This

Financial Stability Review

(FSR)

is one the reports Bank Indonesia provides to public in order to achieve its mission “to achieve and maintain stability of the Indonesian Rupiah through maintaining monetary stability and promoting financial system stability for safeguarding long-term and sustainable national development.”Financial System Stability Bureau

Directorate of Banking Research and Regulation Bank Indonesia

Jl. MH Thamrin No.2, Jakarta 10010 Indonesia

Information and Order:

This FSR document is also made in pdf format and is accessible at Bank Indonesia’s website at http://www.bi.go.id

All inquiries, comments and advice may be addressed to:

Bank Indonesia

Directorate for Banking Research and Regulation Financial System Stability Bureau

Jl. MH Thamrin No. 2, Jakarta, Indonesia Tel: (+62-21) 381 7990, 7353

FSR is issued biannually and has the following objectives:

• To foster public vision on financial system stability issues, both

domestically and internationally;

• To analyze potential risks to financial system stability; and

• To recommend policies to relevant financial authorities for promoting

FOREWORD, vii

EXECUTIVE SUMMARY, ix

Chapter 1 INTRODUCTION, 1

Chapter 2 THE IMPORTANCE OF MAINTAINING FINANCIAL SYSTEM STABILITY, 4

LESSONS LEARNT FROM THE 1997 CRISIS, 4

FINANCIAL SYSTEM STABILITY: WHAT AND WHY IS IT IMPORTANT?, 4

CORE COMPONENTS OF A STABLE FINANCIAL SYSTEM,5 CENTRAL BANK’S ROLE IN FINANCIAL SYSTEM STABILITY, 5

CENTRAL BANK’S ROLE IN FINANCIAL SYSTEM STABILITY , 7

CONCLUSIONS , 8

Chapter 3 EXTERNAL FACTORS, 11 INTERNATIONAL ECONOMY, 11 DOMESTIC ECONOMY, 12 Monetary Conditions, 12 Government’s Finance , 13 Government Bonds, 14 Foreign Debts, 15 Market Confidence, 15 Maturity Profile, 16

REAL SECTOR CONDITION, 17 Small and Medium Enterprises , 17 Pulp and Paper Industry, 19

Chapter 4 PERFORMANCE AND PROSPECT OF INDONESIA’S BANKING INDUSTRY, 21

THE STRUCTURE OF BANKING INDUSTRY, 21 ASSETS STRUCTURE, 21

CREDIT RISK, 22

Non-Performing Loans (NPLs) , 23 Loan Restructuring, 25

Lending Growth , 25 LIQUIDITY RISK, 27 Liquidity Assets, 28 Exchange Offer, 29 Core Deposit, 29

Interbank Call Money, 29

Liquid Assets to Cash Outflow (COF) , 30 Corporate Funds , 30

Household Savings Pattern, 30 Maturity Profile, 31

MARKET RISK, 31

Capital Charge for Market Risk, 32 CAPITAL, 32

BANKS’ PERFORMANCE , 34

CONFIDENCE TO CAPITAL MARKET, 38 Mutual Funds, 39

Impacts on Financial System Stability, 42 Bond Market, 46

Stocks Market, 46

Chapter 6 PAYMENT SYSTEMS IN INDONESIA, 51 RISKS IN PAYMENT SYSTEMS, 48

Clearing System, 49

Realtime Gross Settlement (RTGS), 49

ROLE OF PAYMENT SYSTEMS IN THE STABILITY OF FINANCIAL SYSTEM, 49

Payment Systems Oversight, 50 Risks in Clearing System, 50 Risks in RTGS, 50

ARTICLES

1. Redesigning Indonesia’s Crisis Management – S. Batunanggar

2. Market Risk in Indonesia Banks – Wimboh Santoso & Enrico Hariantoro

3. An Empirical Analysis of Credit Migration In Indonesian Banking – Dadang Muljawan

3.1. Stress Test on Goverment budget (APBN) 2003-04

3.2. Foreign Debt Indicators

3.3. Indonesia Corporate yankee Bonds (Dec 2002) 4.1. Selected Items of Banks Balance Sheets 4.2 Details of Loan

4.3. NPL Stress Test

4.4. Distribution of Loans by Sector 4.5. 14 Large Banks’ Liquidity

4.6. Maturity Profile of Assets and Liabilites of 13 large Banks, December 2002

4.7. Large Exchange Rate Stress Test of Large Bank to CAR

4.8 Interest Rates Stress Test of large of Large Bank to CAR

F i g u r e s

3.1. Non-oil and Gas exports by Country Destination 3.2. US and JAPAN : GDP-Inflation

3.3 US and JAPAN : Current Account

3.4. US and Japan : Discount interest Rate and DJIA & NIKKEI Indices

3.5. Direct and Portfolio Investments 3.6. Domestic Economic Indicators

3.7. Jakarta Composite and Property Sector Indices

3.9. Fixed Rate Government Bond vs SBI

3.10. Indonesia Government Bonds Rating and Yields 3.11. Maturity Profile of Corporate Foreign Debt 3.12. Loans to SME and Non-SME

3.13. Lending growth to SME By Type of Banks 3.14. SME Loans by Type of Business Uses 3.15. GDP by Sectors to Total GDP 3.16. NPL by Sector

4.1. Total Bank and Asset 4.2 Bank Securities and Loans 4.3. Total Loans and NPL

4.4. NPL and Provisions for Loan Losses 4.5. Non Performing Loan

4.6. NPL Stress Test 4.7. Loan Restructuring 4.8 Loan to Deposit Ratio

4.9. Trends of IDR and Foreign Exchange Loans 4.10. New Lending

4.11. Loans by Business Uses 4.12. Property Loan

4.13. Deposit Growth 4.14. Liquid Assets

4.18. Stress Test Exchange Rate 4.19. Interest Rates Stress Test 4.20. Capital ratios

4.21. CAR Evolution

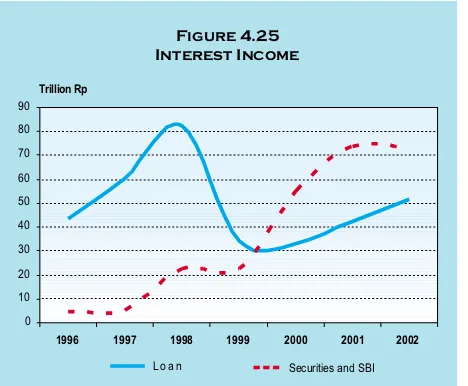

4.22. Source of Interest Income 4.23. Net Earnings and ROA 4.24. Paid-up Capital and ROE 4.25. Interest Income

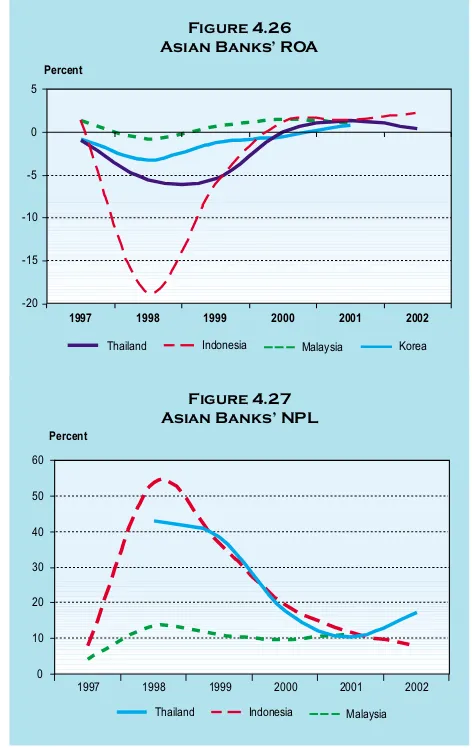

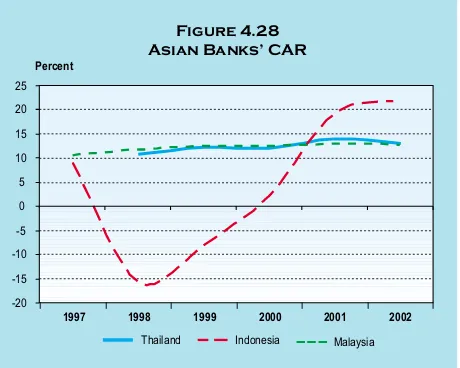

4.26. Asian Banks’ ROA 4.27. Asian Banks’ NPL 4.28. Asian Banks’ CAR

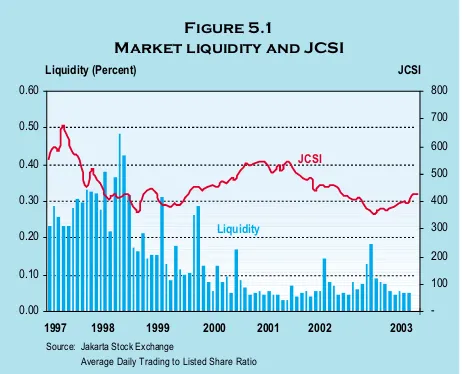

5.1. Market Liquidity and Jakarta Composite Index 5.2. Development of Mutual Funds and Bank Deposit 5.3. Mutual Funds Growth

5.4. Development of Deposit vs Public Funds in Mutual Funds

5.5 Development of YTM of Some Fixed-Rate Bonds and SBI rate

5.6. Government Bonds by Portfolio 5.7. Financial Sector Stock Index

6.1 Real Time Gross Settlements, Clearing and Non-cash Transactions

1. Causes and Process of Financial Crisis

2. Bank Indonesia’s Strategy in Maintaining Financial Stability

3. Pulp and Paper Industry 4. Market Risks

5. Yield Curve of Government Bonds 6. Mutual Funds

The financial crises that took place in almost all corners of the world, Indonesia included, have

driven growing awareness on the importance of financial system stability. Instability in a financial system

brings in adverse implications such as lower economic growth, loss of domestic productivity and gigantic

fiscal cost. Based on these adverse experiences, it is imperative that financial system stability is maintained

for the interests of the public.

Financial stability is basically avoidance of financial crisis. Maintaining financial system stability

is one of the primary functions of Bank Indonesia, which is not less important compared to maintaining

monetary stability. Financial system stability is a prerequisite for monetary stability. This issue is in line

with Bank Indonesia’s mission “to attain and maintain stability of Rupiah by maintaining monetary stability

and promoting financial system stability to secure sustainable long-term national development.” However,

maintaining financial system stability is not the sole responsibility of a central bank. Rather it is also

mutual responsibility of relevant government authorities including Ministry of Finance, Financial

Supervisory Authorities, Deposit Insurance Corporation beside the central bank.

In accordance with the above, Bank Indonesia assesses and monitors trends and issues surrounding

stability of Indonesia’s financial system and provides recommendations to maintain stability of the financial

system. Results of such assessments and monitoring is laid down in a regularly updated “Financial Stability

Review” (the FSR). Unlike such other reports issued by Bank Indonesia, the FSR focuses on such potential

risks which may weaken stability of national financial system, and is more forward-looking orientation.

Every section of this report also describes the prospects of national financial system.

During the course of 2002, Indonesia’s financial system is relatively stable and is expected to remain

so in the years to come. However, alert needs to be maintained particularly on some pertinent issues

including delays in the recovery of loan quality and performance of the banking sector, as well as external

issues such as low growth in the global economy and the government budget deficit due to the huge

obligations from domestic as well as overseas borrowings.

personnel for their dedications, contributions and collaboration for the completion of this first edition of

Financial Stability Review. Finally, we will appreciate all advice, commentaries as well as critics from any

and all parties for further improvements of this review in the future.

Jakarta, April 2003

Indonesian financial system during the course of 2002 is stabilized. This is made possible by the

effective policies in stabilizing exchange rates and controlling inflation as well as the progress made

through the micro-prudential policies covering restructuring program of the banking sector as well as

improvement in banking supervisory and regulatory frameworks. However, certain aspects, the endogenous

and exogenous risks, need to be closely observed as they can potentially disturb financial system stability.

The weakening economy of the major trade partners of Indonesia is one of the driving factors

contributing to the slower growth of exports. As the results, exporting companies, particularly those

whose activities are financed by banks confront augmenting financial risks reducing their capacity to

pay their obligations in timely manner. Such condition is the major driving factor leading to decreasing

a quality of earning assets of banks.

Meanwhile, huge domestic fiscal obligations and international debts have prevented higher economic

and real sector growth. The yet to complete corporate debt restructuring also impedes domestic

corporations to expand their businesses and has brought in adverse impacts to the balance of payment

which may potentially prompt debt crisis and eventually jeopardizing stability of financial system.

Indonesia’s banking structure has not yet changed as the results of the banking crisis back in 1997

that led to the recapitalization of hard-hit banks, all of which have significant impacts to the economy.

Indonesia’s banking system is very much concentrated on the 13 large banks with combined assets of

74.9% from the total assets in banking system.

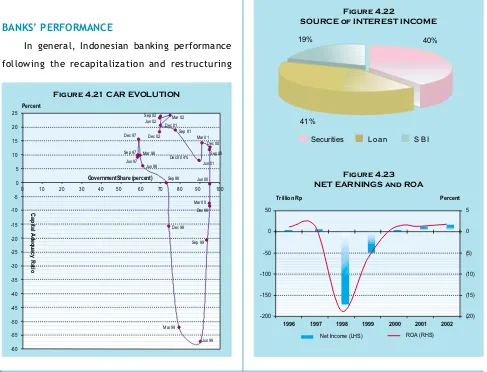

In general, the condition of the banking industry has been improving following the recap program

introduced since 1999. Aggregate ROE stays at 14.8% and CAR at 21.7%. However, the capitalization

capacity of the banks, particularly the recap banks, remains weak as the results of the low loan growth.

Main revenues of the 13 large banks are from bond coupons since their assets are mostly in the form of

recap bonds. Moreover, increased capital at some banks has not been able to absorb the potential

losses, particularly those arising from credit, market and operational risks. With the introduction of the

market risk capital charge, a number of banks will notice a slight capital decrease, although it will

remain above the minimum Capital Adequacy Ratio (8%).

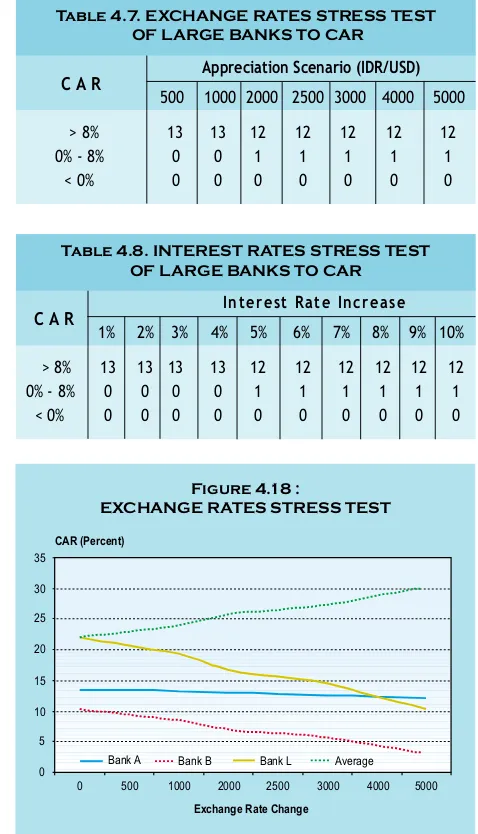

In the course of 2002, the risks surrounding the banking system remain high and with stable trend.

Bank credit risks are high but decreasing. Meanwhile, market risks and banks’ liquidity risks are moderate

during the outbreak of the crisis in 1997, is mainly attributable to the assignment of such non-performing

loans to IBRA, while others are restructured and written off. The primary constraints in lending are: (i)

loan restructuring has been delayed due to non-conducive economic environment; (ii) low absorption by

real sector, particularly corporations, since most of them are still being restructured; (iii) low growth in

new lending, dominated only by small and consumers loans. Monitoring shall be focus on the increasing

possibility that restructured loans as well as non-restructured loans, sold by IBRA to banks, will new

non-performing loans. Stress test indicates that when NPL stays as high as 23.8%, the conditions that

will lead to solvability constraints in some large banks.

The market risks encountered by banking system during 2002 is relatively moderate with stable

trends. This is the result of IDR appreciation against the United States Dollar and the decreasing trend

of interest rates. In general the net open position of 14 large banks is in short position (up to 3 months)

such that the USD depreciation and the lower interest rates have brought positive impacts to their

capital. The short positions reflect bank expectations of declining trends in the interest rate. Banks may

conduct repricing strategy due to the macroeconomic changes. However, future exposure of market

risks, resulting from pressures against the Indonesian Rupiah due to market volatility and political

instability, must be watched.

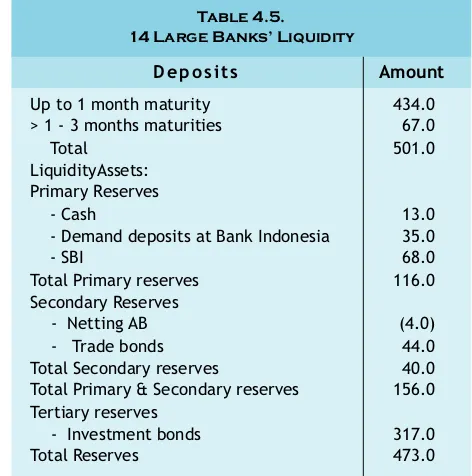

Indonesian banks have adequate liquidity. This condition is reflected in the sufficiency of liquidity

of the 13 large banks and their independence from interbank call money. However, the funding structure

of some large banks, particularly state-owned banks is mostly in the form of corporate deposits (owned

by state-owned and large companies). In order to address such liquidity risk, the 13 large banks need to

balance their funding structure in terms of concentration type as well as maturities.

Meanwhile, there has been improved efficiency in national payment system, particularly

attributable to the successful implementation of Real Time Gross Settlement (RTGS). Under RTGS, risks

associated to settlement, liquidity and operations have been mitigated and are monitored in compliance

with international standards, i.e. Core Principles For Systematically Important Payment System. In

order to further improve efficiency and security of national payment system, future efforts shall be

focused on two primary strategies, namely: (i) minimizing moral hazards and (ii) optimizing policies

between security and efficiency considerations. Therefore, it is necessary to review the roles of Bank

Indonesia in the operations of the payment system and as lender of last resort. In addition, there are

needs for failure-to-settle mechanism in order to reduce systemic risks.

stability. Bank Indonesia also has drafted a blue print on Indonesia’s financial system stability including

policies and framework for Crisis Resolution, which is a prerequisite for the future financial stability.

Now that more defined and comprehensive policies are in place and with the effective coordination

between Bank Indonesia, Government and all stakeholders, a sound and more stable financial system

INTRODUCTION

1

T

he financial crisis that swept over Southeast Asia, Indonesia included, in 1997 has taught us a veryvaluable lesson concerning the importance of

maintaining stability of financial system. During the

past few years, financial system stability has always

been the primary agenda at national and international

levels. The year 1999 saw the establishment of an

international institute and an international forum,

namely the Financial Stability Institute1 and Financial

Stability Forum (FSF)2, intended to assist central banks

and other supervisory authority in strengthening their

financial system. Similar concerns have also been

indicated by IMF and World Bank, who then introduced

a Financial System Assessment Program (FSAP) in order

to strengthen the financial system of the country being

assessed.3

Meanwhile, there has been increasing number

of publications in the forms of books, articles and papers

as well as seminars and conventions discussing financial

crisis and financial system stability. In addition, there

is growing number of central banks creating a unit or

even groups dedicated to addressing financial system

stability issues and financial stability reviews.

Central banks need to maintain financial system

stability based on three primary reasons. Firstly,

financial institutions particularly banks have important

roles -as financial intermediaries and as a transmission

means of monetary policies- in the economy. These

institutions are significantly exposed to high risks

inherent in their operations. Therefore, financial

institutions constitute one of the instability factors most

harmful to the financial system. Secondly, all financial

crises have brought in catastrophic implications to the

economy, lowering economic growth and income. These

eventually create negative impacts to social and

political life if prompt measures fail to address the

crisis rapidly and effectively. Thirdly, financial

instability brings in very expensive fiscal cost in the

course of mitigating the crisis.

In this extent, Bank Indonesia has designated

financial system stability as a complimentary objective

to achieve price stability. Considering the importance

of financial system stability in the course of achieving

the primary objectives, Bank Indonesia is to give more

priority and attention to addressing this issue. In order

to achieve financial system stability, Bank Indonesia

has adopted four major strategies: (i) fostering effective

coordination and cooperation with others; (ii) improving

research and surveillance; (iii) strengthening regulations

and market discipline; and iv) establishing crisis

resolutions and financial safety net. These will be 1. FSI is established by Basel Committee on banking Supervision (BCBS) to

assist supervisory authorities in strengthening their financial system. For further details visit http://www.bis.org/fsi/index.htm. 2. FSF is meant to improve stability of international financial system

through exchange of information and international cooperation in the area of research and surveillance. FSF is composed of such members from relevant authorities (finance ministries, central banks, financial supervisory authorities) from 11 countries, as well as international organizations (such as IMF, World Bank, BIS, OECD), international committees and associations (Basel Committee on Banking Supervision / BCBS), International Accounting Standard Board (IASB), International Association of Insurance Supervisors (IAIS), International Organization of Securities Commissions (IOSCO), Committee on Payment and Settlement System (CPSS), Committee on Global Financial System (CGFS) and European Central Bank. For further details please visit http:// www.fsforum.org/home/home.html.

described in details in Chapter 2.

Furthermore, the function of maintaining

financial system stability is conducted by Bank Indonesia

through two major activities. First, by assessing and

monitoring any and all aspects affecting financial system

stability. The activities under this category are

attributable to crisis prevention. Second, by coordinating

and cooperating with relevant supervisory authorities,

particularly when dealing with crisis resolution.

Assessment of the financial system stability is

conducted by incorporating an early warning system to

monitor and analyze trends in the macro-prudential

and micro-prudential indicators4. The economic

macro-prudential indicators include figures associated with

economic growth, balance of payment, inflation,

interest rate and exchange rate ; the contagion effects,

and all other relevant factors. The micro-prudential

indicators include financial indicators such as Capital

Adequacy, Asset Quality, Management, Earnings,

Liquidity and Sensitivity to Market Risk (CAMELS). The

assessment basically contains identification and

evaluation of risks that may adversely affect financial

system stability and recommendations made to the

government and relevant authorities to carry out

actions necessary to address the matter. The analysis

and recommendations are documented and publicized

on regular basis by Bank Indonesia in a “Financial

Stability Review” (FSR).

The FSR has three basic characteristics: (i)

assessment on conditions and current developments in

the financial system; (ii) reviews are based on risks

which may adversely affect financial system stability;

(iii) a more forward-looking approach by presenting

assessments on the prospects of the financial system

for the year to come. With regard to these

characteristics, the format and focus of analysis of this

FSR may change from one edition to the next in line

with the prevailing conditions, issues, and trends

affecting the economic and financial system.

In general, this first edition of the FSR contains

three primary subjects as described below. Firstly, the

concept and practice at maintaining financial system

stability as presented in a short article entitled “The

Importance Of Maintaining Financial System Stability”

in Chapter 2. This concise article discusses the definition

and the importance of achieving and maintaining

financial system stability, prerequisites for stable

financial system, and the role of Bank Indonesia in

promoting financial system stability.

Secondly, external and internal factors that

adversely affect Indonesian financial system stability

are presented in Chapters 3 and 4. Chapter 3 contains

analysis on developments in the international and

national economies that may affect stability of national

financial system. This chapter also discusses in more

detail domestic financial issues covering foreign debts

and fiscal sustainability. Chapter 4 discusses in detail

the conditions, constraints and risks confronting the

banking system in Indonesia. This issue is very important

considering that the banking sector is the dominant

player – with 75% market segment – in national financial

system. This chapter also discusses structural issues

confronting the banking system including the remaining

high credit risks due to the slow pace of loan

restructuring programs, the low lending growth,

liquidity and market risks, and the performance of the

banking industry. Chapter 5 discusses in detail capital

and risks in payment system with focus on Real Time

Gross Settlement [RTGS] and clearing system. Chapter

7 provides the conclusion.

Thirdly, it contains four articles. The first article

is entitled “Redesigning Indonesia’s Crisis Management:

Lender of Last Resort and Deposit Insurance” (S.

Batunanggar). This article argues fundamental issues

on crisis management: (i) absence of comprehensive

and clearly defined crisis management policies; (ii) the

weakness of the blanket guarantee creating moral

hazards and adding potential to future financial crises;

and (iii) the obscure function of Bank Indonesia as

Lender of Last Resort in the events of systemic crisis.

To redefine Indonesia’s crisis management, two primary

steps are proposed: (i) to gradually replace the blanket

program to limited explicit deposit insurance; and (ii)

to put in place a more transparent policy regarding

lender of last resort for both normal conditions as well

as during systemic crisis. A more transparent LLR policy

will not only function as a more effective instrument

in addressing crisis management but will also put in

place more defined accountability thereby increasing

credibility of central bank, reducing political

interventions and moral hazards, and encouraging

market discipline in order to eventually encouraging

financial system stability.

The second article, “Market Risks In Indonesian

Banks” (by Wimboh Santoso and Enrico Hariantoro)

compares the results of CAR calculation to market risk

between the standard model BIS and the alternative

models, which uses the Exponential Weighted Moving

Average (EMWA) both have been widely used by banking

practitioners. This review is intended to measure as to

how far market risk will adversely affect Indonesia’s

banks in terms of their capital condition. A significant

decline of capital would adversely affect the stability

of Indonesia’s financial system. This review will give

some pictures of how far banks would benefit from

lower capital charge if internal model is applied. This

review proves that the incentive obtained by banks will

be very much dependent on the volatility of the risk

factors. The higher the volatility, the higher capital

charge is. Based on data on volatility of exchange rate

and interest rate, this review concludes that

incorporation of market risk will not reduce a bank’s

CAR to a level below the minimum threshold and

therefore will not create distortions which would

otherwise impair financial system stability. In addition,

application of internal model will generate lower capital

charge considering that volatility of Indonesia’s

exchange rate and interest rate are relatively lower.

The third article, “Empirical Analysis on Loan

Migrations in Indonesia’s Banking Sector” (by Dadang

Muljawan), looks into the relations between industries’

performance and the dynamic lending at certain banks.

From the statistics, two interesting phenomena were

found. Firstly, industrial performance significantly

affects credit migration process. Secondly, there is an

irreversible process in credit migration. This analysis

will provide more analytical information for the

supervisory authority in evaluating banking risks and

efficacy of external oversight.

The last article “New Basel Capital Accord: What

And How It Affects Indonesia’s Banking Sector” (by Indra

Gunawan, Bambang Arianto, Indira & Imansyah),

explores the New Basel Accord and its implications on

FINANCIAL SYSTEM STABILITY

2

LESSONS LEARNT FROM THE 1997 CRISIS

T

here are two most important lessons learned fromthe 1997 crisis. Firstly, the crisis was very

complicated to resolve. And secondly, it was very costly.

The fiscal costs borne by the government for

restructuring problem banks is huge, at 51% of annual

GDP. Indonesia’s crisis is the second worst, after

Argentina crisis (1980-1982), which is 55% of annual

GDP. The crisis not only devastated the national

economy but also affected social and political stability

in Indonesia. However, the crisis has also fostered a

realization of the importance of maintaining a sound

financial institutions and a stable financial market.

Basically, the crisis was caused by two factors.

Firstly, the weak fundamentals of Indonesia’s economy

coupled with inconsistent policies (internal factors).

Secondly, the contagion effects of the financial crisis

started in Thailand on July 1997 (external factors). In

general, the financial system fragility was initiated by

huge un-hedged foreign debts by corporations,

imprudent lending activities, violation of the legal

lending limit to affiliated parties, poor risk management

and governance, and weak bank supervision.

FINANCIAL SYSTEM STABILITY: WHAT AND WHY IS IT IMPORTANT?

Basically, the term financial system stability or

financial stability pertains to the avoidance of financial

crisis (MacFarlane [1999] and Sinclair [2001]). To be

more specific, financial system stability means the

stability of financial institutions and financial markets

in the financial system (Crockett, 1997). Mishkin (1991)

defines financial crisis as disruption to financial markets

where adverse selection and moral hazards worsen so

that financial market is unable to channel funds

efficiently to parties having the best potential

productivity to invest1. From these definitions, it can

be concluded that a stable financial system will create

stable financial institutions and financial markets

capable of avoiding a financial crisis that may adversely

affect national economic infrastructure.

There are three main reasons as to why this

financial system stability [FSS] is important. Firstly, a

stable financial system will create trusting and enabling

environment favorable to depositors and investors in

investing their money in financial institutions as well

as to secure interests of small depositors. Secondly, a

stable financial system will encourage efficient financial

intermediation which will eventually promote

investment and economic growth. Thirdly, a stable

financial system will encourage an effective operation

of markets and improve distribution of resources in the

economy.

On the contrary, an unstable financial system

will bring in harmful implications, such as higher fiscal

cost to resolve troubled financial institutions and

decreasing of gross domestic product due to currency

and banking crisis.

A series of developments which took place in the

past few years have placed maintenance of financial

system stability as a top agenda of the central bank,

supervisory authorities as well as the government,

namely: (i) significant growth in financial transactions;

(ii) growing number of non-bank financial institutions

including the products and services they offer; (iii)

increased complexity and risks in banking activities; and

(iv) huge fiscal cost required to remedy the banking crisis.

In addition, there are other constraints such as

changes of policies, financial instruments and others

faced by banking sector as well as real sector, all of

which will make the duty of maintaining financial

system stability to be complicated.

CORE COMPONENTS OF A STABLE FINANCIAL SYSTEM

The stability of financial system depends on five

components which are associated one with another,

namely: (i) a stable macroeconomic environment; (ii)

well governed financial institutions; (iii) efficient

financial market; (iv) sound prudential oversights; and

(v) safe and reliable payment system (MacFarlane,

1999).

Crisis may be prompted by various risks originating

from the elements in the financial system. The process

leading to a financial crisis is described in Box 1.

Financial system stability can be maintained by

improving resilience of financial institutions and money

market against external volatility. A number of

measures may be taken, such as by applying prudential

standards and good corporate governance within

financial institutions and capital markets, conducive

monetary and fiscal policies, and real sector capable

of promoting economic growth.

Considering that internal weakness within

financial institutions and fragility in capital market,

crisis management policy needs to be put in place.

Therefore, a safety net mechanism and contingency

plan are required to address crisis. For this purpose,

central banks play a very important role in maintaining

stability of financial system, as well as in taking

preventive and corrective actions against crisis. This is

due to the fact that powers to regulate and supervise

as well as to enforce policies of financial institutions

are held by central bank.

CENTRAL BANK’S ROLE IN FINANCIAL SYSTEM STABILITY

Safeguarding financial stability is a core function

of the modern central bank, no less important than

maintaining monetary stability (Sinclair, 2001). Both

are closely correlated and affected one another.

Effectiveness of financial policies will only manifest

itself in an environment in which there is sound financial

system because financial institutions serve as medium

for monetary policy transmission.

There are two major approaches generally

adopted by central bank in maintaining financial system

Real Sector

Monetary Fiscal

International Economy

Financial Institutions, Markets and Financial Infrastructure

Figure:

INTERACTIONS WITHIN A FINANCIAL SYSTEM

Financial crisis may originate from problems

existing within any of the various correlating

components within the financial system such as

financial institutions, banks, non-bank financial

institutions or capital market (first ring); or may

be caused by one or a combination of problems

within the real sector, fiscal or in the payment

system (second ring). Nevertheless, a crisis may also

be spark by some external factor with its contagion

effect that spillover Asia in 1997 (third ring).

Learning from the Asian and Indonesia crisis in

1997, instability of financial system may be occurred

through three major phases (Mishkin, 2001).

Firstly, impaired public confidence in the

financial system. This may be caused by various

problems in the economy or in financial system

Box 1.

CAUSES AND PROCESS OF FINANCIAL CRISIS

such as worsening financial condition of banks,

increased interest rate, decreased share prices and

increased uncertainty.

Then in the second phase, impaired confidence

of customers and investors toward the economy and

the IDR result in the depreciation of the IDR which

then prompts currency crisis.

And finally, such currency crisis would entail

crises of the banking sector prompted by depositors

drawing up their deposits (systemic bank run) which

results in liquidity problem to banks. In addition,

banks would sustain losses from non-performing

loans particularly those of corporations with

un-hedged overseas borrowings. The cost of overseas

loans borne by corporations will skyrocket due to

the depreciation of the IDR against the USD.

The twin crisis (currency and banking crisis) if

not effectively addressed, will result in even wider

complications, as well as social and political

instability.

Consequently, the Government will have to pay

huge of fiscal cost (in the case of Indonesia, 51% of

its Gross Domestic Product) in order to rescue its

banking system. The huge fiscal cost will eventually

be borne by the public, the taxpayers. In addition,

the prolonged financial crisis will bring in adversely

impacts to national economy, such as lower

economic growth and output aggravated by financial

discipline similar to that adopted by Reserve Bank of

New Zealand. Secondly, reliance on regulations. The

latter approach is adopted by wider supervisory

authorities or central banks in both developed and

developing countries. During the past few years, there

has been growing awareness that both approaches need

to be applied more consistently in order to achieve a

better stability in the financial system.

In practice, the definition of financial system

stability [FSS] varies among central banks. Most central

banks state it explicitly in their statutory regulations.

But some rely on joint arrangements such as those

among Bank of England, Financial Services Authority

and HM Treasury.

In general, the role of central banks in stabilizing

financial system covers three primary activities:

a. Research and surveillance

Trends and risks, both internal and external,

affecting the financial system need to be closely

assessed and monitored. Research and surveillance

activity are intended to produce a policy

recommendation for maintaining financial system

stability.

b. Payment systems oversight

Regulation and oversight are required to ensure a

safe and reliable payment systems. The adverse

risks to the payment system, which may lead to

systemic failure and financial crisis, may be

avoided.

c. Crisis resolution

While the latter two activities are related to crisis

prevention, the third activity is taken by the

central bank to address crisis when it actually

occurs. Usually two instruments are used: (i)

providing lending facility to the financial

institutions by the central bank as the lender of

the last resort (LLR); and (ii) to provide deposit

insurance. LLR facilities by central bank may be

given either during normal situation as well as

during systemic crisis. During normal situation,

such facility is provided only to address liquidity

problem for illiquid but solvent banks, and with

sufficient collateral. During systemic crisis, LLR

facility is provided to restructure the banking

system.

CENTRAL BANK’S ROLE IN FINANCIAL SYSTEM STABILITY

Currently, there is no formal legal basis stating

about Bank Indonesia’s function in maintaining

financial system stability. The function, in fact, is

performed simultaneously with its core tasks of

performing monetary policy, bank supervision and

payment system.

Following the 1997 crisis, there has been growing

awareness in the importance of maintaining financial

system stability. In line with the introduction of Law

No. 23 of 1999, Bank Indonesia incorporates the

financial system stability aspect in its mission: “to

achieve and maintain stability of the Indonesian rupiah

through maintaining financial stability and promoting

of financial system stability for sustainable national

development.” In line with its mission and vision, Bank

Indonesia has formulated a framework that contains

the goals, strategy and instruments required for

maintaining the financial system stability.

The roles of maintaining monetary stability and

Both roles are aiming at the same objectives which is

price stability.

In order to achieve a stable financial system,

Bank Indonesia adopts four strategies, namely: (i)

implementing regulation and standards to foster market

discipline; (ii) intensifying research and surveillance;

(iii) improving coordination and cooperation; and (iv)

establishing safety net and crisis resolution framework

(see Box 2).

CONCLUSIONS

Stability of financial system much depends on the

soundness of financial institutions, particularly banks

that dominate the financial system. This will also rely

on the effectiveness bank supervision. Therefore, it is

imperative to have an independent and competent bank

supervisor capable of assessing bank risks and taking

preventive and corrective actions on the problems faced

by banks effectively.

To achieve a stable financial system, effective

coordination must be in place among relevant

authorities. Therefore, there must be a clear division

of roles and responsibilities of each authority. More

importantly is the commitment of the stakeholders to

cooperate in achieving and maintaining financial system

stability. In addition, effective supervision and

consistent law enforcement will foster market players

In order to achieve financial system stability,

Bank Indonesia adopts four strategies:

(1) Implementing regulations and

standards. Consistent implementation of

international prudential regulations and standards

are required as a sound basis for both regulator

and the market players in conducting their

business. In addition, consistent discipline of the

market players need to be fostered.

(2) Intensifying research and surveillance.

Development of financial system the relevant

aspects affecting its stability should be assessed

and monitored. Risks which may endanger

Box 2.

BANK INDONESIA’S STRATEGY IN MAINTAINING

FINANCIAL SYSTEM STABILITY

financial system stability are measured and

monitored by incorporating an early warning system

which is composed of micro-prudential and

macro-prudential indicators. Research and surveillance are

aimed at producing a policy recommendation for

maintaining financial system stability.

(3) Establishing safety net and crisis

resolutions framework. Safety net and crisis

resolutions framework and mechanism are required

for resolving financial crisis, once it occurs. These

include policy and procedures of the lender of the

last resort, and the deposit insurance which will

replace the blanket guarantee. Currently, there is no

An active involvement in creating and maintaining a sound and stable national financial system.

Financial System Stability (FSS) Framework

Achieving and maintaining the stability of Rupiah value by maintaining monetary stability and promoting financial system

stability for sustainable national development.

Implementing Regulation & Standards Intensifying Research & Surveillance Improving Coordination & Surveillance

•Regulation & Standard e.g

Basle principles, CPSIP, IAS, ISA, dsb.

• Market Discipline

• Early Warning Systems

• Macro prudential Indicators • Micro-Prudential Indicators (aggregate) -Internal Coordination – External Coordination & Cooperation

• Lender of last resort

- Normal - Systemic Crisis • Crisis Resolution

- Safety Nets

Establishing Financial Safety Nets & Crises

Resolution

Instruments FSS Objective BI ’s Mission

a clear legal framework for crisis resolution.

According to Law No. 23/1999, Bank Indonesia is

only allowed to provide lending to address liquidity

problem faced by banks during normal times, but

not for systemic crisis situation. Therefore, there is

an urgent need to formulate this policy in the law

which clearly stipulates the roles of Bank Indonesia

as the lender of the last resort in the events of crisis.

(4) Improving coordination and cooperation.

Coordination and cooperation with related gencies

is very crucial especially in crisis times. Usually, the

coordination was formed in a national committee

which is composed of the Bank Indonesia Governor,

Finance Minister and related agencies including the

Head of Deposit Insurance Agencies to be

EXTERNAL FACTORS

3

INTERNATIONAL ECONOMY

A

long with globalization in economics, Indonesia’s financial system will be affected by instability in regional and global economies. It occurs through international trade and money market channels.During the last few years, global economy tends toward a downturn condition. This is provoked by decreasing economic performances of the industrial countries in the world, namely the United States and Japan. Ultimately, this situation will influence Indonesia’s financial system considering that the United States and Japan are the largest markets for Indonesia’s exports. Indonesia’s trade account states with the United States and Japan reach 17.44% and 22.99% respectively of total exports. In addition, both countries are also primary lenders. The slowdown condition of those industrial countries is expected to continue

following terrorists’ attacks at some places within the United States in 2001.

The declining economic conditions of these two major economies was indicated by decreasing Gross Domestic Products (GDP), increasing in inflation, and the current account deficit.

FIGURE 3.1:

NON-OIL AND GAS EXPORTS By COUNTRY OF DESTINATION

FIGURE 3.2:

US and JAPAN : GDP-INFLATION

FIGURE 3.3:

US andJAPAN : CURRENT ACCOUNT

-10 20 30 40 50 60 70 Percent

U S ASEAN Japan

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Inflation (Percent) GDP (Percent)

1995 1996 1997 1998 1999 2000 2001 2002 (2) (1) -1 2 3 4 8 (6) -(4) (2) 2 4 6

GDP-US GDP-Japan Inflation-US Inflation-Japan

Miliar USD (140) (120) (100) (80) (60) (40) (20) -20 40 60

1995 1996 1997 1998 1999 2000 2001 2002

The continuing recession in United States and Japan also affects their capital markets adversely. This was illustrated by the fall in composite indices of the Dow Jones and Nikkei. In fact, such conditions should have encouraged capital inflows to Indonesia. Unfortunately, it is not the case, since Indonesia’s investment environment is not yet conducive, as evidence by a decision of a restructured corporation in Japan to close their factories in Indonesia. Such policies

truly bring negative impacts to the money market due to the decreasing of bank’s lending portfolio in respect to Japanese corporations.

DOMESTIC ECONOMY

Monetary Conditions

During 2002, monetary condition is quite conducive as reflected by lower interest rate and stability of exchange rates. Hopefully, such condition will prevail so as to stimulate economic growth in 2003. Unlike the condition in 2000 and 2001, the SBI interest rate tends to decrease in 2002. This condition indicates that Bank Indonesia has started to ease its monetary policy as inflation rate is still in control, while the rupiah exchange rate remains relatively stable. However, the lower trend of SBI interest rate is not immediately followed by a reduction in lending rates. The declining trend of SBI interest rate will hopefully encourage more lending to real sectors. In spite of such increase in lending, the amount is relatively small and is mostly given to small and medium enterprises. This reflects banks’ caution in lending and At the end of 2002, United States and Japan’s

GDP slightly increased by 2.1% and 0.5% respectively. This was mainly due to the lower discount rate policies introduced by monetary authorities of both countries. Compared to 1999-2000, their GDP in 2002 has not fully recovered and monetary authorities continue their low interest policies.

The fact that both economies were not improved in 2002 caused Indonesia’s exports to decrease. This adversely affect borrower’s financial performance which will eventually cause a negative impact on banks’ assets quality.

Figure 3.4:

US and Japan : Discount interest Rate and DJIA & NIKKEI Indices

FIGURE 3.5:

DIRECT AND PORTFOLIO INVESTMENTS

Percent 10,000 -5,000 15,000 20,000 25,000

1999 2000 2001 2002

U S Japan DJIA NIKKEI

-1 2 3 4 5 6 7 2003

Million USD Million USD

0 500 1000 1500 2000 2500 3000

1998 1999 2000 2001 2002

the low level of absorption by corporations due to ongoing restructurings.

The lower interest rate in fact is not followed with migration of third party capital to capital market or property sector. However, there are indications that banks’ third party funds have migrated to mutual funds.

relatively secure.6 However, we can expect to see

further pressures in fiscal during 2003 and 2004, particularly in connection with budget deficits. Debt to GDP ratio decreased from 88.4% as of June 2002 to 70.4% as of December 2002. However, Indonesia’s debt ratio was much lower than that of other countries such as Argentina (49.4%), Mexico (69.1%) and Turkey (54.2%) before these countries descended to financial crisis.

If the debt is not carefully managed, debt crisis will adversely affect balance of payment and financial performance of the Government. Eventually the condition will also adversely affect financial system stability. One potential issue for the government is refinancing of government bonds (refinancing risks), considering the huge amount of the bonds to mature within a few years (IDR 36.3 trillion in 2004 and IDR 45.8 trillion in 2007). Maturity dates of government bonds prior to and after re-profiling is shown in Figure 3.8.

FIGURE 3.6:

DOMESTIC ECONOMIC INDICATORS

FIGURE 3.7: JAKARTA COMPOSITE and PROPERTY SECTOR INDICES

6 Policy Analysis and Planning Division (2002), “Indonesia’s Medium-Term Fiscal Sustainability.” Rp/USD Percent -2,000 6,000 8,000 10,000 12,000 14,000 4,000 0 10 20 30 40 50 60 70 80

1998 1999 2000 2001 2002

Exchange Rate SBI (%) Interbank (%) Credit /GDP Ratio (%)

2003 0 100 200 300 400 500 600 700 800 0 20 40 60 80 100 120 140 160 180 200

1996 1997 1998 1999 2000 2001 2002

J C S I P S I

2003

Jakarta Composite Stock Index Property Stock Index

Government’s Finance

Bank Indonesia’s review on medium term fiscal resilience indicates that fiscal condition is

FIGURE 3.8:

MATURITY PROFILE OF GOVERNMENT BONDS

Before Reprofiling After Reprofiling Trillion Rp

2002 200320042005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Government Bonds

From the Government Budget [APBN] simple stress test, re-profiling of Government bonds has not fully taken pressure off the government financial condition. There are potentials for budget deficit which will eventually adversely affect the government’s ability in paying principal and interests of government bonds.

In order to address the obligation to pay principal and interest of maturing government bonds, issued in connection with banks re-capitalization program, the Government restructure of maturities and interest rates of the government bonds. As for an initial step, the government re-profile the government bond in 4 State-Owned Banks portfolio involving a sum of IDR 22.8 trillion.

By considering the process and other fiscal assumptions, the stress test shows a negative difference between new debt and maturing debts at 1.37% of GDP or amounting to around IDR 29 trillion in 2004. The condition needs to be resolved with another re-profiling and other strategy such as conducting buy back, boosting additional income from selling assets etc. On the other hand, re-capitalization banks should work in efficient manner and also improve their capital by this means reducing dependence on government financial support.

A developed and efficient government bond market will encourage liquidity. The liquidity is needed to further improve market confidence and capability reduce risks if there is negative shock to the market. Otherwise, market participants will rely on Bank Indonesia’s liquidity support when crisis occurs. The role of Bank Indonesia should be limited only in crisis condition which have systemic impact to the financial

sectors and economy. Sound and liquid government bond market will help government in reducing refinancing risks and arranging bonds maturity profile.

Maintaining the government’s ability to pay recap bonds’ principal and interest at maturing date is critical. Bonds sold at high discount rate may reflect an overcrowded of bonds in similar maturity, investors’

FIGURE 3.9:

Fixed Rate GOVERNMENT BONDS vs SBI

0 20 40 60 80 100 120

Average Fixed-Rate SBI 1 month

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2 0 0 2

Government Bond Price S B I (%)

0 2 4 6 8 10 12 14 16 18 Table 3.1

Stress Test on Goverment budget (APBN) 2003-04

State Revenues 17.76 17.33 15.70

State Expenditures 20.11 19.10 15.10

Primary Balance 3.04 2.45 4.00

Surplus (+) / Deficit (-) -2.35 -1.77 0.60

A. Financing of Government Debentures

1. Maturing Government Debentures -1.18 -2.73

2. Reprofiling of Government Debentures

at 4 State-Owned Banks 0.00 1.06

Sub Total -1.67

B. Overseas Borrowings

a. Program Loans 0.54 0.53

b. Project Loans 1.16 0.97

Sub Total 1.70 1.50 1.80

C.Installments of Overseas Loan Principal -0.76 -0.89 -2.10

Financing (A+B+C) 1.77 -1.97

% of GDP

2002 2003 2004

choice and the issuer financial conditions. It is therefore necessary to maintain sound financial condition to ensure timely payment of bonds’ principal and interest. This will increase market confidence and maintain a more liquid market for government bonds.

Post-crisis financial condition of the Government is not quite promising. At the moment, the Government carries huge burden from both domestic and foreign borrowings. Such situation is worsened by the limited ability to boost revenues considering the non-conducive domestic and international economic environments. Therefore, the future prices of recap bonds will rely on the Government’s ability to improve its financial performance as well as performance of the economy as a whole.

The huge bonds’ principal and interest payment obligations which will prevail in 2004 through to 2008, coupled with budget deficits, may give probability of government debt crisis. The government needs to adopt more stricter fiscal discipline while striving to increase revenues. The re-capitalization banks also need to support government by operating in more sound governance and obtaining profitable financial condition to avoid another possibility of government debt and banking crisis.

Foreign Debts

Foreign debt crisis will adversely affect stability of financial system. Increasing commercial borrowings from overseas lenders under binding contracts without strong repayment capacity, and with uncertainties in social, political, economic and finance situations, may impairs international confidence toward Indonesia’s economy. This situation will damage Indonesia’s rating.

As the implications, lenders will demand higher interest rate as risk premium raising, thus requiring us to mobilize more and more US$ to repay the floating interest obligations as well as for securing new loan commitments. Consequently, there will be high demands for US$ funds and US$-denominated deposits at local banks will be rushed. Such situation will surely adversely affect financial system stability, similar to that which swept throughout Asia and in Argentina.

Market Confidence

The confidence level of investors and rating companies on Indonesia’s financial solvability remains low, as shown by the rating made by Standards & Poor. Foreign investors’ perception on Indonesia’s financial condition is still risky. Yield spread between Indonesian government’s Yankee bonds and US treasury bonds as of December 2002 is relatively wide, namely 266.07 base points. Such condition results in relatively higher risk premium for Indonesia’s government as well as private foreign borrowings. In addition, (lower) rating and (higher) risk premium may result in reduced demands for Indonesian Rupiah, thus adversely affect Rupiah exchange rate which will eventually increase market risk.

FIGURE 3.10:

Indonesia Government Bonds Rating and Yields

banks, advancing technology in production and focusing on productive investments particularly on export-oriented activities. Approval given to the proposed rescheduling of Indonesia’s debts in the amount of US$ 5.4 million during Paris Club III on 12th April 2002 is one

such effort to address the potential risk of debt crisis in Indonesia.

debts. Although, the private debts ratio to export account for 30.8% which exceeding the benchmark level of 20%. The amount of exposure has been decreasing since quarter 4 2002. Moreover, most of the debts have been restructured and anticipated. The projected debt repayment in 1st quarter of 2003 is to

be at US$ 3.4 billion. This will expectedly increase demand for United States Dollar. However, debt repayment realization is relatively small due to the fact that most borrowings have been estimated and the withdrawal will be made only to meet working capital needs of the corporations.

Source : Bloomberg

S&P rating convertion : 1=SD, 2=C-, 3=C, 4=C+ etc. 15=BB, 20=A- (under BB is speculative)

S&P Yield SD Yield A-CCC+ BB 0 2 4 6 8 10 12 14 16 18 20

Jul Apr Oct Dec Jan Jan Mar May Mar Mar Sep Apr Oct May Nov Apr Sep Dec 92 95 97 97 98 98 98 98 99 99 99 00 00 01 01 02 02 02 0 2 4 6 8 10 12 14 16

Debt Service Ratio

Government 15% 11% 10% 10% 7% 11% 11%

Private 21% 33% 48% 47% 34% 31% 20%

Indonesia 36% 45% 58% 57% 41% 41% 31% 20%

Total Debt to

GDP ratio 49% 62% 146% 105% 94% 91% 70% 50%-80%

Ratio 1996 1997 1998 1999 2000 2001 2002 Benchmark Table 3.2:

Foreign Debt Indicators

Maturity Profile

Maturity profile of foreign debts is not yet reasonable however it will not bring in significant adverse impacts to financial system stability since the corporate apply more prudential foreign borrowing activities. Most of private debts (88%) are corporate

As for Indonesia’s bank foreign borrowing, there are two banks issue bonds denominated in foreign currency during 2002. Proceed from such bond issue is primarily used to repay principal and interest of existing foreign borrowings (exchange offer). Generally, Indonesia banks adopt the refinancing pattern to repay their foreign currency borrowing e.g. issue other short-term bonds. Learning from 1997 crisis, although such bonds will not bring much problem in short-term period,

FIGURE 3.11: MATURITY PROFILE OF CORPORATE FOREIGN DEBT

2 0 0 2

Million USD Million USD

2 0 0 3

Bank NBFI Corporate 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 0 200 400 600 800 1000 1200

but in the long run they may adversely affect banking sector and financial systems.

With respect to that, some factors which might adversely affect such foreign currency—denominated bonds issued, must be monitored, such as (1) uncertainty of international economic condition; (2) the relatively low international confidence level on Indonesia’s economy as shown by the low rating; and (3) the relatively low profitability of banking sector. In addition, banks need to be cautious of their foreign currency borrowings by obtaining hedging instruments in order to reduce market risk, considering the fact that banks’ revenues are mostly in Indonesian Rupiah.

However, there are constraints such as insufficiency data regarding private foreign debts. Learning from 1997 crisis, the condition will result in ineffectiveness of monitoring activity such that the risks and instability factors against financial system stability, particularly from foreign debts, cannot be adequately and timely anticipated. Therefore, foreign debts need to be managed in prudential manner and monitored carefully.

REAL SECTOR CONDITION

Small and Medium Enterprises

Loan restructuring process faces with significant obstacles as real sector has not recovered yet. This condition will repress financial system stability.

After recapitalization process, Indonesian banks have not found difficulties in obtaining funds to finance their lending. This is reflected in the increased liquidity in primary reserve (cash, minimum demand deposit and SBI), secondary reserve (trade bonds, inter bank call money) and tertiary reserve (investment bonds).

In fact banks are still reluctant to lend due to the fact that banks are still facing some constraints, among

BNI Cayman Island B- 145

-BNI KP CCC 150 728

Medco Energy Int’l B+ 100 766

Indofood B 280 791

Bank Mandiri CCC 125 703

Telkomsel B+ 150 615

Source: Bloomberg

Rating O/S (Million US$) Yield Spread Table 3.3

Indonesia Corporate yankee Bonds (Dec 2002)

There is a significant risk in such corporate bonds issued overseas against financial stability, due to the volatility of the exchange rate. In addition, most of debts are not fully hedged. Such condition might trigger corporate debt crisis. Eventually, corporate crisis – most of them were financed by banks – will have contagious effect to the banking sector. This was what happen in some east Asia countries, including Indonesia, during the 1997 crisis.

In order to improve effectiveness in foreign debt monitoring, Bank Indonesia has put in place prudential policy and mechanism for monitoring foreign debts.

Figure 3.12

Loans to SME and Non-SME

Small - Scale Enterprise Loan Non Small - Scale Enterprise Loan Trillion Rp -50 100 150 200 250 300 350 400 450

2 0 0 1

Sep

Dec Mar Jun

7 IBRA Report, September 2002.

others, relatively higher non-performing loans, higher risks in real sector -particularly corporations with high debt to equity ratio- and limited information regarding potential borrowers. In addition, banks’ preference in portfolio investments has changed to less risky investment such as placements in SBI, Government Bonds and inter bank money market.

will adversely affect bank’s performance improvement. Therefore, providing loans to small and medium enterprises is one of the options to accelerate economic recovery and to improve banks’ lending portfolio.

In addition, new loans growth was still low because most of large companies restructuring at IBRA were incomplete. The process shows that out of the IDR 369.5 trillion of loans transferred to IBRA, only IDR 19.9 trillion have been restructured, while IDR 17.1 trillion have been fully settled.7

Significant growth in new loans may be expected to occur after completion of the restructuring such corporations. In fact, the restructuring has not gone very well and time consuming due to various constraints particularly uncertainty of business and legal process. Corporate loans dominate banks’ portfolio. Delays in the recovery of real sector particularly corporations

However, it must be noted that such strategy poses risks as banks have insufficient experience in providing loans to small and medium enterprises and time consuming.

As of the third quarter of 2002, lending to small and medium enterprises accounted for IDR 24.6 trillion, which was 41.8% of the total new lending. For the same period, private national forex banks were the biggest lenders to SME, followed by regional development banks and state owned Banks, contributing 12.9%, 10.1% and 6.2% respectively. This tendency needs to be monitored mainly because SME debtors need technical or management assistance as well as marketing training of which not all banks can provide.

SME’s non-performing loan was still low (4.5%). Consumption loan dominated SME lending, which might increase demands for goods and services at local as well as international market. On one side, increased demand would generate enlarged goods and services Q II 2002 Q III 2002

State Bank Forex Private Bank Regional Development Bank Joint-venture Bank Foreign Bank Percent -5 0 5 10 15 20 Non-Forex Private Bank Figure 3.13

LENDING GROWTH TO SME BY TYPE OF BANKS

Figure 3.14

SME LOANS BY TYPES OF BUSINESS USES

Working Capital Loan 43%

Investment Loan 11% Consumer Loan

fact that the figure was still higher than those of other sectors. At the end of 2002, non agriculture and mining sector’s performance showed some improvements. However, the improvement was still accompanied with high non-performing loans in non agriculture and mining sectors, particularly from manufacturing. Considering the importance of non agriculture and mining sectors role, particularly manufacturing sector in domestic economy, the following box 3 illustrates performance of pulp and paper industry.

inflows from international market which, if not properly managed, may adversely affect balance of payment. On the other side, increased demand created business opportunities for companies in order to improve their financial performance.

Pulp and Paper Industry

Due to the 1997 crisis, agriculture and mining sector contribution to GDP decreased, in spite of the

FIGURE 3.16 NPL by SECTOR

10

2001 2002

Agriculture Mining

Industry Electricity

Construction Trading

Transportation Business Services

Social Services Others

-20 30 40 50 60

Percent Figure 3.15

GDP BY SECTORS TO TOTAL GDP

Percent

-2 4 6 8 10 12 14

29 30 31 32 33 34 35 36

Mining & Agriculture Non Mining & Agriculture Percent

Pulp & paper industry was considered as a risky

business. Such that 7 out of 10 pulp & paper companies

are indebted to banks in the amount of IDR 4,136,577

million. In 2000, 97% of the total outstanding loans

given to this industry were restructured. Unfortunately

however, restructuring program is low because of the

following issues:

• Poor restructure analysis conducted by banks, such

failure to assess borrowers’ cash flow capacity,

individually or group.

• Lack of transparency nor cooperation in disclosing

of their financial conditions;

• Low productivity and decreasing revenues due to

lower prices of their products in markets,

accompanied by increasing cost of goods sold;

• Worsening financial condition due to huge

indebtedness, interest and other expenses caused by the Rupiah depreciation against the United

States Dollar.

Yet, in the future, pulp & paper industry will face other challenges, specially low paper consumptions in

Asia (other than Japan) compared to United States,

Box 3.

Pulp and Paper Industry

Japan and Europe. On the other hand, price of raw

material is gradually increase since their HPH (forest

exploration rights) cannot supply adequate raw

material. For illustration, in 1999 group’s own sources

fully supplied raw material requirements, but in 2000

they only contributed 40% of companies demand, and

this generate increases in the log prices.

From 1993 up to June 2002, the average gearing

ratio of 5 pulp & paper companies’ financial statements

had increased. Such increase indicates that this

industry depends more on third party financing instead

of self-financing. On the other side, the deteriorating

of pulp & paper market will weaken most pulp & paper

companies’ revenues.

3,000

2,000

1,000

-(1,000)

(2,000)

(3,000)

Total Debt/Equity Long Term Debt/Equity Total Debt/Total Asset

Dec Dec Dec Dec Dec Dec Dec Dec Dec Jun

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Percent Percent

120

100

80

40

-(20) 60

INDONESIA’S BANKING INDUSTRY

4

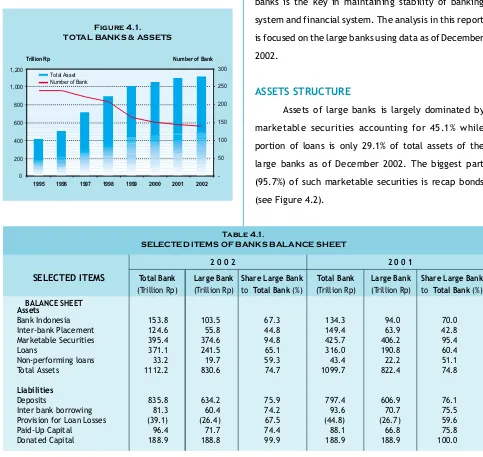

THE STRUCTURE OF BANKING INDUSTRY

Indonesia’s financial system stability relies heavily on

the banking industry covering of about 90% of total asset

of financial system. Similarly, the banking system is

dominated by 13 large banks, including 10 recap banks,

represent 74.8% of the total assets of banking industry.

(see Table 4.1)

Therefore, ensuring soundness of these large

banks is the key in maintaining stability of banking

system and financial system. The analysis in this report

is focused on the large banks using data as of December

2002.

ASSETS STRUCTURE

Assets of large banks is largely dominated by

marketable securities accounting for 45.1% while

portion of loans is only 29.1% of total assets of the

large banks as of December 2002. The biggest part

(95.7%) of such marketable securities is recap bonds

(see Figure 4.2). Figure 4.1.

TOTAL BANKS & ASSETS

Trillion Rp

-50 100 150 200 250 300

Number of Bank

Total Asset Number of Bank

0 200 400 600 800 1,000 1,200

1995 1996 1997 1998 1999 2000 2001 2002

SELECTED ITEMS

Table 4.1.

SELECTED ITEMS OF BANKS BALANCE SHEET

Assets

Bank Indonesia 153.8 103.5 67.3 134.3 94.0 70.0

Inter-bank Placement 124.6 55.8 44.8 149.4 63.9 42.8

Marketable Securities 395.4 374.6 94.8 425.7 406.2 95.4

Loans 371.1 241.5 65.1 316.0 190.8 60.4

Non-performing loans 33.2 19.7 59.3 43.4 22.2 51.1

Total Assets 1112.2 830.6 74.7 1099.7 822.4 74.8

Liabilities

Deposits 835.8 634.2 75.9 797.4 606.9 76.1

Inter bank borrowing 81.360.4 74.2 93.6 70.7 75.5

Provision for Loan Losses (39.1) (26.4) 67.5 (44.8) (26.7) 59.6

Paid-Up Capital 96.4 71.7 74.4 88.1 66.8 75.8

Donated Capital 188.9 188.8 99.9 188.9 188.9 100.0

2 0 0 2 2 0 0 1

Total Bank Large Bank Share Large Bank Total Bank Large Bank Share Large Bank

(Trillion Rp) (Trillion Rp) to Total Bank (%) (Trillion Rp) (Trillion Rp) to Total Bank (%)

Figure 4.3. To