LAMPIRAN

Lampiran 1

Daftar Populasi Perusahaan Perbankan yang Terdaftar di BEI

No Kode

Emiten Nama Perusahaan

Kriteria

Sampel

1 2 3

1 AGRO Bank Rakyat Indonesia Agro Niaga

Tbk √ √ √ S1

2 AGRS Bank Agris Tbk √ × √ -

3 BABP Bank MNC Internasional Tbk √ √ √ S2 4 BACA Bank Capital Indonesia Tbk √ √ √ S3

5 BAEK Bank Ekonomi Raharja Tbk √ √ √ S4

6 BBCA Bank Central Asia Tbk √ √ √ S5

7 BBKP Bank Bukopin Tbk √ √ √ S6

8 BBMD Bank Mestika Dharma Tbk √ × √ -

9 BBNI Bank Negara Indosia (Persero) Tbk √ √ √ S7 10 BBNP Bank Nusantara Parahyangan Tbk √ √ √ S8 11 BBRI Bank Rakyat Indonesia (Persero)

Tbk √ √ √ S9

12 BBTN Bank Tabungan Negara (Persero)

Tbk √ × √ -

13 BBYB Bank Yudha Bhakti Tbk √ × √ -

14 BCIC Bank Mutiara Tbk √ √ √ S10

15 BDMN Bank Danamon Indonesia Tbk √ √ √ S11 16 BEKS Bank Pundi Indonesia Tbk √ √ √ S12

17 BINA Bank Ina Perdana Tbk √ × √ -

18 BJBR Bank Jabar Banten Tbk √ √ √ S13

19 BJTM Bank Pembangunan Daerah Jawa

Timur Tbk √ × √ -

20 BKSW Bank Kesawan Tbk √ √ √ S14

21 BMAS Bank Maspion Indonesia Tbk √ × √ - 22 BMRI Bank Mandiri (Persero) Tbk √ √ √ S15

23 BNBA Bank Bumi Artha Tbk √ √ √ S16

24 BNGA Bank CIMB Niaga Tbk √ √ √ S17

25 BNII Bank Internasional Indonesia Tbk √ √ √ S18

27 BSIM Bank Sinar Mas Tbk √ √ √ S19

28 BSWD Bank Swadesi Tbk √ √ √ S20

29 BTPN Bank Tabungan Pensiunan Nasional

Tbk √ √ √ S21

30 BVIC Bank Victoria Internasional Tbk √ √ √ S22

31 DNAR Bank Dinar Indonesia Tbk √ × √ -

32 INPC Bank Artha Graha International Tbk √ √ √ S23 33 MAYA Bank Mayapada International Tbk √ √ √ S24 34 MCOR Bank Windu Kentjana International

Tbk √ √ √ S25

35 MEGA Bank Mega Tbk √ √ √ S26

36 NAGA Bak Mitraniaga Tbk √ × √ -

37 NISP Bank NISP OCBC Tbk √ √ √ S27

38 NOBU Bank National Nobu Tbk √ × √ -

39 PNBN Bank Pan Indonesia Tbk √ √ √ S28

40 PNBS Bank Pan Indonesia Syariah Tbk √ × √ - 41 SDRA Bank Himpunan Saudara 1906 Tbk √ √ √ S29

Lampiran 2

Daftar Sampel Penelitian Perusahaan Perbankan yang Terdaftar di BEI

No Kode Emiten Nama Perusahaan

1 AGRO Bank Rakyat Indonesia Agro Niaga Tbk 2 BABP Bank MNC Internasional Tbk

3 BACA Bank Capital Indonesia Tbk 4 BAEK Bank Ekonomi RaharjaTbk 5 BBCA Bank Central Asia Tbk 6 BBKP Bank Bukopin Tbk

7 BBNI Bank Negara Indonesia (Persero) Tbk 8 BBNP Bank Nusantara Parahyangan Tbk 9 BBRI Bank Rakyat Indonesia (Persero) Tbk 10 BCIC Bank Mutiara Tbk

15 BMRI Bank Mandiri (Persero) Tbk 16 BNBA Bank Bumi Arta Tbk

17 BNGA Bank CIMB Niaga Tbk

18 BNII Bank Internasional Indonesia Tbk 19 BSIM Bank Sinar Mas Tbk

20 BSWD Bank Swadesi Tbk

21 BTPN Bank Tabungan Pensiunan Nasional Tbk 22 BVIC Bank Victoria International Tbk

23 INPC Bank Artha Graha International Tbk 24 MAYA Bank Mayapada International Tbk 25 MCOR Bank Windu Kentjana International Tbk 26 MEGA Bank Mega Tbk

27 NISP Bank NISP OCBC Tbk 28 PNBN Bank Pan Indonesia Tbk

29 SDRA Bank Himpunan Saudara 1906 Tbk

Lampiran 3

Tabel Hasil Perhitungan Dewan Komisaris

No Kode

Emiten Nama Perusahaan

Tahun

2011 2012 2013 2014

1 AGRO Bank Rakyat Indonesia Agro

Niaga Tbk 4 4 5 5

2 BABP Bank MNC Internasional Tbk 5 4 2 3

3 BACA Bank Capital Indonesia Tbk 3 3 3 3

4 BAEK Bank Ekonomi RaharjaTbk 4 3 3 3

5 BBCA Bank Central Asia Tbk 5 5 5 5

6 BBKP Bank Bukopin Tbk 5 5 6 7

7 BBNI Bank Negara Indonesia

(Persero) Tbk 7 7 7 8

8 BBNP Bank Nusantara Parahyangan

Tbk 5 4 4 4

9 BBRI Bank Rakyat Indonesia

(Persero) Tbk 6 8 8 7

10 BCIC Bank Mutiara Tbk 4 3 3 7

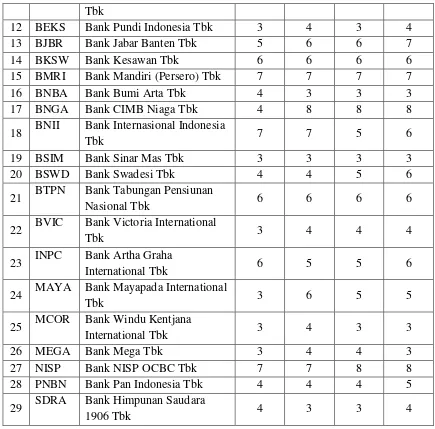

Tbk

12 BEKS Bank Pundi Indonesia Tbk 3 4 3 4

13 BJBR Bank Jabar Banten Tbk 5 6 6 7

14 BKSW Bank Kesawan Tbk 6 6 6 6

15 BMRI Bank Mandiri (Persero) Tbk 7 7 7 7

16 BNBA Bank Bumi Arta Tbk 4 3 3 3

17 BNGA Bank CIMB Niaga Tbk 4 8 8 8

18 BNII Bank Internasional Indonesia

Tbk 7 7 5 6

19 BSIM Bank Sinar Mas Tbk 3 3 3 3

20 BSWD Bank Swadesi Tbk 4 4 5 6

21 BTPN Bank Tabungan Pensiunan

Nasional Tbk 6 6 6 6

22 BVIC Bank Victoria International

Tbk 3 4 4 4

23 INPC Bank Artha Graha

International Tbk 6 5 5 6

24 MAYA Bank Mayapada International

Tbk 3 6 5 5

25 MCOR Bank Windu Kentjana

International Tbk 3 4 3 3

26 MEGA Bank Mega Tbk 3 4 4 3

27 NISP Bank NISP OCBC Tbk 7 7 8 8

28 PNBN Bank Pan Indonesia Tbk 4 4 4 5

29 SDRA Bank Himpunan Saudara

1906 Tbk 4 3 3 4

Lampiran 4

Tabel Hasil Perhitungan Dewan Komisaris Independen

No Kode

Emiten Nama Perusahaan

Tahun

2011 2012 2013 2014

1 AGRO Bank Rakyat Indonesia Agro

Niaga Tbk 0.50 0.50 0.60 0.60

6 BBKP Bank Bukopin Tbk 0.60 0.60 0.67 0.57 7 BBNI Bank Negara Indonesia

(Persero) Tbk 0.43 0.57 0.57 0.50

8 BBNP Bank Nusantara Parahyangan

Tbk 0.60 0.50 0.50 0.50

9 BBRI Bank Rakyat Indonesia

(Persero) Tbk 0.50 0.50 0.50 0.71

10 BCIC Bank Mutiara Tbk 0.50 0.67 0.67 0.43 11 BDMN Bank Danamon Indonesia

Tbk 0.25 0.50 0.50 0.33

12 BEKS Bank Pundi Indonesia Tbk 0.67 0.50 0.67 0.50 13 BJBR Bank Jabar Banten Tbk 0.60 0.67 0.67 0.57 14 BKSW Bank Kesawan Tbk 0.50 0.50 0.50 0.50 15 BMRI Bank Mandiri (Persero) Tbk 0.57 0.57 0.57 0.71 16 BNBA Bank Bumi Arta Tbk 0.67 0.67 0.67 0.67 17 BNGA Bank CIMB Niaga Tbk 0.75 0.50 0.50 0.50 18 BNII Bank Internasional Indonesia

Tbk 0.57 0.57 0.50 0.50

19 BSIM Bank Sinar Mas Tbk 0.67 0.67 0.67 0.67 20 BSWD Bank Swadesi Tbk 0.75 0.75 0.60 0.67 21 BTPN Bank Tabungan Pensiunan

Nasional Tbk 0.50 0.50 0.50 0.50

22 BVIC Bank Victoria International

Tbk 0.67 0.25 0.75 0.75

23 INPC Bank Artha Graha

International Tbk 0.50 0.60 0.60 0.50 24 MAYA Bank Mayapada International

Tbk 0.00 0.50 0.60 0.60

25 MCOR Bank Windu Kentjana

International Tbk 0.33 0.50 0.67 0.67

26 MEGA Bank Mega Tbk 0.67 0.50 0.50 0.67

27 NISP Bank NISP OCBC Tbk 0.43 0.57 0.50 0.50 28 PNBN Bank Pan Indonesia Tbk 0.50 0.50 0.50 0.60 29 SDRA Bank Himpunan Saudara

Lampiran 5

Tabel Hasil Perhitungan Management Ownership

No Kode

Emiten Nama Perusahaan

Tahun

2011 2012 2013 2014

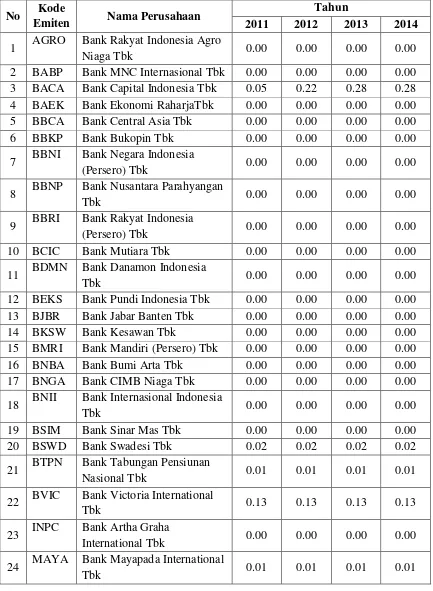

1 AGRO Bank Rakyat Indonesia Agro

Niaga Tbk 0.00 0.00 0.00 0.00

2 BABP Bank MNC Internasional Tbk 0.00 0.00 0.00 0.00 3 BACA Bank Capital Indonesia Tbk 0.05 0.22 0.28 0.28 4 BAEK Bank Ekonomi RaharjaTbk 0.00 0.00 0.00 0.00 5 BBCA Bank Central Asia Tbk 0.00 0.00 0.00 0.00 6 BBKP Bank Bukopin Tbk 0.00 0.00 0.00 0.00 7 BBNI Bank Negara Indonesia

(Persero) Tbk 0.00 0.00 0.00 0.00

8 BBNP Bank Nusantara Parahyangan

Tbk 0.00 0.00 0.00 0.00

9 BBRI Bank Rakyat Indonesia

(Persero) Tbk 0.00 0.00 0.00 0.00

10 BCIC Bank Mutiara Tbk 0.00 0.00 0.00 0.00 11 BDMN Bank Danamon Indonesia

Tbk 0.00 0.00 0.00 0.00

12 BEKS Bank Pundi Indonesia Tbk 0.00 0.00 0.00 0.00 13 BJBR Bank Jabar Banten Tbk 0.00 0.00 0.00 0.00 14 BKSW Bank Kesawan Tbk 0.00 0.00 0.00 0.00 15 BMRI Bank Mandiri (Persero) Tbk 0.00 0.00 0.00 0.00 16 BNBA Bank Bumi Arta Tbk 0.00 0.00 0.00 0.00 17 BNGA Bank CIMB Niaga Tbk 0.00 0.00 0.00 0.00 18 BNII Bank Internasional Indonesia

Tbk 0.00 0.00 0.00 0.00

19 BSIM Bank Sinar Mas Tbk 0.00 0.00 0.00 0.00 20 BSWD Bank Swadesi Tbk 0.02 0.02 0.02 0.02 21 BTPN Bank Tabungan Pensiunan

Nasional Tbk 0.01 0.01 0.01 0.01

22 BVIC Bank Victoria International

Tbk 0.13 0.13 0.13 0.13

23 INPC Bank Artha Graha

International Tbk 0.00 0.00 0.00 0.00 24 MAYA Bank Mayapada International

25 MCOR Bank Windu Kentjana

International Tbk 0.02 0.02 0.03 0.03

26 MEGA Bank Mega Tbk 0.02 0.02 0.02 0.02

27 NISP Bank NISP OCBC Tbk 0.00 0.00 0.00 0.00 28 PNBN Bank Pan Indonesia Tbk 0.00 0.00 0.00 0.00 29 SDRA Bank Himpunan Saudara

1906 Tbk 0.00 0.00 0.00 0.00

Lampiran 6

Tabel Hasil Perhitungan Bank Size

No Kode

Emiten Nama Perusahaan

Tahun

2011 2012 2013 2014

1 AGRO Bank Rakyat Indonesia Agro

Niaga Tbk 28.88 29.03 29.26 29.49

2 BABP Bank MNC Internasional Tbk 29.62 29.64 29.73 29.87 3 BACA Bank Capital Indonesia Tbk 29.18 29.37 29.60 29.86 4 BAEK Bank Ekonomi RaharjaTbk 30.31 30.86 30.99 31.02 5 BBCA Bank Central Asia Tbk 33.58 33.72 33.84 33.95 6 BBKP Bank Bukopin Tbk 31.68 31.82 31.87 32.00 7 BBNI Bank Negara Indonesia

(Persero) Tbk 33.33 33.44 33.59 33.66 8 BBNP Bank Nusantara Parahyangan

Tbk 29.51 29.74 29.93 29.88

9 BBRI Bank Rakyat Indonesia

(Persero) Tbk 33.78 33.94 34.07 34.32 10 BCIC Bank Mutiara Tbk 30.21 30.35 30.31 30.17 11 BDMN Bank Danamon Indonesia

Tbk 32.59 32.68 32.85 32.91

12 BEKS Bank Pundi Indonesia Tbk 29.42 29.67 29.83 29.83 13 BJBR Bank Jabar Banten Tbk 31.63 31.89 31.89 31.96 14 BKSW Bank Kesawan Tbk 28.91 29.17 30.03 30.67 15 BMRI Bank Mandiri (Persero) Tbk 33.94 34.09 34.23 34.38 16 BNBA Bank Bumi Arta Tbk 28.72 28.88 29.03 29.27 17 BNGA Bank CIMB Niaga Tbk 32.75 32.92 33.02 33.08 18 BNII Bank Internasional Indonesia

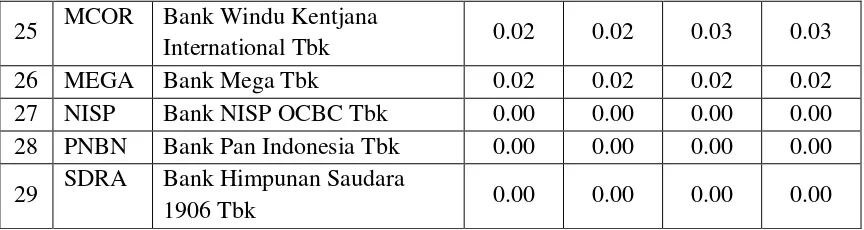

19 BSIM Bank Sinar Mas Tbk 30.45 30.35 30.49 30.69 20 BSWD Bank Swadesi Tbk 28.36 28.56 28.91 29.28 21 BTPN Bank Tabungan Pensiunan

Nasional Tbk 31.47 31.71 31.87 31.95 22 BVIC Bank Victoria International

Tbk 30.10 30.29 30.58 30.69

23 INPC Bank Artha Graha

International Tbk 30.59 30.65 30.68 30.79 24 MAYA Bank Mayapada International

Tbk 30.19 30.47 30.81 31.22

25 MCOR Bank Windu Kentjana

International Tbk 29.50 29.50 29.70 29.91 26 MEGA Bank Mega Tbk 31.76 31.81 31.83 31.83 27 NISP Bank NISP OCBC Tbk 31.72 32.00 32.21 32.27 28 PNBN Bank Pan Indonesia Tbk 32.46 32.63 32.73 32.78 29 SDRA Bank Himpunan Saudara

1906 Tbk 29.26 29.66 29.74 29.43

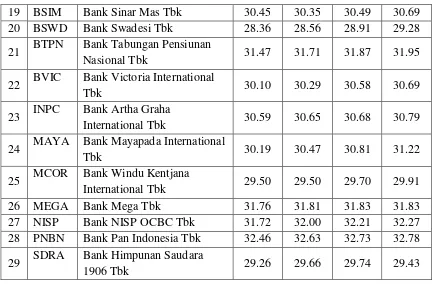

Lampiran 7

Tabel Hasil Perhitungan Profitabiiltas (ROA)

No Kode

Emiten Nama Perusahaan

Tahun

2011 2012 2013 2014

1 AGRO Bank Rakyat Indonesia Agro

Niaga Tbk 1.39 1.60 1.66 1.53

2 BABP Bank MNC Internasional Tbk -1.64 0.10 -0.93 -0.82 3 BACA Bank Capital Indonesia Tbk 0.84 1.30 1.59 1.33 4 BAEK Bank Ekonomi RaharjaTbk 1.49 1.00 1.19 0.30 5 BBCA Bank Central Asia Tbk 3.82 3.60 3.84 3.90

6 BBKP Bank Bukopin Tbk 1.87 1.80 1.75 1.33

7 BBNI Bank Negara Indonesia

(Persero) Tbk 2.94 2.90 3.36 3.49

8 BBNP Bank Nusantara Parahyangan

Tbk 1.53 1.60 1.58 1.32

9 BBRI Bank Rakyat Indonesia

(Persero) Tbk 4.93 5.20 5.03 4.74

Tbk

12 BEKS Bank Pundi Indonesia Tbk -4.75 1.00 1.23 -1.58 13 BJBR Bank Jabar Banten Tbk 2.65 2.50 2.61 1.94 14 BKSW Bank Kesawan Tbk 0.46 -0.80 0.07 1.05 15 BMRI Bank Mandiri (Persero) Tbk 3.37 3.60 3.66 3.57 16 BNBA Bank Bumi Arta Tbk 2.11 2.50 2.05 1.52 17 BNGA Bank CIMB Niaga Tbk 2.85 3.20 2.76 1.44 18 BNII Bank Internasional Indonesia

Tbk 1.13 1.60 1.71 0.67

19 BSIM Bank Sinar Mas Tbk 1.07 1.70 1.71 1.02 20 BSWD Bank Swadesi Tbk 3.66 3.10 3.8 3.37 21 BTPN Bank Tabungan Pensiunan

Nasional Tbk 4.38 4.70 4.54 3.60

22 BVIC Bank Victoria International

Tbk 2.65 2.20 2.10 0.80

23 INPC Bank Artha Graha

International Tbk 0.72 0.70 1.39 0.78 24 MAYA Bank Mayapada International

Tbk 2.07 2.40 2.53 1.98

25 MCOR Bank Windu Kentjana

International Tbk 0.96 2.00 1.74 0.79

26 MEGA Bank Mega Tbk 2.29 2.70 1.14 1.16

27 NISP Bank NISP OCBC Tbk 1.91 1.80 1.81 1.79 28 PNBN Bank Pan Indonesia Tbk 2.02 2.00 1.85 1.79 29 SDRA Bank Himpunan Saudara

Lampiran 8

Output SPSS

Descriptives

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Profitabilitas 116 -7.58 5.20 1.8617 1.79599

Dewan Komisaris 116 2.00 8.00 4.9397 1.66440

Dewan Komisaris Independen 116 .00 1.00 .5767 .12930

Management Ownership 116 .00 .28 .0146 .04730

Ukuran Bank 116 28.36 34.38 31.1617 1.61769

Valid N (listwise) 116

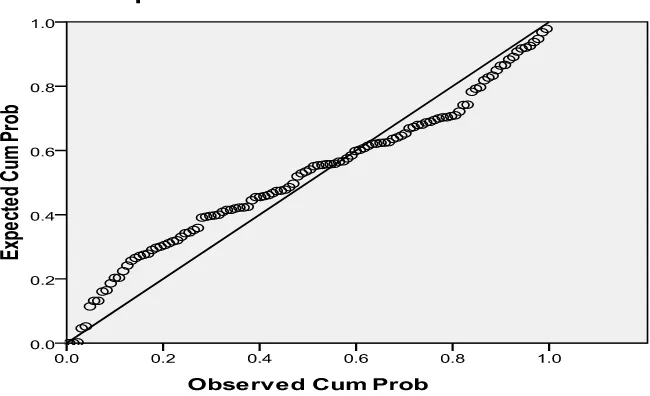

Uji Normalitas

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 116

Normal Parametersa,,b Mean .0000000

Std. Deviation 1.58178237

Most Extreme Differences Absolute .124

Positive .098

Negative -.124

Kolmogorov-Smirnov Z 1.331

Asymp. Sig. (2-tailed) .058

a. Test distribution is Normal.

Grafik Histogram

Uji Multikolinearitas

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.

Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) -12.973 3.572 -3.632 .000

Dewan Komisaris .089 .122 .082 .726 .470 .545 1.835

Dewan Komisaris Independen -.481 1.217 -.035 -.395 .694 .910 1.099

Management Ownership 3.950 3.313 .104 1.192 .236 .918 1.090

Ukuran Bank .469 .121 .422 3.864 .000 .584 1.711

a. Dependent Variable: Profitabilitas

Uji Autokorelasi

Model Summaryb

Model R R Square Adjusted R Square

Std. Error of the

Estimate Durbin-Watson

1 .474a .224 .196 1.61003 1.915

a. Predictors: (Constant), Ukuran Bank, Dewan Komisaris Independen, Management Ownership,

Dewan Komisaris

Uji Heteroskedastisitas

Uji Signifikasi F

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression 83.207 4 20.802 8.025 .000a

Residual 287.734 111 2.592

Total 370.941 115

a. Predictors: (Constant), Ukuran Bank, Dewan Komisaris Independen, Management Ownership, Dewan

Komisaris

Uji Signifikasi t

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.

Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) -12.973 3.572 -3.632 .000

Dewan Komisaris .089 .122 .082 .726 .470 .545 1.835

Dewan Komisaris Independen -.481 1.217 -.035 -.395 .694 .910 1.099

Management Ownership 3.950 3.313 .104 1.192 .236 .918 1.090

Ukuran Bank .469 .121 .422 3.864 .000 .584 1.711