Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji] Date: 11 January 2016, At: 19:34

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Income Tax Preparation Assistance Service

Learning Program: A Multidimensional

Assessment

Richard Aldridge, Richard A. Callahan, Yining Chen & Stacy R. Wade

To cite this article: Richard Aldridge, Richard A. Callahan, Yining Chen & Stacy R. Wade (2015) Income Tax Preparation Assistance Service Learning Program: A Multidimensional Assessment, Journal of Education for Business, 90:6, 287-295, DOI: 10.1080/08832323.2015.1034065

To link to this article: http://dx.doi.org/10.1080/08832323.2015.1034065

Published online: 01 May 2015.

Submit your article to this journal

Article views: 49

View related articles

View Crossmark data

CopyrightC Taylor & Francis Group, LLC ISSN: 0883-2323 print / 1940-3356 online DOI: 10.1080/08832323.2015.1034065

Income Tax Preparation Assistance Service Learning

Program: A Multidimensional Assessment

Richard Aldridge, Richard A. Callahan, Yining Chen, and Stacy R. Wade

Western Kentucky University, Bowling Green, Kentucky, USAThe authors present a multidimensional assessment of the outcomes and benefits of an in-come tax preparation assistance (ITPA) service learning program. They measure the perceived proximate benefits at the delivery of the service program, the actual learning outcome ben-efits prior to graduation, and the perceived long-term benben-efits from a postgraduation alumni survey. Overall, service receivers, service providers, and alumni value their experience and participation in the ITPA program. Assessment of learning outcomes indicates significant increases in participants’ perceived knowledge application, problem-solving, and communi-cation skills. Moreover, the assessed actual learning outcome (i.e., knowledge of individual taxation topics) is notably higher among students participating in the ITPA program than it is for nonparticipating students.

Keywords: business education, income tax assistance program, program assessment, service learning, VITA

Service learning is a pedagogy that combines classroom in-struction with community service, aiming to provide students with experience that will reinforce curriculum; improve in-terpersonal, problem-solving, critical thinking, and writing skills; and connect students to the needs of the community (Gallagher, 2007). Prior research provides evidence that ser-vice learning experience positively affects students’ learning and application of specific concepts (Zamora, 2012). Along-side practical skills enhancement, service learning builds up students’ sense of community service, personal responsibil-ity, and civic engagement as well. While service learning has often been incorporated into medical or legal programs of study, this type of active learning has not been widespread in disciplines within the business curriculum, and little has been written about service learning in academic accounting (Rama, Ravenscroft, Wolcott, & Zlotkowski, 2000). Though there have been more service learning studies in business disciplines since the calling of Rama et al., and some have looked into the Volunteer Income Tax Assistance (VITA) programs (e.g., Christensen, 2010; Clovery & Oladipo, 2008; Drougas & Harrington, 2011; Purcell, 2009), more is research

Correspondence should be addressed to Yining Chen, Western Kentucky University, Department of Accounting, 1906 College Heights Boulevard, Bowling Green, KY 42101-1061, USA. E-mail: yining.chen@wku.edu

Color versions of one or more figures in this article are available online at www.tandfonline.com/vjeb.

essential to build an academic argument regarding the merits of service learning programs in business education.

Support for service learning integration continues to in-crease as institutions respond to greater community requests to assist in the solving of complex societal problems. Along with this increased support is the calling for the admin-istrators and faculty, who are responsible for implement-ing this unique pedagogical approach to student learnimplement-ing, to measure outcome and effectiveness of the program as well as discipline-specific student experiences. Crowe (2003) pointed out that “institutions of higher education require, now more than ever, that administrators and faculty provide re-liable data on student-learning outcomes directly related to service learning initiatives” (p. 110).

This study presents a multidimensional assessment of the outcomes and benefits of an income tax preparation assis-tance (ITPA) service learning program. We measure not only the perceived proximate benefits to service receivers and ser-vice providers during the delivery of the serser-vice program, but also the perceived long-term benefits among accounting graduates who participated in the program. In terms of learn-ing outcomes, we assess the effectiveness of the ITPA pro-gram in improving students’ perceived practical skills, inter-personal skills, citizenship, inter-personal responsibility, problem solving, and school pride. Moreover, we assess the effective-ness of ITPA in enhancing students’ actual learning of the personal income tax topics.

288 R. ALDRIDGE ET AL.

BENEFITS OF SERVICE LEARNING

Service learning projects can provide a triple-win scenario: (a) the students receive an enriched learning experience in terms of civic engagement and social responsibility, appli-cation of skills, and professional development (Flannery & Pragman, 2008); (b) the constituents served have access to services that are needed but typically expensive to acquire (Ayers et al., 2010); and (c) the universities develop stu-dent loyalty and university–community partnership (Hervani & Helms, 2004; Kenworthy-U’ren, 2008). Learning objec-tives typically achieved by service learning events include: practical application of course concepts, enhanced knowl-edge of course subjects, commitment to support commu-nity, motivation to partake in volunteerism, and the oppor-tunity to participate in an internship (Levitt & Schriehans, 2010). Through service learning experience, students of-ten gain an increased level of the sense of social responsi-bility as well as ethical and moral behavior (Poon, Chan, & Zhou, 2011; Rama et al., 2000). Benefits in the dent personal level in terms of student satisfaction, stu-dent perceptions of ability, self-confidence in chosen careers, and desire to perform on complex tasks (Rose, Rose, & Norman, 2005) can also result from service learning ex-perience. Overall, service learning has a positive effect on participating students in their understanding of social issues, personal insight, and cognitive development (Yorio & Ye, 2012).

The many benefits of service learning programs, never-theless, cannot be achieved without the successful planning, design, development, and implementation of the programs. Gujarathi and McQuade (2002) identified five steps neces-sary for a successful service learning initiation: (a) promoting institutional and individual conviction for the value of com-munity service, (b) forming alliances with comcom-munity or so-cial agencies, (c) authenticating the pedagogical legitimacy of service learning, (d) substantiating the benefits of service learning among faculty and students, and (e) selecting or designing appropriate assignments. They stressed that win-ning over the faculty members’ disposition to implement ser-vice learning is the critical success factor. Klink and Athaide (2004), likewise, identified critical success factors of ser-vice learning programs. They stated that a successful serser-vice learning program is characterized by (a) careful screening of suitable social agencies to partner with; (b) effective com-munication of the expectations of social agencies, faculty members, and students; and (c) an optional rather than com-pulsory format.

Though prior literature has shown evidence that service learning offers many benefits, prior studies were inconclu-sive about whether student learning outcomes can be in-creased by service learning programs (Warren, 2012). Sev-eral researchers have attempted to provide evidence that service learning leads to increased student learning. For

instance, Kendrick (1996) compared service learning and non–service learning students in an introduction to sociol-ogy course and found that service learning students per-formed slightly better than non–service learning students on their quizzes and essay questions. On the other hand, Moely, McFarland, Miron, Mercer, and Ilustre (2002) com-pared service learning and non–service learning students and found that service learning students reported a slight de-crease in learning about the academic field over the course of the semester, although it was not as large as the decrease shown by students not participating in service learning. Poon et al. (2011), found that “students have an increased level of sense of social responsibility as well as ethical and moral behavior after the participation in service learning projects. Nevertheless, no significant difference is found for practi-cal learning outcomes between the pre-test and post-test” (p. 185).

RESEARCH OBJECTIVE AND HYPOTHESIS

This study aims to examine the effectiveness and benefits of an ITPA service learning program to both service receivers and service providers. The long-term benefits to account-ing graduates who had participated in the ITPA program are also examined. Moreover, we measure the type and extent of practical learning outcomes affected by the ITPA program. Following Christensen et al. (2010), we evaluate whether ITPA participation has positive effects on the development of students’ confidence in their (a) practical skills, (b) inter-personal skills, (c) citizenship and social responsibility, (d) personal responsibility, (e) problem-solving skills, and (f) school pride. These learning outcomes, explained in Figure 1, align with the core accounting competencies identified in the American Institute of Certified Public Accountants (AICPA) Core Competency Framework (AICPA, 1999) and Pathways Commission Report (Pathways Commission, 2012). Specific research hypotheses are the following:

Hypothesis 1(H1): Service receivers perceive the ITPA ser-vice received as satisfactory and valuable.

H2: Service providers perceive their ITPA experience to be worthwhile and satisfactory.

H3: Accounting alumni value their experience and participa-tion in the ITPA program.

H4: Students, through ITPA participation, increase their level of confidence in learning outcomes such as (a) practical skills, (b) interpersonal skills, (c) citizenship and social responsibility, (d) personal responsibility, (e) problem-solving skills, and (f) school pride.

H5: Students participating in ITPA program demonstrate su-perior actual learning outcomes (i.e., knowledge in indi-vidual taxation subjects) compared to nonparticipating students.

FIGURE 1 Learning outcomes.

THE ITPA PROGRAM AT WESTERN KENTUCKY UNIVERSITY

As an effort to improve accounting education to meet the high standards set by potential employers in the account-ing profession, Clovey and Oladipo (2008) argued that the VITA program provides another vehicle through which es-sential skills can be acquired by college students. The VITA program is an initiative of IRS to provide free taxpayer as-sistance to those who could not afford a paid preparer. While VITA volunteers are not tax experts, they receive training specifically geared toward the type of client they would be assisting. They do not sign the tax returns and are protected from legal liability by the Volunteer Protection Act of 1997 (Doyle, Matt, & Owens, 2005).

Many universities involve accounting students in VITA or similar service learning programs assisting low-income

community members filing tax returns. “If a VITA program is structured with clear-cut aims and objectives, it can play a more important role in the professional preparation of fu-ture qualified accountants than it traditionally has” (Clovey & Oladipo, 2008, p. 60). Christensen, Schmidt, and Wisner (2010) evaluated learning outcomes from students that par-ticipated in VITA programs of eight U.S. universities. Their results show that participating students were more confident in their practical skills, citizenship skills, and personal re-sponsibility compared to students who did not participate. They also had a stronger sense of school pride and more confidence in their interpersonal skills.

In light of the dynamic and rich benefits of service learn-ing and the calllearn-ing for VITA programs as a part of accountlearn-ing curriculum, the accounting department of Western Kentucky University initiated an ITPA service learning program pro-viding tax return services to campus community. The number

290 R. ALDRIDGE ET AL.

TABLE 1 Service Provided

Tax season Service hours Tax returns

2013 168 157

2014 168 160

of service hours provided and tax returns prepared for in the 2013 and 2014 tax seasons are listed in Table 1.

The ITPA program operates two nights a week for a to-tal of five to six weeks from the middle of February to late March. For example, the 2014 operation had ten 3-hr (5–8 pm) sessions involving a total of 168 actual student ser-vice hours along with 40 hr of supervisor work, preseason preparation time, and the time put in by the department of-fice assistant, graduate assistants, and departmental student workers. At least five student workers worked through each session preparing tax returns. In each session, a Beta Alpha Psi member would serve as a greeter to greet the students as they come in, sign them up, bring in the new student client when a preparer finishes a return, and conduct the user satisfaction survey after the completion of the service. The supervising faculty takes care of each day’s setup, supervi-sion of student workers, review of each tax return, and closing everything down after the student workers have left.

The majority of the service receivers are undergraduate students with an exception of a few members of university staff. The approximate time required for one tax return is 1 hr of work by a student worker. The 1 hr includes the time to input the information, to ask necessary questions, to review the return, and to electronically submit the return. The Freedom Edition of Turbotax is used to file the returns (Intuit, 2015). The Freedom Edition prepares federal tax returns and many state tax returns for free for taxpayers who have an adjusted gross income of$30,000 or less, are on active duty in the military, or qualify for the earned income credit.

The service providers are the students enrolled in the sec-ond undergraduate taxation course, federal tax and business entities, offered by the accounting department of Western Kentucky University. The course is offered every semester as an elective course usually taken by accounting seniors with an average enrollment of 25. Students enrolled in the spring semesters provide 6–10 hr of ITPA services in multiple ses-sions as a required project, which counts for 2% of their grade. Through the ITPA participation, students not only ob-tain practical experience in preparing tax returns, but also learn how to work and interact with their student or campus community clients. Survey results indicate that they gen-uinely enjoy helping and interacting with their clients; and those individuals who receive services report that they value the service provided to them. Overall, the service learning program exemplifies a win/win situation for both the student preparers and the clients.

RESULTS

Benefits to Service Receivers/Users

To assess the level of benefits that the ITPA provides to ser-vice receivers, a five-question user satisfaction survey was administered, of which 226 usable copies were collected, 102 and 124 from the 2013 and 2014 tax seasons, respec-tively. Among the 226 service receivers, 127 (56%) were the first-time users of the ITPA service. The numbers of women and men were 138 and 88, respectively. The majority of the service receivers were undergraduate students at the age of 20 years old.

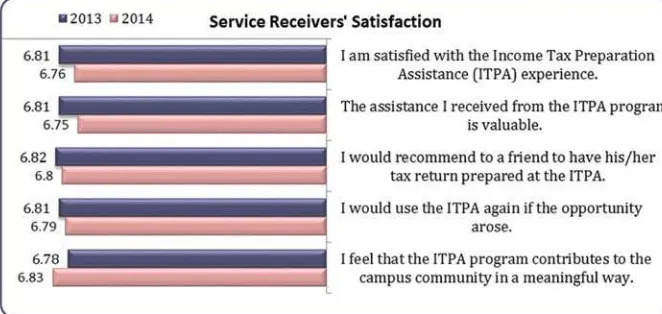

To measure the service receivers’ level of satisfaction, we asked them to answer the following questions using a 7-point Likert-type scale of ranging from 1 (strongly disagree) to 7 (strongly agree). The means of their response along with the five survey questions are listed in Figure 2. On the whole, the high mean scores (ranging from 6.75 to 6.83) afford strong

FIGURE 2 Service receivers satisfaction.

support to H1 that service receivers of the ITPA program are satisfied and consider the service they received valuable. Moreover, the high level of satisfaction is consistently ob-served across service receivers of both service years.

Benefits to Service Providers

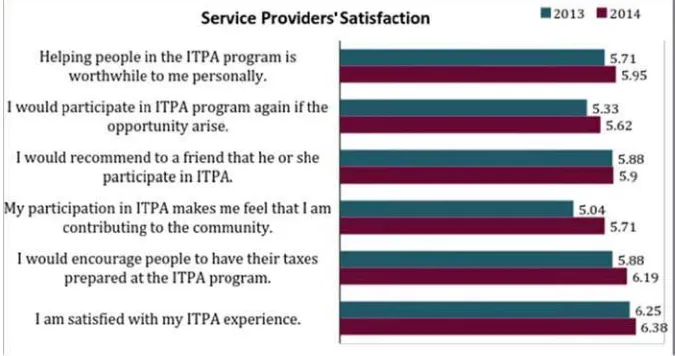

Forty seven students participated in the ITPA program as service providers, twenty four in the tax season of 2013 and twenty three in 2014. They do not include the greeters served in the service sessions. To measure the service providers’ ex-perience and satisfaction level, we asked them to answer six survey questions using the same 7-point Likert-type scale. The means of their response along with the six survey ques-tions are listed in Figure 3. Overall, the participating students conveyed a high level (M=6.31,SD=0.85) of satisfaction with their ITPA experience. They considered helping people via the ITPA program as being worthwhile to them person-ally at a 5.82 level, and would participate in the program again should the opportunity arise at a 5.47 level. The sense of contributing to the community resulting from the partic-ipation in the ITPA program was at a 5.36 level, and their willingness to recommend others to participate in the pro-gram or to have their taxes prepared by the ITPA propro-gram was fairly high, at 6.02 on the 7-point scale. These positive results provide support toH2that service providers consider their ITPA experience worthwhile and satisfactory.

Long-Term Benefits to Accounting Graduates

To assess the long-term benefits of ITPA program, we asked the following questions in the alumni survey to the account-ing graduates who had participated in the ITPA program:

How would you rate the value of your participation in the Income Tax Preparation Assistance Program in terms of (1)

your educational experiences in the accounting program and (2) gaining skills useful to you in your career?

The alumni opinion survey is administered to accounting alumni on the anniversaries of their graduation. We believe meaningful feedback can be obtained from surveying gradu-ates after they have become established in their careers. They may have a refined evaluation in the value of their ITPA ex-periences and the benefits of the ITPA program. A 4-point Likert-type scale ranging from 1 (poor) to 4 (excellent) was used to measure the response. Although the 2012 Alumni Opinion Survey only had two respondents who had partici-pated in the ITPA, their average response rating to both sur-vey questions was 3.5. In the 2013 sursur-vey, there were eleven respondents who had participated in the ITPA, and their av-erage responses to the two questions were 3.27 and 3.36, respectively. These results substantiate the value of the ITPA program in enhancing students’ educational experiences as well as their professional careers. They furthermore provide support toH3that accounting alumni value their experience and participation in the ITPA program.

Benefits in Perceived Learning Outcome

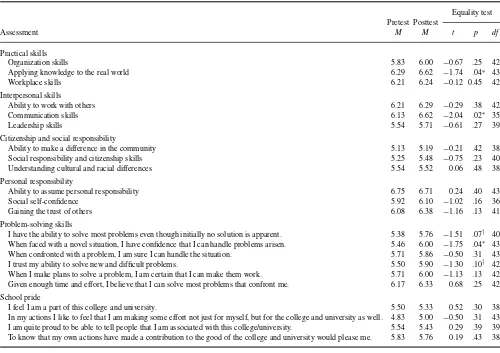

In addition to measuring the general experience of those who participated in the program as service providers, we also as-sess the effectiveness of the ITPA program in improving their perceived practical skills, interpersonal skills, citizenship, personal responsibility, problem solving, and school pride. A survey, using a 7-point Likert-type scale ranging from 1 (not important or strongly disagree) to 7 (most important or strongly agree), was developed based on the service learn-ing benefit identified and validated by Eyler, Giles, Stenson, and Gray (2001) and Christensen et al. (2010). The survey was first pilot tested and then administered to the 24 and 23 service providers in the 2013 and 2014 tax seasons, respec-tively. Table 2 presents the items tested as well as the test

FIGURE 3 Service providers satisfaction.

292 R. ALDRIDGE ET AL.

TABLE 2

Service Provider Benefit (Learning Effectiveness) Assessment

Equality test Pretest Posttest

Assessment M M t p df

Practical skills

Organization skills 5.83 6.00 −0.67 .25 42

Applying knowledge to the real world 6.29 6.62 −1.74 .04∗ 43

Workplace skills 6.21 6.24 −0.12 0.45 42

Interpersonal skills

Ability to work with others 6.21 6.29 −0.29 .38 42

Communication skills 6.13 6.62 −2.04 .02∗ 35

Leadership skills 5.54 5.71 −0.61 .27 39

Citizenship and social responsibility

Ability to make a difference in the community 5.13 5.19 −0.21 .42 38

Social responsibility and citizenship skills 5.25 5.48 −0.75 .23 40

Understanding cultural and racial differences 5.54 5.52 0.06 .48 38

Personal responsibility

Ability to assume personal responsibility 6.75 6.71 0.24 .40 43

Social self-confidence 5.92 6.10 −1.02 .16 36

Gaining the trust of others 6.08 6.38 −1.16 .13 41

Problem-solving skills

I have the ability to solve most problems even though initially no solution is apparent. 5.38 5.76 −1.51 .07† 40

When faced with a novel situation, I have confidence that I can handle problems arisen. 5.46 6.00 −1.75 .04∗ 43

When confronted with a problem, I am sure I can handle the situation. 5.71 5.86 −0.50 .31 43

I trust my ability to solve new and difficult problems. 5.50 5.90 −1.30 .10† 42

When I make plans to solve a problem, I am certain that I can make them work. 5.71 6.00 −1.13 .13 42

Given enough time and effort, I believe that I can solve most problems that confront me. 6.17 6.33 0.68 .25 42

School pride

I feel I am a part of this college and university. 5.50 5.33 0.52 .30 38

In my actions I like to feel that I am making some effort not just for myself, but for the college and university as well. 4.83 5.00 −0.50 .31 43

I am quite proud to be able to tell people that I am associated with this college/university. 5.54 5.43 0.29 .39 39

To know that my own actions have made a contribution to the good of the college and university would please me. 5.83 5.76 0.19 .43 38

†p=.1.∗p=.05.

results. The survey measures participating students’ percep-tion toward their own skills in various prospects, and it was administered once before the starting (pretest) and once after the completion (posttest) of the ITPA program.

We use one-tailedt-test to examine the equality of learning outcomes between pretest and posttest measures. The equal-ity test results indicate significant improvement in students’ perceived learning outcomes in selective practical skills, problem-solving skills, and interpersonal skills. Specifically, students’ perceived practical skill in applying knowledge to the real world increases significantly (p=.04) after the ITPA exposure. Students also show significant improvement (p <.10) in the following three problem-solving skills: (a)

the ability to solve most problems even though initially, no solution is apparent; (b) the confidence to handle a novel situation; and (c) the ability to solve new and difficult prob-lems. In addition, students’ perceived communication skills improves significantly (p=.02) from pretest to posttest mea-sure. Significant improvement, however, was not found from pretest to posttest for citizenship, personal responsibility, and school pride constructs. These results indicate that while the

ITPA service learning program does not enhance students’ sense of personal responsibility and social responsibility, it does contribute to their communication, problem-solving, and knowledge application skills. H4 is, hence, partially supported.

The results of this study align with a number of prior stud-ies that show positive impacts of service learning on practical academic outcomes. First of all, ITPA service learning takes students from classroom settings where focused knowledge and teaching materials are delivered to them into field-based settings where application of knowledge is required in solv-ing real-world complexities. Such settsolv-ings and opportunities bring about improvement in students’ competencies in ap-plying tax knowledge. Results of the same type are sustained by prior studies such as Christensen et al. (2010). Second, students providing ITPA services are exposed to a wide range of problems that require them to identify the relevant issues, research authoritative sources, and analyze the scenario criti-cally in getting the problems solved. Prior studies (e.g., Astin & Sax, 1998; Eyler & Giles, 1999) reported similar results that students in service learning classes with strong

FIGURE 4 Learning objectives and sample test questions.

tion between academic learning and the service experience improved their problem-solving skills. Last, but not least, through ITPA services, students help a diverse set of com-munity clients in filing tax returns where they will have to meet with clients, discuss their cases with them, and com-municate to them about the tax treatments and consequences. The field-based ITPA learning requires students to communi-cate and work closely with clients to accomplish goals, which contributes to the enhanced communication skills observed through the process. Eyler and Giles (1999) reported similar results that service learning significantly affected students’ interpersonal skills.

The results of this study, however, do not concur with Poon et al.’s (2011) finding that students have an increased level of sense of social responsibility as well as ethical and moral behavior after the participation in service learning projects. This inconsistency may be caused by the nature of the ITPA program, which is different from typical service learning pro-grams that emphasize community services. While most of the service learning programs have a strong emphasis in deliver-ing humanity care and social welfare, the ITPA program pro-vides professional tax return services, which require the ap-plication of tax laws and the resolving of complex problems and scenarios. The professional service characteristics and

294 R. ALDRIDGE ET AL.

TABLE 3

Statistics of Actual Learning Outcomes

Participating Nonparticipating

Semester Sample Semester Sample

enrolled size M SD enrolled Size M SD

Spring 2013 19 82 17.64 Fall 2012 6 60 28.28

Spring 2014 23 80 21.67 Fall 2013 13 52 27.74

Fall 2014 11 62 20.89 Overall 42 81 19.73 Overall 30 57 25.04

t(53)=4.30 p=.00007

requirements of the ITPA program can have the propensity to advance students’ knowledge application, problem-solving, and communication skills, but may fall short in developing students’ personal and social responsibilities. Another possi-ble reason that the ITPA program does not increase students’ sense of social responsibility is that ITPA service providers do not participate on a voluntary basis. The compulsory, as opposed to optional, format may prompt students to con-sider their participation as fulfillment of course requirements rather than personal or social responsibilities.

Benefits in Actual Learning Outcomes

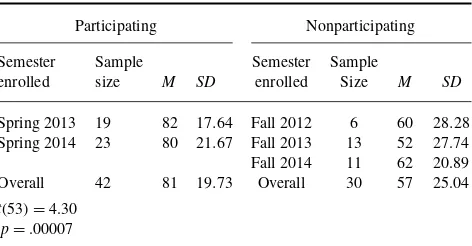

In addition to the benefits in perceived learning outcomes, we also measured the ITPA benefits in actual learning out-comes for those who participated in the program as service providers. Providing that the discipline knowledge gained through the ITPA ties to individual taxation, we measure the learning outcomes in students’ knowledge of individual taxa-tion subjects using a senior assessment test, which was given to accounting seniors shortly before graduation. Specifically, we measured the learning outcomes of participating students and compared them to those of nonparticipating students. We collected data from the senior assessment test across five semesters from the fall of 2012 to the fall of 2014. Among the exam takers, 42 enrolled in the second taxation course in the spring of 2013 and 2014 and participated in the ITPA program, while 30 took the same taxation course in the fall of 2012, 2013, and 2014 and did not participate in the ITPA program. To ensure comparability, the nonparticipating stu-dents are those stustu-dents who took the same taxation course from the same instructor with the only difference that they did not participate in the ITPA program.

We compared the test results between the two groups us-ing a two-tailedt-test. The learning objectives measured and sample test questions are presented in Figure 4, while statis-tics and test results are presented in Table 3. The equality test result indicates a significant difference, t(53) =4.30,

p < .0001, in actual learning outcomes between the two

groups of students. Students participating in the ITPA pro-gram have better learning outcomes (i.e., knowledge in

in-dividual taxation subjects, than nonparticipating students). This result provides support to Hypothesis 5 that students par-ticipating in the ITPA program demonstrate superior actual learning outcomes compared to nonparticipating students.

There would likely be a richer learning experience if the students were able to prepare more complex returns; how-ever, our empirical evidence suggests that preparing even basic returns does reinforce the concepts of gross income, dependent status, and all the various rules that go along with an individual’s claiming personal exemption versus being claimed as a dependent, and the standard deduction rules. While ideally we could require our students providing this service project in the community with a more diverse client base, what we have found is that even with exposure to sim-ple tax returns using basic software and only covering a small range of topics, learning and retention of these concepts is increased.

CONCLUSION

Accounting programs are urged to provide meaningful pro-fessional interactions for students to develop propro-fessional competencies (AICPA, 1999). This empirical study offers accounting educators (a) a better understanding of the mul-tidimensional value of service learning programs; (b) a po-tential model to assess their service learning programs; and (c) positive evidence to support service learning in the ac-counting curriculum. With the successful ITPA experience, accounting programs may expand the scope of tax-based ser-vice learning projects into other projects using tax issues as the content platform (Purcell, 2009).

Contributing to the literature, this study empirically tests the multidimensional benefits of service learning benefits of an ITPA program. Our results indicate that ITPA students actively participate in the learning process, which leads to development of their problem-solving, knowledge applica-tion, and communication skills. Moreover, students, through the active learning in the ITPA program, gain and retain discipline knowledge in individual taxation. These positive learning outcome benefits enrich students’ educational expe-rience in the accounting program. The skills and knowledge gained, furthermore, carry long-term benefits to their future career in the accounting profession.

Future researchers can apply the multidimensional as-sessment proposed by this study to other income tax assistant programs to test the generalizability of the results and conclu-sions presented. The multidimensional assessment can also be applied to other service learning programs for adminis-trators and faculty to provide reliable data on student learn-ing outcomes directly related to service learnlearn-ing initiatives. To further enrich the learning experience and augment the value added to participating students, income tax assistance programs can extend their services to a more diverse audi-ence preparing tax returns beyond the low-income threshold.

Besides, to facilitate learning-based assessment and to bet-ter match the learning objectives of the subject matbet-ter, the learning outcomes aimed by income tax assistance programs can surpass the common core competencies such as inter-personal skills and problem-solving skills and progress into tax-specific learning outcomes.

While having a close-to-real-world complex learning en-vironment is an objective of a service learning program such as ITPA, it creates a challenging task for students to provide professional services to a diverse set of community mem-bers. Students’ experience in overcoming the stress of reality may contribute to the increase in their perceived confidence in practical and problem-solving skills. Though involvement in this service learning activity may be time consuming and seem to disrupt student learning, students are, in fact, better equipped to enter into challenging situations that a complex real world often brings about.

REFERENCES

American Institute of Certified Public Accountants (AICPA). (1999). Core competency framework for entry into the accounting pro-fession. Retrieved from http://www.aicpa.org/interestareas/accounting-education/resources/pages/corecompetency.aspx

Astin, A. W., & Sax, L. J. (1998). How undergraduates are affected by service participation.Journal of College Student Development,39, 251–263. Ayers, L., Gartin, T. L., Lahoda, B. D., Veyon, S. R., Rushford, M., &

Nei-dermeyer, P. E. (2010). Service learning: Bringing the business classroom to life.American Journal of Business Education,3(9), 55–60.

Christensen, A. L., Schmidt, D., & Wisner, P. S. (2010). Assessing ser-vice learning outcomes for students participating in VITA programs. Ad-vances in Accounting Education: Teaching and Curriculum Innovations, 11, 171–195.

Clovey, R., & Oladipo, O. (2008). The VITA program: A catalyst for improv-ing accountimprov-ing education: Certified public accountant.The CPA Journal, 78(12), 60–65.

Crowe, D. C. (2003).Service-learning assessment in management educa-tion: The development of a protocol. (Doctoral dissertation). Saint Louis University, St. Louis, MO.

Doyle, P. E., Matt, M. W., & Owens, B. T. (2005). A student perspective on the IRS’s VITA program.The CPA Journal,75, 44–47.

Drougas, A., & Harrington, S. (2011). Using VITA service learning ex-periences to teach hypothesis testing and p-value analysis.Journal of Instructional Pedagogies,6, 1–15.

Eyler, J. S., & Giles, D. E. Jr. (1999). Where’s the learning in service-learning?San Francisco, CA: Jossey-Bass.

Eyler, J. S., Giles, D. E., Stenson, C. M., & Gray, C. J. (2001).At a glance: What we know about the effects of service learning on college students,

faculty, institutions, and communities(3rd ed.). Nashville, TN: Vanderbilt University.

Flannery, B. L., & Pragman, C. H. (2008). Working toward empirically-based continuous improvements in service learning.Journal of Business Ethics,80, 465–479.

Gallagher, S. H. (2007).A qualitative research study of service learning in three undergraduate business courses. (Doctoral dissertation). University of Massachusetts Lowell, Lowell, MA.

Gujarathi, M. R., & McQuade, R. J. (2002). Service-learning in business schools: A case study in intermediate accounting course.Journal of Ed-ucation for Business,77, 144–150.

Hervani, A., & Helms, M. M. (2004). Increasing creativity in economics: The service learning project.Journal of Education for Business,79, 267–274. Intuit. (2015). TurboTax, freedom edition. Retrieved from

https://turbotax.intuit.com/taxfreedom/

Kenworthy-U’ren, A. L. (2008). A decade of service-learning: A review of the field ten years after JOBE’s seminal special issue.Journal of Business Ethics,81, 811–822.

Klink, R., & Athaide, G. (2004). Implementing service learning in the principles of marketing course. Journal of Marketing Education, 26, 145–153.

Levitt, C., & Schriehans, C. (2010). Adding a community university ed-ucational summit (CUES) to enhance service learning in management education.Journal of Instructional Pedagogies,3, 1–11.

Moely, B. E., McFarland, M., Miron, D., Mercer, S., & Ilustre, V. (2002). Changes in college students’ attitudes and intentions for civic involve-ment as a function of service-learning experiences.Michigan Journal of Community Service Learning, 9,18–26.

The Pathways Commission. (2012).Charting a national strategy for the next generation of accountants. Retrieved from http://commons.aaahq.org/ files/0b14318188/Pathways Commission Final Report Complete.pdf Poon, P., Chan, T. S., & Zhou, L. (2011). Implementation of service-learning

in business education: Issues and challenges.Journal of Teaching in In-ternational Business,22, 185–192.

Purcell, T. J. (2009). Service learning and tax: More than vita.The Tax Adviser,40, 550–552.

Rama, D. V., Ravenscroft, S. P., Wolcott, S. K., & Zlotkowski, E. (2000). Service-learning outcomes: Guidelines for educators and researchers. Is-sues in Accounting Education,15, 657–692.

Rose, J. M., Rose, A. M., & Norman, C. S. (2005). A service-learning course in accounting information systems.Journal of Information Systems,19, 145–172.

Warren, J. L. (2012). Does service-learning increase student learning?: A meta-analysis.Michigan Journal of Community Service Learning,18, 56–61.

Yorio, P. L., & Ye, F. (2012). A meta-analysis on the effects of service-learning on the social, personal, and cognitive outcomes of learning. Academy of Management Learning & Education, 11, 9–27.

Zamora, V. L. (2012). Using a social enterprise service-learning strategy in an introductory management accounting course.Issues in Accounting Education,27, 187–202.