Moreover, in the last ten years, there have been a number of mergers and acquisitions in the banking market. Further improvement in market share distribution and increased capacity of the merged banks increased competition in Indonesia's banking industry. The change in market structure was driven by the policy of deregulation in the banking sector in the 1980s.

The banking architecture will guide the development of the Indonesian banking system over the next ten years. We suspect that at least two policies under the Indonesian banking architecture will directly affect market structure and competition in the banking sector. The study aims to assess the impact of the consolidation policy in the banking sector on market conditions.

Referring to Table 3, a large number of mergers and acquisitions took place in the Indonesian banking industry between 1997 and 2010. Many studies used the Panzar-Rose (PR) method to measure the impact of consolidation policies on competition in the banking industry. Shaffer (1982), Molyneux et al (1994), Bikker and Haaf (2002) and Bandt and Davis (2000) examined the impact of bank consolidations in the United States and European countries on competition.

Molyneux et al (1994) tried to evaluate the impact of consolidation on competition in the early stage of implementation of the internal market policy.

METHODOLOGY 3.1. Empirical Model

Data

It consists of non-consolidated annual balance sheets and profit and loss statements of commercial banks. The annual fluctuation in the number of banks is the result of mergers, takeovers, bank liquidations and entry of banks in the observed period. In the case of mergers and acquisitions, the database only stores the data of the new institution, which is usually a larger bank.

Currently, Indonesia has 4 state-owned banks, 68 local private banks that consist of banks that are into currency services and banks that are not. The shareholders of the regional banks are the provincial government and the municipalities. Compared to other developing countries in Southeast Asia, the number of banks in Indonesia is large.

Bank balance sheets show that, on average, 3 out of 113 banks control more than forty percent of the industry between 2001 and 2009. Descriptive statistical information on the distribution of assets and capital supports the idea of a highly concentrated market. Type of banks (based on categorization of central banks) Type of banks (based on categorization of central banks) Type of banks (based on categorization of central banks) Type of banks (based on categorization of central banks).

Type of banks (based on the central bank categorization) Number of banksNumber of banksNumber of banksNumber of banksNumber of banks. Referring to the data, half of the bank (56 banks) had shares of less than 550 billion rupiah. On the other hand, a very small portion of banks - less than 1 percent or only 7 banks - have equity of more than 10 billion.

Dividing the sample into large, medium and small banks is important to capture the actual behavior of banks in competition with other banks in their categories. The value of equity capital in 2009 will be used as a basis for dividing the sample into large, medium and small banks. In terms of the number of banks on the market, the category of small banks dominates; but the market is controlled by a larger group.

RESULT AND ANALYSIS

Competition in Banking Industry

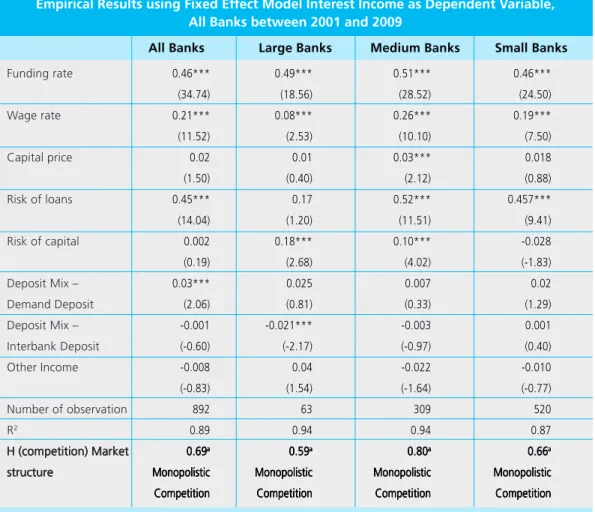

They confirm that fixed effect model is more reliable in capturing the information about what contributes to the difference between banks. The model can therefore capture the information of what contributes to the differences between banks. The F-test shows that the value is significantly different from zero, so it rejects the monopoly hypotheses.

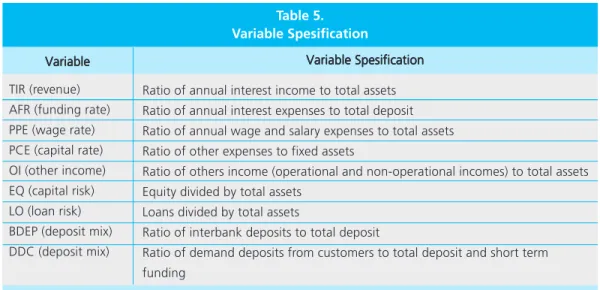

It is also significantly different from one, so it also rejects the perfect competition hypotheses. Empirical results using fixed effect model Interest income as dependent variable, all banks between 2001 and 2009. Funding rate Wage rate Capital price Risk of loans Risk of capital Deposit mix √ Demand deposit Deposit mix √ Interbank deposit Other Income Number of observation R2.

All banks Large banks Medium banks Small banks .. a) the value of the F test shows that H is not significantly different from 0 and 1 (99% confidence level). The value in parentheses is the t-statistic;. The H-statistic varies from 0.59 to 0.80, indicating that the banking market in all groups operated under monopolistic competition. The H-statistic for the group of medium-sized banks is quite high (0.80) and is comparable to the banking market in developed countries and other emerging markets such as Latin American banks (Yeyati and Micco, 2007).

This is quite surprising as in other countries including Europe; the banking market of larger banks is more competitive than that of the smaller banks that usually serve the local market (Bikker and Haaf, 2002). The sign of the coefficients is also positive indicating that the increase in the wage rate is transmitted to income. Positive coefficients for risk of loans imply that banks with a higher percentage of loans on their balance sheets generate higher interest income per rupiah asset.

Thus, in larger banks, it can be concluded that a higher share of equity per asset brings higher income. The deposit mix variables are not significant in explaining income trends, except for the share of interbank deposits in total deposits in the large bank market. The sign of the coefficient is negative, which means that the larger the share of interbank deposits in total deposits, the less income could be earned.

Market Structure and Competition

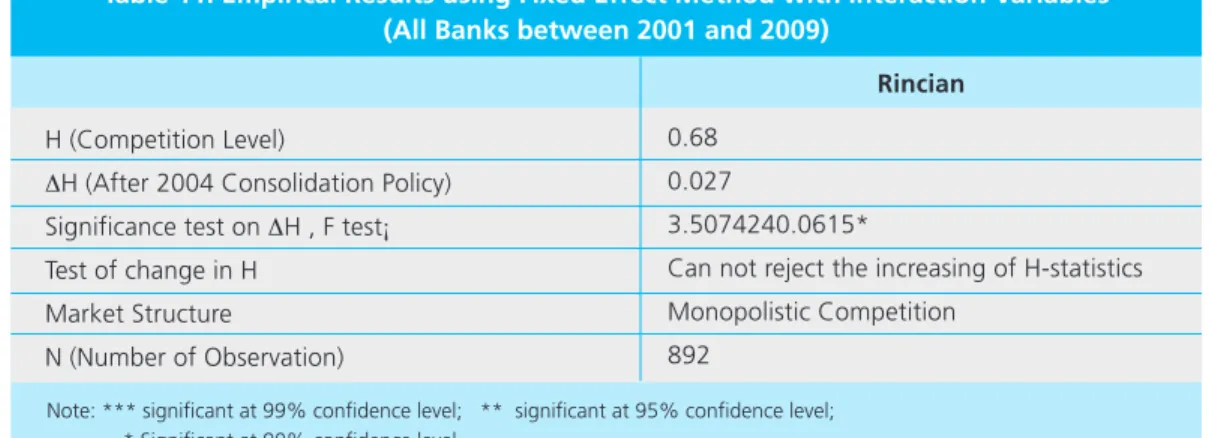

In contrast to developed countries where consolidation increased market concentration7, policy changes reduce concentration in the Indonesian banking market. While in the developed countries and more mature markets of developing countries in Latin America, mergers and acquisitions were driven by the market. It implies that consolidation in the Indonesian banking market does not create more concentrated markets, but improves the distribution of market share.

In the case of large banks, the single presence policy has effectively reduced concentration through the consolidation of PT Bank Niaga Tbk. This merger greatly reduced market concentration, as the new merging bank was not among the top three big banks. Mergers and acquisitions in the market of medium-sized and small banks were aimed at improving the performance of banks after the economic crisis of 1997 or to fulfill the policy of single presence or the policy of minimum capital requirement.

They have a better distribution of market share, as the three largest banks in the group held only less than 35 percent of the market share. But if we compare the value of the concentration changes, the concentration level changes in medium-sized banks and small banks were relatively smaller, especially when we refer to the Herfindahl-Hirschman index. The information on market concentration and competition in medium-sized and small banks helps to understand this phenomenon.

The markets for medium-sized and small banks were highly competitive and less concentrated, so mergers and acquisitions only slightly reduced market concentration. On the other hand, the market of medium-sized banks is the most competitive because it is less concentrated (CR3 average=0.26; HHI average=0.05). Small banks also operate in a rather competitive environment, as each bank has a small share of the total market (CR3 average=0.31; HHI average=0.05).

The result confirms that the consolidation policy has strengthened the competition in the Indonesian banking industry. This greatly increased the scale of the economies of the merging banks and equipped them with greater capacity to compete with other banks. The improvement of the distribution of the market share reduced the market concentration and strengthened the competition.

CONCLUSION

Increasing the economies of scale of the merging banks and improving market share distribution strengthened competition. This is possibly the reason why the big banks in Indonesia operate in a less competitive market rather than the smaller banks.

How foreign entry affects the domestic banking market. Policy research working document. World Bank. Proceedings of a Conference on Bank Structure and Competition (Federal Reserve Banks of Chicago) in May. Alternative specification, Surveyed regression model of empirical results of fixed effect method, Total revenue as dependent variable (All banks between 2001 and 2009).

Capital risk Deposit Mix - Demand deposits Mix Deposits - Interbank deposits Other income Observation Number. Empirical results of the survey fixed-effect regression model with time patterns of all banks between 2001 and 2009.