Keputusan Investasi dalam

Manajemen Bisnis

Keputusan Investasi dalam

Manajemen Bisnis

Peranan Investasi dalam

Manajemen Keuangan

Apa yang Dimaksud dengan

Manajemen Keuangan?

Tujuan Investasi Perusahaan

Organisasi dari Fungsi Investasi

Apa yang Dimaksud dengan

Manajemen Keuangan?

Berkaitan dengan

Pengadaan

, pendanaan,

dan

pengelolaan

aset

dengan beberapa

overall

goal

yang telah

Kebijakan Investasi

Berapa ukuran perusahaan yang

optimal?

Jenis aset apa yang perlu

diadakan?

Aset apa (jika ada) yang harus

INVESTASI PERUSAHAAN 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 35,000,000 40,000,000

Kebijakan Pendanaan

Jenis pendanaan apa yang paling baik?

Campuran pendanaan bagaimana yang

paling baik?

Bagamana dengan Kebijakan Dividend?

Menentukan bagaimana assets (di

NILAI PASAR TOTAL HUTANG 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 300,000,000 350,000,000

Kebijakan Pengelolaan

Aset

Bagaimana memanaje existing assets

efficiently

?

Manajer Keuangan memiliki tingkat

tanggungjawab yang berbeda-beda

atas aset perusahaan.

Penekanan terbesar lebih pada

current

asset management

daripada

fixed asset

NILAI PENGGANTIAN ASET 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000

Apa yang Menjadi Tujuan

Investasi Perusahaan?

Memaksimumkan

kemakmuran

Pemegang Saham!

Penciptaan nilai terjadi saat kita

memaksimumkan harga saham

NILAI PASAR EKUITAS 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000

Beberapa Perspektif Berbeda dari

Tujuan Investasi Perusahaan

Dapat saja meningkatkan laba saat ini

namun merusak nilai perusahaan (misal,

menunda maintenance, menerbitkan

saham biasa utk didepositokan, dsb.).

Memaksimumkan Laba

Memaksimumkan Laba Setlh Pajak.

Tidak menentukan timing atau durasi dari expected

returns.

Mengabaikan perubahan pada tingkat risiko

perusahaan.

Memaksimumkan

Earnings per Share

Memaksimumkan laba setlh pajak dibagi

dengan jml saham beredar.

Masalahnya

Kelebihan dari Memaksimumkan

Kemakmuran Pemegang Saham

Telah Mempertimbangkan:

Laba dan

EPS baik saat ini maupun masa

depan

;

timing, lamanya, dan risiko

dari laba dan EPS

;

kebijakan

dividend

; serta faktor-faktor lain

yang relevan.

Jadi,

share price

dapat dipandang

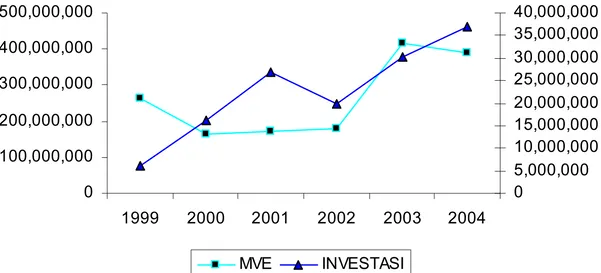

GRAFIK INVESTASI DAN NILAI PASAR EKUITAS 200 EMITEN BEJ

(DATA DALAM JUTAAN RUPIAH)

0

1999 2000 2001 2002 2003 2004

Bentuk Perusahaan

Modern

Terdapat PEMISAHAN antara

pemilik dan pengelola.

Modern Corporation

Peran Management

Seorang

agent

adalah individu yag

diberi wewenang oleh orang lain,

yang disebut principal, untuk

bertindak atas nama principal tsb.

Management betindak sebagai

agent

bagi pemilik

Teori Agency

Teori Agency

merupakan cabang

ilmu ekonomi yang berhubungan

dengan perilaku para

principals

dengan para

agents

mereka.

Jensen dan Meckling membangun

Teori Agency

Incentives

tsb antara lain mencakup

opsi saham

,

penghasilan tambahan

,

serta

bonus

.

Principals harus menyediakan

DIVIDEND YANG DIBAYARKAN 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000

ARUS KAS 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

-10,000,000 0 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000

PENJUALAN BERSIH 200 EMITEN BEJ TAHUN 1999-2004 (DATA DALAM JUTAAN RUPIAH)

0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 300,000,000 350,000,000 400,000,000

Tanggung Jawab Sosial

Memaksimumkan kemakmuran pemegang saham

tidak bertentangan bagi perusahaan untuk memiliki

taggung jawab sosialnya.

Karena produk / jasa yang dihasilkan perusahaan

bersifat baik private maupun social.

Oleh karena itu shareholder wealth maximization

Pengorganisasian Fungsi

Manajemen Keuangan

Board of Directors

President

(Chief Executive Officer)

Vice President Operations

Vice President Marketing

Treasurer

VP of Finance

Controller

Preparing Fin Stmts

Checklist Manajemen

Keuangan

Investment

NPV, IRR, PI, GPM, NPM

Performance

MVE, EPS, PBV, PER, ROI, ROA, ROE

Financing

BUILDING BLOCKS OF MODERN

FINANCE THEORY

1. Savings and Investment in

Perfect Capital Markets

Irving Fisher (1930) shows how capital markets

increase the utility both of economic agents

with surplus wealth (savers) and of agents with investment opportunities that exceed their own wealth (borrowers) by providing each party

with a low-cost means of achieving their goals.

The Fisher Separation Theorem demonstrates

that capital markets yields a single interest rate that both borrowers and lenders can use in

2. Portfolio Theory

Harry Markowitz (1952): “don’t put all your eggs

in one basket”.

Markowitz shows that as you add assets to an

investment portfolio the total risk of that portfolio – as measured by the variance (or standard deviation) of total return – decline continuously, but the expected return of the

portfolio is a weighted average of the expected returns of the individual assets. In other words, by investing in portfolio rather than in

2. Portfolio Theory

His primary theoretical contribution was to

prove that the unique, individual variability in an asset’s return (unsystematic risk) shrinks to insignificance as that asset’s weight in a

2. Portfolio Theory

Efficient Portfolio: risk is minimized for any

given level of expected return or, conversely, where return is maximized for any given level of risk.

The theory, however, did not in and of itself

constitute a useful positive economic theory describing how capital markets quantify and price financial risk. That achievement would come a decade later, when Sharpe (1964)

would add two critical pieces to the Markowitz efficient portfolio to develop (with Lintner

3. Capital Structure Theory

Modigliani and Miller (1958)

The central point of the M&M model is that the

economic value of the bundle of assets owned by a firm derives solely from the stream of

operating cash flows those assets produce. It is the stream of operating cash flows (profits) expected to be generated by those assets that creates value – market participants will

3. Capital Structure

Theory

M&M’s Proposition I:”the market value of any firm

is independent of its capital structure and is given by capitalizing its expected return at the rate ρ appropriate to its risk class”.

M&M’s Proposition II: If the expected return on

the firm’s assets is the constant ρ, then the

3. Capital Structure Theory

Taken together, the two propositions establish

that capital structure is irrelevant in a perfect capital market and the required return on a

given firm’s equity is computed directly from its debt-to-equity ratio and the required return for firms of its risk class.

Since 1958, finance theorists have examined

how relaxing first one and then another assumption affects the capital structure

irrelevance results. The model held up well until corporate taxes, personal taxes, and

3. Capital Structure Theory

The development of agency cost and

asymmetric information models in the

1970s also led to a modification of the

basic M&M model, but even today – after

almost five decades of intensive

theoretical and empirical research – we

can offer no simple, unambiguous answer

to the question, “does capital structure

4. Dividend Policy

Miller and Modigliani (1961)

M&M shows that holding a firm’s investment

policy fixed, the payment of cash dividends

cannot affect firm value in a frictionless market because whatever the firm pays out in dividends it must make up by selling new equity.

Cash flow identity: total cash inflows must equal

5. Asset Pricing Models

Finance became a full-fledged scientific

discipline in 1964 when Sharpe published his paper deriving CAPM.

The CAPM assumes that investors hold

well-diversified portfolio within which the

unsystematic risk of individual assets is

unimportant. Systematic risk, o.t.o.h., refers to an asset’s (or portfolio’s) sensitivity to economy

5. Asset Pricing Models

Sharpe’s main contribution was to uniquely

define systematic risk and to specify exactly how investors can trade off risk and return. He did this by assuming investors can either

invest in risky assets, such as common

stocks, or in a risk-free asset, such as T-bill.

Sharpe’s other contribution was to point out

that, in equilibrium, every asset must offer an expected return that is linearly related to the covariance of its return with expected return on the market portfolio. Mathematically, the

5. Asset Pricing Models

Ross’s (1976) Arbitrage Pricing Theory (APT)

holds that the expected return on a given asset is based on that asset’s sensitivity to one or more systematic factors.

The sensitivities of an asset’s return to each

factor’s realization were called factor loading, and preliminary research suggested that most common stocks were significantly influenced by between three and five factors.

A major problem with the APT, which is still

not solved, is that there is no prior

6. Efficient Capital Market Theory

Fama (1970) presents both a statistical and a

conceptual definition of an efficient capital

market, where efficiency is defined in terms of the speed and completeness with which

capital markets incorporate relevant information into security prices.

In a weak form efficient market, security prices

6. Efficient Capital Market Theory

Research has unambiguously supported

weak form efficiency in almost all major U.S. financial markets.

In a semi-strong-form efficient market,

security prices reflect all relevant, publicly-available information. This is stronger than weak form efficiency, in that it predicts that security prices will always reflect relevant historical information, and will react fully and instantaneously whenever new

6. Efficient Capital Market Theory

In a

strong-form

efficient market, security

7. Option Pricing Theory

Black and Scholes (1973) published an

article describing the model for pricing stock options.

The Black-Scholes Option Pricing Model

(OPM) was a genuine breakthrough because it provided a closed-form solution for

pricing put and call options that relies solely on five observable (or at least readily

calculable) variables; the exercise price of the option, the current price of the firm’s

risk-7. Option Pricing Theory

Very quickly it was discovered that a variety of

systematic biases were present in the pricing model, particularly when it was used to price deep in-the-money and out-of-the-money

options (where the current stock price was, respectively, much greater than or much less than the exercise price of the option.

The basic OPM assumes that stocks do not pay

dividends, and can yield significant pricing

7. Option Pricing Theory

The OPM was developed for European options

– which can only be exercised on the day the option expires – but virtually all real options traded are American options that can be

exercised at any time prior to and including the expiration date.

Since an option gives the owner the right, but

not the obligation, to exercise a trade, it is an ideal tool to use for many hedging activities

8. Agency Theory

The fundamental contribution of the agency

cost model of the firm put forth by Jensen and Meckling (1976) is that it incorporates human nature into a cohesive model of corporate

8. Agency Theory

It is a model that relies on rational behavior

by self-ineterested economic agents who understand the incentives of all the other contracting parties, and who take steps to protect themselves from predictable

exploitation by these parties.

Residual loss, the dollar value of the total

8. Agency Theory

Jensen and Meckling fleshed out their model by

demonstrating both how issuing outside debt can help overcome the agency costs of issuing equity, and how the presence of too much debt can generate an entirely different set of agency problems. This helped convert their work into a full-fledged model of corporate capital

structure, as well as one of corporate

8. Agency Theory

Perhaps the most important application of the

agency cost model is in explaining the

corporate control contests that burst on the scene so dramatically during the 1980s. By viewing the takeover battles of this period as contests between rival management teams for control of corporate resources, it is easy to

8. Agency Theory

(2) why potential acquirers might be willing and

8. Agency Theory

Several aspects of the takeover battles of the

1980s, especially the frequency with which target firm managers and directors adopted value-reducing defenses such as ”poison

pills” and other ”shark repellents,” can only be

explained with an agency cost model that explicitly recognizes the conflict of interest between corporate managers and

shareholders.

Another very important vein of academic

research concerning agency costs has

9. Signaling Theory

Signaling theory was developed in both the

economics and finance literature to explicitly account for the fact that corporate insiders (officers and directors) generally are much

better informed about the current workings and future prospects of a firm than are outside

9. Signaling Theory

Because of the asymmetric information

problem, investors will assign a low average quality valuation to the shares of all firms. In the language of signaling theory, this is

referred as a pooling equilibrium since both

high and low quality firms are relegated to the same valuation “pool”.

Obviously, high-quality firm managers have

9. Signaling Theory

When investors understand the incentives,

they would assign high values to firms that paid high dividends and would assign low valuations to firms that either paid low

dividends or paid none at all. This result is referred to as a separating equilibrium

because investors are able to assign separate, and economically rational,

valuation to high- and low-quality firms. It is also a stable equilibrium, in spite of its

deadweight cost in terms of foregone

investment, because high-quality firms are able to achieve the higher valuation they

9. Signaling Theory

Signaling models, however, have not fared well

in empirical testing because they typically

predict exactly the opposite of what is actually observed corporate behavior. For example,

signaling models typically predict that the most promising (in terms of growth prospects) firms will also pay the highest dividends and will have the highest debt-to-equity ratios. In actual

practice, however, rapidly-growing technology companies tend not to pay any dividends at all while mature companies in stable industries usually pay out most of their earnings as

10. The Modern Theory of

Corporate Control

Motivated by M&A in the 1980s

The first major exposition of a truly modern

theory of corporate control was presented by Bradley (1980), who studies the stock price

performance of companies that are the targets of takeover bids.

Bradley documents that these shares increase in

value by approximately 30% immediately after a

tender offer (a publicly announced offer to buy

shares at a fixed price from anyone who

“tenders” their shares) is announced, and then

10. The Modern Theory of

Corporate Control

Bradley also documents that those shares

which are not purchased in a successful

takeover, as will always occur if a bidder only purchases, say, 51% of the target’s shares, drop in price back towards their initial value immediately after the takeover is completed.

Prior to Bradley’s work, most observers

assumed that bidding firms acquired majority stakes in target firms either to loot the assets of the target company or to profit from an

10. The Modern Theory of

Corporate Control

Bradley’s results are inconsistent with either of

these explanations. Since unpurchased shares remain above their pre-bid price even after a

takeover is completed, it is clear that successful bidders are not looting their acquired

companies because this would have caused the price of unpurchased shares to fall far below

their pre-bid price. On the other hand, since the price of unpurchased shares falls below the

10. The Modern Theory of

Corporate Control

Bradley’s theoretical model assumes that

bidding firm managers will launch a tender

offer primarily in order to gain control over

the assets and operations of a target firm

that is currently being run in a sub-optimal

manner. Once the bidder gains control of

the target, a new, higher valued operating

strategy will be implemented and the

11. The Theory of Financial

Intermediation

Financing through capital markets maybe

costly and using financial intermediation maybe the alternatives.

In academic circles, an early description of the

informational advantage of financial

intermediation was provided in the article by Leland and Pyle (1977). Several other articles that document large, negative returns to

11. The Theory of Financial

Intermediation

James (1987) provides an important

contribution to this literature by

documenting positive returns to corporate

shareholders following the announcement

that a firm has obtained a loan from a

12. Market Microstructure

Theory

Market microstructure is the study of how

securities markets set prices, compensate market makers, and incorporate private information into equilibrium price level.

Microstructure research can be classified into

two separable, though related, streams of analysis. (1) Market structure/spread models

which study the relative merits of different market structure (monopoly specialist versus multiple

12. Market Microstructure

Theory

(2) Price formation models analyze how

private information is incorporated into

securities prices, and study how trade

size, aggregate trading volume, and price

levels are related.

Motivating articles: Ho and Stoll (1981),

SEVERAL BASIC PRINCIPLES

In pricing financial assets, only

systematic risk matters.

Emphasize investment rather than

financing.

Emphasize cash flows rather than

accounting profits.