Refer to Important disclosures in the last page of this report

Stock DataTarget price (Rp) Rp2,100

Prior TP (Rp) Rp2,950

Shareprice (Rp) Rp1,330

Upside/downside (%) +57.9

Sharesoutstanding (m) 6,200

Marketcap. (US$ m) 542

Government of Indonesia 51.0%

Public 49.0%

Estimate Change; Vs. Consensus

2018 2019 PT Indo Premier Sekuritas [email protected] +62 21 5793 1168

Modest 3Q18, still in-line

Earnings grew by 53% in 9M18, in-line with our forecast.

Resilient 9M18 contract achievement (+2% yoy).

To invest in Energy and Water treatment projects.

Maintain Buy albeit lower TP of Rp2,100 (Target P/E of 8.0x).

Modest 3Q18 bottom line with improved margin.

PTPP reported 9M18

Earnings of Rp865bn (+53% yoy), which came in-line with ours (54%), but

slightly below consensus FY18F estimate (50%). Net margin were squeezed to

5.9% in 9M18 (9M17: 7.2%) due to increase in interest expense of Rp464bn

(+95% yoy) and non-controlling interest portion of 22% (9M17: 11%). However,

PTPP booked modest 3Q18 earnings of Rp395bn (+22% qoq, -5% yoy), forming

24% of our FY18F forecast. In addition, 3Q18 net margin was improved to 7.5%

in 3Q18 (vs. 2Q18: 5.6%) given lower opex and increase in other income of

Rp144bn (-39% qoq) and Rp186bn (+85% qoq), respectively.

The only SOE contractor with positive new contract growth.

PTPP booked

new contract of Rp32.5tn in 9M18 (+2% yoy), forming 66% of company’s FY18

guidance of Rp49tn. We are confident that PTPP will be able to achieve our FY18F

target of Rp48tn given new contract pipeline of Rp21.3tn in 4Q18. PTPP will need

77% winning rate to achieve company’s FY18F contract target of Rp49tn. As of

8M18, PTPP has total orderbook of Rp80tn, which translate to 3.5x trailing

12-month sales, providing strong profitability for the next 3 years.

Diversify to Energy and Water treatment projects.

Through it’s subsisdiary,

PP Energi has acquired 95% of oil and fuel storage company in Palembang, PT

Odira Energy. PTPP plans to construct fuel storage in Nipa Island with total

investment of US$400mn. In addition, PTPP is also planning to create a JV to

develop 200MV power plant in Philippine with total investment of Rp4tn. PP Energi

is currently developing another power plant in Solo which will soon reach financial

closing and signing of power purchase agreement (PPA). On the other hand, PTPP

has 3 water treatment projects in their pipeline which located in Bekasi, Bali, and

Tangerang Selatan.

Maintain Buy with TP of Rp2,100 (from Rp2,950).

Given in-line 9M18

earnings and new contract achievement, we maintain our positive stand on PTPP

as one of our top picks in construction sector. As of 9M18, PTPP has the lowest

DER of 0.8x among SOE contractor peers (Industry average: 1.4x). However, we

reduced our target price for PTPP to Rp2,100, based target FY18F P/E of 8.0x as

we raise our risk free rate to 8.5% (from: 7%). Key risk to our call might come

from lower than expected new contract achievement due to infrastructure projects

tender delays.

Pembangunan Perumahan

(

PTPP IJ

)

01 November 2018

Results Note

Source: PTPP, IndoPremier Share Price Closing as of : 31-October-2018

2

Refer to Important disclosures in the last page of this report

Fig. 1: Revenue by segment Fig. 2: 9M18 revenue by segments

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Order book to grow by 7% CAGR in FY17A-FY20F Fig. 4: 9M new contract achievements

Source: Company, IndoPremier Source: Company, IndoPremier

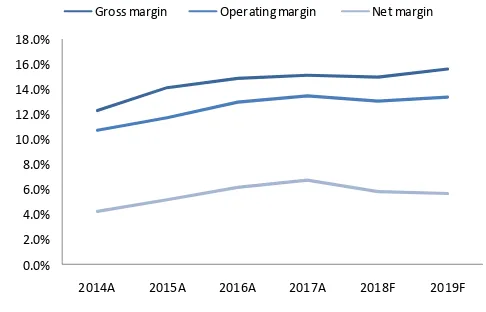

Fig. 5: PTPP has the lowest DER among SOE peers Fig. 6: Margin to improve given property and EPC contribution

Source: Company, IndoPremier Source: Company, IndoPremier

0%

2014A 2015A 2016A 2017A 2018A 2019A 2020A

(Rp Bn)

Construction EPC Property and realty

Equipment rent Precast growth

65%

20% 12%

Construction EPC Property and realty

Equipment rent Precast Energy

Infrastructure

2014A 2015A 2016A 2017A 2018F 2019F 2020F

Carry over New contract

(Rp bn)

WSKT ADHI WIKA PTPP

(x)

WSKT ADHI WIKA PTPP

0.0%

2014A 2015A 2016A 2017A 2018F 2019F

3

Refer to Important disclosures in the last page of this report

Fig.7: 9M18 earnings result

(Rp bn) 9M18 9M17 YoY 3Q18 2Q18 QoQ FY17/ ours FY17/ consensus

Revenue 14,787 13,762 7% 5,280 5,824 -9% 53% 55%

Gross profit 2,228 1,994 12% 765 905 -15% 53% 54%

Operating profit 1,811 1,701 6% 732 710 3% 50% 55%

Net profit 875 990 -12% 395 324 22% 54% 50%

Gross margin 15.1% 14.5% 14.5% 15.5%

Operating margin 12.2% 12.4% 13.9% 12.2%

Net margin 5.9% 7.2% 7.5% 5.6%

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 16,459 21,502 27,938 33,038 36,103

Cost of Sales (14,003) (18,251) (23,748) (27,871) (30,341)

Gross Profit 2,456 3,251 4,190 5,167 5,762

SG&A Expenses (487) (726) (934) (1,158) (1,364)

Operating Profit 1,968 2,525 3,257 4,008 4,398

Net Interest (360) (421) (820) (1,129) (1,077)

Forex Gain (Loss) 22 3 0 0 0

Others-Net 213 328 366 372 382

Pre-Tax Income 1,843 2,436 2,802 3,251 3,703

Income Tax (552) (712) (865) (1,023) (1,127)

Minorities (128) (271) (311) (361) (412)

Net Income 1,163 1,453 1,626 1,867 2,164

Balance Sheet

Cash & Equivalent 9,424 9,587 10,995 13,295 13,524

Receivable 11,154 16,229 18,179 20,065 22,368

Inventory 2,656 2,421 3,239 3,961 4,404

Other Current Assets 1,110 1,671 2,551 2,875 2,871

Total Current Assets 24,344 29,908 34,964 40,197 43,168

Fixed Assets - Net 5,640 9,057 10,508 11,913 12,518

Goodwill 0 0 0 0 0

Non Current Assets 762 1,635 1,552 2,124 2,448

Total Assets 31,233 41,783 48,562 56,053 60,121

ST Loans 1,996 2,154 3,701 4,333 4,710

Payable 10,237 14,506 0 19,415 19,483

Other Payables 1,943 2,731 2,667 3,105 3,413

Current Portion of LT Loans 1,702 1,309 618 713 770

Total Current Liab. 15,879 20,700 24,928 27,565 28,376

Long Term Loans 3,048 5,144 7,314 10,051 10,942

Other LT Liab. 1,510 1,696 2,150 2,624 3,124

Total Liabilities 20,437 27,540 34,392 40,240 42,442

Equity 6,874 7,391 7,391 7,391 7,391

Retained Earnings 2,922 4,063 5,257 6,637 8,241

Minority Interest 1,000 2,789 1,527 1,790 2,053

Total SHE + Minority Int. 10,796 14,243 14,175 15,817 17,684

Total Liabilities & Equity 31,233 41,783 48,567 56,057 60,126

5

Refer to Important disclosures in the last page of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 1,291 1,724 1,937 2,229 2,575

Depr. & Amortization 526 650 649 674 655

Changes in Working Capital (406) (1,139) (213) (1,295) (2,561)

Others 705 561 592 1,099 957

Cash Flow From Operating 2,116 1,796 2,965 2,707 1,627

Capital Expenditure (3,576) (4,939) (2,018) (2,652) (1,584)

Others (114) (370) (305) (251) (126)

Cash Flow From Investing (3,690) (5,309) (2,322) (2,902) (1,709)

Loans 3,068 1,861 3,026 3,463 1,325

Equity 4,414 0 0 0 0

Dividends (148) (307) (436) (488) (560)

Others 508 1,838 (1,739) (471) (387)

Cash Flow From Financing 7,842 3,392 851 2,505 378

Changes in Cash 6,268 (120) 1,494 2,310 296

Financial Ratios

Gross Margin (%) 14.9 15.1 15.0 15.6 16.0

Operating Margin (%) 12.0 11.7 11.7 12.1 12.2

Pre-Tax Margin (%) 11.2 11.3 10.0 9.8 10.3

Net Margin (%) 7.1 6.8 5.8 5.7 6.0

ROA (%) 4.6 4.0 3.6 3.6 3.7

ROE (%) 14.6 11.6 11.4 12.5 12.9

ROIC (%) 9.8 9.2 7.8 7.3 7.3

Acct. Receivables TO (days) 85.4 95.8 93.3 89.5 89.3

Acct. Receivables - Other TO (days) 136.2 136.6 131.5 121.7 125.2

Inventory TO (days) 5.4 7.2 8.4 7.7 7.3

Payable TO (days) 236.2 247.4 249.4 244.6 234.0

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 62.5 60.4 82.1 95.4 92.9

Interest Coverage Ratio (x) 0.2 0.3 0.3 0.3 0.3

Net Gearing (%) (22.0) (5.5) 6.4 13.4 18.3

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS