Ekspansi untuk

2012

Sustainability Report

Keberlanjutan

Expanding for

Performance Area

Programs Carried Out

Environment 1. Paperless office application on the entire administrative activities.

2. Energy-saving campaign, fuel-saving campaign and periodic equipment and operational vehicle examination.

3. Fulfillment of Environmental Impact Analysis (AMDAL) provisions in mining area clearing.

4. Regular maintenance of supporting equipments (diesel, incinerator). 5. Reclamation & Revegetation on the former mining areas.

6. Development of City Forest, Educational Forest, People’s Forest Park and active participation on Musi Watershed Revegetation

7. Periodic maintenance and examination of GRK and ODS gas emission from the entire supporting equipments

Economy 1. Development of coal-based integrated business.

2. Close collaboration with business partners and local partners.

3. Establishment of fostered partners’ clusters and distribution partnership. 4. Coaching and training of fostered partners.

Community Development 1. Program arrangement by involving stakeholders.

2. Programs to include educational, facilities, health, cultural, and environmental aspects.

3. Provision of sufficient fund.

Human Resources Development

1. Quality and balanced recruitment.

2. Increased basic, certified, and managerial competence.

3. Continuous human resourced training, remuneration according to performance,

4. Employee and family health examination.

5. Training and monitoring of work safety and health (WSH).

Customer Service 1. Quality control and responsible marketing communication. 2. Ease of access for customers.

3. Services to customers. 4. Complaint resolution.

5. Periodic customer satisfaction survey.

areas.

5. Reduced carbon dioxide gas emission.

6. Controlled ODS gas emission under environmental quality standard (BML) provisions. 7. Received National Green PROPER rating for Tanjung Enim mining area.

1. Maintained economic performance and capability to harness business opportunities in the future. 2. Increased contribution to the state.

3. Increased contribution to the regional economy.

4. Increased rate of return and increased fostered partners’ turnover.

5. Increased number of fostered partners and increased business activities of fostered partners. 6. Increased surrounding community’s welfare.

7. Increased stakeholders’ welfare.

1. Community empowerment execution went well.

2. Increased community welfare due to improved potential of regional economy. 3. Program execution went according to the plan.

4. Harmonious relationship, preserved environment.

1. Competent, dedicated human resources with more balanced composition. 2. Increased competence, motivation, and performance of human resources. 3. Increased productivity per employee.

4. Increased human resources’ basic competence. 5. Number of work lost due to sick leave is getting lower. 6. Work accident award.

1. Quality, loyal, and long-term customers. 2. No violation of customer privacy. 3. Increased customer satisfaction index. 4. No penalties related to customer complaints.

1. Increased operational performance. 2. Increased PTBA perception/image.

4 Expansion for Sustainability

5 About This Report 5 Reporting Purpose

5 Reporting Scope and Limitation 6 Reporting Approach and Content 6 Data Measurement Technique 6 Periods and Reporting Guidelines 6 Significant Changes

6 GRI Index 7 Assurance 7 Contact Person

8 Message from the President Director

16 PT Bukit Asam (Persero) Tbk Profile 18 Brief History

19 Coal Resources and Reserves 20 Company Shares

21 Company Vision, Mission, and Values 21 Socialization Vision and Mission

22 Structure of Subsidiary Entities, Associated Entities and Joint Control Entities 23 PTBA Business Group

24 Company Operational Location 25 Organization Structure 26 Line of Business 27 Awards 27 Certification 28 Milestones

30 Stakeholders Management

38 Sustainable Governance 41 Governance Structure 45 Main Governance Policies 49 Code of Conduct 50 Corporate Culture

51 Legal Cases Involving the Company

52 Environmental Conservation for Sustainability

54 Commitment, Policy, and Objectives 56 Accredited Environmental Management 56 Environmental Organization Structure

Hal.

67

58 Realization of Land Clearance and Reclamation

59 Text Box: Relocation and Resettlement of Above-Kitchen Area, Tanjung Enim

60 Environmental Management 62 Material Consumption

63 Energy Consumption

64 Water Consumption Conservation

66 Mine Water Treatment with Wetland Method

68 Emission Control

70 Waste Management and Processing

72 Environmental Monitoring

76 Costs for Environmental Management and Conservation

77 Mine Planning and Post-Mining Implementation

78 Text Box: Plant Nursery Center

81 Responsible Mine Closure 83 Awards

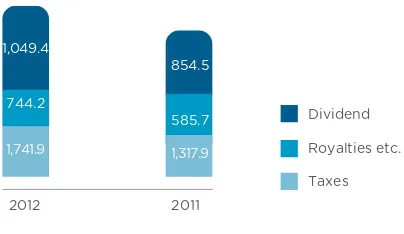

84 Boosting National Growth 87 Contributions to the State

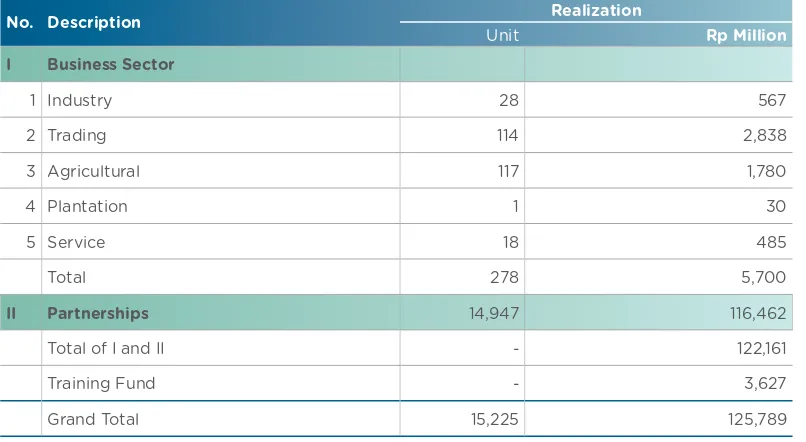

88 Partnership Program, Promoting Regional Economic Growth

92 Relationship with Business Partners 92 Products and Services

94 Product Management 95 Quality Control

128 Maintaining Work Safety and Health (WSH)

130 WSH Executive Organization 131 WSH Program Realization in 2012 132 WSH Performance Statistics in 2012 133 Vigilance Towards Emergency / Accident 133 Work Health

134 WSH Audit and Certification

135 Fire Control and Victim Rescue Drill in Confined Areas

138 Independent Assurance Statement

140 GRI Application Level Check Report

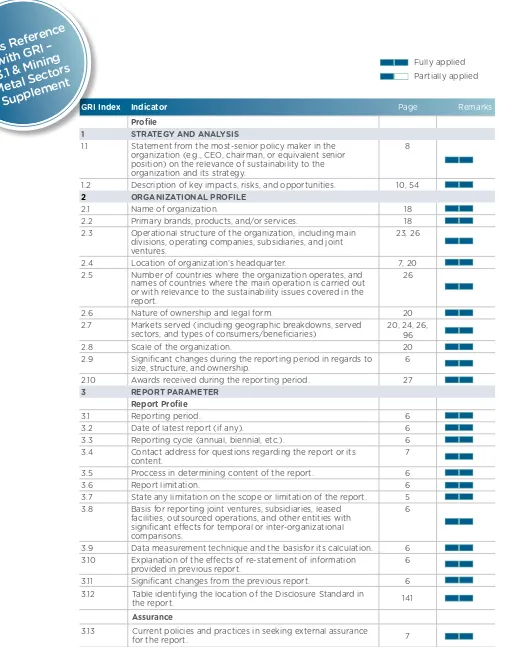

141 Cross References with GRI-3.1 & Mining Metal Sectors Supplement

Page 128

95 Customer Service 96 Marketing and Promotion 97 Business Development

98 Financial Implication of Climate Change 99 Public Perception

102 Bukit Asam Care

104 Improvement of Community Welfare 105 Partnership and Community Development

Program (PKBL)

106 Community Development Program 110 Area Development Program 111 Text Box: “Teranglah Desaku”

112 Managing Sustainable Human Resources

114 Fostering Industrial Relationship with Employees

115 Compliance with Manpower Laws and Regulations

119 Demographics and Number of Employees 120 Competence and Career Development 121 Recruitment

121 Competence Training and Development 122 Performance Appraisal

124 Equal Opportunity in Career Development 124 Remuneration Package

125 Gender Equality in Remuneration 125 Pension Plan

126 Employee Awards

127 Organization Alignment and Human Resources Management System Improvement

127 Excellent Culture Improvement

hal. 23

Cross References

with

GRI-3.1 & Mining

Metal Sectors

Supplement

In 2012, PTBA started to realize various expansion programs that have been designed since several years ago. One unit of mine-mouth thermal power plant (TPP) was successfully completed, and another one was still in the development completion. PTBA plans to build a few other mine-mouth TPPs in the next few years.

Reporting Purpose

The purpose of making this report is to communicate our economic, environmental, and social commitment and performance to the stakeholders and public in a transparent manner. Through this report, we hope that the stakeholders will be able to gain a clear and transparent picture about our sustainable business development activities.

Reporting Scope and Limitation

(3.7)This report discloses all operational performance aspects in the Company’s mining areas and any changes experienced in 2012, including sustainable development, financial condition, and production output. For financial information data such as economic value generated and distributed (refer to Table EC1), the presentation of this report includes subsidiaries’ data that was measured by equity method. Likewise for production output which also includes entire PTBA operation and its subsidiaries.

Reporting Approach and Content

(3.11, 3.5)The reporting process was done in stages, from the data provision, writing process, editing, and accuracy checking of audit data, until we obtained final draft to be subsequently presented in the final report. Unlike our previous sustainability reports, on this 2012 Sustainability Report we applied a more comprehensive approach in fulfilling Global Reporting Initiatives 3.1 index (GRI 3.1) with the needs of report delivery to external party, namely the stakeholders. This Sustainability Report still emphasizes the reporting of program performance in achieving sustainable development as well as efforts to increase stakeholders’ participation in realizing the development.

Meanwhile the content of this report covers the following: (3.11, 3.6)

• Company’s operational areas of Tanjung Enim, Ombilin, Tarahan, Kertapati and Jakarta. • Economic, social, and environmental performance as required by GRI 3.1 indicators. This

year’s report attempts to present all indicators within GRI 3.1 standard.

• Changes that occurred from 1st January through 31st December 2012. • Operational activities required by GRI 3.1 indicators.

• Operational activities in compliance with the laws or other regulations. • Additional indicators contained in GRI 3.1.

Data Measurement Technique

(3.9)We used data measurement technique that is relevant to the sectors being reported and according to the general rules. The information presented is based on materiality principle, that is disclosing information that may influence the stakeholders’ decision making, and may have significant impact towards Company’s economic, social, and environmental performance.

Reporting Period and Guideline

This report is an annual sustainability report and the seventh report produced by the Company since 2005. The last Sustainability Report was published by the Company in June 2012. The period of this Sustanability report includes 1st January to 31st December 2012 and was made in reference to Sustainability Reporting Guidelines & Mining and Metal Sector Supplement RG Version 3.1 (GRI 3.1) &/Mining and Metal Final Version (MMSS Final Version) (3.1, 3.2, 3.3).

Significant Changes

(3.10, 3.11)There are no significant changes related to the structure, accounting principle, or data measurement technique from the previous year’s report. Nor are there significant changes related to business structure, shareholding, and organization structure during the reporting period. (2.9) Therefore, the reporting basis does not contain any changes and does not affect comparability principle. (3.8)

GRI Index

(3.12)Assurance

(3.13)We appointed Mazars to carry out moderate level of assurance towards this report. The independent assurance report is presented on page xx. This report has fulfilled the requirement of Application Level A+ as contained in the GRI Application Level Checking Report released by National Center for Sustainability Reporting (NCSR) on page xx.

Contact Person

(3.4)Any request, feedback or comment on this report may be submitted to:

Corporate Secretary Division

PT. Bukit Asam (Persero) Tbk Jakarta Representative Office Menara Kadin Indonesia 15th floor Jln H.R. Rasuna Said Blok X-5 Kav 2-3 Jakarta – 12950 Indonesia

Telp. (62 21) 525.4014 Fax. (62 21) 525-4002

PTBA Head Office (2.4)

PT Bukit Asam (Persero) Tbk Jln. Parigi No. 1

Tanjung Enim – 31716 Sumatera Selatan

Telp: (62-734) 451-096, 452-352 Fax : (62-734) 451-095, 452-993

Message

from

President

Developing business that

brings positive impact to

environment, integrating

community development

activities with fulfillment

of business operational

requirements and managing

environment before and after

mining with responsibility are

the Company’s commitment

in maintaining sustainability

of the earth and its contents

as well as balancing

economic, social and

environmental performances

Dear Our Distinguished Stakeholders,

In order to enhance the quality of best governance implementation, during the reporting year we have taken several important steps to ascertain that the principles of accountability, fairness, transparency, independency, and responsibility fulfillment towards stakeholders are continually observed. We conducted several programs to enhance the quality of governance implementation, including:

•

Enacting all Whistle-blowing System provisions together with the formation of task force in charge of the system, i.e. Internal Supervision System Work Unit, to enforce accountability and transparency principles.•

Fulfilling compliance principle through environmental audit performed periodically by the central as well as local government.•

Refining Board Manual that gives firm and clear guidelines for Commissioners and Directors’ duty to uphold independency principle.•

Signing the Statement of Compliance towards Code of Conduct by all employees to improve accountability, independency, and equality.•

Setting up definitive Work Unit who monitors the quality of governance implementationand reviews the completeness of internal regulation and policies.

•

Issuing quarterly management report, annual report, PKBL annual report and sustainability report to enforce transparency principle.•

Assessing quality of best governance implementation every year.Moving forward

In managing Company’s operations which are environmental friendly and synergized with surrounding community, in early 2012, the Company launched green mining operation strategy and integration of PKBL disbursement with Company’s operation. Green mining implementation shows Company’s commitment to conduct quality mining activities followed by reclamation, rehabilitation and revegetation to conserve environment and involve surrounding community. Integration of PKBL with operational activities shows Company’s commitment to grow with community through establishment of small industrial centers which can help to fulfill supporting materials of daily operational activities.

In 2013, along with the less-favorable coal market condition, PTBA will still continue the strategy by setting business growth and development target according to our annual business plan.

We are optimistic that with this strategy we will be able to achieve our long-term goal, which is increasing stakeholders’ welfare, as well as conserving environment for a better life in the future.

Closing

Finally, allow me, on behalf of the Board of Directors, to thank all the stakeholders for supporting the Company’s efforts to sustain business operations and to balance economic, social, and environmental performance.

We look forward to any constructive suggestion, input, or criticism for the improvement of the next Sustainability Report.

Jakarta, March 2013

Ir. Milawarma, M.Eng

PT Bukit Asam

(Perser

o) T

bk

• Brief History

• Coal Resources and Reserves

• Company Shares

• Company Vision, Mission, and Values

• Structure of Subsidiary Entities, Associated Entities

and Joint Control Entities

• PTBA Business Group

• Company Operational Location

• Organization Structure

• Line of Business

• Awards

• Certification

• Milestones

Brief History

PT Bukit Asam (Persero), Tbk (2.1), currently known as PTBA, further referred to as We or the Company, was established on 2nd March 1981 by virtue of Republic of Indonesia Government Regulation No. 42/1980. On 23rd December 2002 the Company was listed at the Indonesia Stock Exchange (BEI) under “PTBA” symbol. The Company is a member of Indonesian Coal Producers Association (APBI) and Indonesian Mining Association (IMA) and classified

as a state-owned enterprise (SOE). (4.13)

Initially the Company operated its coal mining business in two mines, i.e. Tanjung Enim Mining Unit (UPTE) located 200 km southwest of Palembang, and Ombilin Mining Unit (UPO) in Sawah Lunto, 90 km southeast of Padang. Today the Company also operates in the vicinity of Samarinda (East Kalimantan).

In line with the national energy security development program, the Company was assigned by the Government to develop coal briquette business in Tanjung Enim – South Sumatera, Natar – Lampung, and Gresik - East Java, and several subsidiaries engaged in coal-related business.

Hence, the Company is now running two business units, i.e. coal mining operation and briquette production. Coal is shipped to consumers from main ports in Lampung and Palembang (Sumatra) as well as Palaran, Samarinda (Kalimantan). While briquette is directly delivered to nearby consumers. The Company, since end of 2012, has started to operate its own thermal power plant (TPP) to fulfill electricity needs independently, and will also sell the excess power to PLN as new income source. The Company is also trying to exploit Coal Bed Methane (CBM) in its operational areas to be integrated with coal mining operation as a new line of business. (2.2)

As circumstances evolve, the Company’s business pursuant to Article 3 of the Articles of Association has developed with the following activities:

- Mining operation covering general research, exploration, exploitation, processing, purifying, transporting, and trading of mining products particularly coal.

- Further processing of mining products particularly coal.

- Trading its own production or other’s production result, at home and abroad. - Managing and operating ports and piers specifically designated for coal. - Managing and operating TPP.

- Providing consultancy and engineering services in coal-mining related fields and processed mining output.

At the time of this report, other business units were still in developmental stage.

We oper

ate in T

anjung Enim, South

Suma

tra and in Samarinda, South

Kalimantan, managing an ar

ea of

over 90

,832 hectar

es, pr

oducing

coal with t

otal r

esour

ces of o

ver

7.3 billion t

ons, sold t

o domes

tic

and o

verseas mark

ets, and w

e

are starting t

o realiz

e economic

potential fr

om the c

onstruction and

The Company owns seven mine-mouth TPP

development projects which are included in IPP scheme with total power of 5,936 MW

Coal Resources and Reserves

The Company holds and operates Mining Business Permit (IUP) of Production Operation for Tanjung Enim coal mine of 66,414 hectares covering Muara Enim Regency and Lahat Regency in South Sumatera, including:

• Air Laya (751/KPTS/Dispertamben/2010, 29th Oct 2010): 7,621 hectares

• Muara Tiga Besar(304/KPTS/Distamben/2010, 30th Apr 2010): 3,300 hectares • Banko Barat (390/KPTS/Tamben/2010, 13th Apr 2010): 4,500 hectares

• Banko-Tengah Blok Barat (391/KPTS/Tamben/2010, 13th Apr 2010): 2,423 hectares • Banko-Tengah Blok Timur (389/KPTS/Tamben/1010, 13th Apr 2010): 22,937 hectares • Banjarsari, Kungkilan, Bunian, Arahan Utara, Arahan Selatan

(461/KPTS/HK-KS/Pertamben/2003): 24,751 hectares

• Bukit Kendi (305/KPTS/Distamben/2010, 30th Apr 2010): 882 hectares

Ombilin coal mine of 2,950 hectares, covering:

• Lembah Segar and Talawi (05.87.Perindagkop, 30th Apr 2010): 2,950 hectares

In addition to those Production Operation IUPs, the Company also holds Production Operation IUPs in Peranap, Indragiri Hulu Riau (09/IUP/545-02/IV/2010, 27th Apr 2010) measuring 17,100 hectares and in Palaran, Samarinda (through subsidiary PT Internasional Prima Coal or IPC) with decree no. 454/375/HK-KS/VII/2010, 19th Jul 2010 measuring 3,238 hectares.

With reference to the resources assessment by an independent consultant, “International Mining Consultant (IMC)” on December 2008, the Company has total coal resources of 7.3 billion tons throughout this Company’s Mining Concession (KP) area. While total mineable reserves reached 1.8 billion tons, excluding mineable reserves in the KP located at Lahat Regency which is still in dispute.

If the mineable reserves at Lahat Regency were included, the Company would have total mineable reserves of over 2,0 billion tons.

Company Shares

The Company shares have been traded at the Indonesia Stock Exchange since 23rd December 2002, under the trading name PTBA. On 31st December 2012, PTBA shares closed at Rp15,100,- per share. At that price, PTBA market capitalization amounted to Rp 34.8 trillion. Shareholders of the Company as of 31st Desember 2012, were the Government of Republic of Indonesia (65.02%) and public (34.98%). (2.4-2.7)

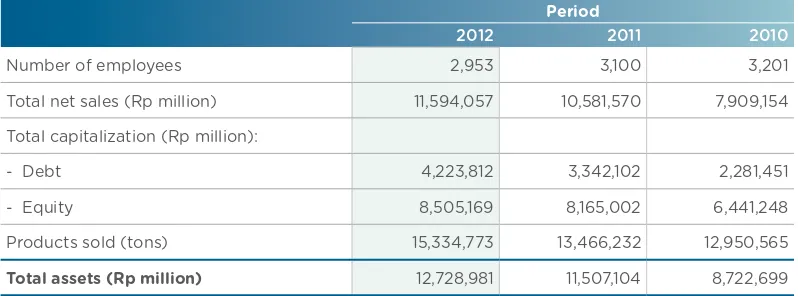

Table of Economic Scale of PT. Bukit Asam (Persero), Tbk (2.8)

Period

2012 2011 2010

Number of employees 2,953 3,100 3,201

Total net sales (Rp million) 11,594,057 10,581,570 7,909,154

Total capitalization (Rp million):

- Debt 4,223,812 3,342,102 2,281,451

- Equity 8,505,169 8,165,002 6,441,248

Products sold (tons) 15,334,773 13,466,232 12,950,565

Company Vision, Mission, and Values

Vision

To be a world-class environmentally-friendly energy company.

Mission

Managing energy sources by developing corporate competence and human excellence to provide maximum added value to the stakeholders and environment.

Values

• Visionary : Being able to look forward and develop long-term projection in business development.

• Integrity : Putting forward trustworthy, open, positive, honest, committed and responsible behaviours.

• Innovative : Always working wholeheartedly to obtain a new breakthrough to produce better products and services than ever before.

• Professional : Carrying out all tasks based on competence with creativity, courage, commitment, and collaboration to improve skills continuously.

• Cost- and

conscious

: Having high awareness in every operational activity by conducting business based on principles of maximum benefit and environmental concern.

Socialization of Company Vision and Mission

The vision and mission statements above are improvement of old statements, formulated at the end of 2012. The statements are the manifestation of Company’s determination to become more active and more involved in sustaining the earth and its contents. The change of vision to become energy company implies the Company’s strong determination to reduce greenhouse emission through transformation of a coal mining company to a coal-based energy company.

To ensure the achievement of vision and mission, the Company periodically socializes the new vision and mission to all employees. Socialization process is conducted in tiers. Vision and mission are explained with top-down approach by top management to all agents who will further explain to their subordinates.

Structure of Subsidiary Entities, Associated Entities and

Joint Control Entities

PT Bukit Asam (Persero) Tbk

COAL MINING

LINE OF BUSINESS

PT Bukit Pembangkit

Innovative 59,75%

PT Bukit Asam Prima 99,99%

PT Bukit Asam Transpacific Railway

10%

PT Bukit Asam Metana Peranap

99,99% PT Bukit Asam

Metana Enim 99,99% PT Bukit Asam Metana Ombilin

99,99%

PT Bukit Asam Banko

65%

COAL

TRADING COAL BEDMETHANE TRANSPORTATION POWER

PLANT

PT Batubara Bukit Kendi

75%

PT Huadian Bukit Asam

Power 45% PT Internasional

PTBA Business Group

(2.3)As business develops, the Company currently owns ten subsidiaries with majority shareholding. The subsidiaries’ operations are synergically related to the Company’s business, such as coal mining, briquette processing, coal transportation, thermal power plant (TPP), coal trading, and methane gas (CBM) mining. PTBA Business Group currently consists of:

Company Name EstablishedYear BusinessLine of Status Ownership

PT Batubara Bukit Kendi 1996 Coal mining Operating** 75%

PT Bukit Pembangkit Innovative 2005 Thermal power plant In development 59.75%

PT Bukit Asam Prima 2007 Coal trading Operating 99.99%

PT Bukit Asam Metana Ombilin 2007 Methane gas mining Not operating yet 99.99%

PT Bukit Asam Metana Enim 2007 Methane gas mining In development 99.99%

PT Bukit Asam Metana Peranap 2007 Methane gas mining Not operating yet 99.99%

PT Bukit Asam Banko 2008 Coal mining Not operating yet 65%

PT Bukit Asam Transpacific Railway 2008 Coal transportation Not operating yet 10%

PT Internasional Prima Coal 2008* Coal mining Operating 51%

PT Huadian Bukit Asam Power 2012 Thermal power plant In development 45%

* PT Internasional Prima Coal was acquired by the Company in 2008 ** Mining Operation was suspended temporarily

Company Operating Location

INDONESIA

Laut Cina Selatan

Laut Cina Selatan

Indian Ocean

JAVA

KALIMANTAN

SUMATERA

Pekanbaru Padang

Jakarta Lampung

Palembang

Samarinda

Gresik

PERANAP Mining Concession

Resources : 0.80 billion tons Mineable reserves : 0.27 billion tons

OMBILIN Mining Concession

Resources : 0.10 billion tons JAKARTA

Representative Office

TELUK BAYUR Port

Stockpile : 90,000 tons Capacity : 2.5 million tons/year Ship : Max. 40,000 DWT

KERTAPATI Pier

Stockpile : 50,000 tons Capacity : 2.7 million tons/year Ship : Max. 8,000 DWT TANJUNG ENIM Briquette Factory

1 2

2

3 1

4

3 1

2 3

Organization Structure

The Company establishes a dynamic, efficient, and effective organization structure that is aligned with industry development and able to support optimum performance growth. PTBA

MUHAMMAD HATTA

HR SM.

CHAIRUNNI BARKATI

BUKIT ASAM HOSPITAL HEAD

MULIATO

LEGAL AND LICENSING SM.

DANANG SUDIRA RAHARJA

CORPORATE SOCIAL RESPONSIBILITy SM.

UDJANG MULYANA

SECURITy MGR.

BAMBANG SULISTYANTO

FACILITIES AND INFRASTRUCTURE SM.

SUHEDI

LAND & BUILDING ASSET MANAGEMENT SM.

nOViAn SuRi

LOGISTICS SM.

ISKANDAR SURYA ALAM

SM. PEMASARAN MARKETING

ISKANDAR SURYA ALAM

MARKETING SM.

SYAIfUL ISLAM

CORPORATE PLANNING SM.

SURYO EKO HADIANTO

CORPORATE DEVELOPMENT SM.

SUHERMAN

ACCOUNTING AND BUDGETING SM.

ADIB UBAIDILLAH

TREASURy AND FUNDING SM.

ENDANG PURNOMO

CORPORATE DEVELOPMENT SM.

ERDAWATI

HEALTH PROGRAM MGR.

JOKO PRAMONO

CORPORATE SECRETARy

BAMBANG SUTRISNO

INTERNAL AUDIT UNIT SM.

ERfAN SAYUTHI

CORPORATE MANAGEMENT SySTEM SM.

fLIDELIN KATILI

ANALySIS, EVALUATION AND PRODUCTION OPTIMIzATION SM.

HERI SUPRIYANTO

OPERATIONS/PRODUCTION DIRECTOR

ANUNG DRI PRASETYA

BUSINESS DEVELOPMENT DIRECTOR

M. JAMIL

COMMERCE DIRECTOR

MAIzAL GAzALI

Line of Business

The Company is currently running two main business operations, i.e. mining and distributing coal to industrial customers, and producing coal briquette for industrial and residential customers. All of coal customers are industrial customers, while for briquette product, 80% of customers are from farm industry, and the rest is residential and small-business customers. All of the Company’s business operation is conducted in Indonesia. (2.5, 2.7)

The Company’s coal products come in various types depending on the calorie caloric content and other specifications, as detailed below:

Coal Brand

CV TM IM ASH VM fC MAx.TS

HGI

Kcal/kg,adb Kcal/kg,ar (%,ar) (%,adb) (%,adb) (%,adb) (%,adb) (%,adb)

BA 55 5,500 4,550 30 15 8 39 38 0.8 50

BA 59 5,900 5,000 28 14 7 39 40 0.8 50

BA 61 6,100 5,000 28 12 7 41 40 0.8 50

BA 63 6,300 5,550 21 10 6 41 43 0.8 55

BA 67 6,700 6,100 16 8 6 42 44 0.8 55

BA 70 LS 7,000 6,450 14 7 4 42 47 0.7 55

BA 70 HS 7,000 6,450 14 7 4 42 47 1.2 55

BA 76 7,600 7,400 5 2 8 14 76 1.2

Awards

(2.10)3rd March 2012 : Business Entity Who Cares About Sport in Indonesian Sport

Conferment 2012, awarded by Minister of youth and Sports.

25th April 2012 : Best Fraud Prevention and Perfomance Management, in

Mining Company category in Asia Anti Fraud 2012.

10th Juli 2012 : Indonesia Green Awards 2012 in selection of Company Who

Cares About Environment from Bisnis dan CSR magazine in cooperation with Ministry of Forestry and Ministry of Industry.

31st Juli 2012 : Green CEO for PTBA President Director from Warta

Ekonomi Magazine.

28th September 2012 : GKPM Awards (Community Empowerment

Trophy), PTBA received:

Gold Award for :

• “Ayo Sekolah = Let’s Go to School” Scholarship

Program, Education category.

• Supplemental Food Program for Nursing

Mother, Social category.

• Supplemental Food Program for Infant, Social

category.

Silver Award for PTBA Employees Cooperative.

04th October 2012 : National Social Solidarity Awards 2012 from Coordinating

Minister of People’s Welfare.

In the event: GKPM Awards (Community Empowerment

Trophy)

21st November 2012 : 4th Rank for Good Corporate Governance in Anugerah Bisnis

Review, selection of 250 best companies in Indonesia.

22nd November 2012 : Best State-Owned Enterprise in Corporate Governance

Implementation and Obligation Fulfillment Towards Stakeholders from Indonesian Institute for Corporate Directorship (IICD).

3rd Desember 2012 : “GREEN RATING” of PROPER Environment for the 4th time

from Ministry of Environment.

“Runner Up of Best Sustainability Report in 2012” which showed appreciation of independent parties (NCSR) on CSR program, environment, and Human Rights exercise in the Company scope

CERTIfICATION:

(4.12)ISO 9001: 2008 Quality Control Management

ISO 14001: 2004 Environmental Conservation Management

OHSAS 18001: 2007 Work Safety Management

Milestones

29th

february

2012

5th

March

2012

July

2012

Ratification of

Whistle-blowing System (SPP)

Guideline.

Signing Collective Labor

Agreement 2012-2014

by President Director

of PTBA, Milawarma,

and Chairman of SPBA,

Rakhmatullah, witnessed

by Minister of Workforce

and Transmigration,

Muhaimin Iskandar.

Became the Main Sponsor of

3rd

October

2012

October –

December

2012

8th

November

2012

Signing of

Management

Commitment

towards SPP

Implementation.

Minister of

Forestry’s visit in

conjunction with

inauguration of

Trees Planting

Program in

Watershed

(DAS), Sungai

Musi.

Signing of

Statement of

Page

PTBA regards the business sustainability in the long term is very closely related with the capability of management and their staffs in interacting and building positive and mutually beneficial relationship with the stakeholders. The interaction, for the stakeholders, implies the understanding and fulfillment of all expectations. While for the Company it implies the understanding and attempt to fulfill the stakeholders’ expectation using existing resources, as efficiently as possible and in an accountable manner.

Therefore, the Company strives to meet both interests through stakeholders management. In the operational business activities, PTBA has carefully identified main stakeholders groups with dominant influence towards business continuity. The stakeholders consist of shareholders/ investors, employees, Government / Regulator (as shareholder or as regulator – through Bapepam-LK), business partners/suppliers (vendors), customers, creditors, surrounding community, and mass media.

The Company believes that limited involvement of the stakeholders in discussing various problems faced by PTBA in its work plan realization will provide important contribution to fulfill the expectation. The limited involvement takes in the form of providing constructive suggestion through the provided forums, such as General Meeting of Shareholders etc. but it shall not violate the provisions as set forth in Articles of Association and the prevailing laws and regulation.

Essentially the involvement is emphasized more on the effort to build intensive, structured, and constructive communication, so that the Company may understand the stakeholders’ expectation clearly. On the other hand, the stakeholders may understand how far the efforts made by the Company to fulfill the expectation and even anticipate how far the expectation is fulfilled. Therefore, in order to give overview of the Company’s ability to fulfill the stakeholders’ expectation, PTBA regularly communicates operational outputs through various media to receive feedback, in the form of expectation and goal targeted by the stakeholders.

Stakeholders Engagement

In order to maintain and improve the benefits of positive and constructive communication as mentioned above, and according to all provisions contained in Articles of Association and the prevailing laws and regulation, the Company conducts intensive communication and manages stakeholders’ involvement in accordance with the characteristic of expectation of each stakeholder group. Brief description of interaction and engagement of stakeholders in maintaining the Company’s business sustainability is as following. (4.14, 4.15)

a. Shareholders

• Conference-call, dialog or communication via phone/multimedia with shareholders/ investors, with intensity as required by the investors.

• Investor gathering, meeting with shareholders in specific moments, such as during Company’s anniversary, ceremony of project completion, etc. Organized as required.

• Organizes AGMS once a year and EGMS as required. • One on One Meeting

During 2012 and 2011, the Company has organized the following activities with the Investors:

Activity name 2012 2011

Non-deal road show 8 5

One on One Meeting 164 125

Conference-call 8 7

Site visit 6 5

RUPSLB - 1

RUPST 1 1

Analyst Meeting 11 3

One on One Meeting

Indirect interaction is conducted through delivery of various news or reports and services to shareholders/investors indirectly. Whereas services to investors and shareholders are provided through:

• providing periodic or special reports, such as Financial Statements, Monthly Exploration

Reports, Coal Sales and Purchase Reports.

• news publishing /press release for significant events related to Company’s operation. • managing and reporting share administration.

• executing shares decision well.

The Company has also launched www.ptba.co.id website to maintain this interaction for 24 hours a day. The purpose of all interactions above is to promote the Company’s image and to provide the latest operational information accurately as well as to understand the shareholders’/investors’ expectation.

b. Government/Regulator

Considering that the Government is the main PTBA shareholder, the Company also provides all services and conducts direct and indirect interaction properly, either through the shareholder’s representative (i.e. Board of Commissioners) or the relevant Minister.

In addition, since the Government is also a regulator (through Bapepam-LK), the Company manages constructive relationship by complying with all prevailing provisions in capital market, considering that the Company’s share is already listed in Indonesian capital market, Indonesia Stock Exchange (BEI).

c. Employees

Reciprocal interaction with employees, as one of the stakeholders, is evidenced by the Company honoring its commitment to maintain and keep conducive work environment. The Company seeks to create the conducive environment through human resources management that is able to maintain the balance between fulfillment of employees’ expectation on good remuneration system, clear and fair career development, and enhancement of employee competence, with the Company’s needs to efficiently and effectively run all operations to ensure sustainable business growth. The commitment is realized through a series of strategic measures in managing human resources as follows:

• Developing and realizing personnel competence and grooming professional candidates for management/leadership level.

• Aligning organization and improving human resource management system.

• Enacting incentive system to encourage employees to do their best for the Company’s

growth and development.

• Conducting dialogs with Labor Union (representative of all employees) in developing

Collective Labor Agreement, as a guideline of the Company’s relationship with the employees.

• Conducting regular meetings between the employees and the Company’s Management

as a direct dialog forum to receive input or as an announcement medium for any program/plan that needs everyone’s attention.

e. Business Partner / Supplier(Vendor)

For the Company, business partners/suppliers (currently there are approximately 2,500 suppliers) are stakeholders with the strategic role as part of business chain. Therefore the Company fosters interactions with the suppliers based on professionalism.

As a commitment to develop long-term relationships with the suppliers, the Company organizes a number of programs such as: (1) specific joint program and (2) training program for local suppliers with certain scale.

During 2012 and 2011, the Company has organized the following activities with the suppliers.

Activity name 2012 2011

Task force 12 12

Coordination meeting 6 5

e. Customers

Customer satisfaction is a benchmark of successful business sustainability. Being a customer-oriented company, the Company is committed to providing the best service according to the established standards and customers’ expectation. Therefore, besides product reliability, other measures aimed at maintaining customers’ trust are taken by the Company, including:

• providing information and education to customers, as required • visiting mining sites as required, and

• opening customer service center.

f. Creditors

In the reporting period, the Company did not have substantial loan yet. However, along with the realization of various development projects that are underway and will be carried out, the Company will need creditor’s role substantially. To maintain and anticipate the future relationship, the Company organizes various events with potential creditors, such as:

• Non-deal road show, as required. • Club deal, as required.

g. Surrounding Community

As stakeholders living around the site, the community received the Company’s serious attention. To interact with the community, the Company fulfills its corporate social responsibility through Partnership and Community Development Program (PKBL) and Area Development Program to enhance community economic potentials and to improve their living standard.

h. Mass Media

The Company is engaged in intense communication with the mass media, as partner in informing operational progress to other stakeholders. The relationship developed is a constructive one that benefits each other. The media needs the news to be broadcasted to the readers / public, while the Company needs media to deliver information about its operational success or its business plan. PTBA fosters relationship with the media with transparency principle. Therefore the Company conducts specific events related with the mass media, namely:

• Press release, delivering news about the success or realization of business plan to the

mass media without face-to-face event.

• Press conference, delivering news directly, along with Q&A session.

Both events are conducted as required.

During 2012 and 2011, the Company has organized the following activities with the media.

Activity name 2012 2011

Press release issued by the Company 18 13

Press release published in the mass media 8 10

Press conference 5 4

All of the Company’s efforts in stakeholders engagement can be referred to in the relevant topics, and shown in the summary table as follows.

Stakeholders Engagement (4.4, 4.14 - 4.17)

Stakeholder Type

Method of Engagement frequency of Meeting

Stakeholders’ Expectation

Customers • Customer complaint

management

• Customer service

center

- Adjusted - Adjusted

1. Guaranteed quality.

2. Safety in delivery and usage 3. On-time delivery.

4. Services beyond expectation.

Shareholders and Investors

• General Meeting of

Shareholders (GMS)

• Investor road shows • Investor gathering • Plant visit

Minimum

•

once Adjusted

•

1. Menjaga dan meningkatkan nilai investasi melalui peningkatan kinerja Perseroan.

2. Terpenuhinya hak-hak pemegang saham, mayoritas maupun minoritas.

3. Keterbukaan informasi terhadap hal-hal yang substantial dan kejelasan arah pengembangan usaha

4. Menghormati hak-hak pemegang saham sesuai UU, Peraturan, AD/ART.

Employees • Through PTBA Labor

Union

• HR organization

alignment

• Routine training/

hearing

Min. once a year or as required

1. Clarity of rights and obligations.

2. Clarity of competence assessment, career development, and fair remuneration with performance.

3. Equality in career development and remuneration. 4. No discriminatory practice.

5. Guaranteed work safety, health, and security. 6. Good work environment.

Government / Regulators Bipartite Meeting • Hearing with • Parliament Work Visit to Field

•

- Adjusted

- Adjusted

- Adjusted

1. Harmonious, constructive, and honest relationship with regulators.

2. PTBA and all employees observe and obey the law

3. PTBA brings positive contribution to surrounding community. Business partners (vendor, supplier, agent, reseller, installer)

• Specific training for

operational partners

• Contract bidding and

procurement

• Management • Supplier assessment

and management

Min. once a year 1. Fair and transparent procurement process. 2. Objective selection and evaluation of business

partners.

3. Accurate and simple procurement administration. 4. On-time product and services payment.

5. Mutually beneficial relationship

Creditors • Plant visit

• Conference call • Club deal

• Corporate Action

Plan Presentation

- Adjusted - Adjusted - Adjusted - Adjusted

1. Clarity of development plan. 2. On-time loan payment.

3. Transparency on operational situation. 4. Update on the latest operational situation.

Mass media • Press release

• Media gathering • Press conference

- Adjusted - Adjusted - Adjusted

1. Accurate news. 2. Latest information. 3. On-time news delivery.

4. Transparency on operational situation.

Community • Discussion on

planning

• Joint supervision of

program realization

• Philanthropic

activities

- Adjusted - Adjusted - Adjusted

1. Harmonious and beneficial relationship. 2. Minimizing operational impacts on the

environment.

3. Participation in environmental conservation activities.

4. Revegetation and reforestation program. 5. Positive contribution towards economic and

Sust

aina

ble

Gov

erna

nce

• Governance Structure

• Main Governance Policies

• Code of Conduct

• Corporate Culture

• Legal Cases involving the Company

PTBA believes that good and consistent implementation of Good Corporate Governance (GCG) along with the improvement of integrity will support the Company’s operations as it allows better decision making, improved operating efficiency and services to the stakeholders, and eventually increased corporate value. Likewise, stakeholders’ satisfaction will be enhanced by maximizing financial achievement and minimizing investment risk, preventing conflict of interest, and boosting investors’ trust.

For PTBA, the implementation of GCG best practice is the key of all accredited operational system that is currently being referred to in daily activities. Therefore, the Company considers periodic evaluation as an important process to enhance the quality of best governance implementation and continuously reflect the latest Company’s condition.

The goals of implementing GCG throughout the Company are as follow:

• Directing and managing the relationship among shareholders, Board of Commissioners, Board of Directors, employees, customers, business partners, community, and environment.

• Managing resources more efficiently and responsibly. • Managing risks better.

• Increasing accountability to stakeholders.

• Preventing irregularity in the management of the Company. • Promoting work ethos.

• Enhancing the Company’s good image.

The Company’s consistency and success in implementing good governance have earned the Company several awards from independent institutions, which are:

• Best Fraud Prevention and Perfomance Management, from Asia Anti Fraud 2012.

• Indonesia Enterprise Risk Management Award 2012, for State-Owned Enterprise (SOE) in Coal Mining Industry from Business Review Magazine.

• The Best in Building and Managing Corporate Image, from Bloomberg Business Week Indonesia magazine & Frontier Consulting Group.

• 1st Rank Indonesia Best Public Companies 2012 in Category energy based on WAI (Wealth Added Index) Method from SWA magazine

• Indonesia Green Awards 2012 from Bisnis dan CSR magazine in cooperation with Ministry of Forestry and Ministry of Industry.

• Best SOE, from Indonesian Institute for Corporate Directorship (IICD) in Corporate Governance implementation and Obligation Fulfillment towards Stakeholders, according to Public Companies standard in Five Asean Countries.

We alw

ays s

trive t

o impr

ove

the quality of go

vernanc

e

implementa

tion as an int

egra

ted

oper

ation b

y maintaining

positiv

e int

eraction with all

stak

eholders based on fiv

e basic

principles on go

vernanc

e and a

t

the same time ensuring busines

s

Board of Commissioners Shareholders

Customers Employees Community General Manager / Senior Manager

GOVERnAnCE STRuCTuRE Of

(4.1)

PT BUKIT ASAM (PERSERO) Tbk

Committee of Business Risk, Nomination, Remuneration & HRD

Audit Committee

Corporate Secretary

Corporate Management

System

Internal Audit Unit

Board of Directors President Director

functional Directors

Governance Structure

General Meeting of Shareholders

(4.4, 4.7, 4.10)

General Meeting of Shareholders (GMS) is the highest organ in the Company’s governance structure. GMS is a forum where shareholders can act on an equal footing to adopt important resolutions associated with their investment in the Company. GMS is also a shareholders’ forum to make important decisions related to and based on the business interest of the Company. At Annual GMS or Extraordinary GMS, shareholders may exercise their rights, voice their opinion and cast their votes on an equal footing. (4.4)

GMS is also a forum to evaluate the accomplishment of Board of Directors and Board of Commissioners by assessing the Key Performance Indicators (KPI) achievement. The KPI clearly sets the targets of Company’s performance in economic, social, environmental, and work safety and health aspects, as well as other aspects such as service to customers, perception towards Company, compliance with laws and regulation, and many more. (4.10)

Whereas employees submit their recommendation or opinion to Board of Commissioners and Board of Directors through their representatives in labor union or any other organization acting on their behalf.

Board of Commissioners and Board of Directors

In two-board system, Board of Commissioners and Board of Directors have differing duty and authority (fiduciary responsibility) in accordance with the law and the Company’s Articles of Association. However, since each function should be independent, no Commissioner has a dual function of concurrently being a Director, either in the parent company or the subsidiaries. (4.3)

Additionally, in the reporting year, no Commissioner in the entire group of the Company functioned as executive officer. Likewise, member of Board of Directors was not allowed to serve concurrently as one level below his/hers. (4.2)

The Company holds monthly meetings of Board of Directors and Board of Commissioners to evaluate the Company’s performance as set forth in KPI. The KPI asserts the minimum threshold of economic, social, and environmental performance, compared to the plan. These meetings also discuss any other proposal that is unrelated to business plans. (4.10)

To ensure oversight independency, at least 20% of total Commissioners are Independent Commissioners, one of whom is appointed Head of Audit Committee. Likewise, at least 20% of total Directors shall come from outside the Company. (4.3)

At GMS, all shareholders have

equal rights to resolve important

matters related to and aimed at

business sustainability

Commissioners and Directors are elected, nominated, and terminated by GMS. Election is made through fit and proper test, which covers basic knowledge on social, economy, and environment. (4.7)

Remuneration of Commissioners and Directors

(4.5)

The sum of remuneration is determined annually at GMS by the recommendation of Remuneration Committee. Amount of remuneration is based on their duty and responsibility and it commensurates with their performance.

Commissioners and Directors receive fixed and incidental remuneration consisting of annual gross base salary (honorarium for Commissioners), total cash, total earnings, and total remuneration as well as other facilities and allowances as recommended by Nomination and Remuneration Committee. Remuneration paid to Commissioners and Directors may differ among them depending on their respective duty and responsibility. Total remuneration paid to Commissioners and Directors is reported in GMS.

Basically, pursuant to Regulation No. Kep-100/ MBU/2002 on evaluation of SOEs’ business soundness, the Company’s performance is evaluated in three aspects, which are financial (weight 67.5%), administrative (weight 14%), and operational. Board of Directors’ tantiem is also determined by social and environmental accomplishments as part of administrative performance evaluation, i.e. effective partnership fund disbursement with 2% weight (maximum 3%) and turnover rate of loan repayment with 3% weight (maximum).

Measurements of economic, environmental, and social performance, including in managing risks and tapping business opportunity, are part of KPI applied to Board of Directors and Board of Commissioners. KPI is reviewed periodically and reported to GMS, and used as the basis for determining the Management’s tantiem. (4.9)

Board of Commissioners

The primary duty of Board of Commissioners is overseeing in a general and specific manner in accordance with the Articles of Association and giving counsel to the Board of Directors in

managing the Company, including overseeing compliance with all prevailing regulations in all operational activities. This mechanism will prevent the Company from monetary penalties or other sanctions for violation of provisions of existing regulations. (SO8)

The Company’s Board of Commissioners currently consists of six people. One of them is the President Commissioner who leads the Board and two of them are Independent Commissioners making up 33 percent of the Board as required in the LLC Law. (4.3)

The current composition of Board of Commissioners is as follows:

President Commissioner Dr.Patrialis Akbar, SH, MH

Commissioner Ir. Robert Heri

Commissioner DR. Ir. Thamrin Sihite, ME

Commissioner Drs. Imam Apriyanto Putro, SE. MM.

Independent Commissioner Suranto Soemarsono, SE. MA.

Independent Commissioner Ir. Abdul Latief Baky, SH. MHum. MSc. FIQ

The Board submits its accountability report at least once a year during GMS. In performing its duties, The Board is assisted by several Committees that are established by and responsible to the Board. The Committees include: Audit Committee, Remuneration, Nomination and HRD Committee, and Insurance and Mining Risk Committee. The result of Commissioners’ performance evaluation will be used by GMS as indicators in remunerating, re-appointing and terminating them. (More description on the duties of Commissioners and Board of Commissioners can be referred to in PTBA 2012 Annual Report).

Board of Directors

Board of Directors is collectively in charge of and responsible for managing the Company for the benefit of the Company in accordance with corporate purpose and objective to ensure that all resources are highly utilized. Directors perform and make decisions according to their respective duty and authority but the performance of each Director remains the Board’s collective responsibility. Directors are nominated and terminated by GMS resolution.

The current Board of Directors is composed of President Director and five Directors as follows:

President Director: Ir. Milawarma, M.Eng

Finance Director: Achmad Sudarto, SE, Ak, MM

Operations/Production Director: Ir. Heri Supriyanto

Business Development Director: Ir. Anung Dri Prasetya, M.Eng

Various activities of Board of Commissioners and Board of Directors as form of the Company’s

concern towards Environment and

Main Governance Policies

The Company has compiled and formulated a series of operating policies with respect to good corporate governance practice to complement GCG Code, which cover the following:

• Internal Audit and Control

The Company develops an effective internal control to protect the Company’s investment and asset from irregularities. The function of Internal Audit and Control is performed by Internal Audit Unit (SPI) and External Auditor.

To perform the task of monitoring and prevention of violations and fraud, every SPI staff has received adequate education and training of audit procedures and the detection of irregularities such as fraud auditing, investigative audit, and advanced internal auditing. In the reporting year, the Company also conducted training on Fraud Detection, Prevention and Investigation for all personnel from SMP, SPI, Legal, and HRD. Therefore the number of employees who have participated in the corruption prevention training is currently 39 people, or approximately 0.01% of total employees. (SO3)

• Corruption Prevention Policy (SO3, SO4)

The company prevention policy is set in the GCG Code and its derivative policy, which is the restriction to give and receive gifts, bribery, and the like. Policy concerning business and work ethics are explained in more details in Code of Conduct.

In implementing Code of Conduct and preventing corruption and other violations of Code of Conduct, PTBA has developed Whistle-blowing System whose operation started since the signing of Management Commitment towards Whistle-blowing System on 8th November 2012. Board of Directors and Labor Union signed their commitment towards the System on 12th December 2012, as witnessed by Deputy of State Minister of SOE and Deputy of Corruption Eradication Commission (KPK) as well as national and local media in South Sumatera.

• Rules and Procedures of Whistle-blowing System

In the reporting year, the Company officially enacted the rules and procedures of Whistle-blowing System (SPP), with the Joint Decree of Board of Commissioners and Board of Directors of PT Bukit Asam (Persero) Tbk No. 03/SK/PTBA-KOM/II/2012 and No. 049/ KEP/Int-0100/PW.01/2012 on 29th February 2012, concerning the system. The Company sets the SPP for various purposes, including:

• Creating a favorable climate to encourage people to report any misconduct that may result in financial or non-financial losses (that may tarnish the Company’s image);

• Minimizing losses as a result of misconduct through early warning system; and • Designing early warning system mechanism to anticipate any problem arising from

misconduct.

Further actions related to the enactment include:

• Establishment and Appointment of SPP Management Team, through Board of Directors

Decree No. 277/KEP/Int-0100/PW.01/2012 dated 10th October 2012.

• Signing of Management Commitment towards SPP implementation.

• Signing of Declaration of Compliance with Code of Conduct by all PTBA employees. • Internal socialization, and

• Public statement of Company’s commitment towards the implementation of GCG

best practices.

To ensure the effectiveness of misconduct control and early warning system, the Company takes necessary measures including: providing misconduct reporting media (hot line, email, special mailbox), setting reporting procedures, and defining types of misconduct that may be reported. To encourage people to report, the Company establishes procedures that will protect the identity of the witnesses and the investigating officers. (HR3, SO3)

Stern sanctions on corruptive acts are also enforced, involving termination of employment followed by appropriate legal action. This policy is a reflection of the Company’s contribution

Further actions related to this policy are:

• Commissioners and Directors set up SPP Unit.

• Establish SPP Unit organization, personnel job description and specification; select candidates and appoint personnel consisting of:

o Protectors of witnesses o Investigating officers o Administrative staff

• Equip SPP staff with training and comparative study, and prepare facilities and instruments, such as:

o Office space, office equipment, communication instrument o Reporting media (hot line, email, special mailbox)

• Write up system documents:

o SPP manual

o Reporting procedure

o Reporting manual (type and gravity of misconduct to be reported to and processed by SPP unit)

o Separate document for sanction for false accusation and slander, protection of confidentiality, and witness protection policy to be endorsed by Directors or Commissioners

o Witness rights in case of abusive action and the right to appeal and to report to the authorities

o Declaration of compliance with SPP to be signed by Directors, Commissioners, and Bukit Asam Labor Union (SPBA)

• Prevention of Political Involvement (SO5, SO6)

The Company is firm about separating business interest from political interest. It strictly forbids the use of assets or the gift of donation to any political party outside the prevailing law. No donation has ever been given by the Company to any political party or politician.

It is the Company’s policy for any employee who holds an executive position in a political party to resign or release that position which should be proven in written statement. Coercing any employee into expressing political aspiration is prohibited. Decision to have political involvement and to use personal resources is entirely at employee’s personal risk.

• Risk Management (EC9, 4.9, 4.11)

The Company establishes an integrated risk management at the corporate level involving every work unit. Development of Risk Management System is part of the Company’s long term strategy by forming special work unit to handle this matter systematically in accordance with the referred risk management standard.

Implementation of the integrated, systematical, and comprehensive Risk Management System began on 1 July 2006. It is a structured, systematical, and recurring process for a continuous improvement of risk management.

Risk management is focused on improving the intensity and quality of risk mitigation to facilitate the Company’s growth. The following actions have been taken by the Company: o Mitigating risk potentials

o Minimizing risk exposure o Optimizing corporate objective

• Conflict of Interest Transactions (4.6)

In an effort to prevent conflict of interest, the Company adopts the following policies: o Members of Board of Commissioners and Board of Directors must disclose their

shareholding in the Company or other companies in a special register as required by the law.

o Every member of the Company must not take advantage of their position for personal gain or others’ benefit that may harm the interest of the Company.

o Every member of the Company must not use material and confidential information for personal gain or others’ benefit that may harm the interest of the Company.

o Every member of the Company should avoid economic interest in the Company that

may cause financial conflict of interest.

This way, all elements of the Company may be free from domination by others, free from any influence and pressure by others to allow objective decision making in transactions with conflict of interest.

• Insider Trading

The Company has set the rules on insider trading as stipulated in Code of Conduct. Business ethics and work ethics laid down in Code of Conduct stipulate that the Company abides by the prevailing laws and regulations regarding insider information particularly with respect to access to sensitive and confidential information. However, Commissioners, Directors, and employees are free to have a long-term investment in the Company’s shares.

In certain cases such as share buy-back program, the Company prohibits Commissioners, Directors, and employees from making transactions when the program is in progress.

• Restriction to Give and Receive Gifts (SO2)

Gift is defined as any form of present given by the Company and its personnel to certain parties with a purpose of influencing such parties to benefit the Company unfairly. Receiving gift is defined as any form of receipt by the Company and its personnel from certain parties to influence the decision of the Company to favor the present giver.

In principle, giving or receiving presents are prohibited by the Company, except when done in accordance with specific rules set by the Company or with the prevailing laws and regulations.

• Goods/Services Procurement

Goods and services procurement is carried out by fair competition as governed by the law and in a manner that is effective, efficient, transparent, competitive, fair/indiscriminative, and accountable. E-procurement and e-auction system has been installed to support procurement in the spirit of good corporate governance. The system should be:

o Implemented consistently;

o Assessed periodically with respect to system adequacy to ensure compliance with effective, efficient, transparent, competitive, fair/indiscriminative, and accountable principles;

o Able to prevent conflict of interest and affiliated transactions by the personnel in procuring goods and services.

• Disclosure, Confidentiality, and Insider Information

The Company promptly disseminates information to shareholders and other stakeholders in order to make quick decision. Sensitive and confidential information is regulated further in Letters and Files Handling Procedures. One of the media for exercising disclosure is the Company’s official website. These policy guidelines are the basic rule for the Corporate Secretary’s activities.

• Mechanism to Voice Opinion to Board of Directors (4.4)

As one of the stakeholders with important role in the Company’s success, the employees have the rights to voice their opinion and give suggestion to the Board of Directors through formal mechanism such as meeting of Labor Union with Management and the Company’s work meetings. The employees can also give their suggestion and opinion through face-to-face event with the Board of Directors, and Board of Directors work visit. Correspondence media such as mail and e-mail can be used as well.

Besides receiving various constructive suggestions to improve Company’s policies, this mechanism has created a more conducive relationship with internal stakeholders, particularly the shareholders and employees, in order to support the Company’s growth.

Code of Conduct

(4.6, 4.11, HR1)

• Code of Conduct

The Company has finalized reviewing and revising the Code of Conduct, readjusting its provisions with GCG Code and the most current common practices. The revised Code of Conduct has been disseminated and enforced since early 2010.

Main Points of Code of Conduct

Essentially, the Company’s Code of Conduct regulates all matters under the responsibility of the Company, individuals of the organization, and other parties doing business with the Company, covering:

One way of socializing CoC is the

• Business Code of Conduct.

The Company’s Business Code of Conduct gives directives as to how the Company should conduct its business with good ethics the way a business entity should, to balance the interest of the Company and that of the stakeholders in accordance with GCG principles and sound corporate values.

• Individual Code of Conduct.

Individual Code of Conduct is an explanation as to how individuals in the Company should act in communicating with others and behave in accordance with good ethics and common moral values.

• Disseminating Code of Conduct and Reporting Violation.

Disseminating Code of Conduct and procedures of reporting misconduct, and violation of Code of Conduct, Company Regulations, other laws and regulations, and imposition of penalty should be done effectively to all levels of the organization and stakeholders of the Company.

• Declaration of Compliance with Code of Conduct.

The declaration is a statement of understanding and readiness of all personnel to observe the Code of Conduct and respect any party assigned by the Company to be in charge of the implementation. The Company sets periodic signing of compliance statement.

• Socialization of Code of Conduct

The Company is committed to effectively disseminate Code of Conduct (CoC) by taking the following steps:

• Disseminating Code of Conduct to all personnel, customers, and partners, and giving

periodic refresher course.

• Evaluating the accomplishment or understanding of the personnel, either during

orientation or operating hours.

• Periodically reviewing the provisions of Code of Conduct for further improvement. If

required, findings from the review will be further embodied in rules and regulations of the Company.

Socialization is conducted by Corporate Management System Work Unit, the unit responsible for GCG implementation, in coordination with Human Resou