour. Previous studies have shown that an individual’s investment behaviour has been linked to specific areas, like attitudes to risk. Paarsch and Shearer (2007) argued that any focus on particular financial issues may not be a good indicator of one’s attitudes and behaviour towards financial matters. However, attitudes can be quite influential in explaining an individual’s investment behaviour.

their social community are very different with Western countries. In eastern culture, women are unequal with men. It can influence whether they want to invest their money or not. Ajzen (1991) and Alleyne and Broome (2011) defined attitudes toward behaviour as “the degree to which a person has a favorable or unfavorable evaluation or appraisal of the behavior in question”. They also defined subjective norms as “the perceived social pressure to perform or not to perform the behavior” (Ajzen, 1991; Alleyne and Broome 2011). Subjective norm refers to the influence of one’s peers, family and referent others in performing the behaviour. In the culture of Indonesian women, family members and friends have big influences in making references before they make decisions because they have good relationships. Ajzen (1991) and Alleyne and Broome (2011) defined perceived behavioural control as “the perceived ease or difficulty of performing the behavior which is assumed as the reflection of past experience as well as anticipation of impediments and obstacles”. The perception of the degree of ease or difficulty of performing an action can encourage or inhibit the performance of the actual behaviour. Attitudes, perceived behavioural control and subjective norms have been proposed to influence behavioural intentions and actual behaviour. Ajzen (1991) and Alleyne and Broome (2011) stated that “as a general rule, the more favorable the attitude and subjective norm towards the behaviour and the greater the perceived behavioral control, the stronger an individual’s intention to perform the behavior under consideration”.

Potential investors are very sensitive about risks. It happened because they have perception of assessment about gain or loss with the investment. Specifically, investments in start-up businesses are considered riskier than other investment options (Mason and Harrison, 2002; Ganzach et al., 2008; Alleyne and Broome, 2011). This is the opportunity to the Indonesian women to make decisions in financial product investments, because they do not have enough experiences about investment that make them afraid of investing.

Indonesian women have subjective norms from their community, usually their friends and family, when they want to make decisions in investment. Family members and friends usually give recommendations and opinions about their behaviours in investing their money. It happened because Indonesian culture always made perception that women are not strong enough when making decisions. Besides, our tradition always positions women behind the men. It made women usually feel afraid when they have to make important decisions, like investing in financial products. Even though they have capabilities and knowledge about financial products, women mostly do not have enough confidence to invest in financial products. It reduced their behavioural intentions in investing.

Thus, this study would like to explore whether the three individual-level antecedents of the TPB as well as risk propensity can significantly predict intentions to invest among the future investors. Based on the review of literature, the researchers provide these following hypotheses:

H1 Attitudes will influence the intentions of investing in financial products. H2 Subjective norms will influence the intentions of investing in financial products. H3 Perceived behavioural control will influence the intentions of investing in financial

products.

3 Research methodology

This study selected samples of women who have knowledge in financial products. The sample is some female lecturers in the Faculty of Economics and Business, Satya Wacana Christian University, Salatiga, Indonesia. The data was collected by using questionnaires with cross sectional design during 2012.

3.1 Development of instrument

To evaluate the relationship between planned behaviour and investment decisions, the researchers formulated a survey questionnaire. The initial questionnaire was piloted to clarify all ambiguities and unclear questions, as well as to choose applicable scenarios that meet the focus of the study. The remainder of this section describes the structure of the questionnaire. Firstly, the questionnaire requested respondents’ demographic data, such as salary, marital status and educational backgrounds. Attitudes, subjective norms, perceived behavioural control and intentions to invest were adapted from East (1993) study. The researchers extended the research to include two aspects of risk, namely two scenarios (highly risk and low risk) and the (Sitkin and Weingart, 1995) risk propensity scale.

3.2 Dependent variables

The intention to invest was measured by using a three-item scale, adapted from East (1993), Brown et al. (1996) and Alleyne and Broome (2011). The questions or statements used were ‘I plan to buy shares in a public company in the future’, ‘If I have the opportunity, I will buy shares in a public company in the future’ and ‘I will never buy shares in a public company within the next 12 months’. All items were measured by using a five-point Likert’s scale, ranging from 1 = extremely unlikely to 5 = extremely likely. The items were combined to form an average score. Higher scores on this scale represent higher intentions in investing.

3.3 Independent variables

and ‘unbeneficial-beneficial’. The items were combined to form an average score. Higher scores on this scale represent more positive attitudes.

Subjective norms were measured using a three-item scale, adapted from East (1993), Brown et al. (1996) and Alleyne and Broome (2011). The questions used were ‘Most people who are important to me would think that I should buy shares in a public company’, ‘People who are important to me think that buying shares in a public company is a good idea’ and ‘People who are important to me think that buying shares in a public company would be a wise idea’. All items were measured using a five-point Likert’s scale, ranging from 1 = extremely unlikely to 5 = extremely likely. The items were combined to form an average score. Higher scores on this scale represent higher attachment to the referent groups.

Perceived behavioural control was measured by using three items adapted from East (1993) and Alleyne and Broome (2011). The questions used were ‘If I want to buy shares in a public company, I can easily do it so’, ‘I have the knowledge to buy shares in a public company’ and ‘here is plenty of opportunity for me to buy shares in a public company’. All three measures were analysed based on five-point Likert’s scale, ranging from 1 = extremely unlikely to 5 = extremely likely. The items were combined to form an average score. Higher scores on this scale represent higher perceived behavioural control towards the behaviour.

Risk propensity was measured by using a five-item scale adopted from Alleyne and Broome (2011) which was developed by Sitkin-Weingart business risk propensity scale. It was modified to address a generic business situation. The questions adopted the (Sitkin and Weingart) scale, which were ‘How likely are you to choose more or less risky alternatives based on the assessment of others to whom you must rely on?’, ‘How likely are you to choose more or less risky alternatives which could have a major impact on your future?’, ‘How likely are you to choose more or less risky alternatives which rely on analyses in high technical complexity?’, ‘How likely are you to initiate a financial action which has the potential to be a backfire?’, ‘How likely are you to support a decision when you are aware that relevant analyses were done while missing several pieces of information?’. All items were measured by using a five-point Likert’s scale, ranging from 1 = extremely unlikely to 5 = extremely likely. The items were combined to form a ten Journal of Eastern Caribbean Studies average score. Higher scores on this scale represent more positive attitudes towards risk.

After the data had been collected, then the researchers tested its reliability and validity. Furthermore, the data was processed by using multiple regressions to determine whether any variables affect the women’s behavioural intention to invest in financial products.

3.4 Statistical models

4 Discussion

The data collected consisted of 50 respondents. Based on this data, the researchers viewed the individual characteristics of each respondent.

Table 1 The characteristics of the respondents

Educational

The majority of the respondents in this study were married women who had Master’s degrees and had sufficient financial knowledge. One exciting thing of the above phenomenon was, although they had sufficient knowledge in finance and enough salary, but none of them were interested to invest in the stock market. Most women actually invest in gold, deposits or property in which they considered more secure. This indicated that women do tend to be more risk averse in making investment decisions by choosing safe investment products.

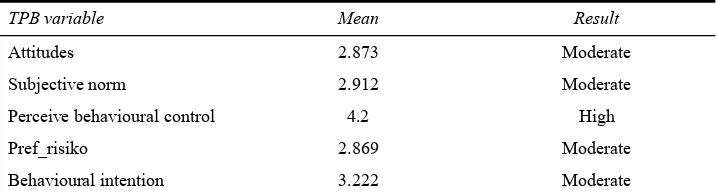

Table 2 Variable score ‘TPB’

TPB variable Mean Result

Attitudes 2.873 Moderate

Subjective norm 2.912 Moderate

Perceive behavioural control 4.2 High

Pref_risiko 2.869 Moderate

Behavioural intention 3.222 Moderate

The respondents had high perception about perceive behavioural control. It happened because they have educational background which supported their knowledge in financial products. It is different with attitude and subjective norm, they just had moderate score. It means that their environments, like family members and friends, did not support them to make investment in financial products and they had perception that investment in financial products were bad, mostly because stock was more closely related to gambling and it was prohibited by their religions. On the other hand, the scores of behavioural intention also showed moderate which means that they were also still doubtful to invest in financial products.

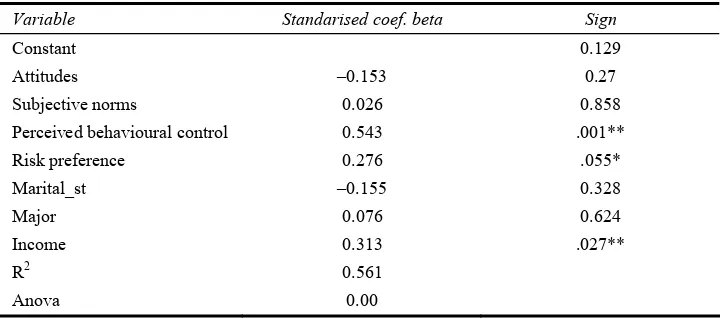

Table 3 The influences of TPB theory and risk preference toward the intention in buying financial products

Variable Standarised coef. beta Sign

Constant 0.129

Attitudes –0.153 0.27

Subjective norms 0.026 0.858

Perceived behavioural control 0.543 .001**

Risk preference 0.276 .055*

Marital_st –0.155 0.328

Major 0.076 0.624

Income 0.313 .027**

R2 0.561

Anova 0.00

Notes: ***sig. 0.01, **sig. 0.05, *sig. 0.1

The results of the regression analysis show that perceived behavioural control affects the intention to buy financial products. This is in line with the research conducted by Alleyne and Broome (2011). It occured because women felt confident and believed that they had the opportunities and enough knowledge to invest in financial products. This conviction arose because the respondents in this study were lecturers in the faculty of economics and business, who had an educational background in finance. Besides, actually the women in Indonesia have plenty opportunity to buy financial product, it happens because security companies have great promotion programmes for potential female investors.

The next variable that is also significant is risk preferences. Risk preference is very important for women because women have more risk-averse tendencies. Women usually love secure product investments like gold, property and deposit, although the level of return that they will receive is low. It is evidence that the risk preferences of women affect their behavioural intention in investing. Alleyne and Broome (2011) also stated that the risk preferences affect a person’s intention to invest. Table 2 shows that there is one control variable that has significant value in determining the intentions to buy financial product; i.e., income. Women who have enough income want to invest their money in financial products. Beckmann and Menkhoff (2008) stated that investors with a higher level of income invest their funds in more dynamic portfolios which are composed by more dynamic stocks.

especially to make sure about financial security for the future of their family. Married women have more responsibility to manage finance in their families. This perception must be changed. The way to make their financial secure is not only by just keeping their money in deposits, but also by doing stock investment. Stock investment has a long term benefit. If women want to make their finance secure for the future, they must have good plannings in investment and have several other financial goals for their retirements. Though women are risk averse, they must realise that keeping all their funds in the forms of ‘safe’ investments will make it difficult to reach their financial goals. Taxes and inflations will spend their small returns and the best thing that they can do is ‘treading the water’, if they are lucky enough. Stock investments, which are riskier than some other investment, also provide the opportunity to beat inflations over a long period and build a solid foundation. Buying and holding good companies for a long term is a way to build a ‘nest egg’.

Asset allocation is one of those investing terms that would be learned. In other words, the people can spread their money in some ‘spots’, so it is not all invested in one spot. They will be seen as its common sense immediately. The important thing to remember is that it is a continual process that they must always have in their minds as they begin investing. If they start out with this mindset, their investments will be in a better position as the years go by.

It would be better if when the women make decision in stock investments for the first time, they must get good advice from the financial planners (who are supported by security firms). They may consider a financial planner as a family doctor; a general practitioner who knows their family situation and history. This person creates an overall plan that is taken into account income, debts, expenses, taxes, insurance needs, retirement goals and dreams to buy a house, a cottage or a car. Besides that, there are specialists. The investment advisors will help them to build a balanced portfolio of stocks, bonds and funds; the estate planners will advise them about inheritance and tax laws; the personal bankers will help them with loans or mutual funds. Nowadays, most investment advisors charge a management fee based on the size of their portfolios. As their portfolio grows, they become wealthier and the investment advisors will earn more, so everyone is satisfied. The planners, on the other hand tend to charge a flat fee for their advice and then they see specialists to obtain each specific solution.

financial products because they get the endorsement from their environments, such as their friends and family members.

Indonesian women have been proved to have the characteristics of risk-averse. Therefore, Indonesian stock exchange should provide trainings about how to invest in stocks and what benefits that can be received by doing it.

5 Conclusions

The results of this study indicated that women in Indonesia had some abilities, such as enough salary and knowledge of financial products. The problem that they faced was the lack of support from their environments. It happened because their friends and family did not support them to invest in financial products, since they considered investing in financial products as a bad thing because financial products had high risks. Another reason of why Indonesian women had fewer interests in investing their money in financial market was because they needed to secure the family’s financial in the future. Finally, the last reason was about their perception about stock investments that were considered as not ‘halal’. Indonesia is one of countries that have the largest Moslem populations in the world. The concept of ‘halal’ in investment is very important for them. JSX must consider financial products with ‘syariah’ labels, because this products can be more attractive compared to the conventional stock investments.

Therefore, the JSX must have special programmes to make Indonesian women become more interested in investing in financial products that are traded in the capital market. The approach can be done by doing promotions and socialisations through local groups, such as the PKK. PKK is expected to provide social supports for Indonesian women about investing. Financial products which will be promoted to Indonesian women should be more specific, like ‘syariah’ mutual fund. This product is also less risky than stock investment.

6 Limitation and suggestions for future research

Acknowledgements

I extend thanks to Edy Hariady who have become partners in the writing of this article and anonymous reviewer that have provided input and assistance during the revision process of this article. In addition I also wish to thank Dr. John Vong who has given me the opportunity to publish this paper in the International Journal of Process Management and Benchmarking.

References

Ajzen, I. (1991) ‘The theory of planned behaviour’, Organisational Behaviour and Human Decision Processes, Vol. 50, No. 2, pp.179–211.

Al-Ajmi, J.Y. (2011) ‘Risk tolerance of individual investors in an emerging market’, Journal of Risk and Diversification, No. 2, pp.101–112 [online]

http://www.journalofriskanddiversification.com/jrd_issue2 (accessed 12 February 2013). Alleyne, P. and Broome, T. (2011) ‘Using the theory of planned behaviour and risk propensity to

measure investment intentions among future investors’, Vol. 36, No. 1, pp.1–20.

Barber, B.M. and Odean, T. (2001) ‘Boys will be boys: gender, overconfidence and common stock investment’, Quarterly Journal of Economics, Vol. 116, No. 1, pp.261–292.

Beckmann, D. and Menkhoff, L. (2008) ‘Will women be women? Analyzing the gender difference among financial experts’, KYKLOS, Vol. 61, No. 3, pp.364–384.

Brown, K.C., Van Harlow, W. and Starks, L.T. (1996) ‘Of tournaments and temptations: an analysis of managerial incentives in the mutual fund industry’, Journal of Finance, Vol. 51, No. 1, pp.85–110.

Carpenter, T. and Reimers, J. (2005) ‘Unethical and fraudulent financial reporting: applying the theory of planned behaviour’, Journal of Business Ethics, Vol. 60, No. 2, pp.115–129. Chen, H. and Volpe, R. (1998) ‘An analysis of personal financial literacy among college students’,

Financial Services Review, Vol. 7, No. 2, pp.107–128.

Dohmen, T. and Falk, A. (2006) Performance, Pay and Multi-Dimensional Sorting: Productivity, Preferences and Gender, IZA Discussion Paper No. 2001, Bonn.

East, R. (1993) ‘Investment decisions and the theory of planned behaviour’, Journal of Economic Psychology, Vol. 14, No. 2, pp.337–375.

Ganzach, Y., Ellis, S., Pazy, A. and Ricci-Siag, T. (2008) ‘On the perception and operationalisation of risk perception’, Judgment and Decision Making, Vol. 3, No. 4, pp.317–324.

Gneezy, U., Niederle, M. and Rustichini, A. (2003) ‘Performance in competitive environments: gender differences’, Quarterly Journal of Economics, Vol. 118, No. 3, pp.1049–1074.

Graham, J.F., Stendardi, E.J., Myers, J.K. and Graham, M.J. (2002) ‘Gender differences in investment strategies: an information processing perspective’, International Journal of Bank Marketing, Vol. 21, No. 1, pp.17–26.

Lusardi, A. and Mitchell, O. (2006) Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education Programs, Working Paper WP 2006-144, University of Michigan Retirement Research Centre, June 2010 [online] http://ssrn.com/abstract=957796 (accessed 20 April 2013).

Mason, C.M. and Harrison, R.T. (2002) ‘Is it worth it? the rates of return from informal venture capital investments’, Journal of Business Venturing, Vol. 17, No. 3, pp.211–236.

Niederle, M. and Vesterlund, L. (2007) ‘Do women shy away from competition? Do men compete too much?’, Quarterly Journal of Economics, Vol. 122, No. 3, pp.1067–1101.

Paarsch, H.J. and Shearer, B.S. (2007) ‘Do women react differently to incentives? Evidence from experimental data and payroll records’, European Economic Review, Vol. 51, No. 7, pp.1682–1707.

Sitkin, S. and Weingart, L. (1995) ‘Determinants of risky decision-making behaviour: a test of the mediating role of risk perceptions and propensity’, Academy of Management Journal, Vol. 38, No. 6, pp.1573–1592.