Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=ubes20

Download by: [Universitas Maritim Raja Ali Haji] Date: 11 January 2016, At: 19:31

Journal of Business & Economic Statistics

ISSN: 0735-0015 (Print) 1537-2707 (Online) Journal homepage: http://www.tandfonline.com/loi/ubes20

Evaluating the Calibration of Multi-Step-Ahead

Density Forecasts Using Raw Moments

Malte Knüppel

To cite this article: Malte Knüppel (2015) Evaluating the Calibration of Multi-Step-Ahead

Density Forecasts Using Raw Moments, Journal of Business & Economic Statistics, 33:2, 270-281, DOI: 10.1080/07350015.2014.948175

To link to this article: http://dx.doi.org/10.1080/07350015.2014.948175

View supplementary material

Accepted author version posted online: 31 Jul 2014.

Submit your article to this journal

Article views: 182

View related articles

Evaluating the Calibration of Multi-Step-Ahead

Density Forecasts Using Raw Moments

Malte K

NUPPEL¨

Deutsche Bundesbank,Wilhelm-Epstein-Str. 14, D-60431 Frankfurt am Main, Germany ([email protected])

The evaluation of multi-step-ahead density forecasts is complicated by the serial correlation of the cor-responding probability integral transforms. In the literature, three testing approaches can be found that take this problem into account. However, these approaches rely on data-dependent critical values, ignore important information and, therefore lack power, or suffer from size distortions even asymptotically. This article proposes a new testing approach based on raw moments. It is extremely easy to implement, uses standard critical values, can include all moments regarded as important, and has correct asymptotic size. It is found to have good size and power properties in finite samples if it is based on the (standardized) probability integral transforms.

KEY WORDS: Density forecast evaluation; Moment test; Normality test; Probability integral transfor-mation.

1. INTRODUCTION

Today, predictions are often made in the form of density fore-casts. Tay and Wallis (2000) gave a survey of the use of density forecasts in macroeconomics and finance. Like point forecasts, density forecasts should be evaluated to investigate whether they are specified correctly. Point forecasts, for example, can be tested for bias. Density forecasts, in general, are tested for calibration. Correct calibration means that the density forecast coincides with the true density of the predicted variable.

This work is concerned with the question, how an evaluation of density forecasts can be conducted if the probability integral transforms (henceforth PITs) are serially correlated. The PIT is the probability of observing a value smaller than or equal to the actual outcome according to the forecast density. Serial correlation of the PITs is a typical feature of multi-step-ahead forecasts.

If the density forecasts are calibrated correctly, the PITs are

uniformly distributed over the interval (0,1), as noted by Dawid

(1984), Diebold, Gunther, and Tay (1998), and Diebold, Tay, and Wallis (1999). The original idea for this evaluation approach dates back to Rosenblatt (1952). If the PITs are independent, they can be used directly for testing the calibration of density forecasts, employing, for example, the Kolmogorov–Smirnov test. Applying an inverse normal transformation to the PITs yields, in the case of correctly calibrated density forecasts, a variable with standard normal distribution (henceforth the INTs, i.e., the inverse normal transforms). This second transformation was proposed by Smith (1985) and Berkowitz (2001).

For one-step-ahead forecasts, the PITs (and the INTs), in ad-dition to uniformity (to standard normality), should display in-dependence. In the words of Mitchell and Wallis (2011), if both

conditions are fulfilled, the density forecasts arecompletely

cal-ibrated. The likelihood ratio test proposed by Berkowitz (2001) can be applied to the INTs to test simultaneously for zero mean, unit variance, and zero autocorrelation based on a first-order au-toregressive model (henceforth AR(1)-model) for the INTs. For multi-step-ahead mean forecasts, even optimal forecasts pro-duce serially correlated forecast errors, and the same holds for

completely calibrated density forecasts, which produce serially correlated PITs and INTs. The evaluation of multi-step-ahead forecasts found in the literature, mostly therefore, focuses on correct calibration only. Basically, three approaches can be dis-tinguished.

One approach, proposed by Corradi and Swanson (2006a) and Rossi and Sekhposyan (2014), uses Kolmogorov-type or Cram´er-von-Mises-type tests that account for the serial cor-relation of the data. However, for these tests, critical values are data dependent. Another approach rests on normality tests for the INTs which are valid in the presence of serial correla-tion. Mitchell and Wallis (2011) mentioned the skewness- and kurtosis-based normality tests proposed by Bai and Ng (2005). Corradi and Swanson (2006b) also suggested, inter alia, the tests proposed by Bai and Ng (2005), and related GMM-type tests

introduced by Bontemps and Meddahib (2005,2012). The tests

of Bai and Ng (2005) were employed by D’Agostino, Gambetti, and Giannone (2013) for the evaluation of their density fore-casts. Finally, in several applications like those by Clements (2004), Mitchell and Hall (2005), Jore, Mitchell, and Vahey (2010), Bache et al. (2011), and Aastveit et al. (2011) one finds a variant of the test by Berkowitz (2001) adapted to the case of serially correlated INTs. Instead of testing for zero mean, unit variance and zero autocorrelation, only the first two hypotheses enter the test. Thus, no restriction is placed on the autoregressive coefficient of the AR(1)-model.

Unfortunately, each of the approaches mentioned has cer-tain disadvantages. As stated above, the tests by Corradi and Swanson (2006a) and Rossi and Sekhposyan (2014) rely on data-dependent critical values, which might be a serious imped-iment for their use by practitioners. Concerning the normality tests proposed above, none of them was originally derived to

© 2015American Statistical Association Journal of Business & Economic Statistics

April 2015, Vol. 33, No. 2 DOI:10.1080/07350015.2014.948175

Color versions of one or more of the figures in the article can be found online atwww.tandfonline.com/r/jbes. 270

evaluate density forecasts. Therefore, these tests are based on skewness and kurtosis, but ignore the information contained

in first and second moments. Since the INTs have astandard

normal distribution under the null hypothesis of correct calibra-tion, large power gains could be achieved by considering those moments. Finally, the test by Berkowitz (2001) is based on the assumption of an AR(1)-process. If this assumption is incorrect, the standard critical values are not valid, so that the test does not have the correct asymptotic size. Moreover, for this test, information from higher-order moments is not employed. As in the case of the normality tests, the evaluation of multi-step-ahead forecasts is not the intended use of the test by Berkowitz (2001). Apparently, the tests mentioned have been applied due to the lack of simple tests specifically designed for this task. The raw-moments tests proposed in this work are intended to help close this gap. They do not suffer from any of the disadvantages mentioned, as they use standard critical values, can employ all moments regarded as important, and have correct asymptotic size.

The effects of estimation uncertainty for the parameters of the forecasting model on the evaluation of density forecasts are not addressed in this work. Put differently, the tests presented here are designed for density forecasts which take the parame-ter uncertainty of the underlying model properly into account, or for density forecasts from models with negligible parame-ter uncertainty. Moreover, the results of Rossi and Sekhposyan (2014) imply that density calibration tests, if they are based on the PITs or INTs, are valid for the evaluation of density forecasts at the estimated parameter values of the forecasting model, if the model is estimated under a rolling or fixed scheme. If the densities are to be evaluated at the pseudotrue parameters of the forecasting model, moment-based calibration tests can be modified accordingly as shown in Chen (2011).

The tests proposed in this work can also be used to test for correct calibration of one-step-ahead forecasts. In this case the tests are robust to serial correlation of the PITs, whereas the commonly used tests would suffer from size distortions.

2. CALIBRATION TESTS BASED ON RAW MOMENTS

Let the continuous random variable of interest be denoted

byxt and the forecast density for this variable in period tby

ˆ

f(xt), where the forecast was made in periodt−h,andhis

a positive integer. Many of the methods used for producing density forecasts can be found in the references mentioned in

Section1. The PIT proposed by Rosenblatt (1952) is given by

ut =Fˆ(xt)=

xt

−∞ ˆ

f(q)dq,

where ˆF(xt) denotes the forecast distribution function

associ-ated with ˆf(xt). If the forecast density ˆf(xt) is equal to the true

densityg(xt), thenut is uniformly distributed over the interval

(0,1) (henceforth referred to asU(0,1) distributed). The INT

proposed by Smith (1985) and Berkowitz (2001) is given by

zt=−1(ut)=−1( ˆF(xt)),

where −1(·) is the inverse of the standard normal

distribu-tion funcdistribu-tion. Under the null of correct calibradistribu-tion, zt has a

standard normal distribution. I will proceed under the common

assumption that zt follows a Gaussian process under the null.

However, it should be noted that there are special nonlinear

pro-cesses where the marginal distribution ofzt witht =1,2, . . .

is standard normal, although the joint distribution is nonnor-mal. Tsyplakov (2011) described a strategy for generating such

sequences ofzt.

To test for correct calibration when the PITs are serially cor-related, practitioners have often used a variant of the test pro-posed by Berkowitz (2001), which was apparently first applied by Clements (2004). It is a likelihood-ratio test for the

zero-mean and unit-variance property ofzt, wherezt is assumed to

follow an AR(1)-process. This test will be referred to as the ˆβ12

test. The other existing test that will be employed in this work is

the ˆµ34test by Bai and Ng (2005) which is based on the

skew-ness and kurtosis ofzt, using an estimated long-run covariance

matrix.

The major complications when testing skewness and kurtosis arise from the fact that the expectation and the variance are unknown and, thus, have to be estimated. Therefore, a

four-dimensional covariance matrix is needed for the ˆµ34test, which

is a joint test of only two moments. When testing forstandard

normality, however, also the expectation and the variance are known under the null. Therefore, one does not need to consider standardized moments like skewness and kurtosis. It is not even necessary to employ central moments like the variance. Instead,

nonstandardized, noncentral moments, that is therawmoments

can be employed, so that tests can be constructed very easily. Moreover, raw moments can be estimated unbiasedly in small samples.

Actually, the raw-moments tests do not have to be based on the standard normal distribution, but any suitable transformation of the PITs can be used. Denote the transformed variables by

yt =H(ut),

whereH(ut) is a real-valued function, andH(ut)=−1(ut)

yields standard normally distributed variablesyt =ztunder the

null. Assuming thatE[|yr

ference between both vectors mentioned, is given by

ˆ

long-run variance ofyri

t −mri byσ

fulfilled, as shown by Sun (1965) and Breuer and Major (1983).

Thus, if the latter condition and the conditionE[m2rN]<∞are

fulfilled, every element of √TDˆr

1r2...rN is asymptotically

nor-mally distributed, because E[m2rN]<∞ implies that all

mo-ments of lower order are finite as well (see, e.g., Billingsley 1995, p. 274). From the Cr´amer-Wold device, it then follows

that √TDˆr

1r2...rN converges to a multivariate normal

distribu-tion, that is,

wherer1r2...rN is the long-run covariance matrix of the vector

series

Thus, a test of the distributional assumption forytcan be based

on the statistic

is symmetric around 0, and if at least one odd and one even raw moment are considered, there is an alternative approach that, asymptotically, leads to the same results as the tests described above, but behaves differently in small samples. This approach

is based on the fact that the long-run covariance ofyri

t −mriand yrj

t −mrjequals 0 ifytis symmetrically distributed around 0 and

ifri+rj is odd. A proof of this property is given in Appendix

A. Obviously, since ˆmriand ˆmrjare asymptotically normal, they

are asymptotically independent if they are uncorrelated. Based on this property, one can construct an alternative test

statistic ˆα0

1r2...rN are calculated in the same way as the test

statis-tic ˆαr1r2...rN in (1),but only using the odd and even moments,

r1r2...rNare asymptotically independent.

Concerning the choice of the transformationH(ut), natural

candidates are given by the INTs and (a standardized version of) the PITs. Tests based on the INTs however, are found to suffer from large size distortions in small samples, especially if raw moments of order four or higher are considered. This is because the fourth raw moment, like the sample kurtosis, is strongly positively skewed in small samples. Moreover, sample skewness

and sample kurtosis of normal variables are uncorrelated, but strongly dependent in small samples, and the same holds for the third and the fourth raw moments. For more details see, for example, Doornik and Hansen (2008) and the references therein. Therefore, this work focuses on the standardized PITs (hence-forth S-PITs). They are obtained as

yt =

it is a standard uniformly distributed random variable, that is, a uniformly distributed variable with an expectation of 0 and a variance of 1. Its skewness and kurtosis equal 0 and 1.8,

respectively. The density ofyt is given by

f(yt)=

under the null. Otherwise,f(yt) will differ from this functional

form, but positive values of the density will continue to be

restricted to the interval−√3≤yt ≤

√

3.

3. MONTE CARLO SIMULATION SETUP

3.1 The Densities

To assess the size and power properties of the tests presented, Monte Carlo simulations are used, where it is assumed that the density of the variable

xt ∼N(0,1) (3)

is to be predicted. Thext’s are identically, but not necessarily

independently, distributed. The density forecasts used will be

identical for each period t, so that the PITs will be serially

dependent if thext’s are serially dependent.

For the density forecasts, normal, two-piece-normal,

Stu-dent’stand normal mixture distributions are considered. The

normal distribution is employed to create correctly calibrated density forecasts, or forecasts whose expectation or variance dif-fer from the true values of 0 and 1, respectively. The two-piece normal distribution is employed to construct density forecasts with correct expectation and variance, but with incorrect skew-ness and kurtosis. To construct density forecasts with correct expectation, variance, and skewness, but incorrect kurtosis, the

standardized Student’stdistribution is used. Finally, the normal

mixture distribution is set up such that its first four moments are identical to those of a standard normal distribution while the shapes of both densities differ markedly. In Appendix B, the densities are described in detail.

Assuming normality ofxt and nonnormality of the forecast

densities instead of the opposite (nonnormalxtand normal

fore-cast densities) has the convenient implication that the

uncondi-tional distribution of the data, that is, ofxt,is always normal

and does not depend on the serial correlation. However, the applicability of the tests presented does not rely on any

distri-butional assumption with respect toxt or the forecast density.

Actually, as follows from Wallis (2008), the subsequent simula-tion results would be identical if the simulated INTs were used as realizations, and the forecast density was the standard normal

Table 1. Moments of misspecified forecast densities used in Monte Carlo simulations

µ µ2 s k m1 m2 m3 m4

Normal −0.50 1 0 3 −0.50 1.25 −1.63 4.56

Normal 0 1.50 0 3 0 2.25 0 15.19

Two-piece normal 0 1 0.73 3.41 0 1 0.73 3.41

Student’st 0 1 0 9 0 1 0 9

Normal mixture 0 1 0 3 0 1 0 3

NOTE:µdenotes the expectation,µ2the variance,sthe skewness,kthe kurtosis,mitheith raw moment.

forecast density. To be more precise, the realizations ˜xt would

be generated as

˜

xt =−1(F(xt))

withxt as defined in (3), and withF(·) being the distribution

function of the normal, two-piece-normal, Student’stor normal

mixture distributions mentioned above. The forecast density

would be given by ˆf( ˜xt)=φ( ˜xt), whereφ(·) denotes the

stan-dard normal density. This approach would lead to results which would be identical to those described in what follows.

3.2 The Simulation Environment

An MA(1)-process is used to generate dependent standard

normal variablesxt, so thatxtevolves according to

xt =εt+ρεt−1

withεt∼iidN(0,(1+ρ2)−1) fort =1,2, . . . T. If the

fore-cast density is standard normal, this process leads toyt’s which

correspond to those of two-step-ahead density forecasts which are, in the words of Mitchell and Wallis (2011), completely cal-ibrated. That is, in addition to the fact that the density forecasts

are correctly calibrated,ytis independent fromyt−2,yt−3,. . . .

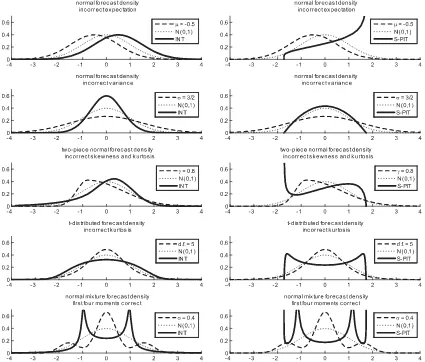

Figure 1. Misspecified forecast densities, the true standard normal densities, and the densities of the corresponding INTs (left column) and S-PITs (right column).

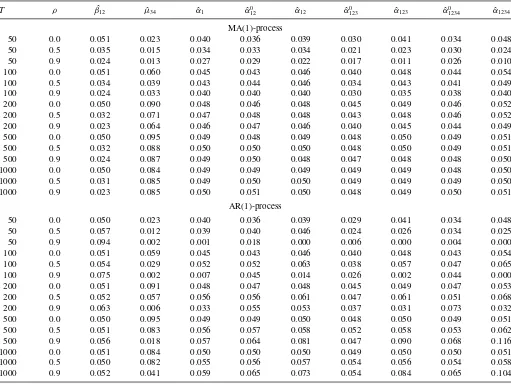

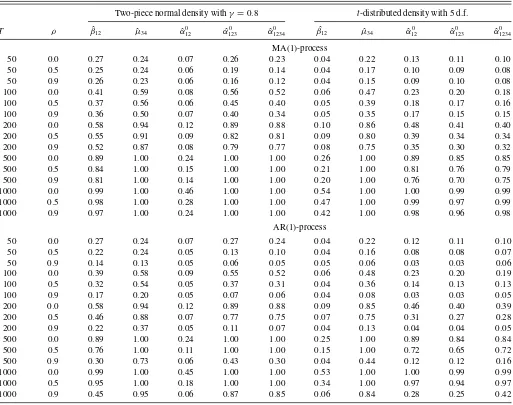

Table 2. Actual sizes of tests

T ρ β12ˆ µ34ˆ α1ˆ αˆ0

12 α12ˆ αˆ

0

123 α123ˆ αˆ

0

1234 α1234ˆ

MA(1)-process

50 0.0 0.051 0.023 0.040 0.036 0.039 0.030 0.041 0.034 0.048 50 0.5 0.035 0.015 0.034 0.033 0.034 0.021 0.023 0.030 0.024 50 0.9 0.024 0.013 0.027 0.029 0.022 0.017 0.011 0.026 0.010 100 0.0 0.051 0.060 0.045 0.043 0.046 0.040 0.048 0.044 0.054 100 0.5 0.034 0.039 0.043 0.044 0.046 0.034 0.043 0.041 0.049 100 0.9 0.024 0.033 0.040 0.040 0.040 0.030 0.035 0.038 0.040 200 0.0 0.050 0.090 0.048 0.046 0.048 0.045 0.049 0.046 0.052 200 0.5 0.032 0.071 0.047 0.048 0.048 0.043 0.048 0.046 0.052 200 0.9 0.023 0.064 0.046 0.047 0.046 0.040 0.045 0.044 0.049 500 0.0 0.050 0.095 0.049 0.048 0.049 0.048 0.050 0.049 0.051 500 0.5 0.032 0.088 0.050 0.050 0.050 0.048 0.050 0.049 0.051 500 0.9 0.024 0.087 0.049 0.050 0.048 0.047 0.048 0.048 0.050 1000 0.0 0.050 0.084 0.049 0.049 0.049 0.049 0.049 0.048 0.050 1000 0.5 0.031 0.085 0.049 0.050 0.050 0.049 0.049 0.049 0.050 1000 0.9 0.023 0.085 0.050 0.051 0.050 0.048 0.049 0.050 0.051

AR(1)-process

50 0.0 0.050 0.023 0.040 0.036 0.039 0.029 0.041 0.034 0.048 50 0.5 0.057 0.012 0.039 0.040 0.046 0.024 0.026 0.034 0.025 50 0.9 0.094 0.002 0.001 0.018 0.000 0.006 0.000 0.004 0.000 100 0.0 0.051 0.059 0.045 0.043 0.046 0.040 0.048 0.043 0.054 100 0.5 0.054 0.029 0.052 0.052 0.063 0.038 0.057 0.047 0.065 100 0.9 0.075 0.002 0.007 0.045 0.014 0.026 0.002 0.044 0.000 200 0.0 0.051 0.091 0.048 0.047 0.048 0.045 0.049 0.047 0.053 200 0.5 0.052 0.057 0.056 0.056 0.061 0.047 0.061 0.051 0.068 200 0.9 0.063 0.006 0.033 0.055 0.053 0.037 0.031 0.073 0.032 500 0.0 0.050 0.095 0.049 0.049 0.050 0.048 0.050 0.049 0.051 500 0.5 0.051 0.083 0.056 0.057 0.058 0.052 0.058 0.053 0.062 500 0.9 0.056 0.018 0.057 0.064 0.081 0.047 0.090 0.068 0.116 1000 0.0 0.051 0.084 0.050 0.050 0.050 0.049 0.050 0.050 0.051 1000 0.5 0.050 0.082 0.055 0.056 0.057 0.054 0.056 0.054 0.058 1000 0.9 0.052 0.041 0.059 0.065 0.073 0.054 0.084 0.065 0.104

NOTE: Actual sizes when the nominal size equals 0.05. Raw-moments tests are based on S-PITs.

Moreover, an AR(1)-process is considered. In this case,xt is

determined by

xt =ρxt−1+εt

withεt∼iidN(0,1−ρ2). The sample sizesT considered are

50, 100, 200, 500, and 1000. The autoregressive and

moving-average parametersρtake on the values 0, 0.5, and 0.9.

The first misspecified normal forecast density considered has

an expectation ofµ= −0.5 and unit variance. The second

mis-specified normal forecast density has an expectation of 0, but

its standard deviation √µ2=σ equals 3/2. The mean-mode

difference γ of the following standardized two-piece normal

forecast density is equal to 0.8. The standardized density of the

t-distribution has 5 degrees of freedom. Finally, the

standard-ized normal mixture density uses the parameter valueσ =0.4.

The moments of these forecast densities are given inTable 1.

The forecast densities, the corresponding densities of the INTs and the S-PITs, and standard normal densities are displayed in Figure 1. In the case of correctly calibrated density forecasts, the density of the S-PITs would be flat and attain a value of

1/√12≈0.3.

The tests considered are the two standard tests employed in the

literature, that is,the ˆβ12test and the ˆµ34test, and various

raw-moments tests based on ˆαr1r2...rNand ˆα

0

r1r2...rN. The parameters for

the ˆβ12test are estimated by maximum likelihood. For the ˆµ34

and the raw-moments tests, the long-run covariance matrices are estimated under the null. That is, the covariances are determined without subtracting the estimated means of the vector series,

which have an expectation of0under the null. With this approach

we follow Bai and Ng (2005). Subtracting the empirical mean would tend to increase the size distortions of the tests, but also improve their power.

Concerning the raw-moments tests, the most parsimonious test is only based on the first moment. Tests with power against more types of density misspecification are obtained by consec-utively adding higher moments. Wherever it is possible, both test statistics, ˆαr1r2...rN and ˆα

0

r1r2...rN,are employed. The largest

moment order considered is 4. This yields the seven test statis-tics ˆα1, ˆα120,αˆ12, ˆα1230 ,αˆ123,αˆ01234,and ˆα1234. As suggested by

Andrews (1991), the quadratic spectral kernel is used for the estimation of the long-run covariance matrix. The truncation lag is also chosen according to Andrews (1991). Employing the Bartlett kernel as in Newey and West (1987) only leads to minor changes of the results.

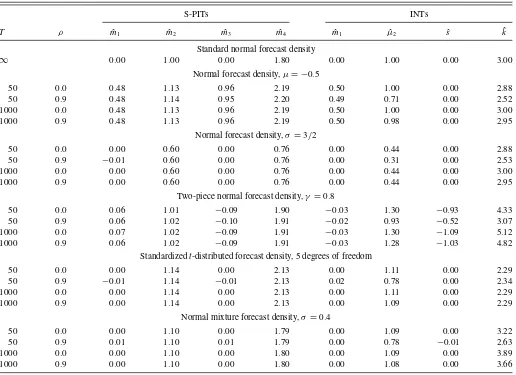

Table 3. Raw sample moments of S-PITs and sample moments of INTs for all forecast densities

S-PITs INTs

T ρ m1ˆ m2ˆ m3ˆ m4ˆ m1ˆ µ2ˆ sˆ kˆ

Standard normal forecast density

∞ 0.00 1.00 0.00 1.80 0.00 1.00 0.00 3.00 Normal forecast density,µ= −0.5

50 0.0 0.48 1.13 0.96 2.19 0.50 1.00 0.00 2.88

50 0.9 0.48 1.14 0.95 2.20 0.49 0.71 0.00 2.52

1000 0.0 0.48 1.13 0.96 2.19 0.50 1.00 0.00 3.00 1000 0.9 0.48 1.13 0.96 2.19 0.50 0.98 0.00 2.95

Normal forecast density,σ=3/2

50 0.0 0.00 0.60 0.00 0.76 0.00 0.44 0.00 2.88

50 0.9 −0.01 0.60 0.00 0.76 0.00 0.31 0.00 2.53 1000 0.0 0.00 0.60 0.00 0.76 0.00 0.44 0.00 3.00 1000 0.9 0.00 0.60 0.00 0.76 0.00 0.44 0.00 2.95

Two-piece normal forecast density,γ =0.8

50 0.0 0.06 1.01 −0.09 1.90 −0.03 1.30 −0.93 4.33 50 0.9 0.06 1.02 −0.10 1.91 −0.02 0.93 −0.52 3.07 1000 0.0 0.07 1.02 −0.09 1.91 −0.03 1.30 −1.09 5.12 1000 0.9 0.06 1.02 −0.09 1.91 −0.03 1.28 −1.03 4.82

Standardizedt-distributed forecast density, 5 degrees of freedom

50 0.0 0.00 1.14 0.00 2.13 0.00 1.11 0.00 2.29

50 0.9 −0.01 1.14 −0.01 2.13 0.02 0.78 0.00 2.34 1000 0.0 0.00 1.14 0.00 2.13 0.00 1.11 0.00 2.29 1000 0.9 0.00 1.14 0.00 2.13 0.00 1.09 0.00 2.29

Normal mixture forecast density,σ =0.4

50 0.0 0.00 1.10 0.00 1.79 0.00 1.09 0.00 3.22

50 0.9 0.01 1.10 0.01 1.79 0.00 0.78 −0.01 2.63 1000 0.0 0.00 1.10 0.00 1.80 0.00 1.09 0.00 3.89 1000 0.9 0.00 1.10 0.00 1.80 0.00 1.08 0.00 3.66

NOTE: ˆmidenotes mean of estimatedith raw moment in 10,000 simulations. ˆµ2,sˆ, and ˆkdenote corresponding values for variance, skewness, and kurtosis, respectively.ρdenotes the

autoregressive coefficient.

To facilitate comparisons between the test statistics, the

size-adjustedpower of the tests will be reported. This requires a

rea-sonably precise estimation of their actual sizes. Using 200,000

Monte Carlo simulations yields an accuracy that appears sat-isfactory for the given purpose, leading to a 95% confidence

interval for the actual size with a width of at most 0.002. The

critical value of the test statistics which is used for the power

computations is determined by the 95% quantile of the 200,000

test statistics computed under the null. For the power

computa-tions, the number of Monte Carlo simulations is set to 10,000,

corresponding to a width of at most about 0.01 for the 95%

confidence interval of the size-adjusted power.

4. SIMULATION RESULTS

4.1 Size

Given a nominal size of 5%, the actual sizes of the ˆβ12test, the

ˆ

µ34 test, and the ˆαr1r2...rN as well as the ˆα

0

r1r2...rN tests based on

the S-PITs are displayed inTable 2. The following statements

concerning the size distortions refer to the absolute differences between the nominal and the actual size, unless otherwise men-tioned.

The size distortions of the raw-moments tests based on the S-PITs are fairly contained. Often, they are considerably smaller if the ˆα0

r1r2...rN tests are used instead of the ˆαr1r2...rN tests. In this

case, the largest negative size distortions are observed for the

case of 50 observations and strong persistence (i.e,in the case

of an AR(1)-process withρ=0.9) with actual sizes often being

below 1%. The largest positive size distortion of the ˆαr01r2...rN

tests is recorded for 200 observations and strong persistence,

where the ˆα12340 test has an actual size of 7.3%. In the case of an

MA(1)-process, the ˆα0r1r2...rN tests always perform well.

If the forecast variable follows an AR(1)-process with no or

only moderate persistence, in general, the ˆβ12 test yields the

smallest size distortions. In the smallest sample and with strong persistence, however, even this test has an actual size of more

than 9%. Given an MA(1)-process, the ˆβ12 test suffers from

size distortions which do not vanish asymptotically. The ˆµ34

test suffers from notable size distortions in many situations. In general, the smallest size distortions of the raw-moments tests

are obtained with the ˆα120 test. While the size distortions of the

ˆ

α1test are often marginally smaller than those of the ˆα012test, in

small samples with strong persistence it underrejects so strongly

that the ˆα012test appears to be preferable. Since, in addition, the

ˆ

α1 test can be expected to have rather low power because it

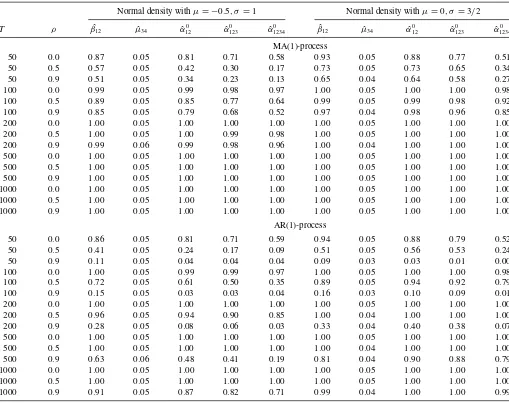

Table 4. Size-adjusted power, normal forecast densities withµ= −0.5,σ=1 and withµ=0,σ =3/2

Normal density withµ= −0.5, σ=1 Normal density withµ=0, σ=3/2

T ρ β12ˆ µ34ˆ αˆ0

12 αˆ

0

123 αˆ

0

1234 β12ˆ µ34ˆ αˆ

0

12 αˆ

0

123 αˆ

0 1234

MA(1)-process

50 0.0 0.87 0.05 0.81 0.71 0.58 0.93 0.05 0.88 0.77 0.51 50 0.5 0.57 0.05 0.42 0.30 0.17 0.73 0.05 0.73 0.65 0.34 50 0.9 0.51 0.05 0.34 0.23 0.13 0.65 0.04 0.64 0.58 0.27 100 0.0 0.99 0.05 0.99 0.98 0.97 1.00 0.05 1.00 1.00 0.98 100 0.5 0.89 0.05 0.85 0.77 0.64 0.99 0.05 0.99 0.98 0.92 100 0.9 0.85 0.05 0.79 0.68 0.52 0.97 0.04 0.98 0.96 0.85 200 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 200 0.5 1.00 0.05 1.00 0.99 0.98 1.00 0.05 1.00 1.00 1.00 200 0.9 0.99 0.06 0.99 0.98 0.96 1.00 0.04 1.00 1.00 1.00 500 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 500 0.5 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 500 0.9 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 1000 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 1000 0.5 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 1000 0.9 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00

AR(1)-process

50 0.0 0.86 0.05 0.81 0.71 0.59 0.94 0.05 0.88 0.79 0.52 50 0.5 0.41 0.05 0.24 0.17 0.09 0.51 0.05 0.56 0.53 0.24 50 0.9 0.11 0.05 0.04 0.04 0.04 0.09 0.03 0.03 0.01 0.00 100 0.0 1.00 0.05 0.99 0.99 0.97 1.00 0.05 1.00 1.00 0.98 100 0.5 0.72 0.05 0.61 0.50 0.35 0.89 0.05 0.94 0.92 0.79 100 0.9 0.15 0.05 0.03 0.03 0.04 0.16 0.03 0.10 0.09 0.01 200 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 200 0.5 0.96 0.05 0.94 0.90 0.85 1.00 0.04 1.00 1.00 1.00 200 0.9 0.28 0.05 0.08 0.06 0.03 0.33 0.04 0.40 0.38 0.07 500 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 500 0.5 1.00 0.05 1.00 1.00 1.00 1.00 0.04 1.00 1.00 1.00 500 0.9 0.63 0.06 0.48 0.41 0.19 0.81 0.04 0.90 0.88 0.79 1000 0.0 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 1000 0.5 1.00 0.05 1.00 1.00 1.00 1.00 0.05 1.00 1.00 1.00 1000 0.9 0.91 0.05 0.87 0.82 0.71 0.99 0.04 1.00 1.00 0.99

NOTE: Raw-moments tests are based on S-PITs.

can only detect misspecifications, which affect the mean of the S-PITs, it will not be considered in what follows.

Summing up, no test can guarantee small size distortions in

all circumstances. However, the ˆα0

r1r2...rN tests based on the

S-PITs always perform well in the case of MA(1)-processes. In the case of AR(1)-processes, they are undersized in small samples

with strong persistence, whereas the ˆβ12test rejects too often in

these cases. The use of the ˆµ34 test and the ˆαr1r2...rNtests cannot

be recommended. Therefore, in what follows, the ˆαr1r2...rN tests

are not considered.

4.2 Size-Adjusted Power

The size-adjusted power (henceforth simply referred to as power) of the tests depends crucially on the sample moments of the S-PITs and INTs. Therefore, these moments are

dis-played in Table 3 for small and large samples (T =50 and

T =1000) and the case of no (ρ=0) and strong (ρ=0.9,

AR(1)-process) persistence. Obviously, the expected sample raw moments do not depend on the sample size or persistence. Differences between the sample raw moments displayed for a

specific forecast density are only caused by the Monte Carlo er-ror. In contrast to the sample raw moments, the sample moment estimators for central and standardized moments can be severely biased.

Turning to the power of the tests, in the case of the

misspec-ified normal forecast densities, the results inTable 4suggest

that, in general, the most powerful test is the ˆβ12 test. It is

su-perior to the other tests especially in small samples with strong

persistence. Otherwise, the ˆα120 test, which is the raw-moment

test corresponding most closely to the ˆβ12test, often has

simi-lar power. The inclusion of higher-order raw moments leads to

power losses. Not surprisingly, the ˆµ34test has power essentially

equal to size.

The misspecifications implied by the two-piece normal fore-cast density are, commonly, most successfully discovered by

the ˆµ34 test and the ˆα0123test, as shown inTable 5. The ˆβ12 test

attains a similar power only ifT =50. The power of the ˆα0

1234

test is comparable to that of the ˆα0

123test. The ˆα012 test has rather

low power, which does not seem surprising, because the mean of the S-PITs is close to 0, and the second raw moment is close

to 1 as shown inTable 3.

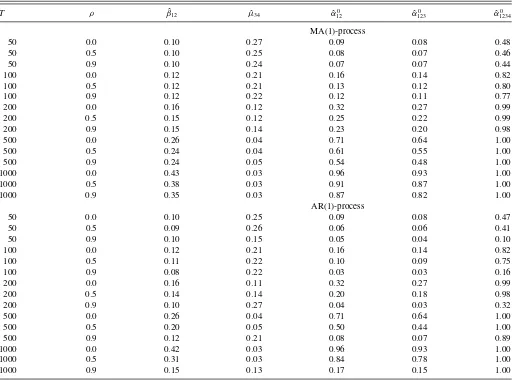

Table 5. Size-adjusted power, two-piece normal forecast density withγ =0.8 and standardizedt-distributed forecast density with 5 degrees of freedom

Two-piece normal density withγ =0.8 t-distributed density with 5 d.f.

T ρ β12ˆ µ34ˆ αˆ0

12 αˆ

0

123 αˆ

0

1234 β12ˆ µ34ˆ αˆ

0

12 αˆ

0

123 αˆ

0 1234

MA(1)-process

50 0.0 0.27 0.24 0.07 0.26 0.23 0.04 0.22 0.13 0.11 0.10 50 0.5 0.25 0.24 0.06 0.19 0.14 0.04 0.17 0.10 0.09 0.08 50 0.9 0.26 0.23 0.06 0.16 0.12 0.04 0.15 0.09 0.10 0.08 100 0.0 0.41 0.59 0.08 0.56 0.52 0.06 0.47 0.23 0.20 0.18 100 0.5 0.37 0.56 0.06 0.45 0.40 0.05 0.39 0.18 0.17 0.16 100 0.9 0.36 0.50 0.07 0.40 0.34 0.05 0.35 0.17 0.15 0.15 200 0.0 0.58 0.94 0.12 0.89 0.88 0.10 0.86 0.48 0.41 0.40 200 0.5 0.55 0.91 0.09 0.82 0.81 0.09 0.80 0.39 0.34 0.34 200 0.9 0.52 0.87 0.08 0.79 0.77 0.08 0.75 0.35 0.30 0.32 500 0.0 0.89 1.00 0.24 1.00 1.00 0.26 1.00 0.89 0.85 0.85 500 0.5 0.84 1.00 0.15 1.00 1.00 0.21 1.00 0.81 0.76 0.79 500 0.9 0.81 1.00 0.14 1.00 1.00 0.20 1.00 0.76 0.70 0.75 1000 0.0 0.99 1.00 0.46 1.00 1.00 0.54 1.00 1.00 0.99 0.99 1000 0.5 0.98 1.00 0.28 1.00 1.00 0.47 1.00 0.99 0.97 0.99 1000 0.9 0.97 1.00 0.24 1.00 1.00 0.42 1.00 0.98 0.96 0.98

AR(1)-process

50 0.0 0.27 0.24 0.07 0.27 0.24 0.04 0.22 0.12 0.11 0.10 50 0.5 0.22 0.24 0.05 0.13 0.10 0.04 0.16 0.08 0.08 0.07 50 0.9 0.14 0.13 0.05 0.06 0.05 0.05 0.06 0.03 0.03 0.06 100 0.0 0.39 0.58 0.09 0.55 0.52 0.06 0.48 0.23 0.20 0.19 100 0.5 0.32 0.54 0.05 0.37 0.31 0.04 0.36 0.14 0.13 0.13 100 0.9 0.17 0.20 0.05 0.07 0.06 0.04 0.08 0.03 0.03 0.05 200 0.0 0.58 0.94 0.12 0.89 0.88 0.09 0.85 0.46 0.40 0.39 200 0.5 0.46 0.88 0.07 0.77 0.75 0.07 0.75 0.31 0.27 0.28 200 0.9 0.22 0.37 0.05 0.11 0.07 0.04 0.13 0.04 0.04 0.05 500 0.0 0.89 1.00 0.24 1.00 1.00 0.25 1.00 0.89 0.84 0.84 500 0.5 0.76 1.00 0.11 1.00 1.00 0.15 1.00 0.72 0.65 0.72 500 0.9 0.30 0.73 0.06 0.43 0.30 0.04 0.44 0.12 0.12 0.16 1000 0.0 0.99 1.00 0.45 1.00 1.00 0.53 1.00 1.00 0.99 0.99 1000 0.5 0.95 1.00 0.18 1.00 1.00 0.34 1.00 0.97 0.94 0.97 1000 0.9 0.45 0.95 0.06 0.87 0.85 0.06 0.84 0.28 0.25 0.42

NOTE: Raw-moments tests are based on S-PITs.

As can also be seen fromTable 5, if the forecast density has

a standardizedt-distribution with 5 degrees of freedom, the ˆµ34

test delivers the best results. Note that this result is related to the fact that the INTs have negative excess kurtosis. For random

variables with positive excess kurtosis, the ˆµ34test has very low

power, as found by Bai and Ng (2005). All raw moments tests attain similar power which here clearly exceeds the power of

the ˆβ12test whenever power exceeds size.

In the case of the normal mixture forecast density, the

behav-ior of the ˆµ34 test reported in Table 6seems counterintuitive

at first sight, because its power appears to decrease with the sample size. However, this can be explained by its asymmetric power properties with respect to excess kurtosis, the bias of the sample kurtosis estimator, and the fact that the sample kurto-sis estimator yields values around 3 in most settings. Broadly speaking, in small persistent samples, the estimated kurtosis is often smaller than 3, and the test has relatively high power in these cases. With even larger sample sizes than considered here,

the power of the ˆµ34test would eventually start to increase. The

ˆ

β12test has relatively low power in almost all cases. The

high-est power, in general, is clearly attained by the ˆα0

1234test. The

high power of the ˆα12340 test compared to all other raw-moments

tests is surprising insofar as, according to Table 3, the fourth

raw sample moment is virtually equal to 1.8, its value under the null. Additional simulations show that, interestingly, the high

power of the ˆα0

1234test stems from the joint consideration of the

second, third, and fourth raw moment. If one of these moments does not enter the test, the power decreases considerably. Ap-parently, the joint distribution of these three sample moments is such that, usually, at least one of the moments is likely to signal departures from the standard uniform distribution.

4.3 Summary

From the Monte Carlo simulations conducted above, it fol-lows that the ˆαr01r2...r

N tests are preferable to the ˆαr1r2...rN tests.

Among the ˆα0r1r2...rN tests, the ˆα120 test tends to give the

small-est size distortions. However, the ˆα12340 test has power against

more types of misspecification, while its size distortions are still

fairly small. Concerning the choice among the ˆβ12test, the ˆµ34

test, and the ˆα0

r1r2...rNtests, the ˆµ34test often has the largest size

Table 6. Size-adjusted power, normal mixture forecast density withσ=0.4

T ρ β12ˆ µ34ˆ αˆ0

12 αˆ

0

123 αˆ

0 1234

MA(1)-process

50 0.0 0.10 0.27 0.09 0.08 0.48

50 0.5 0.10 0.25 0.08 0.07 0.46

50 0.9 0.10 0.24 0.07 0.07 0.44

100 0.0 0.12 0.21 0.16 0.14 0.82

100 0.5 0.12 0.21 0.13 0.12 0.80

100 0.9 0.12 0.22 0.12 0.11 0.77

200 0.0 0.16 0.12 0.32 0.27 0.99

200 0.5 0.15 0.12 0.25 0.22 0.99

200 0.9 0.15 0.14 0.23 0.20 0.98

500 0.0 0.26 0.04 0.71 0.64 1.00

500 0.5 0.24 0.04 0.61 0.55 1.00

500 0.9 0.24 0.05 0.54 0.48 1.00

1000 0.0 0.43 0.03 0.96 0.93 1.00

1000 0.5 0.38 0.03 0.91 0.87 1.00

1000 0.9 0.35 0.03 0.87 0.82 1.00

AR(1)-process

50 0.0 0.10 0.25 0.09 0.08 0.47

50 0.5 0.09 0.26 0.06 0.06 0.41

50 0.9 0.10 0.15 0.05 0.04 0.10

100 0.0 0.12 0.21 0.16 0.14 0.82

100 0.5 0.11 0.22 0.10 0.09 0.75

100 0.9 0.08 0.22 0.03 0.03 0.16

200 0.0 0.16 0.11 0.32 0.27 0.99

200 0.5 0.14 0.14 0.20 0.18 0.98

200 0.9 0.10 0.27 0.04 0.03 0.32

500 0.0 0.26 0.04 0.71 0.64 1.00

500 0.5 0.20 0.05 0.50 0.44 1.00

500 0.9 0.12 0.21 0.08 0.07 0.89

1000 0.0 0.42 0.03 0.96 0.93 1.00

1000 0.5 0.31 0.03 0.84 0.78 1.00

1000 0.9 0.15 0.13 0.17 0.15 1.00

NOTE: Raw-moments tests are based on S-PITs.

distortions, it cannot detect misspecifications which affect first and second moments of the INTs only, and its power can depend in complex ways on sample size and persistence. Therefore, this test does not appear to be well-suited for the evaluation of

density forecasts. The ˆβ12 test has good size properties if the

underlying AR(1)-process assumption is correct, but otherwise suffers from size distortions which do not vanish asymptotically. It appears to be the best choice if the sample size is small, and the data is very persistent. If persistence is only moderate, as

one would expect in the case ofhbeing not too large, or if the

sample is not too small, the ˆα0

1234 test has satisfactory power

against many types of misspecification. Therefore, in general,

the ˆα01234 appears to be the most recommendable test for the

calibration of multi-step-ahead density forecasts.

5. EMPIRICAL APPLICATION

In what follows, the calibration of density forecasts for the logarithm of the daily euro/pound sterling (henceforth EUR/GBP) exchange rate is investigated. The data cover the period from January 4, 2008, to February 28, 2014, and are

displayed inFigure 2. I considerh-step-ahead forecasts withh

equal to 2 and to 3 days.

Denoting the log of the exchange rate at timetby byxt, I

assume thatxt follows a random walk, and that the changes in

xtcan be described by a conditionally heteroscedastic Gaussian

Figure 2. 100 times the logarithm of the daily EUR/GBP exchange rate.

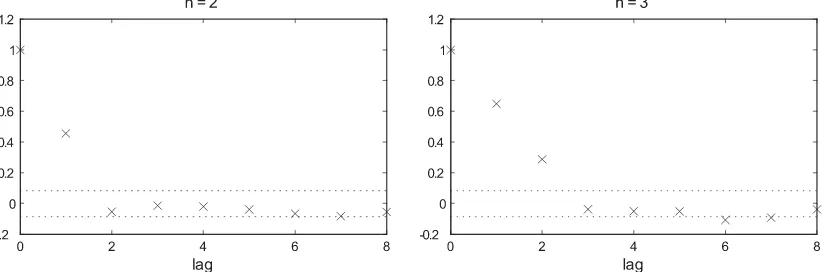

Figure 3. Autocorrelations of the INTs of the density forecasts for the daily EUR/GBP exchange rate for forecast horizonsh=2 andh=3. Dashed lines indicate 95% confidence bounds, calculated as±2/√T.

Table 7. Moments of S-PITs and INTs and test results for calibration of density forecasts for the daily EUR/GBP exchange rate

Moments

S-PITs INTs p-values

ˆ

m1 m2ˆ m3ˆ m4ˆ m1ˆ µ2ˆ αˆ0

1234 αˆ

0

12 β12ˆ

h=2 0.01 0.87 0.02 1.50 0.00 0.85 0.01∗∗ 0.00∗∗∗ 0.12 h=3 0.01 0.86 0.00 1.41 0.00 0.81 0.04∗∗ 0.02∗∗ 0.11

NOTE: Raw-moments tests are based on S-PITs. Sample sizes equalT=555.mˆidenotes theith raw moment, ˆµ2the variance.∗∗∗,∗∗,∗denote rejection at the 1%,5%,10% significance

level.

time series model as in Bollerslev (1986) given by

xt =xt−1+qt, qt=σtεt σt2=b0+b1qt2−1+b2σt2−1

withεt ∼iidN(0,1). A rolling estimation window with 1000

observations is used, andT =555 density forecasts forxt are

evaluated.

The autocorrelations of the resulting INTs are displayed in Figure 3. Obviously, the dynamics of the INTs associated with

the h-step-ahead density forecasts seem to be fairly well

de-scribed by MA(h−1 )-processes. The autocorrelations of the

PITs are very similar to those of the INTs, so that the same statement applies.

To check for correct calibration, the ˆα0

1234 test, the ˆα

0

12 test,

and the ˆβ12test are employed. InTable 7, in addition to the test

results, the first four sample raw moments of the S-PITs as well as the sample mean and variance of the INTs are shown.

The ˆα12340 test rejects the null hypothesis of correct calibration

for both forecast horizons at the 5% significance level. At the

latter level, the ˆα120 test also rejects forh=3, and forh=2 it

rejects at the 1% level. In contrast to that, no rejections occur

with the ˆβ12test. When looking at the moments, it appears likely

that the major misspecification of the forecast densities is their

excessive dispersion. In such a situation, according toTable 4,

the ˆα0

12 test and the ˆβ12 test have similar size-adjusted power.

Yet, the ˆβ12 test is undersized in the presence of an

MA(1)-process with positive MA coefficient, and this property could also hold for MA(2)-processes. This could be a reason why the

ˆ

β12test does not reject here.

6. CONCLUSION

Raw-moments tests for the calibration of multi-step-ahead density forecasts are proposed and compared to two commonly

used tests, the ˆβ12test of Berkowitz (2001), and the ˆµ34 test of

Bai and Ng (2005). These tests employ the inverse normal trans-forms (INTs) of the probability integral transtrans-forms (PITs). The raw-moments tests are based on the standardized PITs (S-PITs). Despite of the autocorrelation of the PITs, the raw-moments tests rely on standard critical values.

It turns out that the ˆµ34 test cannot be recommended for

the evaluation of density forecasts due to potentially large size distortions, complicated power properties, and ignoring

infor-mation from lower-order moments. The ˆβ12 test can be very

useful because of its relatively large power especially in small samples with strong persistence. Yet, if the INTs do not fol-low an AR(1)-process, size distortions occur which do not van-ish asymptotically. Moreover, the test does not use information from higher-order moments.

Tests based on the S-PITs do not suffer from these short-comings, and can therefore, and because of their simplicity, be a very helpful tool for the evaluation of density forecasts. The tests which use the fact that under the null, odd and even sample moments are uncorrelated, perform better in terms of size and power than their counterparts which do not employ

the zero-correlation property. Among the former tests, the ˆα12340

test, which uses the first four raw moments of the S-PITs, has good size and power properties in most settings investigated in this study. Therefore, in general, it appears to be the most recommendable test.

APPENDIX A: PROOF

The following proof shows that the long-run covariance ofyri t −mri andytrj −mrj equals 0 ifyt is symmetrically distributed around 0 and ifri+rjis odd. Consider the standard normal variablezt, and denote the symmetry-preserving transformation byyt =S(zt) whereS(zt) is an odd function. The symmetric density ofytwill be denoted byf(yt). Suppose thatriis odd andrjis even. Then, for the contemporaneous covariance ofyri

t andy

rjdenotes the expectationE[y rj function, implying thatyr

tf(yt) is an odd function. Thus,E[y

For the noncontemporaneous covariance ofyri t andy

Starting withzt, the latter expectation can be rewritten as

E first and the fourth term and the sum of the second and the third term the right-hand side are both equal to 0, so that the entire expression equals 0.

Consideringyri t andy

rj

t instead of the odd functionz ri

t and the even functionzrj

t leads to the same result, because, first,y ri

t also is an odd function andyrj

t also is an even function, and second,f(yt, yt−v)= f(−yt,−yt−v) andf(yt,−yt−v)=f(−yt, yt−v) must hold because yt =S(zt) is a symmetry-preserving transformation. Therefore,

E

Here the densities used for the Monte Carlo simulations are described. Unless otherwise mentioned, their skewness equals 0 and their kurtosis equals 3.

Denoting the standard normal density byφ(·), the normal forecast density is

whereµis the mean andσ the standard deviation ofxt.

The two-piece normal distribution, as described, for example, in Wallis (2004, p. 66), is defined by

withmbeing the mode and with the moments

E[xt]=µ=m+ The parameterγrepresents the mean-mode difference. A positive value ofγcorresponds to a positively-skewed random variablext. Skewness and kurtosis of the standardized two-piece normal distribution are given by

Letτ(xt, v) denote the density function of thet-distribution withv

degrees of freedom withv >4. To obtain a forecast density with unit variance, the scaled forecast density given by

ˆ

is employed. The kurtosis ofxt equals

k= 3v−6 v−4.

Finally, the normal mixture density considered is given by

ˆ

The author thanks J¨org Breitung, Matei Demetrescu, James Mitchell, Barbara Rossi, Karl-Heinz T¨odter, Alexan-der Tsyplakov, Ken Wallis, and participants at the workshop “Uncertainty and Forecasting in Macroeconomics” in Eltville, organized by the Deutsche Bundesbank and the ifo Institute, as well as participants at “The 32nd Annual International Sym-posium on Forecasting” in Boston for helpful comments and suggestions. This article represents the author’s personal opin-ion and does not necessarily reflect the views of the Deutsche Bundesbank.

[Received August 2013. Revised May 2014.]

REFERENCES

Aastveit, K. A., Gerdrup, K. R., Jore, A. S., and Thorsrud, L. A. (2011), “Now-casting GDP in Real-Time: A Density Combination Approach,” Working Paper 2011/11, Norges Bank. [270]

Andrews, D. W. K. (1991), “Heteroskedasticity and Autocorrelation Consistent Covariance Matrix Estimation,”Econometrica, 59, 817–858. [274] Bache, I. W., Jore, A. S., Mitchell, J., and Vahey, S. P. (2011), “Combining

VAR and DSGE Forecast Densities,”Journal of Economic Dynamics and Control, 35, 1659–1670. [270]

Bai, J., and Ng, S. (2005), “Tests of Skewness, Kurtosis, and Normality for Time Series Data,”Journal of Business and Economic Statistics, 23, 49–60. [270,271,274,277,279]

Berkowitz, J. (2001), “Testing Density Forecasts, With Applications to Risk Management,”Journal of Business and Economic Statistics, 19, 465–474. [270,271,279]

Billingsley, P. (1995),Probability and Measure(3rd ed.),New York: Wiley. [272]

Bollerslev, T. (1986), “Generalized Autoregressive Conditional Heteroskedas-ticity,”Journal of Econometrics, 31, 307–327. [279]

Bontemps, C., and Meddahi, N. (2012), “Testing Distributional Assumptions: A GMM Aproach,”Journal of Applied Econometrics, 27, 978–1012. [270] ——— (2005), “Testing Normality: A GMM Approach,”Journal of

Economet-rics, 124, 149–186. [270]

Breuer, P., and Major, P. (1983), “Central Limit Theorems for Non-Linear Functionals of Gaussian Fields,”Journal of Multivariate Analysis, 13, 425– 441. [272]

Chen, Y.-T. (2011), “Moment Tests for Density Forecast Evaluation in the Presence of Parameter Estimation Uncertainty,”Journal of Forecasting, 30, 409–450. [271]

Clements, M. P. (2004), “Evaluating the Bank of England Density Forecasts of Inflation,”The Economic Journal, 114, 844–866. [270,271]

Corradi, V., and Swanson, N. R. (2006a), “Bootstrap Conditional Distribution Tests in the Presence of Dynamic Misspecification,”Journal of Economet-rics, 133, 779–806. [270]

——— (2006b), “Predictive Density Evaluation,” inHandbook of Economic Forecasting(vol. 1), eds. G. Elliott, C. W. J. Granger, and A. Timmermann, North Holland: Elsevier, chapter 5, pp. 197–284. [270]

D’Agostino, A., Gambetti, L., and Giannone, D. (2013), “Macroeconomic Fore-casting and Structural Change,”Journal of Applied Econometrics, 28, 82– 101. [270]

Dawid, A. P. (1984), “Statistical Theory: The Prequential Approach,”Journal of the Royal Statistical Society,Series A, 147, 278–292. [270]

Diebold, F. X., Gunther, T. A., and Tay, A. S. (1998), “Evalu-ating Density Forecasts With Applications to Financial Risk

Management,” International Economic Review, 39, 863–883. [270]

Diebold, F. X., Tay, A. S., and Wallis, K. F. (1999), “Evaluating Density Fore-casts of Inflation: The Survey of Professional Forecasters,” inCointegration, Causality, and Forecasting: Festschrift in Honour of Clive W. J. Granger, eds. R. F. Engle and H. White, Oxford, UK: Oxford University Press, pp. 76–90. [270]

Doornik, J. A., and Hansen, H. (2008), “An Omnibus Test for Univariate and Multivariate Normality,”Oxford Bulletin of Economics and Statistics, 70, 927–939. [272]

Jore, A. S., Mitchell, J., and Vahey, S. P. (2010), “Combining Forecast Densities From VARs With Uncertain Instabilities,”Journal of Applied Econometrics, 25, 621–634. [270]

Mitchell, J., and Hall, S. G. (2005), “Evaluating, Comparing and Combining Density Forecasts Using the KLIC With an Application to the Bank of England and NIESR Fan Charts of Inflation,”Oxford Bulletin of Economics and Statistics, 67, 995–1033. [270]

Mitchell, J., and Wallis, K. F. (2011), “Evaluating Density Forecasts: Fore-cast Combinations, Model Mixtures, Calibration and Sharpness,”Journal of Applied Econometrics, 26, 1023–1040. [270,273]

Newey, W. K., and West, K. D. (1987), “A Simple, Positive Semi-Definite, Het-eroskedasticity and Autocorrelation Consistent Covariance Matrix,” Econo-metrica, 55, 703–708. [274]

Rosenblatt, M. (1952), “Remarks on a Multivariate Transformation,”Annals of Mathematical Statistics, 23, 470–472. [270,271]

Rossi, B., and Sekhposyan, T. (2014), “Alternative Tests for Correct Specifi-cation of Conditional Predictive Densities,” Mimeo, Barcelona Graduate School of Economics, Universitat Pompeu Fabra. [270,271]

Smith, J. Q. (1985), “Diagnostic Checks of Non-Standard Time Series Models,” Journal of Forecasting, 4, 283–291. [270,271]

Sun, T.-C. (1965), “Some Further Results of Central Limit Theorems for Non-Linear Functions of a Normal Stationary Process,”Journal of Mathematics and Mechanics, 14, 71–85. [272]

Tay, A. S., and Wallis, K. F. (2000), “Density Forecasting: A Survey,”Journal of Forecasting, 19, 235–254. [270]

Tsyplakov, A. (2011),Evaluating Density Forecasts: A Comment, MPRA Paper 31184, Germany: University Library of Munich. [271]

Wallis, K. F. (2004), “An Assessment of Bank of England and National Institute Inflation Forecast Uncertainties,”National Institute Economic Review, 189, 64–71. [280]

——— (2008), “Forecast Uncertainty, Its Representation and Evaluation,” in Econometric Forecasting and High-Frequency Data Analysis(vol. 13), eds. R. S. Mariano and Y.-K. Tse, Singapore: World Scientific Publishing Com-pany. [272]