Lampiran 1

Input dan Output Bank Umum Konvensional (BUK) Tahun 2008

(Dalam Jutaan)

Bank Umum

Konvensional Total Aset Simpanan

Biaya Tenaga

Kerja Kredit/Pembiayaan

Laba Operasional Bank BTN 44,992,171 21,220,416 613,321 32,025,231 669,834 Bank BCA 224,729,251 52,967,094 3,200,928 112,846,634 7,605,119 Bank BNI 200,390,507 67,307,399 3,220,991 108,896,144 1,892,014 Bank BII 53,790,638 25,906,881 938,331 35,057,139 81,994 Bank BRI 246,026,225 73,519,757 6,317,638 161,061,059 8,347,565 Bank Mandiri 338,404,265 117,047,354 4,095,663 159,007,051 7,752,840 Bank CIMB

Niaga 102,604,732 47,913,468 1,666,471 74,489,148 1,287,308 Bank Permata 53,959,827 26,366,090 922,019 34,850,805 605,485 Bank

Danamon 104,821,926 54,214,672 2,270,214 64,233,906 2,012,992 Bank Panin 62,772,547 29,445,332 375,589 36,868,879 948,123

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 2

Input dan Output Bank Umum Syariah (BUS) Tahun 2008

(Dalam Jutaan)

Bank Umum

Syariah Total Aset Simpanan

Biaya Tenaga

Kerja Kredit/Pembiayaan

Laba Operasional Bank Muamalat 12,610,853 805,783 145,219 5,020,760 300,692

Bank Bukopin 606,055 18,560 12,026 132,824 1,442

Bank Mega 3,096,201 654,701 88,912 135,521 23,581

Bank BRI 1,466,762 77,365 68,022 233,400 4,084

Input dan Output Bank Umum Konvensional (BUK) Tahun 2009

(Dalam Jutaan)

Bank umum

konvensional Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank BTN 58,516,058 23,909,718 695,713 40,732,954 739,444 Bank BCA 280,817,308 65,006,963 4,061,935 123,596,037 8,404,158 Bank BNI 225,541,328 82,609,539 3,336,683 117,644,695 3,347,581 Bank BII 58,701,483 26,645,710 977,340 37,047,434 358,591 Bank BRI 314,745,744 100,034,299 6,585,617 205,522,394 8,569,748 Bank Mandiri 370,310,994 123,409,519 4,205,057 179,687,845 10,312,469 Bank CIMB

Niaga 106,803,360 46,884,622 1,906,029 82,970,368 2,178,850 Bank Permata 55,900,751 25,115,277 1,131,892 41,201,583 736,650 Bank

Danamon 96,630,214 44,842,744 2,102,538 59,832,098 2,242,686 Bank Panin 76,075,202 30,571,763 456,547 43,196,490 1,229,317

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 4

Input dan Output Bank Umum Syariah (BUS) Tahun 2009

(Dalam Jutaan)

Bank umum

syariah Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank

Muamalat 16,064,093 1,245,352 200,805 5,996,216 77,565 Bank Bukopin 1,974,948 243,798 20,861 323,227 2,886 Bank Mega 4,381,991 996,778 188,979 193,926 83,394

Bank BRI 3,178,386 443,097 90,176 771,230 7,127

Lampiran 5

Input dan Output Bank Umum Konvensional (BUK) Tahun 2010

(Dalam Jutaan)

Bank umum

konvensional Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank BTN 68,385,539 29,513,925 762,897 48,702,920 1,263,720 Bank BCA 320,585,907 67,987,209 4,241,720 153,965,023 9,914,319 Bank BNI 240,293,481 77,361,996 3,817,770 132,852,979 5,461,937 Bank BII 71,579,977 35,445,946 137,429 49,695,623 475,353 Bank BRI 398,393,138 126,309,586 8,104,779 246,968,128 14,407,492 Bank Mandiri 406,000,854 144,710,102 4,552,606 219,032,483 12,928,742 Bank CIMB

Niaga 142,637,071 64,717,462 1,849,845 102,108,984 3,261,532 Bank Permata 73,582,319 31,940,369 1,119,968 50,589,480 1,106,514 Bank

Danamon 113,864,875 48,060,809 2,539,450 75,090,482 2,773,386 Bank Panin 105,424,496 37,865,914 549,327 57,525,466 1,502,270

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 6

Input dan Output Bank Umum Syariah (BUS) Tahun 2010

(Dalam Jutaan)

Bank umum

syariah Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank

Muamalat 21,442,596 2,547,365 253,263 7,501,327 238,431 Bank Bukopin 2,193,952 270,085 41,843 543,491 14,373 Bank Mega 4,637,730 1,182,822 293,340 149,474 85,411 Bank BRI 6,856,386 1,054,006 189,999 1,328,992 9,052 Bank Mandiri 32,481,873 4,174,664 622,679 8,715,920 565,098

Input dan Output Bank Umum Konvensional (BUK) Tahun 2011

(Dalam Jutaan)

Bank umum

konvensional Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank BTN 89,121,459 31,027,400 892,833 59,337,756 1,525,748 Bank BCA 377,250,966 74,418,152 4,843,453 202,268,608 12,908,515 Bank BNI 288,511,901 80,845,197 4,704,523 158,164,743 7,182,546 Bank BII 90,740,977 39,988,171 1,386,973 62,574,123 705,425 Bank BRI 456,531,093 144,095,184 7,897,905 283,586,497 17,610,989 Bank Mandiri 489,106,664 141,994,836 5,097,336 273,962,101 14,547,992 Bank CIMB

Niaga 164,137,582 70,405,483 2,009,404 120,219,882 4,086,283 Bank Permata 101,534,393 46,749,995 1,399,186 65,859,107 1,283,470 Bank

Danamon 127,183,116 50,746,696 2,684,640 86,699,835 3,556,351 Bank Panin 118,261,916 37,519,535 724,734 70,793,812 2,219,356

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 8

Input dan Output Bank Umum Syariah (BUS) Tahun 2011

(Dalam Jutaan)

Bank umum

syariah Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank

Muamalat 32,479,506 3,346,766 410,355 9,902,213 383,619 Bank Bukopin 2,730,027 309,871 44,229 632,574 15,093 Bank Mega 5,565,724 1,618,691 310,735 72,540 73,846 Bank BRI 11,200,823 1,902,555 302,475 1,760,141 5,071 Bank Mandiri 48,671,950 5,095,863 964,882 9,962,919 741,645

Lampiran 9

Input dan Output Bank Umum Konvensional (BUK) Tahun 2012

(Dalam Jutaan)

Bank umum

konvensional Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank BTN 111,748,593 41,541,453 978,390 75,410,705 1,865,192 Bank BCA 436,795,410 73,016,169 5,735,210 256,713,553 14,357,364 Bank BNI 321,534,240 80,788,084 5,129,161 193,016,854 8,343,813 Bank BII 111,161,003 18,766,047 1,654,284 74,318,621 1,222,269 Bank BRI 535,209,156 174,702,342 8,730,000 348,231,964 22,476,323 Bank Mandiri 563,105,056 144,844,747 6,193,255 339,973,690 17,308,235 Bank CIMB

Niaga 192,612,817 80,136,112 2,569,521 133,708,004 5,508,046 Bank Permata 132,130,006 56,504,744 1,850,142 86,955,200 1,762,027 Bank

Danamon 130,474,521 48,707,460 3,069,852 91,532,966 4,478,088 Bank Panin 141,450,516 38,834,008 934,252 91,765,984 2,505,512

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 10

Input dan Output Bank Umum Syariah (BUS) Tahun 2012

(Dalam Jutaan)

Bank umum

syariah Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank

Muamalat 44,854,413 5,949,863 546,875 15,045,617 524,526 Bank Bukopin 3,616,108 413,346 51,390 831,263 26,161 Bank Mega 8,164,921 1,664,319 324,834 36,351 246,934 Bank BRI 14,088,914 2,360,278 323,383 2,663,262 131,035 Bank Mandiri 54,229,396 7,332,436 973,160 10,462,107 1,091,102

Input dan Output Bank Umum Konvensional (BUK) Tahun 2013

(Dalam Jutaan)

Bank umum

konvensional Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank BTN 131,169,730 48,275,905 1,161,101 92,386,308 2,135,909 Bank BCA 488,498,242 86,610,366 6,338,511 312,380,146 16,984,654 Bank BNI 370,716,158 87,145,146 5,405,324 239,363,451 10,975,031 Bank BII 134,445,720 24,588,363 1,750,425 92,062,035 1,738,055 Bank BRI 606,370,242 198,345,998 11,202,859 430,621,874 25,864,852 Bank Mandiri 648,250,177 169,338,524 7,163,504 416,978,030 21,304,334 Bank CIMB

Niaga 211,427,283 87,580,836 2,886,279 143,751,378 5,647,478 Bank Permata 165,542,733 79,164,847 1,998,942 106,980,019 1,994,105 Bank

Danamon 152,021,037 57,159,885 3,459,648 103,895,851 3,678,886 Bank Panin 154,128,770 44,638,997 1,167,174 103,045,656 2,666,596

Sumber: Statistik Perbankan Indonesia (data diolah)

Lampiran 12

Input dan Output Bank Umum Syariah (BUS) Tahun 2013

(Dalam Jutaan)

Bank umum

syariah Total aset Simpanan

Biaya tenaga

kerja Kredit/pembiayaan

Laba operasional Bank

Muamalat 54,694,021 6,295,093 754,059 21,240,407 708,677 Bank Bukopin 4,343,069 425,867 62,577 1,092,737 30,959 Bank Mega 9,121,575 1,284,557 362,352 43,593 181,451 Bank BRI 17,400,914 3,151,441 400,267 4,050,478 179,740 Bank Mandiri 63,965,361 9,115,337 1,192,403 11,113,224 874,903

Lampiran 13

Nilai efisiensi Bank Umum Konvensional dan Bank Umum Syariah

Tahun 2008-2013

Menggunakan Metode DEA

Nama Bank tahun

2008 2009 2010 2011 2012 2013

BTN Konvensional 100 100 100 100 100 100

BCA Konvensional 100 100 100 100 100 100

BNI Konvensional 89 79.1 90.7 90.3 91.6 95.5 BII Konvensional 89.9 83 100 94.2 100 100

BRI Konvensional 100 100 100 100 100 100

Mandiri Konvensional 85.5 100 100 100 100 100 CIMB Niaga

Konvensional 100 100 100 100 100 96.1

Permata Konvensional 89 94.9 96.5 88.6 94.7 91.5 Danamon konvensional 88.2 90.7 95 97.02 100 96.2 Panin Konvensional 100 100 100 100 100 100 Rata-rata Efisiensi 94.16 94.77 98.22 97.01 98.63 97.93

muamalat Syariah 100 100 100 100 100 100

Bukopin Syariah 100 51.9 70.8 76 79.5 76

Mega Syariah 31.9 100 100 87.1 100 100

BRI Syariah 47.1 65 55.4 51.5 65 72.8

Tabel Efisiensi Bank Umum Konvensional Tahun 2008

Laba Operasional

669,834

669,834

0

Bank BCA

Total Aset

224,729,251

224,729,251

0

Simpanan

100

52,967,094

52,967,094

0

Biaya Tenaga Kerja

3,200,928

3,200,928

0

Kredit

112,846,634

112,846,634

0

Laba Operasional

7,605,119

7,605,119

0

Bank BNI

Total Aset

200,390,507

178,948,106

-10.70

Simpanan

89

67,307,399

60,105,300

-10.70

Biaya Tenaga Kerja

3,220,991

2,876,335

-10.70

Kredit

108,896,144

108,896,144

0

Laba Operasional

1,892,014

4,782,050

152.75

Bank BII

Total Aset

53,790,638

48,289,293

-10.23

Simpanan

89.8

25,906,881

22,549,715

-12.96

Biaya Tenaga Kerja

938,331

784,291

-16.42

Kredit

35,057,139

35,057,139

0

Laba Operasional

81,994

605,851

638.90

Bank BRI

Total Aset

246,026,225

246,026,225

0

Simpanan

100

73,519,757

73,519,757

0

Biaya Tenaga Kerja

6,317,638

6,317,638

0

161,061,059

0

Kredit

161,061,059

Laba Operasional

8,347,565

8,347,565

0

Bank Mandiri

Total Aset

338,404,265

289,329,571

-14.50

Simpanan

85.5

Sumber : Hasil pengolahan dengan Banxia Frontier Analysis

Biaya Tenaga Kerja

4,095,663

3,501,718

0

Kredit

159,007,051

159,007,051

0

Laba Operasional

7,752,840

7,752,840

0

Bank CIMB Niaga

Total Aset

102,604,732

102,604,732

0

Simpanan

100

47,913,468

47,913,468

0

Biaya Tenaga Kerja

1,666,471

1,666,471

0

Kredit

74,489,148

74,489,148

0

Laba Operasional

1,287,308

1,287,308

0

Bank Permata

Total Aset

53,959,827

48,018,981

-11.01

Simpanan

89

26,366,090

22,399,698

-15.04

Biaya Tenaga Kerja

922,019

781,243

-15.27

Kredit

34,850,805

34,850,805

0

Laba Operasional

605,485

605,485

0

bank Danamon

Total Aset

104,821,926

92,401,406

-11.85

Simpanan

88.2

54,214,672

36,435,959

-32.79

Biaya Tenaga Kerja

2,270,214

1,877,513

-17.30

Kredit

64,233,906

64,233,906

0

Laba Operasional

2,012,992

2,012,992

0

Bank Panin

Total Aset

62,772,547

62,772,547

0

Simpanan

100

29,445,332

29,445,332

0

Biaya Tenaga Kerja

375,589

375,589

0

Kredit

36,868,879

36,868,879

0

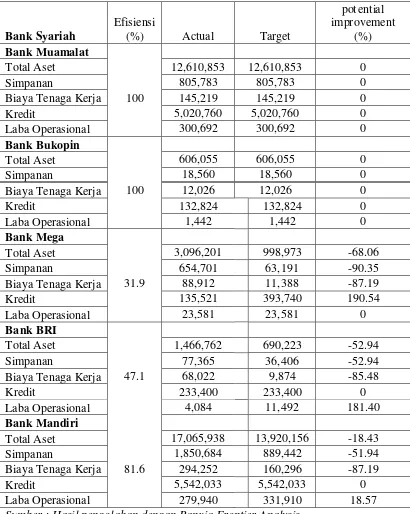

Tabel Efisiensi Bank Umum Syariah Tahun 2008

Sumber : Hasil pengolahan dengan Banxia Frontier Analysis

Bank Syariah

Efisiensi

(%)

Actual

Target

pot ential

improvement

(%)

Bank Muamalat

Total Aset

12,610,853

12,610,853

0

Simpanan

805,783

805,783

0

Biaya Tenaga Kerja

100

145,219

145,219

0

Kredit

5,020,760

5,020,760

0

Laba Operasional

300,692

300,692

0

Bank Bukopin

Total Aset

606,055

606,055

0

Simpanan

18,560

18,560

0

Biaya Tenaga Kerja

100

12,026

12,026

0

Kredit

132,824

132,824

0

Laba Operasional

1,442

1,442

0

Bank Mega

Total Aset

3,096,201

998,973

-68.06

Simpanan

654,701

63,191

-90.35

Biaya Tenaga Kerja

31.9

88,912

11,388

-87.19

Kredit

135,521

393,740

190.54

Laba Operasional

23,581

23,581

0

Bank BRI

Total Aset

1,466,762

690,223

-52.94

Simpanan

77,365

36,406

-52.94

Biaya Tenaga Kerja

47.1

68,022

9,874

-85.48

Kredit

233,400

233,400

0

Laba Operasional

4,084

11,492

181.40

Bank Mandiri

Total Aset

17,065,938

13,920,156

-18.43

Simpanan

1,850,684

889,442

-51.94

Biaya Tenaga Kerja

81.6

294,252

160,296

-87.19

Kredit

5,542,033

5,542,033

0

Lampiran 16

Tabel Efisiensi Bank Umum Konvensional Tahun 2009

Bank Konvensional

Laba Operasional 739,444 739,444 0

Bank BCA

Total Aset 280,817,308 280,817,308 0

Simpanan 65,006,963 65,006,963 0

Biaya Tenaga Kerja 100 4,061,935 4,061,935 0

Kredit 123,596,037 123,596,037 0

Laba Operasional 8,404,158 8,404,158 0

Bank BNI

Total Aset 225,541,328 178,439,745 -20.88

Simpanan 82,609,539 65,357,534 -20.88

Biaya Tenaga Kerja 79.1 3,336,683 2,639,857 -20.88

Kredit 117,644,695 117,644,695 0

Laba Operasional

3,347,581

3,347,581 0

Bank BII

Total Aset 58,701,483 48,706,429 -17.03

Simpanan 26,645,710 21,083,893 -20.87

Biaya Tenaga Kerja 83 977,340 810,929 -17.03

Kredit 37,047,434 37,047,434 0

Laba Operasional 358,591 917,662 155.91

Bank BRI

Total Aset 314,745,744 314,745,744 0

Simpanan 100,034,299 100,034,299 0

Biaya Tenaga Kerja 100 6,585,617 6,585,617 0

Kredit 205,522,394 205,522,394 0

Laba Operasional 8,569,748 8,569,748 0

Bank Mandiri

Total Aset 370,310,994 370,310,994 0

Simpanan 123,409,519 123,409,519 0

Laba Operasional 10,312,469 10,312,469 0 Bank CIMB Niaga

Total Aset 106,803,360 106,803,360 0

Simpanan 46,884,622 46,884,622 0

Biaya Tenaga Kerja 100 1,906,029 1,906,029 0

Kredit 82,970,368 82,970,368 0

Laba Operasional 2,178,850 2,178,850 0

Bank Permata

Total Aset 55,900,751 53,036,615 -5.12

Simpanan 25,115,277 23,282,054 -7.30

Biaya Tenaga Kerja 94.9 1,131,892 946,499 -16.38

Kredit 41,201,583 41,201,583 0

Laba Operasional 736,650 1,081,977 46.88

bank Danamon

Total Aset 96,630,214 87,640,548 -9.30

Simpanan 44,842,744 30,401,932 -32.20

Biaya Tenaga Kerja 90.7 2,102,538 1,769,047 -15.86

Kredit 59,832,098 59,832,098 0

Laba Operasional 2,242,686 2,242,686 0

Bank Panin

Total Aset 76,075,202 76,075,202 0

Simpanan 30,571,763 30,571,763 0

Biaya Tenaga Kerja 100 456,547 456,547 0

Kredit 43,196,490 43,196,490 0

Laba Operasional 1,229,317 1,229,317 0

Lampiran 17

Tabel Efisiensi Bank Umum Syariah Tahun 2009

Bank Syariah

Laba Operasional

2,886

4,181

44.88

Bank Mega

Laba Operasional

7,127

9,976

39.98

Bank Mandiri

Laba Operasional

410,384

410,384

0

Tabel Efisiensi Bank Umum Konvensional Tahun 2010

Bank Konvensional

Efisiensi

(%) Actual Target

potential improvement

(%) Bank BTN

Total Aset 68,385,539 68,385,539 0

Simpanan 29,513,925 29,513,925 0

Biaya Tenaga Kerja 100 762,897 762,897 0

Kredit 48,702,920 48,702,920 0

Laba Operasional 1,263,720 1,263,720 0

Bank BCA

Total Aset 320,585,907 320,585,907 0

Simpanan 67,987,209 67,987,209 0

Biaya Tenaga Kerja 100 4,241,720 4,241,720 0

Kredit 153,965,023 153,965,023 0

Laba Operasional 9,914,319 9,914,319 0

Bank BNI

Total Aset 240,293,481 217,987,092 -9.28

Simpanan 77,361,996 70,180,499 -9.28

Biaya Tenaga Kerja 90.7 3,817,770 3,463,367 -9.28 Kredit 132,852,979 132,852,979 0

Laba Operasional 5,461,937 6,495,604 18.92

Bank BII

Total Aset 71,579,977 71,579,977 0

Simpanan 35,445,946 35,445,946 0

Biaya Tenaga Kerja 100 137,429 137,429 0

Kredit 49,695,623 49,695,623 0

Laba Operasional 475,353 475,353 0

Bank BRI

Total Aset 398,393,138 398,393,138 0

Simpanan 126,309,586 126,309,586 0

Biaya Tenaga Kerja 100 8,104,779 8,104,779 0

Kredit 246,968,128 246,968,128 0

Laba Operasional 14,407,492 14,407,492 0

Bank Mandiri

Total Aset 406,000,854 406,000,854 0

Simpanan 144,710,102 144,710,102 0

Biaya Tenaga Kerja 100 4,552,606 4,552,606 0

Laba Operasional 12,928,742 12,928,742 0 Bank CIMB Niaga

Total Aset 142,637,071 142,637,071 0

Simpanan 64,717,462 64,717,462 0

Biaya Tenaga Kerja 100 1,849,845 1,849,845 0

Kredit 102,108,984 102,108,984 0

Laba Operasional 3,261,532 3,261,532 0

Bank Permata

Total Aset 73,582,319 70,993,135 -3.52

Simpanan 31,940,369 30,816,464 -3.52

Biaya Tenaga Kerja 96.5 1,119,968 806,494 -27.99

Kredit 50,589,480 50,589,480 0

Laba Operasional 1,106,514 1,347,005 21.73

bank Danamon

Total Aset 113,864,875 108,167,254 -5.0

Simpanan 48,060,809 45,655,921 -5.0

Biaya Tenaga Kerja 95 2,539,450 1,572,320 -38.08

Kredit 75,090,482 75,090,482 0

Laba Operasional 2,773,386 2,773,386 0

Bank Panin

Total Aset 105,424,496 105,424,496 0

Simpanan 37,865,914 37,865,914 0

Biaya Tenaga Kerja 100 549,327 549,327 0

Kredit 57,525,466 57,525,466 0

Laba Operasional 1,502,270 1,502,270 0

Tabel Efisiensi Bank Umum Syariah Tahun 2010

Bank Syariah

Efisiensi

(%) Actual Target

potential improvement

(%) Bank Muamalat

Total Aset 21,442,596 21,442,596 0

Simpanan 2,547,365 2,547,365 0

Biaya Tenaga Kerja 100 253,263 253,263 0

Kredit 7,501,327 7,501,327 0

Laba Operasional 238,431 238,431 0

Bank Bukopin

Total Aset 2,193,952 1,553,572 -29.19

Simpanan 270,085 184,563 -31.66

Biaya Tenaga Kerja 70.8 41,843 18,,349 -56.15

Kredit 543,491 543,491 0

Laba Operasional 14,373 17,274 20.19

Bank Mega

Total Aset 4,637,730 4,637,730 0

Simpanan 1,182,822 1,182,822 0

Biaya Tenaga Kerja 100 293,340 293,340 0

Kredit 149,474 149,474 0

Laba Operasional 85,411 85,411 0

Bank BRI

Total Aset 6,856,386 3,798,932 -44.59

Simpanan 1,054,006 451,310 -57.18

Biaya Tenaga Kerja 55.4 189,999 44,869 -76.38

Kredit 1,328,992 1,328,992 0

Laba Operasional 9,052 42,242 366.6

Bank Mandiri

Total Aset 32,481,873 32,481,873 0

Simpanan 4,174,664 4,174,664 0

Biaya Tenaga Kerja 100 622,679 622,679 0

Kredit 8,715,920 8,715,920 0

Laba Operasional 565,098 565,098 0

Lampiran 20

Tabel Efisiensi Bank Umum Konvensional Tahun 2011

Bank

Laba Operasional 1,525,748 1,525,748 0

Bank BCA

Total Aset 377,250,966 377,250,966 0

Simpanan 74,418,152 74,418,152 0

Biaya Tenaga Kerja 100 4,843,453 4,843,453 0

Kredit 202,268,608 202,268,608 0

Laba Operasional 12,908,515 12,908,515 0

Bank BNI

Total Aset 288,511,901 260,574,669 -9,68

Simpanan 80,845,197 73,016,781 -9,68

Biaya Tenaga Kerja 90.3 4,704,523 3,099,251 -34,12

Kredit 158,164,743 158,164,743 0

Laba Operasional 7,182,546 7,182,546 0

Bank BII

Total Aset 90,740,977 85,433,166 -5,85

Simpanan 39,988,171 36,645,863 -8,36

Biaya Tenaga Kerja 94.2 1,386,973 1,045,889 -24,59

Kredit 62,574,123 62,574,123 0

Laba Operasional 705,425 2,126,899 201,51

Bank BRI

Total Aset 456,531,093 456,531,093 0

Simpanan 144,095,184 144,095,184 0

Biaya Tenaga Kerja 100 7,897,905 7,897,905 0

Kredit 283,586,497 283,586,497 0

Laba Operasional 17,610,989 17,610,989 0

Bank Mandiri

Total Aset 489,106,664 489,106,664 0

Simpanan 141,994,836 141,994,836 0

Biaya Tenaga Kerja 100 5,097,336 5,097,336 0

Bank CIMB Niaga

Total Aset 164,137,582 164,137,582 0

Simpanan 70,405,483 70,405,483 0

Biaya Tenaga Kerja 100 2,009,404 2,009,404 0

Kredit 120,219,882 120,219,882 0

Laba Operasional 4,086,283 4,086,283 0

Bank Permata

Total Aset 101,534,393 89,918,193 -11,44

Simpanan 46,749,995 38,569,678 -17,50

Biaya Tenaga Kerja 88.6 1,399,186 1,100,795 -21,33

Kredit 65,859,107 65,859,107 0

Laba Operasional 1,283,470 2,238,566 74,41

Bank Danamon

Total Aset 127,183,116 123,673,593 -2,76

Simpanan 50,746,696 49,094,223 -3,26

Biaya Tenaga Kerja 97.02 2,684,640 1,690,547 -37,03

Kredit 86,699,835 86,699,835 0

Laba Operasional 3,556,351 3,556,351 0

Bank Panin

Total Aset 118,261,916 118,261,916 0

Simpanan 37,519,535 37,519,535 0

Biaya Tenaga Kerja 100 724,734 724,734 0

Kredit 70,793,812 70,793,812 0

Laba Operasional 2,219,356 2,219,356 0

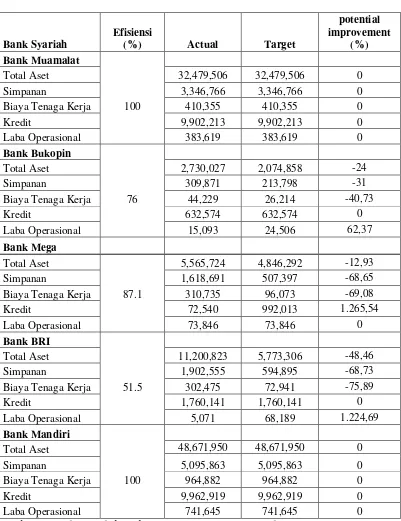

Lampiran 21

Tabel Efisiensi Bank Umum Syariah Tahun 2011

Bank Syariah

Efisiensi

(%) Actual Target

potential improvement

(%) Bank Muamalat

Total Aset 32,479,506 32,479,506 0

Simpanan 3,346,766 3,346,766 0

Biaya Tenaga Kerja 100 410,355 410,355 0

Kredit 9,902,213 9,902,213 0

Laba Operasional 383,619 383,619 0

Bank Bukopin

Total Aset 2,730,027 2,074,858 -24

Simpanan 309,871 213,798 -31

Biaya Tenaga Kerja 76 44,229 26,214 -40,73

Kredit 632,574 632,574 0

Laba Operasional 15,093 24,506 62,37

Bank Mega

Total Aset 5,565,724 4,846,292 -12,93

Simpanan 1,618,691 507,397 -68,65

Biaya Tenaga Kerja 87.1 310,735 96,073 -69,08

Kredit 72,540 992,013 1.265,54

Laba Operasional 73,846 73,846 0

Bank BRI

Total Aset 11,200,823 5,773,306 -48,46

Simpanan 1,902,555 594,895 -68,73

Biaya Tenaga Kerja 51.5 302,475 72,941 -75,89

Kredit 1,760,141 1,760,141 0

Laba Operasional 5,071 68,189 1.224,69

Bank Mandiri

Total Aset 48,671,950 48,671,950 0

Simpanan 5,095,863 5,095,863 0

Biaya Tenaga Kerja 100 964,882 964,882 0

Kredit 9,962,919 9,962,919 0

Laba Operasional 741,645 741,645 0

Tabel Efisiensi Bank Umum Konvensional Tahun 2012

BankKonvensional

Efisiensi

(%) Actual Target

potential improvement (%) Bank BTN

Total Aset 111,748,593 111,748,593 0

Simpanan 41,541,453 41,541,453 0

Biaya Tenaga Kerja 100 978,390 978,390 0

Kredit 75,410,705 75,410,705 0

Laba Operasional 1,865,192 1,865,192 0

Bank BCA

Total Aset 436,795,410 436,795,410 0

Simpanan 73,016,169 73,016,169 0

Biaya Tenaga Kerja 100 5,735,210 5,735,210 0

Kredit 256,713,553 256,713,553 0

Laba Operasional 14,357,364 14,357,364 0

Bank BNI

Total Aset 321,534,240 294,617,823 -8.37

Simpanan 80,788,084 74,025,116 -8.37

Biaya Tenaga Kerja 91.6 5,129,161 4,579,198 -10.72

Kredit 193,016,854 193,016,854 0

Laba Operasional 8,343,813 8,343,813 0

Bank BII

Total Aset 111,161,003 111,161,003 0

Simpanan 18,766,047 18,766,047 0

Biaya Tenaga Kerja 100 1,654,284 1,654,284 0

Kredit 74,318,621 74,318,621 0

Laba Operasional 1,222,269 1,222,269 0

Bank BRI

Total Aset 535,209,156 535,209,156 0

Simpanan 174,702,342 174,702,342 0

Biaya Tenaga Kerja 100 8,730,000 8,730,000 0

Kredit 348,231,964 348,231,964 0

Laba Operasional 22,476,323 22,476,323 0

Bank Mandiri

Total Aset 563,105,056 563,105,056 0

Simpanan 144,844,747 144,844,747 0

Biaya Tenaga Kerja 100 6,193,255 6,193,255 0

Kredit 339,973,690 339,973,690 0

Bank CIMB Niaga

Total Aset 192,612,817 192,612,817 0

Simpanan 80,136,112 80,136,112 0

Biaya Tenaga Kerja 100 2,569,521 2,569,521 0

Kredit 133,708,004 133,708,004 0

Laba Operasional 5,508,046 5,508,046 0

Bank Permata

Total Aset 132,130,006 125,176,915 -5.26

Simpanan 56,504,744 51,731,896 -8.45

Biaya Tenaga Kerja 94.7 1,850,142 1,752,781 -5.26

Kredit 86,955,200 86,955,200 0

Laba Operasional 1,762,027 3,626,190 105.8

bank Danamon

Total Aset 130,474,521 130,474,521 0

Simpanan 48,707,460 48,707,460 0

Biaya Tenaga Kerja 100 3,069,852 3,069,852 0

Kredit 91,532,966 91,532,966 0

Laba Operasional 4,478,088 4,478,088 0

Bank Panin

Total Aset 141,450,516 141,450,516 0

Simpanan 38,834,008 38,834,008 0

Biaya Tenaga Kerja 100 934,252 934,252 0

Kredit 91,765,984 91,765,984 0

Laba Operasional 2,505,512 2,505,512 0

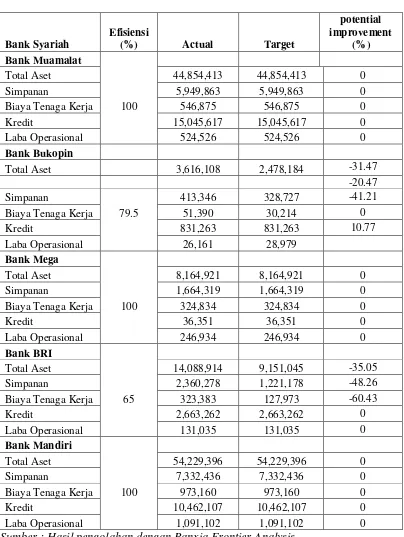

Tabel Efisiensi Bank Umum Syariah Tahun 2012

Bank Syariah

Efisiensi

(%) Actual Target

potential improvement

(%) Bank Muamalat

Total Aset 44,854,413 44,854,413 0

Simpanan 5,949,863 5,949,863 0

Biaya Tenaga Kerja 100 546,875 546,875 0

Kredit 15,045,617 15,045,617 0

Laba Operasional 524,526 524,526 0

Bank Bukopin

Total Aset 3,616,108 2,478,184 -31.47

-20.47

Simpanan 413,346 328,727 -41.21

Biaya Tenaga Kerja 79.5 51,390 30,214 0

Kredit 831,263 831,263 10.77

Laba Operasional 26,161 28,979

Bank Mega

Total Aset 8,164,921 8,164,921 0

Simpanan 1,664,319 1,664,319 0

Biaya Tenaga Kerja 100 324,834 324,834 0

Kredit 36,351 36,351 0

Laba Operasional 246,934 246,934 0

Bank BRI

Total Aset 14,088,914 9,151,045 -35.05

Simpanan 2,360,278 1,221,178 -48.26

Biaya Tenaga Kerja 65 323,383 127,973 -60.43

Kredit 2,663,262 2,663,262 0

Laba Operasional 131,035 131,035 0

Bank Mandiri

Total Aset 54,229,396 54,229,396 0

Simpanan 7,332,436 7,332,436 0

Biaya Tenaga Kerja 100 973,160 973,160 0

Kredit 10,462,107 10,462,107 0

Laba Operasional 1,091,102 1,091,102 0

Lampiran 24

Tabel Efisiensi Bank Umum Konvensional Tahun 2013

Bank Konvensional

Efisiensi

(%) Actual Target

potential improvement

(%) Bank BTN

Total Aset 131,169,730 131,169,730 0

Simpanan 48,275,905 48,275,905 0

Biaya Tenaga Kerja 100 1,161,101 1,161,101 0

Kredit 92,386,308 92,386,308 0

Laba Operasional 2,135,909 2,135,909 0

Bank BCA

Total Aset 488,498,242 488,498,242 0

Simpanan 86,610,366 86,610,366 0

Biaya Tenaga Kerja 100 6,338,511 6,338,511 0

Kredit 312,380,146 312,380,146 0

Laba Operasional 16,984,654 16,984,654 0

Bank BNI

Total Aset 370,716,158 353,875,366 -4.54

Simpanan 87,145,146 83,186,340 -4.54

Biaya Tenaga Kerja 95.5 5,405,324 5,159,772 -4.54

Kredit 239,363,451 239,363,451 0

Laba Operasional 10,975,031 10,975,031 0

Bank BII

Total Aset 134,445,720 134,445,720 0

Simpanan 24,588,363 24,588,363 0

Biaya Tenaga Kerja 100 1,750,425 1,750,425 0

Kredit 92,062,035 92,062,035 0

Laba Operasional 1,738,055 1,738,055 0

Bank BRI

Total Aset 606,370,242 606,370,242 0

Simpanan 198,345,998 198,345,998 0

Biaya Tenaga Kerja 100 11,202,859 11,202,859 0

Kredit 430,621,874 430,621,874 0

Laba Operasional 25,864,852 25,864,852 0

Bank Mandiri

Total Aset 648,250,177 648,250,177 0

Simpanan 169,338,524 169,338,524 0

Biaya Tenaga Kerja 100 7,163,504 7,163,504 0

Bank CIMB Niaga

Total Aset 211,427,283 203,257,584 -3.86

Simpanan 87,580,836 70,657,311 -19.32

Biaya Tenaga Kerja 96.1 2,886,279 2,774,751 -3.86

Kredit 143,751,378 143,751,378 0

Laba Operasional 5,647,478 5,983,008 5.94

Bank Permata

Total Aset 165,542,733 151,469,403 -8.50

Simpanan 79,164,847 53,670,172 -32.20

Biaya Tenaga Kerja 91.5 1,998,942 1,829,005 -8.50

Kredit 106,980,019 106,980,019 0

Laba Operasional 1,994,105 3,804,348 90.78

bank Danamon

Total Aset 152,021,037 146,298,541 -3.76

Simpanan 57,159,885 47,854,806 -16.28

Biaya Tenaga Kerja 96.2 3,459,648 2,702,906 -21.87

Kredit 103,895,851 103,895,851 0

Laba Operasional 3,678,886 6,240,395 69.63

Bank Panin

Total Aset 154,128,770 154,128,770 0

Simpanan 44,638,997 44,638,997 0

Biaya Tenaga Kerja 100 1,167,174 1,167,174 0

Kredit 103,045,656 103,045,656 0

Laba Operasional 2,666,596 2,666,596 0

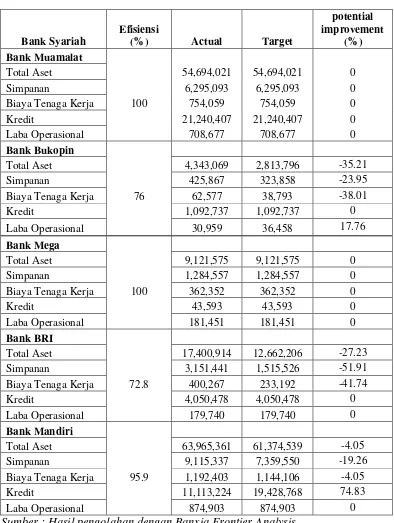

Lampiran 25

Tabel Efisiensi Bank Umum Syariah Tahun 2013

Bank Syariah

Efisiensi

(%) Actual Target

potential improvement

(%) Bank Muamalat

Total Aset 54,694,021 54,694,021 0

Simpanan 6,295,093 6,295,093 0

Biaya Tenaga Kerja 100 754,059 754,059 0

Kredit 21,240,407 21,240,407 0

Laba Operasional 708,677 708,677 0

Bank Bukopin

Total Aset 4,343,069 2,813,796 -35.21

Simpanan 425,867 323,858 -23.95

Biaya Tenaga Kerja 76 62,577 38,793 -38.01

Kredit 1,092,737 1,092,737 0

Laba Operasional 30,959 36,458 17.76

Bank Mega

Total Aset 9,121,575 9,121,575 0

Simpanan 1,284,557 1,284,557 0

Biaya Tenaga Kerja 100 362,352 362,352 0

Kredit 43,593 43,593 0

Laba Operasional 181,451 181,451 0

Bank BRI

Total Aset 17,400,914 12,662,206 -27.23

Simpanan 3,151,441 1,515,526 -51.91

Biaya Tenaga Kerja 72.8 400,267 233,192 -41.74

Kredit 4,050,478 4,050,478 0

Laba Operasional 179,740 179,740 0

Bank Mandiri

Total Aset 63,965,361 61,374,539 -4.05

Simpanan 9,115,337 7,359,550 -19.26

Biaya Tenaga Kerja 95.9 1,192,403 1,144,106 -4.05

Kredit 11,113,224 19,428,768 74.83

Laba Operasional 874,903 874,903 0