25 (2001) 35}83

Life-cycle consumption under social

interactions

Michael Binder

!,

*

, M. Hashem Pesaran

",#

!Department of Economics, University of Maryland, Tydings Hall, College Park, MD 20742, USA "Faculty of Economics and Politics, University of Cambridge, Austin Robinson Building,

Sidgwick Avenue, Cambridge, CB3 9DD, UK #University of Southern California, USA

Abstract

In this paper we examine how social interactions a!ect consumption decisions at various levels of aggregation in a life-cycle economy made up of peer groups. For this purpose, we consider two analytically solvable life-cycle models, one under certainty equivalent behavior and one under prudence, and explicitly allow for three di!erent forms of social interactions in peer groups, namely conformism, altruism, and jealousy. We show that whether social interactions have any e!ects on individuals' optimal consumption decisions critically depends on intertemporal rather than static consider-ations. This is true regardless of whether individuals'preferences are time separable or exhibit habit formation, and whether information within peer groups is homogeneous or disparate. It implies that analyzing the e!ects of social interactions in static rather than intertemporal settings is likely to be misleading. We also show that social interactions, when coupled with either habit formation or prudence, can signi"cantly strengthen the e!ects of habit formation or prudence in the direction of resolving two well-known puzzles in the literature on the permanent income hypothesis, namely excess smoothness and excess sensitivity. ( 2001 Elsevier Science B.V. All rights reserved.

JEL classixcation: D91; E21

Keywords: Life-cycle model; Social interactions; Habit formation; Disparate infor-mation; Prudence

*Corresponding author. Tel.:##(301)405-3475; fax:##(301)405-3542. E-mail address:[email protected] (M. Binder).

1As pointed out, for example, by Kapteyn and Wansbeek (1982), there are also extensive literatures in psychology and sociology stressing the importance of such social interactions in individuals'preferences.

2The"ndings of Clark and Oswald (1996) are in line with a number of other studies. See, for example, Easterlin (1974), Kapteyn and Wansbeek (1982), and Frank (1985) for a discussion of further evidence on the role of individuals'relative economic standing in their peer or social reference group for their self-reported levels of happiness.

1. Introduction

It has long been recognized that an individual's utility, in addition to his/her own current and past consumption decisions, may also be in#uenced by a var-iety of social interactions such as conformism, altruism, or jealousy towards peers' behavior. Pioneering contributions to this literature include Veblen's (1899) analysis of&conspicuous consumption'and Duesenberry's (1949) relative consumption hypothesis.1 Among the di!erent forms of social interactions, conformism, also known as the&band-wagon e!ect', has been emphasized as an important factor for individuals' decisions, for example, by Leibenstein (1950) and Jones (1984). Other forms of social interactions with important implications for consumption decisions in peer groups include altruism and jealousy. Becker (1981), for example, argues that the family is a peer group within which altruism is common, both due to the fact that marriage is often founded on altruistic motives, and also because the reference peer group is small and there are therefore considerable possibilities for interactions. Outside the context of the family, Clark and Oswald (1996), using a survey of British workers, for example,

"nd that levels of job satisfaction reported by workers are at best weakly

correlated with workers'own income, but are signi"cantly negatively correlated with their co-workers'income, suggesting that jealousy could be an important factor in interactions among these workers.2

3See, for example, Pollak (1976), Jones (1984), Kapteyn et al. (1997), and Clark and Oswald (1998) for in#uential studies of the e!ects of social interactions in static settings.

4The same holds true when social interactions are coupled with prudence.

5Throughout this paper we follow Deaton (1992) and refer to the life-cycle model with a represen-tative, in"nitely-lived, and self-centered consumer having quadratic preferences and a rate of time preference that is constant and equal to the market real rate of interest as the permanent income hypothesis.

6See, for example, Deaton (1992) and Muellbauer and Lattimore (1995) for reviews of the empirical literature on excess smoothness and excess sensitivity of consumption at the economy-wide level.

and jealousy, and contrast the resultant decision rules to those in the absence of social interactions. We show that whether social interactions have any e!ects on individuals'optimal consumption decisions critically depends on intertemporal rather than static considerations. This is true regardless of whether individuals'

preferences are time separable or exhibit habit formation, and whether informa-tion within peer groups is homogeneous or disparate. If individuals decide to keep up with the Joneses, then they do so to adapt theirlifetime consumption proxlesto those of their peers. This implies that analyzing the e!ects of social interactions in static rather than intertemporal settings, as is often done in the literature, is likely to be misleading.3

We also show that social interactions, when coupled with habit formation, can have important implications for consumption at the economy-wide level.4

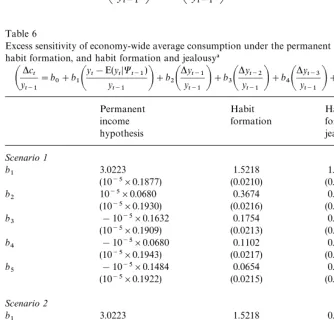

In particular, social interactions can signi"cantly strengthen the e!ects of habit formation in the direction of resolving two well-known puzzles in the literature on the permanent income hypothesis, namely excess smoothness and excess sensitivity.5Allowing for habit formation as well as social interactions, econ-omy-wide average consumption may be signi"cantly smoother than economy-wide average labor income, even if permanent labor income is not smoother than current labor income. This is in contrast to the predictions of the per-manent income hypothesis, but in line with the consensus in the empirical literature, and addresses the excess smoothness puzzle. Furthermore, social interactions can signi"cantly strengthen the sensitivity of changes in economy-wide average consumption to anticipated changes in economy-wide average labor income, helping to overcome the excess sensitivity puzzle.6

7Note that in our notation individuals are uniquely identi"ed in the economy as a whole bythe combinationof the indicesiandh. It is also worth noting that we will take the peer groups as given, and thus will not examine the factors that determine the formation of peer groups.

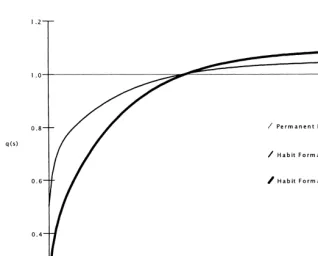

pro"les of individual-speci"c and economy-wide consumption levels as the ones

implied by socially motivated individuals.

The remainder of this paper is organized as follows: Section 2 sets out the life-cycle model under social interactions, distinguishing between conformism and altruism/jealousy. Particular attention will be paid to the speci"cation of individuals'labor income processes and the structure of their information sets. Section 3 discusses the conceptual di$culties involved in determining the optimal consumption decisions in a life-cycle model under social interactions. These di$culties are due to what we call &ex ante belief indeterminacies'. We discuss alternative ways of resolving these di$culties, and derive the individual-speci"c optimal consumption decisions under both homogeneous and disparate information sets, and also allowing for habit formation. We then use these decision rules to analyze the conditions under which social interactions a!ect individuals'consumption decisions. We show, in particular, that whether indi-viduals in any given period attempt to keep up with their peers is determined by intertemporal considerations, re#ecting the shape of their peers' lifetime con-sumption pro"les. Section 4 relaxes the assumption of certainty equivalence implicit in the analysis of Section 3 and considers the case of individuals motivated by prudence as well as social interactions. Section 5 discusses the aggregate implications of the life-cycle model under social interactions, and shows in particular that social interactions may help to overcome two widely analyzed puzzles associated with the permanent income hypothesis, namely excess smoothness and excess sensitivity. Finally, Section 6 provides a brief summary of the main"ndings of the paper, and concludes with some sugges-tions for future research.

2. A life-cycle model under social interactions

We consider an economy composed of a large number of peer groups. Each peer group, indexed byh,h"1, 2,2,H, in turn consists of a small number of

individuals, indexed by i, i"1, 2,2,Nh.7 Thus, there are a total of N

indi-viduals, N"+Hh

/1Nh, in the economy, with H large. We denote by ciht the consumption expenditure of individualiin peer grouphincurred at the begin-ning of periodt. Average consumption in peer grouphis de"ned by

c ht"

A

1

N h

B

Nh + j/1

c

8See, for example, Kapteyn et al. (1997) for a further discussion of how the weights attached to a particular individual in a peer group may be linked to the individual's social characteristics. Our assumption that the individuals in a peer group apply the same set of weights to weight other individuals'consumption levels simpli"es the exposition, but is also in line with some of the empirical literature.

9As will be seen below, these distributional assumptions are much stronger than what is needed for most of the analytical results of this paper to hold.

and economy-wide average consumption is given by

c t"

A

1

N

B

H + h/1N

hcht. (2)

In arriving at his/her consumption decision, we allow for individuali in peer group h to take account of weighted averages of past as well as anticipated current and future period consumption levels of all other individuals in his/her peer group. We denote this weighted average in period t by c8

ht,~i" +Nh

j/1,jEiujhcjht. It is also convenient to denote weighted average consumption in peer group h that includes the consumption of individual i by c8ht"

+Nh

j/1ujhcjht. Throughout the paper, we assume without loss of generality that+Nh

j/1ujh"1, for allh. Interesting examples of weighting schemes, besides the case of equally placed individuals (so that uih"1/N

h, i"1, 2,2,Nh), include the case where individuals at the tails of a peer group's consumption distribution are attached a weight of zero andc8ht,~i is therefore a measure of average consumption of a middle-band of consumers in the peer group, or when non-zero weights are attached only to the consumption of, say, the top 5% or 10% of the individuals in the peer group.8

We assume that the labor income of individualiin peer grouphreceived at the beginning of periodt,y

iht, is generated by

logy

iht"aih#kt# t + s/1

v

s#miht, (3)

or, in"rst-di!erence form,

*logy

iht"k#vt#*miht, (4) with individual-speci"c random component,aih, economy-wide drift,k, econ-omy-wide random component,v

t, and the residual random component,miht. The random componentsaih,v

t, andmihtare assumed to be mutually independent, i"1, 2,2,Nh,h"1, 2,2,H,t"1, 2,2, and distributed identically as normal

variates with zero means and constant variances:9

a

10The notation&P1 'denotes weak convergence in probability.

The assumption that individual-speci"c labor income follows a random walk enables us to directly contrast our results in this paper to the"ndings of the permanent income hypothesis literature. In contrast to much of this literature, however, we specify the random walk to be geometric rather than arithmetic. While this is arguably more appealing even within a representative agent framework, the geometric speci"cation in our framework is particularly desir-able given its plausible implications for the economy's labor income distribu-tion, in contrast to those of an arithmetic random walk speci"cation. It should also be noted that we have speci"ed individuals' labor income such that the economy-wide shocks,v

t, have permanent e!ects, but not the individual-speci"c shocks,miht. This ensures that the labor income distribution is not continually becoming more dispersed, as would be the case if the individual-speci"c shocks,

miht, had permanent e!ects. In line with our earlier notation for consumption at di!erent levels of aggregation, we will denote unweighted peer group average labor income by y

ht"(1/Nh)+jN/1h yjht, its weighted counterpart by y8ht" +Nh

j/1ujhyjht, and economy-wide average labor income byyt"(1/N)+Hh/1Nhyht. Note thaty

tP1 exp(p2a/2#p2m/2)y8t, wherey8t"exp(kt#+st/1vs), asHPR.10 The wealth level of individualiin peer grouphat the beginning of periodtis denoted byA

iht, withAht denoting the unweighted peer group average,AIht the weighted peer group average, andA

t the unweighted economy-wide average. It will be helpful, in what follows, to decompose the information set of individualiin peer grouphat the beginning of periodt,X

iht, into a&common component', W

t~1, containing all the publicly available information at the

beginning of period t, and a private (or individual-speci"c) component,U iht, which is made up of information that at the beginning of periodtis known only to individualiin peer grouph:

X

iht"Wt~1XUiht. (6)

We assume thatW

t~1andUihtare non-decreasing int, withWt~1in turn being

the union of a component relating to peer grouph,W

h,t~1, and a component

relating to all other peer groups,W

t~1,~h. The information setWh,t~1contains

unweighted and weighted peer group averages of consumption, labor income, and wealth datedt!1 and earlier:

W h,t~1"

Mch,t~1,c

h,t~2,2;c8h,t~1,c8h,t~2,2;yh,t~1,yh,t~2,2;y8h,t~1,y8h,t~2,2;

A

11As will become clear below, the relevant distinction in our model is really whether information withinpeer groups is homogeneous or disparate. We do not draw a distinction between the cases where information is homogeneous within peer groups but disparate across peer groups, and where information is homogeneous both within and across peer groups, as such a distinction is not material to our results.

and W

t~1,~h contains unweighted and weighted peer group averages of con-sumption, labor income, and wealth dated t!1 and earlier for peer groups

l"1, 2,2,H,lOh:

W

t~1,~h" Mc

l,t~1,cl,t~2,2;c8l,t~1,c8l,t~2,2;yl,t~1,yl,t~2,2;y8l,t~1,y8l,t~2,2;

A

l,t~1,Al,t~2,2;AIl,t~1,AIl,t~2,2;l"1, 2,2,H, lOhN. (8)

The private information set,U

iht, of individualiin peer grouphis assumed to contain current and lagged values of his/her consumption, his/her labor income, and his/her beginning-of-period wealth:

U

iht"Mciht,cih,t~1,2;yiht,yih,t~1,2;Aiht,Aih,t~1,2N. (9)

We will distinguish between two di!erent information structures. The informa-tion structure characterized by (6)}(9) will be referred to as the disparate information case. Individuals'information sets will be called homogeneous if the information set of individualiin peer grouphis given by the union of the public information set and allindividuals'private information sets.11We denote the homogeneous information set byX

t:

X t"

H Z h/1

Nh

Z j/1

X

jht. (10)

We model intertemporal consumption choices within each peer group by allowing for the presence of various forms of social interactions in individuals'

12We abstract from possible interaction e!ects between&neighboring'peer groups.

13One might argue, as in Postlewaite (1998), that social interactions arise not because individuals are concerned with their standing in their peer groupper se, but because of the presence of social arrangements that imply that an individual's standing in his/her peer group a!ects the individual's own consumption opportunities. As our interest in this paper will be on the short- to medium-run implications of the life-cycle model (11)}(13), it seems a defensible modelling strategy to incorporate social interactions directly into the utility function even if they arose due to social arrangements, as social arrangements are unlikely to change at such horizons.

14To keep the determination of analytical decision rules for consumption tractable, we assume perfect credit markets and in"nite lifetimes in this paper. For a discussion of the computational di$culties that arise in the solution of a life-cycle model under"nite lifetimes and borrowing constraints, see, for example, Binder et al. (2000).

15We thus allow, in particular, for the rate of time preference,oih, to be equal to the market real rate of interest,r. See the Mathematical Appendix for further details.

his/her peer group.12 Our speci"cation thus embeds &the two major forms of endogenous taste change'(Pollak, 1976): social interactions and habit forma-tion.13 We assume that individuali in peer grouph solves the intertemporal optimization problem:14

max Mcih,t`sN=

s/0

E

A

+= s/0bsihu(c

ih,t`s,cih,t`s~1,c8h,t`s,~i,c8h,t`s~1,~i)DXiht

B

(11) subject to the period-by-period budget constraints,A

ih,t`s"(1#r)Aih,t`s~1#yih,t`s!cih,t`s, s"0, 1,2, (12) the transversality condition,

lim s?=

(1#r)~sE(A

ih,t`sDXiht)"0, (13)

and given initial consumption levels, c

ih,t~1 and c8h,t~1,~i, as well as initial wealth levels, A

ih,t~1 and AIh,t~1,~i. In (11)}(13), uiht"u(ciht,cih,t~1,c8ht,~i, c8

h,t~1,~i) represents individual i's current-period utility function for period t, b

ih"1/(1#oih) (oih'0) represents individuali's constant discount factor,ris the constant market real rate of interest, and E()DX

iht) denotes the mathematical conditional expectations operator. To ensure the existence and non-explosive-ness of the optimal consumption decision rules, we assume that the rate of growth of all individuals' labor incomes is strictly less than r and that

b

16In the absence of social interactions and habit formation, and if information is homogeneous across individuals, our model speci"cations reduce to the quadratic speci"cation in Hall (1978) and the negative exponential speci"cation in Caballero (1990), respectively. The analysis of social interactions in the case of constant relative risk aversion (CRRA) utility is beyond the scope of the present paper. Instead, we consider certainty equivalent and constant absolute risk aversion (CARA) behavior as"rst benchmarks. For a discussion of the type of numerical techniques that would be needed to e!ectively analyze social interactions under CRRA-speci"cations of the current-period utility function, see Binder et al. (2000).

17It has been argued that a drawback of this utility speci"cation is that since individuals'utilities are assumed to change smoothly as the individuals deviate from their social comparison level, the di!erence between the behavior of by intention conformist and of self-centered individuals would necessarily be a matter of degree rather than kind (see, for example, Bernheim, 1994). We show in this paper, however, that if one embeds the utility speci"cation (14) in a life-cycle model, the di!erence between the optimal consumption decisions of by intention conformist and of self-centered indi-viduals does not need to vary smoothly with changes inhih. This is because in a life-cycle model this di!erence critically depends on parameters other thanhihalso.

negative exponential speci"cations of the current-period utility function,u iht.16 Our analysis of conformism will be based on the following quadratic speci" -cation:

u

iht"!

A

12

B

[ciht!gihcih,t~1!cih]2!

A

hih2

B

[ciht!gihcih,t~1!(c8ht,~i!gihc8h,t~1,~i)]2, (14) with gih, cih, and hih being contained in compact sets on [0,1), R` and R`0,

respectively, all de"ned such that individuali's marginal utility is positive and diminishing in c

iht. The parameterhih measures the strength of the desire of individual iin peer group hfor conformism. Our approach to modeling con-formism is similar to Jones (1984) in that it speci"es individuals'preferences as a function of an individual-speci"c component as well as a component repres-enting individuals' desire to keep up with the Joneses.17 The parameter

g

ih measures the strength of individuali's preference for habit formation. The formulation of habit formation in (14) is similar to the speci"cations used, for example, by Muellbauer (1988) and Abel (1990).

We shall analyze the case of altruism/jealousy using both quadratic and negative exponential speci"cations of the current-period utility function. Our analysis of altruism/jealousy under quadratic utility will be based on:

u

iht"!(12)[ciht!gihcih,t~1#qih(c8ht,~i!gihc8h,t~1,~i)!cih]2, (15) withgih,c

ih, andqihbeing contained in compact sets on [0, 1),R`and (!1, 1), respectively, all de"ned such that individuali's marginal utility is positive and diminishing in c

18Our approach to modelling altruism and jealousy is similar to the speci"cations employed in the experimental game literature. See, for example, McKelvey and Palfrey (1992) and Mason and Phillips (1999).

19For simplicity, this speci"cation abstracts from habit formation.

20It is beyond the scope of this paper to discuss in detail how the utility functions (14)}(16) might be derived from an axiomatic representation of preferences. However, it is of interest to note that the utility functions (15) (undergih"0) and (16) satisfy the preference axioms of Ok and Koc7kesen

(1997) for&negatively interdependent utility functions'. In particular, in the terminology of Ok and Koc7kesen, the utility functions (15) and (16) are continuous, decomposable, homothetic, additive

with respect to the external e!ect, and exhibit nonvanishing absolute income e!ects. The utility function (14) modelling conformism falls outside the class of&negatively interdependent utility func-tions'considered by Ok and Koc7kesen. Development of sets of plausible axioms for utility functions

under conformism and/or habit formation is an interesting topic for future research.

jealousy in individuali's preferences, with an altruistic individual having a posit-iveqih, and a jealous individual having a negativeqih.18It is worth noting that since we allowqih to take both positive and negative values, our analysis allows for situations where some individuals in a peer group are altruistic while others are jealous. The parameterg

ihin (15) again measures the strength of individual i's preferences for habit formation. To allow for prudence, we shall consider the following negative exponential speci"cation of current-period utility of altruis-tic/jealous individuals:19

u

iht"!

A

1i ih

B

exp[!i

ih(ciht#qihc8ht,~i)], (16)

with iih and qih being contained in compact sets on R` and (!1,1), respec-tively. The degree of altruism or jealousy in individuali's preferences is again measured byqih.20

In what follows, we also de"ne the present discounted value of total lifetime resources of individuali in peer grouphby

¸

iht"(1#r)Aih,t~1#

A

=+ s/0

y ih,t`s

(1#r)s

B

, (17)and the weighted group average present discounted value of total lifetime resources by

¸I

ht"(1#r)AIh,t~1#

A

Nh + j/1

=

+ s/0

ujhy jh,t`s

(1#r)s

B

. (18)The existence of the conditional expectations E(¸

ihtDXiht) and E(¸IhtDXiht) is ensured since by assumption the expected rate of growth ofy

21This follows much of the recent social interactions literature. See, for example, Brock and Durlauf (2000).

3. Individual-speci5c optimal consumption decisions under certainty equivalence

In this section, we derive and analyze the implications of the individual-speci"c optimal consumption decisions implied by the life-cycle model of Sec-tion 2 under the quadratic current-period utility speci"cations (14) (conformism) and (15) (altruism/jealousy), for which certainty equivalence does hold.

3.1. The inxnite regress problem

Under the current-period utility functions (14) and (15) the Euler equation for individualiin peer grouphis given by

E

CA

LuihtThe derivation of the marginal utilitiesLu

iht/Lciht andLuih,t`1/Lcihtdepends on how individualiperceives the e!ect of his own consumption decision,c

iht, on the weighted average consumption of all other individuals in his peer group,c8

ht,~i. We abstract from strategic interactions in a game-theoretic sense, and impose the restrictions that E(Lc8h,t`s,~i/Lcih,t`sDX

iht)"0 fors"0,1,2 . Thus, we as-sume that individuals fully take account of the direct e!ect of their own decisions onc8ht, but take all other individuals'consumption decisions as given, treating them as an external e!ect.21The Euler equation (19) can then be re-written as

22See the proof of Proposition 1. While this proof considers the case of homogeneous informa-tion, the part of the proof dealing with the reduction of a fourth-order rational expectations model to a second-order rational expectations model remains valid under disparate information also.

and

1 ih"

G

[1!b

ih(1#r#gih)#b2ih(1#r)gih]/[1#uihhih] if u

iht is given by (14) (conformism), [1!b

ih(1#r#gih)#b2ih(1#r)gih]/[1#(1!uih)qih] if u

iht is given by (15) (altruism/jealousy).

(24)

As is shown in the Mathematical Appendix, upon ruling out explosive indivi-dual-speci"c consumption decisions this fourth-order di!erence equation under rational expectations can be reduced to a second-order rational expectations equation, namely22

[1#b

ih(1#r)gih]ciht!gihcih,t~1!bih(1#r)E(cih,t`1DXiht)!uihcih

"c

ihM[1#bih(1#r)gih]E(c8htDXiht)!gihc8h,t~1

!b

ih(1#r)E(c8h,t`1DXiht)!uihcihN, (25) where

u ih"

G

[1!b

ih(1#r)]/[1#uihhih] ifu

iht is given by (14) (conformism), [1!b

ih(1#r)]/[1#(1!uih)qih] ifu

iht is given by (15) (altruism/jealousy).

(26)

The individual-speci"c optimal consumption decisions,c

iht, can now be ob-tained using the Euler equation (25) and the period-by-period budget con-straints (12). This is, however, complicated by what may be called&ex antebelief indeterminacies': namely the dependence of the optimal consumption decisions onex anteexpectations which are neither observable nor deducible. Consider the Euler equation (25) under either conformism or altruism/jealousy, so that

cihO0. Individual i in peer group h needs to form expectations about the current and future weighted average consumption decisions in his peer group, which in turn requires him to form expectations about the current and future consumption decisions of all other individuals in his peer group. Knowing that all other individuals face the same Euler equation as (25), a natural way for individualiin peer grouphto resolve this di$culty would be to solve (25) for

c

iht, then aggregate over all individuals with their respective weights and take conditional expectations of the resulting expression with respect toX

23See, for example, Binder and Pesaran (1998) for a more formal discussion of the&in"nite regress in expectations'problem and how it arises in multivariate linear rational expectations models under social interactions and disparate information.

24See, for example, Young (1996) for an explicit model of the dynamic process of a convention being formed through the accumulation of precedent.

weighted group average consumption that he needs in order to solve his decision problem. But it is easily seen that such a solution will still be a function of this individual's expectations about the expectations of all other individuals in his peer group, which are unknown at the beginning of period t. The individual might then plausibly try to use (25) and its group-wide analog to determine these expectations. It is readily veri"ed, however, that the individual will only be able to determine these expectations as functions of another set of yet higher-order expectations of all other individuals in his peer group. Therefore, he will be facing an &in"nite regress in expectations' problem which he cannot resolve without further assumptions on how the individuals in the group form expecta-tions about other individuals' consumption decisions. Any solution would depend onex ante unobservable individual expectations.23

We shall consider two approaches to resolve the&in"nite regress in expecta-tions' problem. First, we follow the standard practice in the literature on decision making under social interactions and assume that the information sets across individuals are homogeneous within peer groups. The homogeneity assumption in e!ect allows individuals in each peer group to deduce current and future expectations of all other individuals in their group. This is a rather restrictive assumption and clearly it is desirable to examine the implications of relaxing it. Our second approach therefore follows Binder and Pesaran (1998) who allow the information sets to be disparate within peer groups, but render individuals' expectations deducible for the other individuals in the group by assuming that all individuals in the group, by convention, form their expecta-tions about the decision and forcing variables of other individuals in the group only on the basis of the public information set,W

t~1.24This approach, as will be

seen in more detail below, has the attractive feature that it yields solutions that re#ect the disparity of information across individuals and are consistent with the key property of the rational expectations hypothesis, namely the orthogonality of individual-speci"c expectations errors to the variables in the individual's information set.

3.2. Homogeneous information

We"rst consider the case where information is homogeneous across

Proposition 1 (Individual-speci"c optimal consumption decisions under con-formism, habit formation, and homogeneous information). Suppose(i)the

cur-rent-period utility function is given by (14), and (ii) information sets are

homogeneous. Then the individual-specixc optimal consumption decisions in peer

grouphunder the life-cycle model(11)}(13)are given by

c

ht"(INh!chx@h)~1Kh1(INh!chx@h)ch,t~1

#(I

Nh!chx@h)~1Kh2(INh!chx@h)E(LhtDXt)

#(I

Nh!chx@h)~1Kh3, (27)

where c

ht"(c1ht, c2ht, 2,cNhht)@, Lht"(¸1ht, ¸2ht, 2, ¸Nhht)@,

x

h5(u1h, u2h, 2, uNhh)@, ch"(c1h, c2h, 2, cNhh)@,

c ih"

A

hih

1#(1#u

ih)hih

B

, (28)

I

Nh is the Nh-dimensional identity matrix, Kh1 is a diagonal matrix with its ith

diagonal element given byj

ih, jih"

A

gihb

ih(1#r)2

B

, (29)

K

h2is a diagonal matrix with itsith diagonal element given by/ih,

/ ih"

A

(1#r!g

ih)(bih(1#r)2!1)

bih(1#r)3

B

, (30)andK

h3 is a diagonal matrix with itsith diagonal element given by

d ih"

A

(1!(1#u

ih)cih)(1!bih(1#r))

bihr(1#r)

B

cih, (31)i"1, 2,2,Nh.

(Individual-speci"c optimal consumption decisions under altruism/jealousy, habit formation, and homogeneous information).Suppose(i)the current-period

utility function is given by(15),and(ii)information sets are homogeneous. Then the

individual-specixc optimal consumption decisions in peer grouphunder the

life-cycle model(11)}(13)are given by(27), where

cih"!

A

qih1!u

ihqih

B

, (32)

d ih"

A

(1!u

ihcih)(1!bih(1#r))

bihr(1#r)

B

cih, (33)andjih and/

25Whenbih(1#r)'1, then for the optimal consumption decisions in (27) to be nonnegative regardless of the past consumption levels, it is necessary that individuals'expected present dis-counted values of total lifetime resources are su$ciently large relative to their bliss points. Through-out this paper we assume that this condition is satis"ed.

The proofs of this and all other subsequent propositions are given in the Mathematical Appendix.

Given that the decision rules under conformism and under altruism/jealousy are the same except for the de"nitions ofc

ihanddih, in what follows we focus on the case of conformism. Clearly, the qualitative implications for the case of jealousy are the same as those for conformism, while for the case of altruism the sign ofc

ih is reversed as compared to the case of conformism.

The set of individual-speci"c optimal consumption decisions (27) represents

a"rst-order panel vector autoregression, PVAR(1), with a rich set of testable

within-equation and cross-equation parametric restrictions. To write (27) in a familiar panel vector autoregressive form and understand the dynamic proper-ties of the decision rules, note that under the labor income speci"cation (3) and (5) we have that

E(¸

ihtDXt)"(1#r)Aih,t~1#

A

1#exp(p2m/2!m

iht)(1#g)

r!g

B

yiht. (34)Substituting (34) in (27), and stacking the endogenous variablesc

ihtandAihtfor alli"1, 2,2,Nh in a vectorxht, we have

x

ht"D1hxh,t~1#D2hyht, (35) wherey

ht"(y1ht,y2ht,2,yNhht)@, and the coe$cient matricesD1h andD2h dir-ectly follow from the decision rules (27) and the period-by-period budget constraints (12). It may be veri"ed that the eigenvalues of D

1h are given byg1h,g2h,2,gNhh, 1/[b1h(1#r)], 1/[b2h(1#r)],2, 1/[bNhh(1#r)], which fall

into [0, 1) if 04g

ih(1, i"1, 2,2,Nh, (as we had assumed), and if oih(r, i"1, 2,2,Nh.25 In the case where oih"r (or bih(1#r)"1) for some i, the

PVAR(1) model in (35) will contain unit roots, in addition to the (geometric) unit root iny

iht, and there exists no long-run relationship betweenciht(orAiht) and y

ht. In this case initial assets have permanent e!ects on consumption decisions and even in the long run consumption depends on initial assets as well as on labor income.

their bliss points, with weights determined by the individuals'placement in the peer group (ujh) as well as the strength of their preference for conformism (cjh, and thushjh). Allowing for conformism, habit formation, and patience (oih(r) in general thus signi"cantly alters the qualitative structure of the consumption decisions as compared to those under the permanent income hypothesis. (Note that the permanent income hypothesis decision rules can be obtained by settingo

ih"ras well as settinggih andhih (and hencecih) equal to zero, for all i, h.)

Yet deeper insights into the di!erences between the consumption decisions under conformism, habit formation, and patience and those under the perma-nent income hypothesis may be obtained by rewriting the set of individual-speci"c consumption decisions (27) for one speci"c individual, say individuali, abandoning the matrix notation. From (27), after some algebra, the consump-tion decision of individualiin peer grouphcan be rewritten as

c

ih, anddih given by (28)}(31), respectively. The decision rule (36) nests as a special case the familiar decision rule in the absence of conformism and habit formation,

Note that (37) implies that individual i's optimal consumption decision is a function of his own (expected present discounted value of total) lifetime resources, E(¸

consumption decision becomes conformism, individuals do take into account not only their own lifetime resources and their own bliss point, but also the lifetime resources and bliss points of all other individuals in their peer group. It is important to note, however, that di!erences in individuals'lifetime resources do not lead to adjust-ments in the optimal consumption decisions under conformism, (39), as com-pared to the case of self-centered individuals, (37),per se. Rather, if individuali, say, has lower labor income and wealth levels in periodtthan all his peers, he will only adjust his periodtconsumption decision to take account of the higher labor income and wealth levels of his peers if his rate of time preference,oih, di!ers from that of his peers. If individual i's rate of time preference is the same as that of all of his peers, that is,oih"o

ih is given by (28), and the only adjustment in the consumption decision implied by the presence of conformism is in the intercept term.

To gain more insight into how (by intention) conformist individuals adjust their consumption decisions for their peers'lifetime resources if their peers'rates of time preference di!er from their own, consider the following simple numerical experiment. Suppose that the peer group has three members,N

h"3, all mem-bers of the peer group being equally placed (uih"1

3, i"1, 2, 3), that the interest

rate is r"(1.03)0.25!1 (taking time to be of quarterly frequency), and that

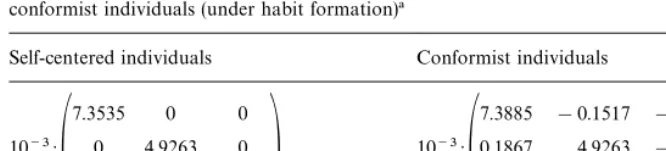

Table 1

Decision rule coe$cients in a peer group of self-centered individuals and in a peer group of conformist individuals (time separable preferences)!

Self-centered individuals Conformist individuals

10~3)

A

9.7806 0 0

0 12.2166 0 0 0 14.6707

B

10~3)

A

9.7454 0.1522 0.3409 !0.1875 12.2165 0.1887 !0.3409 !0.1535 14.7060

B

!The element in theith row andjth column of each matrix gives the coe$cient on E(¸jhtD)t) in

individuali's decision rule.

coe$cients on E(¸

jhtDXt) in the decision rule (39) for all three individuals under the two scenarios that all individuals are self-centered (hih"0,i"1, 2, 3) and that all individuals are conformist (hih"0.25, i"1, 2, 3). (In the coe$cient matrices in Table 1, the element in theith row andjth column of each matrix gives the coe$cient on E(¸

jhtDXt) in individuali's decision rule.) As to be expected, in the absence of conformism, the coe$cient on E(¸

ihtDXt) is higher the more patient individualiis, and the coe$cients on other individuals'

lifetime resources are zero, as individuals are self-centered. In the presence of conformism, individuals adjust their consumption decisions positively for the lifetime resources of peers who are more patient than themselves, and negatively for the lifetime resources of peers who are less patient than themselves. (The signs of these adjustments under the above parameterizations are the same if individuals' preferences for conformism are allowed to di!er.) While the net adjustments of the periodtconsumption levels depend on the relative magni-tudes of the peers' lifetime resources (note that individuals also adjust the coe$cient on their own lifetime resources), Table 1 illustrates that increases or decreases in their peers'lifetime resources do not lead to adjustments in indi-viduals'optimal consumption decisionsper se. Rather, whether an individual in any given period will keep up with the Joneses is determined by intertemporal considerations, re#ecting the shape of the Joneses'lifetime consumption pro"les. Clearly, the implications of social interactions in an intertemporal setting may then just be the opposite of those in a static setting, and analyses of the e!ects of social interactions in static settings can therefore be highly misleading.

What are the implications of incorporating the second facet of endogenous taste change, namely habit formation, into individuals' decision rules? To understand these implications, let us"rst isolate how habit formation by itself a!ects individuals'optimal consumption decisions. Ifhih"0 (and thuscih"0), for alli,h, then the optimal consumption decision (36) reduces to

c

iht"jihcih,t~1#/ihE(¸ihtDXt)#

A

1!bih(1#r)

wherejihand/

ih are given by (29) and (30), respectively. The decision rule (43) has three particularly notable implications. First, a self-centered individual whose preferences exhibit habit formation will consume less during the early stages of his life cycle than a self-centered individual whose preferences are time separable. Since under habit formation consumption levels must be continually increasing in order to o!set the negative e!ect that past consumption has on current-period utility, individuals'consumption levels will be lower during the early stages of the life cycle than they are in the absence of habit formation. Thus the strength of an individual's preference for habit formation a!ects the shape of his lifetime consumption pro"le. Second, under habit formation a self-centered individual will increase his current-period consumption in response to an

unanticipatedincrease in his current-period labor income by a smaller amount

than a self-centered individual whose preferences are time separable. This is because an individual who values habit formation is concerned about the negative e!ects of an increase in his consumption level today on utility derived

ceteris paribusfrom his future consumption levels. The higher the degree of habit

formation, the smaller the e!ect of an unanticipated increase in periodtlabor income on consumption in period t. Third, a self-centered individual whose preferences exhibit habit formation will also increase his current-period con-sumption in response to an anticipated increase in his current-period labor income. This is e!ectively for the same reasons as those underlying the indi-vidual's response to unanticipated changes in his labor income. At the time when he"rst learns about the future increase in labor income (that is, when the increase in labor income is unanticipated), habit formation leads the individual to be careful about not raising his utility standard by too much. The individual will increase his consumption by less than the&annuity'value of the increase in his lifetime resources, leading to further adjustments in his consumption levels, beyond those made at the time when he"rst learned about the future increase in his labor income, once he has already anticipated the increase in his labor income. Note that this is in contrast to a self-centered individual whose prefer-ences are time separable. Such an individual adjusts his consumption level in one step at the time when he"rst learns about the future increase in his labor income.

Keeping the above points in mind, we now consider the properties of the optimal consumption decisions under habit formation and conformism given by (36). From (36), it is easily seen that individuals will adjust their consumption decisions to take account of their peers'past consumption levels and their peers'

lifetime resources if their peers either have a di!erent rate of time preference,o jh, or have a di!erent habit formation coe$cient,gjh: The coe$cientsjjhand/

26Recall the implications of the strength of a self-centered individual's preference for habit formation for the shape of his lifetime consumption path discussed above.

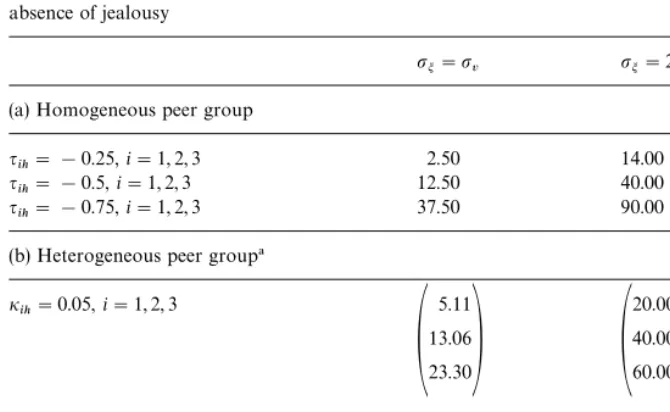

Table 2

Decision rule coe$cients in a peer group of self-centered individuals and in a peer group of conformist individuals (under habit formation)!

Self-centered individuals Conformist individuals

10~3)

A

7.3535 0 0

0 4.9263 0 0 0 2.4992

B

10~3)

A

7.3885 !0.1517 !0.3384 0.1867 4.9263 !0.1867 0.3384 0.1517 2.4642

B

!The element in theith row andjth column of each matrix gives the coe$cient on E(¸jhtD)t) in

individuali's decision rule.

consumption decisions to take account of the lifetime consumption pro"les of their peers.26

In order to illustrate the quantitative importance of the interaction of habit formation and conformism motives, once again consider a peer group with three equally placed members, the interest rate being r"(1.03)0.25!1, and

o

ih"(1.02)0.25!1, i"1, 2, 3, so that all individuals in the peer group are equally patient. Also suppose that the peers' habit formation coe$cients are

g1

h"0.25,g2h"0.5, andg3h"0.75. Table 2 gives the coe$cients on E(¸jhtDXt) in the decision rule (36) for all three individuals under the two scenarios that all individuals are self-centered (h

ih"0, i"1, 2, 3), and that all individuals are conformist (h

ih"0.25, i"1, 2, 3). (In the coe$cient matrices in Table 2, the element in theith row andjth column of each matrix again gives the coe$cient on E(¸

jhtDXt) in individuali's decision rule.)

As to be expected from our discussion above, in the absence of conformism, the coe$cient on E(¸

ihtDXt) is lower the more strongly the individual values habit formation. Under conformism individuals adjust their consumption deci-sions positively with respect to the lifetime resources of peers who value habit formation less strongly, and negatively with respect to the lifetime resources of peers who value habit formation more strongly. While the net adjustments of the consumption levels depend on the relative magnitudes of the peers' lifetime resources, Table 2 again illustrates that whether an individual in any given period will keep up with the Joneses is determined by intertemporal consider-ations, re#ecting the shape of the Joneses'lifetime consumption pro"les.

27This is, of course, not to say that the e!ects of conformism on individuals' consumption decisions through the intercept term would necessarily have to be small. The size of these e!ects depends in particular on individuals'degrees of patience and their bliss consumption levels.

28It may be of interest to note that Gali (1994) in examining the role of conformism in a Lucas-type asset pricing model obtains a related result. In particular, he shows that equilibrium asset prices in a homogeneous information economy in which individuals value conformism may be the same as those in a corresponding economy in which individuals are self-centered, but only if the degree of risk aversion of the individuals in the latter economy is properly adjusted. We, in contrast, show that under quadratic preferences there may be anexactequivalence between the decisions of individuals who are by intention conformist and those of individuals who are by intention non-conformist, even when individuals'preferences are not time separable and display heterogeneity with respect to the degree of conformism and/or individuals'bliss points.

respect tooihandgih. If individuals'rates of time preference and their valuations of habit formation are homogeneous within peer groups, then the apparent paradox can arise that by intention conformist individuals act just as self-centered individuals would. This result critically depends on whether or not there is an intercept term in individuals'decision rules. If all individuals in peer grouphhave the same rate of time preference,o

ih"oh, for alli, with oh not equal to the market interest rate,r, and all individuals in the group value habit formation equally strongly (that is, g

ih"gh, for all i), then each individual's consumption level depends only on his own lagged consumption level and his own lifetime resources, but not on the lagged consumption levels and the lifetime resources of his peers. The conformism e!ect in this case enters the decision rule only through the intercept term, implying a very limited form of interaction among individuals'consumption decisions.27In particular, individualiwill not adjust his consumption decisions to any changes in the lifetime resources of peer

j, jOi, regardless of the strength of individual i's preference for conformism. From (36), it is also clear that under certain, albeit rather extreme, conditions the interaction among individuals'consumption decisions may not only be limited, but there may be an exact equivalence between the optimal consumption decisions of individuals adhering to a self-centered pursuit of their own interests and the optimal consumption decisions of individuals who are socially moti-vated in that they would like to conform. The optimal consumption decisions (36) display this apparent paradox if all individuals in the peer group have the same degree of preference for habit formation, g

h, and the same rate of time preference,o

h, with the rate of time preference furthermore being equal to the market interest rate,r.28

Some intuition for this equivalence result can be obtained by further inspect-ing the Euler equation (25). Under the conditionsgih"g

handoih"oh"r, for alli, and assuming information homogeneity, (25) becomes

(1#g

h)ciht!ghcih,t~1!E(cih,t`1DXt)

"c

29These assumptions appear plausible in cases where the correlation of private information across individuals is not too large. See Binder and Pesaran (1998).

Since in the presence of conformism 1'+Nh

j/1ujhcjh'0, this means that the individual-speci"c and group-wide problems can be solved separately, and correspond to the standard Euler equations

(1#g

h)ciht"ghcih,t~1#E(cih,t`1DXt) (45) at the individual level, and its analog at the peer group level,

(1#g

h)c8ht"ghc8h,t~1#E(c8h,t`1DXt). (46) Seen from this perspective, it becomes clear that the conditions needed for the equivalence result to hold are the same as the ones needed for perfect cross-sectional aggregation of individual-speci"c decisions.

3.3. Disparate information

It is the exception rather than the rule that individuals would know the current-period labor income levels and current-period wealth levels of all other individuals in their peer group when making their own consumption decisions. It is therefore important to examine whether our results derived under homo-geneous information are qualitatively robust to information heterogeneity. In order to isolate the e!ects of allowing for disparate information in a life-cycle model with social interactions, and in order to keep the exposition as simple as possible, we abstract from habit formation, and setg

ih"0, for all i,h.

To overcome the in"nite regress problem arising under disparate information, we follow Binder and Pesaran (1998) and assume that individuals form their expectations about the decision and forcing variables of other individuals in their peer group solely on the basis of publicly available information. In particular, we assume that (i) individuali's beliefs about individual j's current and future consumption levels (iOj) are given by

E(c

jh,t`sDXiht)"E(cjh,t`sDWt~1), (47)

fori,j"1, 2,2,Nh,h"1, 2,2,H, ands"0, 1,2, and that (ii) individuali's

beliefs about individual j's current and future labor income levels (iOj) are given by

E(y

jh,t`sDXiht)"E(yjh,t`sDWt~1), (48)

fori,j"1, 2,2,N

expectations errors to the variables in his information set. The following proposition gives the individual-speci"c optimal consumption decisions under conformism or altruism/jealousy when individuals'information sets are disparate.

Proposition 2 (Individual-speci"c optimal consumption decisions under

con-formism and disparate information). Suppose(i) the current-period utility

func-tion is given by(14)withgih"0,for alli,h, (ii)information sets are disparate,and

(iii) individuals+ expectations about the decision and forcing variables of other

individuals satisfy(47)and(48).Then the individual-specixc optimal consumption

decisions in peer grouphunder the life-cycle model(11)}(13)are given by

c

(Individual-speci"c optimal consumption decisions under altruism/jealousy and disparate information).Suppose(i)the current-period utility function is given by (15) with gih"0, for all i,h, (ii) information sets are disparate, and (iii)

individuals' expectations about the decision and forcing variables of other

indi-viduals satisfy (47) and (48). Then the individual-specixc optimal consumption

decisions in peer grouphunder the life-cycle model (11)}(13)are given by (49),

wherec

ih,/ih,anddih are given by (32), (38),and(33),respectively.

Noting that the decision rules under conformism and under altruism/jealousy are, as under homogeneous information, the same except for the de"nitions of

c

ih and dih, in what follows we again focus on the case of conformism. The individual-speci"c optimal consumption decisions of individuali in (49) com-prise three additive components: The terms in E(¸

ihtDXiht) and in E(¸ihtDWt~1)

that depend on the individual's own lifetime resources, the terms in E(¸

jhtDWt~1),

for alljOi, that depend on the lifetime resources of all other individuals in his peer group, and an intercept term that is the same as the intercept term in the consumption decision under homogeneous information, (27). An important di!erence between the decision rules under disparate and homogeneous in-formation is that under the former individuals cannot adjust their consumption decisions to unanticipated changes in their peers'lifetime resources in the same period as these changes occur. As individuals need to forecast their peers'

30It is worth noting that our model of social interactions and disparate information operates quite di!erently than the information aggregation bias models of Goodfriend (1992) and Pischke (1995). In Goodfriend's and Pischke's models, individuals are self-centered and thus are notper se concerned about the consumption decisions of others. However, observing other individuals'past consumption decisions helps individuals in these models to disentangle the individual-speci"c and economy-wide components of labor income innovations, which matters to individuals as these components are assumed to have di!erent serial correlation structures. As discussed, for example, by Deaton (1992), such a signal extraction speci"cation has observational implications similar to those of habit formation. Embedding such a signal extraction framework within our model of conformism and disparate information would therefore be an interesting avenue for future research.

peer group averages of labor income and wealth levels), their adjustments to their peers'labor income#uctuations only occur with a lag and then only with respect to their peer group average.30

As under homogeneous information, a necessary condition for any such adjustment to occur is that individuals'rates of time preference display hetero-geneity. Therefore, regardless of whether the information structure is homogene-ous or disparate, whether an individual in any given period will keep up with the Joneses is determined by intertemporal considerations. If all individuals in the peer group have the same rate of time preference,o

ih"oh, for all i, then the optimal consumption decisions (49) reduce to

c

iht"/hE(¸ihtDXiht)#dih#cih

A

+Nhj/1ujhdjh 1!+Nh

j/1ujhcjh

B

, (50)

withcih,/

h, anddihgiven by (28), (41), and (42), respectively. Note that (50) is the same as (40), that is, if all individuals in the peer group have the same rate of time preference, then the optimal consumption decisions under disparate information are the same as those under homogeneous information. Inspecting the Euler equation under disparate information, (25), it can be understood why this is the case. From (25), under the condition thato

ih"oh, for alli, the Euler equation under disparate information (and no habit formation) is given by

c

iht!bh(1#r)E(cih,t`1DXiht)!uihcih

"c

ih[E(c8htDXiht)!bh(1#r)E(c8h,t`1DXiht)!uihcih], (51) where

u ih"

A

1!b

h(1#r) 1#u

ihhih

B

. (52)

The only term in the individual-speci"c and group-wide problems in (51) that prevents perfect aggregation to be possible even in the presence of a conformism motive is the intercept term, u

31See, for example, Binder et al. (2000) for a discussion of the analytical solution of a life-cycle model with negative exponential current-period utility without social interactions if labor income follows a geometric random walk.

and therefore does not lead to any di!erences in the solutions under disparate and homogeneous information.

4. Individual-speci5c optimal consumption decisions under prudence

In this section we consider the implications of allowing for a prudence motive for the optimal consumption decisions of altruistic/jealous individuals. In the absence of an altruism/jealousy motive (q

ih"0, for alli,h), it is well known that under the negative exponential utility speci"cation (16) there are non-trivial implications of labor income uncertainty for individuals'optimal consumption decisions, as risk averse intertemporally optimizing individuals will want to provide for future contingencies through precautionary saving. Our main inter-est in this section is in how the presence of a prudence motive a!ects the results obtained above for the case of a quadratic current-period utility speci"cation. To maintain analytical tractability, we assume in this section that the labor income,y

iht, follows an arithmetic random walk process, *y

iht"k#vt#miht, (53) with an economy-wide drift,k, an economy-wide random component,v

t, and the residual random component,m

iht. The random componentsvt andmiht are assumed to be mutually independent, i"1, 2,2,N

h, h"1, 2,2,H, t"1, 2,2, and distributed identically as normal variates with zero means and

constant variances:

v

t&iid N(0,p2v), and mit&iid N(0,p2m). (54)

As we had discussed in Section 2, a geometric random walk speci"cation where only the economy-wide shocks,v

t, have permanent e!ects, has more plausible implications for the economy's labor income distribution. For the case of negative exponential current-period utility, a geometric random walk speci" ca-tion for labor income makes analytical computaca-tion of the individual-speci"c optimal consumption decisions signi"cantly more cumbersome, however.31We thus employ the labor income speci"cation (53) and (54), noting that our numerical experiments that we report below are based on values ofp2

vandp2mfor

32Writing the optimal consumption decisions (55) in panel vector autoregressive form by stacking the endogenous variablesc

ihtandAiht, it is readily veri"ed that the resulting PVAR(1) contains a unit

root, in addition to the unit root iny

iht, and there exists no long-run relationship betweenciht(or

A

iht) andyiht.

Proposition 3 (Individual-speci"c optimal consumption decisions under

altru-ism/jealousy, prudence, and homogeneous information). Suppose (i) the

cur-rent-period utility function is given by(16), (ii)labor income is generated by(53)and

(54), and (iii) information sets are homogeneous. Then the individual-specixc

optimal consumption decisions in peer grouphunder the life-cycle model(11)}(13)

are given by

The optimal consumption decisions under prudence contain, compared to their counterparts under certainty equivalent behavior, an additional additive term re#ecting individuals'desire to insure themselves against future contingen-cies through precautionary saving.32 There are two components to this e!ect, CHih: precautionary saving due to uncertainty about future economy-wide in-novations in labor income and precautionary saving due to uncertainty about individuali's own as well as his peers'future individual-speci"c innovations in labor income.

From (55) and (56), it is clear that heterogeneity in peers' rates of time preference is not a necessary condition for prudent individuals to adjust their consumption decisions with respect to those of their peers (in fact, as logb

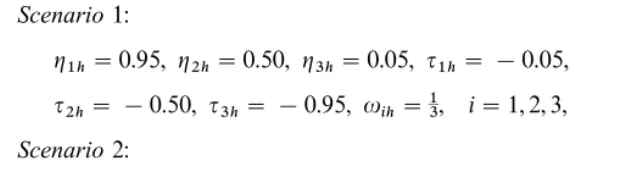

Table 3

Precautionary saving under jealousy: percentage increase compared to precautionary saving in the absence of jealousy

pm"p

v pm"2pv

(a) Homogeneous peer group

qih"!0.25,i"1, 2, 3 2.50 14.00

qih"!0.5,i"1, 2, 3 12.50 40.00

qih"!0.75,i"1, 2, 3 37.50 90.00 (b) Heterogeneous peer group!

iih"0.05,i"1, 2, 3

A

5.11 13.0623.30

B

A

20.00 40.00 60.00

B

i1h"0.06,i2h"0.05,i3h"0.04

A

1.26 14.2442.42

B

A

14.87 40.58 82.01

B

!The entry in theith row of each vector gives the precautionary saving of individuali.33We do not report any numerical results for the case of altruism. While altruism may under certain parameter settings also increase individuals'precautionary saving, such increases are on a signi"cantly smaller scale than those induced by jealousy as reported below.

importance of analyzing the e!ects of social interactions in an intertemporal rather than a static setting.

To gain insight into the potential quantitative importance of social interac-tions for individuals'precautionary saving, we consider a numerical experiment supposing as in the previous section that the peer group has three members,

N

h"3, with all individuals being equally placed (uih"13, i"1, 2, 3). We also

assume that the interest rate is r"(1.03)0.25!1. Table 3 illustrates how jealousy may increase individuals'precautionary saving compared to the pre-cautionary saving decisions of self-centered (yet prudent) individuals. For the case of self-centered individuals Caballero (1990) has already argued that the

levelof precautionary saving generated by a model with negative exponential

current-period utility can be large empirically. Here our concern is only regard-ing the relativemagnitude of precautionary saving under jealousy and in the absence of jealousy.33What matters for this relative magnitude is therelative

size of the volatility of economy-wide labor income innovations,p2

to the volatility of individual-speci"c labor income innovations,p2m, but not their absolute values.

Table 3a considers the case where individuals'degrees of risk aversion and their jealousy motives are homogeneous within peer groups (and thus all individuals decide upon the same amount of precautionary saving). We set

i

ih"0.05, i"1, 2, 3, and consider the two cases where pm"pv and where pm"2p

v.

The results in Table 3a clearly show that jealousy can increase individuals'

precautionary saving quite dramatically. Precautionary saving is increasing both in the degree of individuals'preference for jealousy and in the size of the volatility of individual-speci"c labor income innovations relative to the volatil-ity of economy-wide labor income innovations.

Table 3b considers the case where there is heterogeneity in individuals'

preferences for jealousy and possibly also their degrees of risk aversion (and thus individuals decide upon di!erent amounts of precautionary saving). We set

q1h"!0.25, q2h"!0.5, q3h"!0.75, and again consider the two cases wherepm"p

v and wherepm"2pv.

Table 3b shows that for given degrees of jealousy, relatively modest hetero-geneity in individuals' degrees of risk aversion can have sizable e!ects on individuals'precautionary saving. In particular, an individual who is less jealous but more risk averse than his peers will decrease his precautionary saving as compared to when his peers'degrees of risk aversion are the same as his, and an individual who is more jealous but less risk averse than his peers will increase his precautionary saving as compared to when his peers'degrees of risk aversion are the same as his.

5. Aggregate implications

We now consider the implications of social interactions for the time-series properties of aggregate consumption series. The empirical literature examining aggregate (U.S.) consumption data has focussed on the following two predic-tions of the permanent income hypothesis:

(i) Changes in current-period consumption should vary closely with the in-novations in labor income, unless permanent income is signi"cantly smoother than current labor income.

(ii) Changes in consumption should not respond toanticipatedchanges in labor income.

34There is also a growing literature testing the predictions of the permanent income hypothesis forindividuals'consumption changes in response to anticipated changes in their labor income. For a survey of this literature see, for example, Browning and Lusardi (1996). As of yet, there appears to be no broad consensus as to whether there is an excess sensitivity puzzle at the individual level. But it is worth noting that our model's predictions are consistent with consumption responding to anticipated changes in labor income at the economy-wide level even if the consumption decisions of many individuals in the economy are not responsive to such changes in labor income and are thus consistent with the implications of the permanent income hypothesis in this regard.

35Similar results can also be obtained under the negative exponential current-period utility speci"cation (16), once the variance processes ofv

tandmihtare allowed to be time varying. (See

Caballero, 1990, who discusses this issue for the case of self-centered individuals.)

36The economy-wide average consumption decisions can be obtained by aggregating the indi-vidual-speci"c consumption decisions derived in Section 3 using (1) and (2).

related tounanticipatedchanges in current-period aggregate labor income, even if permanent labor income is not signi"cantly smoother than current labor income (excess smoothness). Furthermore, changes in aggregate consumption

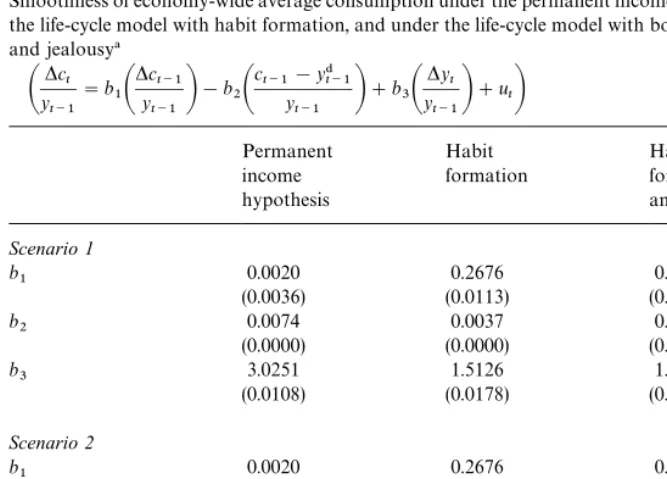

dorespond toanticipatedchanges in aggregate labor income (excess sensitivity). Various modi"cations of the permanent income hypothesis have been suggested in the literature that can help address these puzzles. Among these are habit formation (for example, Muellbauer, 1988), borrowing constraints (for example, Deaton, 1991), aggregation with"nite lifetimes (for example, Clarida, 1991), and aggregation with imperfect information about the composition of labor income (for example, Pischke, 1995).34In this section we show that social interactions, when combined with habit formation, can signi"cantly strengthen the e!ects of habit formation in the direction of resolving the excess smoothness and excess sensitivity puzzles. To simplify the exposition and to focus on the implications of the life-cycle model with endogenous taste change, we assume that information is homogeneous and setoih"r, for alli,h.35

5.1. An error correction representation

The economy-wide time-series implications of the life-cycle model under the quadratic current-period utility functions (14) and (15), and di!erence stationary (log) labor income, (3), are perhaps best understood by examining an error correction representation of the decision rule for economy-wide average con-sumption.36Consider"rst the homogeneous parameter case where there is habit formation (but no social interactions), with g

ih"g, for all i,h. Lagging the economy-wide current-period decision rule for this case one period, subtracting the resultant expression from the economy-wide current-period decision rule, and noting that *A

37See Pesaran (1992) for a similar error correction representation for the case of the permanent income hypothesis.

38See Pesaran (1999) for a discussion of cross-sectional aggregation of linear dynamic models.

39For briefness'sake, we focus on the case of jealousy in this section. The numerical results both for the case of conformism and for the case of altruism are discussed in a note available from the authors upon request.

40We experimented with other values ofpa,pm, andpv, but found that our results are robust to small changes in these parameters.

obtains37

*c t"

A

g

1#r

B

*ct~1!A

r(1#r!g)

1#r

B

(ct~1!y$t~1)#

A

r(1#r!g)(1#r)(r!g)

B

*yt, (59)wheregis the expected rate of growth of economy-wide average labor income,

g"exp(k#p2

v/2)!1. Note that (59) implies that the larger the habit coe$cient g, the smaller the change in consumption in the current period due to deviations of consumption from disposable income in the previous period and due to (unanticipated and anticipated) current-period changes in labor income. In other words, the largerg, the smoother economy-wide average consumption will be, and the excess sensitivity is likely to be less of a problem. When the parameters gih and cih and the initial endowmentsA

ih,t~1 di!er across

indi-viduals, the cross-sectional aggregation of the resultant heterogeneous error correction decision rules will be di$cult and in general does not result in

a"nite-order aggregate error correction model.38We use the functional form of

(59) to measure how much the addition of social interactions to a life-cycle model with habit formation may add to the smoothness of economy-wide average consumption by inspecting the size of the coe$cients in a regression of stochastically simulated aggregate time series of *c

t/yt~1 on simulated time

series of*c

t~1/yt~1, (ct~1!y$t~1)/yt~1, and*yt/yt~1, respectively.

For simplicity, we consider numerical experiments based on an economy with a large number of peer groups of size three (N

h"3) that are homogeneous with respect to the preference parameters.39The preference parameters within peer groups, however, are allowed to di!er. In all the numerical experiments time is taken to be measured in quarters. We also setr"(1.03)0.25!1,g"0.02,pa"

pm"p